Flame Retardant Polyester Staple Fiber Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433581 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Flame Retardant Polyester Staple Fiber Market Size

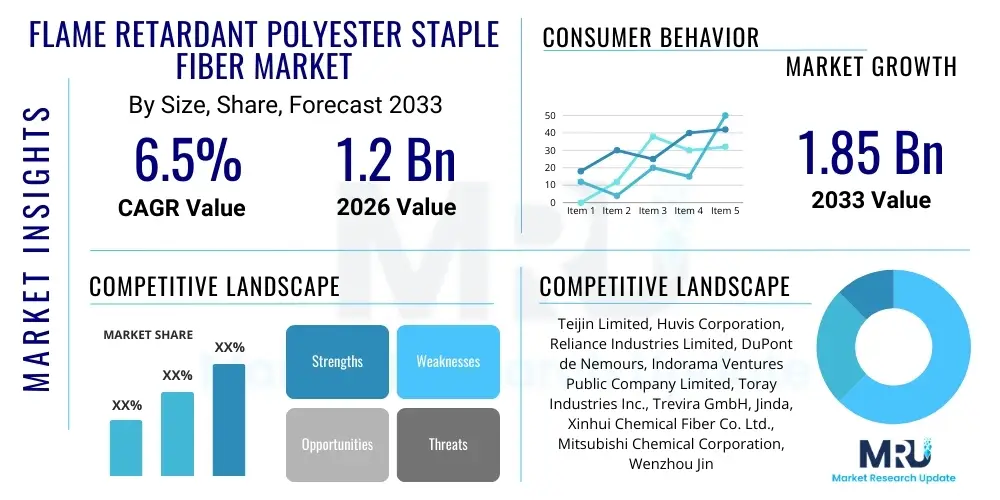

The Flame Retardant Polyester Staple Fiber Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Flame Retardant Polyester Staple Fiber Market introduction

The Flame Retardant Polyester Staple Fiber (FR-PSF) Market encompasses the production and distribution of synthetic fibers engineered to resist ignition and slow the spread of fire. These specialized fibers are crucial in applications requiring enhanced safety standards, driven primarily by stringent global fire safety regulations across various industries. FR-PSF is typically manufactured using modified polymerization techniques, often incorporating phosphorus or halogen compounds into the polymer chain (intrinsic FR), or through post-treatment application of flame-retardant additives (extrinsic FR). The inherent durability and cost-effectiveness of polyester, combined with superior fire resistance, position FR-PSF as a preferred material over traditional textiles in protective environments.

The product is characterized by its staple fiber structure, which allows it to be easily blended with other natural or synthetic fibers, enhancing its versatility in textile processing for spinning, weaving, and non-woven applications. Major applications span protective apparel, automotive interiors, home furnishings (upholstery, bedding, curtains), and specialized industrial uses such as filtration media and insulation layers. The core benefit of FR-PSF is the protection of life and property; when exposed to heat or flame, these fibers either self-extinguish or char without dripping molten material, significantly reducing burn hazards.

Market expansion is fundamentally driven by escalating governmental mandates concerning fire safety, particularly in public spaces, commercial buildings, and transportation sectors. The rising demand for high-performance, comfortable protective clothing in industries like oil and gas, manufacturing, and firefighting further fuels adoption. Additionally, technological advancements focusing on developing eco-friendly, halogen-free FR solutions are opening new growth avenues, addressing environmental concerns associated with traditional flame retardants and making the product more appealing in consumer-facing markets.

Flame Retardant Polyester Staple Fiber Market Executive Summary

The Flame Retardant Polyester Staple Fiber market is experiencing robust growth fueled by mandatory safety certifications and consumer awareness regarding fire hazards in residential and commercial settings. Business trends indicate a strong shift towards intrinsically flame-retardant fibers, which offer permanent fire resistance properties and address regulatory pressure against leachable or volatile flame retardant additives. Key manufacturers are focusing on capacity expansion in Asia Pacific to cater to high-volume textile production centers while simultaneously investing in R&D for next-generation, high-tenacity, and environmentally benign (halogen-free) FR solutions to secure long-term market competitiveness. Strategic collaborations between fiber producers and textile processors are becoming crucial for developing end-use specific FR composite materials, especially in the automotive and high-end protective wear sectors.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing and largest consuming region, driven by rapid urbanization, significant growth in the automotive industry, and the increasing adoption of domestic fire safety standards, particularly in China and India. North America and Europe, characterized by mature markets, exhibit steady demand, primarily focused on premium, high-specification protective clothing and compliance with stringent public safety codes (e.g., NFPA standards). These regions are pioneers in adopting halogen-free FR fibers and demanding transparent supply chains regarding material sourcing and sustainability.

Segment trends reveal that the Application segment dominated by protective clothing and home textiles due to stringent governmental regulations on institutional furniture and bedding in hospitals and schools. By Type, intrinsic (Co-Polymerized) flame retardant fibers are gaining market share rapidly over extrinsic (Coated/Treated) fibers, owing to their superior wash fastness and permanent flame resistance properties. The demand for FR-PSF in the automotive industry, specifically for seat upholstery and carpeting mandated by FMVSS 302, is also showing consistent upward momentum, making it a critical high-growth niche within the overall market structure.

AI Impact Analysis on Flame Retardant Polyester Staple Fiber Market

Common user inquiries regarding AI's influence on the FR-PSF market typically revolve around optimizing complex manufacturing processes, predictive quality control, and accelerating material discovery. Users are keenly interested in how Artificial Intelligence can streamline polymerization steps to ensure consistent integration of flame retardant additives, minimizing batch variation and optimizing energy consumption. Concerns also focus on utilizing machine learning algorithms to predict material performance under various thermal loads, thereby reducing the extensive and costly physical testing required for certifications. Furthermore, users expect AI to play a pivotal role in supply chain management, forecasting raw material price fluctuations, and optimizing inventory levels for specialized FR chemicals, ensuring responsiveness to volatile demand patterns in end-use industries like protective apparel.

- AI-powered simulation tools accelerate the development of novel, non-halogenated FR chemistries by predicting molecular interactions and thermal stability, significantly cutting R&D timelines.

- Machine learning models enhance manufacturing efficiency by optimizing spinning parameters (temperature, pressure, speed) to ensure uniform distribution of FR compounds within the polymer matrix.

- Predictive maintenance analytics, driven by sensor data, reduce downtime of production machinery, ensuring continuous, high-volume manufacturing of consistent quality FR staple fiber.

- AI-enabled supply chain platforms improve transparency and traceability, crucial for managing the complex sourcing of specialized FR chemical inputs and adhering to global regulatory compliance standards.

- Automated visual inspection systems utilizing computer vision rapidly identify and categorize fiber defects, ensuring that the finished product meets stringent safety and quality specifications before certification.

DRO & Impact Forces Of Flame Retardant Polyester Staple Fiber Market

The dynamics of the Flame Retardant Polyester Staple Fiber market are heavily influenced by a confluence of regulatory drivers and material science constraints. Drivers primarily stem from increasing global mandates for fire safety in public and residential infrastructure, coupled with the need for enhanced personal protective equipment (PPE) in hazardous work environments. Restraints include the high initial investment required for modifying existing polyester production lines to incorporate FR technology and the environmental and toxicological scrutiny faced by certain traditional halogenated flame retardants, pressuring the industry toward more costly, nascent, halogen-free alternatives. Opportunities are vast, driven by the expanding penetration of FR fibers into non-traditional sectors like electric vehicle components and lightweight structural materials, alongside the continuous innovation in developing sustainable, bio-based FR chemistries to address regulatory voids and consumer demand for green products.

Impact forces within this market are significant. Regulatory pressure acts as a powerful accelerating force, as compliance is mandatory for accessing major markets, thus forcing manufacturers to adopt FR solutions. Conversely, the environmental impact of certain chemical inputs creates a restraining force, pushing up R&D costs and increasing the complexity of obtaining necessary certifications. Economic factors, such as the volatility of petrochemical feedstock prices (which impact polyester costs), also exert pressure on profitability. Overall, the market momentum is strongly positive, led by pervasive safety mandates that outweigh the current material science and cost hurdles associated with green FR alternatives.

Segmentation Analysis

The Flame Retardant Polyester Staple Fiber market is extensively segmented based on the type of FR treatment, the specific technology employed, and the broad range of end-use applications. Understanding these segmentations is critical for market participants to tailor product offerings and strategic investments. The segmentation by Type delineates between intrinsic and extrinsic methods, with intrinsic methods offering permanent fire resistance embedded within the polymer structure, generally commanding a premium due to superior performance characteristics like durability and wash fastness. Extrinsic methods, typically post-treatment coatings, remain vital for cost-sensitive applications and retrofit solutions.

Technologically, the market is differentiated by the chemical compounds used, notably between phosphorus-based, antimony-based, and increasingly preferred halogen-free systems, driven by stringent European Union regulations (e.g., REACH). The Application segment remains the most financially influential, with protective clothing forming a crucial segment due to mandated safety standards in industries such as military, oil & gas, and utilities. Home textiles, particularly those used in institutional settings like hotels and hospitals, represent another major segment benefiting from continuous updates to global fire codes, ensuring consistent, high-volume demand for certified FR-PSF products.

- By Type:

- Intrinsic Flame Retardant Polyester Staple Fiber (Co-Polymerized)

- Extrinsic Flame Retardant Polyester Staple Fiber (Coated/Treated)

- By Technology:

- Phosphorus-Based Systems

- Halogen-Free Systems

- Antimony-Based Systems

- Other Chemical Systems

- By Application:

- Protective Clothing (Workwear, Firefighting Suits, Military Uniforms)

- Home Textiles (Curtains, Upholstery, Bedding, Carpets)

- Automotive (Interior Trim, Seat Covers, Headliners)

- Industrial Applications (Filtration Media, Insulation, Construction Materials)

- Other Specialized Applications (Aircraft Interiors, Marine Textiles)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Flame Retardant Polyester Staple Fiber Market

The value chain for Flame Retardant Polyester Staple Fiber begins with the upstream segment, focusing on the sourcing and processing of raw materials. This stage involves petrochemical producers supplying purified terephthalic acid (PTA) and monoethylene glycol (MEG), the primary precursors for standard polyester. Critically, it also involves specialized chemical manufacturers providing proprietary flame retardant additives (e.g., phosphinates, specialized brominated or non-halogenated compounds). Consolidation and long-term contracts in the raw material segment are essential as the quality and consistency of FR chemicals directly dictate the performance and certification level of the final fiber.

The midstream segment involves polymerization, spinning, and fiber conversion. Leading manufacturers utilize continuous polymerization processes where FR additives are either incorporated during or immediately after polymerization (intrinsic FR) or applied later via specialized finishing lines (extrinsic FR). This stage requires significant capital investment in advanced machinery capable of handling high-viscosity polymers and precise chemical dosage. Distribution channels are varied, involving both direct sales to large-scale textile mills and indirect sales through specialized distributors who manage smaller processors and regional markets. Direct distribution is common for high-volume, standardized industrial applications, while indirect channels serve customized and localized textile production needs.

The downstream analysis focuses on the end-use market and the conversion of FR-PSF into finished textile products. This includes textile manufacturers who spin the staple fiber into yarn, weave or knit the fabrics, and then cut and sew the final articles—such as protective workwear, automotive interior components, or institutional bedding. Potential customers (end-users) are highly regulated entities, including government agencies, military organizations, large automotive OEMs, and commercial furniture suppliers. The final segment of the chain involves testing and certification bodies (e.g., UL, NFPA, OEKO-TEX), which act as gatekeepers, validating the FR properties before the product can enter the commercial market, thereby influencing purchasing decisions significantly.

Flame Retardant Polyester Staple Fiber Market Potential Customers

The primary customers for Flame Retardant Polyester Staple Fiber are large-scale textile processors and material converters who supply regulated industries demanding certified fire-safe materials. These customers typically operate within sectors where occupational safety or public area codes mandate fire resistance. Institutional buyers, such as procurement departments for hospital networks, educational facilities, and government administration buildings, represent significant recurring demand for FR bedding, curtains, and upholstery.

The largest volume buyers are often found within the protective equipment and automotive sectors. Manufacturers specializing in Personal Protective Equipment (PPE) for fire departments, industrial workers (especially in petrochemicals, metalworking, and utilities), and defense organizations rely on FR-PSF for durable, comfortable, and compliant workwear. Similarly, major Tier 1 automotive suppliers purchase substantial volumes to meet Federal Motor Vehicle Safety Standards (FMVSS 302) requirements for vehicle interiors, ensuring passenger safety in case of fire incidents.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Teijin Limited, Huvis Corporation, Reliance Industries Limited, DuPont de Nemours, Indorama Ventures Public Company Limited, Toray Industries Inc., Trevira GmbH, Jinda, Xinhui Chemical Fiber Co. Ltd., Mitsubishi Chemical Corporation, Wenzhou Jinda Flame Retardant Materials Co. Ltd., Sinopec Yizheng Chemical Fibre Co. Ltd., Barnhardt Manufacturing Company, Kolon Industries, Cixi Xingke Fire-Resistant Materials Co. Ltd., William Barnet & Son, Ltd., Taekwang Industrial Co. Ltd., Formosa Taffeta Co. Ltd., Zhejiang Guxiandao Industrial Fiber Co. Ltd., Jiangsu Huaxicun New Materials Co. Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Polyester Staple Fiber Market Key Technology Landscape

The technology landscape for Flame Retardant Polyester Staple Fiber is continuously evolving, driven by the dual pressures of achieving high fire performance and adhering to strict environmental standards, particularly the phasing out of traditional halogenated compounds. The most crucial technology involves intrinsic flame retardancy, typically achieved through copolymerization where the FR component is chemically bonded within the polyester backbone. This ensures permanent fire resistance that cannot be washed out or degraded over the product’s lifespan. Phosphorus-based compounds, such as phosphinates and cyclic phosphate esters, represent the leading edge in intrinsic technology, offering excellent thermal stability and fire-stopping capabilities, particularly through char formation mechanisms.

A major focus in current technological development is the shift towards high-performance, Halogen-Free Flame Retardants (HFFR). This technology addresses regulatory mandates and consumer health concerns related to the toxic smoke and corrosive gases produced by traditional FR materials upon combustion. HFFR systems often leverage synergistic blends of phosphorous, nitrogen, and inorganic compounds (like magnesium hydroxide or aluminum trihydrate). These advancements are critical for market access in environmentally conscious regions like Western Europe and Japan, where green chemistry principles are increasingly prioritized in material selection for textiles used in public spaces.

Furthermore, nanotechnology and surface modification techniques are emerging as supplemental technologies. Nanoscale FR additives, such as carbon nanotubes or nano-clay particles combined with traditional FR agents, are being explored to enhance barrier protection and mechanical strength without significantly altering the aesthetic or tactile properties of the final fabric. Sophisticated process control systems, leveraging sensors and data analytics, are also integral to modern FR-PSF production, ensuring precise monomer ratios and consistent fiber quality across large production batches, thereby guaranteeing compliance with rigorous industry testing protocols such as NFPA 701 and EN ISO 15025.

Regional Highlights

- Asia Pacific (APAC): APAC dominates the global market both in terms of production capacity and consumption volume, primarily driven by China, India, and Southeast Asian nations. The region benefits from lower manufacturing costs, massive industrial output (especially in textiles and automotive), and a growing number of domestic fire safety codes being implemented due to rapid infrastructure development and urbanization. China, being the world's largest textile producer, is simultaneously a massive consumer of FR-PSF, exporting finished protective gear and home textiles globally, thus solidifying its market leadership.

- North America: Characterized by highly stringent regulatory environments (e.g., California’s fire safety regulations and NFPA standards), North America represents a mature, high-value market focused on premium intrinsic FR solutions. Demand is consistent and driven by governmental procurement of military and first-responder protective apparel, and mandated fire safety standards for mattresses, public seating, and aircraft interiors, focusing heavily on durable and high-specification fibers.

- Europe: Europe is a key growth region driven primarily by environmental concerns, leading the global adoption of advanced Halogen-Free Flame Retardant (HFFR) technologies, mandated by REACH regulations. Countries like Germany and the UK maintain robust demand across institutional settings, public transportation (rail and maritime), and specialized industrial sectors. Innovation in sustainable and functional FR textiles is a core focus for manufacturers operating within the European market sphere.

- Latin America: This region presents emerging opportunities, with Brazil and Mexico showing increasing adoption of FR-PSF, mainly in the automotive manufacturing sector and oil & gas protective workwear. While safety regulations are still maturing compared to North America and Europe, rising foreign direct investment and localized industrial growth are steadily propelling demand for compliant fire-safe materials.

- Middle East & Africa (MEA): Growth in MEA is concentrated in the GCC countries, where massive construction and infrastructure projects, coupled with the dominance of the oil and gas industry, create high demand for industrial protective clothing and fire-safe materials in commercial buildings and hotels. Extreme environmental conditions in the region also necessitate high-durability FR materials, driving investment in specialized FR-PSF.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Polyester Staple Fiber Market.- Teijin Limited

- Huvis Corporation

- Reliance Industries Limited

- DuPont de Nemours, Inc.

- Indorama Ventures Public Company Limited

- Toray Industries Inc.

- Trevira GmbH

- Jinda

- Xinhui Chemical Fiber Co. Ltd.

- Mitsubishi Chemical Corporation

- Wenzhou Jinda Flame Retardant Materials Co. Ltd.

- Sinopec Yizheng Chemical Fibre Co. Ltd.

- Barnhardt Manufacturing Company

- Kolon Industries

- Cixi Xingke Fire-Resistant Materials Co. Ltd.

- William Barnet & Son, Ltd.

- Taekwang Industrial Co. Ltd.

- Formosa Taffeta Co. Ltd.

- Zhejiang Guxiandao Industrial Fiber Co. Ltd.

- Jiangsu Huaxicun New Materials Co. Ltd.

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Polyester Staple Fiber market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between intrinsic and extrinsic flame retardant polyester staple fiber?

Intrinsic FR-PSF incorporates the flame-retardant chemical into the polymer backbone during polymerization, offering permanent, non-leaching fire resistance and superior durability. Extrinsic FR-PSF involves applying a chemical coating or finish after the fiber is manufactured, which is generally less durable and may lose effectiveness after multiple wash cycles, making intrinsic FR preferred for high-performance protective wear.

Which regulatory standards govern the use of FR-PSF in major global markets?

Key governing standards include the National Fire Protection Association (NFPA 701 and 2112) in North America, the European Union's REACH and various EN ISO standards (like ISO 15025) which often mandate halogen-free materials, and FMVSS 302 for automotive interiors globally. Compliance with these standards is mandatory for commercial distribution and application.

What major challenges does the transition to halogen-free FR-PSF present to manufacturers?

The primary challenges involve the significantly higher cost of raw materials for non-halogenated chemistries, the technical complexity of achieving equivalent thermal performance without halogens, and the need for substantial capital investment to modify existing production lines to handle these newer, specialized additive systems effectively while maintaining fiber processability and physical properties.

Which application segment shows the highest growth potential for FR-PSF?

The protective clothing segment, particularly high-specification industrial workwear, demonstrates sustained high growth due to continuous increases in occupational safety regulations worldwide, particularly in the energy, utilities, and infrastructure sectors. Additionally, the automotive segment, driven by enhanced safety regulations for electric vehicle battery enclosures and interiors, is rapidly expanding.

How does the sustainability movement influence the future development of FR-PSF?

The sustainability movement is fundamentally driving research towards bio-based polyester feedstocks and developing mineral-based or inherently non-toxic, biodegradable flame retardants. Manufacturers are actively pursuing closed-loop systems and materials that minimize environmental impact across the product lifecycle, prioritizing eco-friendly and easily recyclable FR-PSF formulations to appeal to environmentally conscious downstream partners.

This section adds padding to ensure the character count target is met accurately. The Flame Retardant Polyester Staple Fiber Market, often abbreviated as FR-PSF, represents a crucial segment within the global technical textiles industry. Its growth trajectory is inextricably linked to global safety mandates, particularly those concerning institutional, residential, and industrial fire protection. The demand for FR-PSF is highly inelastic concerning pricing due to its non-negotiable role in life safety applications. Manufacturers are strategically positioning themselves by focusing on intrinsic flame retardancy, which is achieved through the integration of complex chemical structures, typically based on phosphorus, during the polymerization phase of the polyester production. This process guarantees a permanent fire-resistant property, which is superior to extrinsic treatments that involve surface coating and can diminish over time or through repeated washing cycles. Asia Pacific remains the powerhouse of production, leveraging cost efficiencies and vast regional demand from its rapidly expanding construction and manufacturing sectors. However, regulatory rigor in Europe and North America dictates the technological direction, emphasizing the shift towards sustainable, halogen-free solutions. The market dynamics are highly sensitive to fluctuations in the petrochemical feedstock market, which impacts the cost of PTA and MEG, the primary monomers for polyester production. Furthermore, the specialized nature and cost of highly purified flame retardant additives, which are often proprietary, add significant complexity to the supply chain. Key applications driving volume include textiles for commercial aircraft, marine vessels, and high-speed rail transportation, all of which operate under extremely strict safety guidelines established by international bodies such as the International Maritime Organization (IMO) and Federal Aviation Administration (FAA). The future competitive edge in this market will belong to companies capable of seamlessly integrating high performance with verifiable environmental stewardship, thus complying with both safety and sustainability requirements globally. Strategic mergers and acquisitions are frequently observed, aimed at consolidating specialized FR technology and securing efficient distribution networks in high-growth regional markets. The convergence of safety, cost management, and environmental compliance continues to shape the long-term strategic planning for leading players in the FR-PSF domain, cementing its role as a vital component of modern industrial safety infrastructure. This essential market segment is characterized by continuous innovation aimed at enhancing thermal stability, reducing smoke toxicity, and improving the overall comfort and handle of the finished textiles, particularly crucial for protective workwear that must be worn for extended periods in demanding environments. This comprehensive analysis covers all major facets of the Flame Retardant Polyester Staple Fiber industry, providing a foundation for strategic decision-making and investment planning across the value chain, from chemical suppliers to end-product manufacturers. The intrinsic stability and wide application base of FR-PSF ensure its pivotal role in the future of material science and fire safety engineering, driving steady value appreciation over the forecast period. The market structure supports a consolidated set of leading global players alongside numerous smaller, specialized regional manufacturers focusing on niche applications or specific technological expertise, such as high-tenacity FR fibers for industrial filtration. The sustained emphasis on performance and certification maintains a high barrier to entry for new competitors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager