Flame Retardant Polyester Fibre Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438112 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Flame Retardant Polyester Fibre Market Size

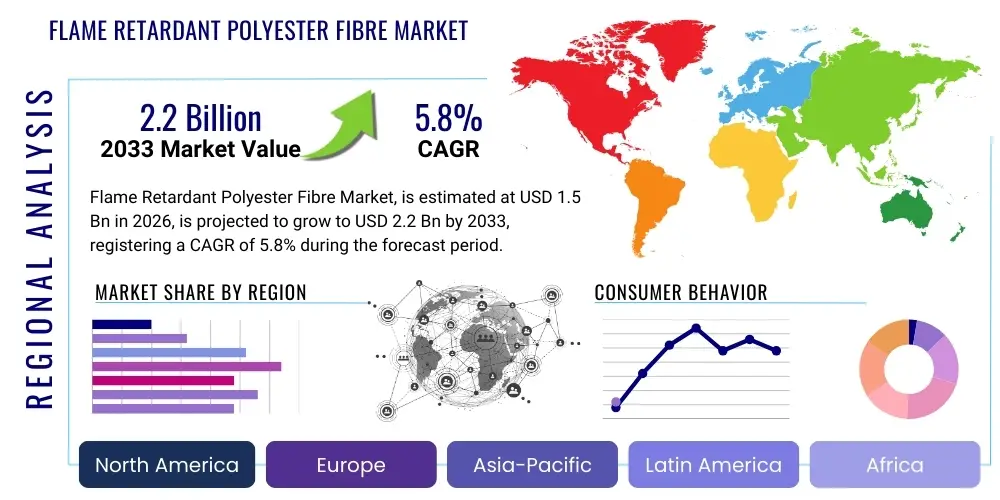

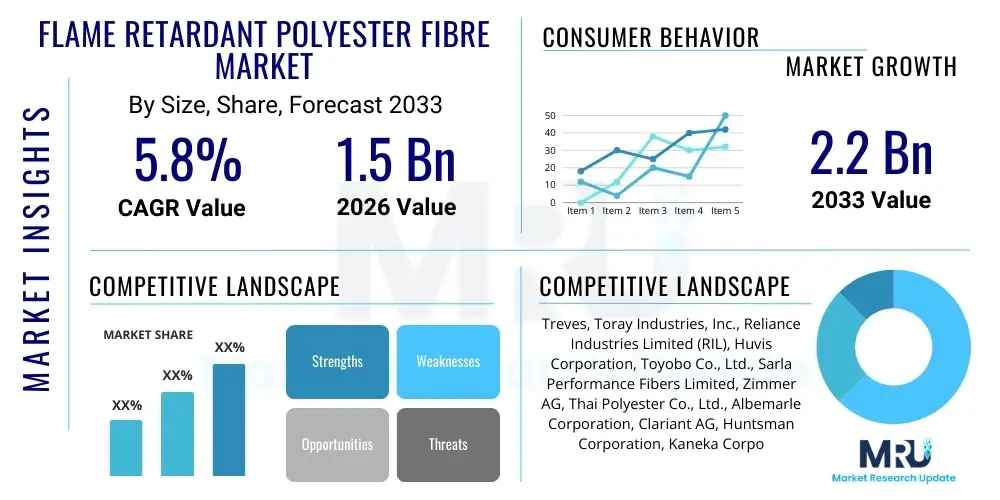

The Flame Retardant Polyester Fibre Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 2.2 Billion by the end of the forecast period in 2033.

This projected growth is primarily driven by the escalating implementation of stringent fire safety codes and building regulations across major global economies, particularly in the construction and transportation sectors. Governments and regulatory bodies worldwide are increasingly mandating the use of materials that inherently reduce flammability, thereby boosting the demand for inherently flame retardant synthetic fibers like polyester. The adoption of these fibers in high-risk environments, such as commercial aviation interiors, public transportation seating, and industrial protective wear, contributes substantially to the overall market expansion.

The market valuation reflects a fundamental shift among manufacturers towards developing non-halogenated flame retardant solutions, responding to growing environmental and health concerns associated with traditional halogen-based chemicals. Innovation in polymer science, particularly the successful incorporation of phosphorus, nitrogen, or inorganic additives directly into the polyester backbone during polymerization, is enabling the creation of durable, high-performance fibres that maintain their flame retardancy throughout their lifecycle. This technological evolution not only meets regulatory requirements but also appeals to consumer preferences for safer and more sustainable textile products, reinforcing the market trajectory toward the forecasted valuation.

Furthermore, rapid urbanization and infrastructure development in emerging economies, particularly in the Asia Pacific region, necessitate higher safety standards in residential and commercial buildings. This rising awareness regarding fire hazards, coupled with increased disposable income leading to higher consumption of upholstered furniture and home textiles, stimulates consistent market growth. The robust demand from the furniture and bedding industries, which must comply with strict national flammability standards (such as CAL 117 in the US or relevant European standards), guarantees a stable revenue stream, solidifying the market’s projected achievement of the USD 2.2 Billion milestone by 2033.

Flame Retardant Polyester Fibre Market introduction

The Flame Retardant Polyester Fibre Market encompasses the production and distribution of modified polyethylene terephthalate (PET) or polybutylene terephthalate (PBT) fibers designed to inhibit or slow the spread of fire. These specialized fibers achieve flame retardancy either through chemical treatments applied to the surface (topical finish) or, more commonly and effectively, through intrinsic modification where fire-retardant additives are incorporated directly into the polymer matrix prior to extrusion. The core objective of these products is to enhance safety in various end-use applications where standard textiles pose a fire risk, providing critical reaction time during fire incidents. Key benefits include enhanced life safety, compliance with mandatory international fire codes, durability of the fire-retardant properties, and versatility across numerous textile applications, ranging from protective clothing to automotive interiors and large-scale architectural textiles.

The primary applications driving the consumption of flame retardant polyester fibers are highly regulated sectors. These include the home textiles market (mattresses, curtains, upholstery, and bedding), the contract textiles segment (used in hotels, hospitals, and educational institutions), the transportation industry (aircraft seating, train carriages, and automotive interiors), and specialized industrial protective clothing (uniforms for firefighters, chemical workers, and military personnel). The inherent physical and economic advantages of polyester—such as its strength, wrinkle resistance, cost-effectiveness, and ease of dyeing—when combined with permanent flame retardant properties, make it a preferred material over other more expensive inherently flame-resistant fibers like aramid or modacrylic in applications where both performance and cost efficiency are critical considerations for large volume procurement.

Major driving factors influencing the market trajectory include the continually evolving regulatory landscape demanding stricter flammability performance, particularly in commercial and public spaces following high-profile fire accidents globally. Technological advancements, especially in developing environmentally benign, non-halogenated flame retardant systems (such as phosphorus-based compounds), are mitigating health and environmental concerns, thereby promoting broader adoption. Furthermore, the increasing focus on sustainability and durability mandates products that retain their safety characteristics after repeated washing and wear, which inherently modified polyester fibres are adept at providing, thus creating a reliable demand funnel across all key geographical regions where safety regulations are rigorously enforced and updated.

Flame Retardant Polyester Fibre Market Executive Summary

The Flame Retardant Polyester Fibre Market is characterized by strong regulatory influence and intense technological innovation centered on safety and sustainability. Current business trends indicate a distinct shift away from traditional halogenated flame retardants towards environmentally preferable non-halogenated alternatives, driven by EU directives like REACH and stricter consumer preferences in North America and Western Europe. Key players are investing heavily in R&D to improve the thermal stability and processability of phosphorus-based additives, ensuring that the finished fibers meet stringent performance metrics without compromising textile aesthetics or comfort. Strategic partnerships between chemical suppliers and fiber manufacturers are vital for securing consistent supply chains and accelerating the commercialization of novel, high-performance intrinsic flame retardant solutions, particularly for specialized applications like filtration and medical textiles where safety is non-negotiable.

Regionally, Asia Pacific (APAC) stands out as the fastest-growing market, primarily fueled by massive infrastructural expansion, booming construction activity, and the rapid urbanization process demanding safer residential and commercial interiors. While North America and Europe remain mature markets characterized by established, highly complex regulatory structures (e.g., FAR 25.853 for aerospace, or IMO standards for marine), they provide high-value opportunities for premium, certified non-halogenated products. The market in APAC, led by China and India, is currently balancing increasing domestic production capacity with the adoption of global safety standards, leading to a surge in demand for affordable, yet certified, flame retardant polyester used in domestic furniture and automotive production. This geographical dynamic dictates that global manufacturers must maintain localized production facilities and compliance teams to navigate varied market demands effectively.

Segment trends reveal that the intrinsic or permanent flame retardant segment, where the additive is chemically bonded or entrapped within the polymer, commands a premium and is projected to exhibit the highest CAGR due to superior durability and resistance to laundering compared to surface-treated fibres. Application-wise, the home textiles and contract furnishings segment remains the largest consumer, mandated by institutional safety requirements. However, the transportation sector, particularly the aerospace and rail segments, is showing accelerated growth due to continuous efforts to lightweight materials while simultaneously enhancing passenger safety through advanced composite and textile materials. This segmented growth underscores the market's dependence on regulatory enforcement and product differentiation based on the persistence and method of flame retardancy achieved in the final textile product.

AI Impact Analysis on Flame Retardant Polyester Fibre Market

Common user questions regarding AI's impact on the Flame Retardant Polyester Fibre Market frequently revolve around optimizing chemical formulations, predicting material performance under specific fire conditions, and streamlining complex supply chain logistics for specialized additives. Users are concerned about how AI can accelerate the transition to sustainable, non-halogenated solutions by quickly simulating thousands of potential compound interactions, thereby reducing lengthy, costly laboratory trials. The key themes include leveraging Machine Learning (ML) for predictive maintenance in polymerization plants, using AI to ensure consistent fiber quality control (identifying subtle structural defects impacting thermal stability), and integrating AI-driven supply chain transparency tools to manage the sourcing and compliance documentation for raw materials, especially specialized phosphorus or inorganic additives that have strict regulatory provenance requirements.

In the realm of Research and Development, Artificial Intelligence is fundamentally transforming how flame retardant compounds are discovered and optimized. Traditional methods of synthesizing and testing new chemical structures are time-consuming; however, AI and computational chemistry models can now predict the efficacy, thermal decomposition profiles, and material compatibility of novel additives before physical synthesis. This accelerates the time-to-market for next-generation, environmentally friendly FR polyester fibers, ensuring they meet both flammability standards and sustainability goals simultaneously. Furthermore, AI-powered image processing and sensor data analysis during the fiber extrusion phase can monitor polymer melt viscosity and additive dispersion uniformity in real-time, drastically reducing batch variation and improving the reliability of the permanent flame retardant characteristics of the final product.

Operationally, AI enhances market responsiveness and efficiency. Predictive analytics, utilizing large datasets on global regulatory changes, raw material pricing fluctuations, and demand forecasting, allows manufacturers to optimize inventory levels of critical additives and manage global logistics with greater precision. For instance, ML algorithms can analyze regional fire safety incident data alongside weather patterns and demographic shifts to accurately predict future demand peaks in specific application areas, such as high-density residential housing or temporary construction shelters. This optimization minimizes waste, improves resource allocation, and allows manufacturers to maintain competitive pricing, which is crucial in the commodity-driven polyester market while ensuring compliance documentation is digitally managed and verifiable for AEO purposes.

- AI optimizes the molecular design of non-halogenated flame retardant additives, significantly reducing R&D cycles and costs.

- Machine Learning algorithms predict fiber performance and thermal stability under varying environmental and fire conditions, enhancing product reliability.

- Predictive maintenance schedules for polymerization and spinning equipment are improved using AI, minimizing downtime and ensuring consistent quality.

- AI-driven supply chain analytics improve transparency and traceability of specialized chemical raw materials, ensuring regulatory compliance (e.g., REACH).

- Quality control processes are automated using computer vision systems to detect microscopic defects in fibers that could compromise flame retardancy.

- Generative AI assists in creating optimized process parameters for fiber extrusion, improving additive dispersion homogeneity.

- Demand forecasting models, utilizing ML, enhance inventory management for seasonal or application-specific textile requirements.

DRO & Impact Forces Of Flame Retardant Polyester Fibre Market

The Flame Retardant Polyester Fibre Market is fundamentally shaped by powerful regulatory drivers (D) mandating heightened fire safety in public and private domains, especially concerning commercial interiors, transportation, and specialized protective gear. These drivers include the continuous revision and stricter enforcement of standards like NFPA (North America), EN standards (Europe), and ISO norms globally. These regulations compel end-users to adopt inherently safer materials, directly stimulating market growth for high-performance FR polyester. However, the market faces significant restraints (R), primarily stemming from increasing environmental scrutiny and health concerns associated with legacy flame retardants, particularly halogenated compounds, which can release toxic fumes during combustion. This pressure necessitates costly R&D investments in developing eco-friendly, non-toxic alternatives, raising initial manufacturing costs.

Opportunities (O) abound in the development and commercialization of sustainable and bio-based flame retardant systems. The growing consumer demand for ‘green’ products, coupled with corporate social responsibility initiatives, provides a strong market incentive for innovators to integrate natural or phosphorus/nitrogen-based chemistry that offers permanent flame retardancy without compromising human health or environmental standards. Furthermore, the expansion of the high-growth construction sector in emerging economies presents a substantial opportunity for mass-market adoption of certified FR contract textiles. The market's stability is heavily reliant on impact forces related to regulatory harmonization and enforcement. The lack of uniform global standards (varying requirements between the US, EU, and Asia) necessitates complex, region-specific product development and certification processes, acting as a frictional force. Conversely, successful enforcement of fire codes acts as a positive impact force, transforming voluntary adoption into mandatory market demand.

The overall market trajectory is poised toward sustainable compliance. The imperative to replace older, problematic FR chemistries with intrinsically modified polyester fibres (using innovative polymeric phosphorus compounds) represents both a primary driver and a technological opportunity. The major restraint remains the cost parity challenge; non-halogenated FR additives are often more expensive than their traditional counterparts, potentially impeding adoption in highly price-sensitive segments. However, the increasing legal liability associated with non-compliant products compels large corporations to absorb these higher costs. Therefore, the long-term impact force pushing the market is the convergence of legal mandates, technological innovation focused on sustainability, and the undeniable requirement for enhanced life safety in densely populated urban environments globally.

Segmentation Analysis

The Flame Retardant Polyester Fibre Market is intricately segmented based on technology type, material composition, and diverse end-use applications, reflecting the varied performance requirements across different industries. Segmentation by technology type is crucial, dividing the market into topical/coated treatments and intrinsic/inherent modifications. Intrinsic modification, where the flame retardant properties are chemically locked into the fiber structure during synthesis, holds a dominant position and higher growth projection due to the permanent and durable nature of the flame retardancy, which survives repeated washing and abrasion, fulfilling rigorous institutional demands. Conversely, topical treatments offer a cost-effective solution for less stringent applications but require reapplication or replacement over time.

Material composition predominantly focuses on standard polyethylene terephthalate (PET) which is the most common base polymer, but also includes specialized variants like flame retardant polybutylene terephthalate (PBT) used in engineering plastics and high-temperature applications. The application segmentation demonstrates the broad utility of these fibers, covering critical sectors such as home furnishings (upholstery, mattresses, drapes), transportation (aerospace, rail, bus interiors requiring specific self-extinguishing properties), and protective wear (industrial uniforms, military textiles). Each segment is governed by a unique set of flammability standards, necessitating customized fiber formulations and rigorous certification processes before market entry, ensuring specialized product lines for each end-use area.

Further analysis of segmentation reveals that the home textiles segment, driven by large volume consumer goods production, consumes the highest volume, largely dictated by furniture flammability standards. However, the fastest growth is observed in technical textiles, specifically in filtration media and non-woven fabrics used in construction and insulation, where enhanced fire safety combined with high tensile strength and chemical resistance is required. This segmentation profile highlights the maturity of the technology across commodity applications while simultaneously showing exponential potential in highly engineered, specialized industrial and transportation textile components where failure to comply results in significant legal and financial penalties, thus justifying premium pricing for certified materials.

- By Technology Type:

- Intrinsic/Inherent Flame Retardant Polyester Fibres (Permanent)

- Topical/Treated Flame Retardant Polyester Fibres (Non-Permanent)

- By Material Composition:

- Polyethylene Terephthalate (PET) Based FR Fibre

- Polybutylene Terephthalate (PBT) Based FR Fibre

- Recycled Polyester (rPET) FR Fibre

- By Chemical Additive:

- Phosphorus-Based FR System

- Nitrogen-Based FR System

- Halogenated FR System (Declining Segment)

- Inorganic Additives (e.g., metal hydroxides)

- By Application:

- Home Textiles (Bedding, Upholstery, Curtains)

- Contract Furnishings (Hospitality, Healthcare, Educational Institutions)

- Transportation (Automotive, Aviation, Rail, Marine)

- Protective Clothing (Industrial Safety, Military, Fire Services)

- Industrial and Technical Textiles (Filtration, Insulation, Tents, Tarpaulins)

Value Chain Analysis For Flame Retardant Polyester Fibre Market

The value chain for the Flame Retardant Polyester Fibre Market begins upstream with the sourcing of petrochemical raw materials—primarily purified terephthalic acid (PTA) and monoethylene glycol (MEG)—alongside specialized flame retardant chemical additives, such as phosphorus polyols or organo-phosphorous compounds. The upstream complexity lies in ensuring a consistent supply of high-purity FR additives that comply with global toxicity standards and possess the necessary thermal stability to withstand the high temperatures of the polymerization process. Direct suppliers of these specialized additives (often multinational chemical companies) play a critical role, as their proprietary technology dictates the final fire safety performance and cost structure of the fiber. Manufacturers often engage in long-term contracts with these suppliers to manage quality and compliance risks effectively.

The midstream stage involves polymerization and fiber manufacturing. This critical phase includes the incorporation of the FR additive into the polymer melt (for inherent flame retardancy) followed by extrusion, spinning, and finishing processes. The efficiency and quality of this stage determine the physical properties and the permanence of the flame retardant characteristics. Distribution channels are varied, involving both direct and indirect routes. Direct distribution occurs when large fiber manufacturers sell directly to major integrated textile mills or specialized technical textile producers who require high volumes of custom specifications, such common in the automotive or aerospace supply chains. Indirect distribution utilizes specialized agents, distributors, and trading houses, particularly for smaller orders or regional markets where logistical complexity or local regulatory knowledge is required to bridge the gap between manufacturer and smaller garment producers or fabric wholesalers.

Downstream analysis focuses on conversion, fabrication, and the end-user markets. Fiber is sold to textile converters for weaving, knitting, or non-woven production, then fabricated into final products like apparel, upholstery covers, or technical components. Potential customers, spanning institutions, transportation companies, and consumer goods firms, exert substantial power over the downstream value chain, demanding rigorous compliance documentation and third-party certification (e.g., UL, OEKO-TEX). The complexity of certification and the need for stringent quality control at every stage—from chemical input to final textile testing—drives up costs but ensures market credibility. The integration of digital tracking and compliance management systems is becoming essential to maintain transparency throughout this complex, multi-tiered value chain, ensuring that the flame retardancy claims are verifiable from the polymer base to the finished product.

Flame Retardant Polyester Fibre Market Potential Customers

Potential customers for Flame Retardant Polyester Fibre are predominantly entities operating within highly regulated environments or those responsible for public safety and high-value asset protection. The largest segment of buyers includes manufacturers of contract furnishings and home textiles, such as major furniture brands, bedding manufacturers, and commercial interior design firms that supply hotels, healthcare facilities, and universities. These buyers are driven by compulsory flammability standards, such as California Technical Bulletin 117 (CAL 117) and equivalent European standards, which mandate the use of compliant materials in mattresses and upholstered items to protect occupants and minimize institutional liability, thereby making regulatory adherence the primary purchase criterion over purely economic considerations.

Another crucial customer group resides in the transportation sector, encompassing Original Equipment Manufacturers (OEMs) in aerospace, rail, and high-end automotive industries. Aerospace manufacturers require fibers compliant with the Federal Aviation Regulation (FAR) 25.853, demanding materials that exhibit extremely low heat release rates and smoke toxicity. Similarly, rail and marine industries adhere to specific International Maritime Organization (IMO) or national rail safety standards. These customers purchase specialized, intrinsically flame retardant polyester fibers, often blended with other high-performance materials, for seating, carpeting, wall coverings, and insulation. The purchasing decisions in this segment are characterized by high quality thresholds, long qualification cycles, and a willingness to pay a premium for certified, lightweight, and durable materials essential for passenger safety.

Finally, industrial and military procurement agencies represent significant niche buyers. These customers require protective clothing and technical textiles, such as filter media, conveyor belts, and specialized uniforms for personnel operating in hazardous conditions (e.g., firefighters, military ground troops, and oil rig workers). For these applications, FR polyester is valued for its combination of flame resistance, chemical durability, and cost-effectiveness compared to aramid or carbon fibers. Procurement is typically conducted through large governmental tenders, emphasizing specifications related to multiple performance criteria, including high limiting oxygen index (LOI), durability after washing, and compliance with specific military or national safety standards for specialized protective gear.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 2.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Treves, Toray Industries, Inc., Reliance Industries Limited (RIL), Huvis Corporation, Toyobo Co., Ltd., Sarla Performance Fibers Limited, Zimmer AG, Thai Polyester Co., Ltd., Albemarle Corporation, Clariant AG, Huntsman Corporation, Kaneka Corporation, Jiangsu Sanfangxiang Group Co., Ltd., Teijin Limited, Invista, DuPont de Nemours, Inc., LCY Chemical Corp., SK Chemicals, Kolon Industries, Inc., PHP Fibers GmbH |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Polyester Fibre Market Key Technology Landscape

The technological landscape of the Flame Retardant Polyester Fibre market is dominated by advancements in intrinsic modification techniques, moving away from post-treatment methods. The focus is on integrating additives directly into the polymer chain during the polymerization process or melt spinning, ensuring permanent fire resistance. Key technologies involve the use of phosphorus and nitrogen-containing compounds. Phosphorus-based flame retardants, such as organophosphorus esters or reactive phosphonates, are preferred because they function primarily in the condensed phase, promoting char formation which insulates the substrate from heat and oxygen, effectively suffocating the fire. Successful integration requires these additives to possess high thermal stability, preventing degradation during the high-temperature processing of polyester, while also maintaining the desired physical and aesthetic properties of the final fiber.

A significant area of innovation involves the development of non-halogenated polymer systems. Due to environmental concerns regarding the potential release of dioxins and furans from halogenated flame retardants during combustion or disposal, regulatory pressure has accelerated the shift toward cleaner chemistries. This transition has spurred research into synergistic systems, where phosphorus, nitrogen, and inorganic compounds (like antimony trioxide alternatives or certain metal hydroxides) are combined. These combinations often provide superior performance at lower loading levels, enhancing the overall efficiency and reducing the cost of the additives. Nanotechnology is also emerging, where nanoparticles of fire-retardant materials, such as layered silicates or carbon nanotubes, are dispersed into the polymer matrix. These nano-additives enhance char formation and barrier properties, leading to highly effective flame retardancy with minimal impact on fiber strength and clarity.

Furthermore, technology related to textile processing and compliance testing is equally critical. Advanced spectroscopic methods and standardized burn tests (e.g., vertical flammability tests, heat release measurements via cone calorimetry) are essential for validating product claims and ensuring compliance with complex international standards like ISO 15025 or specialized aerospace protocols. Manufacturers are also employing sophisticated process control systems and extrusion technology that allow for extremely homogeneous dispersion of additives within the fiber cross-section. This meticulous control is vital because poor dispersion can lead to weak spots, reducing the overall efficacy of the flame retardant characteristics. The continuous need to balance cost, performance, and environmental responsibility drives ongoing technological refinement in both chemical synthesis and fiber engineering practices across the entire supply chain.

Regional Highlights

Regional dynamics play a crucial role in shaping the Flame Retardant Polyester Fibre Market, with varying regulatory frameworks and application demands driving market disparities. North America, particularly the United States, represents a highly mature market characterized by extremely stringent and well-enforced fire safety codes, especially in institutional, commercial, and transportation sectors. Regulations such as the Federal Aviation Administration (FAA) requirements and state-specific furniture flammability standards (like those established by California) mandate the use of high-specification, often intrinsic, flame retardant materials. This region focuses heavily on certified, high-performance, and non-halogenated FR solutions, leading to premium pricing and stable demand from compliance-driven industries.

Europe is another mature market where growth is governed by the comprehensive REACH regulation, which dictates strict environmental and health standards for chemical substances, accelerating the adoption of sustainable, non-toxic flame retardants. European Union directives concerning construction products and marine equipment also push textile manufacturers toward certified FR polyester. Countries like Germany and the UK exhibit high demand in the contract textiles segment (hotels, schools) and automotive interiors, focusing on materials that offer permanent safety characteristics while meeting rigorous smoke and toxicity standards, reinforcing the European market's emphasis on environmentally sound, intrinsically modified fibers.

The Asia Pacific (APAC) region is the engine of future market growth. Driven by rapid industrialization, massive infrastructure projects (including high-speed rail networks), and increasing regulatory awareness in populous countries like China and India, the demand for FR polyester is skyrocketing. While price sensitivity remains a factor in certain mass-market segments, the increasing harmonization of regional standards with international benchmarks (pushed by exporting manufacturers) is boosting the consumption of higher-quality, certified FR fibers. APAC is not only the largest consumer but also the largest producer of polyester fibers globally, positioning the region as central to the evolution of cost-effective, high-volume FR polyester manufacturing and adoption.

- North America: Strongest regulatory environment (FAA, NFPA), high demand for non-halogenated intrinsic fibers, focus on aerospace and automotive interiors.

- Europe: Driven by REACH regulations and stringent contract furnishing standards, emphasis on sustainable, low-toxicity phosphorus/nitrogen chemistries.

- Asia Pacific (APAC): Highest volume growth due to infrastructure boom, increasing urbanization, and expanding domestic manufacturing; growing adoption of international flammability standards.

- Latin America (LATAM): Emerging market characterized by localized regulatory adoption, rising demand in public transportation, and imported FR technology.

- Middle East and Africa (MEA): Growth tied to significant construction and hospitality projects (UAE, Saudi Arabia), requiring imported, high-specification FR textiles for large-scale developments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Polyester Fibre Market.- Treves

- Toray Industries, Inc.

- Reliance Industries Limited (RIL)

- Huvis Corporation

- Toyobo Co., Ltd.

- Sarla Performance Fibers Limited

- Zimmer AG

- Thai Polyester Co., Ltd.

- Albemarle Corporation

- Clariant AG

- Huntsman Corporation

- Kaneka Corporation

- Jiangsu Sanfangxiang Group Co., Ltd.

- Teijin Limited

- Invista

- DuPont de Nemours, Inc.

- LCY Chemical Corp.

- SK Chemicals

- Kolon Industries, Inc.

- PHP Fibers GmbH

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Polyester Fibre market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the difference between intrinsic and treated flame retardant polyester fibers?

Intrinsic (or inherent) flame retardant polyester fibers have FR chemicals permanently integrated into the polymer chain during manufacturing, offering durability against washing and abrasion. Treated fibers involve applying a topical chemical finish, which may degrade over time or after laundering, offering non-permanent resistance.

Are halogenated flame retardant polyester fibres still used, and what are the alternatives?

While halogenated FR fibers offer high performance, their use is declining rapidly, particularly in North America and Europe, due to environmental and health concerns related to toxic smoke and persistent organic pollutants. The industry is transitioning primarily to sustainable non-halogenated alternatives, chiefly phosphorus-based and nitrogen-based chemistries.

Which end-use application drives the highest demand for FR polyester?

The Home Textiles and Contract Furnishings sector generates the highest volume demand due to mandatory flammability standards for mattresses, upholstery, and drapes in residential, institutional, and commercial buildings globally, ensuring consistent large-scale material consumption.

How does the strict regulatory environment in aviation impact the FR polyester market?

Aviation regulations (like FAR 25.853) impose extremely high standards for low flammability, heat release, and minimal smoke toxicity. This forces manufacturers to develop premium, certified intrinsic FR polyester, often utilizing specialized polymer blends, driving technological innovation and commanding high market prices in this niche segment.

What technological advancement is most critical for future growth in this market?

The most critical technological advancement is the successful synthesis and commercialization of highly efficient, high-durability, bio-based and non-halogenated phosphorus or silica-based additives that can be incorporated intrinsically without negatively affecting the mechanical properties or processability of the polyester fiber.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager