Flame-Resistant Polyurethanes Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433781 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Flame-Resistant Polyurethanes Market Size

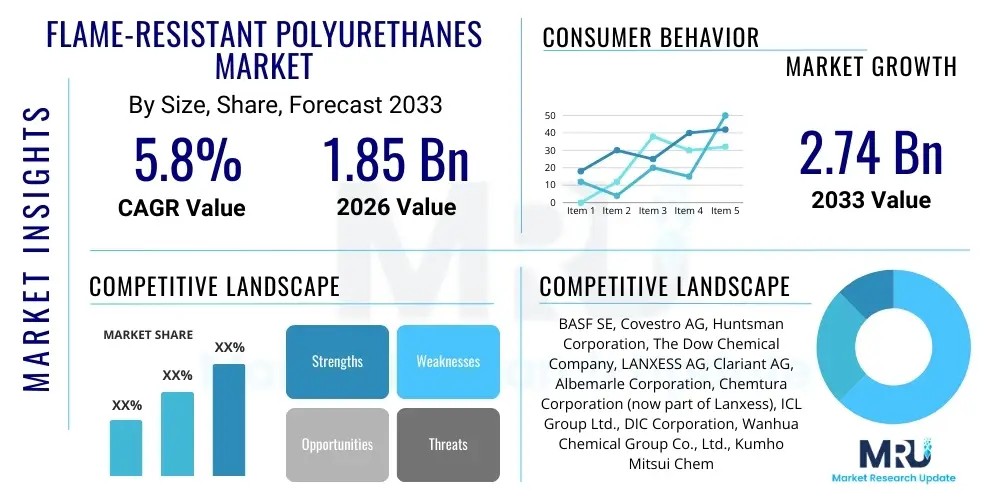

The Flame-Resistant Polyurethanes Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.74 Billion by the end of the forecast period in 2033.

Flame-Resistant Polyurethanes Market introduction

Flame-Resistant Polyurethanes (FR PUs) represent a critical segment within the advanced materials industry, characterized by their inherent ability to inhibit or suppress combustion, thereby enhancing safety across various critical applications. These materials are derived by incorporating specific fire retardant (FR) additives—ranging from halogenated compounds to environmentally preferred non-halogenated alternatives like phosphorus or nitrogen-based agents—into the polyurethane matrix during synthesis. The primary function of FR PUs is to meet increasingly stringent global fire safety regulations, providing crucial time for evacuation and minimizing property damage in the event of a fire. They are widely recognized for maintaining the desirable physical properties of standard polyurethanes, such as excellent thermal insulation, high strength-to-weight ratio, and durability, while significantly boosting fire performance. This synthesis of functional benefits and critical safety attributes positions FR PUs as indispensable components in sectors where thermal management and safety are paramount concerns, fundamentally impacting modern design and construction standards worldwide.

The product portfolio includes rigid foams, flexible foams, coatings, adhesives, and elastomers, each tailored for distinct end-use environments. Rigid foams dominate the construction sector, utilized extensively for high-performance insulation in walls, roofs, and pipes, where they contribute to energy efficiency alongside fire safety. Flexible foams are essential in the furniture, bedding, and transportation industries, improving occupant safety by slowing ignition rates in seating and interior components. Major applications driving market adoption include infrastructure projects that mandate compliance with rigorous building codes (e.g., Euroclass, ASTM standards), and the automotive sector, where lightweight FR materials contribute to both fuel efficiency and enhanced crash safety standards, particularly concerning interior components that must resist burning or dripping. Furthermore, the electrical and electronics sector relies heavily on FR PU coatings and potting compounds to encapsulate sensitive circuitry, preventing thermal runaway and subsequent fire propagation.

The market benefits significantly from the material's superior thermal stability and the customization potential of fire retardant packages, allowing manufacturers to achieve optimal fire-rating classes without heavily compromising mechanical integrity or processing ease. Driving factors are multifaceted, primarily centered around escalating global regulatory pressure mandating flame retardancy in public and residential infrastructure, particularly in high-density urban areas. Simultaneously, technological advancements focusing on developing sustainable, high-performance, non-halogenated FR solutions are mitigating historical environmental concerns associated with halogenated chemistries, thereby opening up new market opportunities in environmentally conscious regions like Western Europe and North America. The convergence of safety demands, performance requirements, and sustainability trends is cementing the indispensable role of flame-resistant polyurethanes across global industrial landscapes.

Flame-Resistant Polyurethanes Market Executive Summary

The Flame-Resistant Polyurethanes Market is characterized by robust growth, propelled by global shifts toward stricter regulatory enforcement in construction and transportation sectors, particularly concerning passive fire protection systems. Key business trends indicate a definitive move away from traditional halogenated fire retardants towards advanced non-halogenated solutions, such as organophosphorus compounds, intumescent systems, and inorganic fillers, driven by both consumer preference and legislative actions like the European Union's REACH regulation. Industry consolidation and strategic partnerships focused on supply chain optimization and joint product development for specialized high-performance applications (like aerospace interiors and high-speed rail) are shaping the competitive landscape. Furthermore, material innovation is concentrated on creating multifunctional FR PUs that offer enhanced durability, reduced smoke generation, and minimized toxic gas release, establishing new benchmarks for material safety and sustainability within the polyurethane value chain.

Regionally, Asia Pacific (APAC) stands out as the primary growth engine, fueled by rapid urbanization, massive infrastructure development, and increasing adoption of international fire safety standards in major economies like China and India. North America and Europe, while mature markets, command significant value share due to stringent existing fire safety legislation (e.g., FAA flammability standards for aircraft, US building codes) and a mature automotive manufacturing base that demands certified FR materials. These regions are leading the technological transition towards bio-based and non-halogenated FR additives, reflecting a commitment to sustainable chemistry. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, displaying accelerating demand driven by foreign investment in construction and energy infrastructure projects that often adhere to high international safety specifications, creating substantial untapped potential for specialized FR PU products.

In terms of segments, Rigid Foam maintains the highest market share due to its critical role in energy-efficient and fire-safe building insulation, benefiting directly from global energy efficiency mandates. The fastest-growing segment, however, is projected to be Coatings, Adhesives, & Sealants (CAS), necessitated by the proliferation of wood-plastic composites and engineered lumber in construction which require effective surface fire protection, and the increasing complexity of electronic devices demanding robust thermal and fire management solutions. The transition within the fire retardant type segment confirms the dominance of non-halogenated chemistries, primarily driven by environmental stewardship and evolving health and safety standards that prioritize materials with lower toxicity profiles and reduced persistence in the environment. This segmented market evolution emphasizes the industry’s response to functional demands and regulatory frameworks simultaneously.

AI Impact Analysis on Flame-Resistant Polyurethanes Market

User inquiries regarding AI's influence in the Flame-Resistant Polyurethanes market often center on three critical themes: accelerating material discovery, optimizing manufacturing processes, and predicting material performance under extreme fire conditions. Users are particularly interested in how Artificial Intelligence and Machine Learning (ML) can shorten the typically lengthy research and development cycle for new, sustainable, and highly effective non-halogenated fire retardant chemistries. Concerns frequently revolve around the data requirements needed to train robust ML models capable of accurately simulating complex thermal degradation and intumescent behaviors of novel polymer formulations. Expectations are high regarding AI’s ability to predict failure points, optimize reaction parameters for improved product consistency, and manage complex supply chains involving numerous chemical precursors, ultimately enhancing efficiency and reducing the cost associated with achieving the highest safety certifications.

AI's role is transformative in shifting the paradigm from trial-and-error synthesis to data-driven material design. Specifically, ML algorithms are being deployed to screen vast libraries of potential chemical structures, correlating molecular features with desired flammability metrics (e.g., limiting oxygen index, heat release rate). This predictive modeling capability significantly reduces the need for expensive and time-consuming physical testing required to achieve certifications like UL 94 or ISO 5660. By simulating polymer behavior under varied temperature and atmospheric conditions, AI allows manufacturers to fine-tune the formulation of FR additives, ensuring maximum efficacy at minimum loading levels, which preserves the desirable physical properties of the base polyurethane while achieving superior flame resistance.

Furthermore, operational AI is essential in optimizing the complex manufacturing processes inherent in polyurethane production, particularly the precise metering and mixing of FR additives which often have high viscosity or are sensitive to shear forces. Predictive maintenance models, driven by sensor data analytics, ensure equipment uptime and maintain product quality consistency, which is paramount in safety-critical materials. The integration of AI in quality control systems allows for real-time analysis of foam cell structure, density, and fire retardant dispersion, ensuring every batch meets the required specifications for specialized applications like aerospace insulation or medical devices. This adoption of smart manufacturing practices, leveraged by AI, solidifies the market's ability to respond quickly to regulatory changes and escalating demand for high-quality, certified FR materials.

- Accelerated discovery of novel non-halogenated fire retardant compounds using ML-driven simulation.

- Optimization of polyurethane reaction kinetics and mixing processes for enhanced manufacturing efficiency.

- Predictive modeling of material flammability (e.g., heat release rate, smoke density) under simulated fire scenarios.

- Improved supply chain visibility and risk management for critical chemical precursors and additives.

- Implementation of AI in quality control for real-time monitoring of FR dispersion and material homogeneity.

- Reduction in R&D costs and time required to achieve specialized industry safety certifications.

DRO & Impact Forces Of Flame-Resistant Polyurethanes Market

The Flame-Resistant Polyurethanes market dynamics are governed by a critical balance between safety mandates, material sustainability concerns, and economic factors. The primary Drivers include the globalization of stringent fire safety regulations, notably in the construction and transportation sectors (air, rail, and automotive), demanding higher fire integrity and lower smoke toxicity standards for building materials and vehicle interiors. The rapid expansion of urbanization and infrastructure investment, particularly in developing economies, further accelerates demand for certified, high-performance insulation solutions where FR PUs excel. Conversely, significant Restraints impede maximum growth, primarily the fluctuating price and limited availability of key chemical intermediates, such as isocyanates and polyols, often tied to petrochemical market volatility. A persistent restraint is the lingering complexity and high cost associated with formulating effective, environmentally benign non-halogenated fire retardant systems that can match the cost-performance ratio of older, halogenated counterparts without negatively affecting the mechanical properties of the polyurethane matrix. Overcoming the cost barrier for advanced non-halogenated alternatives remains a major challenge for mass market penetration.

The core Opportunities reside in the rapid technological advancement of bio-based polyols and bio-sourced fire retardants, which align with circular economy principles and increasingly strict environmental legislation, offering a viable pathway for sustainable product differentiation. Furthermore, the emerging market for fire-resistant coatings and sealants in electric vehicle (EV) battery packs presents a high-growth niche, as thermal runaway prevention in large-scale lithium-ion battery arrays is a critical safety challenge requiring specialized polymer solutions. Developing multifunctional FR PUs that also offer enhanced antimicrobial or corrosion resistance properties expands their application scope beyond traditional insulation and seating, particularly into demanding healthcare and marine environments, providing fertile ground for innovation and market expansion in specialized, high-value segments.

The collective Impact Forces indicate a market structure primarily shaped by non-market factors, specifically regulatory pressure and societal safety expectations, which outweigh immediate cost concerns in many safety-critical applications. Legislative shifts act as the primary catalyst, immediately dictating material specifications and accelerating the obsolescence of less safe chemistries. The strong force exerted by environmental legislation and consumer preference for green building materials pushes manufacturers toward capital-intensive R&D into sustainable FR technologies. As these technological breakthroughs mature, the overall cost structure of non-halogenated FR PUs is expected to decrease, mitigating the historical restraint associated with price parity, thus reinforcing the long-term trend of growth driven by mandatory safety compliance and increasing environmental stewardship across global industries.

Segmentation Analysis

The Flame-Resistant Polyurethanes market is comprehensively segmented based on product type, the nature of the fire retardant used, and the diverse applications across various end-use industries. This structure reflects the specialized requirements of different market verticals, ranging from the need for bulky, insulating rigid foams in construction to the precise, lightweight requirements of flexible foams in aerospace interiors. Understanding these segments is crucial as the choice of PU type and fire retardant dictates performance characteristics such as insulation efficiency, mechanical strength, smoke density, and regulatory compliance. The shift in additive choice, specifically the rise of phosphorus-based compounds, underscores the market’s pivot towards sustainable and low-toxicity solutions, while the end-use segments highlight the critical safety role these materials play in large-scale human environments, guaranteeing market stability and consistent demand growth tied to global infrastructure development and safety standards implementation.

- By Product Type:

- Flexible Foam

- Rigid Foam

- Coatings, Adhesives & Sealants (CAS)

- Elastomers

- By Fire Retardant Type:

- Halogenated Fire Retardants (TCCP, TDCPP)

- Non-Halogenated Fire Retardants (Phosphorus-based, Nitrogen-based, Inorganic fillers)

- By End-Use Industry:

- Construction (Insulation, Roofing, Structural Composites)

- Transportation (Automotive, Aerospace, Rail)

- Furniture & Bedding

- Electrical & Electronics (Potting, Encapsulation)

- Others (Textiles, Footwear, Marine)

Value Chain Analysis For Flame-Resistant Polyurethanes Market

The value chain for the Flame-Resistant Polyurethanes market begins with the Upstream Analysis, involving the sourcing and processing of core raw materials: crude oil and natural gas derivatives that yield polyols and isocyanates (MDI, TDI). This stage is characterized by high capital intensity and vulnerability to global petrochemical price volatility. A crucial, specialized upstream component is the manufacturing of fire retardant additives, where companies invest heavily in chemical synthesis to produce high-performance agents, increasingly focusing on complex, non-halogenated phosphorus and nitrogen compounds. Successful upstream integration requires robust R&D to manage both cost efficiency and the purity and chemical structure necessary for optimal flame resistance performance in the final polymer matrix. Supply security and specialized chemical production capabilities are paramount at this foundational level.

The midstream process involves the major polyurethane manufacturers who synthesize the various FR PU systems (pre-polymers, components A and B) and specialty material suppliers who integrate the FR additives. This stage involves sophisticated reaction engineering and quality control to ensure uniform dispersion of the fire retardant, which is critical for achieving consistent fire ratings and maintaining mechanical properties. Distribution Channels are complex and multifaceted. Direct channels are typically utilized for large-volume industrial end-users, such as major construction companies, automotive OEMs, and aerospace manufacturers, where direct technical support and customized formulation delivery are required. Indirect channels, involving specialized chemical distributors and regional agents, handle sales to smaller fabricators and converters, providing logistical support and smaller batch requirements. Effective distribution must navigate complex hazardous material regulations pertaining to isocyanates.

The Downstream Analysis focuses on the fabrication and conversion of FR PU systems into final products (e.g., cutting rigid foam boards, molding flexible seating, or applying coatings). This stage sees value addition through application-specific processing. The market is driven by the final End-Users/Buyers, which include building contractors, automotive Tier 1 suppliers, and furniture manufacturers. These buyers' requirements are strictly defined by regulatory bodies (NFPA, IMO, FAA), making compliance a non-negotiable purchasing criterion. The transition toward non-halogenated products is being significantly influenced by downstream demand from environmentally conscious end-users and retailers, reinforcing the need for continuous innovation in FR chemistry to meet both performance and sustainability mandates throughout the entire value chain.

Flame-Resistant Polyurethanes Market Potential Customers

The primary consumers, or End-Users/Buyers, of flame-resistant polyurethanes are enterprises operating in environments where public and structural safety are heavily regulated. The largest cohort of potential customers resides within the Construction industry, including commercial and residential builders, insulation specialists, and HVAC system installers, all demanding certified FR rigid foams for thermal envelope integrity, wall panels, and piping insulation. These buyers seek materials that minimize lifecycle costs by offering superior energy efficiency alongside guaranteed fire safety compliance, making purchasing decisions highly dependent on recognized certifications (e.g., FM approval, CE marking, or local building code approval) and long-term durability data. Architectural firms and construction engineers often influence material selection early in the design phase, emphasizing the need for manufacturers to engage with specifications writers.

The Transportation sector represents another critical customer base, encompassing original equipment manufacturers (OEMs) in automotive, high-speed rail, and commercial aerospace. Automotive buyers require flexible FR foams and coatings for seating, dashboards, and acoustic insulation to meet FMVSS 302 standards, focusing on lightweight solutions that contribute to fuel economy or EV range. Aerospace and rail customers represent a high-value, highly regulated segment, prioritizing materials with extremely low heat release, low smoke density, and minimal toxic gas emission (e.g., adherence to stringent FAA and EASA requirements). Procurement decisions here are heavily weighted towards material traceability, stringent quality control, and successful long-term performance history, making it a specialized and demanding market segment.

Additionally, specialized industries such as Furniture and Bedding manufacturers (seeking compliance with California TB 117 or European standards), and the Electrical and Electronics sector (requiring FR potting compounds and encapsulation resins for circuits and power supplies) constitute significant potential customer segments. These buyers look for reliable, high-volume supply and materials that integrate seamlessly into their automated assembly processes. The growing demand for advanced fire safety solutions in data centers, telecommunications equipment, and renewable energy infrastructure (wind turbines, solar panel assemblies) is expanding the customer landscape, requiring FR PU elastomers and coatings that perform reliably in extreme operating conditions while mitigating fire risk associated with high-power electrical components and sensitive equipment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.74 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Covestro AG, Huntsman Corporation, The Dow Chemical Company, LANXESS AG, Clariant AG, Albemarle Corporation, Chemtura Corporation (now part of Lanxess), ICL Group Ltd., DIC Corporation, Wanhua Chemical Group Co., Ltd., Kumho Mitsui Chemicals Inc., Stepan Company, Polychem Resins, Carpenter Co., Fomo Products, Inc., Cannon Group, Sika AG, Momentive Performance Materials Inc., Tosoh Corporation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame-Resistant Polyurethanes Market Key Technology Landscape

The technological landscape of the Flame-Resistant Polyurethanes market is currently undergoing a rapid evolution, primarily focused on optimizing the flame retardancy mechanism while ensuring sustainability and low toxicity. The shift is centered on advanced materials science, moving away from legacy technologies based on physical flame inhibition provided by halogenated compounds (like TCCP) towards sophisticated chemical mechanisms. A key area of innovation is the development of next-generation Non-Halogenated Fire Retardants (NHFRs), particularly organophosphorus compounds and nitrogen-based systems, which operate mainly via condensed-phase mechanisms, forming a protective char layer (intumescence) upon heating. This char layer acts as a barrier, isolating the substrate from heat and oxygen, thereby reducing fuel availability and heat release rate. Research is heavily invested in customizing these NHFRs to ensure optimal compatibility and dispersibility within the polyol/isocyanate system, preventing issues like plasticization or foam destabilization, which often plague additive incorporation.

Another crucial technological frontier is the integration of nanotechnology and inorganic fillers to enhance fire performance without significantly increasing material weight or processing complexity. Nanoparticles such as carbon nanotubes, layered silicates, and metal hydroxides (like aluminum trihydrate, ATH, and magnesium hydroxide, MDH) are utilized as synergists with existing phosphorus-based FRs. These inorganic additives not only dissipate heat through endothermic decomposition but also reinforce the char structure, making it more robust and effective at high temperatures. The formulation technology aims to achieve exceptionally high Limiting Oxygen Index (LOI) values and meet critical tests for low smoke density, which is paramount for life safety in enclosed environments like aircraft and subways. Furthermore, the development of reactive FRs, which chemically bond to the PU backbone rather than remaining as physical additives, represents a significant technological leap, improving permanence and reducing leaching risk while minimally impacting the polymer's mechanical properties, thereby catering to high-durability applications.

The convergence of material engineering with digital tools, as highlighted in the AI analysis, constitutes an emerging technology landscape. High-throughput experimentation and computational chemistry are accelerating the screening and optimization of new FR formulations, enabling faster compliance with evolving global standards such as the European Construction Products Regulation (CPR) and various UL ratings. Furthermore, process technology advancements in high-pressure metering and mixing equipment ensure the uniform incorporation of both traditional and novel high-viscosity FR agents into continuous processing lines for rigid and flexible foams, guaranteeing consistent product quality at industrial scales. The ongoing technological mandate is clear: deliver superior fire resistance, exceptional mechanical integrity, and reduced environmental footprint, driving the industry towards complex, synergistic, and highly customized chemical solutions tailored to specific end-use thermal and safety requirements.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market, primarily driven by explosive growth in infrastructure development, rapid urbanization, and a notable increase in public spending on energy-efficient and fire-safe buildings in China, India, and Southeast Asian nations. The region is characterized by substantial demand for FR rigid foams in construction insulation. While historically reliant on cost-effective halogenated solutions, the adoption of stricter international building codes (often imported via multinational developers) is pushing local manufacturers toward advanced non-halogenated technologies, particularly in high-rise commercial and complex industrial structures.

- North America: This region holds a significant market share, distinguished by exceptionally rigorous and well-enforced federal, state, and local fire safety standards (e.g., NFPA 285, stringent foam flammability requirements in California). Demand is robust across transportation (automotive and aerospace, meeting FAA regulations), and high-performance insulation. The market trend here is overwhelmingly directed toward high-cost, certified, non-halogenated FR solutions, driven by consumer preference for green chemistry and legislative bans or restrictions on specific legacy halogenated compounds, necessitating continuous reformulation and certification efforts by suppliers.

- Europe: The European market is mature and highly regulated, governed by the Construction Products Regulation (CPR) and the REACH legislation, which strongly favors sustainable, low-toxicity materials. Europe leads the technological transition toward bio-based polyols and innovative, phosphorus-based reactive FR additives. Growth is steady, fueled by mandated thermal efficiency upgrades in existing building stock and strict automotive fire safety standards (ECE R118). Western Europe focuses intensely on life-cycle assessment (LCA) and the circular economy, necessitating FR PUs that are easily recyclable or derived from renewable sources.

- Latin America (LATAM): LATAM is an emerging market experiencing accelerated demand, primarily linked to industrial expansion, commercial building projects, and modernization of public transport infrastructure in Brazil and Mexico. Although local regulatory environments are often less unified than in North America or Europe, large foreign investments and international company operations typically require compliance with global safety benchmarks, creating pockets of high demand for certified FR PU systems, particularly in specialized mining and petrochemical applications.

- Middle East and Africa (MEA): Growth in the MEA region is directly linked to large-scale, high-profile construction projects (e.g., UAE, Saudi Arabia) and the development of energy and logistics infrastructure. The arid climate necessitates high-performance insulation (FR rigid foam), and safety standards are often dictated by European or US benchmarks due to the nature of international contractors. The market presents specific opportunities for FR coatings and elastomers required for resilient, safety-critical applications in oil and gas facilities, where fire resistance is paramount.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame-Resistant Polyurethanes Market.- BASF SE

- Covestro AG

- Huntsman Corporation

- The Dow Chemical Company

- LANXESS AG

- Clariant AG

- Albemarle Corporation

- ICL Group Ltd.

- DIC Corporation

- Wanhua Chemical Group Co., Ltd.

- Kumho Mitsui Chemicals Inc.

- Stepan Company

- Polychem Resins

- Carpenter Co.

- Fomo Products, Inc.

- Cannon Group

- Sika AG

- Momentive Performance Materials Inc.

- Tosoh Corporation

- Evonik Industries AG

Frequently Asked Questions

Analyze common user questions about the Flame-Resistant Polyurethanes market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers shifting demand towards Flame-Resistant Polyurethanes?

The primary drivers are the increasing stringency of global fire safety regulations in construction and transportation, the urgent need for high-performance, energy-efficient building insulation, and consumer and regulatory pressure demanding safer, lower-toxicity, non-halogenated material solutions. Urbanization and rapid infrastructure modernization further accelerate this demand.

How do non-halogenated fire retardants (NHFRs) function differently than traditional halogenated additives?

NHFRs, typically phosphorus or nitrogen-based, operate primarily through an intumescent mechanism, meaning they react under heat to form a protective, insulating char layer on the material surface. This char layer acts as a barrier, starving the fire of oxygen and reducing the fuel release rate, in contrast to halogenated systems which inhibit the fire chemically in the gas phase but often produce higher smoke toxicity.

Which end-use industry holds the largest market share for FR Polyurethanes?

The Construction industry holds the largest market share, predominantly utilizing FR rigid polyurethane foams for high-efficiency thermal insulation in roofing, walls, and structural composites. This dominance is due to the critical mandate for both energy savings and adherence to rigorous passive fire protection building codes worldwide.

What major challenges currently restrain the growth of the FR Polyurethanes market?

Key restraints include the volatile cost and supply chain instability of petrochemical raw materials (polyols and isocyanates). Furthermore, the complex formulation and higher production cost of high-performance non-halogenated systems often make them less competitive on price compared to older, less environmentally preferred halogenated alternatives, particularly in price-sensitive emerging markets.

How is technological innovation impacting the future of FR Polyurethanes?

Innovation is focused on developing bio-based polyols and renewable fire retardants to enhance sustainability. Key technological advancements include the use of nanotechnology to synergistically improve FR performance and the application of Artificial Intelligence (AI) and machine learning for faster, cost-effective screening and optimization of new chemical formulations that meet evolving low smoke and low toxicity regulatory requirements.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager