Flight Propulsion Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434305 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Flight Propulsion Systems Market Size

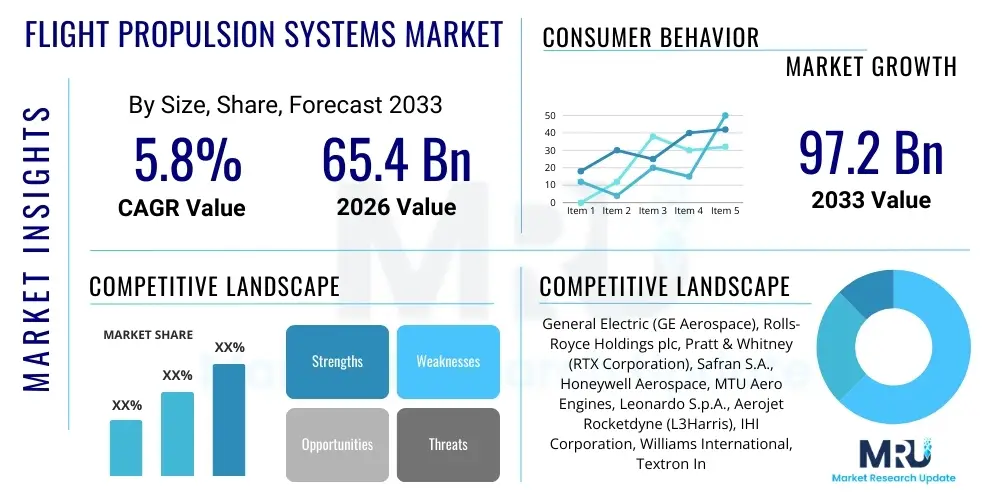

The Flight Propulsion Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 65.4 Billion in 2026 and is projected to reach USD 97.2 Billion by the end of the forecast period in 2033.

Flight Propulsion Systems Market introduction

Flight propulsion systems encompass the sophisticated technological assemblies designed to generate thrust necessary for sustained atmospheric and extra-atmospheric flight. These critical systems include gas turbine engines (turbofans, turboprops, turbojets), ramjets, rocket engines, and increasingly, electric and hybrid-electric propulsion units. The essential function is converting energy—chemical (fuel) or electrical—into kinetic energy that moves the aircraft. Major applications span the entire aerospace ecosystem, including commercial passenger and cargo transport, advanced military tactical and strategic platforms, general aviation, and emerging sectors such as Urban Air Mobility (UAM) and space launch vehicles. The continued expansion of global air traffic, coupled with sustained investment in next-generation military capabilities and the urgent need for enhanced fuel efficiency and reduced emissions, serves as the primary impetus driving market expansion and innovation.

Flight Propulsion Systems Market Executive Summary

The market landscape for flight propulsion systems is characterized by intense technological competition focused predominantly on achieving superior thrust-to-weight ratios, enhanced thermal efficiency, and minimal noise profiles. Current business trends indicate a significant shift toward aftermarket services, Maintenance, Repair, and Overhaul (MRO), which increasingly contribute to the revenue streams of major original equipment manufacturers (OEMs). Furthermore, the long-term trend involves substantial R&D expenditure directed at Sustainable Aviation Fuels (SAFs) compatibility and the development of disruptive propulsion architectures like open rotor designs and hydrogen-powered engines. Regionally, the market maintains significant strength in North America and Europe due to established military procurement cycles and major OEM presence, while the Asia Pacific region exhibits the highest growth trajectory, fueled by robust demand for new commercial aircraft deliveries and burgeoning domestic aerospace manufacturing capabilities. Segmentally, the turbofan category remains the market cornerstone, though hybrid-electric propulsion is emerging as a critical growth segment, particularly within general aviation and smaller regional jet platforms, reflecting stringent environmental regulations and operational cost pressures.

AI Impact Analysis on Flight Propulsion Systems Market

User inquiries regarding Artificial Intelligence (AI) in flight propulsion systems frequently revolve around predictive maintenance capabilities, optimizing engine operational performance in real-time, and accelerating the design cycle of new components. Users are primarily concerned with how AI can minimize expensive unscheduled downtime, enhance component lifespan through sophisticated diagnostics, and aid in the complex modeling of novel combustion and aerodynamic systems. Key themes highlight the expectation that machine learning algorithms will revolutionize MRO procedures, moving from scheduled checks to condition-based monitoring, thereby maximizing asset utilization and significantly reducing direct operating costs (DOCs). Furthermore, there is strong interest in the application of Generative Design AI to create lighter, more durable turbine blades and combustor linings that withstand extreme thermal and pressure conditions, pushing the boundaries of material science and engine performance envelopes.

- AI-driven Predictive Maintenance (PdM) algorithms optimize MRO schedules, reducing unscheduled grounding events by up to 30%.

- Machine Learning (ML) enhances real-time Engine Health Monitoring (EHM), analyzing telemetry data streams to detect subtle anomalies before critical failure.

- Generative Design AI accelerates the development of complex propulsion components, optimizing topology for superior thermal management and reduced weight.

- AI simulations and digital twins improve engine control systems, dynamically adjusting fuel mixtures and variable geometry features for peak efficiency across diverse flight regimes.

- Natural Language Processing (NLP) assists maintenance technicians by rapidly sifting through vast historical maintenance logs and technical documentation for faster troubleshooting.

- Reinforcement Learning (RL) is used in developing adaptive cycle engines, allowing the engine to modify its operating characteristics based on mission profile and ambient conditions.

DRO & Impact Forces Of Flight Propulsion Systems Market

The Flight Propulsion Systems Market is primarily driven by the imperative to replace aging global aircraft fleets with new, fuel-efficient models, coupled with escalating defense expenditures focused on advanced stealth and hypersonic capabilities. Restraints include the extremely high capital investment required for new engine development programs, the complex and lengthy certification processes imposed by regulatory bodies (e.g., FAA, EASA), and the geopolitical instability affecting global supply chains for critical raw materials such as titanium and nickel superalloys. Opportunities are abundant in the rapid commercialization of hybrid-electric and fully electric propulsion systems for smaller aircraft, alongside the potential breakthrough in hydrogen combustion technology for long-haul commercial platforms, addressing the industry's net-zero carbon pledges. The market is profoundly influenced by five core impact forces: technological advancements (driving efficiency), stringent environmental regulations (mandating cleaner technologies), fluctuating fuel costs (influencing purchasing decisions), geopolitical tensions (boosting military spending), and OEM long-term service agreements (creating high barriers to entry for competitors in the aftermarket). These forces collectively necessitate continuous innovation while stabilizing the revenue streams of established industry leaders through proprietary MRO contracts.

Segmentation Analysis

The comprehensive analysis of the Flight Propulsion Systems Market relies heavily on detailed segmentation across key dimensions, providing stakeholders with targeted insights into specific demand drivers and competitive dynamics. Primary segmentation focuses on the technological nature of the engine (e.g., turbofan versus rocket), the platform application (commercial, military, general aviation), and the specific components comprising the system (e.g., compressor, turbine, nozzle). The granularity provided by this breakdown allows for precise forecasting, especially concerning the demand divergence between the high-thrust, high-bypass ratio turbofans dominating commercial aerospace and the high-speed, high-performance turbojets and scramjets prioritized within military and specialized applications. The emerging segmentation by technology, particularly separating conventional internal combustion engines from novel hybrid and electric powertrains, is crucial for tracking investment flows into sustainable aviation initiatives and assessing market readiness for disruptive technologies over the next decade.

- By Engine Type: Turbofan, Turboprop, Turbojet, Piston Engine, Rocket Engine, Ramjet/Scramjet, Electric/Hybrid-Electric.

- By Aircraft Type: Commercial Aviation (Narrow-body, Wide-body, Regional Jets), Military Aviation (Fighter, Transport, Bomber), General Aviation, Unmanned Aerial Vehicles (UAVs).

- By Component: Compressor, Turbine, Combustor, Nozzle, Gearbox, Fuel System, Control Systems (FADEC).

- By Technology: Conventional Combustion, Hybrid-Electric, All-Electric, Hydrogen Propulsion.

- By End-User: OEM (Original Equipment Manufacturers), MRO (Maintenance, Repair, and Overhaul) Service Providers, Airlines/Operators, Government/Defense Agencies.

Value Chain Analysis For Flight Propulsion Systems Market

The value chain for flight propulsion systems is exceptionally complex, characterized by deep integration, high barriers to entry, and stringent quality control standards mandated by aviation authorities. Upstream analysis focuses on the acquisition and processing of highly specialized raw materials, including advanced composites, single-crystal alloys for turbine blades, and titanium forgings. Critical Tier 2 and Tier 3 suppliers, specializing in sophisticated metallurgical processes and precision machining, feed into the Tier 1 component manufacturers who produce major sub-assemblies like compressors, combustor modules, and gearboxes. The upstream segment is heavily consolidated, often involving long-term strategic relationships between material suppliers and engine OEMs, dictated by reliability and regulatory compliance requirements.

Midstream activities are dominated by Original Equipment Manufacturers (OEMs), such as Rolls-Royce and General Electric, responsible for engine design, integration, assembly, rigorous testing, and certification. This stage requires massive investment in R&D and intellectual property protection. The relationship often involves joint ventures (e.g., CFM International, a partnership between GE Aerospace and Safran Aircraft Engines) to manage development risks and share market access. Crucially, the engine’s total lifecycle cost and performance characteristics are determined here, impacting downstream operational efficiency.

Downstream analysis includes distribution channels, which are typically direct from the OEM to the aircraft manufacturer (e.g., Boeing, Airbus). Aftermarket services, encompassing MRO, spare parts provisioning, and long-term service agreements (LTAs), form a significant and highly profitable distribution segment. OEMs usually manage these services directly or through authorized service centers, ensuring proprietary technology protection and quality control. Indirect distribution plays a limited role but includes independent MRO providers that specialize in specific engine types or component repairs, often working under license, primarily serving smaller airlines or older fleets, though the trend increasingly favors OEM-managed, data-driven service contracts.

Flight Propulsion Systems Market Potential Customers

The primary and most financially significant end-users of flight propulsion systems are the major global commercial airlines and cargo operators, which demand highly reliable, fuel-efficient engines for their extensive narrow-body and wide-body fleets. These customers prioritize long Mean Time Between Overhaul (MTBO) statistics, comprehensive warranty support, and favorable terms on long-term service agreements (LTAs) to manage operational predictability and cost over decades of service. Their purchasing decisions are heavily influenced by the engine’s specific fuel consumption (SFC) and overall contribution to reducing the aircraft's carbon footprint, aligning with global decarbonization goals and shareholder mandates.

A second crucial customer segment is the global defense establishment, including air forces and naval aviation commands, across major industrialized nations and allied partners. These governmental end-users place paramount importance on performance characteristics such as high thrust-to-weight ratio, resilience in extreme conditions, stealth capabilities (for military turbojets), and technological superiority for maintaining air dominance. Procurement cycles are long and heavily regulated, often necessitating localized manufacturing offsets and technology transfer agreements, driving significant sales in the high-margin military segment, which typically uses highly specialized, low-volume production systems, such as advanced fighter engines or sophisticated rocket propulsion for strategic missiles.

The emerging potential customer base includes aerospace start-ups focused on Urban Air Mobility (UAM), eVTOL (electric Vertical Take-Off and Landing) aircraft developers, and private space launch providers. While currently representing a smaller volume, these innovative players are driving demand for novel propulsion technologies, including high-density battery packs, electric motors, and efficient hybrid systems, alongside smaller, reusable rocket engines. Furthermore, Original Equipment Manufacturers (OEMs) of airframes (like Embraer and Bombardier) are key customers as they integrate these complex systems during aircraft manufacturing, solidifying their position as direct buyers in the value chain, subsequently transferring ownership and MRO responsibility to the operational airline customer.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 65.4 Billion |

| Market Forecast in 2033 | USD 97.2 Billion |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | General Electric (GE Aerospace), Rolls-Royce Holdings plc, Pratt & Whitney (RTX Corporation), Safran S.A., Honeywell Aerospace, MTU Aero Engines, Leonardo S.p.A., Aerojet Rocketdyne (L3Harris), IHI Corporation, Williams International, Textron Inc., BAE Systems, Mitsubishi Heavy Industries (MHI), CFM International, PowerJet, Rocket Lab, Reaction Engines Ltd., ZeroAvia, Electric Power Systems. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flight Propulsion Systems Market Key Technology Landscape

The current technology landscape in flight propulsion is dominated by the continuous refinement of the high-bypass turbofan engine, which maximizes fuel efficiency by increasing the proportion of airflow bypass relative to the air passing through the core. Advancements focus heavily on optimizing the internal aerodynamics of the compressor and turbine sections, incorporating sophisticated 3D-printed components made from Ceramic Matrix Composites (CMCs) and advanced nickel superalloys. These materials allow engines to operate at significantly higher combustion temperatures, directly translating into greater thermal efficiency and reduced fuel consumption. Furthermore, the integration of advanced Full Authority Digital Engine Control (FADEC) systems allows for precise, real-time management of engine parameters, ensuring peak performance and facilitating integrated engine health monitoring.

A major disruptive technological trend involves the aggressive pursuit of Sustainable Aviation Solutions, primarily through two pathways: hybrid-electric propulsion and hydrogen combustion. Hybrid-electric systems, utilized primarily in regional and general aviation, integrate traditional combustion cores with electric motors, optimizing power output during different flight phases (takeoff, cruise) to reduce fuel burn and noise. Conversely, the development of hydrogen-powered propulsion necessitates significant R&D into specialized cryogenic fuel storage, novel fuel injection systems, and redesigning the combustor to manage the high flame speed and low energy density of liquid hydrogen. These zero-emission technologies are expected to reach commercial viability for larger platforms within the 2035-2040 timeframe, fundamentally reshaping the market structure.

In the defense and space sectors, the focus remains on high-speed, high-performance technologies, including adaptive cycle engines and advanced rocket systems. Adaptive cycle engines, designed for sixth-generation fighters, can dynamically change their bypass ratio depending on whether the mission requires high-speed sprint (low bypass) or long-range cruise (high bypass), providing unparalleled operational flexibility. Simultaneously, the burgeoning space economy drives demand for reusable rocket propulsion, characterized by technologies such as additive manufacturing for complex cooling channels, robust igniter systems, and advanced throttling capabilities for soft landings, exemplified by liquid oxygen/methane engines designed for high-cycle count reuse.

Regional Highlights

- North America: This region maintains its dominance due to the presence of key industry giants (e.g., GE Aerospace, Pratt & Whitney) and massive governmental defense spending, specifically through the procurement of advanced tactical aircraft (F-35, B-21) and next-generation missile defense systems. The market is highly mature, characterized by strong aftermarket service networks and significant R&D investment into both military hypersonics and future commercial aviation technologies like hydrogen propulsion. Regulatory bodies, such as the FAA, play a pivotal role in setting global certification standards.

- Europe: The European market, led by major players like Rolls-Royce and Safran, demonstrates a strong commitment to environmental sustainability, driving innovation in fuel-efficient turbofans and actively investing in SAF and hybrid-electric technologies through collaborative programs (e.g., Clean Sky). Military procurement remains robust, focused on modernizing NATO air capabilities and developing indigenous defense platforms. Government funding mechanisms and the collaborative nature of European aerospace supply chains ensure a steady output of technological advancements.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, primarily driven by explosive growth in commercial air travel demand, necessitating hundreds of new aircraft deliveries and corresponding engine acquisitions, particularly in China and India. There is increasing investment in building domestic aerospace manufacturing capabilities and MRO infrastructure to reduce reliance on Western OEMs. Defense modernization programs across Japan, South Korea, and Australia also contribute significantly to the demand for advanced military propulsion systems.

- Latin America: This region represents a smaller but expanding market, characterized mainly by commercial fleet modernization efforts focused on regional and narrow-body aircraft, alongside selective military upgrades. The market largely depends on imports of engines and MRO services from North American and European providers. Brazil, with its established aerospace industry (Embraer), serves as a regional hub for assembly and specialized maintenance activities.

- Middle East and Africa (MEA): The Middle East is a high-value market driven by the expansion of major global flag carriers (e.g., Emirates, Qatar Airways) which operate large wide-body fleets requiring high-thrust, high-efficiency engines. Significant investment in new airport infrastructure and defense modernization, particularly in Saudi Arabia and the UAE, sustains demand. The African market growth is more restrained, focusing primarily on MRO services for older fleets and regional air transport expansion.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flight Propulsion Systems Market.- General Electric (GE Aerospace)

- Rolls-Royce Holdings plc

- Pratt & Whitney (RTX Corporation)

- Safran S.A.

- Honeywell Aerospace

- MTU Aero Engines AG

- Leonardo S.p.A.

- Aerojet Rocketdyne (L3Harris Technologies)

- IHI Corporation

- Williams International

- Textron Inc.

- BAE Systems plc

- Mitsubishi Heavy Industries (MHI)

- CFM International (JV between GE and Safran)

- PowerJet (JV between Safran and UEC)

- Rocket Lab USA, Inc.

- Reaction Engines Ltd.

- ZeroAvia

- Electric Power Systems (EPS)

- Ametek Inc.

Frequently Asked Questions

Analyze common user questions about the Flight Propulsion Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for new turbofan engines?

The primary driver is the need for enhanced operational efficiency and compliance with stringent environmental regulations. Airlines are replacing older fleets with new-generation aircraft equipped with high-bypass ratio turbofans, which offer significant reductions in fuel consumption, lowering operating costs and CO2 emissions substantially.

How are Ceramic Matrix Composites (CMCs) impacting engine performance?

CMCs are advanced materials used in the hot sections of engines (combustor and turbine). They are lighter and can withstand significantly higher temperatures than traditional metallic superalloys, allowing engines to run hotter and more efficiently, thereby increasing thrust and fuel economy while reducing the need for complex cooling systems.

Which segments of the flight propulsion market are projected to experience the fastest growth?

The Hybrid-Electric and All-Electric Propulsion segments are expected to exhibit the highest growth rates, driven by the emergence of Urban Air Mobility (UAM) platforms and regional aircraft manufacturers seeking zero- or low-emission solutions compliant with future sustainability mandates.

What role do long-term service agreements (LTAs) play in the profitability of propulsion OEMs?

LTAs, often referred to as Power-by-the-Hour contracts, ensure predictable, high-margin revenue streams for OEMs over the 20-30 year lifecycle of an engine. These proprietary contracts cover MRO, parts supply, and data analytics, creating strong barriers to entry for third-party service providers.

What are the key challenges facing the adoption of hydrogen propulsion technology?

Key challenges include developing lightweight and safe cryogenic storage systems for liquid hydrogen on board aircraft, ensuring complex regulatory certification for hydrogen combustion engines, and establishing a robust global infrastructure for green hydrogen production and airport refueling logistics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager