Flange Nut Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438226 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Flange Nut Market Size

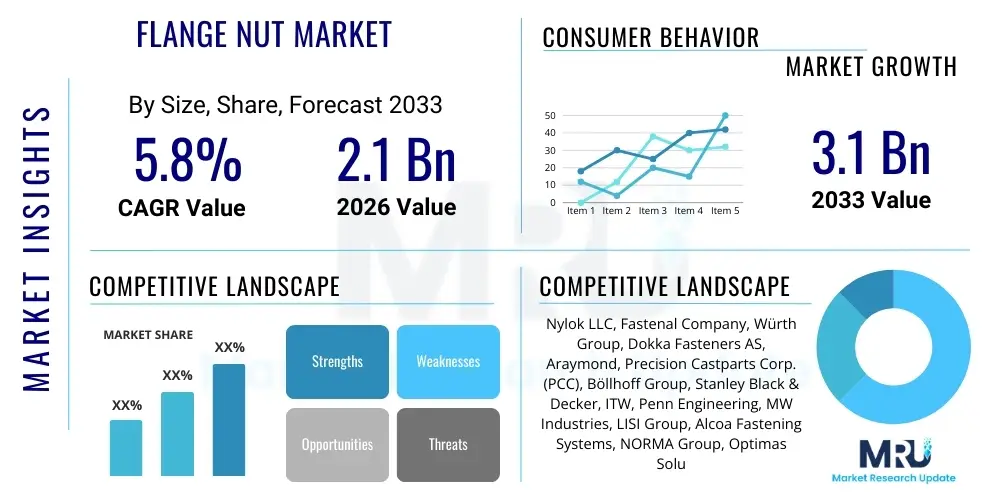

The Flange Nut Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at $2.1 Billion in 2026 and is projected to reach $3.1 Billion by the end of the forecast period in 2033.

Flange Nut Market introduction

The Flange Nut Market encompasses the global production, distribution, and consumption of specialized fasteners designed with an integrated washer-like base, known as a flange, which distributes the load across a larger surface area. This design characteristic is pivotal in maintaining joint integrity, especially when dealing with softer materials or in applications subject to vibration and high thermal stress. The primary objective of the flange is to eliminate the need for a separate washer, thereby streamlining assembly processes, reducing inventory complexity, and enhancing the overall performance and reliability of the bolted joint. Flange nuts are manufactured primarily from materials such as carbon steel, stainless steel, and various alloys, often coated with zinc or other protective finishes to prevent corrosion, making them essential components across heavy industries.

Major applications for flange nuts span a broad spectrum of industrial and infrastructural sectors. In the automotive industry, they are indispensable for chassis assembly, engine mounting, and wheel fastening, where their self-locking capabilities (in serrated variants) are crucial for safety and operational longevity. Similarly, the construction and infrastructure sectors utilize flange nuts extensively in structural steel erection, pipeline assembly, and heavy equipment manufacturing due to their superior load distribution capacity, which prevents damage to the underlying surface and maintains strong clamping force under dynamic loads. The increasing demand for lightweight, high-performance fasteners that meet stringent international quality standards, such as ISO and DIN, is a central driving factor for market expansion, particularly within advanced manufacturing environments.

The benefits derived from using flange nuts are manifold, directly contributing to their growing adoption over traditional nut-and-washer combinations. These benefits include improved assembly speed, enhanced resistance to loosening due to vibration—especially with serrated flanges—and better structural integrity by minimizing surface deformation or marring. Furthermore, the market is driven by global trends in urbanization and industrial automation, leading to increased capital expenditure on machinery, vehicles, and infrastructure projects requiring reliable and standardized fastening solutions. The transition towards high-strength, corrosion-resistant materials for fasteners in critical applications, such as wind turbines and offshore platforms, further underscores the sustained demand profile for these specialized nuts globally, cementing their role as critical components in modern engineering.

Flange Nut Market Executive Summary

The Flange Nut Market is characterized by robust business trends driven primarily by the global resurgence in manufacturing and heavy industrial activity, coupled with significant advancements in material science focusing on lightweight yet high-strength steel and alloy fasteners. Key market players are increasingly investing in sophisticated manufacturing technologies, such as advanced cold forming and surface treatment processes, to produce high-precision, fatigue-resistant flange nuts that meet the demanding specifications of the aerospace and high-end automotive sectors. A crucial business trend involves the consolidation of the fragmented supply chain, where large multinational fastening corporations are acquiring regional specialists to expand their geographical reach and enhance their portfolio of specialized products, including metric and imperial serrated and non-serrated flange nuts, optimizing economies of scale in procurement and distribution.

From a regional perspective, the Asia Pacific (APAC) region currently dominates the market, largely propelled by rapid industrialization, massive infrastructure development in countries like China and India, and the establishment of major global automotive and electronics manufacturing hubs. North America and Europe, while exhibiting more mature market conditions, show steady growth, primarily fueled by the replacement market, strict regulatory requirements for structural safety, and high adoption rates of premium, technologically advanced fasteners used in renewable energy projects (wind and solar) and precision machinery. The Middle East and Africa (MEA) region presents significant emerging opportunities due to substantial investments in oil and gas infrastructure expansion, coupled with burgeoning construction and transportation projects requiring durable, robust fastening solutions capable of withstanding harsh environmental conditions.

Segmentation trends indicate a clear preference for serrated flange nuts, particularly in applications exposed to high levels of vibration, due to their superior self-locking mechanism compared to standard varieties. In terms of material segmentation, stainless steel flange nuts are experiencing elevated growth, driven by their requisite use in high-corrosion environments such as marine, chemical processing, and certain automotive applications where longevity is paramount. The primary application segment driving overall demand remains the automotive industry, which continuously seeks high-volume, standardized fastening solutions, followed closely by the industrial machinery sector, particularly within the robotics and automation equipment manufacturing spheres, where joint reliability is non-negotiable for operational efficiency and safety compliance.

AI Impact Analysis on Flange Nut Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Flange Nut Market often revolve around operational efficiency, quality control, and predictive supply chain management. Users frequently inquire: "How can AI reduce defect rates in fastener manufacturing?" or "Will AI-driven demand forecasting stabilize material costs?" and "How is AI influencing fastener design optimization for new materials?" These questions reveal user expectations centered on leveraging AI to move beyond traditional quality inspection methods (like manual gauging) toward automated, zero-defect manufacturing systems. There is also significant interest in how machine learning can be applied to complex supply chain data—predicting volatility in steel prices, optimizing logistics routes, and managing global inventory to avoid shortages, which are critical concerns for high-volume, low-margin components like flange nuts. Furthermore, users expect AI to accelerate R&D, enabling rapid simulation and testing of novel fastener geometries and coatings to improve performance metrics such as torque-tension control and fatigue life.

The key themes emerging from this analysis confirm that AI's influence is primarily felt in three domains: manufacturing precision, quality assurance, and systemic operational improvements. Concerns focus on the high initial investment required for integrating AI systems into legacy manufacturing environments and the need for skilled labor capable of managing and interpreting complex data generated by industrial IoT devices and sensors monitoring forming presses and heat treatment cycles. Expectations are high regarding the use of AI-powered vision systems for real-time dimensional and surface defect detection, significantly outpacing human inspection capabilities. This shift towards smart manufacturing promises unparalleled consistency and adherence to tight tolerance specifications essential for critical applications, such as aerospace engine components where reliability cannot be compromised, making the integration of AI a strategic imperative for market leaders.

Summarily, AI is transitioning the Flange Nut Market from conventional fabrication to an optimized, data-driven ecosystem. Predictive maintenance algorithms are reducing machine downtime and improving the lifespan of tooling equipment used in the cold forming process. Demand forecasting models, incorporating global economic indicators and specific end-user project pipelines, allow manufacturers to better align production schedules and inventory levels, mitigating risks associated with volatile raw material prices (primarily steel and alloys). Ultimately, AI integration is viewed not just as a cost-cutting measure but as a fundamental enabler for achieving higher quality standards and ensuring supply chain resilience in a globally competitive and complex industrial landscape.

- AI-powered Vision Systems: Real-time, non-contact defect detection (e.g., incomplete thread, flange cracks) ensuring zero-defect output.

- Predictive Maintenance: Optimizing tooling lifespan and reducing machine downtime in forming and threading processes.

- Supply Chain Optimization: Utilizing machine learning for accurate demand forecasting and minimizing inventory holding costs.

- Generative Design: Accelerating the optimization of flange nut geometry for maximum strength-to-weight ratio.

- Process Parameter Control: Real-time adjustment of heat treatment and surface finishing parameters for superior material properties.

DRO & Impact Forces Of Flange Nut Market

The dynamics of the Flange Nut Market are governed by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the market's trajectory and the strategic decisions of key industry players. The central driving force is the relentless expansion of global infrastructure and construction sectors, particularly in emerging economies, requiring vast quantities of standardized, high-performance fastening components. Additionally, the tightening of global safety standards and the increased operational demands within high-stress applications like oil and gas pipelines, renewable energy installations, and modern vehicle assembly necessitate the use of specialized fasteners with enhanced self-locking features and superior load distribution capabilities, directly favoring flange nuts. Technological advancements in material science, leading to lighter, stronger, and more corrosion-resistant fasteners (e.g., specialty stainless steel alloys), further act as powerful market drivers, encouraging replacement cycles and new product adoption across various industrial verticals.

However, the market faces significant Restraints that temper potential growth. The primary restraint is the volatility and cyclical nature of raw material prices, notably steel, zinc, and nickel, which directly impacts manufacturing costs and profit margins, making long-term pricing stability challenging. Furthermore, the market for standard flange nuts is highly competitive and susceptible to counterfeiting, particularly from manufacturers in lower-cost regions, leading to pricing pressure and intellectual property concerns for established brands focusing on quality and certification. The complex and lengthy certification processes required for fasteners utilized in highly regulated sectors, such as aerospace and medical devices, also create an entry barrier and slow down product deployment, adding to the operational complexity faced by producers.

Opportunities for sustained growth are primarily concentrated in the penetration of new, high-growth application areas and leveraging technological differentiation. The burgeoning electric vehicle (EV) market presents a massive opportunity, requiring specialized non-ferrous and insulated flange nuts that address unique fastening challenges related to battery packs and lightweight body structures. Moreover, the increasing global focus on sustainability and circular economy principles opens avenues for manufacturers to develop and market fasteners made from recycled materials or designed for easier disassembly and recycling (Design for Disassembly). The development of Smart Fasteners—nuts embedded with sensors for structural health monitoring—represents a high-value niche opportunity, particularly attractive to infrastructure managers and critical industrial asset owners looking to transition towards predictive maintenance regimes, thereby justifying higher price points and offering a significant competitive advantage over commoditized products.

Segmentation Analysis

The Flange Nut Market is meticulously segmented based on material composition, nut type, and application area, providing a detailed framework for understanding market dynamics and specific demand patterns across various industrial sectors. The segmentation by material is crucial as it dictates the fastener's mechanical properties, including tensile strength, operating temperature range, and corrosion resistance, directly correlating to the intended use environment. Carbon steel and stainless steel dominate the volume, but the high-performance segment relies heavily on specialized alloys to meet stringent requirements in aerospace and high-speed automotive applications. Type segmentation differentiates between serrated and non-serrated variants, reflecting the choice between enhanced vibration resistance and smooth surface interaction, which significantly influences suitability for dynamic versus static joints.

Analyzing segmentation provides strategic insights into investment areas; for example, the strong growth forecasted for stainless steel serrated flange nuts suggests increasing industry prioritization of joint integrity and corrosion prevention in harsh outdoor and marine environments. The differentiation between various types of coatings—such as zinc plating, hot-dip galvanizing, and specialized anti-corrosion treatments—also functions as an implicit segmentation factor, catering to specific regulatory or lifespan requirements in construction and infrastructure projects. Manufacturers use this granular data to tailor their product lines, ensuring compliance with global standards (e.g., ISO, ASME, DIN) and optimizing inventory management based on regional application demand, allowing for focused production runs.

The application segmentation reveals the most significant demand drivers. While traditional industries such as construction and general industrial machinery remain the backbone of demand, high-growth segments like electric vehicles (EVs) and renewable energy (particularly wind energy installations, which require extremely large, high-tensile flange nuts) are emerging as critical revenue streams. Understanding these segment interactions is vital for competitive positioning, as manufacturers must often hold specific industry certifications (like AS9100 for aerospace) to access high-margin application segments, requiring significant upfront quality control and testing investments tailored to highly specialized fastener specifications beyond standard commercial grades.

- By Material:

- Carbon Steel

- Stainless Steel (e.g., A2, A4)

- Alloy Steel

- Non-Ferrous Alloys (e.g., Aluminum, Brass)

- By Type:

- Serrated Flange Nut

- Non-Serrated Flange Nut (Smooth Flange)

- Locking Flange Nut (e.g., with Nylon Insert or prevailing torque features)

- By Application:

- Automotive (Chassis, Engine, Wheels)

- Construction and Infrastructure (Structural Steel)

- Industrial Machinery and Equipment

- Aerospace and Defense

- Renewable Energy (Wind Turbines, Solar Racking)

- By Coating:

- Zinc Plated

- Hot Dip Galvanized (HDG)

- Phosphate Coated

Value Chain Analysis For Flange Nut Market

The Value Chain for the Flange Nut Market begins with Upstream Analysis, which focuses primarily on the sourcing and processing of raw materials. This segment is highly concentrated around major global steel producers and specialized alloy suppliers. The primary raw materials include steel wire rods (low, medium, and high carbon steel, stainless steel grades), which must adhere to strict chemical composition and mechanical property standards before being supplied to fastener manufacturers. Price fluctuations and availability of these base metals—particularly due to global trade policies or geopolitical events—have a profound and immediate impact on the profitability of the entire downstream chain. Manufacturers utilize rigorous material testing and certification processes at this stage to ensure the integrity and compliance of the finished product, relying heavily on long-term supplier relationships for consistent quality and volume discounts necessary for mass production.

Midstream activities involve the core manufacturing processes: cold or hot forging, threading, heat treatment (for strength), and surface finishing (coating or plating for corrosion resistance). This is the segment where technological differentiation is most acute, utilizing high-speed multi-station forming machines and advanced CNC threading equipment to ensure tight dimensional tolerances and superior mechanical performance. Distribution channels form the link between manufacturing and the end-user. Direct distribution involves large-volume sales to Original Equipment Manufacturers (OEMs), such as major automotive companies or heavy machinery producers, often secured through long-term contracts specifying precise JIT (Just-in-Time) delivery schedules. Indirect channels rely on a vast network of authorized distributors, industrial supply houses, and specialized fastener wholesalers, which stock a wide variety of sizes, grades, and coatings to serve the Maintenance, Repair, and Operations (MRO) market and smaller construction contractors, providing inventory proximity and convenience for geographically dispersed customers.

The Downstream analysis focuses on end-user integration and service components. The final stage involves the assembly and application of the flange nuts in the designated equipment or structure. Value-added services at this stage, such as kitting (packaging fasteners customized for specific assembly kits), technical support, application engineering consultation, and inventory management programs (like Vendor Managed Inventory or VMI), are crucial differentiators. Customers in critical sectors demand thorough traceability—requiring certification records back to the raw material batch. The complexity of the global supply chain necessitates robust logistics and quality assurance protocols, where the efficiency of the direct distribution network is paramount for OEMs who require high consistency, while the robustness of the indirect network is essential for stabilizing pricing and availability within the highly fragmented MRO segment, completing the critical cycle of value delivery.

Flange Nut Market Potential Customers

The primary cohort of potential customers for the Flange Nut Market consists of Original Equipment Manufacturers (OEMs) across several industrial behemoths. Within the automotive sector, this includes major global vehicle manufacturers producing passenger cars, commercial trucks, and heavy-duty specialty vehicles. These buyers prioritize fasteners that offer high vibration resistance (serrated flange nuts are highly favored), standardization across global platforms, and consistent high volume supply that complies with IATF 16949 quality management standards. For these OEMs, the cost-per-piece must be aggressively managed, but without sacrificing the necessary mechanical performance metrics crucial for safety-critical joints like suspensions and axles. Long-term supplier agreements and the ability to integrate into automated assembly lines are key criteria for securing these high-value contracts.

Another significant customer base resides in the heavy industrial and construction sectors. This includes structural steel fabricators, industrial pipeline constructors, infrastructure developers (bridges, rail), and manufacturers of large industrial machinery such as stamping presses, compressors, and material handling systems. These customers typically require larger diameter, higher-strength flange nuts, often with heavy corrosion protection (like hot-dip galvanizing), to ensure structural longevity in outdoor or chemically aggressive environments. Reliability and adherence to specific national and international structural codes (e.g., AISC, Eurocodes) are paramount for these buyers, meaning the ability to provide extensive material traceability documentation and testing reports is a non-negotiable requirement for successful sales engagement and vendor qualification.

The third major segment encompasses the Maintenance, Repair, and Operations (MRO) market, alongside specialized niche industries like aerospace, marine, and renewable energy. MRO customers, served primarily through distributors, require a diverse inventory portfolio and rapid availability for emergency repairs or routine equipment upkeep. Aerospace customers, conversely, demand highly specialized, often custom-engineered flange nuts made from exotic materials (like titanium or high-nickel alloys) that meet extremely strict material and dimensional tolerances (e.g., AS9100 certification). The renewable energy sector, particularly wind turbine manufacturers, represents a burgeoning consumer base, requiring massive, high-tensile flange nuts capable of withstanding extreme dynamic loads and cyclic fatigue over a 20-30 year lifespan, prioritizing quality and long-term durability over marginal cost savings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $2.1 Billion |

| Market Forecast in 2033 | $3.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nylok LLC, Fastenal Company, Würth Group, Dokka Fasteners AS, Araymond, Precision Castparts Corp. (PCC), Böllhoff Group, Stanley Black & Decker, ITW, Penn Engineering, MW Industries, LISI Group, Alcoa Fastening Systems, NORMA Group, Optimas Solutions, ATF, G&L Gesipa GmbH, Sherex Fastening Solutions, Keller & Kalmbach GmbH, EJOT Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flange Nut Market Key Technology Landscape

The technological landscape of the Flange Nut Market is dominated by advancements in cold forging and forming processes, which are critical for achieving the high mechanical properties and precise geometric dimensions required for load-bearing applications. Modern multi-station cold formers allow manufacturers to transform raw steel wire into a finished flange nut with minimal material waste and high production speeds, often performing the heading, flanging, and initial piercing operations sequentially. The key technological focus here is on tool design and wear reduction, utilizing advanced carbide tooling and monitoring systems to sustain high throughput and consistency over long production runs. Furthermore, advancements in specialized roller-threading technology ensure superior thread integrity and fatigue resistance compared to traditional cut threads, which is essential for fasteners used in high-vibration automotive and machinery environments where joint integrity must be maintained without failure.

Beyond primary forming, the technological landscape includes sophisticated surface engineering and coating technologies aimed at enhancing corrosion resistance and modifying friction coefficients. The transition from simple zinc plating to environmentally friendly and high-performance coatings, such as zinc-nickel and specialized ceramic coatings, is a key trend, particularly driven by stringent environmental regulations (like RoHS and REACH) and the need for fasteners that can survive highly corrosive conditions (e.g., road salt exposure in automotive use). Control over the friction coefficient is also managed technologically through specialized lubricants and finishes; this is crucial because the torque-tension relationship—how much clamping force is achieved per unit of applied torque—is directly influenced by the nut's surface, impacting the reliability of the entire bolted joint. Manufacturers are leveraging precise coating thickness control systems and non-contact inspection technologies to ensure uniformity and compliance.

The application of Industry 4.0 principles, including industrial IoT (IIoT) and advanced sensors, forms the emerging frontier of technology in this market. This involves embedding sensors into manufacturing equipment to collect real-time data on temperature, pressure, and vibration during the forging and heat treatment processes. This data is then utilized for statistical process control (SPC) and predictive quality management, ensuring that deviations are corrected instantly, minimizing scrap rates and maximizing efficiency. Advanced Non-Destructive Testing (NDT) methods, such as magnetic particle inspection and ultrasonic testing, are increasingly being adopted to verify the integrity of high-stress flange nuts used in aerospace and heavy equipment before shipment. These technologies collectively support the market's demand for zero-defect production and enhanced product traceability throughout the entire life cycle.

Regional Highlights

The Asia Pacific (APAC) region stands out as the undisputed leader in the Flange Nut Market, driven by unprecedented growth in manufacturing output, rapid urbanization, and massive governmental investments in infrastructure and transport networks across countries like China, India, and Southeast Asia. APAC serves as the global manufacturing hub for automobiles and industrial machinery, leading to extraordinarily high demand for standardized fasteners. The regional market is characterized by a mix of high-volume local producers focused on cost efficiency and multinational firms catering to the high-specification, export-oriented sectors, making competition fierce but demand consistently strong. The increasing shift of global supply chains towards India and Vietnam for diversified sourcing is expected to sustain high growth rates for the fastener market throughout the forecast period.

North America and Europe represent mature markets defined by stringent quality requirements, technological adoption, and a strong preference for high-grade, specialized flange nuts used in high-value industries. In North America, demand is heavily influenced by the aerospace and defense sectors, along with the rapidly expanding domestic automotive industry, especially the growth of electric vehicle manufacturing, which demands unique, non-corrosive, and lightweight fasteners. European market growth is stable, driven primarily by the German machinery manufacturing sector (Machinenbau) and significant investments in offshore wind energy projects, requiring large-format, heavily protected flange nuts that comply strictly with EU environmental and safety directives (e.g., CE marking). These regions are generally price-insensitive when compared to APAC, prioritizing reliability, supply chain resilience, and certification conformity.

Latin America, the Middle East, and Africa (MEA) are crucial emerging markets presenting significant opportunities, albeit with higher operational complexities. Latin America's market potential is tied to volatility in commodity prices and political stability, but major investments in mining and basic infrastructure offer substantial long-term demand for construction-grade fasteners. The MEA region is witnessing major demand growth fueled by large-scale government-backed infrastructure projects, particularly in the Gulf Cooperation Council (GCC) states focusing on diversifying their economies beyond oil, leading to high consumption of galvanized and corrosion-resistant flange nuts for construction, oil, and gas processing facilities. While these regions typically import the majority of high-specification fasteners, increasing local assembly and manufacturing capabilities are expected to drive localized growth in the latter half of the forecast period, requiring specific product localization strategies from global vendors.

- Asia Pacific (APAC): Dominant market share due to high-volume automotive and infrastructure production; focus on standardization and cost efficiency.

- North America: Stable growth fueled by aerospace, defense, and high-specification EV manufacturing; demand for high-performance and specialty alloys.

- Europe: Driven by advanced industrial machinery and major renewable energy projects (especially offshore wind); emphasis on quality, traceability, and environmental compliance.

- Middle East & Africa (MEA): High growth potential from oil and gas infrastructure and massive urban development projects; requirement for superior corrosion resistance.

- Latin America: Demand linked to mining, infrastructure, and heavy machinery; market characterized by volatile economic conditions but long-term foundational needs.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flange Nut Market.- Nylok LLC

- Fastenal Company

- Würth Group

- Dokka Fasteners AS

- Araymond

- Precision Castparts Corp. (PCC)

- Böllhoff Group

- Stanley Black & Decker

- Illinois Tool Works (ITW)

- Penn Engineering

- MW Industries

- LISI Group

- Alcoa Fastening Systems

- NORMA Group

- Optimas Solutions

- ATF Inc.

- G&L Gesipa GmbH

- Sherex Fastening Solutions

- Keller & Kalmbach GmbH

- EJOT Group

Frequently Asked Questions

Analyze common user questions about the Flange Nut market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical advantage of a serrated flange nut over a standard nut and washer assembly?

The primary advantage is enhanced joint integrity under dynamic loads. The serrations bite into the bearing surface, providing a mechanical locking feature that significantly increases resistance to loosening caused by vibration, thermal expansion, and cyclic stress, thereby eliminating the need for a separate lock washer and simplifying the assembly process.

Which material grade of flange nut is most recommended for applications in highly corrosive environments like marine or chemical processing?

Stainless steel flange nuts, specifically those made from A4 (316 grade) stainless steel, are highly recommended. A4 stainless steel offers superior resistance to chloride corrosion compared to standard A2 (304 grade), making it essential for maritime applications, chemical processing plants, and environments with high salt exposure or caustic agents to ensure long service life.

How is the growth of the Electric Vehicle (EV) industry influencing demand and specifications for flange nuts?

The EV industry is driving demand for lightweight and non-ferrous flange nuts, often made from aluminum alloys, to reduce overall vehicle weight and maximize battery efficiency. Additionally, specific insulation and non-conductive coatings are required for fasteners used near battery packs to manage electrical isolation and thermal concerns, pushing technological innovation in material science and specialized coating processes.

What are the key certification standards that flange nut manufacturers must adhere to for selling into the automotive and aerospace sectors?

For the automotive sector, compliance with IATF 16949 (Quality Management System for Automotive Production) is mandatory. For the aerospace sector, adherence to AS9100 (Quality Management System for Aviation, Space, and Defense Organizations) is crucial, ensuring stringent quality control, full traceability, and compliance with precise dimensional and mechanical property specifications required by airworthiness authorities.

How does the volatile pricing of raw materials, particularly steel, impact the operational profitability within the Flange Nut Market?

Raw material price volatility significantly compresses manufacturer profit margins, especially in the high-volume, standard-grade segment where costs cannot be fully passed on to OEMs without intense negotiation. Manufacturers mitigate this risk through strategic long-term procurement contracts, hedging strategies, and adopting advanced manufacturing technologies (like cold forming) to minimize material scrap and maximize conversion efficiency per unit of raw input.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager