Flame Retardant Suit Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435209 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Flame Retardant Suit Market Size

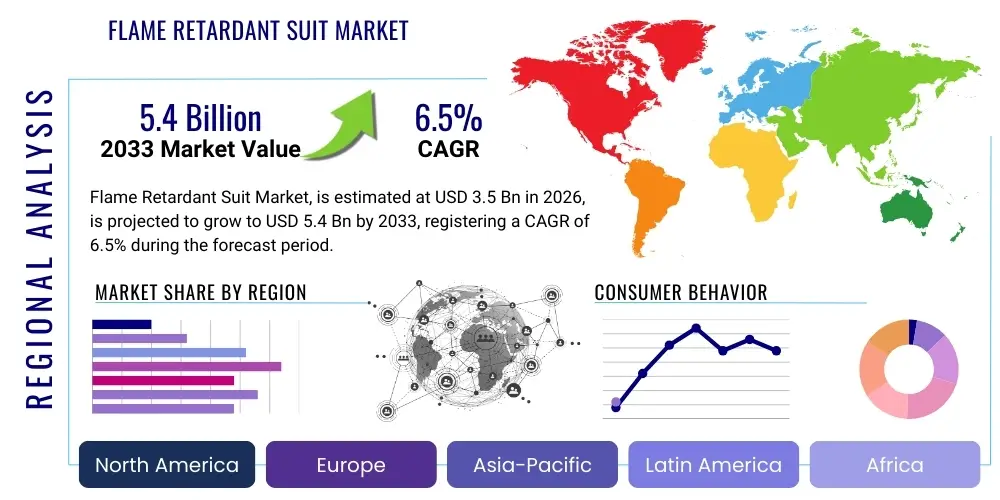

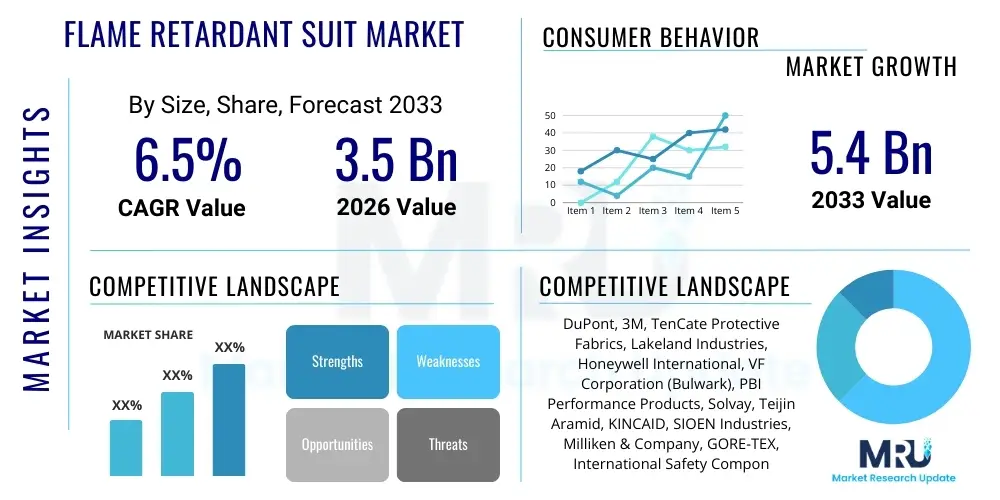

The Flame Retardant Suit Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.4 Billion by the end of the forecast period in 2033.

Flame Retardant Suit Market introduction

The Flame Retardant Suit Market encompasses the global trade of specialized protective clothing designed to resist ignition and prevent the spread of fire, offering critical protection to personnel operating in environments exposed to extreme heat, flames, electric arc flashes, or molten metal splash. These suits are meticulously engineered using inherent or treated flame-resistant materials such as Aramid, Modacrylic, PBI, and treated cotton blends, ensuring that the garments self-extinguish when the source of ignition is removed, thereby minimizing burn injuries. The foundational objective of these products is compliance with stringent international safety standards, including ISO, NFPA, and OSHA mandates, which drive mandatory adoption across high-risk industrial sectors globally. The evolution of materials science, focusing on lighter weight, enhanced breathability, and increased durability, continues to shape product innovation and adoption rates.

Major applications of flame retardant suits span across diverse industries where thermal hazards are prevalent. Key sectors include oil and gas exploration, refining, and transportation, heavy manufacturing, electrical utilities, mining operations, and professional firefighting services. The inherent necessity for these suits stems from the catastrophic potential of thermal incidents, necessitating investment in high-performance Personal Protective Equipment (PPE). Furthermore, military and defense sectors utilize specialized flame-retardant uniforms designed to withstand ballistic threats alongside thermal protection, highlighting the multi-functional requirement of advanced protective textiles. The expansion of infrastructure projects and the revival of industrial activity post-pandemic are bolstering the demand for reliable protective gear.

The market benefits from several significant driving factors, primarily centered around increasing awareness of worker safety and the globalization of regulatory frameworks. Technological advancements are key, offering enhanced comfort and protection which encourages consistent worker compliance. Benefits to end-users include reduced risk of severe injury, lower healthcare costs associated with workplace accidents, and improved operational uptime due to enhanced worker confidence and safety protocols. The demand for multi-hazard protection, combining flame resistance with chemical or electrical hazard resistance, is a nascent trend further stimulating market growth and technological investment among leading manufacturers.

Flame Retardant Suit Market Executive Summary

The Flame Retardant Suit Market is characterized by robust regulatory enforcement and continuous innovation in material science, defining core business trends. Geographically, North America and Europe currently dominate due to mature regulatory environments and high industrialization rates, particularly within the oil & gas and utilities sectors. However, the Asia Pacific region is poised for the fastest growth, propelled by rapid industrial expansion, increasing foreign direct investment in manufacturing hubs, and the gradual adoption of standardized safety regulations, moving away from cheaper, less compliant alternatives. Key business trends include vertical integration among suppliers to control the quality of raw materials, increasing focus on customizable solutions based on specific hazard profiles, and a growing emphasis on traceability and smart PPE technologies leveraging integrated sensors for monitoring environmental conditions and user health. Strategic partnerships between textile manufacturers and garment producers are essential for optimizing supply chains and ensuring product efficacy.

Regional trends highlight differing consumption patterns and regulatory nuances. While Western markets prioritize high-performance, inherently flame-resistant (IFR) fibers like Aramid and PBI, emerging economies often rely on treated cotton or synthetic blends for cost efficiency, though regulatory pressures are slowly shifting this balance towards premium materials. Investment in local manufacturing capabilities in regions like Southeast Asia and Latin America is increasing to bypass logistical challenges and cater to region-specific sizing and comfort requirements dictated by varying climatic conditions. Furthermore, governmental procurement, particularly within defense and public safety sectors globally, remains a stable and significant revenue stream, prioritizing high-specification, certified protective clothing that meets stringent quality assurance benchmarks.

Segment trends underscore the dominance of Aramid fibers (e.g., Nomex, Kevlar) due to their superior strength-to-weight ratio and inherent thermal stability, making them the material of choice across high-specification applications like petrochemicals and firefighting. Within the application segmentation, the industrial sector, particularly oil and gas, continues to be the largest consumer, driven by extensive operational requirements and catastrophic risk profiles associated with flammable materials. However, the fastest-growing segment is expected to be utilities and electrical work, catalyzed by increasing investments in renewable energy infrastructure and the critical need for arc flash protective suits. Manufacturers are actively diversifying their portfolios to include specialized sub-segment products, such as lightweight coveralls for warm climates and enhanced visibility suits for nocturnal operations, catering to highly specific operational demands.

AI Impact Analysis on Flame Retardant Suit Market

Common user inquiries concerning the integration of Artificial Intelligence (AI) into the Flame Retardant Suit Market primarily revolve around predictive maintenance, material optimization, and enhanced regulatory compliance. Users frequently ask how AI can contribute to designing lighter, yet more protective fabrics by simulating thermal stress environments (digital twins), or how machine learning algorithms can analyze vast datasets of workplace accidents to proactively refine suit specifications and design flaws. A central theme is the expectation that AI will move PPE beyond passive protection towards an active safety system. Concerns often focus on the cost implications of implementing smart textiles and the challenges related to data privacy and integration with existing industrial safety infrastructure. Overall, there is a strong anticipation that AI will revolutionize the supply chain, from automated quality inspection during manufacturing to optimized inventory management based on real-time risk assessment in industrial sites.

- AI-driven simulation and material science optimization reduces development time for new flame-retardant fibers, leading to enhanced performance and reduced weight.

- Predictive maintenance analytics, leveraging data from integrated sensors (IoT), forecast wear and tear, ensuring suits are retired before their protective capacity is compromised.

- Automated quality control systems use computer vision to detect microscopic flaws in fabric weave or seam integrity during the manufacturing process, improving overall product reliability.

- Machine learning algorithms enhance personalized PPE sizing and fit recommendations, minimizing gaps in protection caused by ill-fitting garments.

- AI aids in optimizing supply chain logistics and inventory management by predicting seasonal demand shifts and regulatory changes impacting material requirements.

- Risk assessment platforms utilize AI to correlate specific job roles, environmental variables, and incident data to recommend the precise level of flame protection needed, ensuring optimized purchasing decisions.

DRO & Impact Forces Of Flame Retardant Suit Market

The dynamics of the Flame Retardant Suit Market are dictated by a powerful combination of safety legislation (Drivers), high raw material and R&D costs (Restraints), and burgeoning opportunities in smart textiles and emerging markets (Opportunities). The overarching Impact Forces are driven primarily by governmental regulatory bodies and the corporate focus on Environmental, Social, and Governance (ESG) criteria, which increasingly mandate superior worker protection. Stringent enforcement of standards like NFPA 2112 for flash fire protection and NFPA 70E for electrical arc flash protection compels businesses operating in hazardous environments to regularly update and replace existing PPE with certified, high-performance alternatives. This regulatory stick, combined with the ethical and reputational incentive of minimizing workplace fatalities, forms the principal market engine. However, the high fluctuation in the prices of specialty chemicals and advanced fibers, coupled with lengthy certification processes, acts as a brake on rapid market expansion, particularly in cost-sensitive regions.

Key drivers include the rapid expansion of industrial sectors in Asia Pacific, the modernization of aging energy infrastructure globally, and increasing public and governmental scrutiny following industrial accidents, which invariably leads to tighter safety mandates. Technological innovation in textile finishing and lightweight fiber development further catalyzes market growth by offering superior comfort without compromising safety, encouraging higher compliance among workers. Conversely, significant restraints include the proliferation of counterfeit or non-compliant protective gear, which undercuts certified manufacturers and poses substantial risks to users. Additionally, the complex maintenance requirements and laundering protocols necessary to preserve the flame-retardant properties of the suits present an operational challenge for end-users, affecting the lifespan and consistent protective efficacy of the products.

Opportunities are abundant in the integration of wearable technology, transforming traditional suits into 'smart' monitoring platforms capable of detecting heat stress, gas leaks, and worker fatigue, thereby moving towards predictive safety measures. Furthermore, the push towards sustainability offers a major competitive edge; manufacturers investing in bio-based or recycled flame-retardant materials and processes are well-positioned to meet the growing corporate demand for environmentally responsible sourcing. The increasing demand from non-traditional high-risk sectors, such as specialized waste management and chemical handling, also represents an untapped potential for tailored protective solutions, requiring suppliers to continuously innovate their product line to address complex, multi-hazard scenarios effectively.

Segmentation Analysis

The Flame Retardant Suit Market is analyzed across multiple critical dimensions, primarily focusing on the material composition, the specific application or hazard environment, and the end-use industry. This segmentation provides a granular view of market dynamics, allowing stakeholders to identify high-growth niches and tailor product development to meet specific functional requirements. The material segmentation is crucial as it determines the level of inherent protection, durability, and cost. Application segmentation differentiates between the thermal severity and duration of exposure, informing design requirements—for instance, structural firefighting gear requires significantly higher thermal stability than petrochemical workwear. Understanding these segments helps manufacturers optimize their production strategies and sales channels, ensuring optimal alignment with regulatory mandates and customer needs across the global industrial landscape.

- By Material Type:

- Aramid (e.g., Meta-Aramid, Para-Aramid)

- Modacrylic

- PBI (Polybenzimidazole)

- Treated Cotton and Blends

- Others (including Nomex, FR Rayon blends)

- By Application:

- Industrial Safety (Oil & Gas, Petrochemicals, Manufacturing, Welding)

- Firefighting (Structural, Wildland, Proximity)

- Military & Defense

- Electrical Utilities and Arc Flash Protection

- Motorsports and Racing

- Others (e.g., Laboratories, Aviation)

- By End-Use Industry:

- Energy Sector

- Chemical and Pharmaceutical

- Construction and Infrastructure

- Mining

- Transportation and Logistics

- Public Safety and Government Agencies

Value Chain Analysis For Flame Retardant Suit Market

The value chain for the Flame Retardant Suit Market is intricate, starting with the specialized chemical and textile industry (upstream) and extending through sophisticated manufacturing and certified distribution channels (downstream). Upstream analysis focuses on key suppliers of flame-retardant polymers, specialty fibers (like PBI and Aramid), and chemical treatments. This stage is dominated by a few global chemical giants, meaning raw material pricing and availability significantly influence the final product cost and market competitiveness. Innovation at this stage is critical, focusing on developing lighter, more sustainable, and inherently flame-resistant materials. Manufacturers must secure reliable, certified sourcing to maintain product integrity and comply with international standards, as any compromise in raw material quality can negate the suit's protective function.

The mid-stream segment involves the transformation of raw fibers into finished garments. This includes spinning, weaving, textile finishing (treatment), and garment construction. Quality control is paramount here, involving rigorous testing for thermal stability, tensile strength, and colorfastness. Manufacturing often requires specialized machinery and strict processing environments to ensure the flame-retardant properties are maintained through the cutting and stitching phases. Companies focusing on advanced ergonomic design, incorporating features like mobility gussets and enhanced ventilation, add substantial value at this stage, differentiating their products beyond basic protective capability.

Downstream analysis covers distribution channels, which include direct sales to large institutional buyers (military, major oil companies), specialized safety equipment distributors, and increasingly, e-commerce platforms targeting smaller industrial clients. Direct channels are crucial for customized, high-volume orders, allowing for technical consultation and after-sales support. Indirect channels, primarily through authorized distributors, are essential for penetrating regional markets and providing local inventory stocking. Certification and technical expertise are fundamental value-adds in the downstream segment, as purchasers rely on distributors to provide products that meet specific local and international regulatory requirements, emphasizing the importance of informed sales and technical representation.

Flame Retardant Suit Market Potential Customers

Potential customers for flame retardant suits are concentrated within industries where thermal exposure, fire, and electric arc hazards are inherent operational risks, necessitating mandatory personal protective equipment procurement. The primary consumer demographic comprises large industrial corporations, especially those in the Oil & Gas (Upstream, Midstream, Downstream), Petrochemical, and Chemical manufacturing sectors, where flash fire risks are high due to volatile substances. These entities prioritize high-specification, multi-hazard protective wear, typically favoring inherently flame-resistant (IFR) materials like Aramid. Secondarily, the Electrical Utilities sector, including power generation, transmission, and distribution companies, forms a vital customer base, specifically requiring arc flash rated protective suits (compliant with NFPA 70E) to mitigate severe thermal injuries from electrical incidents. Government and Public Safety organizations, notably municipal, state, and federal firefighting departments, military branches, and emergency response teams, represent a stable customer segment demanding the highest level of certified protection and durability.

Beyond these core industrial segments, specialized commercial end-users also drive significant demand. This includes welding and metalworking industries where molten metal splash is a concern, construction sites operating near heat sources or requiring temporary protection, and aviation/aerospace maintenance facilities. Furthermore, the professional motorsports and racing industry requires highly specialized, lightweight, flame-retardant gear compliant with FIA standards. Purchasing decisions within these segments are heavily influenced by regulatory compliance requirements, insurer mandates, product durability, and wearer comfort—which directly impacts compliance and operational efficiency. Procurement managers prioritize suppliers who offer verifiable certification documentation and reliable supply chains, emphasizing quality assurance over marginal cost savings due to the critical nature of the product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.4 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | DuPont, 3M, TenCate Protective Fabrics, Lakeland Industries, Honeywell International, VF Corporation (Bulwark), PBI Performance Products, Solvay, Teijin Aramid, KINCAID, SIOEN Industries, Milliken & Company, GORE-TEX, International Safety Components (ISC), Newtex Industries, Chicago Protective Apparel, Westex by Milliken, Kappler, NSA (National Safety Apparel), Workrite Uniform Company. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flame Retardant Suit Market Key Technology Landscape

The technology landscape of the Flame Retardant Suit Market is undergoing a rapid transformation, moving beyond basic protective textiles to incorporate multi-functional fabrics and digital integration. A primary area of innovation is in inherent fiber technology, where advanced polymers such as PBI and various aramid isomers offer permanent flame resistance without requiring chemical treatments, ensuring protection that lasts the lifespan of the garment. Manufacturers are continually working to improve the thermal protective performance (TPP) while simultaneously reducing fabric weight and increasing breathability, addressing the critical industry need for enhanced worker comfort and reduced heat stress, particularly in hot climates. The development of specialized finishes that provide additional properties, such as resistance to chemicals, moisture wicking, and enhanced durability against abrasion, further defines the high-end technology segment of the market.

A significant technological shift is the increasing adoption of smart textiles and Internet of Things (IoT) integration. This involves embedding micro-sensors, conductive threads, and flexible electronics directly into the fabric structure of the suits. These sensors are designed to monitor vital parameters such as the external temperature, heat flux, internal humidity, and the wearer's heart rate and body temperature. The data collected provides real-time safety alerts to both the wearer and remote safety supervisors, allowing for immediate intervention in hazardous situations or preemptive action against heat exhaustion. This transformation of PPE from a passive shield to an active monitoring system represents a major technological leap, particularly valuable in critical high-risk applications like confined space entry or deep-sea oil rig operations.

Furthermore, advancements in non-woven and composite textile technologies are creating new possibilities for lightweight, highly insulating liners and outer shells, specifically benefiting structural firefighting gear where extreme thermal insulation is required. Manufacturing technologies, including sophisticated 3D body scanning and automated cutting systems, are improving the precision of garment construction, leading to superior fit and coverage, which directly translates to enhanced safety performance. The focus on sustainable textile processing, utilizing PFC-free water repellents and reducing the environmental footprint of flame-retardant chemical applications, is also a key technological priority, responding to growing corporate environmental responsibility demands and securing long-term market viability.

Regional Highlights

- North America: This region holds a leading position in the Flame Retardant Suit Market, driven by strict regulatory regimes enforced by OSHA and NFPA, especially within the vast oil and gas, petrochemical, and electrical utilities sectors. The high adoption rate of premium, inherently flame-resistant materials and continuous investment in advanced safety training and equipment refurbishment programs characterize this market. The U.S. remains the largest consumer, primarily due to mandatory compliance laws and a strong industrial safety culture, creating stable demand for certified high-performance arc flash and flash fire protection garments.

- Europe: Europe is a mature and highly competitive market, distinguished by rigorous CEN and ISO standards. Western European countries, particularly Germany, the UK, and France, exhibit high demand for multi-norm protective clothing that addresses multiple hazards simultaneously (e.g., flame, antistatic, chemical splash). Emphasis on worker welfare and safety compliance, coupled with a growing focus on sustainable and recyclable FR textiles, drives regional innovation and procurement decisions among major manufacturing and utility companies.

- Asia Pacific (APAC): APAC is anticipated to be the fastest-growing region during the forecast period. This growth is fueled by rapid industrialization, massive infrastructure development, expansion of manufacturing bases (especially in China, India, and Southeast Asia), and increasing awareness regarding industrial safety standards. While traditionally cost-sensitive, the gradual implementation of stricter local safety regulations, often harmonized with international standards, is accelerating the shift from cheap, non-certified alternatives toward high-quality, professional FR suits across the energy and heavy industry sectors.

- Middle East and Africa (MEA): This region is dominated by substantial demand emanating from the massive oil and gas and petrochemical operations, particularly in the Gulf Cooperation Council (GCC) countries. High temperatures and specific operational hazards mandate specialized, breathable, yet highly protective FR suits. Demand growth is closely tied to investment cycles in the energy sector, and large national oil companies are key procurers, prioritizing certified protection aligned with international industry benchmarks.

- Latin America: The market here is moderately growing, driven primarily by the mining and energy sectors in countries like Brazil, Mexico, and Chile. The adoption rate is improving as local governments enforce more rigorous workplace safety legislation. However, market penetration and growth are often hindered by economic volatility and reliance on imported protective materials, though local manufacturing initiatives are slowly emerging to address regional supply needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flame Retardant Suit Market.- DuPont

- 3M

- TenCate Protective Fabrics

- Lakeland Industries

- Honeywell International

- VF Corporation (Bulwark)

- PBI Performance Products

- Solvay

- Teijin Aramid

- KINCAID

- SIOEN Industries

- Milliken & Company

- GORE-TEX

- International Safety Components (ISC)

- Newtex Industries

- Chicago Protective Apparel

- Westex by Milliken

- Kappler

- NSA (National Safety Apparel)

- Workrite Uniform Company

Frequently Asked Questions

Analyze common user questions about the Flame Retardant Suit market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between inherently flame-resistant (IFR) and treated flame-retardant (FR) suits?

IFR suits, typically made from materials like Aramid or PBI, have protection built directly into the molecular structure of the fiber, ensuring the flame-resistant properties cannot be washed out or worn away. Treated FR suits use chemical applications applied to the fabric surface (often cotton), which can degrade over time and through laundering cycles, requiring careful maintenance protocols.

Which industry accounts for the largest demand for Flame Retardant Suits globally?

The Oil and Gas (O&G) industry, encompassing upstream exploration to downstream refining, is the largest consumer globally. This demand is driven by the extreme risk of flash fires and the mandatory need to comply with stringent standards such as NFPA 2112 to protect personnel working with highly volatile and flammable hydrocarbons.

How do regulatory standards like NFPA and ISO influence the purchasing decisions in the market?

Regulatory standards are the most critical driver, mandating the use of certified protective clothing in high-risk environments. Compliance with specific standards (e.g., NFPA 70E for arc flash or ISO 11612 for heat and flame protection) ensures that suits meet minimum safety performance criteria, forcing corporations to purchase certified products from reliable, audited manufacturers.

What role does sustainability play in the future development of Flame Retardant Suits?

Sustainability is becoming a key technological differentiator, influencing R&D towards bio-based and recycled fibers, and manufacturing processes that minimize the use of hazardous chemicals (like PFCs). Consumers, particularly large Western corporations, are increasingly demanding FR suits that align with their corporate ESG targets, driving the market towards greener textile solutions.

Are smart textiles expected to replace traditional flame retardant materials?

Smart textiles, which integrate sensors for active monitoring, are not intended to replace traditional flame-retardant materials. Instead, they enhance the protective capabilities of existing materials (like Aramid or PBI) by adding proactive safety functions such as heat stress detection and real-time hazard alerts, thereby creating a multi-functional, integrated protective solution.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager