Flexible Graphite Sheet Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435058 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Flexible Graphite Sheet Market Size

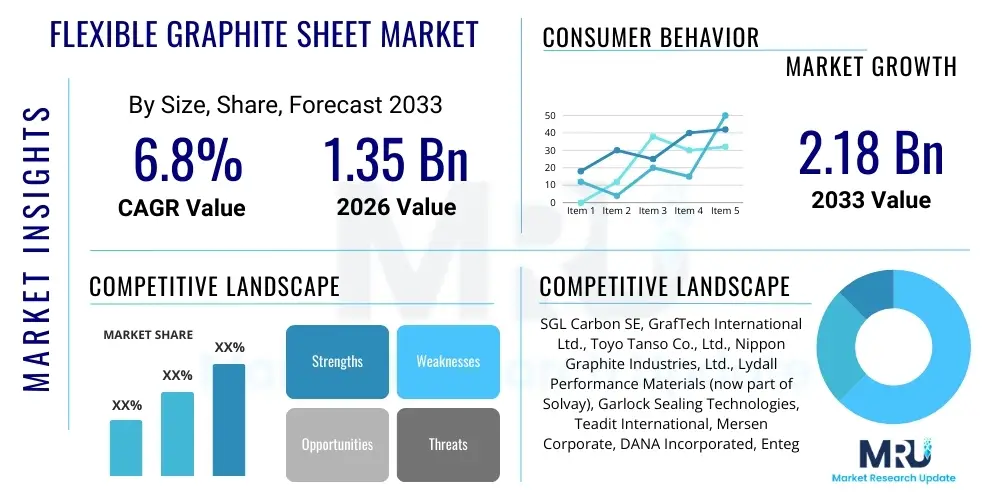

The Flexible Graphite Sheet Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 1.35 Billion in 2026 and is projected to reach USD 2.18 Billion by the end of the forecast period in 2033.

Flexible Graphite Sheet Market introduction

The Flexible Graphite Sheet Market encompasses the manufacturing and distribution of thin layers of highly graphitized carbon materials, characterized by exceptional thermal stability, chemical resistance, and high electrical conductivity. These sheets are derived from expanded natural flake graphite and are processed without the use of binders, maintaining a high level of purity and anisotropy. Their inherent flexibility allows them to be cut, pressed, or laminated into various forms, making them highly desirable for demanding sealing and thermal management applications across multiple industries.

Key products within this market include graphite foils, laminated sheets, reinforced graphite sheets, and die-formed rings. These materials are primarily utilized in gaskets and sealing applications for petrochemical, chemical processing, and power generation industries due to their ability to withstand extreme temperatures and corrosive environments. Furthermore, flexible graphite sheets are increasingly critical in thermal interface materials (TIMs) for consumer electronics and electric vehicle (EV) battery packs, where efficient heat dissipation is essential for performance and safety.

The primary driving factors propelling market expansion include the stringent regulations favoring high-performance, durable sealing solutions in critical industrial infrastructure and the accelerating adoption of electric vehicles, which require advanced, lightweight thermal management solutions. The superior properties of flexible graphite, such as resistance to harsh chemicals and fire safety compliance, position it as a preferred material over traditional asbestos or conventional polymer composites, thereby ensuring sustained growth across specialized industrial and high-tech sectors globally.

Flexible Graphite Sheet Market Executive Summary

The Flexible Graphite Sheet Market is currently experiencing robust growth, driven primarily by the global transition towards sustainable energy and increasing industrial safety standards. Business trends indicate a significant shift towards thinner and higher-density flexible graphite materials, optimizing performance in compact electronic devices and high-temperature seals. Manufacturers are focusing on developing reinforced composite sheets, often incorporating metal inserts or specialized polymer backings, to enhance mechanical strength and handle higher sealing pressures, thereby broadening application scope in oil and gas and aerospace sectors. Strategic partnerships aimed at securing raw graphite supply chains and optimizing expansion processes are central to maintaining competitive advantage in this specialized materials market.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, fueled by rapid industrialization, extensive expansion in chemical and power generation capacity, and the region’s status as a global hub for electronics and electric vehicle manufacturing. North America and Europe maintain strong demand, particularly in stringent, high-value applications such as nuclear power, aerospace, and high-performance automotive segments, necessitating compliance with strict regulatory frameworks regarding emissions and safety. Investment in localized production facilities within these regions is increasing to mitigate supply chain vulnerabilities and meet specific regional material specifications.

Segmentation trends reveal that the industrial sealing segment (gaskets and packings) remains the largest application area due to the essential nature of flexible graphite in maintaining operational integrity under extreme conditions. However, the thermal management segment is exhibiting the highest Compound Annual Growth Rate (CAGR), predominantly driven by the surging production of advanced consumer electronics, data centers, and the exponential growth of the Electric Vehicle (EV) industry. Product-wise, high-purity, thin graphite foils are witnessing increased demand for applications requiring maximum thermal conductivity and minimum weight, reflecting a continuous innovation cycle focused on performance enhancement and miniaturization.

AI Impact Analysis on Flexible Graphite Sheet Market

User inquiries regarding the intersection of Artificial Intelligence (AI) and the Flexible Graphite Sheet market frequently revolve around process optimization, material discovery, and supply chain resilience. Key concerns users articulate include how AI can enhance the quality control during the graphite expansion and calendering processes, thereby reducing defects and material waste. Expectations are high regarding AI's potential to simulate and predict the performance of novel graphite composites under extreme temperature and pressure conditions, speeding up the R&D cycle for specialized sealing and thermal materials. Furthermore, users often seek information on AI's role in optimizing global procurement strategies for raw graphite flake, addressing volatility and geopolitical risks associated with key sourcing regions.

The core theme emerging from user questions is the shift from traditional empirical methods to data-driven decision-making in materials science. Companies are expected to leverage machine learning (ML) algorithms to analyze massive datasets related to manufacturing parameters—such as expansion temperature, pressure, and binder concentrations (when applicable)—to achieve unparalleled consistency in sheet density and surface finish. AI models are also anticipated to forecast demand fluctuations in key end-use industries like EVs and semiconductors, enabling manufacturers to optimize production schedules and manage inventory more effectively, thus increasing operational efficiency and reducing costs across the value chain. This integration promises a higher degree of material customization and performance predictability.

- AI optimization of raw material sourcing and pricing forecasts to mitigate geopolitical supply chain risks.

- Machine learning models for predicting optimal expansion parameters, enhancing graphite sheet purity and density consistency.

- Accelerated R&D through AI simulations of thermal and mechanical performance in complex sealing geometries.

- Automated visual inspection systems (computer vision) for real-time quality control during lamination and slitting processes.

- Predictive maintenance analytics for manufacturing equipment, minimizing downtime and increasing plant utilization rates.

DRO & Impact Forces Of Flexible Graphite Sheet Market

The Flexible Graphite Sheet Market is significantly shaped by a dynamic interplay of Drivers, Restraints, and Opportunities (DRO), collectively constituting the market's Impact Forces. Key drivers include stringent global environmental regulations, particularly those governing fugitive emissions in the oil & gas and chemical sectors, which mandate the use of zero-leakage, high-integrity sealing materials like flexible graphite. Concurrently, the exponential growth in Electric Vehicle (EV) production acts as a powerful driver, as flexible graphite is indispensable for thermal management within battery packs and high-power electronics, optimizing cooling efficiency and battery lifespan. These powerful market forces create consistent, non-cyclical demand for specialized graphite products, underpinning the overall market expansion trajectory.

Restraints primarily revolve around the volatility and concentration risk associated with the supply of natural graphite flake, the primary raw material. Geopolitical tensions and high dependency on specific mining regions can lead to sharp price fluctuations, impacting manufacturing margins and potentially increasing end-product costs. Furthermore, while highly efficient, flexible graphite sometimes faces competition from advanced synthetic materials or specialized elastomers in certain lower-temperature or less-demanding applications, requiring continuous innovation to justify the material's premium price point. Managing cost efficiency against raw material scarcity remains a critical challenge for market participants.

Opportunities for growth are predominantly centered around emerging high-tech applications. The proliferation of 5G infrastructure, advanced computing, and hyperscale data centers necessitates superior thermal interface materials, opening vast avenues for thin graphite films. Moreover, the long-term trend towards hydrogen energy and large-scale renewable energy storage systems (e.g., flow batteries) presents lucrative opportunities, as flexible graphite components are essential for corrosion resistance and current collection within fuel cells and energy storage devices. Successfully capitalizing on these novel applications through targeted product development will be key to unlocking significant future market potential and establishing technological leadership.

Segmentation Analysis

The Flexible Graphite Sheet market is segmented based on the critical parameters of product type, reinforcement material, application, and end-use industry, providing a granular view of market dynamics and specialized demand areas. The product segmentation differentiates between pure graphite foils, which are ideal for high-thermal applications, and laminated sheets, which offer enhanced mechanical strength and handle higher sealing pressures. Understanding these segment dynamics is crucial for manufacturers to tailor production capabilities and for consumers to select the optimal material for their specific thermal or sealing requirements, ensuring both performance efficacy and cost effectiveness in deployment.

- By Product Type:

- Graphite Foil (Pure Flexible Graphite)

- Graphite Laminates (Reinforced Sheets)

- Graphite Composite (Die-formed Rings, Expanded Graphite Powder)

- By Reinforcement Material:

- Metal Inserts (Stainless Steel, Nickel)

- Polymer Films (PET, PTFE)

- Fiberglass or Ceramic Fiber

- By Application:

- Sealing (Gaskets, Packing, Valve Stem Seals)

- Thermal Management (Heat Sinks, Thermal Interface Materials, Heat Spreaders)

- Current Collection & Electrode Materials (Fuel Cells, Batteries)

- By End-Use Industry:

- Chemical and Petrochemical Processing

- Power Generation (Nuclear, Fossil Fuel, Renewables)

- Automotive and Transportation (Electric Vehicles, Internal Combustion Engines)

- Electronics and Semiconductors

- Aerospace and Defense

Value Chain Analysis For Flexible Graphite Sheet Market

The value chain for the Flexible Graphite Sheet Market commences with the upstream sourcing and processing of raw natural flake graphite, where miners extract and purify the material. This stage is critical as the quality and grade of the raw flake graphite directly influence the final properties of the flexible sheet. Following mining, the flakes undergo chemical intercalation and high-temperature expansion, transforming them into expanded graphite. Efficiency in this expansion process is vital for maximizing yield and achieving the desired volume expansion ratio, which determines the material's density and compressibility, ultimately impacting the final product's sealing effectiveness.

The midstream focuses on manufacturing and conversion, where expanded graphite is calendered into flexible foil sheets. Further processing involves lamination, often with metal inserts (like stainless steel mesh or foil) or polymer films, to create reinforced composite sheets designed for high-pressure industrial applications. Distribution channels then play a crucial role in delivering these specialized materials. Direct distribution is common for large industrial end-users (e.g., major chemical plants, automotive OEMs) who require customized specifications and technical support, ensuring tight integration between the manufacturer and the end-application engineering team.

Indirect distribution involves specialized distributors and fabricators who cut, stamp, or mold the sheets into final products such as gaskets, heat sinks, or valve packings before supplying them to diverse End-Use Industries. This downstream activity ensures materials are readily available in the required formats and volumes across diverse geographical locations, serving both Maintenance, Repair, and Operations (MRO) markets and Original Equipment Manufacturers (OEMs). The proximity and technical capabilities of these fabricators are key competitive factors, ensuring rapid response and application-specific product delivery to critical sectors like electronics and power generation.

Flexible Graphite Sheet Market Potential Customers

Potential customers for flexible graphite sheets span a broad spectrum of highly regulated and performance-driven industries where thermal stability, sealing integrity, and chemical resistance are paramount. In the industrial sector, major chemical and petrochemical complexes, oil refineries, and large-scale power generation facilities (including nuclear and conventional thermal plants) are primary buyers. These entities utilize flexible graphite extensively in critical static sealing applications, such as flange gaskets, valve packings, and heat exchanger seals, demanding materials that adhere to stringent safety and environmental emission standards, particularly regarding volatile organic compounds (VOCs).

Another rapidly expanding customer base is the automotive and electric vehicle (EV) sector. EV manufacturers rely on flexible graphite sheets as essential thermal interface materials (TIMs) to manage the intense heat generated by high-density battery cells and power electronics, crucial for extending battery life and ensuring vehicle safety. Additionally, the electronics industry, encompassing manufacturers of high-performance smartphones, servers, data centers, and 5G base stations, procures thin graphite foils as heat spreaders and heat sinks, essential for thermal management in miniaturized, high-power computing devices, thereby maintaining operational performance and preventing overheating issues.

The market also serves specialized, high-specification customers in the aerospace and defense industries, where lightweight, fire-resistant, and high-temperature sealing and shielding materials are non-negotiable for engine components and structural integrity. Furthermore, emerging energy sectors, specifically hydrogen fuel cell developers and battery storage system integrators, represent significant growth opportunities, as flexible graphite serves as a core material for bipolar plates in proton exchange membrane (PEM) fuel cells and as current collectors in certain advanced battery architectures due to its high electrical conductivity and corrosion resistance.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.35 Billion |

| Market Forecast in 2033 | USD 2.18 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | SGL Carbon SE, GrafTech International Ltd., Toyo Tanso Co., Ltd., Nippon Graphite Industries, Ltd., Lydall Performance Materials (now part of Solvay), Garlock Sealing Technologies, Teadit International, Mersen Corporate, DANA Incorporated, Entegris, Inc., Schunk Group, Superior Graphite, Beihai Power Material Co., Ltd., Guilin Hualian Carbon Co., Ltd., Morgan Advanced Materials, Zibo Kailong Chemical Co., Ltd., Trelleborg AB, UCAR Carbon. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible Graphite Sheet Market Key Technology Landscape

The core technology underpinning the Flexible Graphite Sheet Market remains the chemical intercalation and thermal expansion process of natural flake graphite, but contemporary advancements focus heavily on refining the calendering and reinforcement techniques. Key technological progress involves ultra-high-pressure calendering processes designed to achieve extremely high-density graphite foils (up to 1.6 g/cc), which significantly enhances thermal conductivity and mechanical strength, making these materials suitable for demanding aerospace and high-end semiconductor thermal applications. Innovation in surface treatment technologies, such as plasma etching or coating, is also becoming critical to improve adherence to metal substrates and prevent chemical leaching in aggressive environments.

Another vital area of technological focus is the development of advanced composite structures. This involves integrating flexible graphite with novel reinforcement materials beyond traditional stainless steel. Research is concentrated on incorporating high-performance, non-metallic materials, such as carbon fiber veil or advanced synthetic polymers like PEEK, to create lighter, stronger, and more resilient sheets optimized for low-pressure sealing environments in automotive applications or for use in fuel cell stacks where metallic contamination must be strictly avoided. These composite technologies allow graphite sheets to handle cyclical loading and vibration more effectively, extending service life.

Furthermore, technology related to miniaturization and precision fabrication is rapidly advancing, driven by the electronics market demand. Laser cutting and intricate stamping techniques are utilized to produce complex, highly precise geometries required for modern heat spreaders and Thermal Interface Materials (TIMs). Manufacturers are also exploring continuous processing methods to reduce batch variation and increase throughput, incorporating sophisticated in-line sensors and analytical tools (often leveraging AI/ML) to monitor and adjust density, thickness uniformity, and purity in real-time, thereby ensuring consistent quality and maximizing material utilization efficiency throughout the production line.

Regional Highlights

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, primarily driven by China, Japan, and South Korea. This dominance is attributed to robust manufacturing sectors, especially in consumer electronics, battery production for EVs, and massive infrastructure projects in chemical and power generation industries. Government initiatives supporting new energy vehicles and large-scale industrial modernization projects continue to fuel unprecedented demand for high-performance sealing and thermal management solutions.

- North America: North America holds a significant share, characterized by high-value applications in the aerospace, defense, and oil & gas sectors. Stringent environmental regulations, particularly regarding methane emissions, mandate the use of high-integrity, flexible graphite sealing materials, ensuring persistent demand. The strong presence of major automotive OEMs and technology firms also drives the adoption of advanced graphite products for EV thermal management and high-performance computing cooling solutions.

- Europe: The European market is mature and highly innovation-focused, propelled by strict EU environmental and industrial safety standards (e.g., TA-Luft requirements for fugitive emissions). Germany and the UK are key contributors, driven by the presence of specialized chemical manufacturing, high-end engineering, and a strong commitment to renewable energy and hydrogen technology development, where flexible graphite is crucial for fuel cell components and energy storage sealing.

- Latin America (LATAM): Growth in LATAM is more moderate but steady, tied primarily to investments in the oil and gas exploration, refining, and mining sectors, particularly in Brazil and Mexico. The demand is concentrated on heavy industrial sealing applications where durability and resistance to harsh processing chemicals are necessary for maintaining operational longevity and safety standards in aging infrastructure.

- Middle East and Africa (MEA): The MEA region's demand is overwhelmingly dominated by the massive oil, gas, and petrochemical industries located primarily in the GCC nations. Flexible graphite is a critical MRO and OEM material used for maintaining seals and integrity in high-temperature, high-pressure environments characteristic of hydrocarbon processing plants, ensuring safety and compliance within strategic energy infrastructure.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Graphite Sheet Market.- SGL Carbon SE

- GrafTech International Ltd.

- Toyo Tanso Co., Ltd.

- Nippon Graphite Industries, Ltd.

- Mersen Corporate

- Lydall Performance Materials (now part of Solvay)

- Garlock Sealing Technologies

- Teadit International

- DANA Incorporated

- Entegris, Inc.

- Schunk Group

- Superior Graphite

- Beihai Power Material Co., Ltd.

- Guilin Hualian Carbon Co., Ltd.

- Morgan Advanced Materials

- Zibo Kailong Chemical Co., Ltd.

- Trelleborg AB

- UCAR Carbon

- Imerys Graphite & Carbon

- Showa Denko K.K.

Frequently Asked Questions

Analyze common user questions about the Flexible Graphite Sheet market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of flexible graphite sheets over traditional asbestos or elastomer gaskets?

Flexible graphite offers superior chemical inertness, enabling resistance to almost all corrosive media except strong oxidizing agents, along with an exceptionally wide operating temperature range (up to 3000°C in non-oxidizing environments), higher thermal conductivity, and excellent compressibility and resilience, ensuring a superior, long-lasting seal, especially in high-temperature industrial processes.

How is the demand for flexible graphite sheets linked to the growth of the Electric Vehicle (EV) industry?

EV growth is a major driver, primarily because flexible graphite sheets are critical components for thermal management within battery packs. They function as high-efficiency heat spreaders or thermal interface materials (TIMs), dissipating heat away from individual cells and power electronics to ensure optimal battery performance, prevent thermal runaway, and extend the lifespan of the vehicle's propulsion system.

Which regions currently dominate the consumption of flexible graphite sheets, and what factors contribute to this dominance?

The Asia Pacific (APAC) region, led by China, dominates consumption due to its status as the global manufacturing hub for electronics and EVs, coupled with rapid expansion in chemical processing and power generation infrastructure. This high volume of industrial and high-tech manufacturing creates massive, sustained demand for both sealing and advanced thermal management products.

What are the main types of reinforcement materials used in flexible graphite laminates to enhance performance?

The main reinforcement materials include thin metallic inserts, typically 316 or 304 stainless steel foils or tangs, which significantly increase the mechanical strength, handle higher sealing pressures, and prevent blow-out. Non-metallic reinforcements like fiberglass or specialized polymer films (e.g., PTFE or PET) are used to enhance handling, reduce creep, and improve chemical compatibility in specific applications.

What are the biggest challenges faced by manufacturers in the Flexible Graphite Sheet Market?

The primary challenge is the consistent volatility in the global supply and pricing of high-quality natural graphite flake, which is essential for manufacturing. Geopolitical factors and reliance on concentrated mining sources create supply risks and necessitate robust inventory and procurement strategies to maintain cost competitiveness and production stability.

The following detailed analysis provides further context on market dynamics and strategic considerations for stakeholders operating within the Flexible Graphite Sheet Market. The complexity of material specifications across industries—ranging from ultra-thin films for consumer electronics to robust, reinforced gaskets for high-pressure valves—requires manufacturers to maintain diverse product portfolios and specialized fabrication capabilities. This necessity drives ongoing investment in both process technology and quality control, ensuring compliance with stringent international standards such as ISO and API specifications for industrial sealing performance.

In the chemical and petrochemical sectors, the shift towards processing increasingly aggressive and complex feedstocks, often under elevated pressure and temperature conditions, solidifies flexible graphite's position as the material of choice. Its non-aging properties and resistance to thermal cycling significantly reduce maintenance frequency and operational downtime, offering substantial long-term cost savings compared to materials requiring frequent replacement. Market growth is further bolstered by the replacement cycle in aging industrial infrastructure globally, where old asbestos-based seals are phased out in favor of safer, high-performance graphite solutions.

Looking ahead, the convergence of flexible graphite technology with micro-manufacturing techniques represents a key innovation frontier. The ability to create ultra-thin, customizable graphite thermal films suitable for flexible and wearable electronics opens up entirely new market segments beyond traditional industrial applications. Companies investing in advanced coating and encapsulation technologies to enhance graphite's oxidation resistance at elevated temperatures are poised to capture market share in high-efficiency, next-generation engines and extreme-environment aerospace components, maintaining high demand for technologically sophisticated products.

The sustainability angle is also increasingly impactful. As graphite is a highly durable and long-lasting material, and certain grades can be manufactured without environmentally harsh binders, it aligns well with corporate sustainability mandates. This 'green' attribute, combined with its role in enabling cleaner technologies like EVs and fuel cells, makes flexible graphite sheets a strategically important material for companies aiming to meet both performance goals and environmental, social, and governance (ESG) targets. Manufacturers are actively pursuing certifications to highlight the environmental benefits and superior lifespan of their graphite products.

The value chain risk assessment indicates that managing the cost of energy required for the thermal expansion process is a crucial operational challenge, particularly in regions with high industrial electricity rates. Manufacturers are increasingly adopting energy-efficient expansion technologies and optimizing thermal recovery processes to minimize utility costs and maintain competitive pricing. This focus on operational efficiency complements the efforts to secure stable, long-term supply contracts for raw flake graphite, often involving strategic investments in graphite mining ventures or long-term partnerships with purification specialists to ensure material quality and supply predictability throughout the forecast period.

The impact of digitalization, extending beyond AI applications, involves implementing robust IoT (Internet of Things) solutions across manufacturing plants. Real-time data collection on calendering pressure, temperature profiles, and material thickness allows for predictive quality control and dynamic process adjustments. This level of granular control is essential for producing the highly consistent, defect-free sheets required by semiconductor and high-end automotive customers, where material failure tolerance is virtually zero, reinforcing the need for continuous technological upgrading and automation in production facilities.

In conclusion, the Flexible Graphite Sheet Market is characterized by high technological barriers to entry and sustained demand driven by non-discretionary industrial needs and revolutionary thermal management requirements in new energy sectors. Strategic growth will be achieved by focusing on high-density, reinforced composite materials tailored for extreme conditions and by aggressively pursuing opportunities in the EV and green energy segments, while simultaneously mitigating risks associated with raw material sourcing and volatile energy costs through operational and supply chain optimization.

The segmentation analysis further reveals that the thermal management segment, while currently smaller than industrial sealing, is undergoing a rapid evolution. The demand here is not simply for bulk heat dissipation but for highly precise, ultra-thin heat spreaders that can be integrated seamlessly into compact product designs. This sub-segment requires specialized R&D capabilities, often involving collaborative development with electronic component manufacturers to meet specific thermal resistance and dimensional tolerances. Investment in these specialized manufacturing lines offers higher margins and reduced exposure to the cyclicality of heavy industry.

Geographically, while APAC dictates volume, technological leadership often originates from North America and Europe, particularly in areas like nuclear-grade graphite or aerospace-certified materials. These regional differences underscore the need for a bifurcated market strategy: focusing on volume and cost leadership in APAC, while maintaining premium, high-specification technical sales and engineering support in the mature Western markets, ensuring revenue stability across varied economic cycles and regulatory environments.

The competitive landscape is dominated by a few integrated global players who possess control over the expansion technology and have established long-term supply agreements. New entrants typically focus on niche applications or specialized fabrication services. Mergers and acquisitions are common strategies for established players looking to quickly integrate advanced reinforcement technologies or gain immediate access to specialized end-user markets, such as high-temperature gasket fabrication expertise or battery component supply chains, consolidating market power and intellectual property.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager