Flexible Firestop Sealant Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436809 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Flexible Firestop Sealant Market Size

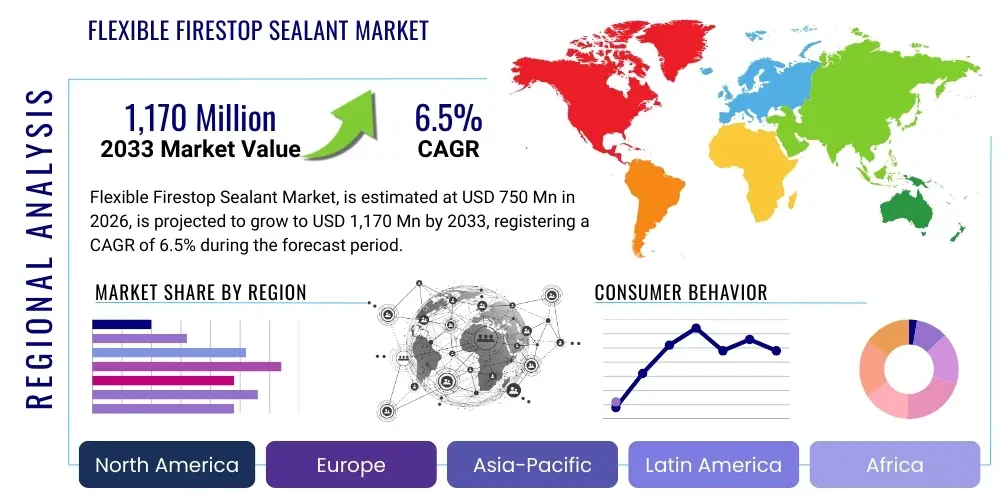

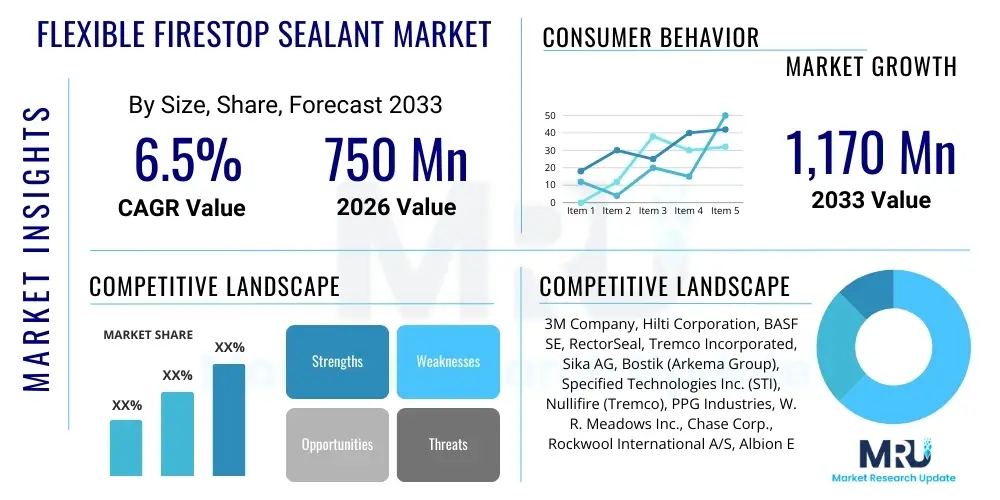

The Flexible Firestop Sealant Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 750 Million in 2026 and is projected to reach USD 1,170 Million by the end of the forecast period in 2033. This growth trajectory is fundamentally driven by the escalating global focus on fire safety standards, particularly within complex modern infrastructure and high-rise commercial structures. The intrinsic ability of these sealants to maintain fire resistance ratings in moving joints and dynamic penetration seals makes them indispensable in compliant construction.

Flexible Firestop Sealant Market introduction

Flexible firestop sealants are specialized chemical formulations designed to prevent the passage of fire, smoke, and toxic gases through openings, joints, and penetrations in fire-rated walls and floors, while simultaneously accommodating building movement due to thermal expansion, seismic activity, or structural load changes. These products typically utilize intumescent or elastomeric technologies, allowing them to expand when exposed to heat, thereby sealing gaps effectively. The primary applications span across commercial buildings, hospitals, data centers, industrial facilities, and residential complexes where strict adherence to building codes, such as those governed by organizations like ASTM, UL, and EN standards, is mandatory. The material composition often includes acrylics, silicones, polyurethanes, or hybrid polymers, tailored for specific flexibility and environmental durability requirements.

The core benefit of incorporating flexible firestop sealants is the enhanced life safety and asset protection they provide, serving as a critical component of passive fire protection systems. Unlike rigid firestopping materials, flexible variants ensure the continuity of the fire barrier even when the structure experiences normal operational stress or movement. This capability significantly reduces the risk of premature fire containment failure, which is crucial in modern, structurally complex buildings. Furthermore, many contemporary flexible sealants are formulated to offer excellent acoustic insulation and smoke suppression characteristics, adding multi-functional value beyond basic fire protection.

Market growth is predominantly driven by increasing global infrastructure development, particularly in emerging economies, coupled with the rigorous enforcement of updated international building and fire safety codes. The shift toward modular construction techniques and the increasing complexity of mechanical, electrical, and plumbing (MEP) service penetrations within structures necessitate advanced sealing solutions that maintain integrity under dynamic conditions. Key stakeholders, including architects, fire safety consultants, and building owners, are increasingly prioritizing high-performance, third-party certified flexible firestop systems, fueling innovation toward low-VOC (Volatile Organic Compound) and environmentally sustainable products.

Flexible Firestop Sealant Market Executive Summary

The Flexible Firestop Sealant Market is characterized by robust regulatory influence and rapid technological evolution, particularly the development of highly flexible, multi-functional hybrid sealants that meet stringent fire and smoke containment requirements while offering superior movement capability (up to 50% joint movement). Business trends indicate a strong move towards comprehensive system certification, where manufacturers provide tested assemblies rather than standalone products, ensuring end-to-end compliance for contractors. Sustainability is emerging as a critical competitive differentiator, driving the demand for halogen-free and low-VOC formulations, aligning with global green building initiatives and certifications such as LEED and BREEAM. Strategic mergers and acquisitions among major material science and chemical companies are consolidating market share and facilitating faster access to specialized distribution channels serving professional fireproofing contractors.

Regionally, the Asia Pacific (APAC) stands out as the fastest-growing market segment, fueled by massive investment in commercial real estate, public infrastructure (transportation hubs, utilities), and high-density residential projects in countries like China, India, and Southeast Asia. Regulatory harmonization and the adoption of international fire standards in these regions are compelling developers to upgrade passive fire protection measures. North America and Europe, while mature, maintain steady growth, primarily driven by strict maintenance and retrofit projects, coupled with the introduction of highly specialized, high-performance sealants targeting niche applications like healthcare facilities and data centers, where uptime and seismic resistance are paramount.

Segment trends highlight the dominance of silicone-based sealants in high-movement and high-temperature environments due to their exceptional elastomeric properties and durability. However, the acrylic and hybrid polymer segments are gaining momentum, particularly in general construction and residential firestopping, owing to their ease of application, paintability, and cost-effectiveness. The end-use segment shows commercial construction remaining the largest consumer, driven by complex MEP installations and large-scale joint sealing requirements, while the industrial segment, including specialized applications like chemical plants and energy facilities, demands sealants with extreme chemical resistance and exposure tolerance, pushing innovation in specialized elastomer compositions.

AI Impact Analysis on Flexible Firestop Sealant Market

User inquiries regarding AI's impact on the firestop sealant market commonly revolve around how artificial intelligence can accelerate material discovery, optimize complex supply chains, and enhance the quality and compliance auditing processes required for passive fire protection. Key themes include the use of machine learning to predict the intumescent behavior of novel chemical compounds under extreme heat, reducing lengthy physical testing cycles; optimization of manufacturing processes to minimize waste and ensure batch consistency crucial for fire rating; and the integration of AI-powered computer vision systems for automated installation quality checks on construction sites, addressing the industry concern about human error in application. Users are keen to understand if AI can democratize access to customized sealant formulations based on specific project requirements (e.g., unique substrate compatibility or movement ratings) and if predictive analytics can stabilize raw material procurement, which is often volatile in the specialty chemical sector.

- AI-driven Predictive Material Modeling: Accelerating the discovery and testing of new intumescent and elastomeric polymers, reducing R&D time for sealants with higher flexibility and superior fire ratings (e.g., higher L-ratings for smoke control).

- Supply Chain Optimization: Using machine learning to forecast demand, manage inventory of specialized raw materials (e.g., fillers, binders, functional additives), and mitigate supply chain disruptions impacting production consistency.

- Automated Quality Control (AQC): Implementing AI-powered computer vision systems during manufacturing to monitor mixing ratios and curing processes, ensuring batch-to-batch homogeneity critical for achieving certified fire performance.

- Installation Verification via Computer Vision: Utilizing AI integrated into drones or site cameras to automatically inspect firestop installations, verifying correct joint filling depth, sealant width, and adherence to certified drawings, thereby drastically reducing inspection time and potential compliance failure.

- Smart Building Integration: Connecting sealant performance data (via embedded sensors or digital twins) with building management systems, allowing predictive maintenance alerts if the sealant integrity is compromised due to excessive movement or environmental factors.

DRO & Impact Forces Of Flexible Firestop Sealant Market

The dynamics of the Flexible Firestop Sealant Market are heavily influenced by stringent regulatory frameworks and the increasing complexity of modern construction, creating significant demand for certified, high-performance materials. Drivers include the global proliferation of high-rise construction and densely populated urban centers, which inherently mandate superior passive fire protection standards, pushing demand for sealants with proven longevity and movement capabilities. However, the market faces restraints such as the perceived high initial cost of specialized flexible sealants compared to general construction caulks, coupled with the critical reliance on highly skilled labor for correct installation, where application errors can negate the product’s effectiveness. Opportunities arise from the rapidly expanding renovation and retrofit sector, especially in older commercial buildings needing seismic upgrades and fire code compliance updates, presenting a consistent stream of demand for advanced elastomeric firestop solutions.

Key drivers include mandatory adherence to international standards (e.g., ISO, UL, EN) which are increasingly demanding not just fire resistance (F-rating) but also smoke and gas leakage control (L-rating), criteria that flexible sealants are optimized to meet in dynamic joints. Furthermore, major infrastructure projects, including data centers, tunnels, and renewable energy facilities, impose unique and rigorous environmental and movement stress requirements on building materials, requiring sealants that can withstand chemical exposure, UV degradation, and sustained structural shifts without losing fire integrity. The move toward prefabricated and modular construction necessitates the use of sealants that can accommodate wide joint tolerances and provide robust sealing in factory-built modules that are later assembled on site, driving innovation in rapid-cure and high-adhesion formulations.

Restraints are notably complex; beyond cost, manufacturers grapple with the variability in application substrates and environmental conditions, requiring extensive product testing and specialization, which raises production costs. A significant restraining factor is the lack of standardized training among general construction crews regarding firestop installation protocols; misapplication remains the single largest cause of firestop failure in post-incident investigations. Opportunities are vast in the realm of sustainable chemistry, where bio-based and non-toxic intumescent agents are replacing traditional chemical compounds, catering to the growing demand from eco-conscious developers and green building projects. Furthermore, the development of intelligent, digitally traceable firestopping materials that simplify inspection and compliance record-keeping offers a major avenue for market differentiation and growth, particularly as regulatory bodies seek better traceability throughout a building’s lifecycle.

Impact forces in this market are predominantly external, stemming from governmental policy and construction cycles. Regulatory mandates act as a powerful positive impact force, continually elevating baseline safety requirements and broadening the scope of necessary firestopping applications. Conversely, economic downturns and fluctuations in raw material prices (especially silicone and specific polymers) exert significant negative impact, affecting profit margins and potentially slowing down large-scale infrastructure projects. The increasing prevalence of complex, multi-functional building designs ensures that the demand for sophisticated, certified flexible sealants will continue to rise, outweighing constraints associated with cost and installation difficulty as failure consequences are too high for developers to ignore.

Segmentation Analysis

The Flexible Firestop Sealant Market is systematically segmented based on Product Type (material composition), End-Use Sector (application environment), and Application Method. The differentiation in material type—primarily silicone, acrylic, urethane, and various hybrids—is crucial as it determines the sealant’s movement capability, fire rating duration, temperature resistance, adhesion profile, and cost structure. Silicone sealants command a premium due to their superior elasticity and thermal stability, making them ideal for high-movement joint applications in demanding industrial and exterior environments. Acrylic sealants, offering good fire performance and easy water clean-up, dominate the interior and low-movement residential segment due to their cost-effectiveness and ease of use.

The End-Use segmentation highlights the Commercial sector (office buildings, retail, hospitality) as the dominant consumer, driven by complex mechanical and electrical service penetrations and the necessity for extensive floor-to-wall joint firestopping in large structures. Residential demand is robust, particularly in multi-family and high-density housing where compartmentalization and fire safety integrity are critical for code compliance. The Industrial segment, encompassing power generation, petrochemicals, and heavy manufacturing, requires highly specialized flexible sealants that must also resist chemical attack, vibration, and extreme temperature cycling, often demanding third-party certifications beyond standard building codes.

Further analysis of the segmentation reveals that hybrid polymer sealants are a rapidly growing category. These formulations combine the best features of different chemistries, such as the movement capability of silicone with the paintability and environmental friendliness of water-based acrylics, offering a versatile solution that addresses the needs of multiple application environments without compromising critical performance characteristics. This trend towards hybridization is key for manufacturers looking to capture market share across diverse projects while streamlining product inventory. Certification and tested assembly systems are becoming inseparable from product segmentation, as customers prioritize holistic solutions over individual components.

- Product Type:

- Silicone Based Sealants (High movement, high temperature)

- Acrylic Based Sealants (Interior, low movement, cost-effective)

- Urethane/Polyurethane Based Sealants (Durable, chemical resistance, exterior)

- Hybrid Sealants (Combining silicone and urethane properties, versatile)

- End-Use Sector:

- Commercial Construction (Office, Retail, Data Centers, Healthcare)

- Residential Construction (Multi-family, High-rise residential)

- Industrial Facilities (Power Plants, Manufacturing, Oil & Gas)

- Infrastructure & Transportation (Tunnels, Airports, Bridges)

- Application Method:

- Trowel/Caulking Gun Applied

- Pumped/Bulk Applied

Value Chain Analysis For Flexible Firestop Sealant Market

The value chain for flexible firestop sealants begins with upstream raw material suppliers, specifically manufacturers of specialty chemicals, polymers (silicone precursors, acrylic emulsions, polyurethanes), fire-retardant additives (intumescent fillers), and functional pigments. The highly technical nature of firestopping requires stringent quality control at the raw material stage, as inconsistencies in components directly impact the critical fire performance metrics. Key upstream activities involve advanced synthesis and purification of these materials, often sourced from global chemical giants. Manufacturers maintain deep relationships with a select few specialized suppliers to ensure material provenance and stability, which is vital given the non-negotiable compliance standards of the final product. Price volatility in base polymers remains a critical risk factor managed at this stage.

The manufacturing stage involves complex formulation, compounding, and rigorous testing processes. Manufacturers invest heavily in R&D to optimize viscoelastic properties, adhesion to diverse substrates, and most importantly, expansion rates and char stability under fire conditions, leading to numerous certified assembly designs. The distribution channel is bifurcated into direct sales to large construction firms and specialized fire protection contractors for massive projects, and indirect sales through a well-established network of industrial distributors, building supply wholesalers, and specialized fire safety dealers. The indirect channel dominates general sales, providing inventory and local delivery services, while technical support and large-volume project negotiations often go through the direct route.

Downstream activities are dominated by specialized subcontractors and general contractors responsible for the final installation. The effectiveness of the firestop system relies heavily on professional application, which includes surface preparation, accurate joint sizing, and correct application depth, often dictated by complex engineering judgments. After-market services include compliance audits, repair, and maintenance, particularly crucial in facilities requiring frequent penetrations or modifications (like data centers and hospitals). The lifecycle value is high, as buildings require periodic inspection and sometimes repair or replacement of firestop systems over decades. The strong relationship between manufacturers and certified installation partners is paramount to maintaining product integrity and reducing liability throughout the project lifecycle.

Flexible Firestop Sealant Market Potential Customers

Potential customers for flexible firestop sealants are primarily concentrated within the construction and building maintenance ecosystem, prioritizing compliance, system integrity, and longevity. The largest purchasing segment consists of specialized fire protection subcontractors who are contracted specifically to design, procure, and install passive fire protection systems, including all joint and penetration sealing. These professionals demand sealants with comprehensive third-party testing, ease of application, and reliable availability, often focusing on high-volume, certified assemblies that simplify the inspection process and reduce project risk. Their buying decisions are based heavily on technical specifications and the extent of manufacturer support.

General contractors (GCs) and Construction Management firms also represent a substantial customer base, although they typically purchase indirectly through distributors. GCs are responsible for overall project completion and compliance, often setting the product specifications based on architectural drawings and local code requirements. They prioritize cost-effectiveness, application speed, and compatibility with other building materials. In addition, large-scale infrastructure developers and facility owners (e.g., hospital networks, data center operators, government agencies) act as key influencers and end-users, focusing on the long-term durability and maintenance burden of the installed sealants. These customers often mandate premium, high-movement, and low-smoke emission products for critical infrastructure.

The secondary customer segment includes building maintenance and facility management teams involved in post-construction modifications, renovations, and repairs. These teams require smaller volumes of versatile, easy-to-use flexible sealants for routine maintenance of wall and floor openings or minor structural upgrades. Their preference leans towards versatile hybrid or acrylic sealants that can be easily stored, dispensed, and are compatible with various existing substrates. Furthermore, distributors and wholesalers are key immediate customers, acting as the necessary link between manufacturers and the fragmented end-user market, stocking diversified portfolios tailored to local regulatory nuances and construction material preferences.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750 Million |

| Market Forecast in 2033 | USD 1,170 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, Hilti Corporation, BASF SE, RectorSeal, Tremco Incorporated, Sika AG, Bostik (Arkema Group), Specified Technologies Inc. (STI), Nullifire (Tremco), PPG Industries, W. R. Meadows Inc., Chase Corp., Rockwool International A/S, Albion Engineering Company, Everkem Diversified Products, Tenmat Inc., Promat International, Trelleborg AB, Den Braven Sealants, Fosroc International. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible Firestop Sealant Market Key Technology Landscape

The technological landscape of flexible firestop sealants is characterized by continuous material science innovation aimed at enhancing movement capability, extending fire ratings, and improving environmental performance. The cornerstone technology remains intumescence, where sealants contain chemical agents that swell significantly when exposed to high temperatures, creating a dense, insulating char barrier that seals the gap and prevents the passage of fire and hot gases. Modern intumescent formulations utilize sophisticated micro-encapsulation techniques to ensure long-term shelf stability and controlled, high-volume expansion rates, crucial for effectively sealing large or dynamic joints in applications such as control joints and curtain wall perimeter seals.

A major trend driving the technology landscape is the development of advanced hybrid polymer sealants. These products merge the structural integrity and ease of application associated with acrylics or urethanes with the high movement capability and durability typically reserved for silicone, offering superior all-around performance. These hybrid formulations often simplify installation by adhering well to a wider variety of construction substrates, including concrete, metals, and plastics, without requiring extensive surface priming. Furthermore, there is an increasing shift towards non-halogenated and low-VOC (Volatile Organic Compound) chemistries, driven by stringent indoor air quality regulations and green building standards, pushing manufacturers to reformulate products to achieve compliance while maintaining critical fire and movement performance metrics.

Other key technological advancements include rapid-curing formulations, which are crucial for accelerating project timelines, particularly in modular construction and quick-turnaround retrofit projects where reducing curing time minimizes site downtime. Additionally, advancements in elastomeric properties focus on sealants capable of surviving sustained movement cycles (e.g., +/- 50% or more) over the lifespan of the building, ensuring the fire barrier remains intact regardless of seismic activity or continuous thermal cycling. The integration of digital identification technology, such as embedded RFID or QR codes on packaging and documentation, is also gaining traction, enabling easier traceability and verification of certified products on site, improving compliance tracking and quality assurance for inspectors and project managers.

Regional Highlights

- North America (NA): North America represents a mature yet highly regulated market, where demand is consistently driven by stringent building codes enforced by organizations such as UL and FM Approvals, and local jurisdictions like the International Code Council (ICC). The region emphasizes certified systems and mandatory installer training. Growth is sustained by critical infrastructure upgrades (e.g., seismic retrofitting in California) and booming construction in the data center and healthcare sectors, which demand premium silicone and hybrid sealants with high L-ratings (smoke seal performance). The focus on renovation of aging commercial real estate further contributes significantly to consumption, necessitating materials that integrate seamlessly with existing fire protection infrastructure.

- Europe: The European market is defined by diverse national regulations and the increasing adoption of unified standards (e.g., EN 1366 series) across the EU. Sustainability is a primary regional driver, leading to high demand for low-VOC, halogen-free, and bio-based flexible sealants, particularly in Nordic countries and Germany. The construction trend towards energy-efficient and airtight buildings necessitates multi-functional sealants that provide firestopping, acoustic dampening, and air-barrier capabilities. The retrofit market, driven by directives aimed at improving the fire safety of older high-rise residential blocks, ensures steady demand, especially for highly flexible perimeter sealants and joint fillers.

- Asia Pacific (APAC): APAC is the fastest-growing region, fueled by rapid urbanization, massive infrastructure spending, and an increasing awareness of fire safety standards, often adopting international benchmarks like UL or Australian standards. Countries like China, India, and Southeast Asian nations are witnessing explosive growth in commercial and high-density residential construction. While cost-effectiveness remains important, the escalating number of high-profile building fires is forcing regulators to adopt stricter codes, particularly demanding flexible sealants for seismic joints and large penetrations, thereby accelerating the transition from basic fillers to certified, high-performance firestop products.

- Latin America (LATAM): The LATAM market is characterized by sporadic growth linked directly to major economic and political stability factors, but it shows promising long-term potential. Key markets, including Brazil and Mexico, are seeing increased foreign investment in commercial and industrial projects, which often mandates the use of international fire safety standards. This influx is driving the adoption of certified flexible firestop sealants, moving away from conventional methods. However, widespread enforcement and localized supply chain maturity remain challenges.

- Middle East and Africa (MEA): The MEA region, particularly the GCC countries (UAE, Saudi Arabia, Qatar), is a significant consumer of premium flexible sealants due to mega-projects, complex high-rise structures, and extreme environmental conditions (high heat, UV exposure) that demand highly durable, silicone-based firestop solutions. The regulatory environment is often based on NFPA and international standards due to a high volume of international developers. Africa remains a nascent market, but infrastructure and commercial development in key urban hubs are beginning to generate focused demand for compliant firestopping materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Firestop Sealant Market.- 3M Company

- Hilti Corporation

- BASF SE

- RectorSeal

- Tremco Incorporated

- Sika AG

- Bostik (Arkema Group)

- Specified Technologies Inc. (STI)

- Nullifire (Tremco)

- PPG Industries

- W. R. Meadows Inc.

- Chase Corp.

- Rockwool International A/S

- Albion Engineering Company

- Everkem Diversified Products

- Tenmat Inc.

- Promat International

- Trelleborg AB

- Den Braven Sealants

- Fosroc International

Frequently Asked Questions

Analyze common user questions about the Flexible Firestop Sealant market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary difference between flexible and rigid firestop sealants?

Flexible firestop sealants are designed to maintain their fire rating integrity in dynamic joints and penetrations that experience movement (e.g., structural, seismic, thermal cycling). Rigid sealants are typically used in static applications where no movement is anticipated. Flexibility is measured by percentage of joint movement capability, often exceeding +/- 25% to ensure continuous fire containment under stress.

Which material type dominates the Flexible Firestop Sealant Market and why?

Silicone-based flexible sealants often dominate the high-performance segment due to their exceptional elastomeric properties, high-temperature resistance, and longevity. They provide superior movement accommodation and are widely certified for demanding applications like curtain wall joints and critical infrastructure projects requiring high L-ratings (smoke control).

How do global fire safety codes influence market demand?

Increasingly strict enforcement of global fire safety codes, such as those from UL, EN, and NFPA, drives market demand by mandating certified passive fire protection solutions in all commercial and high-density residential construction. These regulations specifically require sealants with verified fire resistance ratings (F-rating) and effective smoke containment (L-rating) for all through-penetrations and construction joints.

What are the key application areas for high-movement firestop sealants?

High-movement firestop sealants are primarily used in critical structural joints such as expansion joints, control joints, floor-to-wall interface joints, and perimeter seals for curtain wall systems. These applications require sealants capable of sustaining structural movement caused by thermal changes, load shifts, or seismic activity while maintaining a continuous fire barrier integrity.

What opportunities are emerging from the sustainable chemistry trend in this market?

The sustainability trend is driving opportunities in developing low-VOC (Volatile Organic Compound) and halogen-free firestop sealant formulations, meeting the requirements of green building certifications (LEED, BREEAM). Manufacturers are focusing on bio-based intumescent additives and non-toxic polymer backbones to cater to the growing demand for environmentally responsible construction materials without compromising fire performance.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager