Flight Safety Camera Systems Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435228 | Date : Dec, 2025 | Pages : 257 | Region : Global | Publisher : MRU

Flight Safety Camera Systems Market Size

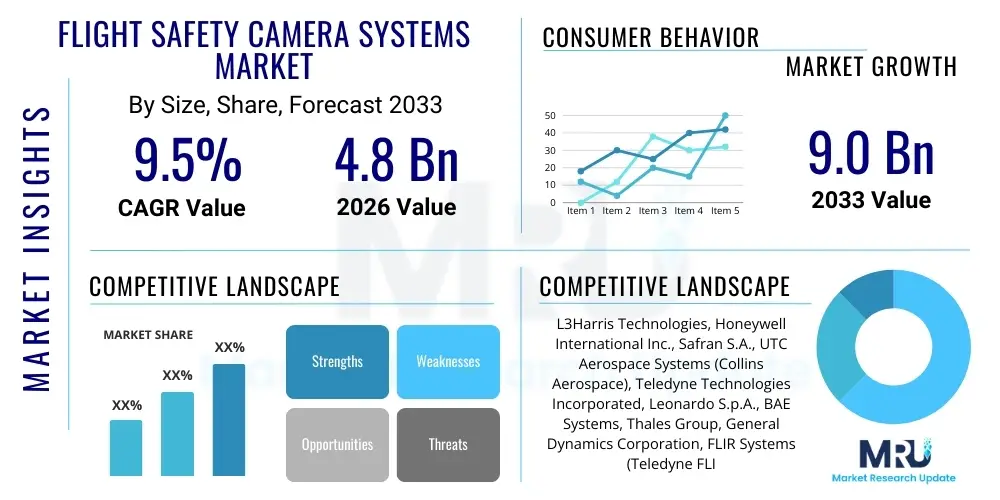

The Flight Safety Camera Systems Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at USD 4.8 Billion in 2026 and is projected to reach USD 9.0 Billion by the end of the forecast period in 2033.

Flight Safety Camera Systems Market introduction

The Flight Safety Camera Systems Market encompasses advanced visual monitoring equipment integrated into various aircraft platforms, including commercial airliners, military jets, business aviation, and Unmanned Aerial Vehicles (UAVs). These systems are designed to enhance situational awareness, provide critical visual evidence for accident investigation, and improve ground operation safety. Key products range from high-definition external cameras used for monitoring landing gear and wings to cockpit cameras capturing flight deck activity and sophisticated infrared sensors for enhanced vision systems (EVS).

Major applications of these camera systems include recording flight deck operations for safety audits and training, assisting pilots during complex maneuvers such as taxiing and docking, and providing a real-time view of critical external components during flight. The necessity for these systems is driven primarily by stricter regulatory mandates from bodies like the FAA and EASA requiring enhanced flight data monitoring capabilities and improved operational transparency. These technologies are crucial in mitigating risks associated with runway incursions, bird strikes, and ensuring the structural integrity of the aircraft mid-flight.

The principal driving factors include the rapid modernization of global commercial fleets, increasing adoption of digital cockpits, and the continuous advancement in imaging and data processing technologies, which allows for smaller, lighter, and more resilient camera modules. The inherent benefit of these systems is the profound improvement in overall flight safety and efficiency, offering unparalleled visual documentation that complements traditional flight data recorders, thereby reducing operational costs associated with incidents and optimizing maintenance schedules.

Flight Safety Camera Systems Market Executive Summary

The Flight Safety Camera Systems Market is characterized by robust growth, driven primarily by mandatory safety regulations and technological convergence, particularly integrating High-Definition (HD) and thermal imaging into standard aircraft architecture. Business trends indicate a strong move toward integrated sensor suites, offering multi-spectral imaging and real-time data streaming capabilities to ground crew and maintenance teams, significantly enhancing predictive maintenance strategies. Key industry players are focusing on miniaturization and robust certification (DO-160 compliance) to meet the stringent demands of the aerospace environment. The adoption rate is notably high in emerging markets where new aircraft procurement cycles are peaking, demanding the installation of the latest safety technologies.

Regional trends highlight North America and Europe as foundational markets due to early adoption, strict regulatory frameworks, and the presence of major aerospace manufacturers and system integrators. However, the Asia Pacific (APAC) region is demonstrating the fastest growth trajectory, fueled by expanding air travel, massive fleet expansion, and increasing defense spending, compelling local airlines and military forces to invest heavily in advanced safety monitoring tools. The Middle East also represents a significant growth pocket due to large capital expenditures on new generation long-haul aircraft and the establishment of world-class aviation hubs requiring optimal ground safety management.

Segment trends underscore the dominance of the Component segment, specifically the market for advanced Camera/Sensor modules (CMOS/CCD technologies) and high-capacity, crash-protected data recorders. The Platform segment sees commercial aviation holding the largest market share, though the military and UAV segments are experiencing accelerated penetration due to the critical need for visual intelligence during surveillance and mission-critical operations. Furthermore, the application segment shows strong momentum in Situational Awareness and Ground Operations monitoring, reflecting the industry's focus on minimizing accidents during low-speed maneuvers and taxiing phases.

AI Impact Analysis on Flight Safety Camera Systems Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move flight safety camera systems beyond mere recording to proactive risk mitigation. Common questions center on the ability of AI to instantly analyze visual data streams to detect anomalies, predict component failures (such as icing or structural cracks), and autonomously assist pilots during critical phases of flight like landing and taxiing. There is significant interest in AI's role in processing vast amounts of camera footage quickly for regulatory compliance checks and crew performance evaluation, reducing the reliance on tedious manual review.

The key themes of user concern revolve around the reliability and certification of AI algorithms within safety-critical systems. Users seek assurance that AI decision-making processes are transparent (explainable AI) and that hardware integration meets stringent aerospace standards for robustness and fault tolerance. Expectations are high regarding AI's potential to revolutionize situational awareness by fusing camera data with other sensors (radar, LIDAR) to create enhanced, actionable intelligence, particularly in degraded visual environments (DVE).

Overall, AI is expected to transform flight safety camera systems from passive data capture devices into active, intelligent monitoring and decision-support tools. This shift necessitates significant investment in high-performance edge computing capabilities embedded within the camera hardware itself, enabling real-time object recognition (e.g., runway debris, unauthorized personnel) and immediate alerting, thereby drastically improving response times to emergent safety threats.

- AI-Powered Real-Time Anomaly Detection: Utilizing ML algorithms to instantly identify deviations in monitored parameters (e.g., abnormal wing flap extension, engine vibrations visualized through camera feed).

- Enhanced Vision System (EVS) Integration: AI algorithms improving image clarity, fusion, and object recognition under low visibility or fog conditions, providing synthetic vision overlays.

- Automated Foreign Object Debris (FOD) Detection: ML processing ground camera feeds during taxi and takeoff to immediately alert air traffic control or pilots regarding debris on the runway.

- Predictive Maintenance based on Visual Data: Analyzing long-term video data to detect subtle changes like hydraulic leaks, surface corrosion, or wear and tear on landing gear before failure occurs.

- Optimized Data Storage and Retrieval: Employing AI to tag and categorize video events efficiently, making forensic analysis following an incident faster and more focused on critical moments.

DRO & Impact Forces Of Flight Safety Camera Systems Market

The market's dynamics are shaped by stringent regulatory drivers and impactful technological restraints, while presenting significant opportunities in integrated systems. Drivers include mandatory requirements for cockpit voice and video recorders (CVVR) expansion, increasing global air traffic leading to greater complexity in air and ground operations, and the continuous demand from insurance companies and regulatory bodies for exhaustive flight documentation. The major restraints involve the high certification costs and lengthy qualification processes required for aerospace hardware (DO-160, DO-178C), the complexity of integrating new digital systems into older legacy aircraft fleets, and concerns regarding data privacy and cybersecurity of high-resolution video streams.

Opportunities lie in the development of lightweight, resilient, and networked camera systems compatible with the next generation of digital aircraft architecture (e.g., Ethernet backbone aircraft). Expanding applications into the rapidly growing drone and urban air mobility (UAM) sectors offers lucrative untapped markets. Furthermore, the integration of multi-spectral sensing (combining visible light, infrared, and hyperspectral imaging) presents a pathway to offer comprehensive environmental awareness solutions that go beyond simple visual monitoring.

The market is subjected to moderate to high impact forces. Porter's Five Forces analysis suggests high bargaining power of buyers, especially major aircraft OEMs and large airline groups, due to customized solution requirements and volume procurement. Supplier power is moderate, as specialized sensor and optics providers hold proprietary technology. The threat of new entrants is low due to extremely high barriers to entry related to regulatory compliance and capital investment. However, the threat of substitution is moderate, primarily from non-visual sensing technologies (advanced radar, LIDAR) which could potentially offer similar situational awareness capabilities in some contexts, pushing camera system manufacturers to continuously innovate and integrate their solutions.

Segmentation Analysis

The Flight Safety Camera Systems Market is intricately segmented based on Component, System Type, Platform, and Application, reflecting the diverse operational requirements across the aviation industry. This multi-faceted segmentation allows stakeholders to target specialized needs, from simple data recording units to complex, multi-camera networks that offer 360-degree real-time surveillance. Understanding these segments is critical for manufacturers, as the performance requirements (e.g., thermal resistance, low-light capability, frame rate) vary significantly between systems intended for external wing monitoring versus internal cargo bay surveillance, driving product development strategies and market prioritization.

The market structure is moving toward modularity, allowing airlines and operators to select and integrate camera systems based on specific fleet needs and regulatory mandates, enhancing cost-effectiveness and scalability. The increasing digitalization of the cockpit and cabin further drives the demand for camera systems that can seamlessly interface with existing avionics suites, focusing segmentation efforts on software compatibility and data link capabilities. Furthermore, stringent safety standards are continually redefining what constitutes essential equipment, favoring segments that provide critical operational feedback and forensic capabilities.

- Component: Camera/Sensors, Recorders/Storage Units (CVR/FDR integration), Display Systems, Software/Analytics (Video Management Systems).

- System Type: Cockpit View Monitoring Systems, External View/Perimeter Monitoring Systems (Tail, Wing, Landing Gear), Cabin/Cargo Area Monitoring Systems, Enhanced Vision Systems (EVS).

- Platform: Commercial Aviation (Narrow-body, Wide-body), Military Aircraft (Fighters, Transports), Business Jets and General Aviation, Unmanned Aerial Vehicles (UAVs)/Drones.

- Application: Flight Data Recording and Forensics, Situational Awareness and Navigation Assistance, Ground Operations Monitoring (Taxiing, Parking), Security and Surveillance Monitoring.

Value Chain Analysis For Flight Safety Camera Systems Market

The value chain for Flight Safety Camera Systems is highly specialized and sequential, beginning with upstream raw material and component sourcing. The upstream segment is dominated by highly specialized manufacturers of ruggedized lenses, advanced image sensors (CCD/CMOS), microprocessors for edge computing, and crash-protected memory components. These suppliers must adhere to incredibly tight specifications for temperature tolerance, vibration resistance, and reliability, resulting in high levels of intellectual property concentration and often limiting the number of qualified suppliers, which grants them moderate leverage within the chain.

The midstream involves system integrators and camera system manufacturers who specialize in packaging these advanced components into certified aerospace enclosures, developing proprietary video management software, and securing regulatory approvals (e.g., TSO certification). This stage adds significant value through system engineering, testing, and customization to meet OEM platform specifications. The downstream segment involves direct distribution to major aircraft manufacturers (OEMs) for line-fit installation and indirect distribution channels involving Maintenance, Repair, and Overhaul (MRO) providers and third-party modification centers for aftermarket retrofitting. Direct channels are crucial for new aircraft programs, while MROs handle the extensive retrofit market, particularly for older aircraft seeking regulatory compliance or operational upgrades.

Distribution channels heavily favor a direct B2B approach, particularly when dealing with Tier 1 aircraft integrators like Boeing, Airbus, or major military contractors. However, the aftermarket segment relies on indirect distributors who maintain long-term relationships with regional airlines and smaller fleet operators. The specialized nature of these systems dictates that distribution partners must also provide comprehensive technical support and installation services, making the service component an intrinsic part of the distribution value proposition. Optimization within the value chain focuses on streamlining the certification process and reducing the lead time for highly customized orders.

Flight Safety Camera Systems Market Potential Customers

The primary end-users and buyers of Flight Safety Camera Systems are concentrated across four distinct but overlapping groups within the global aviation ecosystem, each driven by unique motivations, whether regulatory compliance, enhanced operational efficiency, or strategic military advantage. Commercial airliners, spanning major international carriers to regional airlines, constitute the largest customer base, driven universally by the need to comply with EASA and FAA mandates regarding flight data capture and to mitigate liability risks through comprehensive visual documentation of flight events.

Aircraft Original Equipment Manufacturers (OEMs), such as Airbus, Boeing, Embraer, and Bombardier, represent a critical customer segment, integrating these camera systems as standard or optional features during the manufacturing process (line-fit). Their demand is volume-based and centers on reliability, weight reduction, and seamless integration with existing avionics architecture. Furthermore, the global military and defense sector, including air forces and naval aviation divisions, is a high-value customer, prioritizing systems for enhanced reconnaissance, pilot situational awareness during combat or surveillance missions, and robust systems capable of operating in extreme environmental conditions.

Finally, the rapidly expanding sectors of Business Aviation (private jets, corporate fleets) and the emerging Unmanned Aerial Systems (UAS) market are growing customer bases. Business jet operators seek the same safety enhancements as commercial airlines, focusing particularly on ground operations monitoring and passenger safety. UAS operators require specialized, lightweight camera systems for regulatory compliance in beyond visual line of sight (BVLOS) operations and for detailed inspection or monitoring tasks, pushing the boundaries of miniaturization and autonomous data processing.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.8 Billion |

| Market Forecast in 2033 | USD 9.0 Billion |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | L3Harris Technologies, Honeywell International Inc., Safran S.A., UTC Aerospace Systems (Collins Aerospace), Teledyne Technologies Incorporated, Leonardo S.p.A., BAE Systems, Thales Group, General Dynamics Corporation, FLIR Systems (Teledyne FLIR), Astronics Corporation, Curtiss-Wright Corporation, Moog Inc., Meggitt PLC, Cox Engineering Co., SVS-Vistek GmbH, Vision Systems International LLC, Kappa optronics GmbH, AD Aerospace, ST Engineering. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flight Safety Camera Systems Market Key Technology Landscape

The technological landscape of the Flight Safety Camera Systems market is defined by the convergence of high-performance optics, durable avionics computing, and advanced data management. Key innovations revolve around increasing image quality (4K resolution and above) and enhancing sensor resilience to extreme environments (high altitude, drastic temperature changes). The shift from traditional analog systems to fully digital, networked camera solutions utilizing high-speed Ethernet (e.g., ARINC 818) is paramount, enabling faster data transfer and seamless integration with Electronic Flight Bags (EFBs) and other cockpit displays. Miniaturization technology is also critical, allowing robust cameras to be placed in hard-to-access locations, such as the leading edge of wings or within the landing gear bay, without impacting aerodynamics or weight distribution.

A significant trend is the adoption of multi-spectral imaging technologies, primarily combining visible light cameras with infrared (IR) or thermal sensors. These Enhanced Vision Systems (EVS) are crucial for improving pilot performance during low-visibility conditions like fog, heavy rain, or night operations, enabling pilots to "see through" weather phenomena that would typically halt operations. Furthermore, the integration of Solid-State Recorders (SSRs) for video data storage, replacing older magnetic tape systems, has drastically improved data reliability, retrieval speed, and crash protection capabilities, adhering to rigorous ED-112/DO-178C standards for flight recorder systems.

The future technology landscape is heavily invested in Edge Computing and AI capabilities. Embedding powerful microprocessors within the camera unit allows for instantaneous video analysis at the source, reducing the burden on central aircraft computers and minimizing data latency. This capability facilitates real-time alerts for identified anomalies, such as potential bird strikes or runway incursions, transitioning the system from a post-incident forensic tool to a preventative safety mechanism. Furthermore, cybersecurity protocols for encrypted video transmission and storage are becoming standardized, ensuring data integrity against sophisticated network threats, which is a major technological focus for all leading manufacturers.

Regional Highlights

- North America: Dominates the global market share, driven by the presence of major aircraft manufacturers (Boeing, Lockheed Martin), strict regulatory environment (FAA mandates for enhanced CVVR systems), and high defense spending, fostering innovation in military and commercial platforms.

- Europe: A mature market characterized by stringent safety requirements imposed by EASA and strong participation from European aerospace giants (Airbus, Safran, Thales). This region is pioneering the adoption of integrated EVS/Synthetic Vision Systems (SVS) and cockpit video recording for training and analysis.

- Asia Pacific (APAC): Projected as the fastest-growing region due to explosive growth in commercial air travel, massive fleet modernization programs across China and India, and increasing regional defense capabilities. Government initiatives to improve aviation safety standards are accelerating the retrofit market penetration.

- Latin America: Characterized by a steady but slower adoption rate, primarily focused on compliance retrofits for aging fleets and cautious investment in new systems. Market growth is tied to the expansion of regional low-cost carriers and increasing collaboration with North American MRO providers.

- Middle East and Africa (MEA): Significant investment fueled by wealthy Gulf nations establishing world-class aviation hubs. Demand centers on equipping new wide-body aircraft with the latest safety and surveillance technology, alongside high expenditure on military surveillance systems.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flight Safety Camera Systems Market.- L3Harris Technologies

- Honeywell International Inc.

- Safran S.A.

- UTC Aerospace Systems (Collins Aerospace)

- Teledyne Technologies Incorporated

- Leonardo S.p.A.

- BAE Systems

- Thales Group

- General Dynamics Corporation

- FLIR Systems (Teledyne FLIR)

- Astronics Corporation

- Curtiss-Wright Corporation

- Moog Inc.

- Meggitt PLC

- Cox Engineering Co.

- SVS-Vistek GmbH

- Vision Systems International LLC

- Kappa optronics GmbH

- AD Aerospace

- ST Engineering

Frequently Asked Questions

Analyze common user questions about the Flight Safety Camera Systems market and generate a concise list of summarized FAQs reflecting key topics and concerns.What regulations mandate the use of cockpit video recording systems in commercial aircraft?

The primary regulations driving the adoption of Cockpit Voice and Video Recorders (CVVR) are mandates from aviation bodies like the FAA (Federal Aviation Administration) and EASA (European Union Aviation Safety Agency), specifically related to expanding recording capabilities beyond traditional audio to include visual data for accident investigation and flight training standardization.

How do Flight Safety Camera Systems enhance pilot situational awareness?

These systems enhance awareness by providing pilots with real-time visual feedback on external aircraft status, particularly areas not visible from the cockpit, such as landing gear position, wing flap alignment, and runway proximity during taxiing. Enhanced Vision Systems (EVS) further improve awareness in poor visibility using thermal and infrared sensors.

What is the typical lifespan and maintenance cycle for these camera systems?

Flight safety camera systems are designed for high reliability and long operational life, typically matching the aircraft's lifecycle (20+ years). Maintenance primarily involves periodic functional checks and software updates, though crash-protected recorders require specialized handling and calibration to maintain certification compliance.

Is the integration of AI feasible for real-time analysis in aerospace cameras?

Yes, AI integration is highly feasible and rapidly increasing through the use of edge computing. High-performance processors are embedded within camera hardware, allowing real-time object detection and anomaly alerting (e.g., runway debris, icing detection) without relying on external or cloud-based data processing, crucial for safety-critical applications.

Which market segment currently exhibits the highest growth potential?

The External View/Perimeter Monitoring Systems segment and the UAV/Drone Platform segment show the highest growth potential. External view systems are increasingly mandated for ground safety, while the drone market requires lightweight, high-resolution cameras for sophisticated inspection and navigation tasks, pushing technological boundaries.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager