Flexible Spacer Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432570 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Flexible Spacer Market Size

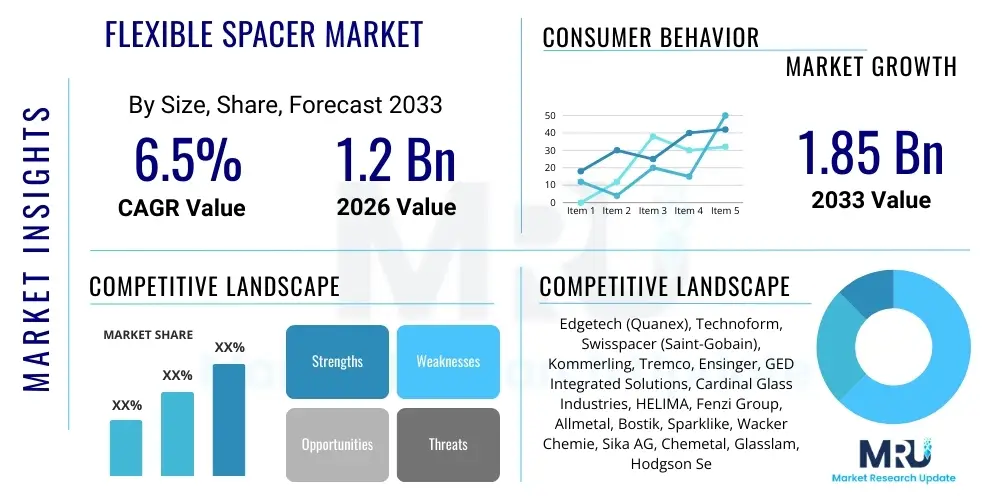

The Flexible Spacer Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Flexible Spacer Market introduction

The Flexible Spacer Market encompasses advanced sealing systems primarily utilized in Insulating Glass Units (IGUs). Flexible spacers, distinct from traditional rigid aluminum bars, are composite materials designed to separate the glass panes while minimizing thermal bridging, thereby significantly enhancing the energy efficiency of windows and facades. These products are generally composed of thermoplastic elastomers, structural foam, or silicone, often incorporating an integrated desiccant matrix and a primary sealant layer, offering superior durability and reduced condensation risk.

Flexible spacers find major applications across the construction industry, specifically in residential buildings, commercial complexes, and specialized structures such as refrigerated transport and cold storage facilities where stringent thermal performance is critical. The primary benefit of adopting flexible spacers is the substantial reduction in heat transfer across the edge of the IGU, leading to lower heating and cooling costs and improved occupant comfort. Furthermore, their flexible nature allows for greater movement tolerance and improved aesthetics compared to metallic alternatives.

Key driving factors accelerating the market growth include increasingly strict global energy efficiency regulations, particularly building codes mandating passive house standards and net-zero energy construction. The growing demand for high-performance windows in developing economies, coupled with consumer preference for aesthetically pleasing, large-format glass facades, further bolsters adoption. Continuous innovation in material science, focusing on enhanced moisture barriers and longevity, continues to propel the market forward.

Flexible Spacer Market Executive Summary

The Flexible Spacer Market is undergoing robust expansion driven by global imperatives for energy conservation and sustainable building practices. Business trends highlight a pronounced shift from commodity rigid spacers toward high-performance, warm-edge flexible systems, necessitating increased investment in automated manufacturing processes capable of handling complex composite materials. Key competitive strategies revolve around technological differentiation, particularly the development of multi-layered spacer systems offering superior thermal performance and UV resistance, alongside establishing strong partnerships with IGU manufacturers and fenestration suppliers globally.

Regionally, Europe remains the dominant market, characterized by mature regulatory frameworks (such as the EU's Energy Performance of Buildings Directive) and high adoption rates of advanced window technologies. However, the Asia Pacific region is emerging as the fastest-growing market, fueled by massive urbanization, infrastructure development, and increasing awareness regarding green building standards in countries like China and India. North America demonstrates consistent growth, largely driven by state-level energy efficiency incentives and the renovation of aging building stock.

Segment trends indicate that thermoplastic spacers (TPS) are witnessing significant growth due to their adaptability and efficient integration into highly automated production lines. Applications in the commercial sector, requiring large, complex curtain wall systems, are driving demand for flexible solutions that can maintain structural integrity and thermal performance across diverse architectural designs. Furthermore, the integration of smart technologies into windows is creating a niche demand for spacers that are compatible with integrated sensors and low-emissivity coatings, pushing material science towards conductive or sensor-ready compositions.

AI Impact Analysis on Flexible Spacer Market

User queries regarding the impact of Artificial Intelligence (AI) on the Flexible Spacer Market frequently center on themes of manufacturing optimization, predictive quality control, and the integration of smart window functionalities. Users are keen to understand how AI can reduce material waste and variability in the highly precise IGU manufacturing environment, which directly affects spacer integrity and longevity. Common concerns also involve using machine learning algorithms to predict long-term performance and failure points of installed flexible spacers under varying climate conditions, optimizing product warranties and reliability claims.

The immediate impact of AI is centered around factory automation and process refinement. AI-driven vision systems are being deployed on production lines to detect minute defects in spacer application, desiccant filling, and corner alignment, far surpassing human capability and increasing throughput while maintaining quality. Predictive maintenance algorithms analyze data from machinery sensors to anticipate wear and tear, minimizing downtime and ensuring continuous production of defect-free flexible spacers, which is crucial given the high cost associated with production interruptions in sealed unit manufacturing.

Looking ahead, AI will significantly influence product design and development. Generative design tools are utilizing AI to simulate thousands of material combinations and structural geometries for flexible spacers, aiming to achieve optimal thermal resistance (low U-values) and moisture vapor transmission rates (MVTR) with minimal material usage. This optimization extends the product life cycle and reinforces the value proposition of flexible spacers in the rapidly evolving high-performance building sector.

- AI-enhanced quality control ensures precise application and integrity of flexible spacer components, reducing manufacturing defects.

- Machine learning models optimize material composition, specifically thermoplastic blends and desiccant integration, for superior longevity and thermal performance.

- Predictive analytics supports supply chain management, forecasting demand fluctuations for raw materials like silicone and butyl based on construction pipeline data.

- AI-driven automation reduces labor costs and increases the speed of IGU assembly using flexible spacers, improving scalability for high-volume manufacturers.

- Generative design optimizes the geometric profile of flexible spacers to minimize thermal bridging effects while maximizing structural adhesion and flexibility.

DRO & Impact Forces Of Flexible Spacer Market

The Flexible Spacer Market is fundamentally influenced by stringent regulatory drivers favoring energy efficiency, balanced against the volatility of raw material costs and production complexities. Drivers include global mandates for sustainable building standards, pushing the construction industry toward products with superior thermal performance, positioning flexible spacers as essential components in modern, high-efficiency windows. Opportunities arise from technological integration, specifically the incorporation of flexible spacers into dynamic windows (e.g., electrochromic glass) and the expanding retrofitting market in developed economies, while restraints largely center on the high initial capital investment required for IGU manufacturers to transition from traditional rigid systems to complex flexible spacer automation lines.

Drivers: The primary driver remains the legislative environment across major economies. Governmental initiatives, such as stricter building insulation codes and tax incentives for energy-saving installations, create a guaranteed demand floor for high-performance IGUs utilizing warm-edge technology. Consumer awareness concerning long-term operational costs and environmental impact further reinforces this demand. Furthermore, the aesthetic advantage of flexible spacers, allowing for cleaner sightlines and minimized visual intrusion, supports their adoption in premium architectural projects featuring expansive glass elements.

Restraints: The most significant restraint is the higher unit cost of advanced flexible spacers compared to conventional aluminum systems. While the long-term energy savings offset this cost, initial procurement remains a hurdle, particularly in price-sensitive emerging markets. Additionally, the performance of flexible spacers is highly dependent on precise application and adherence during the manufacturing process; inconsistencies can lead to premature seal failure, requiring sophisticated and expensive quality assurance procedures that smaller manufacturers may struggle to implement effectively. Volatility in the cost of petrochemical-derived raw materials, such as specific polymers and desiccants, also impacts overall market stability and pricing.

Opportunities: Significant opportunities exist in the expanding specialized glass market, including fire-rated, noise-reduction, and structural glazing applications, where the superior sealing and structural characteristics of flexible spacers are essential. The integration of advanced functionality, such as smart windows and building-integrated photovoltaics (BIPV), presents novel requirements that conventional rigid spacers cannot meet, positioning flexible spacer manufacturers at the forefront of innovation. Furthermore, penetrating the vast, under-served market of window replacement and retrofitting, particularly in regions with cold climates, offers substantial long-term growth potential.

Impact Forces: The impact forces are predominantly environmental and technological. The rising global focus on decarbonization places immense pressure on the construction sector to adopt energy-efficient solutions, making the thermal performance offered by flexible spacers a non-negotiable requirement. Technologically, the rapid development of thermoplastic materials and advanced sealant chemistry continues to improve the product lifecycle and thermal metrics, pushing older, less efficient technologies out of the market. Regulatory pressure acts as a consistent accelerator, ensuring that the warm-edge technology represented by flexible spacers becomes the default standard rather than a premium option.

Segmentation Analysis

The Flexible Spacer Market is analyzed based on Material Type, Application, and End-User, providing a granular view of market dynamics and adoption patterns across different sectors. Material segmentation is crucial as it defines the thermal and structural performance characteristics of the spacer, with key categories including Thermoplastic Spacer (TPS), Structural Foam, and Silicone Foam systems. Each material addresses specific needs regarding automation compatibility, climate suitability, and cost structure, influencing their dominant position in various geographical markets.

Application segmentation differentiates between residential, commercial, and industrial usage. The commercial sector, characterized by large curtain walls and high regulatory thermal performance requirements, typically drives demand for the highest-performing, most durable flexible spacers. Conversely, the residential segment focuses on balancing cost-effectiveness with substantial energy savings in standard window configurations. End-user classification helps identify primary procurement pathways, distinguishing between sales to IGU manufacturers, window fabricators, and specialized building component suppliers.

The ongoing trend of market segmentation highlights a move towards highly specialized products, such as flexible spacers optimized for extreme weather conditions (both hot and cold) and those engineered for noise reduction glass units. This customization allows manufacturers to capture niche markets and achieve higher margins by providing tailored thermal and moisture protection solutions that exceed baseline performance requirements stipulated by current building codes globally.

- By Material Type:

- Thermoplastic Spacer (TPS)

- Structural Foam

- Silicone Foam

- Hybrid Systems

- By Application:

- Residential Windows and Doors

- Commercial Building Facades and Curtain Walls

- Refrigerated Display Cases and Cold Storage

- Specialty Glass (e.g., Transit, Military)

- By End-User:

- Insulating Glass Unit (IGU) Manufacturers

- Window and Door Fabricators

- Architectural Glazing Contractors

- Building Component Suppliers

- By Sealant Type:

- Single-Seal Systems

- Dual-Seal Systems (Primary and Secondary)

Value Chain Analysis For Flexible Spacer Market

The value chain for the Flexible Spacer Market begins with the highly specialized upstream procurement of raw materials, primarily high-grade polymers (butyl, silicone, polyisobutylene), desiccants (molecular sieves), and specialized chemicals for adhesion. Upstream manufacturers focus on R&D to enhance material performance, specifically moisture barrier capabilities and UV stability, which are critical determinants of the final product's quality and longevity. Price volatility and supply chain security for these specialized chemicals pose ongoing challenges, requiring flexible spacer manufacturers to maintain diverse supplier relationships and inventory buffers.

Midstream activities involve the complex manufacturing and formulation processes, where raw materials are extruded, molded, or assembled into the final flexible spacer product, often integrating the desiccant and primary sealant in a single, continuous process (e.g., for TPS). This stage requires significant capital expenditure on automated production lines, quality control systems, and proprietary extrusion technologies to ensure precise dimensional tolerance and consistent thermal performance across batches. Large manufacturers often hold significant intellectual property related to their material compositions and application methods.

Downstream activities are dominated by distribution channels, primarily focusing on supplying high-volume IGU manufacturers globally. Direct distribution is common for large OEM clients, ensuring technical support and tailored product specifications. Indirect channels utilize specialized distributors who handle inventory, smaller orders, and logistics for regional window and door fabricators. Effective technical service and training provided by the flexible spacer supplier are crucial downstream components, as improper application at the IGU assembly level can negate the product's thermal advantages and lead to field failures.

The distribution channel is predominantly business-to-business (B2B), targeting professional fabricators. Direct distribution offers greater control over branding and technical specifications, suitable for proprietary high-performance systems. Indirect channels, leveraging specialized building materials distributors, allow for wider market penetration, especially in fragmented regional markets. The final link is the installation and construction phase, where architects and builders, influenced by performance metrics (U-values) and aesthetic considerations, ultimately drive the choice of IGU componentry.

Flexible Spacer Market Potential Customers

The primary customers for flexible spacers are large-scale Insulating Glass Unit (IGU) manufacturers who integrate these components into the sealed double or triple glazing units they produce. These manufacturers prioritize consistency, thermal performance ratings (U-value improvement), compatibility with automated sealing equipment, and long-term durability, often entering into long-term supply agreements with flexible spacer providers. Their purchasing decisions are heavily influenced by regulatory compliance requirements and the ability of the spacer to meet stringent quality standards necessary for large commercial projects.

A second major customer segment includes window and door fabricators who may perform the IGU assembly in-house or purchase the finished units. For these users, ease of handling, inventory management (especially for TPS systems that require specific application temperatures), and overall system cost-effectiveness are paramount. This segment often demands a variety of sizes and colors to match diverse architectural specifications, driving complexity in the supplier's product portfolio.

Other significant potential customers include specialized glass fabricators focusing on demanding applications such as architectural curtain walls, refrigerated display cases, and high-security or ballistic glass. These applications require flexible spacers engineered to handle extreme loads, rapid temperature changes, or specific fire resistance ratings. Furthermore, governmental and institutional construction bodies, though not direct purchasers, act as strong influencers, dictating specifications for public infrastructure and housing projects that must utilize the highest energy-efficient window technologies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Edgetech (Quanex), Technoform, Swisspacer (Saint-Gobain), Kommerling, Tremco, Ensinger, GED Integrated Solutions, Cardinal Glass Industries, HELIMA, Fenzi Group, Allmetal, Bostik, Sparklike, Wacker Chemie, Sika AG, Chemetal, Glasslam, Hodgson Sealants, H.B. Fuller, Fuxing Glass |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flexible Spacer Market Key Technology Landscape

The technological landscape of the Flexible Spacer Market is dominated by advancements in material science focused on improving thermal performance and moisture barrier integrity. The shift from traditional metallic spacers to warm-edge technologies involves continuous innovation in polymer chemistry, particularly the development of highly specialized thermoplastic elastomers (TPEs) and silicone foams. These materials are engineered to possess extremely low thermal conductivity while maintaining high resistance to UV degradation and temperature cycling, ensuring the long-term effectiveness of the insulating gas fill (e.g., Argon or Krypton) within the IGU cavity.

A significant technological focus is on enhancing the integrated desiccant matrix within the flexible spacer structure. Modern flexible spacers often feature highly porous desiccant powders or granules embedded directly into the polymer matrix. Technological developments aim to maximize the desiccant loading capacity and speed of moisture absorption while ensuring the material maintains adequate structural integrity and adhesion. This integration simplifies the IGU manufacturing process and improves the long-term moisture defense of the unit, directly impacting window lifespan and preventing internal condensation.

Furthermore, automation technology is intrinsically linked to the market's growth. The use of specialized application machinery, such as automated hot-melt extruders for TPS systems and robotic application lines for structural foam spacers, dictates the adoption rate of flexible spacers. Manufacturers are investing heavily in machinery that ensures continuous, seamless application of the spacer material and eliminates manual errors associated with cutting and corner joining, which are common failure points in traditional systems. This push for automation reduces manufacturing cycle times and lowers the overall cost of producing high-performance IGUs.

The emergence of hybrid spacer systems represents another critical technological trend. These systems combine the structural rigidity of certain materials with the thermal flexibility of others, aiming to achieve the optimal balance between load-bearing capability and thermal performance. Research is also underway on developing smart spacers that could potentially incorporate micro-sensors for monitoring internal IGU conditions (like gas leakage or moisture levels) in high-end, maintenance-critical installations, further enhancing the functional value of the window assembly beyond basic insulation.

Dispensing technology is crucial for efficient manufacturing. Precision dispensing machinery ensures that the flexible spacer material is applied uniformly and accurately onto the glass surface. Advances in servo-driven robotics and nozzle design have led to faster, more reliable application speeds, essential for large-volume IGU producers. This specialized equipment not only handles the application but also often integrates the secondary seal application (e.g., silicone or polysulfide), ensuring a complete, durable seal perimeter is formed around the glass unit. The ability to switch quickly between different spacer widths and profiles using computerized controls offers fabricators significant operational flexibility and efficiency.

In terms of material development, attention is increasingly being paid to sustainability and environmental impact. Manufacturers are exploring bio-based or recycled polymer options for flexible spacer formulations, aiming to reduce the carbon footprint of the final IGU product. While challenging due to the stringent performance requirements (especially longevity and moisture resistance), this focus aligns with broader industry trends towards circular economy principles. Furthermore, chemical advancements are yielding materials with improved gas retention properties, critical for maximizing the thermal benefits of expensive insulating gases like Krypton or Xenon in high-performance triple-pane units.

Another technological frontier involves improving the adhesion and compatibility between the flexible spacer, the glass surface, and the secondary sealant. Chemical primers and surface treatments are sometimes integrated into the manufacturing process to ensure an impenetrable bond, even under extreme temperature fluctuations or structural stress typical of large commercial facades. Failure in adhesion is the primary cause of IGU failure, making research into sealant chemistry and surface preparation a continuously high-priority area for innovation within the market.

Finally, predictive modeling and simulation software play a vital role in the technological ecosystem. Before a flexible spacer product is physically manufactured, advanced computer simulation tools are used to model its long-term thermal performance, structural load capacity, and resistance to environmental factors like humidity and UV exposure. This accelerates the R&D cycle, reduces the need for extensive physical prototyping, and allows manufacturers to provide highly accurate performance guarantees to architects and builders, leveraging advanced finite element analysis (FEA) techniques.

Regional Highlights

The regional dynamics of the Flexible Spacer Market are heavily segmented by the maturity of building codes, climatic requirements, and the pace of new construction activity. Europe, characterized by highly stringent energy efficiency directives such as the Passive House standard and mandatory U-value requirements, represents the most mature and technologically advanced market. North America is driven by a mix of state-level regulations and consumer demand for energy-saving solutions in both new construction and extensive renovation projects.

- Europe (Dominant Market due to Regulatory Rigor):

Europe holds the largest market share for flexible spacers, primarily due to decades of consistent and increasing pressure from the European Union to reduce energy consumption in buildings. Directives like the Energy Performance of Buildings Directive (EPBD) effectively mandate the use of warm-edge technologies in new installations and major renovations. Countries such as Germany, the UK, and the Scandinavian nations show the highest adoption rates, driven by extreme climate variability necessitating robust thermal insulation.

The market in Europe is characterized by a high preference for premium, proven flexible spacer systems (like TPS and structural foam) that offer certified long-term performance necessary for achieving low U-values (typically below 1.0 W/m²K). Competitive differentiation often revolves around third-party certifications and the automation compatibility of the spacer system with existing European IGU production lines. The renovation wave, aiming to modernize aging housing stock, further ensures sustained demand for high-performance flexible spacers throughout the forecast period.

- Asia Pacific (Fastest Growing Market):

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate, fueled by explosive growth in urban construction, rapid industrialization, and a gradual shift towards adopting global green building standards. Major economies like China and India are seeing a massive increase in commercial and high-rise residential construction, where modern, energy-efficient facades are becoming standard. While the initial market penetration of flexible spacers remains lower than in Europe, the sheer volume of new construction provides a colossal growth opportunity.

Market growth in APAC is currently driven by international developers and luxury projects where high thermal performance is specified. However, governmental initiatives, such as China’s focus on sustainable urban development, are beginning to drive widespread adoption. Challenges remain regarding cost sensitivity and the fragmented nature of the construction supply chain, often favoring more cost-effective, though less efficient, solutions. However, increasing awareness of the long-term energy cost benefits is rapidly changing purchasing behaviors in key metropolitan areas.

- North America (Stable Growth and Technology Adoption):

North America demonstrates stable and consistent growth, largely influenced by energy codes enforced at the state and regional levels (e.g., California, Northeast states). The market is characterized by a strong emphasis on durability and resistance to extreme temperatures (both very hot summers and cold winters). Flexible spacers are increasingly becoming the standard component for high-end residential windows and energy-efficient commercial projects seeking LEED certification.

Technological adoption is high in this region, particularly in automated manufacturing lines. The market sees a strong presence of large domestic glass and window manufacturers who have integrated proprietary flexible spacer technology into their IGU offerings. Furthermore, the substantial size of the replacement and retrofitting market contributes significantly to demand, as homeowners and building managers seek to upgrade old, poorly insulated windows to maximize energy savings and comfort.

- Latin America, Middle East, and Africa (MEA) (Emerging Demand Centers):

While smaller in market size, these regions present unique growth pockets. In the Middle East, the focus is heavily on resisting intense solar heat gain, driving demand for flexible spacers in conjunction with highly reflective or low-emissivity (Low-E) glass to manage heat transfer and cooling loads efficiently. Large-scale infrastructure and urbanization projects in the Gulf Cooperation Council (GCC) countries are boosting commercial applications.

In Latin America and Africa, market penetration is nascent and largely concentrated in major urban centers and high-value construction. Growth is dependent on the future implementation of national energy efficiency standards and the development of local IGU manufacturing capabilities. Currently, import dependency for specialized flexible spacer components remains high, affecting pricing and adoption rates outside of major commercial centers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flexible Spacer Market.- Edgetech (A Quanex Building Products Company)

- Technoform

- Swisspacer (Part of Saint-Gobain)

- Kommerling (Part of H.B. Fuller)

- Tremco (Part of RPM International Inc.)

- Ensinger

- GED Integrated Solutions

- Cardinal Glass Industries

- HELIMA

- Fenzi Group

- Allmetal

- Bostik (Part of Arkema)

- Sparklike

- Wacker Chemie AG

- Sika AG

- Chemetal

- Glasslam

- Hodgson Sealants

- H.B. Fuller

- Fuxing Glass

Frequently Asked Questions

What is the primary benefit of using a flexible spacer over a rigid aluminum spacer?

The primary benefit of using a flexible spacer (warm-edge technology) is significantly improved thermal insulation at the edge of the Insulating Glass Unit (IGU). Flexible spacers drastically reduce thermal bridging, leading to lower U-values, minimal condensation risk, and substantial energy savings in heating and cooling costs compared to highly conductive aluminum spacers.

Which material type dominates the Flexible Spacer Market segmentation?

Thermoplastic Spacer (TPS) systems and Structural Foam systems currently dominate the market. TPS is widely valued for its high compatibility with automated manufacturing processes and excellent thermal performance, while structural foam offers superior desiccant integration and UV stability, making both materials leading choices for high-performance IGU production globally.

How do energy efficiency regulations impact the demand for flexible spacers?

Energy efficiency regulations, particularly in Europe and North America, act as a major market driver by mandating lower U-values (better insulation) for new and renovated buildings. Flexible spacers are essential components for meeting these strict thermal performance standards, thereby guaranteeing sustained demand for warm-edge technology in the construction sector.

What is the role of the desiccant integrated within the flexible spacer?

The desiccant, usually a molecular sieve embedded in the spacer material, plays a critical role in absorbing any residual moisture trapped inside the IGU cavity during manufacturing or that permeates the seal over time. This prevents internal condensation and fogging, preserving the clarity and thermal performance of the insulating glass unit throughout its expected lifespan.

Is the Flexible Spacer Market seeing high adoption in the Asia Pacific region?

Yes, the Asia Pacific region is the fastest-growing market segment. While starting from a lower base compared to Europe, rapid urbanization, massive commercial construction projects, and increasing governmental focus on green building certification are driving swift and substantial adoption of high-performance flexible spacers across major economies like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager