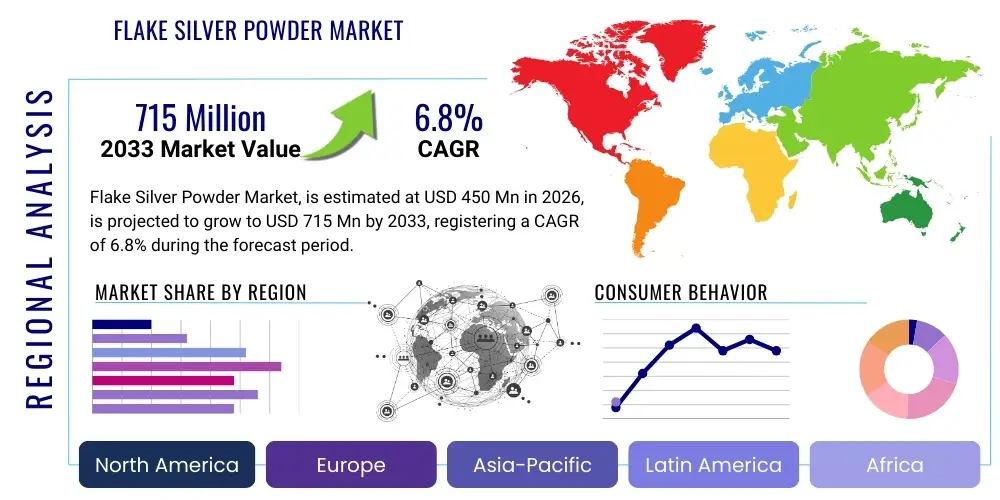

Flake Silver Powder Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437122 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Flake Silver Powder Market Size

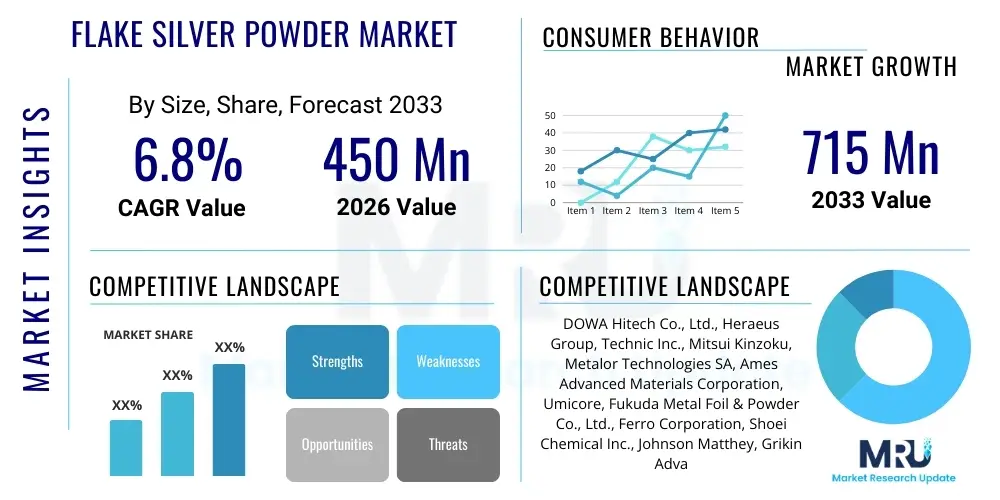

The Flake Silver Powder Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 715 Million by the end of the forecast period in 2033.

Flake Silver Powder Market introduction

The Flake Silver Powder (FSP) market encompasses the specialized production and distribution of micro and nano-sized silver particles characterized by a flattened, flake-like morphology, crucial for achieving superior conductivity and density in electronic formulations. This unique morphology ensures optimal particle-to-particle contact, minimizing electrical resistance when incorporated into conductive inks, pastes, and epoxies. Flake silver powder serves as a foundational material in the fabrication of essential electronic components, enabling high-performance circuitry and efficient thermal management systems across diverse sectors. The stringent purity requirements and control over particle size distribution (PSD) are paramount, driving continuous innovation in synthesis methods to meet the evolving demands of miniaturization and complex substrate adherence.

Major applications of flake silver powder are predominantly concentrated within the electronics industry, particularly in thick film conductive pastes utilized for manufacturing multilayer ceramic capacitors (MLCCs), printed circuit boards (PCBs), and RFID antennas. Furthermore, the solar energy sector represents a significant consumer, where FSP is critical for creating front-side and back-side electrodes in photovoltaic (PV) cells, maximizing energy harvesting efficiency. The primary benefits derived from using FSP include exceptional electrical and thermal conductivity, excellent resistance to migration, and long-term reliability under varying environmental stresses, making it indispensable for high-reliability applications such as automotive electronics and medical devices.

The market is primarily driven by the escalating demand for advanced consumer electronics, particularly smartphones and wearables, which necessitate ever-smaller components and high-density packaging (HDP). The global rollout of 5G technology, requiring complex filtering systems and high-frequency capabilities, further fuels the consumption of high-purity silver pastes. Moreover, the accelerating adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS) relies heavily on reliable silver-based components for sensors and power electronics, establishing a stable and growing demand trajectory for specialized flake silver powder products throughout the forecast period.

Flake Silver Powder Market Executive Summary

The Flake Silver Powder market demonstrates robust growth, chiefly propelled by significant technological shifts across the automotive, telecommunications, and solar power industries. Business trends indicate a strategic focus on vertical integration among key producers, aiming to mitigate the volatility associated with raw silver pricing and secure specialized intellectual property related to nano-flaking processes. Companies are increasingly investing in proprietary surface treatment chemistries to enhance the printability and sintering kinetics of their powder offerings, catering specifically to advanced manufacturing techniques like jet printing and additive manufacturing. Consolidation activities, particularly in Asia Pacific, reflect the necessity for economies of scale and control over high-volume, cost-competitive production lines, solidifying the global oligopoly structure.

Regional trends highlight the Asia Pacific (APAC) region, dominated by China, Japan, South Korea, and Taiwan, as the undisputed global manufacturing hub, commanding the largest market share due to its established ecosystem for electronics fabrication and photovoltaic cell production. While APAC drives volume, North America and Europe maintain critical relevance through concentrated research and development activities, focusing on high-end, niche applications such as aerospace electronics, medical implants, and defense components, which require ultra-high purity and customized particle metrics. The imposition of stricter environmental regulations in Western markets is also influencing manufacturers to develop solvent-free and low-temperature sintering silver paste formulations, pushing the boundaries of material science.

Segmentation trends reveal a strong shift toward the nano-flake segment, driven by the push for circuit miniaturization and enhanced flexibility in printed electronics, although micro-flake silver powder remains dominant in established thick film applications and solar panel production due to its cost efficiency and ease of handling. Within applications, conductive pastes and inks continue to be the primary revenue generators, but the solar segment, particularly high-efficiency passivated emitter rear cell (PERC) and heterojunction technology (HJT) cells, is exhibiting the fastest growth due to global renewable energy mandates. Success in this evolving market hinges on a producer's ability to offer powders with precise aspect ratios and narrow size distributions tailored to specific printing technologies, ranging from screen printing to aerosol jet printing.

AI Impact Analysis on Flake Silver Powder Market

User inquiries regarding the influence of Artificial Intelligence (AI) on the Flake Silver Powder market primarily center on optimization, predictive capabilities, and material innovation. Key themes include how AI can reduce manufacturing defects, improve the complex synthesis process of silver flakes, and potentially predict future demand and supply chain risks associated with precious metal procurement. Users also express curiosity about AI's role in accelerating the discovery of new silver-based composite materials or substitution alternatives, fearing that enhanced material science modeling might lead to obsolescence for certain traditional FSP products. The overarching expectation is that AI integration will lead to higher material consistency, lower production costs, and a significant acceleration in research and development cycles, particularly concerning the relationship between particle morphology and final electronic performance.

The integration of machine learning algorithms within production environments allows manufacturers to analyze vast datasets pertaining to temperature controls, chemical concentrations, and mixing rates during the chemical reduction process, which is notoriously sensitive to variability. By applying predictive maintenance and optimization routines, AI systems can fine-tune reaction parameters in real-time, resulting in a more uniform particle size distribution and aspect ratio, directly improving the powder's performance in high-precision printing applications. This advancement addresses a core concern of end-users: the variability in batch quality, ensuring that conductive pastes maintain consistent rheology and sintering characteristics.

Furthermore, in the application domain, AI is instrumental in simulating the performance of silver pastes on various substrates and under different environmental conditions, reducing the need for extensive physical prototyping. Generative design tools driven by AI are beginning to assist researchers in modeling novel surface treatments or stabilizing agents for silver flakes, crucial for preventing oxidation and improving dispersion stability in ink formulations. This systematic, data-driven approach to materials science significantly accelerates time-to-market for specialized FSP products tailored for next-generation flexible and stretchable electronic devices, fundamentally changing the pace of innovation within the sector.

- AI-driven optimization of chemical synthesis parameters, leading to highly controlled particle size distribution (PSD) and aspect ratio.

- Predictive modeling for raw silver price volatility and supply chain disruption mitigation, enhancing procurement strategies.

- Automated quality control systems using image recognition to instantly detect morphological defects in silver flakes, ensuring batch consistency.

- Machine learning algorithms accelerating the R&D cycle for novel silver composite materials and advanced surface passivation techniques.

- Optimization of conductive paste formulation rheology based on AI simulations, improving printing efficiency and reducing material waste.

DRO & Impact Forces Of Flake Silver Powder Market

The Flake Silver Powder market is characterized by a dynamic interplay of potent drivers, stringent restraints, and significant long-term opportunities, all influenced by powerful external impact forces. Key drivers include the relentless global expansion of data centers and associated high-frequency electronics necessitated by 5G deployment, alongside the explosive growth in Electric Vehicle (EV) adoption, which demands reliable silver-based contacts and sensors for power management systems. Simultaneously, the persistent push for high-efficiency solar cells, particularly advanced topologies like HJT and PERC, maintains a steady, high-volume requirement for specialized silver pastes. These factors collectively create a robust environment for sustained market expansion, prioritizing high-performance and nano-scaled FSP products.

However, the market faces significant restraints, primarily centered around the inherent volatility and high cost of silver, which accounts for a substantial portion of the final product price and necessitates sophisticated hedging strategies for manufacturers. The threat of substitution, particularly the rise of copper and carbon-based conductive materials in certain low-to-mid-range applications, places ongoing price pressure on silver powder producers. Furthermore, increasingly strict regulatory environments, such as global efforts to restrict certain processing chemicals, require continuous investment in R&D to ensure compliance without compromising product performance, adding complexity and cost to the manufacturing process.

Opportunities for long-term growth are strongly concentrated in emerging technological domains, notably flexible and stretchable electronics (e.g., smart textiles, wearable medical sensors) which demand advanced nano-flake formulations that can withstand mechanical stress without cracking. The growing adoption of additive manufacturing (3D printing) for electronics fabrication presents a greenfield opportunity for highly specialized conductive inks based on FSP. The key impact forces include the high bargaining power of suppliers (precious metal miners and refiners), given the finite nature of the raw material, and the intense competitive rivalry among powder manufacturers globally, pushing constant innovation in particle morphology and surface coating technologies to differentiate products and command premium pricing in specialized end-user markets.

Segmentation Analysis

The Flake Silver Powder market is comprehensively segmented based on key criteria including the physical attributes of the powder (particle size and purity), the specific application methodology, and the dominant end-use industries. Analyzing these segments provides critical insights into specific demand pockets and technological requirements across the value chain, enabling targeted product development and market penetration strategies. The primary segmentation dimensions help distinguish between commodity products used in bulk applications like standard thick-film pastes and highly specialized nano-flakes required for advanced, high-resolution printed electronics and biosensors.

- By Particle Size

- Micro-sized Flake Silver Powder (Typically 1 µm to 10 µm)

- Nano-sized Flake Silver Powder (Below 100 nm to 1 µm)

- By Purity Level

- High Purity (99.99% and above)

- Standard Purity (99.9% to 99.99%)

- By Application

- Thick Film Pastes (for MLCCs, Resistors, Conductive Traces)

- Photovoltaic Cell Electrodes (Front and Back side)

- Conductive Inks for Printed Electronics (RFID, Flexible Circuits)

- Polymer Thick Film (PTF) Pastes

- Thermal Management Materials (Epoxies, Adhesives)

- By End-Use Industry

- Electronics and Semiconductors

- Automotive (EVs, ADAS Sensors)

- Solar Energy (Photovoltaics)

- Medical and Healthcare (Biosensors, Wearables)

- Aerospace and Defense

Value Chain Analysis For Flake Silver Powder Market

The value chain for Flake Silver Powder begins upstream with the sourcing and refinement of high-purity silver. This stage involves complex mining operations, followed by electrolytic refining processes to achieve the required 99.99% or greater purity necessary for electronic applications. The stability of this upstream segment is largely determined by global silver commodity markets, geopolitical stability in mining regions, and the operational efficiency of major global refiners. Specialized chemical suppliers also play a critical role, providing the necessary precursor salts and stabilizing agents crucial for controlling the final particle morphology during synthesis. Effective long-term contracts and strategic partnerships at this stage are essential for mitigating price risk and ensuring a continuous supply of pristine raw material.

The midstream processing stage is the core value addition, where refined silver is converted into the flake morphology. This process typically involves chemical reduction methods (like the polyol process) or physical milling/atomization techniques, followed by stringent washing, drying, and classification to ensure tight control over Particle Size Distribution (PSD) and aspect ratio. Manufacturers often employ proprietary surface treatment technologies—applying organic or inorganic protective layers—to enhance powder dispersibility, prevent agglomeration, and improve compatibility with various solvents and polymers used in downstream paste formulation. Distribution channels for FSP are often direct, especially for large-volume customers or those requiring highly customized powder specifications, given the technical nature and high value of the product.

Downstream analysis focuses on the transformation of FSP into end products, predominantly conductive pastes and inks, undertaken by specialized formulation companies or vertically integrated electronics manufacturers. These formulated products are then utilized by OEMs (Original Equipment Manufacturers) across various sectors—semiconductors (for die attach), photovoltaics (for grid lines), and automotive companies (for conductive bonding). Indirect distribution often occurs through regional technical distributors who manage warehousing and provide application support to smaller end-users. The success of the downstream segment is directly tied to advancements in printing technology and miniaturization trends, emphasizing the critical need for collaborative development between powder producers, paste formulators, and end-device manufacturers to optimize performance characteristics.

Flake Silver Powder Market Potential Customers

Potential customers for Flake Silver Powder are concentrated in high-technology manufacturing sectors that require reliable electrical conductivity and thermal performance within compact component designs. The primary customer base comprises manufacturers of thick film electronic components, including those producing multi-layer ceramic capacitors (MLCCs), chip resistors, and hybrid integrated circuits (HICs), where FSP is integral to forming the internal and external electrodes. These companies demand powders with superior packing density and low sintering temperatures to optimize manufacturing throughput and component longevity. The automotive sector, specifically suppliers developing power control units, battery management systems (BMS), and high-frequency radar sensors for autonomous vehicles, represents a highly lucrative customer segment due to the stringent reliability standards required.

Another dominant customer group is the photovoltaic industry, specifically leading solar cell manufacturers that employ crystalline silicon technology. These customers rely on high-purity silver flake powders for the metallization paste used to print the highly conductive grid lines on the solar cell surface. Their procurement decisions are heavily influenced by the powder’s compatibility with high-speed screen printing and its ability to achieve minimum line widths while maximizing fill factor and energy conversion efficiency. As solar technology continues to evolve towards higher efficiencies (like HJT cells), the demand for ultra-fine, specially treated silver flakes increases correspondingly, demanding continuous innovation from FSP suppliers.

Furthermore, the rapidly expanding field of printed and flexible electronics provides an increasing customer base, including specialized producers of RFID tags, smart packaging, and wearable health monitors. These end-users require nano-sized silver flakes formulated into inks that exhibit excellent rheological properties suitable for inkjet or aerosol jet printing onto non-traditional, flexible substrates (e.g., PET, polyimide). These customers prioritize low-temperature processing capabilities to prevent substrate damage and require high conductivity even when the film is subjected to bending or stretching. Research institutions and advanced materials developers also constitute a critical, albeit lower-volume, customer segment, driving demand for experimental and bespoke FSP formulations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 715 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DOWA Hitech Co., Ltd., Heraeus Group, Technic Inc., Mitsui Kinzoku, Metalor Technologies SA, Ames Advanced Materials Corporation, Umicore, Fukuda Metal Foil & Powder Co., Ltd., Ferro Corporation, Shoei Chemical Inc., Johnson Matthey, Grikin Advanced Materials Co., Ltd., The Silver Institute, Novamet Specialty Products Corporation, GGP Metalpowder AG, ACM Research, PV Nano Cell Ltd., Shanghai Custom Nano Co., Ltd., Cermet Material Technology Co., Ltd., Chengdu Jingle Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flake Silver Powder Market Key Technology Landscape

The technological landscape of the Flake Silver Powder market is defined by sophisticated chemical and physical methods aimed at precise control over the morphology, surface characteristics, and particle size distribution (PSD), which are direct determinants of the final conductive paste performance. The predominant synthesis method is the chemical reduction process, particularly the polyol method, which allows for the low-cost, high-volume production of uniformly shaped flakes by controlling the reduction kinetics of silver salts in a polyhydric alcohol solvent. Advanced iterations of this technique focus on utilizing specific stabilizing agents and surfactants to prevent Ostwald ripening and ensure the generation of ultra-fine, nano-scale flakes with very high aspect ratios, crucial for maximizing conductivity at low volume loadings in paste formulations.

Complementary physical methods, such as high-energy ball milling and specialized atomization techniques, are employed primarily for producing larger, micro-sized flakes or for mechanically shaping powders produced via chemical routes. Recent technological advancements in milling emphasize cryogenic milling and specialized fluid jet milling, which mitigate potential crystal lattice damage and oxidation during the physical shaping process, ensuring the integrity and purity of the metallic core. Furthermore, post-processing surface modification is a critical technological step; this involves applying proprietary organic passivation layers, often fatty acids or functionalized polymers, to the surface of the flakes. These coatings prevent oxidation, improve the powder’s compatibility with specific paste solvents, and ensure optimal dispersion stability, which is essential for achieving high-resolution printing performance.

The industry is also rapidly adopting process control technologies, often leveraging AI and IoT sensors, to monitor synthesis parameters in real-time, thereby reducing batch-to-batch variation—a significant challenge in powder production. A key trend involves developing bifunctional powders, where silver flakes are coated or hybridized with secondary materials (e.g., carbon nanotubes or graphene) to enhance properties beyond conductivity, such as mechanical strength or specific sensing capabilities. Additionally, the drive toward low-temperature sintering pastes requires FSP formulations designed to activate and achieve high density at temperatures compatible with flexible plastic substrates (below 150°C), necessitating the use of advanced nanoscale flakes and specialized sintering aids or flux agents.

Regional Highlights

Regional dynamics are critical to understanding the global Flake Silver Powder market, characterized by distinct patterns of consumption, manufacturing dominance, and regulatory pressures across major economic zones.

- Asia Pacific (APAC): APAC commands the dominant share of the global FSP market, driven by its unparalleled manufacturing capacity in consumer electronics, semiconductors, and solar photovoltaics. Countries like China, South Korea, Japan, and Taiwan host the largest integrated electronics supply chains, leading to massive consumption of both micro and nano silver pastes. China, in particular, is the largest consumer and producer, benefiting from extensive government support for its domestic electronics and renewable energy sectors. This region dictates global pricing and volume trends, and future growth is intrinsically linked to the expansion of 5G infrastructure and high-efficiency solar cell production within these countries.

- North America: North America represents a mature, high-value market focused heavily on specialized, mission-critical applications in aerospace, defense, and high-end medical devices, where reliability and stringent purity standards are paramount. While not a volume leader, the region leads in R&D, particularly in developing advanced materials for additive manufacturing (3D printed electronics) and flexible hybrid electronics. Demand is primarily driven by technological innovation and governmental contracts, emphasizing customized, ultra-high-purity silver flake formulations for demanding operating environments.

- Europe: Europe maintains a significant market presence, primarily fueled by the strong automotive sector, especially the production of electric and hybrid vehicles (EVs/HEVs) and associated power electronics and sensors. The region also has a strong focus on industrial electronics and high-reliability components. European demand is characterized by a high preference for environmentally compliant materials, accelerating the development and adoption of solvent-free and low-volatile organic compound (VOC) silver pastes, often requiring specialized flake surface treatments to meet strict REACH regulations.

- Latin America (LATAM) and Middle East & Africa (MEA): These regions currently hold smaller market shares but exhibit high growth potential, primarily tied to local infrastructure development and increasing penetration of consumer electronics manufacturing. LATAM sees growth driven by emerging industrialization in countries like Brazil and Mexico, particularly in automotive and domestic appliance manufacturing. MEA growth is closely linked to renewable energy projects (large-scale solar farms) and telecommunications expansion, creating nascent but important demand for high-performance silver pastes in utility applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flake Silver Powder Market.- DOWA Hitech Co., Ltd.

- Heraeus Group

- Technic Inc.

- Mitsui Kinzoku

- Metalor Technologies SA

- Ames Advanced Materials Corporation

- Umicore

- Fukuda Metal Foil & Powder Co., Ltd.

- Ferro Corporation

- Shoei Chemical Inc.

- Johnson Matthey

- Grikin Advanced Materials Co., Ltd.

- The Silver Institute (As a representative industry body influencing standards)

- Novamet Specialty Products Corporation

- GGP Metalpowder AG

- ACM Research

- PV Nano Cell Ltd.

- Shanghai Custom Nano Co., Ltd.

- Cermet Material Technology Co., Ltd.

- Chengdu Jingle Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Flake Silver Powder market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand for nano-flake silver powder?

The increasing miniaturization of electronic devices, the proliferation of flexible and printed electronics, and the necessity for low-temperature sintering pastes compatible with sensitive substrates (e.g., plastics) are the primary drivers for nano-flake demand, enabling high-resolution and high-density circuitry.

How does the high volatility of silver prices impact Flake Silver Powder manufacturers?

Silver price volatility significantly impacts manufacturing costs, requiring FSP producers to implement complex hedging strategies, optimize production efficiency, and focus on high-value, differentiated products to justify premium pricing and maintain profitability margins against raw material fluctuations.

Which application segment consumes the largest volume of Flake Silver Powder globally?

The Photovoltaic (PV) sector, particularly for front and back-side metallization of high-efficiency solar cells (PERC, HJT), currently accounts for the largest volume consumption of micro-sized Flake Silver Powder due to the massive scale of global solar energy production.

What are the key technological challenges in producing ultra-fine nano-flake silver powder?

Key challenges include achieving precise control over particle morphology and aspect ratio during synthesis, preventing agglomeration during drying and storage, and ensuring uniform surface passivation to maintain conductivity and prevent oxidation while minimizing batch-to-batch inconsistency.

Is there a significant substitution threat to Flake Silver Powder from alternative conductive materials?

Yes, substitution is a constant restraint, primarily from copper powder, nickel, and advanced carbon materials (graphene, carbon nanotubes) in lower-cost, high-volume applications where silver's ultra-high conductivity is not strictly essential. However, silver remains irreplaceable in high-reliability and critical high-frequency applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager