Flexible PV Cell Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433191 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Flexible PV Cell Market Size

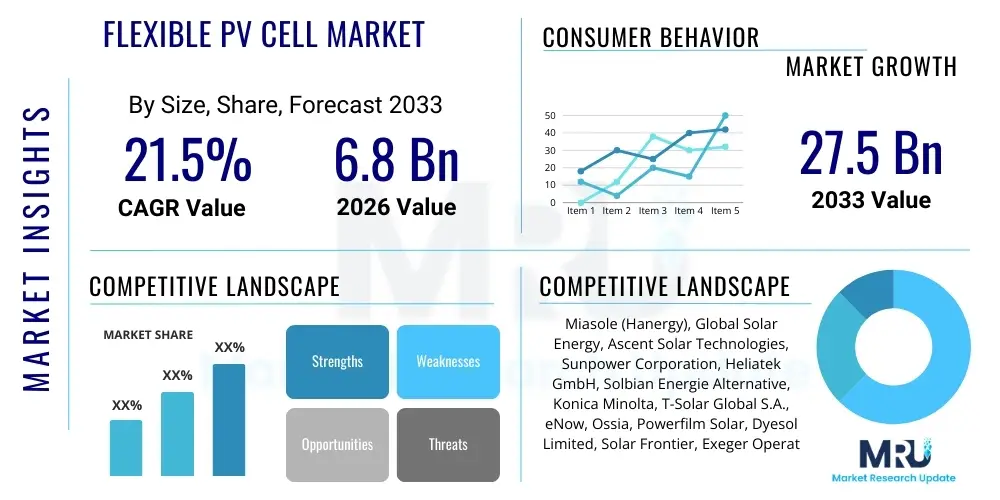

The Flexible PV Cell Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% between 2026 and 2033. The market is estimated at $6.8 Billion in 2026 and is projected to reach $27.5 Billion by the end of the forecast period in 2033.

Flexible PV Cell Market introduction

The Flexible Photovoltaic (PV) Cell Market encompasses solar cells fabricated on flexible substrates, such as polymer films, metal foils, or lightweight glass, allowing them to be bent, rolled, or conform to curved surfaces. Unlike traditional rigid silicon panels, flexible PV cells utilize various thin-film technologies, including amorphous silicon (a-Si), Copper Indium Gallium Selenide (CIGS), Cadmium Telluride (CdTe), and organic photovoltaics (OPV) or perovskite solar cells. This innovation addresses significant limitations of conventional solar technology, offering advantages in weight, portability, ease of integration, and architectural aesthetics. Flexible PV technology is characterized by its high power-to-weight ratio, making it ideal for applications where weight and profile are critical considerations.

Major applications driving market adoption include Building Integrated Photovoltaics (BIPV), portable power solutions for military and consumer electronics, aerospace components (satellites and drones), and transportation sectors such as automotive roofs and electric vehicles (EVs). The demand is significantly fueled by global decarbonization mandates and the continuous pursuit of renewable energy sources that can be deployed rapidly and efficiently in diverse environments. The inherent lightweight and durability features of flexible PV cells ensure reduced installation costs and logistical complexity, particularly in remote or challenging terrains. Furthermore, the aesthetic advantage allows for seamless integration into existing infrastructure without compromising design integrity.

Key driving factors for market expansion include advancements in material science, specifically in developing stable and highly efficient perovskite structures suitable for flexible substrates, coupled with increasing government incentives supporting decentralized power generation. Benefits derived from utilizing flexible PV cells include enhanced energy independence for portable devices, superior aesthetic qualities compared to bulky traditional panels, resilience against micro-cracking due to substrate flexibility, and a lower environmental footprint during manufacturing (especially for organic and thin-film solutions). These combined technological and market advantages position flexible PV cells as a transformative technology within the renewable energy landscape.

Flexible PV Cell Market Executive Summary

The Flexible PV Cell Market is undergoing rapid commercial maturation, transitioning from specialized niche applications (like military and space) to mass-market integration, primarily in BIPV and consumer electronics. Key business trends indicate significant investment in roll-to-roll manufacturing processes, which dramatically reduce production costs and enable large-scale output, positioning thin-film technologies (CIGS and perovskites) as major contenders against traditional silicon. Strategic partnerships between PV manufacturers and construction/automotive companies are accelerating deployment and standardization. The market exhibits robust competition focused on improving power conversion efficiency (PCE) and enhancing the long-term stability and lifespan of flexible materials, which remain critical barriers to widespread adoption. Furthermore, the rise of custom-sized and aesthetically pleasing PV cells is opening new high-margin opportunities in bespoke architectural projects and urban energy solutions.

Regionally, Asia Pacific (APAC) dominates the market, largely driven by massive government renewable energy targets in China, India, and Japan, coupled with robust manufacturing infrastructure and lower production costs. North America and Europe are exhibiting strong growth in high-value segments, specifically BIPV and flexible electronics, supported by favorable regulatory environments promoting Net Zero energy buildings and increased consumer spending on high-tech portable energy solutions. Developing regions, particularly Latin America and the Middle East, are emerging as significant opportunity hubs for decentralized power generation where traditional grid infrastructure is lacking or unstable, making lightweight, rapidly deployable flexible PV solutions highly attractive. European markets are particularly focused on sustainable and circular economy principles, favoring flexible PV technologies with lower embedded energy and easier end-of-life recycling potential.

Segment-wise, thin-film technologies, particularly CIGS and a-Si, currently hold substantial market share due to established manufacturing reliability, although emerging perovskite PV cells are expected to experience the highest growth rate due to their exceptional efficiency potential and low material usage. Application-wise, BIPV remains the largest revenue generator, driven by mandates for energy-efficient construction, while portable electronics and specialized off-grid applications represent the fastest-growing segments. The transportation segment, encompassing integrated solar roofs for EVs and commercial vehicles, is gaining momentum as manufacturers seek to increase vehicle range and reduce charging reliance. This dynamic segmentation underscores a market moving towards specialization, where the flexibility attribute is leveraged to solve diverse and specific energy needs across multiple industries.

AI Impact Analysis on Flexible PV Cell Market

User queries regarding AI's influence in the Flexible PV Cell Market frequently center on three critical areas: material discovery, manufacturing efficiency, and predictive maintenance. Users are concerned with how AI can rapidly screen novel flexible solar materials (like stable perovskite compounds) to accelerate R&D cycles, which typically involve long experimental periods. Another major theme is the optimization of complex, high-throughput manufacturing processes, such as roll-to-roll deposition, where slight variations can impact cell performance and yield. Consumers and industry stakeholders also inquire about using AI-driven analytics to monitor large-scale flexible solar installations (e.g., solar farms or BIPV arrays) for early fault detection and performance degradation prediction, ensuring maximum energy harvest and extending product lifespan. AI is generally expected to be a game-changer by reducing time-to-market for next-generation flexible cells and significantly improving operational reliability in deployment.

- AI-driven material informatics accelerates the discovery and optimization of novel flexible compounds, such as enhancing perovskite stability and efficiency under stress.

- Machine learning algorithms optimize deposition techniques (e.g., sputtering, printing) in roll-to-roll manufacturing, improving uniformity and reducing material waste, thereby boosting yield rates.

- Predictive modeling uses sensor data to forecast the lifespan and performance degradation of flexible PV modules, enabling proactive maintenance scheduling and warranty adjustments.

- Computer vision systems, integrated into the production line, perform high-speed quality control checks, identifying microscopic defects in flexible substrates far faster than manual inspection.

- AI supports the optimal design and placement of flexible solar installations on complex curved surfaces (e.g., vehicle bodies or specialized architecture), maximizing insolation capture.

- Development of smart inventory and supply chain management specifically tailored for the highly sensitive precursor materials used in thin-film flexible PV manufacturing.

- Natural Language Processing (NLP) aids in synthesizing vast amounts of academic and industrial data on flexible solar research, identifying trends and potential breakthroughs.

DRO & Impact Forces Of Flexible PV Cell Market

The Flexible PV Cell Market is defined by a strong interplay of innovation and market acceptance challenges. Key drivers include the mandatory shift towards lightweight, portable energy solutions, particularly in consumer electronics and mobility sectors, coupled with increasing governmental support for decentralized renewable energy generation projects globally. However, the market faces significant restraints, primarily centered around the lower conversion efficiency of many flexible technologies compared to conventional silicon and persistent concerns regarding the long-term stability and moisture sensitivity of newer materials like perovskites and some CIGS formulations when deployed in harsh environments. These restraints necessitate substantial R&D investment to bridge the performance and durability gap before mass adoption can be fully realized.

Opportunities for growth are vast, particularly in emerging applications such as Internet of Things (IoT) devices, wearable technology requiring power sources seamlessly integrated into fabrics, and the massive untapped potential of BIPV integration into non-traditional structures (e.g., curved glass facades and membrane roofs). The continuous reduction in manufacturing costs associated with high-throughput roll-to-roll processing presents a key opportunity to achieve cost parity with traditional PV. Impact forces primarily revolve around the speed of technological evolution; if perovskite solar cells achieve commercial-grade stability, they will revolutionize the market by offering high efficiency at a low cost, potentially disrupting the established thin-film and crystalline silicon markets. Conversely, volatile raw material prices for materials like indium or tellurium, and the complexity of recycling multi-material flexible cells, exert downward pressure on profitability and sustainability claims.

Technological breakthroughs in encapsulation and barrier materials are critical impact forces determining future market growth, addressing the vulnerability of flexible PV to environmental degradation. Market penetration is also heavily influenced by regulatory standards related to building codes and vehicle integration; stringent certifications require flexible cells to demonstrate comparable lifetimes and safety standards to rigid panels. The current competitive landscape is forcing established players to invest in next-generation flexible technologies, while numerous start-ups specializing in printed electronics and novel materials introduce intense price competition and rapid innovation cycles. Ultimately, the ability of manufacturers to scale production of highly efficient, durable, and cost-effective flexible cells will dictate the market trajectory and competitive success over the forecast period.

Segmentation Analysis

The Flexible PV Cell Market is extensively segmented based on the technologies used, the materials employed for the active layer, the end-user application areas, and the geographic regions of deployment. This detailed segmentation allows stakeholders to target specific niches where the unique advantages of flexible solar—such as low weight and conformability—provide maximum value. Technology segmentation distinguishes between established thin-film methods (a-Si, CIGS, CdTe) and nascent, high-potential technologies (Perovskite and Organic PV), highlighting the varying levels of maturity, cost structure, and efficiency performance. Application segments categorize usage from large-scale power generation (BIPV) to highly specialized, low-power uses (wearables and sensors), reflecting the wide spectrum of functional requirements placed on the technology.

Material segmentation is crucial, as the choice of substrate (polymer, metal foil, or thin glass) dictates the flexibility, durability, and maximum processing temperature of the cell, directly impacting its suitability for various manufacturing techniques like roll-to-roll printing versus vacuum deposition. Furthermore, end-user categorization provides insight into the primary market drivers; the construction sector values integration and aesthetics, while the military and aerospace sectors prioritize high power-to-weight ratios and resilience. The ongoing trend is towards developing standardized, highly efficient flexible modules that can serve multiple high-volume application segments while maintaining the integrity required for long operational lifetimes.

Geographic analysis reveals pronounced differences in adoption rates, regulatory support, and manufacturing dominance. APAC leads due to heavy investment in solar manufacturing capacity, while North America and Europe focus on premium, integrated solutions like flexible BIPV and niche transportation uses. Understanding these segment dynamics is essential for market players to allocate R&D resources effectively, standardize flexible module sizes for diverse applications, and formulate targeted marketing strategies based on the specific needs of end-user industries, such as durability for outdoor uses or minimal weight for aerial platforms.

- By Technology:

- Amorphous Silicon (a-Si)

- Copper Indium Gallium Selenide (CIGS)

- Cadmium Telluride (CdTe)

- Organic Photovoltaics (OPV)

- Perovskite Solar Cells (PSC)

- Dye-Sensitized Solar Cells (DSSC)

- By Application:

- Building Integrated Photovoltaics (BIPV)

- Portable Power Generation (Consumer Electronics, Camping Gear)

- Transportation (Automotive Solar Roofs, Marine Vessels, Drones)

- Aerospace & Defense (Satellites, Military Equipment)

- Wearable Devices and IoT Sensors

- Off-Grid Power Generation

- By Substrate Material:

- Polymer (e.g., PET, PEN, Polyimide)

- Metal Foil (e.g., Stainless Steel)

- Ultra-Thin Glass

- By Module Structure:

- Rigid-Flexible Hybrid Modules

- Fully Flexible Modules

Value Chain Analysis For Flexible PV Cell Market

The value chain for the Flexible PV Cell Market begins with upstream analysis focusing on the procurement and refinement of critical raw materials and precursor chemicals. This stage includes sourcing specialized flexible substrates (high-performance polymers like Polyimide or PEN, or thin metal foils), high-purity metals (Indium, Gallium, Copper, Cadmium, Tellurium), and the proprietary chemicals necessary for the deposition of active photovoltaic layers, particularly complex perovskite and CIGS inks. Reliability in this upstream segment is paramount, as the quality and consistency of these materials directly dictate the efficiency and lifespan of the resulting flexible cell. Key activities involve specialized chemical synthesis and the development of cost-effective, durable flexible barrier layers and encapsulation films that protect the sensitive PV layers from moisture and oxygen.

The manufacturing and processing stage represents the core downstream analysis activity, focusing heavily on specialized fabrication techniques. This involves advanced coating and printing methods, such as roll-to-roll (R2R) processing, sputtering, and chemical bath deposition, which are crucial for producing high volumes of flexible cells at low cost. R2R manufacturing, in particular, requires significant capital investment but promises high throughput and scalability, distinguishing flexible PV production from traditional batch-based silicon wafer processing. This stage also includes module assembly, where flexible cells are interconnected and laminated using lightweight, UV-resistant encapsulation materials designed to maintain flexibility while ensuring long-term durability suitable for varied deployment environments, such as curved roofs or portable chargers.

Distribution channels for flexible PV products are highly segmented, reflecting the diverse application areas. Direct channels are commonly utilized for large BIPV projects and specialized aerospace/defense contracts, involving direct engagement between manufacturers and construction firms or government agencies to ensure bespoke design and integration. Indirect channels primarily serve the consumer electronics and portable power segments, relying on distributors, wholesalers, and specialized retailers to move standardized products like flexible chargers, solar backpacks, or small-scale off-grid kits. Specialized installers trained in flexible BIPV integration form a critical part of the channel, ensuring the proper application and maintenance of these non-traditional solar solutions. Efficient logistics are vital, capitalizing on the lightweight nature of the product to reduce shipping costs compared to heavy glass panels.

Flexible PV Cell Market Potential Customers

The potential customer base for the Flexible PV Cell Market is exceptionally broad, spanning multiple industrial sectors driven by the need for lightweight, conformable, or aesthetically integrated power solutions. The largest segment of end-users are construction and infrastructure companies involved in Building Integrated Photovoltaics (BIPV), where flexible cells can be seamlessly incorporated into roofing membranes, curved glass facades, and tensioned fabric structures, transforming the building envelope into an energy generator without altering architectural design. These customers prioritize longevity, fire safety, and aesthetic versatility, often demanding customized solutions for large-scale projects. The need for flexible, high-efficiency solutions is particularly acute in the retrofitting market, where existing structures cannot support the weight of traditional panels.

Another major buyer segment is the consumer electronics industry and manufacturers of portable power devices. This includes companies producing solar-powered backpacks, flexible chargers, mobile device accessories, and specialized outdoor equipment (camping, emergency response). For this segment, the critical purchasing criteria are high durability, low weight, and rapid deployment capabilities. Furthermore, the burgeoning market for wearables and smart textiles represents a high-growth customer area, requiring ultra-thin, highly conformable cells that can be integrated directly into clothing or sensor patches without compromising user comfort or mobility. These applications typically demand low-power consumption solutions that function reliably under constant flexing and strain.

Specialized industrial buyers, including aerospace and defense contractors, constitute a high-value customer group. These users deploy flexible PV cells in niche, demanding applications such as powering Unmanned Aerial Vehicles (UAVs/drones), small satellites (CubeSats), and remote military communication equipment, where the power-to-weight ratio is the absolute highest priority. Automotive manufacturers are rapidly becoming key customers, integrating flexible PV into vehicle roofs to extend EV range, power ancillary systems, and reduce the parasitic load on the main battery. These automotive applications demand cells that withstand extreme temperatures, vibrations, and high speeds, necessitating rigorous testing and certification processes to meet stringent industry standards for vehicle integration and reliability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $6.8 Billion |

| Market Forecast in 2033 | $27.5 Billion |

| Growth Rate | 21.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Miasole (Hanergy), Global Solar Energy, Ascent Solar Technologies, Sunpower Corporation, Heliatek GmbH, Solbian Energie Alternative, Konica Minolta, T-Solar Global S.A., eNow, Ossia, Powerfilm Solar, Dyesol Limited, Solar Frontier, Exeger Operations AB, First Solar, Solarge, Armor Group, 3M Company, Mitsubishi Chemical, Sumitomo Chemical |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible PV Cell Market Key Technology Landscape

The Flexible PV Cell Market is defined by intense technological competition between established thin-film methods and disruptive, highly efficient emerging solar chemistries. The current commercial landscape is dominated by Copper Indium Gallium Selenide (CIGS) and amorphous Silicon (a-Si), primarily due to their proven manufacturing scalability using continuous roll-to-roll (R2R) techniques on flexible metal or polymer foils. CIGS technology offers high efficiencies approaching crystalline silicon benchmarks, coupled with relatively high stability, making it suitable for durable BIPV and large-scale applications. Amorphous silicon, while having lower efficiency, benefits from low material usage and simplified deposition processes, ideal for large-area coverage where weight reduction is prioritized over peak power density.

The most transformative recent development is the rapid progression of Perovskite Solar Cells (PSCs). PSCs promise exceptional power conversion efficiencies (PCEs), potentially exceeding 25% even on flexible substrates, while utilizing inexpensive and abundant raw materials processed via low-temperature solution methods (like printing or coating). This low-cost, high-efficiency potential is driving massive research and commercialization efforts globally, specifically focused on overcoming the material's inherent instability to moisture, heat, and UV light. Advances in 2D/3D perovskite architectures, novel encapsulation barrier films (using thin metal oxides or specialized polymers), and the integration of inorganic stabilizing agents are key technological pathways currently being pursued to commercialize stable flexible perovskite modules within the forecast period.

Furthermore, Organic Photovoltaics (OPV) and Dye-Sensitized Solar Cells (DSSC) represent critical segments within the flexible PV landscape, specializing in specific use cases. OPVs, while generally exhibiting lower efficiencies than CIGS or PSCs, offer unique advantages such as customizable transparency and color, making them highly desirable for aesthetic architectural applications, semi-transparent windows, and integrated consumer electronics. DSSCs are niche technologies primarily used for indoor, low-light applications (e.g., IoT sensors) where their superior performance under diffuse lighting conditions outweighs their typically lower overall outdoor efficiency. Continuous innovation in conductive flexible electrodes (replacing brittle Indium Tin Oxide, ITO, with materials like silver nanowires or carbon nanotubes) and improved R2R manufacturing precision are essential enablers of growth across all flexible PV technology types.

Regional Highlights

- Asia Pacific (APAC): APAC is the largest and fastest-growing market, fundamentally driven by aggressive national renewable energy targets, particularly in China and India. China dominates the manufacturing landscape, benefiting from significant government subsidies and established supply chains for thin-film production, leading to competitive pricing. Japan and South Korea are focusing heavily on sophisticated flexible BIPV solutions and advanced portable power devices. Rapid urbanization and the resultant demand for energy-efficient, integrated building designs fuel this regional dominance, supported by readily available raw material sourcing and expansive production capabilities. The region is a primary hub for CIGS and a-Si R&D and production scaling.

- North America: This region is characterized by high adoption in specialized, high-value markets, including military applications, aerospace (UAVs and space), and premium residential/commercial BIPV. The U.S. market is significantly influenced by state-level mandates and incentives promoting solar adoption and green building standards. Investment is heavily focused on next-generation technologies like flexible perovskites and advanced encapsulation techniques to meet stringent reliability requirements. The development of integrated solar vehicle charging solutions and advanced off-grid power systems for remote installations also represents a substantial market segment.

- Europe: Europe exhibits strong growth driven by strict decarbonization policies, the EU Green Deal, and a deep focus on architectural integration and sustainable manufacturing practices. Germany, France, and the Scandinavian countries are leaders in BIPV deployment, favoring flexible cells for curved structures and historical building renovations where weight limitations are critical. The European market prioritizes sustainability and circular economy principles, putting pressure on manufacturers to develop flexible PV solutions with low embedded carbon and high recyclability. Heliatek (OPV) and other specialized firms are prominent, catering to niche, high-aesthetic segments.

- Latin America: This region represents an emerging market opportunity, particularly in areas with poor or underdeveloped grid infrastructure. The low weight and ease of deployment of flexible PV cells make them ideal for remote rural electrification projects, portable charging kits, and small community power systems. Brazil and Mexico are leading the adoption, driven by favorable solar insolation rates and governmental initiatives aimed at extending energy access. Market growth, however, can be constrained by economic volatility and reliance on imported technology.

- Middle East and Africa (MEA): Growth in MEA is concentrated in specialized sectors, primarily utility-scale flexible solar farms in sandy, challenging terrains and off-grid power for telecommunications towers and oil/gas infrastructure. The exceptional solar irradiance makes this region highly viable for PV deployment. Flexible PV, especially durable CIGS on metal foils, offers advantages in handling high temperatures and reducing dust accumulation compared to traditional glass panels. The UAE and Saudi Arabia are making significant investments in large-scale renewable projects, including innovative flexible PV applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible PV Cell Market.- Miasole (Hanergy Holding Group)

- Global Solar Energy (Owned by Hanergy)

- Ascent Solar Technologies Inc.

- Sunpower Corporation (Subsidiary Maxeon Solar Technologies)

- Heliatek GmbH

- Solbian Energie Alternative Srl

- Konica Minolta Inc.

- T-Solar Global S.A.

- eNow, Inc.

- Ossia Inc.

- Powerfilm Solar Inc.

- Dyesol Limited (Now part of Greatcell Solar)

- Solar Frontier K.K.

- Exeger Operations AB

- First Solar, Inc.

- Solargis Inc.

- Armor Group

- 3M Company

- Mitsubishi Chemical Corporation

- Sumitomo Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Flexible PV Cell market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary advantages of flexible PV cells over traditional rigid panels?

Flexible PV cells offer superior benefits in weight reduction, enabling high power-to-weight ratios critical for aerospace and portable applications. They conform easily to curved surfaces (BIPV, vehicles), reduce installation costs due to simpler handling, and are more resilient to physical stress and micro-cracking than brittle glass-based modules. This conformability allows for seamless architectural integration.

Are flexible PV cells as efficient as crystalline silicon panels?

Historically, commercial flexible PV cells (like a-Si or standard CIGS) have been slightly less efficient than top-tier crystalline silicon (c-Si). However, emerging flexible technologies, particularly advanced CIGS and next-generation perovskite solar cells (PSCs), are rapidly closing this efficiency gap, with laboratory-scale flexible PSCs demonstrating efficiencies comparable to and sometimes exceeding c-Si benchmarks, though stability remains the commercialization challenge.

Which thin-film technology is currently dominant in the flexible PV market?

Copper Indium Gallium Selenide (CIGS) is currently one of the dominant technologies in the commercial flexible PV market due to its high efficiency, relatively good stability, and scalability through roll-to-roll manufacturing processes on lightweight substrates like metal foil. Amorphous silicon (a-Si) also holds a significant share, particularly for applications where very low material cost and large-area coverage are prioritized over peak power density.

What major application segment is driving the growth of the flexible PV market?

The Building Integrated Photovoltaics (BIPV) segment is a primary driver, utilizing flexible cells for integration into roofing materials, façades, and non-load-bearing structural elements where traditional heavy glass panels are unsuitable. Additionally, the increasing demand for integrated solar solutions in the transportation sector, especially for electric vehicle roofs, is rapidly fueling market expansion.

What role does roll-to-roll (R2R) manufacturing play in flexible PV production?

Roll-to-roll (R2R) processing is fundamental to the commercial viability of flexible PV cells. This continuous, high-throughput manufacturing method drastically reduces production costs, increases scalability, and minimizes material waste compared to traditional batch processing, positioning R2R as the key technology for achieving cost parity with conventional solar modules and enabling mass market adoption.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager