Flame Retardant Regenerated Cellulose Fibre Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433491 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Flame Retardant Regenerated Cellulose Fibre Market Size

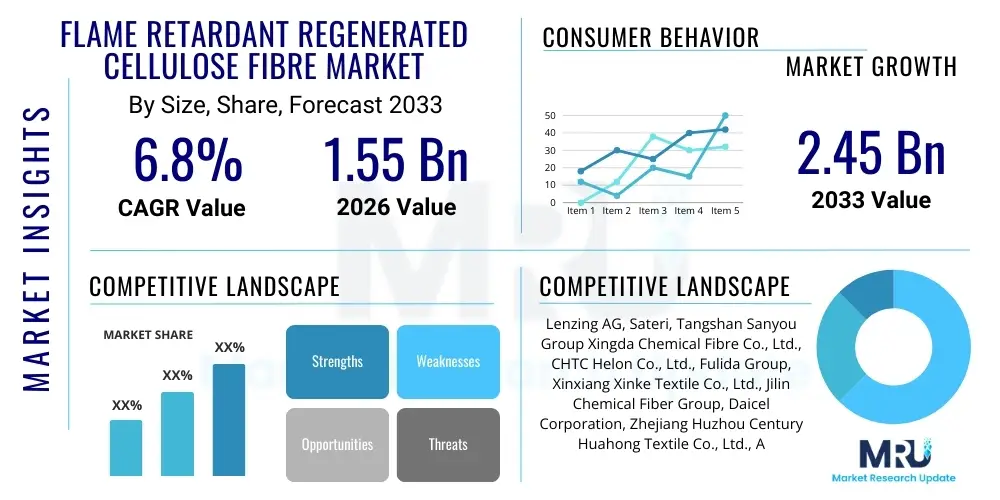

The Flame Retardant Regenerated Cellulose Fibre Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.55 billion in 2026 and is projected to reach USD 2.45 billion by the end of the forecast period in 2033.

Flame Retardant Regenerated Cellulose Fibre Market introduction

The Flame Retardant Regenerated Cellulose Fibre (FR-RCF) Market encompasses advanced textile materials derived from natural cellulose sources (like wood pulp) that have been chemically modified or treated during the regeneration process to achieve inherent or durable flame-retardant properties. These specialized fibers are distinct from synthetic FR fibers due to their superior moisture absorption, comfort, breathability, and sustainability profile. Key products include high-performance viscose fibers, modal fibers, and lyocell fibers imbued with non-halogenated phosphorus, nitrogen, or silicon compounds, ensuring that the fire-blocking capability is integrated into the polymer matrix rather than applied as a topical finish. The primary applications span crucial safety sectors such as protective clothing for industrial workers, firefighters, military personnel, and specialized furnishings in public transportation, aerospace, and high-risk commercial environments where compliance with stringent fire safety regulations is mandatory. The core benefits of FR-RCF include excellent thermal insulation, reduced smoke generation, superior chemical stability, and a lower environmental impact compared to traditional synthetic FR alternatives, driving widespread adoption across regulated industries. The market is fundamentally driven by escalating global mandates for workplace safety, stricter fire codes (especially in developed economies), and a growing consumer preference for sustainable and comfortable protective textiles, positioning FR-RCF as a critical component in next-generation safety apparel.

Flame Retardant Regenerated Cellulose Fibre Market Executive Summary

The Flame Retardant Regenerated Cellulose Fibre (FR-RCF) market is experiencing robust expansion, fundamentally driven by the convergence of stringent global safety regulations and the textile industry's pivot toward sustainable, high-performance materials. Key business trends include significant investment in research and development aimed at commercializing cost-effective, non-halogenated flame retardant systems to replace historically used, environmentally concerning additives. Furthermore, strategic partnerships between chemical suppliers and fiber manufacturers are accelerating the integration of inherent FR technology into mass production lines, focusing on achieving multi-functional properties such as anti-static, antimicrobial, and UV protection alongside flame resistance. Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market, propelled by rapid industrialization, expansion of manufacturing and energy sectors, and the resultant increase in demand for industrial protective clothing mandated by local governments. Europe maintains its position as a mature, yet highly dynamic market, fueled by the stringent Personal Protective Equipment (PPE) Directive and a strong consumer and corporate preference for eco-friendly, bio-based textiles. Segment-wise, the Protective Clothing application dominates the revenue share, specifically in oil & gas, welding, and electrical utility industries. Concurrently, the Inherent FR Technology segment is projected to exhibit the highest CAGR, reflecting the shift away from post-treatment methods toward intrinsically safe materials that offer permanent fire resistance, enhancing the durability and lifespan of the end products and offering superior compliance assurance to end-users.

AI Impact Analysis on Flame Retardant Regenerated Cellulose Fibre Market

User inquiries regarding AI's influence in the FR-RCF market primarily revolve around optimizing material composition, accelerating new product development cycles, and enhancing supply chain resilience. Users are keen to understand how computational chemistry and machine learning can predict the synergistic effects of various flame retardant additives (e.g., phosphorus-nitrogen combinations) within the cellulose matrix, thereby reducing lengthy physical experimentation and time-to-market. Another critical theme is the implementation of AI for predictive quality control within the fiber manufacturing process, ensuring consistent FR efficacy and compliance across large batches. Concerns also focus on the adoption rate and the required digital infrastructure investment, especially among smaller specialty fiber producers. The consensus expectation is that AI will be transformative, particularly in developing novel, sustainable, and highly efficient halogen-free FR systems, and automating complex processing parameters like spinning speed and chemical bath concentration to maximize yield and minimize waste, ultimately lowering the premium price currently associated with high-performance FR-RCF.

- AI-driven computational material science accelerates the discovery and optimization of novel, non-halogenated flame retardant chemistries compatible with regenerated cellulose.

- Machine learning models enhance manufacturing efficiency by predicting optimal processing parameters (temperature, concentration, spin rate) to ensure uniform FR integration.

- Predictive maintenance and quality control systems reduce defects and variability, ensuring consistent compliance with international fire safety standards (ISO, NFPA).

- AI-powered demand forecasting and supply chain optimization improve inventory management and responsiveness to volatile raw material costs (e.g., wood pulp, chemical intermediates).

- Automated analysis of regulatory data and safety standards ensures immediate compliance updates for global market penetration.

DRO & Impact Forces Of Flame Retardant Regenerated Cellulose Fibre Market

The market dynamics for Flame Retardant Regenerated Cellulose Fibre are dictated by a powerful combination of legislative pressure, technological innovation, environmental scrutiny, and manufacturing cost sensitivities. The primary drivers stem from increasingly stringent global occupational safety regulations, particularly those mandating the use of certified flame-retardant clothing in high-hazard environments like petroleum, utility, and metallurgical industries. This regulatory push, exemplified by standards such as NFPA 2112 and EN ISO 11612, creates a non-negotiable demand floor for FR textiles. Furthermore, the accelerating trend toward sustainability favors FR-RCF over synthetic alternatives, as regenerated cellulose offers biodegradability and is sourced from renewable resources, aligning with corporate social responsibility goals and consumer demand for eco-friendly textiles. The market is also heavily influenced by technological breakthroughs in intumescent and non-halogenated chemistries, which enhance the fiber's intrinsic safety profile without compromising comfort or breathability.

However, the market faces significant restraints, primarily centered on the relatively higher production cost of FR-RCF compared to traditional or post-treated synthetic fibers (like polyester or nylon), which can limit adoption in price-sensitive markets, particularly in developing nations. The complex chemical processing required to integrate FR compounds inherently into the cellulose structure demands specialized equipment and expertise, leading to elevated capital expenditure for manufacturers. Another key challenge is the technical difficulty associated with maintaining high tenacity and durability in the fiber while simultaneously incorporating effective FR agents. The chemical modification process can sometimes negatively impact the desirable physical properties of the regenerated cellulose, requiring constant material science refinement to balance safety efficacy with textile performance. Regulatory ambiguity regarding 'green chemistry' definitions across different jurisdictions also presents a logistical challenge for global manufacturers.

Opportunities for future expansion are vast, particularly in the niche markets of defense and aerospace, where demand for lightweight, high-performance, and non-melting FR materials is acute. The development of multi-functional FR-RCF that also incorporates phase change materials (PCMs) for thermal regulation or advanced sensor integration presents a significant commercial pathway. Moreover, geographical expansion into rapidly industrializing regions of Africa and Southeast Asia, coupled with the increasing penetration of FR-RCF into non-traditional applications such as smart home textiles, automotive interiors, and healthcare facility bedding, promises substantial long-term growth. The collective impact forces show a decisive market shift towards mandated safety and sustainability, outweighing the initial hurdles related to manufacturing cost and complexity, positioning FR-RCF for continued robust growth throughout the forecast period.

- Drivers:

- Growing enforcement of occupational safety regulations (e.g., NFPA, OSHA) across industrial sectors.

- Increasing demand for sustainable, bio-based, and comfortable protective textiles.

- Technological advancements in non-halogenated, environmentally benign flame retardants.

- Restraints:

- Higher manufacturing cost and price premium compared to conventional or post-treated synthetic fibers.

- Complexity of integrating FR agents while maintaining desired mechanical properties (tenacity, dye-ability).

- Supply chain volatility and raw material cost fluctuation (wood pulp, specialty chemicals).

- Opportunities:

- Expansion into niche, high-value applications like military apparel, aviation interiors, and high-specification defense textiles.

- Development of multi-functional fibers offering FR, antimicrobial, and thermal regulation properties simultaneously.

- Market penetration in emerging economies undergoing rapid infrastructure and industrial build-out.

- Impact Forces:

- The cumulative force of global fire safety standards is the dominant market driver.

- Sustainability mandates are pushing substitution away from legacy halogenated treatments.

- Cost optimization through large-scale, automated production processes remains critical for mass market adoption.

Segmentation Analysis

The Flame Retardant Regenerated Cellulose Fibre market is meticulously segmented based on the type of flame retardant technology deployed, the specific product form of the fiber, and the end-use application sectors, which allows for a granular assessment of market dynamics and targeted strategic development. Segmentation by technology distinguishes between fibers where the FR property is intrinsically built into the polymer chain during spinning (Inherent FR) and those where the finished textile is treated afterward (Treated/Post-Treated FR). The product segment identifies standard viscose, modal, and specialty lyocell fibers, each offering distinct performance characteristics in terms of strength, drape, and cost. Most crucially, the application segmentation highlights the areas of highest demand, led predominantly by Protective Clothing for industrial safety, followed by Home & Contract Textiles, and specialized technical textiles for military and aerospace use. This analytical framework is essential for understanding shifting demand patterns, such as the overwhelming market preference migrating toward inherently flame-retardant solutions due to their superior durability and permanent safety profile across repeated wash cycles.

- By Technology:

- Inherent Flame Retardant Fibres

- Treated Flame Retardant Fibres

- By Product Type:

- FR Viscose

- FR Modal

- FR Lyocell (Tencel)

- Other Specialty RCFs

- By Application:

- Protective Clothing (Industrial, Military, Fire Services)

- Home & Contract Textiles (Bedding, Upholstery, Curtains)

- Automotive & Transportation Interiors

- Aerospace & Defense Textiles

- Specialty Technical Textiles

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Flame Retardant Regenerated Cellulose Fibre Market

The value chain for the Flame Retardant Regenerated Cellulose Fibre market begins with upstream activities involving the sourcing of raw materials, primarily high-purity dissolving wood pulp derived from sustainable forest management. This stage is highly capital-intensive and requires rigorous quality control, as the purity of the cellulose feedstock directly influences the final fiber properties. The next critical upstream component involves the specialized chemical industry providing highly engineered flame retardant additives, often phosphorus-based compounds or specialized intumescent systems, which are manufactured under strict safety and environmental standards. Fiber manufacturers then engage in the core process of regeneration, utilizing techniques like wet spinning (viscose process) or solvent spinning (lyocell process) to integrate the FR chemicals into the fiber structure. This manufacturing step is highly proprietary, determining the ultimate performance and cost of the FR-RCF.

Moving into the downstream segment, the raw FR fibers (filament or staple) are sold to textile spinners and weavers who convert them into yarns and then into high-specification fabrics. These fabrics must often pass rigorous third-party testing and certification (e.g., ISO 11612, EN 469) before being adopted by end-use manufacturers. The distribution channel is often complex, involving direct sales to large protective apparel brand owners (for high-volume industrial use) or specialized distributors and agents for niche markets like defense or aerospace. Direct channels are preferred for highly customized or proprietary materials, ensuring technical support and quality traceability. Conversely, indirect channels involving general textile distributors are common for standard FR home textiles or non-critical applications, optimizing logistics and market reach.

The efficiency of the entire value chain is heavily dependent on the collaboration between chemical suppliers and fiber producers to develop synergistic material systems that meet strict environmental mandates (avoiding REACH-restricted substances) while providing permanent FR properties. The final link involves specialized garment manufacturers who design and produce certified protective gear, ensuring proper fit and adherence to performance standards, ultimately selling directly or through authorized industrial safety equipment suppliers to major corporations (e.g., oil companies, utility providers). Pressure for transparency, sustainability, and traceability flows backward from the end-user (e.g., regulatory bodies and corporate procurement departments) through the entire chain, emphasizing the necessity of verifiable material claims.

Flame Retardant Regenerated Cellulose Fibre Market Potential Customers

The primary customer base for Flame Retardant Regenerated Cellulose Fibre consists of entities that operate in environments where flash fire, arc flash, or intense radiant heat exposure are daily occupational risks, making certified protective apparel a mandatory requirement. Major end-users include large multinational corporations in the oil and gas extraction and refining sector, electric power generation and distribution utilities, and heavy manufacturing industries such as metallurgy and welding workshops. These buyers prioritize materials that offer permanent FR protection combined with high levels of wearer comfort and moisture management, which FR-RCF excels at providing compared to heavier, less breathable alternatives like aramid blends. Military and defense procurement agencies are also significant customers, demanding lightweight, multi-threat protective garments for soldiers, focusing on materials that resist melting and dripping while offering excellent thermal protection in volatile combat scenarios.

Beyond the core industrial safety sector, the second largest consumer segment is the contract textile market, comprising purchasers for commercial, public, and institutional spaces, including hotels, hospitals, cruise ships, and theaters. These buyers need textiles for curtains, upholstery, and bedding that comply with stringent flammability standards (like IMO standards for maritime use or NFPA 701) without compromising aesthetic appeal or long-term durability. The growing focus on improving fire safety standards in residential buildings, particularly in multi-family dwellings, also expands the customer base to include large-scale residential textile suppliers and furniture manufacturers looking for safer, yet comfortable and eco-friendly, materials for interior applications. Essentially, any sector where regulatory compliance for fire safety intersects with the need for comfort, natural feel, and environmental responsibility constitutes a key potential customer segment for FR-RCF.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.55 billion |

| Market Forecast in 2033 | USD 2.45 billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lenzing AG, Sateri, Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd., CHTC Helon Co., Ltd., Fulida Group, Xinxiang Xinke Textile Co., Ltd., Jilin Chemical Fiber Group, Daicel Corporation, Zhejiang Huzhou Century Huahong Textile Co., Ltd., Aoshen Group, Royal DSM, Indorama Ventures Public Company Limited (IVL), Toyobo Co., Ltd., Kuraray Co., Ltd., China Hi-Tech Group Corporation (CHTC), Shandong Ruyi Technology Group Co., Ltd., Aditya Birla Group (Grasim Industries), Kelheim Fibres GmbH, Fire Safe Textiles, Kaneka Corporation |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Regenerated Cellulose Fibre Market Key Technology Landscape

The technological landscape of the Flame Retardant Regenerated Cellulose Fibre market is primarily defined by the method used to impart fire resistance: extrinsic post-treatment or intrinsic modification during the fiber spinning process. The most advanced and commercially preferred technologies today focus on inherent flame retardancy, particularly through the use of dope-additive processes. This involves incorporating the FR compound directly into the viscous spinning solution (dope) before extrusion. Dominant chemical technologies include phosphorus-based compounds, which function primarily as condensed-phase char-forming agents, and nitrogen-phosphorus synergistic systems, offering highly effective, durable FR performance while minimizing smoke generation—a critical factor in enclosed environments like aircraft or subways. Companies are heavily investing in proprietary methods to ensure the chemical compatibility and uniform dispersion of these additives within the cellulose matrix to prevent leaching or degradation during washing or use, guaranteeing permanent FR properties throughout the garment's lifespan.

Furthermore, significant technological efforts are concentrated on phasing out halogenated flame retardants due to rising environmental and health concerns and aligning with directives like REACH in Europe. The shift towards sustainable, non-halogenated chemistries (such as bio-based phosphates and inorganic compounds like aluminum or magnesium hydroxides, used synergistically) represents the forefront of innovation. Specialty fiber manufacturers are also focusing on optimizing the physical properties of the fiber alongside FR performance. This includes developing high-tenacity FR Lyocell fibers using the environmentally friendly NMMO solvent system, which offers superior strength and modulus compared to traditional viscose processes, making them suitable for demanding technical textile applications.

The manufacturing technology itself, encompassing sophisticated spinning techniques (e.g., continuous filament spinning for uniform industrial yarn, or high-speed staple fiber production), is continuously refined. Process automation, often enhanced by AI and sensor technology, ensures precise control over the coagulation bath composition and temperature, which is essential for uniform FR incorporation and fiber quality. The industry is also exploring novel surface modification techniques, such as plasma treatment or nano-encapsulation of FR agents, to potentially offer enhanced performance or hybrid FR solutions, although inherent FR remains the gold standard for high-performance protective wear due to its superior durability and permanent effect against multiple hazards. This drive for performance, sustainability, and process control defines the competitive edge in the current technology landscape.

Regional Highlights

- Asia Pacific (APAC): Dominating Growth and Industrial Demand

The Asia Pacific region is forecast to exhibit the highest Compound Annual Growth Rate (CAGR) in the FR-RCF market throughout the forecast period. This rapid growth is directly attributable to the region's intense pace of industrial expansion, particularly in high-risk sectors like manufacturing, construction, energy, and petrochemicals in countries such as China, India, and Southeast Asian nations. As governments in these regions implement and increasingly enforce stricter workplace safety regulations, the demand for certified protective clothing rises exponentially. Furthermore, APAC houses several major global textile and fiber manufacturing hubs, including large producers of regenerated cellulose, providing a strong local supply chain advantage. The increasing awareness and adoption of international safety standards (e.g., NFPA, ISO) among multinational companies operating in the region further boost the consumption of high-specification FR-RCF, often used in conjunction with aramid and modacrylic blends to achieve multi-hazard protection. While cost sensitivity remains a factor, the shift toward higher-value, inherently FR materials is accelerating due to quality mandates from export-oriented manufacturers and large, safety-conscious local enterprises.

China, in particular, is both a massive producer and consumer, driven by its expansive domestic market and its role as a key exporter of protective apparel globally. The increasing focus on localizing high-end technology, including non-halogenated FR solutions, is expected to reduce import dependency and drive competitive pricing locally. India and South Korea are also emerging as significant consumers, propelled by growth in their respective infrastructure and power generation sectors. Regional regulatory bodies are slowly but surely aligning local standards with international best practices, guaranteeing sustained long-term demand. The combination of mandatory safety compliance, substantial manufacturing capacity, and an expanding industrial base solidifies APAC’s position as the primary engine of market volume and revenue growth.

- Europe: Regulatory Compliance and Sustainability Leadership

Europe represents a mature and technologically advanced market for FR-RCF, characterized by the strictest environmental and safety legislation globally. Demand is primarily driven by the European Union’s Personal Protective Equipment (PPE) Regulation (EU) 2016/425, which mandates high standards for protective clothing used across all industries, notably emergency services (firefighters, rescue personnel) and the energy sector. The robust adoption of FR-RCF here is strongly influenced by the simultaneous requirement for inherent flame retardancy and sustainable sourcing. European consumers and industries show a pronounced preference for bio-based materials like regenerated cellulose over synthetic or halogen-containing alternatives, aligning with the EU's Green Deal objectives and the REACH regulation’s constraints on hazardous chemical use. This focus on sustainability has driven innovation toward high-performance FR Viscose and FR Lyocell products.

Germany, France, and the UK are the leading consumers, owing to their large established manufacturing and utility sectors and highly organized emergency response infrastructures. The shipbuilding and railway industries within Europe also represent crucial niche markets, adhering to specific stringent internal fire safety requirements (like IMO standards). Furthermore, the European market is a hub for specialized textile innovation, meaning there is significant integration of FR-RCF into sophisticated, multi-layer protective systems designed to offer protection against chemicals, heat, and static electricity simultaneously. Although growth rates may be lower than in APAC, the European market commands a significant portion of the market value due to the premium nature of the high-specification, inherently FR, and eco-certified fibers demanded by the region’s stringent regulatory environment.

- North America: High Performance and Defense Applications

North America, led by the United States, is a substantial and high-value market, primarily defined by rigorous industry-specific standards established by organizations like the NFPA (National Fire Protection Association) and OSHA (Occupational Safety and Health Administration). The demand for FR-RCF is particularly strong in the highly regulated oil and gas, electrical utility, and metalworking sectors, where compliance with standards such as NFPA 2112 (for flash fire) and NFPA 70E (for arc flash) is mandatory. FR-RCF is highly valued in these applications for its comfort, breathability, and ability to blend effectively with synthetic fibers like aramids to create hybrid protective fabrics that meet exacting performance benchmarks while minimizing heat stress on the wearer.

A key differentiator for the North American market is the strong presence of the defense and aerospace industries. These sectors require materials with extremely low flammability, minimal smoke toxicity, and high durability for specialized military uniforms, aircraft seating, and interior cabin components. The U.S. Department of Defense procurement often specifies high-performance, non-melting fibers, which FR-RCF, particularly proprietary inherent FR variants, successfully addresses. Technological development in North America is focused on achieving superior thermal protective performance (TPP) and reducing total weight. While North American manufacturers must address the same environmental concerns as Europe, the market prioritizes demonstrated, certified protective efficacy above all, ensuring sustained demand for premium FR-RCF solutions.

- Latin America (LATAM) and Middle East & Africa (MEA): Emerging Safety Adoption

The LATAM and MEA regions are characterized by emerging market dynamics where the adoption of advanced FR textiles is still in a transitional phase but accelerating. In the Middle East and Africa, the massive investments in oil, gas, and petrochemical infrastructure, particularly in the Gulf Cooperation Council (GCC) countries and North Africa, are the main drivers. Extreme heat in these regions makes FR-RCF highly desirable due to its inherent comfort and moisture management capabilities, reducing heat stress for workers in mandatory protective gear. Adoption is driven primarily by international companies implementing global safety protocols for their local operations.

In Latin America, countries like Brazil and Mexico are witnessing gradual regulatory shifts and increased industrial activity, leading to a rising need for compliant protective wear. However, price sensitivity in both MEA and LATAM often favors treated FR fibers over inherent FR, presenting an opportunity for manufacturers to penetrate the market with cost-effective solutions while simultaneously promoting the long-term benefits of durable inherent FR materials. As safety standards mature and major industrial projects continue to expand, these regions are projected to become increasingly important secondary growth centers for the FR-RCF market.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Regenerated Cellulose Fibre Market.- Lenzing AG

- Sateri

- Tangshan Sanyou Group Xingda Chemical Fibre Co., Ltd.

- CHTC Helon Co., Ltd.

- Fulida Group

- Xinxiang Xinke Textile Co., Ltd.

- Jilin Chemical Fiber Group

- Daicel Corporation

- Zhejiang Huzhou Century Huahong Textile Co., Ltd.

- Aoshen Group

- Royal DSM

- Indorama Ventures Public Company Limited (IVL)

- Toyobo Co., Ltd.

- Kuraray Co., Ltd.

- China Hi-Tech Group Corporation (CHTC)

- Shandong Ruyi Technology Group Co., Ltd.

- Aditya Birla Group (Grasim Industries)

- Kelheim Fibres GmbH

- Fire Safe Textiles

- Kaneka Corporation

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Regenerated Cellulose Fibre market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of Inherent FR Regenerated Cellulose over Treated FR Fibers?

The primary advantage is durability and permanence. Inherent FR fibers have the flame retardant chemical incorporated into the polymer structure during spinning, ensuring the FR properties cannot be washed out, faded, or chemically removed, thereby providing lifetime protection superior to surface-level chemical treatments.

How do Flame Retardant Regenerated Cellulose Fibres contribute to sustainability compared to synthetic FR alternatives?

FR-RCFs are bio-based, derived from renewable natural sources (wood pulp), and are typically biodegradable. They also often utilize non-halogenated FR chemistry, reducing the environmental footprint and aligning with strict global chemical regulations like REACH, making them a sustainable choice for protective apparel.

Which end-use application segment currently dominates the demand for FR Regenerated Cellulose Fibres?

The Protective Clothing segment is the dominant application, driven by strict regulatory requirements in hazardous industries such as oil & gas, electrical utilities, welding, and fire services, where high comfort, breathability, and certified fire resistance are mandatory for worker safety and compliance.

What are the main regulatory standards driving the adoption of FR-RCF in the global market?

Key regulatory standards include NFPA 2112 (Flash Fire Protection) and NFPA 70E (Arc Flash Protection) in North America, and EN ISO 11612 (Heat and Flame Protection) and the EU PPE Regulation in Europe. Compliance with these standards necessitates high-performance, durable FR materials like FR-RCF.

What is the key restraint impeding the faster adoption of Flame Retardant Regenerated Cellulose Fibres?

The principal restraint is the higher manufacturing cost and the resulting price premium of FR-RCF compared to mass-produced, lower-cost synthetic fibers or standard cellulose textiles with simpler chemical finishes. This cost disparity limits faster penetration into budget-sensitive commercial and residential textile markets.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager