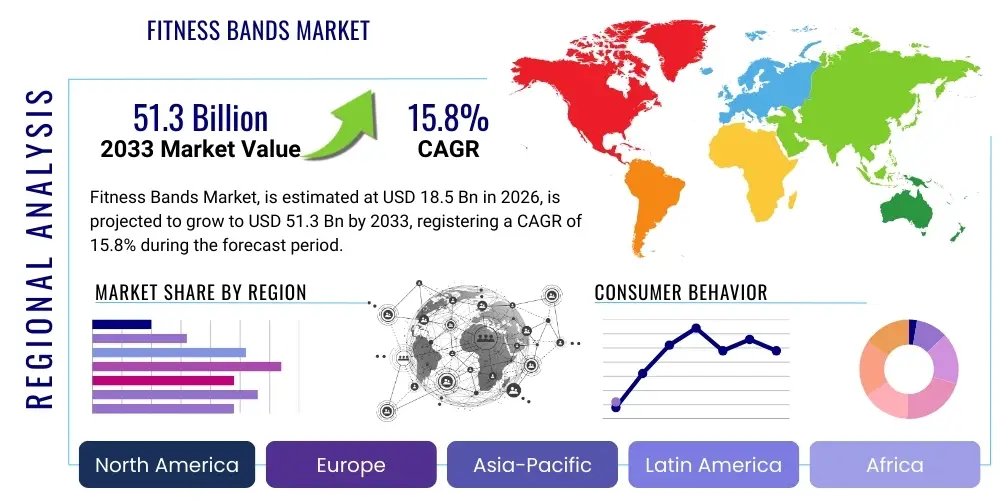

Fitness Bands Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438238 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fitness Bands Market Size

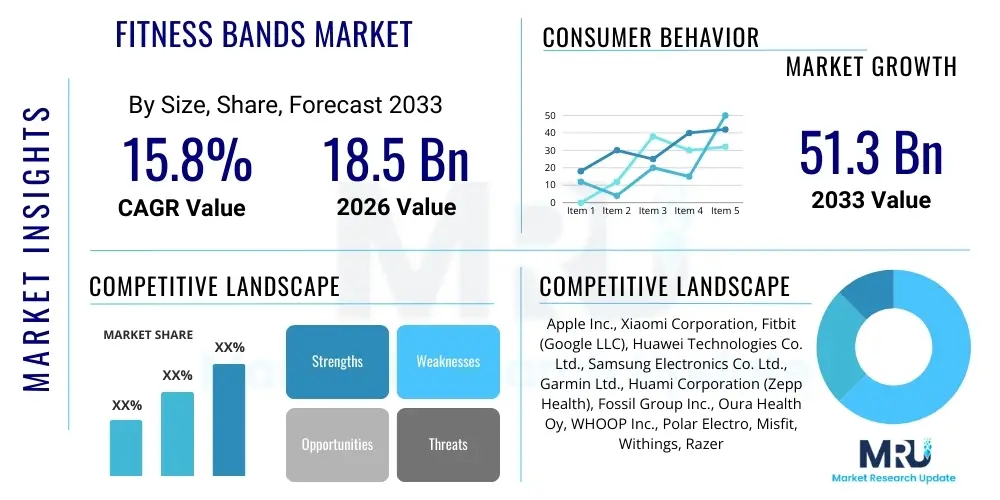

The Fitness Bands Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.8% between 2026 and 2033. The market is estimated at USD 18.5 Billion in 2026 and is projected to reach USD 51.3 Billion by the end of the forecast period in 2033. This significant expansion is driven by the increasing global focus on proactive health management, the rising prevalence of chronic lifestyle diseases, and continuous advancements in sensor technology that enhance data accuracy and user experience. Market growth is further catalyzed by the integration of sophisticated health monitoring capabilities, moving fitness bands beyond simple step counting to complex biometric analysis, including electrocardiograms (ECG) and blood oxygen saturation (SpO2) measurements, thereby broadening their appeal across consumer and clinical applications.

The valuation reflects the robust demand from diverse end-user segments, spanning recreational fitness enthusiasts, athletes, and patients requiring remote physiological monitoring. Regional disparity in adoption rates, coupled with varying disposable incomes and access to digital infrastructure, influences the overall market trajectory. Developed economies, particularly in North America and Western Europe, represent mature markets characterized by high penetration of premium-priced devices, while the Asia Pacific region is expected to exhibit the highest growth velocity due to rapid urbanization, increasing health awareness initiatives, and the emergence of cost-effective domestic manufacturers providing entry-level devices.

Fitness Bands Market introduction

The Fitness Bands Market encompasses wearable technology devices designed primarily to track and monitor physical activity, physiological parameters, and general health metrics of the wearer. These devices typically include sophisticated sensors capable of measuring heart rate, steps taken, distance covered, calories burned, sleep quality, and increasingly, specialized metrics like blood pressure variation and stress levels. The product category spans basic activity trackers to more advanced hybrid devices that merge basic tracking capabilities with limited smartwatch functionalities. Major applications center on promoting preventive healthcare, managing chronic conditions such as diabetes and cardiovascular disease through continuous data collection, and enhancing performance for competitive athletes and casual fitness enthusiasts. Key benefits include personalized health insights, motivational feedback loops, and seamless integration with broader digital health ecosystems, providing users with actionable data to modify behavior and improve well-being.

Market growth is substantially driven by the rising global incidence of lifestyle-related ailments, necessitating continuous monitoring outside traditional clinical settings. Furthermore, significant investments in miniaturized, energy-efficient sensor technology (e.g., photoplethysmography (PPG) sensors) have dramatically improved the accuracy and form factor of these devices, making them desirable everyday accessories. The increasing interoperability standards, allowing fitness bands to connect easily with smartphones, third-party health applications, and Electronic Health Records (EHR) systems, solidify their position as crucial components in the digitalization of personal health management. The combination of improved aesthetics, extended battery life, and enhanced software capabilities continues to drive mass-market adoption globally, moving these devices from niche technological gadgets to indispensable tools for health maintenance.

Fitness Bands Market Executive Summary

The Fitness Bands Market is undergoing a rapid evolution characterized by significant business, regional, and segment trends prioritizing advanced health sensing and software-driven services. Business trends reveal a shift from pure hardware sales toward subscription-based health coaching and premium data analytics services, emphasizing recurring revenue streams and deeper customer engagement. Key manufacturers are aggressively pursuing strategic partnerships with healthcare providers, insurance companies, and corporate wellness programs to embed their devices and data platforms into institutional settings, thereby validating the clinical relevance of wearable-collected data. Competition is intensifying, forcing established technology giants and specialized wearable firms alike to focus heavily on clinical validation and data security compliance, particularly concerning global standards like HIPAA and GDPR, which govern sensitive health information.

Regional trends indicate North America maintaining a strong position due to high consumer purchasing power and proactive regulatory support for digital health innovation, making it a critical market for launching high-end, medically focused devices. Conversely, the Asia Pacific region is poised to become the primary engine for volume growth, fueled by vast population bases, improving internet connectivity, and a growing middle class interested in affordable health monitoring solutions. Segment trends show a clear polarization: the basic, low-cost tracker segment remains robust for entry-level users, while the high-end segment, often hybrid devices or smart rings incorporating advanced sensors (e.g., continuous glucose monitoring integration), is experiencing accelerated growth driven by consumers seeking comprehensive, medical-grade monitoring capabilities that are reliable and non-invasive. The core shift across all segments is the transition from simple activity tracking to predictive diagnostics and personalized health guidance, leveraging machine learning algorithms applied to continuous biometric data.

AI Impact Analysis on Fitness Bands Market

User inquiries regarding Artificial Intelligence (AI) in the Fitness Bands Market predominantly revolve around three key themes: the capability of AI to provide hyper-personalized health insights, the accuracy of predictive diagnostic features, and concerns surrounding data privacy and security when highly sensitive biometric data is processed by complex algorithms. Users are keen to understand how AI transforms raw physiological data (like heart rate variability or sleep cycles) into actionable, clinically relevant advice, moving beyond generic recommendations to truly individualized interventions for fitness, recovery, and early disease detection. There is a high expectation that AI integration will unlock predictive health modeling, allowing devices to alert users to potential health crises (e.g., atrial fibrillation events or elevated stress levels leading to burnout) before symptoms manifest, thereby enhancing the device's value proposition from monitoring to prevention.

The integration of deep learning models and sophisticated AI algorithms is fundamentally reshaping the utility and intelligence of fitness bands. AI engines are crucial for refining sensor data accuracy, compensating for movement artifacts, and providing highly granular analysis of complex physiological states such as sleep stages (REM, deep, light) or recovery status. Furthermore, AI facilitates the development of intelligent coaching platforms embedded within the fitness band ecosystem, offering real-time feedback and dynamic adjustment of workout regimens or nutritional advice based on the user's current physiological readiness. However, the adoption of AI-driven features also introduces regulatory challenges, especially regarding the classification of such devices as medical devices, and necessitates rigorous adherence to data governance policies to maintain consumer trust, particularly concerning the ethical use and anonymization of vast quantities of longitudinal health data collected by these devices.

- Enhanced Data Personalization: AI algorithms analyze thousands of data points to generate highly tailored recommendations for sleep optimization, exercise intensity, and nutritional intake.

- Predictive Health Analytics: Utilizing machine learning to identify subtle patterns indicative of potential health issues, such as early onset cardiac irregularities or respiratory distress, enabling proactive intervention.

- Improved Sensor Accuracy: AI compensates for noise and movement artifacts in raw sensor readings, significantly improving the reliability of metrics like heart rate variability (HRV) and calorie expenditure estimates.

- Automated Behavior Change Coaching: AI platforms provide dynamic, real-time coaching prompts and motivational nudges based on user performance and physiological status.

- Fraud Detection and Data Integrity: AI models are employed to ensure the data collected is authentic and to prevent manipulation or misrepresentation of fitness activities.

DRO & Impact Forces Of Fitness Bands Market

The Fitness Bands Market is strategically influenced by a confluence of powerful Drivers, inherent Restraints, and transformative Opportunities, collectively known as DRO, whose impact forces dictate market direction and saturation. Major drivers include the global push towards preventive healthcare models, driven by escalating healthcare costs and the need for remote patient monitoring (RPM) solutions for chronic diseases. The increasing technological sophistication of sensors—allowing for non-invasive, continuous measurement of crucial biometric indicators—further accelerates adoption. Conversely, market restraints largely center on consumer concerns regarding data privacy, security breaches of sensitive health information, and the regulatory complexities involved in standardizing data formats and ensuring interoperability across different platforms. The high rate of device abandonment, often due to perceived inaccuracy or lack of sustained user engagement after the initial novelty wears off, also presents a significant challenge to market saturation.

Opportunities for growth are concentrated in the clinical and insurance sectors, where validated wearable data can significantly impact risk assessment, premium calculation, and telemedicine integration. The development of specialized fitness bands focusing on niche health requirements, such as fertility tracking, mental health monitoring through biofeedback, or geriatric care, offers substantial avenues for market penetration beyond general wellness. The impact forces show that regulatory standardization (an opportunity) counteracts data security risks (a restraint), while technological advancement (a driver) directly addresses issues of device accuracy. The strongest positive impact force remains the pervasive consumer trend toward self-quantification and digital wellness, ensuring sustained demand for accessible and informative personal health monitoring tools. Successful market navigation requires manufacturers to balance innovative feature integration with robust data protection frameworks, thereby converting market opportunities into sustainable revenue growth while mitigating regulatory and consumer resistance.

Segmentation Analysis

The Fitness Bands Market is meticulously segmented across several critical dimensions, including product type, application, operating system compatibility, distribution channel, and pricing structure, enabling manufacturers to tailor offerings to specific consumer demographics and functional requirements. Product segmentation distinguishes between basic fitness trackers, which offer essential metrics like step count and sleep monitoring, and advanced trackers or hybrid wristbands that incorporate capabilities often found in smartwatches, such as integrated GPS, mobile payment functionality, and sophisticated medical-grade sensors (e.g., ECG). Application segmentation is moving increasingly towards clinical validation, distinguishing between general consumer wellness, which accounts for the largest volume, and specialized medical monitoring applications required for managing specific chronic conditions or participating in clinical trials. The evolution of these segments reflects the market's maturity and its increasing ability to serve both motivational fitness needs and clinical diagnostic requirements effectively.

Distribution channel analysis highlights the increasing dominance of online retail channels, which offer wider product selection, competitive pricing, and direct-to-consumer relationships, contrasting with traditional brick-and-mortar retail that emphasizes immediate availability and tactile product experience. Geographically, the segmentation emphasizes the distinct market maturity and growth dynamics between developed regions, which are saturated with high-end, brand-name devices, and emerging markets, where affordability and basic functionality drive purchasing decisions. Furthermore, the segmentation by operating system (e.g., iOS and Android compatibility) remains critical as seamless integration with the user's primary mobile platform dictates user experience and data synchronization reliability, influencing long-term device retention and customer loyalty, especially in ecosystems dominated by major tech players who control both the wearable hardware and the underlying software platform.

- By Product Type:

- Basic Fitness Trackers (Pedometer, Calorie counter)

- Smart Fitness Bands (Incorporating notifications and advanced sensor fusion)

- Hybrid Wristbands (Blending analog watch aesthetics with digital tracking)

- By Application:

- General Wellness and Fitness (Recreational use)

- Chronic Disease Management (Diabetes, Cardiovascular)

- Sleep Monitoring and Analysis

- Sports Performance and Coaching

- By Compatibility:

- iOS Compatible

- Android Compatible

- Cross-Platform

- By Distribution Channel:

- Online Retail Channels (E-commerce, Company Websites)

- Offline Retail Channels (Specialty Stores, Consumer Electronics Outlets, Pharmacies)

- By Price Range:

- Low-End (Under $50)

- Mid-Range ($50 - $150)

- Premium/High-End (Above $150)

Value Chain Analysis For Fitness Bands Market

The value chain for the Fitness Bands Market is complex, beginning with extensive upstream activities centered on research and development (R&D) and sophisticated component manufacturing. The upstream segment is dominated by specialized suppliers of microprocessors, advanced biometric sensors (e.g., optical PPG sensors, accelerometers, gyroscopes), and high-density, energy-efficient batteries. Intense R&D efforts are focused on miniaturization, improving sensor accuracy in challenging conditions, and extending battery life to enable continuous, multi-day monitoring without interruption. Component sourcing and manufacturing logistics are critical, often involving global supply chains anchored in Asia Pacific, demanding stringent quality control and effective risk management to maintain profitability and meet high-volume production requirements necessary for competitive pricing in a consumer electronics environment.

The core manufacturing and assembly phase transitions into the downstream activities, which are focused on marketing, distribution, and post-sale service. Distribution channels are varied, involving both direct and indirect methods. Direct distribution, predominantly through company-owned e-commerce platforms and physical stores, allows for greater control over branding, pricing, and direct customer feedback acquisition. Indirect channels utilize extensive networks of major consumer electronics retailers, online marketplaces (like Amazon or Alibaba), and specialized sporting goods stores, facilitating broad market reach and localized consumer access. The effectiveness of the downstream segment is highly dependent on strategic marketing campaigns that successfully communicate the health benefits and technological superiority of the devices, moving the product from a general gadget category to a recognized health and wellness tool.

Post-sales service and software support constitute a crucial part of the value chain, particularly the continuous development and updates of the companion applications and cloud platforms that process the collected data. This software ecosystem creates significant value by transforming raw data into meaningful health insights and personalized recommendations, thereby fostering sustained user engagement and loyalty. Successful value chain management requires robust coordination between hardware design, software development, and efficient global distribution logistics, coupled with a strong emphasis on cybersecurity measures to protect the sensitive health data being collected, ensuring compliance with global data protection regulations and sustaining consumer trust in the digital health ecosystem supported by the fitness bands.

Fitness Bands Market Potential Customers

Potential customers for the Fitness Bands Market are highly diversified, extending far beyond the initial target segment of young, tech-savvy fitness enthusiasts to include substantial demographic groups interested in chronic disease management and preventive aging. The core user base remains individuals focused on quantifying their performance, optimizing workouts, and tracking general wellness metrics such as daily step count and sleep quality. This segment values features such as ruggedness, aesthetic design, and deep integration with existing fitness applications. However, significant growth potential lies in the older adult population and individuals managing specific chronic health conditions. These end-users are primarily driven by the need for simplified, reliable monitoring tools that can provide longitudinal data for physician review, aiding in the management of conditions like hypertension, diabetes, and certain cardiovascular risks, making the clinical accuracy and regulatory approval of the devices paramount.

A rapidly growing segment comprises corporate wellness programs and health insurance providers who leverage fitness bands to incentivize healthy behavior, monitor employee fitness levels, and potentially reduce long-term healthcare claims. In this institutional context, the buyers are organizations seeking scalable, secure data platforms and devices capable of anonymous group-level data aggregation and reporting. Furthermore, clinical researchers and pharmaceutical companies represent a niche but high-value customer group, utilizing medical-grade fitness bands for remote data collection in clinical trials, offering continuous and unbiased physiological data points that traditional episodic clinical visits cannot capture. These diverse buyer needs dictate the necessity for a wide range of product offerings, from low-cost, high-volume trackers for corporate wellness initiatives to highly certified, specialized devices for medical applications, showcasing the market's breadth across consumer, corporate, and clinical sectors.

The evolution of feature sets, particularly the integration of medical-grade sensors and AI-driven predictive analytics, continuously expands the end-user base. Buyers are increasingly seeking devices that seamlessly integrate health tracking into daily life without requiring significant manual input or complex operation. Key buying criteria across all segments include long battery life, reliable sensor accuracy, data security assurance, and user-friendly software interfaces. The shift in buyer motivation from simple curiosity to essential health management tools underscores the long-term sustainability and projected growth within the specialized healthcare applications of fitness bands, positioning them as essential personal diagnostic tools rather than mere consumer electronics gadgets.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 18.5 Billion |

| Market Forecast in 2033 | USD 51.3 Billion |

| Growth Rate | 15.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Apple Inc., Xiaomi Corporation, Fitbit (Google LLC), Huawei Technologies Co. Ltd., Samsung Electronics Co. Ltd., Garmin Ltd., Huami Corporation (Zepp Health), Fossil Group Inc., Oura Health Oy, WHOOP Inc., Polar Electro, Misfit, Withings, Razer Inc., GOQii, Suunto, LENOVO, HONOR, TomTom International, Coros Global. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fitness Bands Market Key Technology Landscape

The technological landscape of the Fitness Bands Market is fundamentally defined by advancements in sensor integration, ultra-low power consumption components, and sophisticated data processing platforms. At the core are multi-sensor arrays, including highly accurate Photoplethysmography (PPG) sensors for continuous heart rate monitoring and blood oxygen saturation (SpO2), micro-electromechanical systems (MEMS) accelerometers and gyroscopes for motion tracking, and bioimpedance sensors for body composition analysis and potentially continuous glucose monitoring (CGM) through non-invasive techniques. The ongoing miniaturization of these components allows for slimmer, more aesthetically pleasing form factors without compromising measurement reliability. A key technological focus is enhancing the signal-to-noise ratio in sensor readings, particularly during high-intensity activity, often achieved through advanced sensor fusion algorithms that combine inputs from multiple sources to derive more accurate physiological metrics and reduce error rates associated with user movement.

Connectivity and battery technology represent the secondary pillars supporting the market's evolution. Bluetooth Low Energy (BLE) remains the standard for device-to-smartphone communication, optimized for minimal power draw while ensuring high-speed data transfer necessary for continuous logging. Furthermore, the development of high-density lithium-ion and solid-state batteries, coupled with highly optimized system-on-chip (SoC) architectures, has extended battery life from days to weeks, significantly addressing a major consumer pain point and enabling continuous, overnight tracking crucial for accurate sleep and recovery analysis. Data processing technology is rapidly moving from local device computation to cloud-based AI analytics, where vast datasets are utilized to refine algorithms, offering users more personalized and predictive insights compared to simple threshold alerts or predefined reports generated solely on the device.

Emerging technologies, such as advanced haptic feedback systems, flexible display materials, and seamless integration with ambient computing environments (smart homes, connected cars), are defining the next generation of fitness bands. Emphasis is also placed on creating software ecosystems that prioritize open standards and interoperability, allowing user data to be easily shared with certified healthcare providers or third-party wellness applications, subject to robust consumer consent protocols. Furthermore, advancements in specialized materials, particularly hypoallergenic polymers and advanced coatings, ensure comfort and durability, enhancing the appeal of 24/7 wear. This continuous technological arms race, centered on accuracy, longevity, and software intelligence, is crucial for market players seeking a competitive edge and validating their devices for increasingly stringent clinical applications.

Regional Highlights

The global Fitness Bands Market exhibits distinct growth patterns and maturity levels across key geographical regions, influenced by economic development, healthcare infrastructure, and cultural adoption rates of wearable technology. North America, encompassing the United States and Canada, currently holds the largest market share in terms of revenue, driven by high disposable incomes, early adoption of cutting-edge consumer electronics, and a strong presence of key industry players and aggressive marketing campaigns promoting digital health solutions. The region benefits from proactive corporate wellness programs and significant investments in health tech startups, fostering an environment where advanced, high-end fitness bands with medical certifications (e.g., FDA clearance for ECG features) command premium prices and gain rapid market acceptance, particularly in the realm of remote patient monitoring.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is attributable to rapid urbanization, increasing health awareness among the burgeoning middle class in countries like China, India, and Southeast Asia, and the availability of cost-effective devices manufactured locally. The high prevalence of lifestyle diseases, coupled with substantial government investments in digital healthcare infrastructure, creates a massive addressable market. While the average selling price of fitness bands in APAC is generally lower than in North America, the sheer volume of sales, particularly through online distribution channels, ensures exponential market expansion, focusing initially on basic tracking capabilities before transitioning to more advanced, medically oriented features as consumer demand matures.

Europe represents a mature and highly regulated market, where penetration is high, but growth is tempered by stringent regulatory requirements, especially the General Data Protection Regulation (GDPR), which demands meticulous data security and privacy compliance from manufacturers. Western European countries like Germany, the UK, and France are strong adopters, driven by public health initiatives and aging populations prioritizing proactive health management. The focus in Europe tends toward integration with existing national healthcare systems and devices that can prove long-term effectiveness and clinical reliability. Latin America and the Middle East and Africa (MEA) currently represent smaller market shares but are projected to see accelerated growth as digital infrastructure improves, internet access expands, and local economic conditions facilitate higher consumer spending on digital health products, with basic activity tracking and affordable entry-level models dominating initial adoption phases.

- North America: Market leader in revenue; characterized by high consumer spending, early adoption of clinically validated features, and strong integration into the healthcare reimbursement system.

- Asia Pacific (APAC): Highest growth rate; driven by population size, affordability focus, rising health awareness, and urbanization in developing economies.

- Europe: Mature market focusing on regulatory compliance (GDPR), integration with public healthcare systems, and high demand for reliable, aesthetic devices.

- Latin America (LATAM): Emerging market with increasing demand driven by rising internet penetration and improving access to imported consumer electronics.

- Middle East and Africa (MEA): Growth centered on urban centers and Gulf nations, primarily adopting premium devices for corporate wellness and general fitness monitoring.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fitness Bands Market.- Apple Inc.

- Xiaomi Corporation

- Fitbit (Google LLC)

- Huawei Technologies Co. Ltd.

- Samsung Electronics Co. Ltd.

- Garmin Ltd.

- Huami Corporation (Zepp Health)

- Fossil Group Inc.

- Oura Health Oy

- WHOOP Inc.

- Polar Electro

- Misfit

- Withings

- Razer Inc.

- GOQii

- Suunto

- LENOVO

- HONOR

- TomTom International

- Coros Global

Frequently Asked Questions

Analyze common user questions about the Fitness Bands market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth trajectory for the Fitness Bands Market?

The market is projected to expand significantly, reaching an estimated USD 51.3 Billion by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of 15.8%. This growth is primarily fueled by the accelerating integration of medical-grade sensors and AI-driven personalized health analytics.

How is AI transforming the utility of fitness bands beyond basic tracking?

AI integration is moving fitness bands toward predictive health modeling, enhancing sensor accuracy by filtering noise, and providing highly individualized coaching and diagnostic insights regarding sleep quality, stress levels, and potential cardiac irregularities.

What are the primary challenges restraining market growth?

Key challenges include significant consumer apprehension regarding data privacy and the security of sensitive biometric data, regulatory complexities concerning medical device classification, and the high rate of long-term device abandonment due to user disengagement.

Which geographical region is expected to lead market growth in terms of volume?

The Asia Pacific (APAC) region is forecasted to exhibit the highest volume growth velocity, driven by large population bases, rapid urbanization, increasing health awareness initiatives, and the competitive availability of affordable, feature-rich fitness bands.

What critical technologies are defining the next generation of fitness bands?

The next generation is defined by high-accuracy multi-sensor arrays (e.g., advanced PPG, non-invasive CGM feasibility), ultra-low power consumption architectures (extending battery life), and highly specialized AI algorithms for generating clinical-grade, actionable health insights.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager