Flame Resistant and Retardant Fabric Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432954 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Flame Resistant and Retardant Fabric Market Size

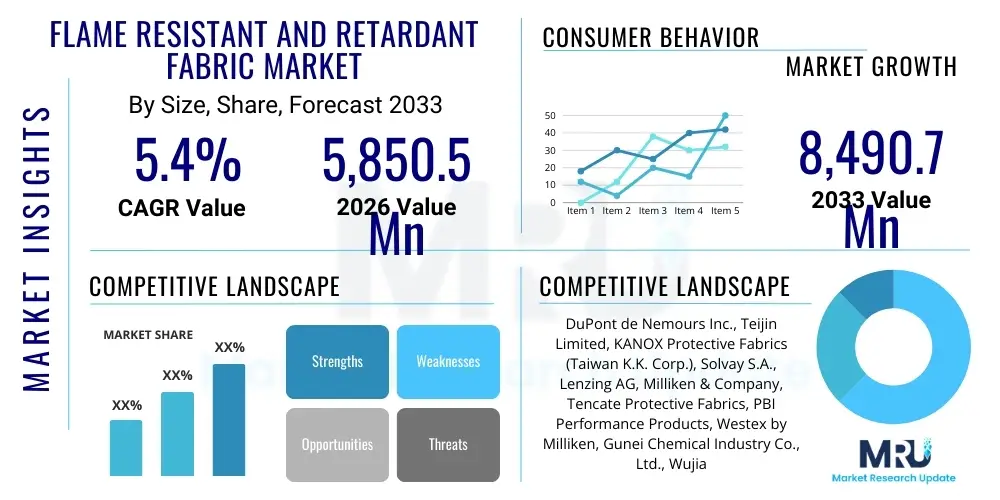

The Flame Resistant and Retardant Fabric Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.4% between 2026 and 2033. The market is estimated at USD 5,850.5 Million in 2026 and is projected to reach USD 8,490.7 Million by the end of the forecast period in 2033.

Flame Resistant and Retardant Fabric Market introduction

The Flame Resistant (FR) and Retardant Fabric Market encompasses advanced textile materials engineered to resist ignition, prevent the spread of fire, and provide essential thermal protection to individuals and assets. These specialized fabrics are crucial in environments where exposure to high heat, flames, or electrical arcs is a constant occupational hazard. Key product types include inherently flame-resistant fabrics, where the protective properties are built into the fiber structure (such as Aramids or Modacrylics), and chemically treated fabrics, where compounds are applied to standard materials like cotton or polyester to achieve fire resistance. The demand is intrinsically linked to stringent global safety regulations and increasing industrialization, particularly across sectors like oil and gas, construction, manufacturing, and defense.

Major applications for FR fabrics span personal protective equipment (PPE), including protective clothing, gloves, and hoods for industrial workers, firefighters, and military personnel. Beyond PPE, these materials are widely utilized in automotive and aerospace interiors, upholstery for public seating areas, and specialized bedding and curtains in institutional settings like hospitals and prisons, where enhanced fire safety is mandatory. The core benefits derived from these fabrics include reduced burn severity, extended evacuation time during a fire incident, and protection against molten splash and radiant heat, thereby significantly improving worker safety and minimizing potential liabilities for corporations.

Driving factors propelling market expansion include rising awareness regarding workplace safety standards, particularly in emerging economies undergoing rapid industrial development. Furthermore, technological advancements leading to lighter, more comfortable, yet highly protective fabrics are making adoption easier for end-users. The continuous evolution of international regulatory bodies, such as OSHA, NFPA, and ISO, imposing stricter compliance requirements for worker safety attire, creates a sustained demand floor for high-performance FR solutions, thereby cementing the market's robust growth trajectory over the forecast period.

Flame Resistant and Retardant Fabric Market Executive Summary

The global Flame Resistant and Retardant Fabric market is characterized by robust growth driven primarily by escalating mandatory safety protocols across high-risk industries, coupled with innovations in textile chemistry aiming for improved comfort and durability. Key business trends indicate a strong shift toward inherently fire-resistant fibers over chemically treated alternatives, favored for their long-term protection and wash durability, minimizing the need for frequent replacements. Strategic partnerships between textile manufacturers and PPE providers are intensifying, focusing on developing integrated, high-visibility solutions that comply with diverse international standards. Furthermore, sustainability is emerging as a significant market theme, with companies exploring bio-based or eco-friendly flame retardant treatments to meet the growing environmental, social, and governance (ESG) expectations of corporate clients.

Regionally, Asia Pacific (APAC) is projected to exhibit the highest growth rate, fueled by massive infrastructure investments, expansion of the manufacturing base, and increasingly enforced occupational safety laws in countries like China and India. North America and Europe, while mature markets, maintain dominance in terms of market value due to highly standardized safety regulations and high adoption rates in sophisticated end-use industries like military and aerospace. The regulatory landscape in the West sets the global precedent for performance requirements, forcing continuous innovation in material science and testing protocols, ensuring that these regions remain central to high-value product segments.

Segment trends highlight the dominance of the Aramid fiber segment, specifically Meta-aramids and Para-aramids, due to their exceptional thermal stability, high tenacity, and lightweight characteristics, making them indispensable in firefighting and military applications. However, the treated fabric segment remains vital for cost-sensitive applications within general industrial workwear. By application, the Personal Protective Equipment (PPE) category commands the largest market share, directly correlated with the headcount and safety requirements of heavy industries. Conversely, the public transportation and upholstery sector is showing accelerated growth, prompted by recent global fire incidents emphasizing the need for stricter fire safety measures in public domains.

AI Impact Analysis on Flame Resistant and Retardant Fabric Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Flame Resistant and Retardant Fabric Market typically revolve around efficiency, innovation, and supply chain resilience. Users frequently ask: "How can AI optimize the chemical formulation of flame retardants for improved efficacy and reduced toxicity?" "Will AI-driven predictive maintenance in manufacturing facilities increase the lifespan or quality control of FR fabrics?" and "Can machine learning algorithms enhance the customization of PPE design based on specific worker risk profiles and environmental conditions?" The core theme summarized from these inquiries is an expectation that AI will transition FR fabric production from a reactive, materials-based science to a proactive, data-driven engineering field, focusing on hyper-optimization of material properties, minimization of hazardous waste during treatment, and highly personalized safety solutions.

AI's primary influence is expected in the material R&D phase, utilizing computational chemistry and machine learning models to rapidly screen thousands of potential flame retardant compounds and fiber combinations. This accelerates the identification of novel, non-halogenated, and inherently safer chemistries, reducing development time and costs associated with traditional laboratory testing. Furthermore, in the production environment, AI algorithms deployed on manufacturing lines can analyze complex sensor data (temperature, moisture content, chemical uptake) in real-time to precisely control the flame retardant treatment process, thereby ensuring batch consistency, minimizing material waste, and guaranteeing superior fire-resistant performance that meets rigorous certification standards.

Beyond material science, AI contributes significantly to the strategic management of the market. Predictive analytics can forecast shifts in regulatory demands or sudden spikes in raw material costs (e.g., aramid pulp), allowing manufacturers to optimize inventory and procurement strategies. Moreover, integrating AI with digital twins allows companies to simulate the fabric performance under various extreme conditions (fire, abrasion, chemical exposure) before physical prototyping, dramatically improving product design cycles and ensuring that the final FR textile solution offers the absolute maximum level of protection mandated by end-user requirements and regulatory compliance bodies.

- AI-driven optimization of non-halogenated flame retardant formulations for enhanced safety and compliance.

- Predictive maintenance and quality control in manufacturing, reducing defects in chemical treatment processes.

- Machine learning enhancement of material synthesis, enabling rapid screening of novel FR polymer structures.

- Supply chain optimization through AI forecasting of raw material price volatility and regulatory shifts.

- Development of customized, fit-for-purpose PPE using AI analysis of wearer data and environmental risk matrices.

- Digital twin simulation of fabric performance under extreme thermal and mechanical stress, speeding up certification.

DRO & Impact Forces Of Flame Resistant and Retardant Fabric Market

The market trajectory for Flame Resistant and Retardant Fabrics is critically shaped by a confluence of internal market drivers and external regulatory pressures, offset by various restraining factors, while numerous opportunities exist for strategic expansion. The key drivers center around increasingly rigorous global safety standards, primarily the enforcement of mandates across the oil and gas, petrochemical, and electrical utility sectors, where severe burns are a primary occupational risk. Simultaneously, market growth is significantly restrained by the high production cost of inherently FR fibers like aramid, which often makes premium protective apparel prohibitive for small and medium-sized enterprises (SMEs), particularly in developing regions. These fabrics are further challenged by the imperative to balance high protection levels with the desired characteristics of comfort, breathability, and aesthetic appeal for the wearer.

Opportunities for market stakeholders primarily lie in developing innovative, cost-effective hybrid solutions that offer superior protection while being environmentally benign, focusing heavily on replacing traditional, toxic halogenated flame retardants with sustainable alternatives. The penetration of FR fabrics into emerging applications, such as large-scale battery storage facilities, electric vehicle manufacturing, and advanced aerospace components, represents new, high-growth revenue streams. The impact forces influencing the market are substantial; regulatory bodies impose continuous pressure for product improvement and transparency, while buyer power remains moderate, driven by large corporate contracts seeking bulk volumes at competitive prices. Supplier power is high for specialized fibers (like aramids) controlled by a few dominant chemical producers, creating potential pricing instability for manufacturers.

Overall, the market dynamic favors firms that can invest heavily in R&D to meet the dual challenge of high performance and low environmental impact. The constant evolution of fire safety technologies, driven by severe fire incidents and heightened public scrutiny, ensures sustained demand. However, managing the cost-effectiveness and recyclability of advanced FR materials will determine the long-term success and widespread adoption across diverse industrial landscapes. The competitive landscape is also witnessing consolidation, as larger players acquire specialized technology providers to gain proprietary access to cutting-edge flame resistance chemistry.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5,850.5 Million |

| Market Forecast in 2033 | USD 8,490.7 Million |

| Growth Rate | 5.4% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont de Nemours Inc., Teijin Limited, KANOX Protective Fabrics (Taiwan K.K. Corp.), Solvay S.A., Lenzing AG, Milliken & Company, Tencate Protective Fabrics, PBI Performance Products, Westex by Milliken, Gunei Chemical Industry Co., Ltd., Wujiang City Zhongkuai Textiles Co., Ltd., Huntsman Corporation, Sioen Industries NV, Mount Vernon Mills, Inc., ITT Inc. (Ensign-Bickford Aerospace & Defense), Royal Ten Cate (TenCate Advanced Composites), 3M Company, BASF SE, Albemarle Corporation, Kaneka Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Segmentation Analysis

The Flame Resistant and Retardant Fabric market is analyzed based on Type, Material, Application, and End-Use Industry, reflecting the diversity in both the technology used and the needs of the consumer base. Segmentation by Type differentiates between chemically Treated FR Fabrics, which offer a cost-effective solution often applied to natural fibers like cotton, and Inherently FR Fabrics, such as aramids and PBI, whose molecular structure provides permanent, high-level thermal protection. This distinction is crucial as end-users choose based on longevity, budget constraints, and the severity of the expected hazard.

The Material segmentation is key to understanding the value chain dynamics, with high-performance synthetic materials like Aramid (Meta-aramid and Para-aramid) commanding a premium due to their superior strength-to-weight ratio and heat resistance, predominantly used in demanding sectors like military and firefighting. Conversely, modified natural fibers and chemically treated blends provide bulk volume for general industrial and manufacturing applications. Application segmentation confirms the market dominance of Personal Protective Equipment (PPE), followed by transportation (especially aerospace and rail), where stringent public safety requirements drive demand for fire-blocking layers and interior upholstery.

Finally, the End-Use Industry analysis highlights the Oil & Gas and Petrochemical sectors as primary drivers, given the high risk of flash fire and explosion, mandating compliance with NFPA 2112 standards for FR garments. The Construction and Manufacturing sectors represent massive volume opportunities, albeit often favoring cost-optimized treated solutions, whereas Defense and Public Safety (firefighting and military) demand the highest performance and durability, driving innovation in advanced materials and textiles.

- Type:

- Treated FR Fabrics (e.g., chemically treated cotton, polyester blends)

- Inherently FR Fabrics (e.g., Aramid, Modacrylic, PBI, PEEK)

- Material:

- Aramid (Meta-Aramid, Para-Aramid)

- Modacrylic

- Polyester/Nylon Blends

- PBI (Polybenzimidazole)

- Viscose/Rayon Blends

- Treated Cotton

- Application:

- Personal Protective Equipment (PPE)

- Automotive/Transportation Interiors (Seats, Panels, Carpeting)

- Defense and Public Safety (Military Uniforms, Firefighter Gear)

- Home Furnishings (Bedding, Upholstery)

- Others (Industrial Filters, Insulation)

- End-Use Industry:

- Oil and Gas

- Construction and Manufacturing

- Mining

- Chemical and Pharmaceutical

- Electrical Utilities

- Aerospace and Defense

Value Chain Analysis For Flame Resistant and Retardant Fabric Market

The value chain for the Flame Resistant and Retardant Fabric Market initiates with the upstream segment, dominated by specialized chemical and fiber manufacturers. These companies produce the foundational inputs: either high-performance synthetic fibers like aramids, PBI, and modacrylics (which are inherently FR) or the complex chemical formulations used for topical treatment (including phosphorus-based and nitrogen-containing compounds). The proprietary nature of these raw materials, especially the inherently FR polymers, grants significant pricing power and strategic leverage to the upstream suppliers, creating a significant barrier to entry for new market participants. Innovation at this stage is focused on enhancing flame resistance while simultaneously improving fiber comfort and reducing environmental toxicity.

The midstream comprises textile manufacturers, weavers, knitters, and finishers who convert raw fibers and chemicals into finished FR textiles. This stage involves highly technical processes, including spinning, weaving the protective layers, and applying the chemical treatments and finishing coats (for water repellency or enhanced durability). Quality assurance and mandatory third-party certification (e.g., UL classification, NFPA compliance) are critical activities at this stage, adding substantial cost and time. Distribution channels for these finished fabrics are bifurcated: direct sales to large, integrated PPE manufacturers or indirect sales through specialized technical textile distributors and agents who serve smaller garment makers and regional industrial clients.

The downstream segment includes garment manufacturers, safety equipment providers, and direct industrial end-users. Garment manufacturers design and construct the final PPE—firefighter suits, specialized industrial coveralls, etc.—tailoring the fabric to meet specific industry standards (e.g., NFPA 2112 for flash fire). Direct channels involve large oil and gas companies or military organizations sourcing custom-developed garments directly from major textile firms. Indirect channels involve industrial wholesalers and safety retailers who supply the general market. The complexity of regulatory compliance means that the expertise and certification status of distributors and garment makers significantly influence procurement decisions made by the final end-user/buyer.

Flame Resistant and Retardant Fabric Market Potential Customers

The primary customers and buyers in the Flame Resistant and Retardant Fabric Market are organizations operating in high-hazard environments where regulatory bodies mandate the use of specialized protective apparel to minimize catastrophic burn injuries. The largest segment of end-users comprises entities in the upstream and downstream Oil & Gas industry, including drilling companies, refineries, and pipelines, where flash fire risks are paramount. These buyers require NFPA-compliant, high-durability fabrics for standard daily workwear and specialized turnout gear.

Another crucial customer segment is government and public safety agencies, encompassing military forces, municipal firefighting departments, and police tactical units. These customers prioritize inherently FR materials (Aramids, PBI) for lightweight, high-performance protection that must withstand extreme conditions and offer maximum thermal insulation. Furthermore, large infrastructure owners such as electrical utility companies and mining operations are significant buyers, where risks involve electric arc flash and exposure to subterranean thermal hazards, requiring specific arc-rated (AR) textiles.

Beyond PPE, the secondary potential customer base includes manufacturers in the transportation sector, specifically automotive, aerospace, and rail manufacturers, who integrate FR fabrics into vehicle interiors (seats, roof liners, insulation) to comply with internal fire safety standards (e.g., FAR 25.853 for aircraft interiors). Institutions like hospitals, schools, and correctional facilities also constitute a niche, mandatory customer group for fire-retardant furnishings and bedding, driven by public safety regulations aimed at reducing the rate of fire spread in densely populated or vulnerable environments.

Flame Resistant and Retardant Fabric Market Key Technology Landscape

The technological landscape of the Flame Resistant and Retardant Fabric market is continually evolving, driven by the need for enhanced protection, reduced toxicity, and improved comfort. A core technological area is the advancement in fiber chemistry, specifically the development of Meta-aramids and Para-aramids that offer superior thermal stability and mechanical performance. Recent innovations focus on bio-based and sustainable Inherently FR fibers, attempting to achieve high performance without relying on petroleum-derived synthetics. Furthermore, the blending of high-performance fibers with cellulosic materials (like FR Viscose or Modal) is a key trend, aiming to maintain the high FR performance while significantly increasing the moisture management and softness of the final garment.

In the domain of chemical treatment, the focus has shifted intensely towards non-halogenated flame retardants (NHFRs). Traditional treatments often contained brominated or chlorinated compounds, which raise environmental and health concerns upon incineration or disposal. NHFR technologies, predominantly based on phosphorus and nitrogen compounds, are being engineered for durable performance, ensuring the flame resistance property survives numerous industrial laundering cycles. Research efforts are concentrating on microencapsulation techniques and nanocoatings to physically embed the FR chemicals within the fiber structure, resulting in highly effective, wash-durable treatments that do not compromise the fabric's breathability or feel.

Another crucial technological development involves smart textiles and advanced finishing techniques. This includes integrating sensor technology into FR garments to monitor the wearer’s physiological status or external environmental hazards (like extreme heat exposure). Furthermore, specialized finishes are being developed for multi-hazard protection, combining FR properties with resistance to chemicals, oil, water, and static electricity (Anti-Stat finishes). These composite textile technologies allow end-users, particularly in the oil and gas sector, to consolidate multiple protective functions into a single, comfortable garment, significantly enhancing overall worker compliance and safety effectiveness.

Regional Highlights

- Asia Pacific (APAC) Dominance and Growth: APAC is anticipated to be the fastest-growing region, primarily driven by rapid industrialization, large-scale infrastructural projects (especially in construction and manufacturing), and the gradual but firm enforcement of national occupational health and safety standards in developing economies like India, China, and Southeast Asian nations. China, as a major manufacturing and textile hub, not only consumes vast amounts of FR fabric for its domestic industrial workforce but also acts as a major global exporter.

- North America Market Maturity and Regulatory Strength: North America holds a dominant market share in terms of value, underpinned by extremely strict and well-enforced regulations, particularly those established by OSHA and NFPA. High adoption rates are standard across the high-value sectors of Oil & Gas (NFPA 2112), Electrical Utilities (NFPA 70E for Arc Flash), and military/aerospace. The market here demands premium, inherently FR solutions with high certification rigor and focus on advanced materials like Para-aramids.

- European Regulatory Environment and Sustainability Focus: Europe is characterized by stringent environmental regulations (REACH), heavily influencing the shift away from halogenated flame retardants towards sustainable and non-toxic alternatives. The region shows robust demand from the transportation sector (rail and aerospace interiors) and the chemical industry. Countries like Germany and the UK are leaders in adopting specialized, sustainable FR textile technologies and often set the benchmark for high-quality protective standards.

- Middle East & Africa (MEA) Oil & Gas Demand: MEA represents a significant revenue stream, heavily reliant on the large-scale operations within the Oil & Gas and Petrochemical industries, particularly in the Gulf Cooperation Council (GCC) countries. Extreme climate conditions in this region necessitate FR fabrics that also offer excellent heat stress management and UV protection, driving demand for specialized, lightweight synthetic blends that comply with international safety mandates.

- Latin America Emerging Adoption: The market in Latin America is growing steadily, propelled by increasing foreign investment in mining, petrochemicals, and energy infrastructure, leading to improved regulatory enforcement. Brazil and Mexico are key markets, showing rising demand for cost-effective FR solutions, predominantly chemically treated fabrics, though the premium inherently FR segment is growing in high-risk mining environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Resistant and Retardant Fabric Market.- DuPont de Nemours Inc.

- Teijin Limited

- KANOX Protective Fabrics (Taiwan K.K. Corp.)

- Solvay S.A.

- Lenzing AG

- Milliken & Company

- Tencate Protective Fabrics

- PBI Performance Products

- Westex by Milliken

- Gunei Chemical Industry Co., Ltd.

- Wujiang City Zhongkuai Textiles Co., Ltd.

- Huntsman Corporation

- Sioen Industries NV

- Mount Vernon Mills, Inc.

- ITT Inc. (Ensign-Bickford Aerospace & Defense)

- Royal Ten Cate (TenCate Advanced Composites)

- 3M Company

- BASF SE

- Albemarle Corporation

- Kaneka Corporation

Frequently Asked Questions

Analyze common user questions about the Flame Resistant and Retardant Fabric market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between inherently FR and treated FR fabrics?

Inherently FR fabrics (e.g., Aramids, PBI) have protective properties built into their molecular structure, offering permanent, non-degradable flame resistance. Treated FR fabrics (e.g., chemically treated cotton) rely on a chemical application that can diminish over time or through repeated laundering, though they are generally more cost-effective.

Which industry drives the highest demand for high-performance FR fabrics?

The Oil and Gas, Petrochemical, and Electrical Utility sectors drive the highest demand for high-performance, certified FR fabrics (often Arc-Rated and NFPA 2112 compliant) due to the severe and immediate risk of flash fire and arc flash incidents, necessitating maximum thermal protection.

How is the market addressing the environmental impact of flame retardants?

The market is rapidly shifting toward non-halogenated flame retardants (NHFRs), utilizing phosphorus-based or nitrogen-containing chemistries, to comply with strict global environmental regulations (like REACH) and meet consumer demand for safer, more sustainable, and non-toxic protective textile solutions.

What key factors are restraining the adoption of FR fabrics in developing regions?

The primary restraint is the high initial cost associated with premium inherently FR materials (like aramid fibers) compared to standard workwear, compounded by budget constraints within SMEs and inconsistent regulatory enforcement in several developing regional markets.

What role does technology play in improving FR fabric comfort and durability?

Advanced textile blending, often combining high-performance synthetics with FR cellulosic fibers, significantly improves comfort, moisture wicking, and breathability. Nanotechnology is also being used to create highly durable finishes that maintain FR integrity through numerous wash cycles without sacrificing fabric softness or flexibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager