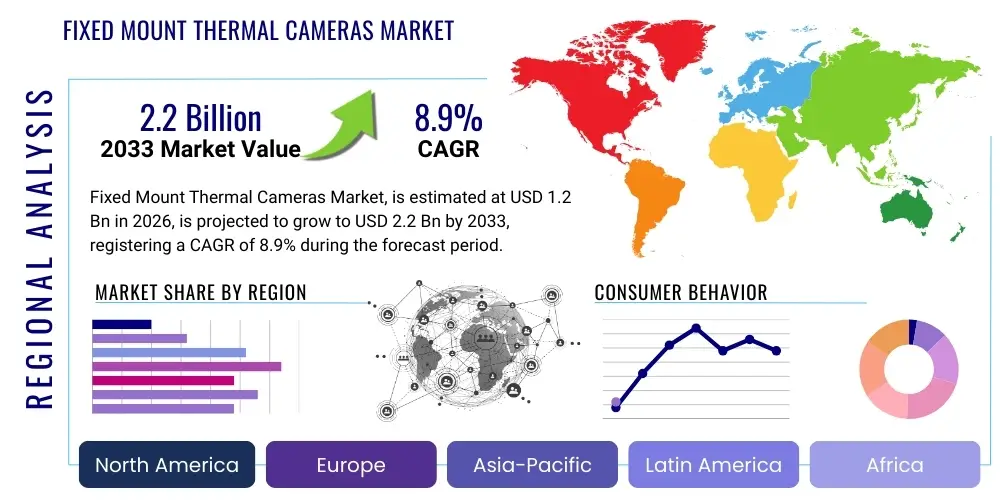

Fixed Mount Thermal Cameras Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438092 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fixed Mount Thermal Cameras Market Size

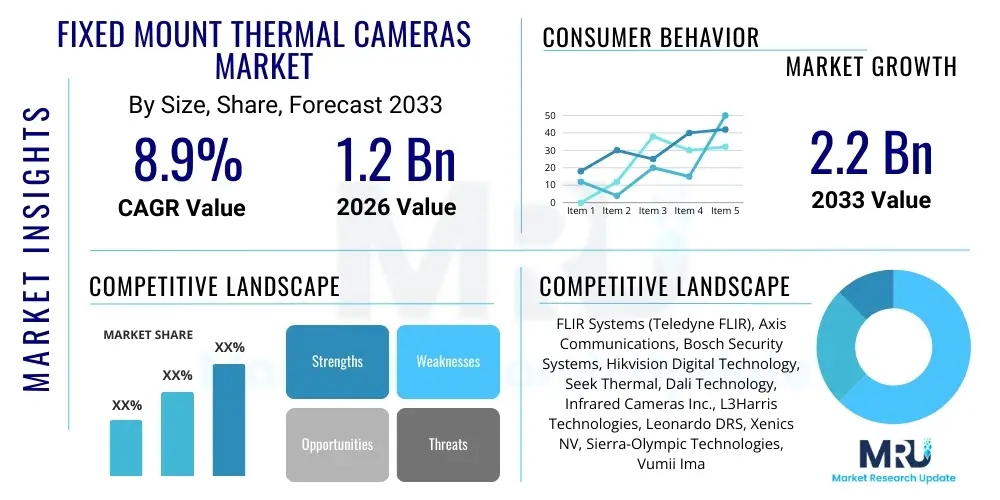

The Fixed Mount Thermal Cameras Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.9% between 2026 and 2033. The market is estimated at $1.2 Billion in 2026 and is projected to reach $2.2 Billion by the end of the forecast period in 2033.

Fixed Mount Thermal Cameras Market introduction

The Fixed Mount Thermal Cameras Market encompasses advanced imaging solutions designed for permanent installation in critical infrastructure, industrial environments, and security systems. These cameras utilize infrared technology to detect heat signatures, providing visual data regardless of ambient light conditions, making them indispensable for 24/7 monitoring, predictive maintenance, and sophisticated surveillance applications. Their rugged design and integration capabilities allow them to operate reliably in harsh environments, from offshore platforms and power plants to military installations and perimeter security systems. The core appeal lies in their ability to provide proactive insights into equipment health and detect anomalies like elevated temperatures or unauthorized intrusions.

Product descriptions typically emphasize high resolution, sensitivity (low Noise Equivalent Temperature Difference - NETD), and integration standards (such as ONVIF compliance for networking). Major applications span across industrial automation for monitoring high-temperature processes, fire detection and prevention in large facilities, and critical infrastructure protection, including electrical substations and nuclear facilities. The primary benefits derived from these systems include enhanced operational safety, reduced downtime through early fault detection, and superior situational awareness compared to traditional visible light cameras.

Driving factors for sustained market growth are fundamentally linked to increasing global security concerns, stringent industrial safety regulations, and the rapid adoption of Industry 4.0 principles, which demand continuous, automated monitoring of assets. Furthermore, technological advancements in uncooled microbolometer sensors are making high-performance thermal imaging more accessible and affordable, thereby expanding the market reach into commercial and smaller industrial applications that previously relied solely on portable or less sophisticated systems. The necessity for reliable, non-contact temperature measurement in complex processes is further solidifying the market's trajectory.

Fixed Mount Thermal Cameras Market Executive Summary

The Fixed Mount Thermal Cameras Market is experiencing robust expansion, driven primarily by strong business trends focusing on digitalization and predictive maintenance across critical industries. Key business trends include the increasing integration of thermal cameras with sophisticated video management systems (VMS) and cloud-based analytics platforms, enabling remote diagnostics and centralized monitoring of global assets. Furthermore, the defense sector remains a significant consumer, necessitating high-specification, ruggedized cameras for border surveillance and tactical operations, ensuring sustained investment in high-end cooled camera technology. The shift toward subscription-based software services accompanying the hardware purchase is also a growing trend, providing recurring revenue streams for market players.

Regionally, North America maintains market dominance due to high defense spending, established stringent safety standards, particularly in the oil and gas sector, and the presence of major technological innovators. However, the Asia Pacific (APAC) region is projected to exhibit the highest growth rate, fueled by rapid industrialization, extensive smart city initiatives, and substantial investment in manufacturing and energy infrastructure, particularly in countries like China, India, and South Korea. Europe remains a mature market, emphasizing industrial process control and environmental monitoring compliance, driven by EU directives on industrial emissions and safety protocols.

Segment-wise, the uncooled camera segment is forecast to dominate the volume, benefiting from lower costs and sufficient performance for most commercial security and industrial monitoring tasks. Conversely, the cooled camera segment, despite its higher price point, will lead in value growth in specialized fields like long-range surveillance and advanced military targeting systems, where high sensitivity and rapid frame rates are non-negotiable. End-user segmentation shows that the industrial sector (including manufacturing and utilities) holds the largest market share, consistently requiring reliable temperature monitoring for quality assurance and safety compliance, followed closely by the burgeoning infrastructure protection segment.

AI Impact Analysis on Fixed Mount Thermal Cameras Market

User inquiries concerning the impact of Artificial Intelligence (AI) on the Fixed Mount Thermal Cameras Market frequently center around automated anomaly detection, false alarm reduction, and the enhancement of thermal data interpretation. Users are keen to understand how AI-driven analytics can transform raw thermal footage into actionable intelligence, moving beyond simple temperature thresholds to contextual pattern recognition. Concerns often relate to the computational requirements for processing high-resolution thermal data at the edge and ensuring the reliability of automated decision-making in critical environments like fire detection or equipment failure prediction. Expectations are high regarding AI's ability to personalize monitoring profiles for specific assets and significantly reduce the operational burden on security and maintenance staff.

The integration of AI is transitioning fixed mount thermal cameras from mere data collection tools into sophisticated, intelligent sensors. AI algorithms, particularly deep learning models, enable the camera systems to accurately classify objects (humans, vehicles, specific equipment) even in challenging conditions like heavy fog or complete darkness, significantly enhancing perimeter security effectiveness. Furthermore, AI facilitates predictive maintenance by establishing baselines of normal operational heat signatures; any subtle deviation from these learned norms triggers an immediate, highly specific alert, thereby preventing catastrophic failures and optimizing maintenance schedules, leading to significant cost savings.

This intelligent processing at the edge—where AI models are embedded directly within the camera hardware—minimizes bandwidth requirements and allows for near-instantaneous decision-making, crucial for high-speed industrial processes and immediate threat response. AI is thus not only refining the functionality of existing thermal camera applications but is also unlocking entirely new uses, such as advanced behavioral analysis in public spaces or detailed energy efficiency audits by mapping thermal loss patterns within buildings with unprecedented accuracy, ensuring the market remains dynamic and highly capable.

- AI-driven automated anomaly detection for predictive maintenance.

- Significant reduction in false alarms through intelligent object recognition and classification.

- Enhanced situational awareness by fusing thermal data with visible light and metadata.

- Implementation of edge computing for real-time processing and immediate alerts.

- Optimized resource allocation based on AI-predicted failure probabilities.

- Advanced tracking and behavioral analysis in complex surveillance scenarios.

DRO & Impact Forces Of Fixed Mount Thermal Cameras Market

The Fixed Mount Thermal Cameras Market is substantially influenced by a convergence of strong drivers, significant restraints, and clear opportunities that collectively shape its trajectory and impact forces. The primary drivers include the escalating need for robust security systems globally, particularly for critical infrastructure like airports, borders, and energy grids, coupled with increasingly stringent industrial safety regulations requiring non-contact temperature monitoring in manufacturing and processing plants. These drivers create a sustained, non-negotiable demand base for reliable 24/7 thermal monitoring solutions. However, the market faces restraints such as the relatively high initial capital expenditure required for high-resolution and specialized cooled thermal cameras, which can limit adoption among small and medium-sized enterprises (SMEs). Furthermore, the necessity for specialized training for maintenance personnel to accurately interpret and manage thermal data acts as a secondary barrier to widespread adoption, particularly in emerging economies.

Opportunities for growth are predominantly centered around technological evolution, specifically the advent of low-cost, high-performance uncooled microbolometers that democratize access to thermal technology. Additionally, the growing trend of integrating thermal cameras with Internet of Things (IoT) ecosystems and edge computing provides opportunities for enhanced data processing and remote management, boosting system efficiency and utility. The expansion into new applications, such as drone-mounted inspection systems communicating with fixed ground cameras and leveraging machine learning for environmental monitoring, presents untapped revenue streams. These opportunities often counterbalance the cost restraints by providing a higher, demonstrable return on investment (ROI) through prevented downtime and enhanced security.

The key impact forces driving market development are technological innovation in sensor materials, particularly the shift towards Vanadium Oxide (VOx) and amorphous silicon (a-Si) detectors for uncooled options, and geopolitical stability which directly influences defense spending and infrastructure protection investments. The market also feels the force of standardization efforts, specifically the push for greater interoperability between different camera brands and VMS platforms, which simplifies deployment and integration for end-users. Regulatory adherence acts as a positive impact force, ensuring consistent demand for certified and reliable thermal monitoring solutions across critical industries globally, forcing manufacturers to maintain high quality and performance standards.

Segmentation Analysis

The Fixed Mount Thermal Cameras Market is structurally segmented based on crucial attributes including technology, resolution, application, and end-user, enabling a granular understanding of market dynamics and targeted deployment strategies. Technology segmentation differentiates between Cooled and Uncooled thermal cameras, with the latter dominating due to cost-effectiveness and zero-maintenance requirements, while the former caters to high-performance, long-range, and scientific applications demanding high sensitivity. Resolution segmentation involves VGA and higher resolutions, which are increasingly adopted for large area coverage and detailed object recognition, contrasting with lower resolutions used for basic spot-checking and short-range security.

Application segmentation reveals key deployment areas such as Industrial Process Monitoring, Surveillance and Security, Fire Detection, and Measurement & Testing. Surveillance and Security consistently capture the largest market share, driven by rising perimeter protection needs. End-user analysis provides insights into the primary purchasing sectors: Defense and Military, Industrial (including Oil & Gas, Power Generation), Commercial (Retail, Datacenters), and Government & Infrastructure. Each end-user segment has unique requirements regarding temperature range, environmental ruggedness, and integration complexity, influencing manufacturer specialization.

This structured segmentation allows market participants to tailor their offerings, focusing either on the mass-market, high-volume uncooled industrial cameras or the high-margin, specialized cooled cameras required by defense contractors and advanced research facilities. The industrial process monitoring segment, specifically, is seeing rapid expansion as automation increases the need for continuous, non-contact temperature checks to ensure product quality and prevent equipment overheating, showcasing a high-growth niche within the broader market structure.

- By Technology:

- Cooled Fixed Mount Thermal Cameras

- Uncooled Fixed Mount Thermal Cameras

- By Resolution:

- Below 320x240

- 320x240 to 640x480 (VGA)

- Above 640x480 (HD and higher)

- By Application:

- Industrial Process Monitoring (Condition Monitoring, QA/QC)

- Surveillance and Security (Perimeter Protection, Border Control)

- Fire Detection and Prevention

- Measurement and Testing

- Automotive Night Vision Testing

- By End-User:

- Defense and Military

- Industrial Sector (Oil & Gas, Manufacturing, Power Generation)

- Commercial (Data Centers, Logistics, Retail)

- Government and Public Infrastructure (Transportation, Utilities)

Value Chain Analysis For Fixed Mount Thermal Cameras Market

The value chain for the Fixed Mount Thermal Cameras Market begins with intensive upstream activities focused on research and development (R&D) and the procurement of highly specialized components, most notably the infrared sensor arrays (microbolometers or detector engines) and precision optics (Germanium lenses). Upstream analysis reveals a high degree of consolidation among sensor manufacturers, as technological expertise and fabrication complexity create significant entry barriers. Key sensor suppliers, often vertically integrated with camera manufacturers, dictate pricing and supply stability for the entire market. The quality and performance of these core components are paramount, impacting the final camera's sensitivity (NETD) and resolution, which are critical competitive differentiators.

The midstream focuses on manufacturing and assembly, where raw sensors are integrated with processing electronics, housing, and software. Leading manufacturers invest heavily in advanced calibration and quality control procedures to ensure accuracy and compliance with military and industrial standards. Distribution channels are varied, incorporating both direct and indirect sales models. Direct sales are common for large-scale governmental or defense contracts, where detailed customization and specialized integration services are required. Indirect channels, involving system integrators, value-added resellers (VARs), and authorized distributors, handle the majority of commercial and smaller industrial sales, offering localized support and complex system integration services.

Downstream analysis centers on installation, system integration, and post-sales support, crucial elements influencing customer satisfaction and long-term deployment success. Fixed mount cameras require professional installation and configuration to ensure optimal field-of-view and accurate calibration within the operational environment. Post-sales services, including software updates, calibration checks, and preventive maintenance contracts, contribute significantly to the total lifetime value. Effective downstream partners are essential for leveraging the full potential of these advanced monitoring tools, often integrating the thermal camera feed into a client’s existing security or asset management platform, ensuring seamless data flow and maximizing system ROI.

Fixed Mount Thermal Cameras Market Potential Customers

Potential customers for fixed mount thermal cameras are concentrated in sectors that require continuous, non-contact monitoring of heat signatures for safety, security, and operational efficiency, driven by high-value assets or critical safety requirements. The largest segment of end-users are the Industrial entities, particularly those within the Oil and Gas, Petrochemical, and Power Generation industries. These buyers utilize thermal cameras extensively for monitoring pipe work, vessel levels, flare stacks, and electrical switchgear to detect hot spots and impending equipment failure before catastrophic events occur. Their purchasing decisions are often based on reliability, integration compatibility with SCADA systems, and compliance with rigorous industrial safety standards like NFPA and OSHA.

The second major cohort comprises Government and Infrastructure entities, including national defense agencies, border protection services, maritime organizations, and operators of critical public infrastructure such as dams, bridges, and transportation hubs. These customers demand long-range surveillance capabilities, high mean time between failures (MTBF), and often require cooled thermal cameras for military and long-range security applications. For these segments, the camera’s ability to provide clear imagery in all weather and light conditions is paramount, making thermal imaging a foundational element of their layered security architecture.

Furthermore, the Commercial sector, encompassing large data centers, warehouse logistics, and advanced manufacturing facilities (e.g., semiconductor production), represents a rapidly growing customer base. Data centers, for example, use fixed thermal cameras to monitor server racks and power distribution units for localized overheating, ensuring continuous operation and preventing costly downtime. These commercial buyers prioritize ease of installation, network scalability, and the camera's ability to integrate with AI-powered analytics to automate condition monitoring and optimize facility management protocols efficiently.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.2 Billion |

| Market Forecast in 2033 | $2.2 Billion |

| Growth Rate | 8.9% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | FLIR Systems (Teledyne FLIR), Axis Communications, Bosch Security Systems, Hikvision Digital Technology, Seek Thermal, Dali Technology, Infrared Cameras Inc., L3Harris Technologies, Leonardo DRS, Xenics NV, Sierra-Olympic Technologies, Vumii Imaging, Thermoteknix Systems, Guide Infrared, Hanwha Vision, Iray Technology, Bullard, Optris GmbH, Testo SE & Co. KGaA, Opgal Optronic Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fixed Mount Thermal Cameras Market Key Technology Landscape

The technology landscape of the Fixed Mount Thermal Cameras Market is defined by continuous improvements in sensor technology, digital processing capabilities, and data integration platforms. The foundational technology remains the infrared sensor, categorized primarily into Cooled and Uncooled variants. Cooled cameras, typically based on materials like Mercury Cadmium Telluride (MCT) or Indium Antimonide (InSb), offer superior sensitivity, higher frame rates, and the ability to detect minute temperature differences over extremely long distances. They require active cooling mechanisms (like Stirling coolers), contributing to their higher cost and complexity, making them essential for high-end defense and scientific applications where performance is non-negotiable.

The dominant technological shift lies within Uncooled thermal cameras, utilizing Microbolometers made of Vanadium Oxide (VOx) or Amorphous Silicon (a-Si). Recent advancements have dramatically lowered the Noise Equivalent Temperature Difference (NETD) for uncooled sensors, pushing their performance closer to that of older cooled systems while significantly reducing size, weight, power, and cost (SWaP). This technological leap has expanded the market accessibility, enabling deployment in commercial security and routine industrial inspection tasks. Manufacturers are focusing on reducing pixel pitch (e.g., from 17 microns down to 12 microns or less), allowing higher resolution imaging in physically smaller camera bodies, enhancing versatility and discreet installation options.

Beyond the sensor itself, crucial technological developments include the proliferation of intelligent imaging processors. These processors facilitate on-board video analytics, enabling functionalities like automatic target detection, fire classification, and temperature deviation alarming without relying solely on centralized servers. Furthermore, spectral filtering techniques are advancing, allowing cameras to isolate specific thermal signatures or gases for specialized industrial monitoring applications. The widespread adoption of standardized network protocols (such as IP, PoE+, and RTSP/ONVIF) ensures seamless integration of these sophisticated thermal sensors into existing networked security and automation infrastructure, fostering greater ease of deployment and system scalability across diverse industrial and commercial environments globally.

Regional Highlights

Regional dynamics play a crucial role in shaping the demand and technological adoption within the Fixed Mount Thermal Cameras Market, reflecting differences in security spending, industrial maturity, and regulatory frameworks.

- North America (NA): NA represents the largest market share, characterized by high defense budgets, advanced technological adoption, and stringent regulations governing industrial safety, particularly within the vast Oil & Gas and Power Generation sectors. The US Department of Defense and homeland security agencies are primary drivers for high-performance cooled camera systems. Furthermore, early adoption of AI and edge computing solutions for surveillance significantly boosts market maturity.

- Europe: Europe holds a significant market share, driven primarily by industrial automation standards and strong regulatory emphasis on worker safety and environmental monitoring (e.g., detecting methane leaks). Countries like Germany and the UK show high demand for process monitoring cameras, while Eastern European nations are increasing investments in border control and infrastructure protection, leading to steady, sustained growth focused on quality and compliance.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, fueled by massive investments in new manufacturing infrastructure, smart city development, and critical infrastructure projects (e.g., electrical grids and transportation networks). Rapid industrialization in China and India creates explosive demand for cost-effective uncooled cameras for commercial security and fire prevention. Government spending on public safety and surveillance systems also contributes significantly to market expansion.

- Latin America (LATAM): The LATAM market is growing steadily, primarily focused on securing resource extraction sites (mining, oil production) and large agricultural operations. Demand here is often tied to securing long perimeters and monitoring remote facilities, where thermal cameras provide essential monitoring capability despite limited infrastructure presence. Economic stability and governmental focus on reducing illicit activities are key growth determinants.

- Middle East and Africa (MEA): MEA is a high-value market, heavily concentrated around the Gulf Cooperation Council (GCC) states. Demand is dominated by massive investments in critical national infrastructure, oil and gas processing plants, and military procurement. The need for robust perimeter security around high-value assets in potentially volatile geopolitical regions ensures continued high demand for advanced, ruggedized fixed mount thermal systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fixed Mount Thermal Cameras Market.- FLIR Systems (Teledyne FLIR)

- Axis Communications

- Bosch Security Systems

- Hikvision Digital Technology

- Seek Thermal

- Dali Technology

- Infrared Cameras Inc.

- L3Harris Technologies

- Leonardo DRS

- Xenics NV

- Sierra-Olympic Technologies

- Vumii Imaging

- Thermoteknix Systems

- Guide Infrared

- Hanwha Vision

- Iray Technology

- Bullard

- Optris GmbH

- Testo SE & Co. KGaA

- Opgal Optronic Industries

Frequently Asked Questions

Analyze common user questions about the Fixed Mount Thermal Cameras market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between Cooled and Uncooled Fixed Mount Thermal Cameras?

Cooled cameras use cryocoolers to significantly lower the sensor temperature, resulting in extremely high sensitivity (lower NETD), higher resolution, and longer detection ranges, typically used for defense and long-range surveillance. Uncooled cameras, based on microbolometers, are smaller, cheaper, maintenance-free, and suitable for most industrial monitoring and short-to-mid-range commercial security applications.

How is AI impacting the performance and utility of these thermal systems?

AI is integrated into fixed thermal cameras to enable sophisticated on-board analytics, dramatically reducing false alarms by accurately classifying heat sources (e.g., distinguishing between an animal and a human). AI also facilitates predictive maintenance by identifying subtle, learned deviations from normal operating temperatures, automating condition monitoring in industrial settings.

Which industrial sectors are the largest adopters of fixed thermal cameras?

The largest industrial adopters are the Oil and Gas, Petrochemical, and Power Generation sectors. These industries rely heavily on fixed thermal cameras for continuous condition monitoring of critical infrastructure like electrical substations, pipelines, and process control equipment, where detecting heat anomalies is crucial for safety and preventing costly operational downtime.

What are the key technical specifications to consider when purchasing a fixed thermal camera?

Key specifications include the detector resolution (higher resolution offers greater detail), the Noise Equivalent Temperature Difference (NETD, lower values indicate higher sensitivity), the Field of View (FOV) determined by the lens, and the integration compatibility with existing network infrastructure and VMS platforms (e.g., ONVIF compliance and PoE+ support).

Is the integration of fixed thermal cameras with visible light cameras common?

Yes, thermal/visible camera fusion is increasingly common and highly desirable, particularly in security and surveillance applications. This technology combines the thermal camera’s ability to see in total darkness with the visible camera’s high-definition detail for identification and verification, resulting in superior situational awareness and more robust monitoring capabilities.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager