Flame Retardant Armored Cables Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435821 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Flame Retardant Armored Cables Market Size

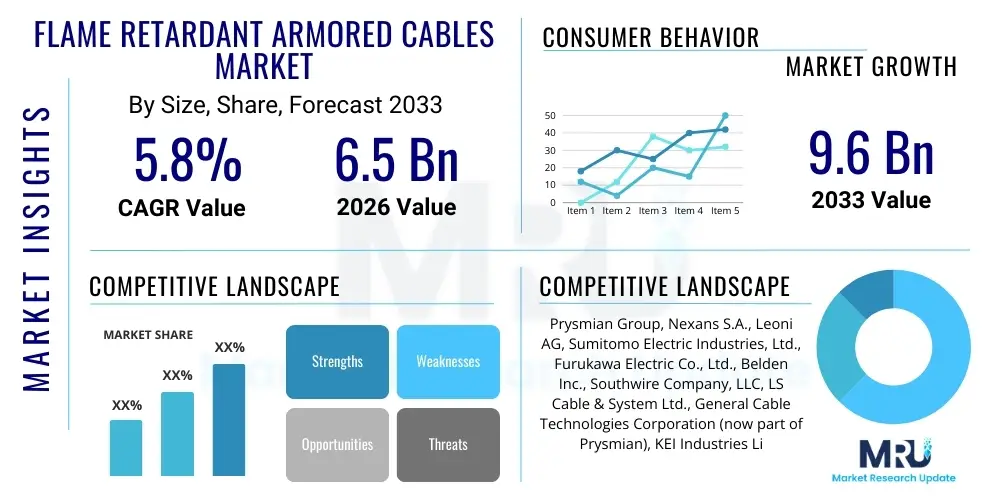

The Flame Retardant Armored Cables Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 9.6 Billion by the end of the forecast period in 2033.

Flame Retardant Armored Cables Market introduction

The Flame Retardant Armored Cables Market encompasses specialized electrical conductors designed with an inherent capability to resist the spread of fire while simultaneously offering enhanced mechanical protection against crushing, impact, and tensile stress. These cables are critical safety components utilized across hazardous environments and public infrastructure projects where operational continuity and minimizing fire risk are paramount. The product construction typically involves conductors, insulation, bedding, armor (usually steel tape or steel wire), and an outer flame-retardant jacket. The flame retardancy is achieved through specialized sheathing materials, such as Low Smoke Halogen-Free (LSHF) compounds or specific PVC formulations, which delay combustion and reduce smoke emission, significantly improving evacuation and firefighting efforts in the event of an electrical fault or external fire. This dual functionality of fire safety and physical resilience positions these cables as essential assets in industries requiring high reliability.

Major applications for flame retardant armored cables span critical sectors including oil and gas exploration and refining, petrochemical processing plants, power generation facilities (both conventional and renewable), large-scale data centers, and urban mass transit systems. These environments often face stringent safety regulations and operational challenges, necessitating cables that can maintain circuit integrity under harsh conditions while complying with global safety standards like IEC 60332 and UL 1685. The robustness provided by the armor, coupled with the safety features of the flame-retardant jacket, makes them superior choices for fixed installations, especially in exposed locations, direct burial applications, or areas susceptible to rodent damage. The escalating global focus on infrastructure upgrades, coupled with stricter regulatory mandates regarding electrical safety in public and industrial settings, fundamentally drives the adoption rate of these specialized cables.

Key benefits derived from utilizing flame retardant armored cables include prolonged circuit integrity during a fire event, minimized toxic smoke and corrosive gas release, and superior mechanical durability, leading to reduced maintenance costs and fewer operational interruptions. Driving factors influencing market growth are multifaceted, notably the rapid industrialization in developing economies, expanding global energy grids requiring safer transmission infrastructure, and significant investments in fire safety systems for smart buildings and smart cities. Furthermore, the ongoing transition from traditional cables to Low Smoke Zero Halogen (LSZH) variants, particularly in enclosed public spaces, reflects the industry's commitment to enhanced safety and environmental standards, thereby propelling innovation and demand within this specific cable segment.

Flame Retardant Armored Cables Market Executive Summary

The Flame Retardant Armored Cables Market is experiencing robust growth fueled by accelerated industrial expansion, especially within the Asia Pacific region, coupled with intensifying global regulatory scrutiny over electrical safety standards. Business trends highlight a strong shift toward sustainable and eco-friendly cable solutions, emphasizing the transition from conventional PVC jackets to advanced LSHF and LSZH materials to meet environmental mandates and improve public safety in crowded environments. Key technological innovation focuses on enhancing the fire survival time (circuit integrity) of armored cables, crucial for emergency systems like ventilation, alarms, and firefighting pumps. Manufacturers are increasingly integrating advanced polymer chemistry to optimize flame retardancy without compromising mechanical strength or flexibility, thereby serving niche applications requiring ultra-high performance, such as nuclear power facilities and deep-sea drilling platforms. Strategic alliances and mergers among cable producers and material suppliers are also reshaping the competitive landscape, aiming for vertical integration and optimized supply chain resilience.

Regional trends indicate that the Asia Pacific (APAC) currently dominates the market share, attributed to massive infrastructure development projects, including high-speed rail networks, smart city initiatives, and substantial capacity additions in the power and manufacturing sectors, particularly in China and India. North America and Europe, characterized by mature markets, are focusing primarily on modernization, replacement of aging infrastructure, and strict adherence to specific national and regional safety codes (e.g., NFPA in the US, Eurocodes in Europe). These regions exhibit high adoption rates for premium, high-specification LSHF armored cables. The Middle East and Africa (MEA) region is emerging rapidly, driven by large-scale oil and gas projects and extensive urbanization, requiring high volumes of durable, fire-safe cables suitable for challenging climatic conditions and explosion-proof environments. Latin America follows suit, with increased investment in mining and renewable energy infrastructure boosting the regional demand for armored solutions.

Segment trends underscore the dominance of the power cable segment due to widespread utility distribution and transmission infrastructure requirements. However, the control and instrumentation cable segment is registering the fastest growth, propelled by the proliferation of automated industrial processes, IoT integration in manufacturing, and complex process control systems that demand reliable, interference-resistant, and fire-safe wiring. In terms of insulation material, XLPE (Cross-Linked Polyethylene) continues to lead due to its superior thermal resistance and longevity, while LSHF materials are projected to witness the steepest growth curve as regulatory preference leans heavily towards low-smoke emission specifications. End-user analysis confirms that the construction sector, encompassing commercial and residential building safety upgrades, remains a perennial major consumer, closely followed by the demanding specifications required within the oil & gas and petrochemical industries for hazardous zone installations.

AI Impact Analysis on Flame Retardant Armored Cables Market

Common user questions regarding AI's impact on the Flame Retardant Armored Cables Market often revolve around predictive maintenance capabilities, optimizing material selection for enhanced fire safety, and streamlining quality control during manufacturing. Users are keenly interested in how AI can forecast cable failure based on environmental stress factors (temperature, vibration, moisture ingress) monitored via IoT sensors embedded near critical installations, thus transitioning from reactive to proactive replacement cycles. Concerns also center on AI’s role in simulating fire scenarios to validate and certify new flame retardant compound formulations faster than traditional physical testing, thereby accelerating product development. Expectations are high that AI algorithms will enhance supply chain efficiency by predicting raw material fluctuations (especially copper and polymer pricing) and optimizing inventory levels for specialized armored cable types, leading to better cost management and reduced lead times for large projects.

- AI-driven predictive maintenance optimizes replacement cycles of cables based on real-time stress data, minimizing unexpected failures in critical infrastructure.

- Integration of machine learning algorithms accelerates the development and testing of novel flame retardant compounds, improving efficacy and compliance speed.

- AI enhances quality control and defect detection during the extrusion and armoring processes, ensuring consistent mechanical integrity and fire performance.

- Optimization of manufacturing processes using AI minimizes material waste and energy consumption, supporting sustainability goals.

- Smart inventory management systems powered by AI predict demand for specific armored cable types across regions, improving supply chain responsiveness.

- AI modeling simulates complex fire propagation scenarios to assist engineers in selecting the most appropriate cable specifications for high-risk installations.

- Automated monitoring of installation environments via edge computing and AI detects early signs of thermal overload or insulation breakdown, preventing fires.

DRO & Impact Forces Of Flame Retardant Armored Cables Market

The market for Flame Retardant Armored Cables is primarily driven by rigorous global regulatory standards mandating fire safety in public and industrial infrastructure, particularly the adoption of international standards like IEC 60332 and EN 50575, which stipulate minimum performance levels for flame propagation and smoke emission. Significant restraints include the volatility of raw material costs, specifically copper, aluminum, and specialty polymer additives, which affects manufacturing costs and profitability, often leading to procurement challenges for large projects. Furthermore, the inherent complexity and specialized nature of these armored cables require advanced installation techniques and skilled labor, which can increase overall project costs compared to standard non-armored wiring. However, substantial opportunities arise from the global smart grid development initiatives, extensive investments in renewable energy infrastructure (wind and solar farms), and the modernization of aging railway and mass transit systems, all of which demand highly durable, fire-safe electrical connectivity solutions. These forces collectively shape the competitive dynamics and future trajectory of the specialized cable market.

Key drivers center on the global urbanization trend, which necessitates large-scale commercial and residential complex development, requiring fire-resistant building materials to ensure occupant safety and structural integrity. Simultaneously, the aggressive expansion of industrial sectors, especially data centers and automated factories (Industry 4.0), demands uninterrupted power supply and data transmission protected against physical damage and fire hazards. The continuous push toward Low Smoke Zero Halogen (LSZH) and Low Smoke Halogen-Free (LSHF) cables, spurred by increasing environmental awareness and stricter enforcement of regional safety codes (such as the Construction Products Regulation in Europe), mandates the replacement of older cable types, creating significant replacement market demand. Moreover, the critical role these cables play in maintaining circuit integrity for emergency services (e.g., emergency lighting, alarm systems) during a fire incident further solidifies their essential market position.

Restraints are frequently encountered in the form of intense price competition, particularly from unorganized local manufacturers in certain emerging economies who may not strictly adhere to international quality and safety certifications, potentially undermining market standards. The long product life cycle of high-quality armored cables also limits immediate replacement demand, shifting focus toward large, new infrastructure builds. Opportunities are abundant in areas like specialized offshore applications, including deep-sea oil rigs and marine infrastructure, where corrosive environments and high mechanical stress require customized, high-performance armored cables with specialized jacketing. Developing innovative, lightweight armor materials, such as non-metallic composites, that offer comparable mechanical protection with reduced weight and easier installation presents a substantial avenue for future market differentiation and penetration, particularly in weight-sensitive aerospace and defense applications.

Segmentation Analysis

The Flame Retardant Armored Cables Market is segmented based on the type of insulation material, the armoring type, voltage level, end-user industry, and product type (functional classification). This granular segmentation helps in understanding the specific requirements across varied operational environments, from low-voltage building wiring to high-voltage utility transmission. Insulation material segments, such as XLPE, PVC, and LSHF/LSZH, are critical, as they dictate the cable's thermal resistance, dielectric strength, and most importantly, its fire safety characteristics. The armoring type, predominantly steel wire armored (SWA) or steel tape armored (STA), defines the mechanical protection level, crucial for direct burial or heavy industrial use. End-user classification reveals the most demanding sectors, with power distribution and industrial manufacturing consistently driving volume, while telecommunications and data centers drive demand for specialized, high-bandwidth armored solutions.

- By Product Type:

- Power Cables

- Control Cables

- Instrumentation Cables

- Data Cables (Fiber Optic and Copper)

- By Insulation Material:

- Cross-Linked Polyethylene (XLPE)

- Polyvinyl Chloride (PVC)

- Ethylene Propylene Rubber (EPR)

- Low Smoke Halogen-Free (LSHF/LSZH)

- By Armoring Type:

- Steel Wire Armored (SWA)

- Steel Tape Armored (STA)

- Aluminum Wire Armored (AWA)

- Non-Metallic Armored (Composite/FRP)

- By Voltage Level:

- Low Voltage (LV - up to 1 kV)

- Medium Voltage (MV - 1 kV to 35 kV)

- High Voltage (HV - above 35 kV)

- By End-User Industry:

- Oil & Gas and Petrochemical

- Industrial Manufacturing

- Power Generation and Distribution (Utility)

- Construction (Commercial and Residential)

- Mining

- Transportation (Railways, Airports)

- Data Centers and Telecommunications

Value Chain Analysis For Flame Retardant Armored Cables Market

The value chain for flame retardant armored cables begins with the procurement of essential raw materials, primarily copper and aluminum for conductors, and specialized polymers (XLPE, PVC, LSHF) coupled with fire retardant additives (such as ATH, Mg(OH)2) for insulation and sheathing. This upstream stage is characterized by high price volatility and reliance on specialized chemical suppliers for high-performance additives. Manufacturers then undertake the critical processes of wire drawing, conductor stranding, insulation extrusion, cable core twisting, and the complex armoring application (SWA or STA), which requires heavy machinery and precise quality control to ensure mechanical and fire safety specifications are met. The high capital expenditure associated with manufacturing facilities and the necessity for certified testing laboratories (for IEC, UL, and regional compliance) mark this stage.

The midstream of the value chain is dominated by distribution and logistics. Due to the weight, volume, and project-specific nature of armored cables, efficient warehousing, cutting, and transportation services are crucial. Distribution channels are varied, including direct sales to major EPC contractors and utility companies for large infrastructure projects, and reliance on authorized distributors and wholesale electric suppliers for smaller industrial and commercial installations. The specification process is heavily influenced by consultants and electrical engineers who define the precise technical requirements (e.g., fire rating, voltage, conductor size, environmental suitability), making technical support and certification validation a vital part of the manufacturer’s offering. Post-manufacturing, cables undergo rigorous third-party certification and regulatory approval before they can be deployed.

The downstream stage involves the installation and end-user deployment across various sectors. The complexity of armored cable installation requires highly specialized labor and adherence to strict wiring codes, particularly in hazardous locations (e.g., Oil & Gas facilities). Direct engagement with engineering, procurement, and construction (EPC) firms is common for mega-projects, ensuring seamless integration and compliance. The final stage includes post-installation testing, maintenance, and eventually, decommissioning and recycling, where sustainable practices are becoming increasingly important for managing copper and aluminum scrap, minimizing environmental impact. The direct channel is preferred for very large utilities and specialized industrial clients demanding highly customized products, while the indirect channel through authorized dealers serves the broad commercial construction and industrial retrofit markets, ensuring wider geographical reach.

Flame Retardant Armored Cables Market Potential Customers

Potential customers for flame retardant armored cables are predominantly large entities across critical infrastructure sectors that prioritize operational reliability and adherence to stringent safety regulations. The primary end-users are major Engineering, Procurement, and Construction (EPC) companies involved in developing industrial plants, power stations, and public transportation infrastructure. These customers require cables in high volumes, often custom-specified for harsh operating environments, demanding certified fire performance and robust mechanical protection. Utility companies (national and regional power grid operators) are constant consumers, utilizing medium and high-voltage armored cables for underground transmission and distribution networks where reliability against physical damage and fire spread is essential to grid stability. Furthermore, governmental bodies overseeing public safety, such as those managing mass transit systems (subways, railways) and large-scale public facilities (hospitals, schools, airports), constitute significant potential customers due to mandatory safety regulations concerning smoke and fire containment in enclosed spaces.

The oil and gas industry, encompassing both upstream (exploration and production) and downstream (refining and processing) activities, represents one of the most demanding customer segments. These facilities are often designated as hazardous locations (Class 1, Division 1/Zone 1), requiring specialized armored cables that are not only flame retardant but also resistant to hydrocarbons, chemicals, and extreme temperatures. Similarly, the mining industry relies heavily on armored cables for power distribution and communication within deep underground shafts, where the risk of physical damage and fire spread necessitates the highest levels of protection. The increasing global investment in data centers also drives substantial demand; these facilities require vast quantities of low-smoke, zero-halogen armored data and power cables to maintain connectivity and minimize catastrophic damage in confined, high-density environments, ensuring business continuity.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 9.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Prysmian Group, Nexans S.A., Leoni AG, Sumitomo Electric Industries, Ltd., Furukawa Electric Co., Ltd., Belden Inc., Southwire Company, LLC, LS Cable & System Ltd., General Cable Technologies Corporation (now part of Prysmian), KEI Industries Limited, Polycab India Limited, Havells India Ltd., The Okonite Company, Encore Wire Corporation, Tofle Corporation, NKT A/S, Elsewedy Electric, Jiangsu Shangshang Cable Group, Tele-Fonika Kable S.A. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Armored Cables Market Key Technology Landscape

The technological landscape of the Flame Retardant Armored Cables Market is primarily defined by advancements in polymer science aimed at enhancing fire performance, while simultaneously improving mechanical properties and reducing environmental impact. A key area of innovation is the development and commercialization of advanced Low Smoke Halogen-Free (LSHF) and Low Smoke Zero Halogen (LSZH) compounds. These materials utilize non-halogenated flame suppressants, such as metal hydroxides (e.g., magnesium hydroxide and aluminum trihydroxide), which release water vapor upon heating, effectively cooling the combustion zone and suppressing fire without generating corrosive, toxic fumes typical of traditional PVC. Manufacturers are continually working to increase the loading of these inorganic fillers while maintaining acceptable flexibility, extrusion properties, and tensile strength, a persistent challenge in material engineering. Furthermore, the integration of nanotechnologies, such as nanoclay composites, into the cable jacket matrix is being explored to improve barrier properties and reduce heat release rates more effectively.

Another crucial technological focus is on optimizing the armoring layer for specific applications. While traditional Steel Wire Armor (SWA) and Steel Tape Armor (STA) remain prevalent, especially in heavy industrial and utility projects, there is a growing trend toward lighter, more flexible alternatives. This includes the development of interlocking aluminum armor (AIA) for improved flexibility and weight reduction, particularly favored in North American industrial standards. For highly specialized environments, composite armoring, often utilizing fiberglass reinforced plastics (FRP) or aramid fibers, is gaining traction. These non-metallic armors offer comparable mechanical protection and superior corrosion resistance, making them ideal for petrochemical, marine, and highly corrosive chemical plant environments, while also eliminating eddy current losses inherent in magnetic armoring materials. These composites also contribute to overall cable weight reduction, easing installation and reducing structural load in building applications.

Digitalization and smart manufacturing techniques are also influencing the landscape, particularly through the implementation of highly precise continuous vulcanization (CCV) lines and advanced extrusion control systems. These systems utilize sophisticated sensors and data analytics to maintain ultra-tight tolerances on insulation thickness and eccentricities, thereby ensuring consistent dielectric performance and prolonged service life. Furthermore, traceability and authentication technologies, such as RFID chips or embedded fiber optics, are increasingly integrated into high-value armored cables to combat counterfeiting and provide lifecycle data management. For critical circuits, manufacturers are also investing heavily in Mica tape technology applications to ensure "circuit integrity" (Fire Resistance - maintaining function during a fire) for required duration (e.g., 90 minutes), critical for fire alarm and emergency ventilation systems as mandated by standards like IEC 60331, demonstrating a continuous drive toward enhanced life safety functions.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, primarily fueled by rapid urbanization, massive government investment in infrastructure (e.g., China’s Belt and Road Initiative, India’s Smart Cities Mission), and significant expansion of industrial capacity. Countries like China, India, and Southeast Asian nations are witnessing high demand from the power, manufacturing, and transportation sectors. The region's increasing focus on renewable energy adoption (solar and wind farms) and data center construction mandates the use of specialized, high-performance armored cables, though price sensitivity remains a key factor, often leading to fierce competition among local and international players.

- North America: This region is characterized by stringent safety regulations (NFPA, NEC standards) and a strong demand for high-specification products, particularly in the oil & gas and petrochemical sectors, where explosion-proof and highly durable cables are necessary. The market growth is driven largely by the modernization and replacement of aging power grid infrastructure (smart grid initiatives) and heavy investment in commercial construction and data center expansion. The U.S. and Canada prioritize UL-certified, high-reliability armored cables, focusing heavily on LSHF variants in public access areas.

- Europe: Europe is a mature market defined by rigorous environmental and safety standards, notably the Construction Products Regulation (CPR), which strictly governs the fire performance of cables installed in buildings. This regulatory push accelerates the adoption of premium LSZH armored cables. Key drivers include investments in cross-border power interconnections, railway infrastructure upgrades, and the automotive manufacturing sector. Germany, the UK, and France are major consumers, demanding technologically advanced cables with robust fire classification ratings (e.g., B2ca, Cca).

- Middle East and Africa (MEA): This region exhibits significant growth potential, especially driven by massive infrastructure projects in the Gulf Cooperation Council (GCC) countries, including mega-city developments and substantial capacity expansion in the energy sector (oil, gas, and utility-scale solar). The requirement for armored cables capable of withstanding extreme high temperatures, high solar radiation, and corrosive coastal environments is paramount, necessitating specialized sheathing materials alongside standard flame retardancy.

- Latin America (LATAM): Market growth in LATAM is closely linked to investment cycles in the mining industry, infrastructure repair, and expansion of utility networks, particularly in Brazil, Mexico, and Chile. Economic fluctuations can restrain investment, but the underlying need for safer, durable electrical infrastructure in industrial zones and urban centers ensures sustained demand for standard and medium-voltage armored, flame-retardant solutions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Armored Cables Market.- Prysmian Group

- Nexans S.A.

- Leoni AG

- Sumitomo Electric Industries, Ltd.

- Furukawa Electric Co., Ltd.

- Belden Inc.

- Southwire Company, LLC

- LS Cable & System Ltd.

- General Cable Technologies Corporation (now part of Prysmian)

- KEI Industries Limited

- Polycab India Limited

- Havells India Ltd.

- The Okonite Company

- Encore Wire Corporation

- Tofle Corporation

- NKT A/S

- Elsewedy Electric

- Jiangsu Shangshang Cable Group

- Tele-Fonika Kable S.A.

- Universal Cable (M) Berhad

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Armored Cables market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between flame retardant and fire resistant cables?

Flame retardant cables are designed to prevent the spread of fire along a cable bundle after the ignition source is removed. Fire resistant (or fire survival) cables, conversely, are designed to maintain electrical circuit functionality and integrity for a specified duration (e.g., 90 minutes) during an actual fire event, crucial for emergency systems.

Which regulatory standards govern the fire performance of armored cables globally?

Globally, key standards include the International Electrotechnical Commission (IEC) standards, such as IEC 60332 (flame retardancy) and IEC 60331 (fire resistance). In Europe, the Construction Products Regulation (CPR) defines fire classification (Euroclasses). In North America, UL standards (e.g., UL 1685) and NFPA codes are mandated for installation and cable performance.

What is the main driver for the adoption of Low Smoke Halogen-Free (LSHF) armored cables?

The main driver is enhanced public safety in enclosed spaces (tunnels, subways, data centers, hospitals). LSHF cables significantly reduce the emission of toxic, corrosive gases and dense smoke when exposed to fire, thereby improving visibility for evacuation and minimizing damage to electronic equipment and structural elements.

What factors influence the choice between Steel Wire Armor (SWA) and Steel Tape Armor (STA)?

SWA provides superior mechanical protection against tensile stress and impact, making it ideal for vertical runs and high-stress industrial environments. STA, while offering adequate crushing protection, is generally more flexible and lighter, making it suitable for standard direct burial or fixed installations where flexibility is advantageous.

How is the volatility of copper prices impacting the armored cable market?

Copper is a major raw material cost component. Price volatility directly increases manufacturing costs and inventory risks. Manufacturers often utilize pricing mechanisms based on the London Metal Exchange (LME) copper price and engage in hedging strategies, but high and unpredictable prices can restrain large project procurement and shift focus toward aluminum conductors where feasible.

What role does digitalization play in the future of armored cable manufacturing?

Digitalization leverages IoT sensors and AI to optimize manufacturing processes, ensuring consistent quality control and reducing material variability. It also enables predictive maintenance models for installed cables, shifting management from reactive repair to proactive replacement, thereby extending asset life and ensuring system reliability, especially in critical infrastructure.

What are the primary applications of flame retardant armored control cables?

Flame retardant armored control cables are essential for signaling, monitoring, and process automation in industrial environments. Key applications include connecting control panels, remote instrumentation, factory automation systems, and managing emergency shutdown systems in petrochemical plants, refineries, and power generation facilities where robust communication and physical protection are critical.

How do specialized polymer additives achieve effective flame retardancy in cable jacketing?

Specialized polymer additives, particularly metal hydroxides like ATH (Aluminum Trihydroxide) and MDH (Magnesium Dihydroxide), function endothermically. When heated, they decompose, releasing water vapor, which cools the combustion zone and dilutes flammable gases. This physical mechanism effectively suppresses the flame without introducing halogenated (toxic) compounds, meeting LSHF requirements.

Which end-user segment is anticipated to witness the highest growth in armored cable demand?

The Power Generation and Distribution segment, specifically encompassing large utility infrastructure upgrades and the build-out of renewable energy facilities (wind, solar), is expected to maintain the highest volume demand. However, the Data Center and Industrial Automation segments are projected to record the fastest percentage growth due to global digitalization trends.

What are the challenges associated with recycling high-performance armored cables?

Recycling high-performance armored cables is challenging due to the complex composite structure involving metals (copper/aluminum), various polymer layers (XLPE, PVC, LSHF), and the steel or aluminum armor. Efficient separation of these components, particularly extracting high-purity copper and responsibly disposing of or reusing specialized fire-retardant polymer waste, requires high-cost, specialized recycling technologies.

How does the voltage level affect the design requirements of flame retardant armored cables?

As the voltage level increases (Medium Voltage and High Voltage), the design must incorporate thicker, more specialized insulation materials (usually XLPE or EPR) to manage electrical stresses and partial discharge. Furthermore, the cable construction requires advanced shielding layers and robust armoring to ensure mechanical protection without compromising the integrity of the complex dielectric structure, making HV armored cables highly customized products.

Why are armored cables commonly used in direct burial applications?

Armored cables are utilized in direct burial applications because the metallic armoring (SWA or STA) provides essential mechanical protection against external stresses, such as crushing loads from vehicular traffic, shifting soil, and potential damage from excavation equipment or rodents. This mechanical shield prevents physical damage to the conductors and insulation, ensuring long-term operational integrity without the need for additional conduit or protective ducts.

What are the specific requirements for armored cables used in the petrochemical industry?

Petrochemical applications require cables that are not only flame retardant but also resistant to hydrocarbons, oils, corrosive chemicals, and extreme temperatures, often needing ATEX or IECEx certification for hazardous zones. These cables typically feature specialized outer jackets (like Chlorinated Polyethylene - CPE or specific polyurethanes) coupled with robust armor to withstand both chemical degradation and physical damage in harsh, potentially explosive environments.

How does the implementation of smart grid technology influence demand for armored cables?

Smart grid implementation increases demand for high-reliability, armored cables as it involves extending and modernizing power distribution networks, often underground, to improve resilience against physical threats and natural disasters. Smart grids require extensive armored data and fiber optic cables alongside power cables for real-time monitoring and two-way communication, necessitating durable, fire-safe solutions to support grid automation.

What is the significance of the "smoke density" requirement in cable standards?

Smoke density is a critical safety parameter, especially in enclosed public spaces, as high smoke levels rapidly obscure visibility, hindering safe evacuation. Standards like IEC 61034 measure smoke emission; lower smoke density ensures that occupants have more time and better conditions to exit a fire scene, making it a crucial specification for LSHF/LSZH armored cables used in transport and commercial buildings.

Are non-metallic armored cables gaining market acceptance, and where are they primarily used?

Yes, non-metallic armored cables (using materials like fiberglass or aramid yarns) are gaining acceptance, particularly where weight reduction, superior corrosion resistance, and magnetic interference minimization are paramount. They are primarily used in marine vessels, offshore installations, specific mining applications, and environments requiring inherent spark suppression or where the use of magnetic materials is restricted.

What technological challenge is associated with optimizing flame retardancy and flexibility simultaneously?

The primary technological challenge is that high levels of inorganic fillers (metal hydroxides) necessary for effective flame suppression tend to stiffen the polymer matrix, reducing the cable's flexibility and making it harder to install. Manufacturers must develop sophisticated polymer blending techniques and use specific coupling agents to achieve high fire rating while maintaining the required bending radius and ease of handling.

How do manufacturers ensure the longevity and durability of the outer sheath of armored cables?

Manufacturers ensure longevity by using UV-resistant, abrasion-resistant, and weather-proof outer sheathing materials, such as specialized grades of polyethylene or heavy-duty PVC compounds, depending on the application. Rigorous testing for resistance to oil, ozone, and extreme temperatures (thermal cycling) is conducted, ensuring the outer layer protects the critical armor and insulation throughout the cable’s intended service life, often exceeding 30 years.

Which regional market segment currently holds the largest market share for these cables?

The Asia Pacific (APAC) region currently holds the largest market share, driven by unprecedented levels of infrastructure development, rapid industrialization, high population density necessitating stringent safety standards, and sustained investment in utility and power distribution projects across major economies like China and India.

What is the impact of counterfeit cables on the Flame Retardant Armored Cables Market?

Counterfeit cables pose a significant threat, particularly regarding safety compliance. Uncertified counterfeit products often use inferior materials, failing to meet the specified fire safety standards (flame retardancy, smoke emission) or mechanical strength requirements. This undermines legitimate manufacturers, introduces massive safety risks into infrastructure, and requires constant vigilance from regulatory bodies and authorized distributors.

How does the shift toward renewable energy affect the demand for armored cables?

The shift toward renewable energy (wind and solar) significantly boosts demand. Renewable projects require extensive runs of durable, armored medium-voltage cables for collector systems, transmission links, and inter-array connections, particularly in challenging environments like offshore wind farms or remote solar installations where mechanical protection and fire resistance are essential for large-scale power aggregation.

What is the significance of the corrosion aspect when specifying flame retardant cables?

Corrosion is critical because conventional flame retardant materials like PVC can release hydrochloric acid when burned, severely corroding nearby metals, sensitive electronics, and structural steel. LSHF cables eliminate this risk, making them mandatory in data centers, hospitals, and any facility housing expensive, sensitive electronic equipment where post-fire damage must be minimized.

Why are instrumentation cables often armored and flame retardant?

Instrumentation cables carry critical low-voltage signals for monitoring and control systems in industrial processes. Armoring protects these sensitive signals from physical damage and electromagnetic interference (when utilizing specialized armor designs), while flame retardancy ensures that a local fire does not compromise the integrity of the plant's control and safety systems, maintaining operational oversight.

What market opportunities exist related to the refurbishment of existing infrastructure?

Significant market opportunities lie in the refurbishment of aging utility and transportation infrastructure in developed economies. As old cables reach the end of their service life, they are replaced with modern, compliant flame-retardant armored cables, especially those meeting contemporary LSHF standards, ensuring systems meet current safety and performance codes without major structural overhauls.

How does the mining sector's specific needs drive specialized armored cable design?

The mining sector demands highly specialized armored cables due to harsh operating conditions, including constant movement, abrasion, moisture, and potential exposure to methane gas. Cables must be highly rugged, sometimes featuring double armoring, and designed with materials that resist crushing and cutting, while also complying with mandatory flame-retardant standards specific to underground environments (e.g., MSHA/Mine Safety and Health Administration compliance).

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager