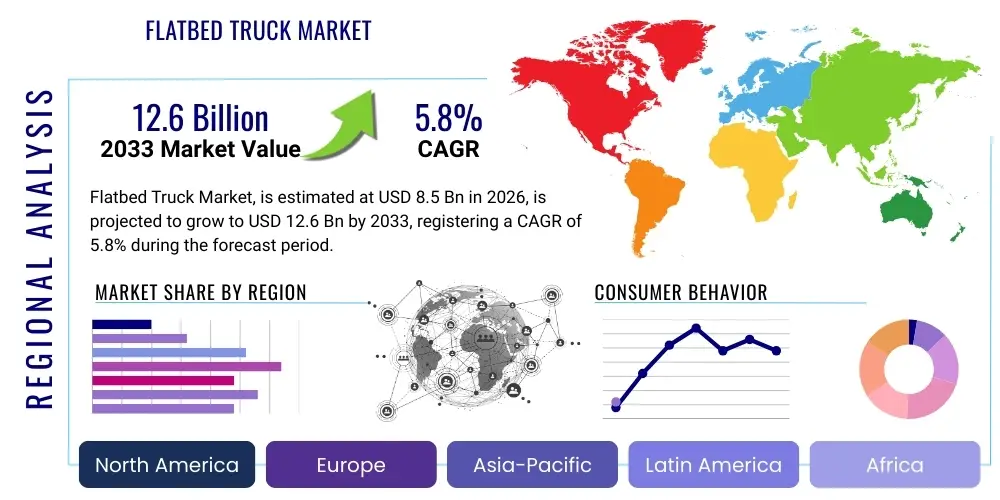

Flatbed Truck Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438051 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Flatbed Truck Market Size

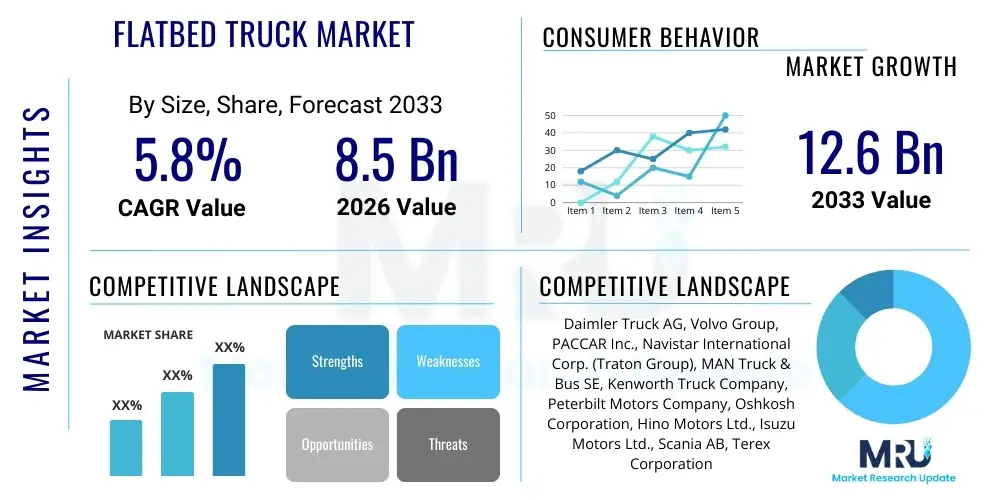

The Flatbed Truck Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 8.5 Billion in 2026 and is projected to reach USD 12.6 Billion by the end of the forecast period in 2033. This robust growth trajectory is underpinned by sustained infrastructural development globally, increasing demand for construction materials transportation, and the logistical flexibility inherent in flatbed designs, making them indispensable for specialized freight.

Flatbed Truck Market introduction

The Flatbed Truck Market encompasses the production, distribution, and utilization of commercial vehicles characterized by an open, unroofed platform body, designed specifically for transporting large, heavy, or irregularly shaped cargo that cannot be easily accommodated within enclosed trailers. These trucks are vital components of the global logistics and construction ecosystems, providing superior ease of loading and unloading via cranes or forklifts from the sides, rear, or top. The inherent versatility of the flatbed design allows for secure transport of diverse freight, including machinery, building materials like steel beams and lumber, oversized components, and heavy equipment, positioning flatbed trucks as essential assets in industrial supply chains.

Key applications of flatbed trucks span across several high-growth sectors, primarily construction, oil and gas, manufacturing, and utilities. In the construction industry, they facilitate the timely delivery of prefabricated components and raw materials crucial for project timelines. Their benefits include enhanced accessibility for cargo handling, capacity for extreme weights (especially when paired with multi-axle configurations), and compliance with specific regulatory requirements for transporting non-standard loads. This market dynamism is intrinsically linked to macroeconomic factors, particularly the levels of public and private investment in infrastructure projects across emerging and developed economies.

The principal driving factors accelerating market expansion include rapid urbanization, leading to an increased necessity for housing and commercial development; the expansion of renewable energy projects requiring the transport of large components like wind turbine blades; and the increasing complexity of global supply chains necessitating specialized hauling capabilities. Furthermore, advancements in truck manufacturing, such as the implementation of lightweight, high-strength materials (e.g., advanced aluminum alloys) and improved engine efficiency compliant with stringent emission norms (like Euro VI or EPA standards), contribute significantly to the appeal and operational viability of modern flatbed truck fleets. The convergence of these factors solidifies the flatbed truck market’s indispensable role in the modern logistics landscape.

Flatbed Truck Market Executive Summary

The Flatbed Truck Market is experiencing significant operational and technological transformation, largely driven by the imperative for enhanced logistical efficiency, sustainability, and safety across the transportation sector. Current business trends indicate a strong move toward fleet modernization, where operators are replacing older, less efficient models with next-generation trucks featuring advanced telematics, improved aerodynamics, and cleaner engine technologies. Original Equipment Manufacturers (OEMs) are focusing on modular designs that allow for easy customization of the flatbed platform, catering to highly specific sectoral needs, particularly within heavy machinery movement and large-scale infrastructural material delivery. Strategic partnerships and leasing models are also becoming prevalent, allowing smaller logistics providers to access high-capacity, specialized flatbed trucks without prohibitive upfront capital investment.

Regionally, the market exhibits varied growth patterns. Asia Pacific (APAC) leads the global market in terms of volume and growth potential, fueled by massive government spending on infrastructure development in countries like China, India, and Southeast Asian nations, coupled with booming manufacturing output. North America remains a highly mature market characterized by stringent safety standards and high adoption rates of heavy-duty and specialized flatbed configurations necessary for oil and gas and construction sectors. Europe shows steady growth, heavily influenced by regulatory pressures for low-emission vehicles and a strong focus on intermodal transport solutions, demanding highly durable and efficient flatbed equipment. The Middle East and Africa (MEA) are emerging rapidly, benefiting from large-scale construction mega-projects, particularly in the Gulf Cooperation Council (GCC) states.

Segment trends underscore a shift towards specialized flatbed types, such as drop-deck and step-deck configurations, which offer advantages in height restriction compliance and stability for exceptionally tall loads. In terms of truck weight capacity, the heavy-duty segment (above 16 metric tons Gross Vehicle Weight Rating or GVWR) commands the largest market share due to its essential role in construction and mining. However, the medium-duty segment is gaining traction, particularly for urban delivery and localized construction projects where maneuverability and fuel efficiency are prioritized. Furthermore, the rising adoption of electric and hybrid flatbed trucks, although nascent, represents a critical segment trend, responding directly to global decarbonization mandates and consumer demand for environmentally responsible freight solutions.

AI Impact Analysis on Flatbed Truck Market

User queries regarding the impact of Artificial Intelligence (AI) on the flatbed truck market primarily revolve around operational efficiency, safety enhancement, and the potential for autonomous driving technologies. Common themes reflect concerns about the integration costs of sophisticated AI-driven systems (such as predictive maintenance and route optimization software) and the required upskilling of the existing driver workforce. Expectations are high concerning AI's capability to mitigate the high risks associated with transporting oversized and specialized cargo, particularly through real-time load monitoring and dynamic stability control. Furthermore, users frequently inquire about how AI-powered logistics platforms can optimize complex scheduling, ensuring precise delivery windows crucial for construction and industrial projects.

The deployment of AI is fundamentally restructuring the planning and execution phases of flatbed transport. AI algorithms are instrumental in predictive maintenance, analyzing vast datasets from vehicle sensors (engine performance, tire pressure, brake wear) to accurately predict potential mechanical failures before they occur. This proactive approach significantly reduces unexpected downtime, which is highly costly in the specialized hauling sector, thereby ensuring higher utilization rates for high-value assets. Additionally, advanced telematics integrated with machine learning models are optimizing fuel consumption by suggesting the most efficient speeds, routes, and driving behaviors tailored to the specific load characteristics and road conditions.

Looking forward, AI is the backbone of emerging autonomous flatbed hauling concepts. While full autonomy for heavy, specialized loads remains challenging due to regulatory and complexity factors, driver assistance systems powered by AI (such as advanced adaptive cruise control, lane-keeping assist for wide loads, and collision avoidance systems) are rapidly becoming standard. These AI features enhance safety, particularly during long-haul operations or in challenging environments, indirectly addressing the persistent industry issue of driver shortages by making the profession safer and less physically demanding. The ultimate integration of AI will transform flatbed logistics from a reactive transport service into a highly optimized, predictive supply chain component.

- AI-driven Route Optimization: Utilizing machine learning to calculate optimal routes considering load dimensions, road restrictions, traffic, and weather, minimizing transit time and fuel costs.

- Predictive Maintenance: Analyzing real-time diagnostic data to anticipate equipment failures, dramatically reducing unplanned truck downtime and extending asset lifespan.

- Enhanced Safety Systems: Integration of AI for superior driver assistance, including sophisticated blind-spot detection and autonomous emergency braking tailored for heavy, asymmetric loads.

- Dynamic Pricing and Capacity Management: Employing AI to adjust freight pricing and manage available flatbed capacity based on real-time market demand and operational costs.

- Autonomous Yard Operations: Using AI and robotics to automate trailer hook-up, cargo staging, and movement within secure depot or construction site environments.

- Load Security Monitoring: Implementing AI vision systems to continuously monitor load stability and securement devices during transit, alerting the driver to potential shifts.

DRO & Impact Forces Of Flatbed Truck Market

The dynamics of the Flatbed Truck Market are dictated by a powerful combination of drivers (D), restraints (R), and opportunities (O), collectively shaping the impact forces felt by industry stakeholders. Key drivers include the global resurgence of infrastructure development, particularly megaprojects focused on rail, road, and utility expansion, which inherently require specialized flatbed transport for oversized and heavy materials. Another significant driver is the globalization of manufacturing supply chains, leading to increased movement of finished goods and raw materials that exceed standard container dimensions. These drivers create a sustained, non-cyclical demand floor for high-capacity flatbed logistics services.

However, the market faces critical restraints that moderate growth. The most persistent restraint is the increasing stringency of environmental regulations worldwide, pushing manufacturers toward more expensive, compliant engine technologies and alternative fuels, thereby increasing the Total Cost of Ownership (TCO) for operators. Furthermore, the chronic shortage of skilled commercial drivers, particularly those qualified to handle specialized flatbed hauling which requires specific training in load securement and handling complex permits, acts as a severe operational bottleneck. Economic volatility and cyclical downturns in the construction and manufacturing sectors also impose temporary but sharp restraints on demand for new fleet purchases.

Opportunities for market growth lie primarily in technological innovation and regional expansion. The transition towards electric and hydrogen-powered heavy-duty trucks presents a major opportunity for early adopters to gain a competitive edge in sustainability-conscious markets. Furthermore, the development of smart logistics platforms incorporating IoT and AI allows flatbed operators to offer highly optimized, premium services. Geographically, untapped potential exists in rapidly industrializing regions of Africa and parts of Latin America, where basic infrastructure is being rapidly built. The impact forces are thus characterized by a strong underlying demand countered by high regulatory and operational costs, pushing the industry towards efficiency-enhancing digital solutions and cleaner powertrains.

- Drivers:

- Global Infrastructure Development and Construction Boom.

- Growth in Oil, Gas, and Renewable Energy Sector Projects (e.g., wind farms).

- Need for specialized transport of oversized and heavy equipment.

- Increased trade and globalization of industrial production.

- Restraints:

- High upfront capital costs for specialized high-capacity flatbed trucks.

- Stringent government regulations concerning emissions and noise pollution.

- Shortage of specialized drivers trained in complex load securing procedures.

- Fluctuations in raw material prices (steel and aluminum) impacting manufacturing costs.

- Opportunities:

- Integration of advanced telematics, IoT, and AI for fleet management.

- Development and adoption of electric and hydrogen fuel cell flatbed trucks.

- Expansion of customized and modular flatbed trailer solutions.

- Market penetration in emerging economies focusing on primary industrialization.

Segmentation Analysis

The Flatbed Truck Market is segmented based on several critical parameters, including type of trailer/deck, axle configuration, load capacity (duty type), and end-use application. This segmentation provides a granular view of market dynamics, enabling stakeholders to tailor their product offerings to specific operational demands. The foundational distinction lies between standard flatbed trailers, which offer a simple, continuous surface, and specialized variants like drop-deck, step-deck, or extendable trailers designed to handle unique cargo profiles such as oversized machinery or exceptionally long structural elements. Analyzing these segments is crucial as each category serves a distinct niche within the complex logistics landscape, influencing pricing power and procurement cycles.

The most influential segmentation is by duty type, categorizing trucks into light-duty, medium-duty, and heavy-duty vehicles. Heavy-duty flatbeds, characterized by high GVWR and multi-axle setups, consistently dominate the revenue share due to their indispensable role in large-scale construction, mining, and energy projects where high payloads are mandatory. Conversely, the medium-duty segment is witnessing accelerated adoption, especially in last-mile delivery of construction supplies and urban logistics, offering a balance between carrying capacity and operational agility. The choice of segment is directly correlated with regulatory limits on weight and size, which vary significantly by region and dictate the operational flexibility of the fleet.

Furthermore, segmentation by end-use application highlights the core demand drivers. The construction sector remains the largest consumer of flatbed trucks, essential for moving steel, concrete segments, scaffolding, and cranes. However, the energy sector, encompassing both traditional oil and gas and rapidly expanding renewables, demands highly specialized flatbed units capable of navigating challenging terrains and securing sensitive, often cylindrical, components. This multidimensional segmentation underscores the specialized nature of the flatbed market, differentiating it significantly from general freight trucking and driving customized manufacturing processes.

- By Type of Trailer/Deck:

- Standard Flatbed

- Step-Deck/Drop-Deck Trailers

- Removable Gooseneck (RGN) Trailers

- Lowboy Trailers

- Extendable/Telescopic Trailers

- By Duty Type (GVWR):

- Medium-Duty Flatbed Trucks (Class 5–7)

- Heavy-Duty Flatbed Trucks (Class 8 and above)

- By Axle Configuration:

- Single Axle

- Tandem Axle

- Multi-Axle (Tri-Axle and Quad-Axle)

- By Application:

- Construction and Infrastructure

- Oil & Gas and Energy (including renewables)

- Manufacturing and Industrial Goods

- Mining and Quarrying

- Transportation and Logistics

- By Propulsion Type:

- Internal Combustion Engine (ICE)

- Electric and Hybrid

Value Chain Analysis For Flatbed Truck Market

The value chain of the Flatbed Truck Market begins with the upstream activities centered on raw material procurement and component manufacturing. Upstream analysis involves the sourcing of critical materials such as high-grade steel and aluminum alloys used for chassis and deck construction, powertrain components (engines, transmissions), and specialized axle systems capable of supporting heavy loads. Key suppliers in this phase include metal processing companies, engine manufacturers (Cummins, Caterpillar, etc.), and specialized braking system producers. Efficiency and cost optimization at this stage depend heavily on global commodity prices and the stability of the automotive supply chain. Flatbed truck OEMs prioritize vertical integration or robust long-term contracts to ensure the supply of quality, compliant components, particularly those related to emission control and safety standards.

The midstream phase focuses on the Original Equipment Manufacturing (OEM) process, where truck chassis and cabs are assembled, followed by the crucial process of installing the specialized flatbed bodies or coupling mechanisms for trailers. This stage involves significant engineering and customization, especially for specialized trailers like RGNs or multi-axle extendables. Distribution channels form the next critical link, encompassing both direct sales from OEMs to large fleet operators and indirect sales through authorized dealer networks, which often provide local maintenance, financing, and customization services. Direct sales are common for governmental entities or major logistics corporations, while smaller operators typically rely on the dealer network for localized support and quicker turnaround times.

The downstream analysis focuses on the end-user operations, utilization, and maintenance of the flatbed assets. End-users, ranging from construction companies to specialized heavy haul carriers, drive demand for aftermarket services, including parts replacement, routine maintenance, and technological retrofitting (e.g., adding advanced telematics). The operational efficiency of the trucks, including fuel consumption and tire lifespan, directly impacts the profitability of the logistics provider. The relationship between manufacturers, dealers, and end-users is symbiotic; high-quality maintenance and timely availability of spare parts are paramount to maximizing asset utilization and minimizing costly operational downtime, particularly in demanding sectors like mining and energy infrastructure development.

Flatbed Truck Market Potential Customers

Potential customers, or end-users/buyers, of flatbed trucks are highly diverse but generally belong to sectors engaged in large-scale infrastructure, production, and high-weight logistics operations. The dominant customer base includes major commercial construction and civil engineering firms that require constant and reliable transport of structural steel, concrete beams, prefabricated walls, and heavy construction equipment between fabrication sites, storage yards, and active building locations. For these customers, the primary purchasing criteria include maximum payload capacity, deck length adjustability, and overall vehicle durability to handle challenging job site environments and stringent safety regulations regarding load securement.

Another crucial segment of potential customers is specialized heavy haulage and third-party logistics (3PL) providers who focus exclusively on transporting oversized and overweight cargo, often requiring complex permitting and escort services. These providers invest in high-end, multi-axle, and highly customizable flatbed and lowboy trailers (such as Removable Gooseneck trailers) to move items like industrial plant components, massive machinery, or large aerospace elements. For 3PLs, reliability and compliance with specific regional weight and dimension laws are paramount, driving demand for technologically advanced flatbed systems with sophisticated axle configurations and dynamic load distribution capabilities.

Furthermore, industries such as mining, oil and gas exploration, utility service providers (especially those involved in power grid construction), and major manufacturers (automotive tooling, large machinery fabrication) represent significant captive fleet users. For these corporate buyers, flatbed trucks are essential operational assets used for internal logistical movements of raw materials, drill pipe, turbines, or finished capital equipment. Their purchasing decisions are often influenced by the total lifecycle cost, fuel efficiency, and the integration capabilities of the truck fleet with existing enterprise resource planning (ERP) and supply chain management systems, favoring long-term, high-durability vehicles. The growing renewable energy sector is also becoming a major buyer, necessitating specialized long flatbeds for transporting wind turbine components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 8.5 Billion |

| Market Forecast in 2033 | USD 12.6 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Daimler Truck AG, Volvo Group, PACCAR Inc., Navistar International Corp. (Traton Group), MAN Truck & Bus SE, Kenworth Truck Company, Peterbilt Motors Company, Oshkosh Corporation, Hino Motors Ltd., Isuzu Motors Ltd., Scania AB, Terex Corporation, Wabash National Corp., Foton Motor Group, BYD Company Ltd., TATA Motors, XCMG Group, FAW Group, CIMC Vehicles, Hyundai Motor Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flatbed Truck Market Key Technology Landscape

The technological landscape of the Flatbed Truck Market is rapidly evolving, driven primarily by twin pressures: regulatory demands for reduced emissions and operational demands for improved safety and efficiency in heavy hauling. The most significant foundational technology shift involves powertrain electrification. While Internal Combustion Engines (ICE) currently dominate, heavy investments are being made in developing high-capacity battery-electric trucks (BETs) and hydrogen fuel cell electric trucks (FCETs) specifically designed for Class 8 heavy-duty applications. These cleaner energy technologies require specialized battery management systems and lighter chassis designs to compensate for battery weight, ensuring compliance with legal payload limits and maximizing range critical for long-haul specialized freight.

Beyond propulsion, advanced telematics and the Internet of Things (IoT) sensors form the critical digital infrastructure underpinning modern flatbed operations. IoT sensors embedded in the chassis, tires, and load-securing mechanisms provide real-time data on vehicle performance, load stability, and driver behavior. This data feeds into Fleet Management Systems (FMS) and AI-powered logistics platforms, enabling features like predictive maintenance, dynamic route planning optimized for load size, and instantaneous alerts regarding shifting cargo. The precise monitoring offered by these systems is particularly valuable in flatbed hauling where cargo shifting can lead to severe accidents and regulatory penalties.

Furthermore, technology related to safety and driver assistance is paramount. Advanced Driver Assistance Systems (ADAS), including enhanced forward collision warning, lane departure warnings customized for wide loads, and electronic stability control (ESC), are becoming standard features. Specialized flatbed equipment often integrates hydraulically controlled suspension systems and axle lift technologies, optimized using sensor data to improve maneuverability on construction sites and comply with varying weight distribution regulations across different jurisdictions. The integration of high-strength, lightweight materials like advanced composites and tailored steel also falls under the technological landscape, allowing for higher payloads without exceeding Gross Vehicle Weight Limits.

Regional Highlights

Regional dynamics significantly influence the Flatbed Truck Market, reflecting varying levels of industrialization, infrastructure spending, and regulatory environments. Asia Pacific (APAC) currently holds the dominant share and is expected to exhibit the highest growth rate during the forecast period. This dominance is attributable to massive governmental and private sector investments in infrastructure, encompassing road networks, smart cities, and industrial corridors in major economies like China, India, and rapidly developing Southeast Asian nations. The demand in APAC is heavily skewed towards medium and heavy-duty flatbeds necessary for the constant movement of bulk construction materials and heavy machinery.

North America (NA) represents a mature, high-value market characterized by stringent safety and environmental standards and a strong appetite for premium, technologically advanced flatbed solutions. The demand here is driven by the robust construction, oil and gas, and manufacturing sectors, leading to a high penetration of heavy-duty Class 8 trucks and specialized lowboy and RGN trailers. High labor costs and a persistent driver shortage in North America accelerate the adoption of advanced automation and fleet management systems designed to maximize operational productivity and safety across large geographical distances.

Europe maintains a substantial market presence, characterized by a regulatory focus on reducing emissions, which is driving the adoption of Euro VI compliant trucks and accelerating research into electric and hybrid heavy vehicles. The European market prioritizes high efficiency and intermodal transport capabilities, necessitating flatbed designs that are easily transferable between road and rail networks. Growth in the Middle East and Africa (MEA) is rapidly expanding, fueled by significant construction mega-projects (such as NEOM in Saudi Arabia and various industrialization programs) and burgeoning demand from the region’s oil, gas, and renewable energy sectors, requiring specialized, high-capacity flatbeds capable of operating in harsh environmental conditions.

- Asia Pacific (APAC): Market leader driven by infrastructure megaprojects, rapid urbanization, high volume manufacturing, and government stimulus in China, India, and Japan.

- North America (NA): High-value market focused on heavy-duty Class 8 specialized hauling, strong adoption of telematics, and sustained demand from energy and housing construction sectors.

- Europe: Growth driven by fleet modernization, strict emission mandates (pushing EV/Hybrid adoption), and specialization in tailored flatbeds for diverse cross-border transport requirements.

- Latin America (LATAM): Emerging market driven by mining activities, agricultural expansion, and localized infrastructure improvements in Brazil and Mexico.

- Middle East & Africa (MEA): High growth potential fueled by large-scale government construction projects, diversification efforts away from oil dependence, and expansion of utility infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flatbed Truck Market.- Daimler Truck AG

- Volvo Group

- PACCAR Inc. (Kenworth and Peterbilt)

- Navistar International Corp. (Traton Group)

- MAN Truck & Bus SE (Traton Group)

- Scania AB (Traton Group)

- Hino Motors Ltd.

- Isuzu Motors Ltd.

- Oshkosh Corporation

- TATA Motors

- Foton Motor Group

- CIMC Vehicles

- Wabash National Corp.

- Hyundai Motor Company

- BYD Company Ltd.

- XCMG Group

- Terex Corporation

- Dongfeng Motor Corporation

- Freightliner Trucks (Daimler subsidiary)

- SANY Group

Frequently Asked Questions

Analyze common user questions about the Flatbed Truck market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving demand in the Flatbed Truck Market?

The primary driver is global investment in large-scale infrastructure and construction projects, including commercial and residential developments, road expansions, and energy utility construction, all requiring specialized transport for oversized materials like steel and heavy machinery.

How are environmental regulations impacting flatbed truck manufacturers?

Environmental regulations, such as stringent emission standards (Euro VI, EPA Tier 4), are forcing manufacturers to rapidly invest in high-cost, cleaner technologies, primarily focusing on advanced ICE systems, and accelerating the research and development of electric (BET) and hydrogen fuel cell (FCET) flatbed trucks to meet future compliance goals.

Which geographical region represents the largest growth opportunity for flatbed truck sales?

Asia Pacific (APAC) currently represents the largest market share and the highest growth opportunity, driven by sustained, large-scale infrastructure investment and booming industrialization across countries like India and China, fueling demand for both heavy-duty and medium-duty flatbed fleets.

What are the main advantages of using a Removable Gooseneck (RGN) trailer?

RGN trailers offer superior operational flexibility, primarily allowing heavy or oversized equipment (like excavators or construction machinery) to be driven directly onto the low loading deck from the front. This capability is essential for transporting non-standard cargo while maintaining legal height restrictions.

How is AI technology used to improve efficiency in specialized flatbed hauling?

AI is crucial for predictive maintenance, analyzing sensor data to minimize unexpected downtime, and for advanced route optimization that considers complex factors like load dimensions, bridge heights, and dynamic road restrictions, thereby enhancing safety and reducing operational costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager