Flexible Food and Beverage Packaging Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432893 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Flexible Food and Beverage Packaging Market Size

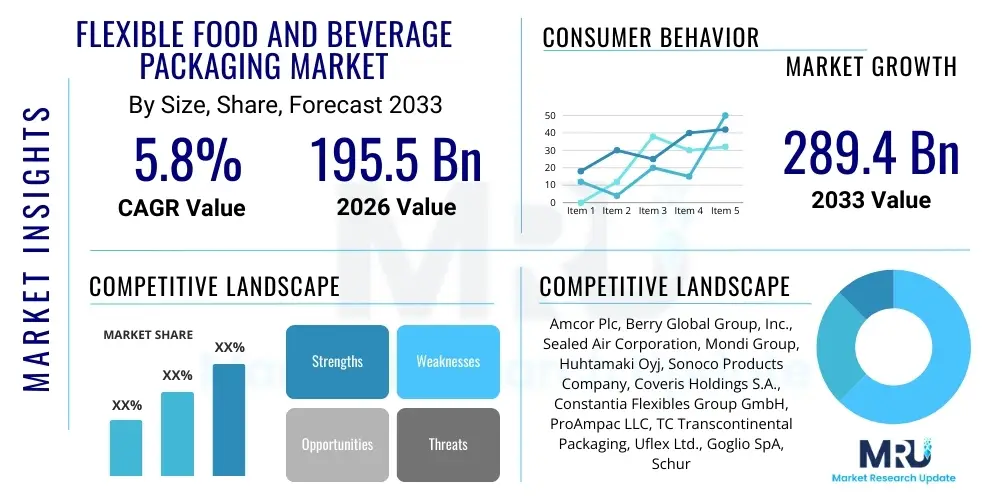

The Flexible Food and Beverage Packaging Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 195.5 Billion in 2026 and is projected to reach USD 289.4 Billion by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by the evolving global consumer preference for convenience, sustainability, and portion control, coupled with advancements in material science that enhance product shelf life and safety across diverse food categories.

Flexible Food and Beverage Packaging Market introduction

The Flexible Food and Beverage Packaging Market encompasses packaging solutions made from pliable materials such as films, foils, pouches, bags, and wraps, designed to protect and preserve food and beverages. These products are utilized across a vast spectrum of applications, including baked goods, snacks, dairy, ready-to-eat meals, frozen foods, and liquid refreshments. The inherent versatility and lightweight nature of flexible packaging materials translate directly into lower transportation costs and reduced material usage compared to rigid alternatives, providing significant economic benefits to manufacturers and contributing to a lower carbon footprint throughout the supply chain.

Major applications of flexible packaging include high-barrier films for extending the shelf life of perishable items, stand-up pouches for ease of storage and consumption, and resealable structures that cater to modern consumer demands for multi-use functionality. The shift towards e-commerce and smaller household sizes has amplified the need for durable, space-efficient, and easily disposable packaging formats. Furthermore, ongoing innovation in multilayer laminates and specialized coatings ensures robust product protection against moisture, oxygen, and light, which is critical for maintaining the sensory and nutritional integrity of packaged goods in various environmental conditions.

Key benefits driving market adoption include superior graphic printing capabilities that enhance brand visibility and consumer appeal at the point of sale, coupled with optimized material usage which aligns with corporate sustainability mandates. Driving factors include increasing disposable incomes in emerging economies, rapid urbanization necessitating packaged and processed foods, and the continuous development of bio-degradable and compostable flexible materials responding directly to stringent global environmental regulations and heightened consumer ecological awareness. These interconnected drivers solidify the strategic importance of flexible packaging within the global food and beverage industry structure.

Flexible Food and Beverage Packaging Market Executive Summary

The Flexible Food and Beverage Packaging Market is characterized by robust business trends centered on sustainability integration, rapid digitalization of production processes, and strategic mergers and acquisitions aimed at supply chain consolidation and technological diversification. Companies are heavily investing in circular economy initiatives, specifically focusing on mono-material structures that simplify recycling processes and reduce dependency on virgin plastics. The adoption of smart packaging features, such as QR codes, temperature indicators, and NFC tags, is emerging as a critical trend, providing enhanced traceability, consumer engagement, and improved supply chain transparency, particularly for high-value or temperature-sensitive goods.

Regionally, the Asia Pacific (APAC) stands as the dominant and fastest-growing market, propelled by rapid industrialization, burgeoning middle-class populations, and the large-scale shift from traditional unpackaged goods to modern retail formats requiring robust flexible solutions. North America and Europe, while mature, are leading the charge in advanced sustainable solutions, driven by stringent regulatory frameworks such as the European Union’s Packaging and Packaging Waste Regulation (PPWR), which necessitates rapid innovation in recyclable and reusable flexible formats. Latin America and the Middle East & Africa (MEA) are witnessing accelerated growth, fueled by increasing foreign investment in local food processing infrastructure and growing demand for imported packaged consumer goods.

Segment trends highlight the prominence of plastic films and laminates due to their cost-effectiveness and barrier properties, though the fastest growth is observed in paper-based flexible packaging driven by sustainability goals. Among applications, the ready-to-eat meals and snack food sectors show exceptional growth, requiring high-performance, easy-open, and resealable pouches and stand-up bags. The primary segment shift is towards lightweight, high-barrier functional films, allowing for maximized shelf life extension while minimizing material volume. This trend underscores the industry's focus on efficiency and waste reduction across all consumer packaged goods (CPG) categories.

AI Impact Analysis on Flexible Food and Beverage Packaging Market

User queries regarding the impact of Artificial Intelligence (AI) on flexible packaging frequently revolve around optimizing production efficiency, enhancing quality control, and developing predictive models for supply chain resilience and demand forecasting. Users are concerned about how AI-driven machine vision systems can rapidly detect minuscule defects in high-speed film production lines, ensuring zero-defect packaging reaches the market. Key expectations focus on AI's ability to minimize material waste during lamination and printing processes, thereby addressing both cost pressures and sustainability mandates. Furthermore, there is significant interest in using generative AI models to simulate new packaging designs based on desired functional properties (e.g., barrier performance) and aesthetic requirements, accelerating the time-to-market for novel flexible formats.

AI is fundamentally transforming the operational landscape of flexible packaging manufacturers by facilitating hyper-efficient predictive maintenance protocols. By analyzing real-time data streams from printing presses, laminators, and slitting equipment, AI algorithms can accurately predict equipment failures before they occur, drastically reducing unscheduled downtime and improving overall equipment effectiveness (OEE). This proactive approach to maintenance minimizes operational bottlenecks, ensuring continuous supply, which is crucial in the high-volume, low-margin environment of packaging manufacturing. Moreover, AI-powered systems are crucial for optimizing complex scheduling tasks, integrating variables such as material inventory, production capacity, and urgent client orders to maximize throughput.

In terms of sustainability and material science, AI plays a pivotal role in advanced material development and circularity efforts. Machine learning models are being employed to analyze the recyclability potential of complex multi-layer structures and suggest optimal compositions for mono-material conversion without compromising essential barrier properties. AI also enhances sorting and recycling efficacy at end-of-life facilities by improving recognition capabilities for different film types and polymers, which is essential for increasing the capture rate of flexible packaging waste. This integration of AI addresses consumer demands and regulatory pressures for verifiable sustainable packaging solutions, positioning it as a core technology for future market growth.

- AI-driven Predictive Maintenance: Reduces machine downtime and optimizes OEE in high-speed converting operations.

- Quality Control Automation: Utilizes machine vision for real-time, high-precision defect detection on film surfaces and printed graphics.

- Supply Chain Optimization: Forecasts material demands and logistics needs, enhancing responsiveness to volatile raw material costs.

- Sustainable Design Optimization: ML algorithms rapidly prototype and test mono-material structures for maximized recyclability.

- Process Parameter Control: Dynamically adjusts heat sealing, lamination, and printing parameters to minimize material waste and energy consumption.

- Enhanced Traceability: Integrates data across the value chain, improving anti-counterfeiting measures and consumer safety assurances.

DRO & Impact Forces Of Flexible Food and Beverage Packaging Market

The Flexible Food and Beverage Packaging Market is influenced by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), which collectively shape its trajectory and competitive landscape. The primary drivers are the surging global demand for processed and convenient food items, particularly in developing economies, and the inherent cost-effectiveness and efficiency benefits offered by flexible formats (lower material weight, reduced storage space, and minimized transportation fuel usage). Counterbalancing these drivers are significant restraints, primarily stemming from environmental concerns surrounding single-use plastics and the inherent difficulty in efficiently recycling complex, multi-layer flexible structures, leading to regulatory pressures and consumer backlash against certain plastic types.

Impact forces acting on the market include technological advancements in high-barrier films, the proliferation of specialized machinery for flexible packaging, and shifts in global commodity prices, particularly for polymers and aluminum foils. Political and regulatory forces, especially governmental bans or taxation schemes on non-recyclable plastic packaging, are exerting immense pressure on manufacturers to rapidly pivot their product portfolios towards bio-plastics and fiber-based alternatives. Socio-cultural forces, characterized by increasing consumer awareness regarding sustainable choices and a preference for transparency in product sourcing, are also compelling brands to adopt environmentally friendly packaging designs and clear labeling regarding recyclability or compostability claims.

Key opportunities abound in the development of truly circular flexible packaging solutions, including the commercialization of certified compostable films that perform comparably to traditional plastics and the widespread adoption of chemical recycling technologies capable of processing mixed plastic waste. Furthermore, the expansion of retort pouches for shelf-stable foods and vacuum packaging solutions for specialized meat and dairy products presents significant niche growth opportunities. Strategic expansion into regions with underdeveloped cold chain logistics infrastructure also requires innovative flexible solutions that provide extended ambient shelf life, thus capitalizing on market penetration in underserved geographic areas.

Segmentation Analysis

The Flexible Food and Beverage Packaging Market is highly fragmented and segmented based on material, type, application, and geography, allowing for precise market targeting and strategic analysis. Segmentation by material is crucial as it dictates the functional properties, cost structure, and sustainability profile of the final package. Polyethylene (PE) and Polypropylene (PP) films currently dominate due to their excellent barrier properties, seal strength, and cost-efficiency. Segmentation by type differentiates between stand-up pouches, flat pouches, wraps, bags, and others, with stand-up pouches demonstrating the highest growth due to consumer preference for convenience and brand visibility. The application segmentation covers virtually the entire food supply chain, from fresh produce and meat to beverages and confectionery, providing a comprehensive view of end-user needs.

- By Material:

- Plastic (Polyethylene (PE), Polypropylene (PP), Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polyamide (PA/Nylon))

- Paper & Paperboard

- Metal (Aluminum Foil)

- Cellulose

- By Type:

- Bags & Sacks

- Pouches (Stand-up, Flat, Retort)

- Films & Wraps (Stretch, Shrink, Barrier)

- Lids & Laminates

- By Application:

- Dairy Products

- Bakery & Confectionery

- Meat, Poultry, and Seafood

- Fruits and Vegetables

- Ready-to-Eat (RTE) Meals

- Snacks & Savory

- Beverages (Juices, Water, Alcoholic)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America

- Middle East & Africa (MEA)

Value Chain Analysis For Flexible Food and Beverage Packaging Market

The value chain of the Flexible Food and Beverage Packaging Market starts with upstream activities involving the sourcing and production of raw materials, primarily petrochemicals derived into resins (polymers), paper pulp, and aluminum ingots. Key upstream challenges include volatility in crude oil prices, which directly impacts polymer costs, and the need for high-purity, food-grade materials that meet stringent safety regulations. Suppliers in this segment focus heavily on process efficiency and establishing stable, long-term contracts with large packaging converters to mitigate market fluctuations. The quality and type of base resin determine the fundamental functional properties, such as oxygen transmission rate and moisture barrier, essential for food preservation.

Midstream processes involve converters who transform raw materials into final flexible formats through complex processes like extrusion, lamination, printing (flexography and rotogravure), and specialized converting (sealing, slitting, and pouch making). This stage is highly capital intensive and requires advanced machinery and sophisticated quality control measures. Distribution channels are varied, including direct sales to large multinational food and beverage corporations (direct channel), and sales through specialized packaging distributors who cater to small- and medium-sized enterprises (SMEs) (indirect channel). The trend toward integrated converters who manage both material production and final converting is intensifying, aiming for greater supply chain control and cost reduction.

Downstream analysis focuses on the end-users—the Food and Beverage manufacturers—who fill, seal, and prepare the products for market. Performance criteria at this stage are paramount, requiring packaging to interface seamlessly with high-speed automated filling lines. Post-consumption management, including recycling and waste collection infrastructure, represents the final critical link in the value chain, heavily influencing material selection at the upstream stage. Optimization across the entire chain, from resin pellet to consumer disposal, is required to meet the demands for both performance and environmental responsibility, making collaboration between raw material producers, converters, and CPG companies vital for innovation.

Flexible Food and Beverage Packaging Market Potential Customers

The primary potential customers and end-users of flexible food and beverage packaging are the global conglomerates and regional companies operating within the Consumer Packaged Goods (CPG) sector. These buyers prioritize high-volume supply, consistency in material quality, high-speed machine compatibility, and specialized barrier properties necessary for preserving product freshness and extending shelf stability. Major segments include multi-national food processors focused on frozen foods, ready meals, and highly perishable items like processed meats, requiring specialized vacuum and modified atmosphere packaging (MAP) solutions to maintain quality across complex global distribution networks.

A secondary, rapidly expanding customer base includes specialty food manufacturers, artisanal producers, and the burgeoning nutraceutical and supplement industries. These smaller enterprises often require customized, low-volume runs with advanced, high-definition digital printing capabilities to maximize brand differentiation and appeal to niche consumer segments. Their purchasing decisions are often driven by flexibility in order size, quick turnaround times, and access to sustainable, high-end film structures, often sourced through indirect distribution channels or specialized B2B e-commerce platforms focused on packaging supplies. The beverage sector, particularly non-carbonated drinks and high-growth energy shots, also relies heavily on flexible solutions like spouted pouches for convenience and portability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 195.5 Billion |

| Market Forecast in 2033 | USD 289.4 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Amcor Plc, Berry Global Group, Inc., Sealed Air Corporation, Mondi Group, Huhtamaki Oyj, Sonoco Products Company, Coveris Holdings S.A., Constantia Flexibles Group GmbH, ProAmpac LLC, TC Transcontinental Packaging, Uflex Ltd., Goglio SpA, Schur Flexibles Group, Smurfit Kappa Group Plc, WestRock Company, Glenroy Inc., Printpack Inc., Jindal Poly Films, RPC Group (now part of Berry Global), Winpak Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible Food and Beverage Packaging Market Key Technology Landscape

The technological landscape of the Flexible Food and Beverage Packaging Market is centered on enhancing material performance, improving sustainability metrics, and optimizing manufacturing efficiency. Key advancements include the development and widespread adoption of high-barrier coating technologies, such as Aluminum Oxide (ALOx) and Silicon Oxide (SiOx) deposition, which offer transparency while providing oxygen and moisture barrier properties comparable to aluminum foil. These coatings are crucial for preserving sensitive products and simultaneously facilitating easier recycling, as they eliminate the need for complex, non-recyclable metalized layers. The shift towards solvent-free lamination processes is also a critical technological evolution, reducing the use of harmful volatile organic compounds (VOCs) and improving both worker safety and the environmental profile of packaging converters, aligning with global regulatory trends.

Advanced printing technologies, specifically high-definition Flexography and Digital Printing, are driving market innovation in aesthetics and personalization. Digital printing allows for shorter production runs, rapid prototyping, and variable data printing, which is highly beneficial for targeted marketing campaigns and seasonal product variants, significantly reducing inventory and obsolescence risk for CPG companies. Furthermore, the development of sophisticated modified atmosphere packaging (MAP) films with tailored gas permeability rates ensures optimal preservation for specific perishable items like fresh-cut salads or red meats. These technological integrations allow packaging to transition from merely a protective shell to an active component in preserving product quality and extending economic viability.

A major focus remains on material innovation geared towards circularity. This includes the commercial scaling of bio-based polymers (e.g., PLA, PHA) derived from renewable resources, which offer a reduced carbon footprint, although challenges related to performance and end-of-life management persist. Crucially, the technology of mono-material flexible structures, designed to contain only one type of polymer (e.g., all PE or all PP), is being heavily pursued. This simplification is necessary to meet the demanding requirements of mechanical recycling facilities, ensuring that flexible packaging waste can be reliably processed and returned to the manufacturing loop, thereby closing the critical sustainability gap in the sector.

Regional Highlights

Regional dynamics play a significant role in shaping the demand, technology adoption, and regulatory environment of the Flexible Food and Beverage Packaging Market, with distinct growth drivers influencing each major geographical area. The market maturity and consumer behavior vary widely, leading to specialized requirements for packaging solutions across the globe. Understanding these regional nuances is essential for market players seeking strategic expansion and localization of their product offerings to maximize market penetration and ensure compliance with local standards.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, characterized by expansive populations, rapid urbanization, and a dramatic increase in disposable income, particularly in China, India, and Southeast Asian nations. The region’s growth is fueled by the strong demand for small-portion, convenient packaged foods and beverages suitable for busy urban lifestyles. While cost remains a significant factor, regulatory pressure is increasing in key countries like Japan and South Korea, pushing for innovation in sustainable and fully recyclable flexible options. The diverse logistical challenges across the region necessitate robust, high-barrier flexible solutions that can withstand varied temperature and humidity extremes.

- North America: The North American market is highly mature and innovation-driven, with a strong focus on premium, functional, and sustainable packaging. Consumer demand is tilting heavily toward resealable pouches, high-performance stand-up bags, and flexible formats integrated with smart technology for consumer engagement and traceability. Regulatory action, particularly concerning Extended Producer Responsibility (EPR) schemes, is forcing brand owners to prioritize mono-material and compostable options. The large presence of multinational CPG headquarters in the U.S. drives substantial investment in advanced converting technologies.

- Europe: Europe is characterized by the strictest environmental legislation, particularly the EU directives aimed at promoting a circular economy and reducing plastic waste. This regulatory environment acts as a massive catalyst for innovation in flexible paper-based packaging, bio-plastics, and chemical recycling infrastructure investment. The market shows strong demand for high-quality, lightweight packaging for dairy, baked goods, and prepared meals. Sustainability compliance is a non-negotiable factor for market entry and dominance across Western European countries, leading to widespread adoption of certified sustainable packaging materials.

- Latin America (LATAM): Growth in LATAM is strong, driven by economic recovery and expanding modern retail chains, replacing traditional market formats. Flexible packaging, particularly films and pouches, is favored for its cost-efficiency and ability to protect food during distribution across large, often challenging geographical areas. Brazil and Mexico are the key growth engines, showing increasing consumer acceptance of packaged processed goods, although infrastructure gaps often necessitate robust, protective packaging structures.

- Middle East & Africa (MEA): This region is experiencing high demand due to population growth and increasing reliance on imported and processed foods, especially in the GCC countries and South Africa. Flexible packaging is vital for ensuring long shelf life in hot climates, prioritizing high-barrier and temperature-resistant films for both domestic consumption and export. Investment in local packaging manufacturing capacity is increasing, reducing dependency on imports and further driving regional market expansion across diverse product categories.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Food and Beverage Packaging Market.- Amcor Plc

- Berry Global Group, Inc.

- Sealed Air Corporation

- Mondi Group

- Huhtamaki Oyj

- Sonoco Products Company

- Coveris Holdings S.A.

- Constantia Flexibles Group GmbH

- ProAmpac LLC

- TC Transcontinental Packaging

- Uflex Ltd.

- Goglio SpA

- Schur Flexibles Group

- Smurfit Kappa Group Plc

- WestRock Company

- Glenroy Inc.

- Printpack Inc.

- Jindal Poly Films

- Winpak Ltd.

- AptarGroup, Inc.

Frequently Asked Questions

Analyze common user questions about the Flexible Food and Beverage Packaging market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from rigid to flexible food and beverage packaging?

The primary drivers are cost savings due to reduced material usage and lighter transportation weight, enhanced consumer convenience features like resealability and easy opening, and the increasing demand for sustainable, lower-footprint packaging solutions. Flexible formats offer superior material-to-product ratio efficiency.

How are environmental regulations impacting material innovation in flexible packaging?

Regulations, particularly in Europe, are forcing manufacturers to abandon non-recyclable multi-layer films and invest heavily in mono-material structures (e.g., all-PE or all-PP), bio-based polymers, and compostable films to ensure alignment with mandated recycling rates and Extended Producer Responsibility (EPR) schemes.

Which type of flexible packaging is experiencing the fastest growth rate?

Stand-up pouches (SUPs) are demonstrating the fastest growth due to their high visibility on retail shelves, excellent graphic potential, structural stability, and superior functionality for consumers, making them popular across snacks, beverages, and pet food categories.

What role does barrier technology play in extending the shelf life of flexible packaged goods?

Barrier technology involves using specialized materials or coatings (like ALOx or EVOH) to prevent the ingress of oxygen, moisture, and UV light, which cause spoilage. High-barrier films are critical for extending the ambient or chilled shelf life of perishable foods, crucial for global distribution networks.

What are the key technological challenges facing the recycling of flexible packaging?

The main challenges include the difficulty in separating and sorting various mixed polymers found in complex laminates, high contamination rates in collection streams, and the limited infrastructure for mechanically processing thin films compared to rigid plastics. Chemical recycling is emerging as a potential solution to address these complexity issues.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager