Flexible Fire Barrier Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436461 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Flexible Fire Barrier Sealant Market Size

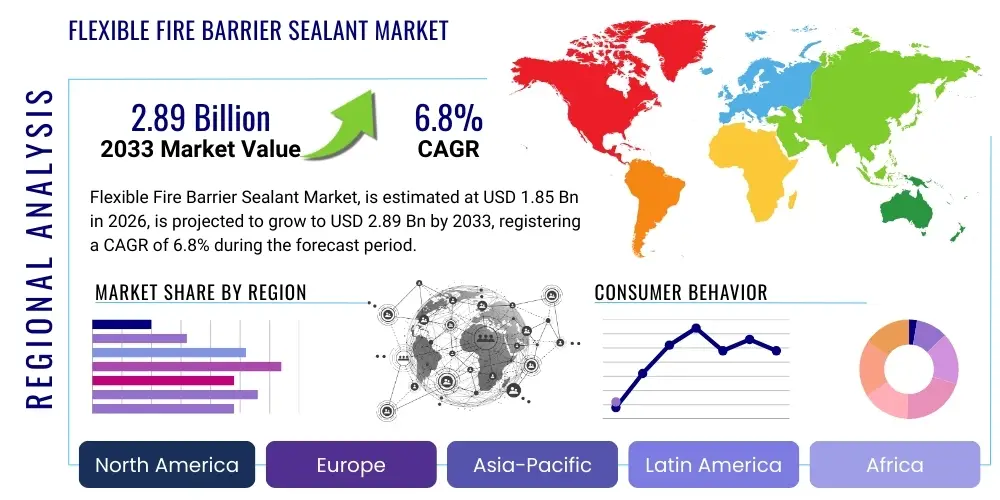

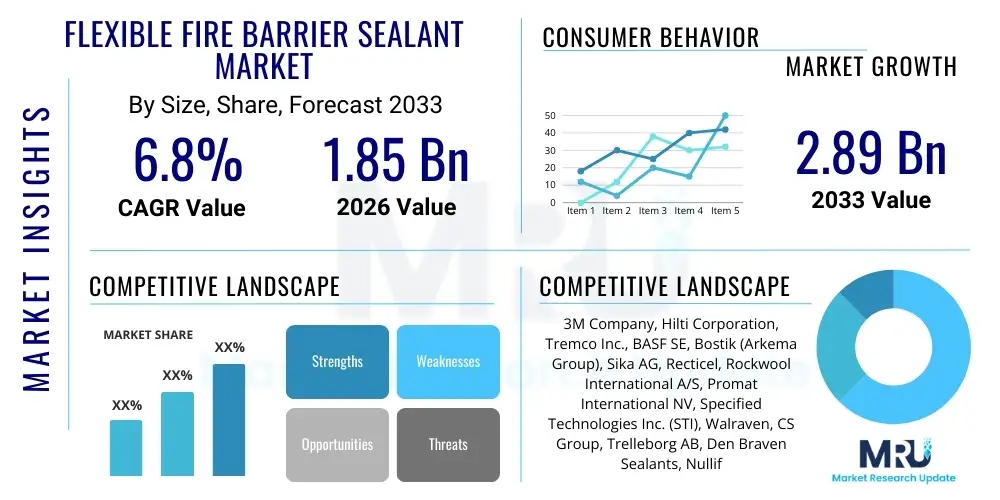

The Flexible Fire Barrier Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $1.85 Billion in 2026 and is projected to reach $2.89 Billion by the end of the forecast period in 2033.

Flexible Fire Barrier Sealant Market introduction

The Flexible Fire Barrier Sealant Market encompasses specialized chemical compounds designed to prevent the passage of fire, smoke, and toxic gases through openings and joints in fire-rated constructions. These sealants are crucial components of passive fire protection systems, maintaining the integrity of compartmentation strategies in buildings. The inherent flexibility of these products allows them to accommodate movement, expansion, and contraction within structural elements, particularly around penetrations such as cables, pipes, and ducts, ensuring the fire rating remains intact even under stress. This adaptability distinguishes them from rigid firestop solutions, making them indispensable in modern, large-scale construction where thermal and structural dynamics are significant considerations.

Major applications of flexible fire barrier sealants span across critical sectors including high-rise commercial buildings, institutional facilities (hospitals, universities), complex industrial plants (petrochemicals, manufacturing), and extensive infrastructure projects (tunnels, transportation hubs). The increasing stringency of global building codes, mandated by authorities such as the International Code Council (ICC) and European standards (EN), is the primary driver compelling the adoption of certified and tested flexible sealant systems. These products often utilize advanced polymer chemistry—such as silicone, acrylic, and urethane bases—formulated with intumescent or ablative properties that react under heat to form a protective char or foam layer, effectively sealing the breach and providing crucial time for evacuation and intervention.

The primary benefits driving market expansion include enhanced life safety protection, minimized property damage during a fire event, and compliance with increasingly rigorous fire safety regulations worldwide. Furthermore, the ease of application and long-term durability, especially when compared to alternative, less adaptable firestopping materials, contribute significantly to their high demand. Key driving factors involve the global boom in commercial and residential construction, particularly in rapidly urbanizing regions like Asia Pacific, coupled with the mandatory requirement for upgrading aging infrastructure in developed economies to meet contemporary safety standards. Technological advancements focusing on low volatile organic compound (VOC) content and improved adhesion capabilities are further propelling market maturation.

Flexible Fire Barrier Sealant Market Executive Summary

The Flexible Fire Barrier Sealant Market is characterized by robust growth, driven primarily by tightening global fire safety legislation and the necessity for highly resilient infrastructure across commercial and industrial verticals. Key business trends indicate a strong industry focus on sustainability, leading to the rapid development and commercialization of halogen-free, non-toxic, and low-VOC sealant formulations, positioning compliance as a core competitive advantage. Furthermore, consolidation among key manufacturers is occurring as companies seek to integrate specialized application technologies and expand their certified product portfolios, particularly those offering comprehensive systems solutions rather than standalone products. The shift towards modular construction techniques necessitates sealants that can be applied effectively both in pre-fabricated units and on-site, driving demand for high-performance, fast-curing formulations.

Regionally, the market exhibits differential growth patterns. North America and Europe maintain maturity, defined by stringent certification processes (e.g., UL, CE marking) and mandatory retrofit projects in existing building stock. Conversely, the Asia Pacific region, led by China and India, is experiencing exponential growth owing to massive infrastructural development, rapid urbanization, and the progressive adoption of international fire safety standards in high-density structures. Latin America and the Middle East also show promising potential, fueled by large-scale commercial real estate investments and complex industrial projects requiring high-specification passive fire protection solutions to mitigate operational risks in harsh environments.

Segment trends underscore the dominance of silicone-based sealants due to their excellent flexibility, long-term UV resistance, and superior performance in dynamic joints. However, acrylic-based sealants are gaining significant traction in less demanding or cost-sensitive interior applications owing to their ease of application and paintability. Application-wise, the cable and pipe penetration segment remains the largest volume consumer, reflecting the increasing complexity and density of electrical and mechanical services within modern buildings. Industrially, the energy and petrochemical sectors demand specialty formulations capable of resisting extreme temperatures and chemical exposure, pushing innovation toward advanced elastomeric and hybrid chemistries.

AI Impact Analysis on Flexible Fire Barrier Sealant Market

Users frequently inquire about how Artificial Intelligence (AI) can streamline compliance processes, optimize material formulation, and enhance quality control within the firestopping industry. Key thematic concerns revolve around predictive maintenance schedules for existing sealant installations, the use of computer vision for automated inspection of sealant application quality, and the potential for AI algorithms to identify novel, high-performance, and sustainable material compositions that meet evolving fire standards. There is a high expectation that AI will transition the industry from reactive compliance checking to proactive material specification and application assurance, thereby minimizing human error and ensuring consistent fire safety across large-scale projects. Users also anticipate AI tools aiding architects and engineers in integrating firestopping requirements seamlessly during the early stages of Building Information Modeling (BIM), improving estimation accuracy and reducing waste.

- AI-driven optimization of chemical formulations, accelerating the discovery of new intumescent and elastomeric chemistries with enhanced thermal stability and lower environmental impact.

- Implementation of Computer Vision and Machine Learning (ML) algorithms for automated, real-time quality inspection during sealant installation, ensuring application depth, width, and adherence meet regulatory specifications.

- Integration of AI into Building Information Modeling (BIM) platforms, allowing for predictive analysis of fire compartmentation requirements, automatic specification of suitable sealants based on substrate and penetration type, and clash detection relating to firestopping placement.

- Use of predictive analytics for assessing the long-term performance and potential degradation of installed fire barrier sealants, facilitating proactive maintenance and replacement strategies in critical infrastructure.

- Optimization of supply chain and inventory management by forecasting demand for specific sealant types across different geographical regions based on construction permits and regulatory changes.

DRO & Impact Forces Of Flexible Fire Barrier Sealant Market

The market dynamics are governed by a complex interplay of Drivers, Restraints, and Opportunities (DRO), collectively forming significant impact forces. The primary driver is the non-negotiable imperative of life safety, enforced by continually updated global fire codes (such as NFPA, IBC, and various ISO standards), which mandate the use of certified fire barrier materials in all fire-rated assemblies, directly boosting demand. Concurrently, the increasing complexity of modern building services—characterized by a high density of cable bundles, pneumatic tubes, and piping systems—creates numerous potential avenues for fire propagation, demanding flexible and highly effective sealant solutions that can seal irregular or dynamic voids. This regulatory and infrastructural complexity sustains market momentum, ensuring consistent demand regardless of short-term economic fluctuations in the construction sector.

Restraints primarily revolve around the challenges associated with proper installation and cost sensitivity in emerging markets. Flexible fire barrier sealants require precise application by trained personnel to function effectively, and improper installation remains a significant liability and market constraint. Furthermore, the specialized nature and certified testing requirements associated with high-performance elastomeric sealants result in a premium price point compared to general construction sealants, which can lead to substitution or cost-cutting measures in projects where code enforcement is lax. Another restraint is the confusion surrounding the plethora of product certifications and standards globally, making specification and procurement complex for multinational construction firms, necessitating global harmonization of performance criteria.

Significant opportunities lie in the rapidly expanding retrofit market, especially in developed economies updating older structures to current seismic and fire standards. The transition towards sustainable construction practices opens doors for manufacturers developing bio-based or highly recyclable sealant formulations that align with Green Building initiatives (e.g., LEED certification). The impact forces driving the market are overwhelmingly positive, driven by non-discretionary safety expenditures and legislative mandates, making the market highly resilient. However, the force of technological substitution—where advanced fire barriers such as pre-formed collars or wraps might replace traditional sealant applications in certain niche areas—requires continuous innovation in sealant chemistry to maintain relevance and competitive edge.

Drivers

- Strict Regulatory Mandates: Increasing enforcement and updating of international building and fire codes, such as mandatory fire ratings for compartmentation in high-rise and public buildings, driving the need for certified firestopping products.

- Growing Complexity of Building Infrastructure: The proliferation of data cables, fiber optics, and mechanical systems creates numerous penetrations that must be sealed with flexible materials to maintain the integrity of fire barriers.

- Focus on Life Safety and Property Protection: Heightened awareness among developers, insurers, and end-users regarding passive fire protection's role in minimizing casualties and property damage.

- Urbanization and High-Rise Construction Boom: Rapid urbanization globally, particularly in Asia, necessitates the construction of taller, more complex buildings where flexible, dynamic firestopping solutions are essential.

Restraints

- Installation Complexity and Skill Gap: Improper or inconsistent installation of sealants, often due to lack of trained labor, compromises the effectiveness of the fire barrier system, leading to regulatory challenges.

- High Initial Cost: Certified, specialized flexible fire barrier sealants often have a higher cost compared to non-rated or general-purpose sealing compounds, posing challenges in cost-sensitive projects.

- Substitution by Non-Compliant Materials: Risk of unauthorized substitution of certified sealants with cheaper, non-compliant alternatives during the construction phase, particularly in regions with weak regulatory oversight.

Opportunities

- Retrofit and Renovation Market: Massive opportunities in upgrading existing commercial and residential buildings to meet modern, stringent fire safety codes, requiring the replacement of older, non-compliant firestops.

- Green Building Standards Integration: Developing and marketing low-VOC, sustainable, and eco-friendly sealant chemistries aligns with global green building initiatives (e.g., LEED, BREEAM), opening new market segments.

- Technological Innovation in Intumescence: Advancements in nano-technology and intumescent material science to create highly effective, thinner-layer sealants with superior adhesion and faster cure times.

Segmentation Analysis

The Flexible Fire Barrier Sealant Market is rigorously segmented across various dimensions, including chemical composition (type), application area, and end-use sector, providing a granular view of demand patterns and technological preferences. The core segmentation by type—primarily silicone, acrylic, and urethane—reflects performance requirements related to movement capability, environmental exposure, and fire rating duration. Silicone-based sealants dominate high-performance applications due to their exceptional elastomeric properties and UV resistance, crucial for exterior joints and high-movement areas. Conversely, application segmentation focuses on the specific structural breach being sealed, differentiating requirements for linear joints versus complex mechanical and electrical penetrations, which dictates material consistency and installation complexity.

The segmentation by end-use highlights distinct vertical market demands. Commercial construction, encompassing offices, retail spaces, and hotels, is the largest consumer due to high occupancy rates and the subsequent strict safety regulations applied to public spaces. Industrial end-users, especially in power generation, chemicals, and oil and gas, require sealants that offer not only fire resistance but also robust resistance to aggressive chemicals, extreme temperatures, and vibrations, pushing demand toward highly specialized hybrid polymers. Residential construction, while generally using lower-specification products, represents a growing volume market as mandatory fire separation becomes standard in multi-family dwellings and large housing developments globally.

Strategic analysis of these segments reveals that future growth will be concentrated in segments demanding advanced fire ratings (2 hours or more) and high flexibility (accommodating joint movement up to 50%). The infrastructural segment, including tunnels, bridges, and mass transit systems, is projected to witness rapid growth, driven by massive governmental investments and the need for durable, long-life sealant systems capable of withstanding severe operational stresses and environmental degradation. Manufacturers are strategically focusing R&D efforts on meeting the specific needs of these high-value industrial and infrastructure applications, moving beyond general-purpose construction applications.

- By Type

- Silicone-based Sealants: High flexibility, excellent UV and weather resistance, suitable for exterior and dynamic joints.

- Acrylic-based Sealants: Economical, easy to apply and paint, typically used for interior, low-movement joints and gaps.

- Epoxy-based Sealants: Used in high-strength, high-temperature industrial applications where structural integrity is paramount.

- Urethane-based Sealants: Offer good adhesion and abrasion resistance, commonly used in floor joints and areas exposed to foot traffic or mild chemical spills.

- Hybrid and Other Sealants: Including water-based intumescent mastics and advanced polymers blending the benefits of silicone and polyurethane.

- By Application

- Joints and Gaps (Linear Joints): Sealing expansion, control, and construction joints in walls and floors, requiring high movement capability.

- Cable and Pipe Penetrations (Through Penetrations): Sealing complex arrays of electrical, mechanical, and plumbing services passing through fire-rated barriers.

- Curtain Walls and Perimeter Barriers: Protecting the interface between floor slabs and the exterior curtain wall system against fire spread.

- Service Openings and Ducts: Sealing HVAC openings, access hatches, and ventilation ductwork.

- By End-use Sector

- Commercial Buildings (Offices, Retail, Hospitality): Largest segment due to high occupancy and density of services.

- Residential Buildings (Multi-family, High-density Housing): Driven by increased fire safety regulations in apartment complexes.

- Industrial and Manufacturing: Includes heavy industrial facilities, cleanrooms, and manufacturing plants requiring specialized chemical and temperature resistance.

- Infrastructure and Public Utilities (Tunnels, Airports, Power Plants): Demanding long-life, robust sealants for critical national assets.

- Institutional (Hospitals, Educational Facilities): Requiring highly reliable firestopping due to vulnerable occupants and critical infrastructure.

Value Chain Analysis For Flexible Fire Barrier Sealant Market

The value chain for flexible fire barrier sealants begins with upstream raw material suppliers, predominantly chemical manufacturers providing highly specialized polymers (silicones, polyurethanes, acrylics), intumescent additives (e.g., graphite, phosphorus compounds), fillers, and plasticizers. This stage is crucial as the performance, flexibility, and longevity of the final product are highly dependent on the purity and formulation capability of these chemical components. Suppliers of proprietary intumescent technology hold significant influence due to intellectual property surrounding fire reaction mechanisms. Fluctuations in the cost and availability of key petrochemical derivatives, such as silicone precursors or isocyanates, directly impact the profitability of sealant manufacturers downstream, necessitating strong relationships and supply diversification strategies.

The midstream stage involves the sealant manufacturers themselves, who perform compounding, mixing, packaging, and, most importantly, the rigorous third-party testing and certification required for market entry (UL, FM Global, CE marking, etc.). Brand reputation and the breadth of certified systems are critical competitive factors at this stage. Manufacturers often invest heavily in R&D to optimize application characteristics, such as viscosity, cure time, and adhesion across diverse construction substrates (concrete, drywall, metal). Direct distribution channels involve manufacturers selling high-volume specialized products directly to large construction contractors or specialized fire protection sub-contractors for major infrastructure projects, allowing for tailored technical support and efficient supply logistics.

The downstream segment is dominated by distribution channels, which include major industrial distributors, specialized fire safety product wholesalers, and large retail chains catering to smaller contractors and maintenance teams. Indirect distribution, leveraging these networks, is vital for achieving broad market reach, especially in residential and general commercial segments. The end-users—ranging from general contractors and electrical/mechanical contractors to fire safety installers and maintenance personnel—rely heavily on technical specification support provided by the distributors and manufacturers to ensure compliant product selection and installation. Successful market penetration relies on effective training programs and robust documentation to mitigate the risk associated with improper application at the final point of use.

Flexible Fire Barrier Sealant Market Potential Customers

The primary purchasers and end-users of flexible fire barrier sealants are diverse entities across the construction and industrial sectors, all unified by the common need to comply with fire safety regulations and protect occupants and assets. General contractors and construction management firms represent a major buying group, as they are responsible for overall project compliance and procurement of all necessary building materials. However, the specialized nature of firestopping often means that purchasing decisions are delegated to highly specialized subcontractors, specifically firestopping contractors, mechanical and electrical contractors (MEP), and plumbing contractors, as they are the ones installing the services that penetrate fire-rated barriers.

Beyond the construction phase, facility management companies, institutional operators (like university or hospital maintenance departments), and industrial plant owners constitute a significant potential customer base for maintenance and retrofit projects. These entities require sealants for routine upkeep, repairs, and compliance upgrades to existing structures. For example, a petrochemical plant operator must regularly inspect and reseal penetrations to ensure operational integrity and safety, often requiring sealants that are chemically resistant and certified for explosion protection (Ex requirements) in addition to fire resistance. This sustained demand from the maintenance and compliance sector provides a resilient revenue stream for manufacturers, independent of new construction cycles. Furthermore, government agencies managing public infrastructure, such as transportation departments and utility companies, are crucial buyers for long-term infrastructure projects.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $1.85 Billion |

| Market Forecast in 2033 | $2.89 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Hilti Corporation, Tremco Inc., BASF SE, Bostik (Arkema Group), Sika AG, Recticel, Rockwool International A/S, Promat International NV, Specified Technologies Inc. (STI), Walraven, CS Group, Trelleborg AB, Den Braven Sealants, Nullifire, Jotun Group, USG Corporation, International Protective Coatings (AkzoNobel), Tenmat, Fire Protection Products Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible Fire Barrier Sealant Market Key Technology Landscape

The technology landscape for flexible fire barrier sealants is driven by advancements in polymer chemistry aimed at enhancing fire performance, movement capacity, and sustainability while simultaneously improving installation efficiency. A key technological focus remains on developing next-generation intumescent formulations. Traditional sealants rely on carbon-based char formation; however, modern research integrates micro-encapsulated technology and advanced binders to create ultra-fast reacting, low-smoke, halogen-free intumescents. These systems expand manifold when exposed to heat, rapidly sealing complex geometric penetrations (like cable bundles), thereby meeting the stringent low-smoke and non-toxic gas emission requirements crucial in highly occupied public spaces and transit systems where smoke inhalation is the primary cause of fire fatalities. This drive for high-performance, safer chemistry defines the current innovation trajectory.

Another pivotal area is the development of hybrid polymer sealants, which combine the best attributes of silicone and polyurethane technologies. These hybrid formulations offer superior adhesion to a wider variety of substrates, exceptional elasticity to cope with high seismic or wind-load induced movement (critical for curtain wall perimeters), and improved paintability and aesthetic finish compared to pure silicone alternatives. Manufacturers are focusing heavily on moisture-curing technology within these hybrid systems to ensure rapid, reliable installation in diverse and often challenging climate conditions, reducing curing time and minimizing construction delays. The incorporation of nanotechnology is also being explored to uniformly disperse flame retardants and reinforcement agents within the sealant matrix, enhancing mechanical strength without compromising flexibility or increasing viscosity.

Finally, technology integration with digital construction methodologies is rapidly maturing. Many leading sealant providers are developing BIM (Building Information Modeling) objects and libraries for their specific firestopping systems. This allows architects and engineers to accurately model and specify the correct fire barrier sealant and system assembly in a 3D environment, automating material quantity takeoffs and reducing specification errors. Furthermore, the integration of quick-response (QR) codes and RFID technology on sealant cartridges and packaging is enabling better traceability, digital documentation of installation details, and simplifying the auditing process for regulatory bodies and project managers, ensuring that the certified product is correctly matched to the certified application system on site. This digital evolution is crucial for maintaining quality control across large-scale, intricate fire safety installations.

Regional Highlights

Regional dynamics significantly influence the flexible fire barrier sealant market, primarily due to variations in construction maturity, seismic activity, and the enforcement level of fire safety regulations. North America, encompassing the United States and Canada, represents a high-value, highly regulated market. Demand here is stabilized by the stringent requirements set forth by organizations like Underwriters Laboratories (UL) and FM Global, particularly concerning through-penetration firestop systems and perimeter fire barriers in large commercial and healthcare facilities. The emphasis is on documented compliance and certified installers, leading to a strong preference for premium, tested sealant systems. Furthermore, the ongoing cycle of seismic retrofitting and energy efficiency upgrades in older buildings provides continuous, robust demand for flexible firestopping solutions capable of accommodating high dynamic movement.

The Asia Pacific (APAC) region is projected to be the fastest-growing market globally, fueled by unprecedented rates of urbanization and massive investments in commercial real estate, public infrastructure, and heavy industrial capacity, particularly in China, India, and Southeast Asian nations. While regulatory standards are progressively aligning with international norms, the challenge often lies in consistent enforcement and the prevalence of local, lower-cost sealant manufacturers. However, major multinational construction projects in capital cities are driving the adoption of high-performance, international-standard flexible sealants. Europe maintains a mature market characterized by the strict requirements of the Construction Products Regulation (CPR) and CE marking for harmonized European standards. Western European nations emphasize sustainability and low-VOC products, pushing manufacturers toward eco-friendly and bio-based sealant alternatives, while mandatory fire testing standards ensure a consistent demand for premium, certified materials across the continent.

- North America (US, Canada): Characterized by mature markets, strict code enforcement (IBC, NFPA), and high demand for specialized, certified silicone and elastomeric sealants driven by seismic requirements and large-scale infrastructure renewal projects.

- Europe (Germany, UK, France): Focus on sustainability, mandatory CE certification, and high adoption of low-VOC, high-flexibility sealants in energy-efficient buildings and complex infrastructure projects like cross-border tunnels and transit systems.

- Asia Pacific (China, India, Japan, South Korea): Highest growth region driven by massive urbanization, the expansion of high-density residential and commercial towers, and the progressive integration of international fire safety standards into national building codes.

- Latin America (Brazil, Mexico): Emerging market potential driven by large-scale mining and oil/gas projects requiring specialized industrial-grade firestopping, though market penetration is often hampered by varying levels of regulatory enforcement.

- Middle East and Africa (MEA): High demand, particularly in the Gulf Cooperation Council (GCC) states, fueled by mega-construction projects (commercial towers, smart cities) demanding the highest fire ratings and sealants capable of withstanding extreme desert temperatures and harsh environmental conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Fire Barrier Sealant Market.- 3M Company

- Hilti Corporation

- Tremco Inc.

- BASF SE

- Bostik (Arkema Group)

- Sika AG

- Recticel

- Rockwool International A/S

- Promat International NV

- Specified Technologies Inc. (STI)

- Walraven

- CS Group

- Trelleborg AB

- Den Braven Sealants

- Nullifire

- Jotun Group

- USG Corporation

- International Protective Coatings (AkzoNobel)

- Tenmat

- Fire Protection Products Inc.

Frequently Asked Questions

Analyze common user questions about the Flexible Fire Barrier Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What distinguishes flexible fire barrier sealants from standard firestopping materials?

Flexible fire barrier sealants, typically silicone or urethane-based, are engineered specifically to maintain their fire-resistive properties when subjected to structural movement, expansion, or contraction. Unlike rigid cementitious or mineral wool firestops, these elastomeric sealants can accommodate dynamic joint movement (e.g., thermal, seismic, or wind sway) up to 50% without cracking or failing, ensuring the integrity of the fire compartmentation is maintained under stress, which is critical for modern, large-span structures and perimeter seals.

Which chemical base dominates the high-performance segment of the market and why?

Silicone-based fire barrier sealants currently dominate the high-performance segment, primarily due to their superior chemical properties, including exceptional long-term elasticity, high UV resistance, and wide operating temperature range. These qualities make them ideal for exterior applications, curtain wall perimeter barriers, and critical interior installations where durability and minimal degradation over time are paramount, offering reliable performance for up to four-hour fire ratings in dynamic assemblies.

How do global regulatory standards impact the growth and specification of flexible fire barrier sealants?

Global regulatory standards, such as those published by UL (Underwriters Laboratories), European EN standards (e.g., EN 1366), and the International Code Council (IBC), are the fundamental drivers of market growth. These codes mandate the use of third-party tested and certified firestop systems for every penetration and joint in fire-rated construction. The constant updating and increasing stringency of these standards, particularly regarding smoke and toxicity limits, compel manufacturers to innovate and ensure their flexible sealants meet the highest levels of documented performance and compliance, thus promoting market legitimacy and premium product adoption.

What role does BIM (Building Information Modeling) play in the future adoption of these sealants?

BIM is becoming increasingly vital as it enables precise, digital specification of fire barrier systems early in the design phase. Manufacturers provide specific BIM objects for their flexible sealants, allowing architects and engineers to visualize penetration details, accurately calculate material quantities, and confirm code compliance before construction begins. This integration minimizes costly on-site installation errors, improves coordination between trades (MEP and Firestopping), and provides a verifiable digital record for quality assurance and compliance auditing, streamlining the construction documentation process.

What is the key difference between intumescent and ablative flexible fire barrier sealant technology?

Intumescent sealants react to heat by swelling significantly (expanding up to 10-20 times their original volume), forming a dense, insulating char that closes the breach and restricts the passage of fire and hot gases. Ablative sealants, conversely, slowly sacrifice their surface material when exposed to fire, dissipating the heat energy through an endothermic reaction and creating a hard, protective char layer that slowly erodes, protecting the material underneath. Flexible sealants primarily utilize intumescent technology when sealing cables or pipes, as the expansion mechanism is necessary to seal voids left by melting plastic.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager