Flea and Tick Product Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431362 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Flea and Tick Product Market Size

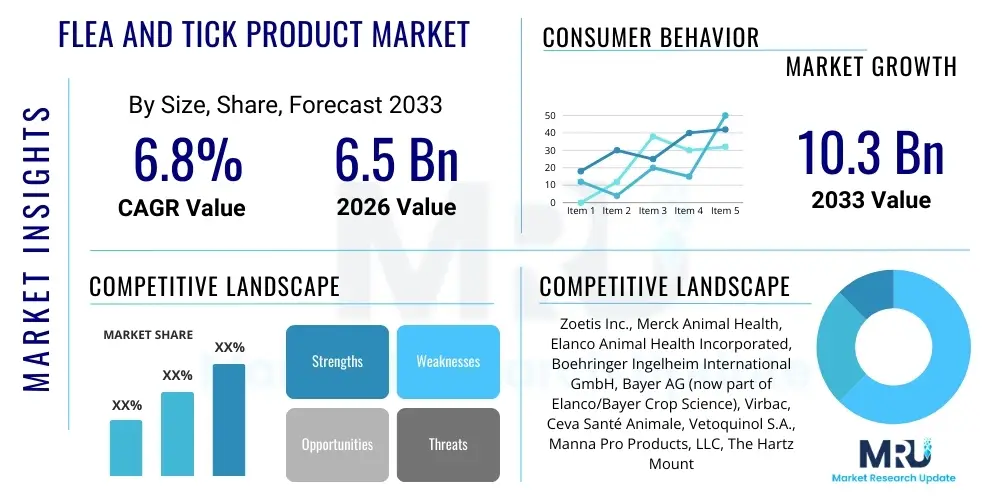

The Flea and Tick Product Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 6.5 Billion in 2026 and is projected to reach USD 10.3 Billion by the end of the forecast period in 2033.

Flea and Tick Product Market introduction

The Flea and Tick Product Market encompasses a wide range of pharmaceutical and chemical solutions designed to prevent, control, and eliminate ectoparasites in companion animals, primarily dogs and cats. These products are crucial for maintaining pet health, preventing zoonotic diseases, and ensuring overall animal welfare. The core product categories include topical spot-ons, oral chewables and tablets, medicated collars, shampoos, and sprays, each offering varying degrees of efficacy, duration, and ease of application. Recent advancements have focused heavily on systemic protection offered by oral medications, which have rapidly gained market share due to their convenience, effectiveness, and reduced risk of environmental contamination compared to traditional topical applications.

Major applications of these products span preventive care regimens, therapeutic treatment of active infestations, and environmental control in homes and kennels. The primary benefits include protection against discomfort, prevention of secondary skin infections, and, most importantly, mitigation of serious diseases transmitted by these vectors, such as Lyme disease, Rocky Mountain spotted fever, and tapeworm infections spread by fleas. The continuous nature of flea and tick threats, often exacerbated by climate change extending the parasite season, necessitates year-round preventive strategies, driving consistent demand across developed and rapidly developing economies.

The market growth is fundamentally driven by the rising global population of companion animals, increasing levels of pet humanization—where owners prioritize premium health and wellness products for their pets—and greater consumer awareness regarding vector-borne diseases. Furthermore, innovative product formulations that combine treatments for multiple parasites (e.g., heartworm and intestinal parasites alongside fleas and ticks) into a single, convenient dose are enhancing compliance and boosting market value. Regulatory scrutiny regarding product safety and chemical resistance, however, dictates the pace of new product development and market entry, pushing manufacturers toward novel, safer, and more potent active ingredients.

Flea and Tick Product Market Executive Summary

The Flea and Tick Product Market is characterized by robust growth, propelled primarily by the shift towards high-value oral systemic treatments and the expansion of direct-to-consumer (DTC) e-commerce channels. Business trends show strong consolidation among leading animal health pharmaceutical companies, alongside significant investment in R&D aimed at overcoming parasite resistance to existing chemical classes like isoxazolines and neonicotinoids. Mergers and acquisitions are common as established players seek to acquire novel chemistries or expand their portfolio into specialized application methods. Sustainability and perceived safety are emerging business priorities, influencing packaging, formulation, and marketing strategies, especially in regions with stringent environmental regulations.

Regionally, North America and Europe currently dominate the market due to high pet ownership rates, advanced veterinary infrastructure, and high expenditure per pet on premium health products. However, the Asia Pacific (APAC) region is projected to register the fastest growth, driven by rapid urbanization, rising disposable incomes, and the associated increase in organized pet care services and veterinary access in countries like China and India. Latin America and MEA are seeing steady, though slower, adoption, often driven by government initiatives related to zoonotic disease control and increasing awareness of pet health importance.

Segment trends highlight the overwhelming preference for oral products (chewable tablets), which offer superior ease of use and long-lasting efficacy, often extending protection for up to three months. The distribution segment is witnessing a fierce competition between veterinary clinics, which traditionally held a monopoly on prescription-strength products, and online pharmacies/retailers, which offer competitive pricing and convenience. Product innovation is focusing heavily on combination therapies that address a broader spectrum of parasites, ensuring pet owner compliance and providing comprehensive protection in a single application.

AI Impact Analysis on Flea and Tick Product Market

User queries regarding the impact of AI in the Flea and Tick Product Market center around three key themes: enhanced diagnostics, optimized product formulation, and personalized preventative care schedules. Users frequently ask if AI can predict infestation outbreaks based on environmental data (climate, geography) and if it can aid in the discovery of entirely new classes of parasiticides that bypass current resistance mechanisms. There is a strong expectation that AI will move beyond simple data aggregation to offer prescriptive insights for pet owners and veterinarians, thereby maximizing the efficacy and minimizing the side effects of treatments. Key concerns revolve around data privacy related to pet health monitoring and the potential displacement of traditional diagnostic methods by automated, AI-driven tools, requiring significant retraining of veterinary professionals.

- AI-driven predictive modeling for regional and seasonal parasite outbreaks, optimizing inventory management and targeted public health campaigns.

- Accelerated discovery of novel active pharmaceutical ingredients (APIs) through AI screening of chemical libraries against parasite target receptors, addressing growing resistance issues.

- Personalized dosing and treatment schedules based on machine learning analysis of individual pet factors (weight, breed, lifestyle, geographical location).

- Integration of AI in smart collars and connected devices for real-time monitoring of pet scratching or behavioral changes indicative of infestation.

- Optimization of manufacturing processes and quality control through AI vision systems and predictive maintenance in large-scale production facilities.

- Enhanced veterinary diagnostic support systems using deep learning to analyze skin cytology or blood samples for evidence of infestation or vector-borne disease.

- Automated customer service bots and virtual veterinary assistants providing initial guidance on product selection and application instructions, improving user adherence.

DRO & Impact Forces Of Flea and Tick Product Market

The dynamics of the Flea and Tick Product Market are governed by a complex interplay of Drivers (D), Restraints (R), and Opportunities (O), creating distinct Impact Forces (IF). The primary driver is the rising pet population coupled with the increasing trend of pet humanization, leading to higher willingness among owners to spend on premium preventative healthcare. Global climate change acts as a force multiplier, extending the parasite season and geographical range, necessitating year-round protection and boosting consistent demand. These factors collectively create a strong positive impact force, anchoring the market's fundamental growth trajectory and ensuring continuous profitability for innovators.

Significant restraints include the escalating issue of parasite resistance to currently approved chemical compounds, particularly the established isoxazoline class, which mandates continuous and costly research and development efforts to introduce novel chemistries. Furthermore, stringent regulatory approval processes in key markets (FDA, EMA) and growing consumer backlash or caution regarding systemic pesticides potentially impacting pet health or the environment pose hurdles. These restraints exert downward pressure, forcing market players to invest heavily in safety studies and robust regulatory compliance, often slowing the pace of product launch and increasing operational costs.

Opportunities are abundant, primarily centered on developing combination products that simplify treatment regimens (e.g., simultaneous flea, tick, and heartworm protection), and exploring biological or naturally derived alternatives to synthetic chemicals that appeal to environmentally conscious consumers. The massive shift towards e-commerce and telehealth veterinary consultations offers an opportunity to streamline distribution and enhance personalized advice. The impact forces are thus mixed; while demand is exceptionally strong (Driver), the technical challenge of resistance and regulatory environment (Restraint) shapes the competitive landscape, rewarding companies capable of long-term innovation and maintaining robust safety profiles.

Segmentation Analysis

The Flea and Tick Product Market is highly segmented based on product type, animal type, distribution channel, and treatment nature, reflecting the diverse needs of pet owners and veterinary practitioners. The segmentation based on product formulation is arguably the most dynamic, showing a substantial shift away from older methods like sprays and dips toward systemic, highly convenient options such as oral chewable tablets and long-lasting topical spot-ons. Understanding these segments is critical for manufacturers to tailor their marketing and distribution strategies, particularly recognizing the differing regulatory requirements and consumer preferences between prescription-only systemic treatments and over-the-counter options.

Segmentation by animal type remains crucial, with the canine segment dominating the market in terms of value due to the higher overall population and greater exposure to outdoor environments, necessitating more frequent and robust prophylactic treatments. However, the feline segment is witnessing rapid growth as manufacturers introduce formulations specifically designed for the sensitive physiologies and behavioral needs of cats, moving past the historical challenge of administering medication to felines. The distribution channel split, differentiating between veterinary clinics, which provide expert diagnosis and sell premium prescription products, and retail/e-commerce, which focuses on convenience and competitive pricing for OTC products, defines the primary competitive battlegrounds in the market.

- By Product Type: Oral Medications (Chewables, Tablets), Topical Medications (Spot-ons, Sprays, Shampoos, Dips), Collars, Powders, Others (Wipes, Environment Control).

- By Animal Type: Dogs, Cats, Other Companion Animals (Rabbits, Ferrets).

- By Distribution Channel: Veterinary Clinics & Hospitals, Retail Stores (Pet Stores, Mass Merchandisers), E-commerce/Online Pharmacies.

- By Treatment Nature: Prescription-Based, Over-the-Counter (OTC).

- By End-Use: Home Use, Veterinary Use (Clinics, Shelters).

Value Chain Analysis For Flea and Tick Product Market

The value chain for the Flea and Tick Product Market begins with Upstream Analysis, focusing on research and development (R&D) and the sourcing of Active Pharmaceutical Ingredients (APIs). R&D is highly specialized and capital-intensive, focusing on identifying novel synthetic molecules or biological agents that offer high efficacy and improved safety profiles, often requiring collaborations between pharmaceutical chemists and veterinary experts. Sourcing involves procuring high-purity chemicals, often subject to strict regulatory oversight, from specialized contract manufacturing organizations (CMOs) globally. The efficiency and patent protection within this upstream stage are critical determinants of competitive advantage and pricing power in the downstream markets.

The Midstream stage encompasses manufacturing, formulation, and packaging. Manufacturing involves sophisticated processes, particularly for oral chewable forms which require specialized palatability and controlled-release technologies. Quality control is paramount to ensure consistency, dosage accuracy, and stability across different geographical climates. Packaging innovation, such as single-dose blister packs for enhanced user compliance and child-resistant closures, adds significant value. This stage is dominated by large animal health pharmaceutical companies possessing the necessary regulatory compliance infrastructure and high-volume production capabilities.

The Downstream Analysis involves the distribution channel, covering both Direct and Indirect pathways. Direct distribution primarily involves sales teams interacting directly with large veterinary hospital chains or institutional buyers. Indirect distribution relies heavily on wholesalers, distributors, and ultimately, the endpoint sellers: Veterinary Clinics & Hospitals, specialized pet retail outlets, and the rapidly growing E-commerce platforms. Veterinary clinics serve as critical gatekeepers for prescription-only systemic treatments, offering professional consultation, which justifies their premium pricing model. Conversely, the rise of online pharmacies offers consumers an increasingly convenient and cost-effective route for purchasing both OTC and prescribed products, exerting downward pressure on traditional retail margins and forcing omnichannel strategies among leading brands.

Flea and Tick Product Market Potential Customers

The primary End-Users/Buyers in the Flea and Tick Product Market are pet owners, encompassing a diverse demographic ranging from single-person households to multi-pet families, all motivated by the desire to maintain the health and comfort of their companion animals. These customers typically make purchasing decisions based on a combination of factors: product efficacy (protection duration and speed of kill), convenience of application (oral vs. topical), veterinary recommendation, and cost. High-income pet owners tend to prefer premium, often prescription-based oral treatments that offer integrated parasite protection and require less frequent application, reflecting the broader trend of pet humanization where health outcomes are prioritized over budget constraints.

A secondary, yet profoundly influential, customer segment comprises Veterinary Clinics and Hospitals. While they act as a distribution channel, they are also pivotal decision-makers, purchasing stock and recommending specific brands to pet owners based on clinical trials, perceived safety, and effectiveness against regional parasite strains. Veterinarians are often the first line of defense and the most trusted source of information, making market penetration strategies heavily reliant on securing their endorsement and ensuring consistent product availability within their practices. This segment is especially important for the introduction and establishment of new, innovative prescription chemistries.

Other significant institutional buyers include Animal Shelters, Rescues, and large-scale Animal Boarding Facilities and Kennels. These organizations require bulk purchases of cost-effective, high-efficacy products for prophylactic treatment of newly admitted animals and environmental control within their facilities. Their purchasing criteria often prioritize value for money and broad-spectrum activity to manage potential widespread infestations quickly. The purchasing requirements of these institutional customers drive demand for large-format packaging and reliable, easy-to-apply formulations suitable for high-throughput administration.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 6.5 Billion |

| Market Forecast in 2033 | USD 10.3 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Zoetis Inc., Merck Animal Health, Elanco Animal Health Incorporated, Boehringer Ingelheim International GmbH, Bayer AG (now part of Elanco/Bayer Crop Science), Virbac, Ceva Santé Animale, Vetoquinol S.A., Manna Pro Products, LLC, The Hartz Mountain Corporation, Bio-Groom, Central Garden & Pet Company, Perrigo Company plc, PetIQ, Inc., Zydus Animal Health. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flea and Tick Product Market Key Technology Landscape

The technological landscape of the Flea and Tick Product Market is currently dominated by advancements in systemic anti-parasitic agents, specifically the isoxazoline class (e.g., fluralaner, afoxolaner, sarolaner), which are administered orally and provide highly effective, long-duration protection by targeting the arthropod nervous system. The technological challenge now revolves around sustaining this efficacy in the face of widespread resistance development. Consequently, research efforts are intensively focused on developing novel chemical scaffolds that target different receptors or biochemical pathways in the parasites, ensuring next-generation effectiveness. Furthermore, sophisticated pharmaceutical formulation technology is crucial, enabling the creation of palatable chewable matrices that ensure pets willingly consume the medication, thereby guaranteeing the prescribed dosage and high treatment compliance.

Beyond active ingredients, technology is heavily influencing delivery systems. Innovations in slow-release technology are optimizing medicated collars and spot-on formulations to provide more consistent and safer concentrations over extended periods, minimizing peaks and troughs in systemic concentration. Microencapsulation and nanotechnology are being explored to enhance the solubility, stability, and bioavailability of complex molecules, particularly those with poor absorption characteristics. The integration of advanced veterinary diagnostics, including PCR testing for vector-borne pathogens and next-generation sequencing to monitor resistance genes in flea and tick populations, provides valuable feedback loops to R&D teams, accelerating the pipeline for new product introductions.

Digital technology is increasingly intersecting with product delivery and adherence. This includes the development of mobile applications for dose reminders, tracking pet treatment history, and leveraging telemedicine platforms for prescription fulfillment and consultation. Furthermore, advancements in manufacturing technology, such as continuous manufacturing processes, are being adopted by major players to enhance product purity, reduce production time, and lower overall operational costs compared to traditional batch manufacturing. The focus on safety is driving the adoption of advanced toxicity screening technologies, often utilizing in-vitro models, to predict potential adverse effects early in the development cycle, aligning with increasing regulatory demands for evidence-based safety profiles.

Regional Highlights

- North America: This region holds the largest market share, driven by high pet ownership rates, significant disposable income allocated to pet health, and a robust veterinary infrastructure. The market is characterized by high adoption of premium, prescription-only oral systemic treatments, supported by extensive marketing campaigns and strong veterinary recommendation rates. The U.S. market is particularly competitive, with a strong emphasis on combination products offering heartworm, intestinal parasite, and ectoparasite protection in a single dose, maximizing client convenience and compliance. Regulatory environments are mature, demanding rigorous clinical data for product approval, fostering trust in high-value products.

- Europe: Europe represents the second-largest market, exhibiting strong demand driven by high pet humanization rates, particularly in Western European countries (Germany, France, UK). The market shows a strong, but slightly slower, shift from topical solutions to oral systemic treatments compared to North America, influenced by varying national regulatory approaches and stronger consumer demand for perceived environmentally friendly or 'natural' alternatives. Germany and the UK are key growth drivers, benefiting from high penetration of pet insurance and advanced veterinary care standards. Resistance management and careful use of established chemical classes are critical regional concerns influencing purchasing decisions.

- Asia Pacific (APAC): APAC is the fastest-growing market, propelled by rapid urbanization, substantial increases in disposable income, and the formalization of the pet care industry, especially in emerging economies like China, India, and Southeast Asia. The region is seeing a massive transition from traditional, low-cost treatments (powders, sprays) to modern, effective pharmaceutical products as access to organized veterinary services improves. While cost sensitivity remains high in certain segments, the growing middle class is increasingly willing to pay for imported, high-quality brands. Local manufacturing and distribution partnerships are crucial for market entry, addressing diverse climatic and regulatory conditions.

- Latin America (LATAM): This region displays dynamic growth potential, primarily centered in countries like Brazil and Mexico, which have large and growing companion animal populations. The market is highly sensitive to price fluctuations and economic stability, leading to a strong demand for efficacious yet cost-effective solutions. Distribution often relies heavily on agricultural supply stores and local pharmacies in addition to veterinary clinics. Education and awareness campaigns regarding vector-borne diseases (which are often endemic in tropical zones) are vital drivers of demand for prophylactic treatments.

- Middle East and Africa (MEA): The MEA market is the smallest but shows steady, concentrated growth, largely confined to urban centers and expatriate communities in the UAE, Saudi Arabia, and South Africa. Growth is contingent on the expansion of structured veterinary services and increasing adherence to Western standards of pet health care. Climatic conditions in parts of Africa lead to year-round parasite burden, creating persistent demand. Infrastructure challenges and regulatory complexity are major factors shaping distribution and product registration strategies in this diverse region.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flea and Tick Product Market.- Zoetis Inc.

- Merck Animal Health

- Elanco Animal Health Incorporated

- Boehringer Ingelheim International GmbH

- Virbac

- Ceva Santé Animale

- Vetoquinol S.A.

- Manna Pro Products, LLC

- The Hartz Mountain Corporation

- Bio-Groom

- Central Garden & Pet Company

- Perrigo Company plc

- PetIQ, Inc.

- Zydus Animal Health

- Wahl Clipper Corporation (Pet Division)

- Sergeant's Pet Care Products, Inc.

- Beaphar B.V.

- Adama Agricultural Solutions Ltd. (Animal Health)

- Chanelle Pharma

- Norbrook Laboratories Ltd.

Frequently Asked Questions

Analyze common user questions about the Flea and Tick Product market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the current growth of the Flea and Tick Product Market?

The primary factor driving market growth is the global trend of pet humanization, which results in increased owner expenditure on premium, preventative healthcare products, coupled with the rapid adoption of highly effective, convenient oral systemic treatments.

How is the escalating issue of parasite resistance impacting product development?

Parasite resistance necessitates substantial R&D investment in discovering and launching novel chemical classes, such as new isoxazoline derivatives or entirely new mode-of-action compounds, ensuring continued product efficacy and maintaining veterinary trust.

Which product type currently dominates the market share and why?

Oral medications, particularly chewable tablets, currently dominate the market share. This dominance is attributed to their superior convenience, palatability, consistent systemic protection regardless of bathing, and long-lasting efficacy, often protecting pets for up to three months per dose.

What role does e-commerce play in the distribution channel for these products?

E-commerce platforms are increasingly critical, offering competitive pricing and unparalleled convenience for both prescription fulfillment and Over-the-Counter product sales, challenging the traditional monopoly held by veterinary clinics for premium products and driving omnichannel strategies among manufacturers.

Which geographical region is anticipated to experience the fastest growth rate?

The Asia Pacific (APAC) region is projected to experience the fastest growth rate due to accelerated urbanization, rising middle-class disposable incomes, and the ongoing formalization and modernization of the veterinary and pet care sector in populous countries like China and India.

What are the key technological advancements expected to shape the future of flea and tick control?

Future technology focuses on combination therapy formulations integrating multiple parasite controls, the use of AI for predictive disease modeling and personalized dosing, and the development of non-chemical or biological alternatives to address consumer preferences and chemical resistance challenges.

How do climate change patterns affect the demand for flea and tick products?

Climate change extends the active parasite season and expands the geographic range of vectors, leading to a critical need for year-round preventative treatment protocols in regions previously experiencing seasonal relief, thereby ensuring sustained, consistent market demand.

What are the main concerns pet owners express regarding flea and tick collars?

Common concerns include localized skin irritation, potential systemic absorption of active ingredients, and safety risks if pets ingest the collar material. Manufacturers are addressing this through improved slow-release matrices and safer, less volatile chemicals.

Why is veterinary recommendation crucial for prescription-based flea and tick products?

Veterinary recommendation is crucial because prescription systemic products are high-efficacy pharmaceuticals requiring professional diagnosis, ensuring appropriate usage based on the pet's health profile and the local prevalence of resistant parasite populations, reinforcing consumer trust and adherence.

What is the difference between prescription and over-the-counter (OTC) flea and tick treatments?

Prescription treatments typically contain newer, highly potent, and systemic active ingredients (like isoxazolines) regulated for distribution only through licensed veterinarians. OTC treatments use older, often topical, chemical classes that are deemed safe for unsupervised consumer purchase.

How does the segmentation by animal type influence product formulation?

Product formulation is highly specific; dog products often offer higher dosages and different flavorings for palatability, while cat products must strictly avoid ingredients like permethrin (toxic to cats) and focus on less stressful application methods, such as small topical spot-ons or specialized oral liquids.

What defines the upstream segment of the market's value chain?

The upstream segment is defined by intensive R&D efforts aimed at synthesizing novel active pharmaceutical ingredients (APIs) and securing intellectual property. It also includes the high-stakes sourcing of high-purity chemical precursors necessary for formulation.

How are pet shelters impacting the demand side of the market?

Pet shelters drive demand for cost-effective, high-volume products used for initial parasite cleansing and prophylaxis of large numbers of animals, requiring reliable products that prevent widespread infestation within their facilities before adoption.

What is the typical duration of protection offered by modern flea and tick oral chewables?

Modern oral chewables generally offer systemic protection lasting either 30 days (monthly) or 90 days (quarterly), with the three-month duration products gaining significant preference among consumers for enhanced convenience and compliance.

Which countries in the European region are leading the adoption of new flea and tick products?

The United Kingdom, Germany, and France are the leading European markets, characterized by high pet ownership, mature veterinary care markets, and consumer willingness to invest in premium preventative products and veterinary services.

Why is palatability a critical factor in the success of oral flea and tick medications?

Palatability is critical because if a pet refuses the medication, compliance fails, and the treatment is ineffective. Manufacturers invest heavily in proprietary flavor technologies (e.g., beef-flavored matrices) to ensure the pet accepts and consumes the full prescribed dose willingly.

What is the current trend regarding the use of natural or herbal flea and tick alternatives?

There is a growing consumer interest in natural or herbal alternatives, driven by concerns over synthetic pesticides. While currently small in market share, this trend encourages R&D into plant-derived essential oils and biological controls, though their efficacy often remains lower than pharmaceutical options.

How does regulatory scrutiny affect market entry for new chemical products?

Regulatory scrutiny mandates extensive and expensive toxicology, efficacy, and environmental studies, often taking several years, which raises the barrier to market entry and concentrates new product launches among well-funded pharmaceutical companies capable of navigating these complex requirements.

What role do contract manufacturing organizations (CMOs) play in this market?

CMOs play a key role in specialized production, particularly for novel dosage forms like complex oral chewable formulations or sophisticated delivery systems, allowing animal health companies to outsource manufacturing while focusing on core R&D and marketing activities.

How is the concept of integrated pest management (IPM) applied to flea and tick control?

IPM encourages a multi-faceted approach, combining systemic treatments with environmental control (treating bedding, carpets), regular veterinary checks, and targeted applications based on risk assessment, moving beyond relying solely on a single chemical treatment.

What is the primary barrier to market expansion in Latin America?

The primary barrier in Latin America is economic volatility and high price sensitivity among consumers, making high-cost premium products challenging to adopt widely, requiring manufacturers to offer tiered product portfolios and manage efficient local supply chains.

How are manufacturers ensuring the safety of flea and tick products for younger animals?

Manufacturers conduct specialized clinical trials to establish safety margins for puppies and kittens, often requiring lower concentration formulations or specific chemical exclusions, with regulatory approval often specifying the minimum weight or age for safe administration.

What impact does the availability of pet insurance have on purchasing decisions?

In regions with high pet insurance penetration (like the UK and Sweden), owners are more likely to opt for premium, year-round preventative care, as the perceived cost barrier is lowered, leading to increased uptake of high-value combination products.

What are the anticipated effects of digitalization on product adherence?

Digitalization, via connected devices and reminder apps, is expected to significantly improve product adherence by ensuring owners remember scheduled doses, which is crucial for maintaining effective, gap-free parasite protection and maximizing treatment outcome.

How does the shift towards single-dose combination products benefit the market?

The shift benefits the market by simplifying the treatment regimen for pet owners, leading to higher compliance rates, reducing the risk of parasite gaps, and increasing the overall revenue per transaction for pharmaceutical companies selling comprehensive protection solutions.

What is the crucial role of environmental products (sprays, powders) in the market?

Environmental products are crucial for treating the home environment, where the majority of the flea life cycle (eggs, larvae) occurs. They complement topical or oral treatments by breaking the life cycle and preventing reinfestation in heavily contaminated areas.

How do manufacturers mitigate the environmental impact of their products?

Mitigation efforts include reducing volatile organic compounds (VOCs) in topical sprays, developing more targeted and biodegradable chemical formulations, and ensuring responsible packaging design that uses sustainable materials and minimizes waste.

What factors differentiate the feline segment growth from the canine segment?

Feline segment growth is driven by the introduction of user-friendly, non-stressful formulations and a delayed realization among cat owners of the need for internal and external parasite control, whereas the canine segment is already mature and focused on premiumization and combination therapies.

Why are veterinarians focusing on combination products for heartworm and ectoparasites?

Veterinarians favor these combinations because they address multiple severe health threats (heartworm being fatal and ectoparasites transmitting disease) simultaneously, ensuring broader patient protection while simplifying inventory management and improving client compliance.

How is competition intensifying between veterinary clinics and online retailers in this market?

Competition is intensifying as online retailers gain access to formerly vet-exclusive prescription products, forcing veterinary clinics to emphasize value-added services like diagnostics and personalized consultation to justify their premium product pricing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager