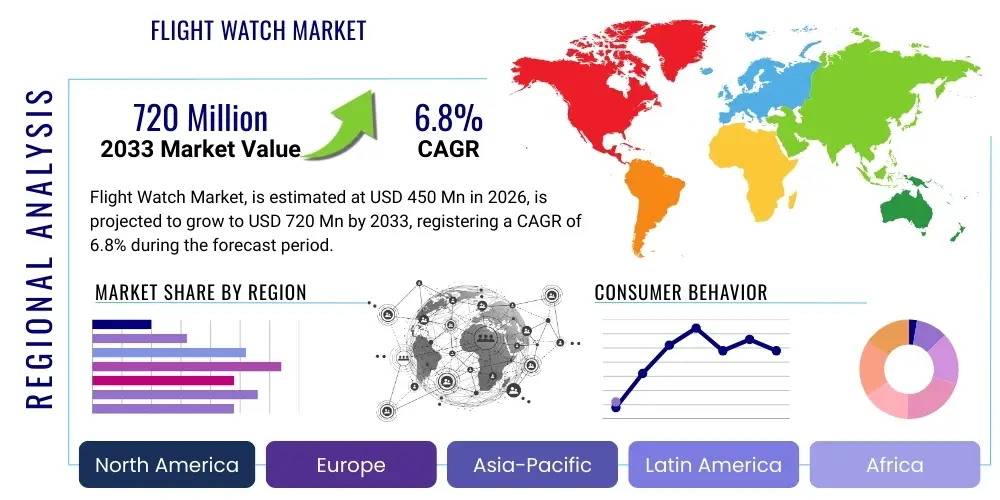

Flight Watch Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435340 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Flight Watch Market Size

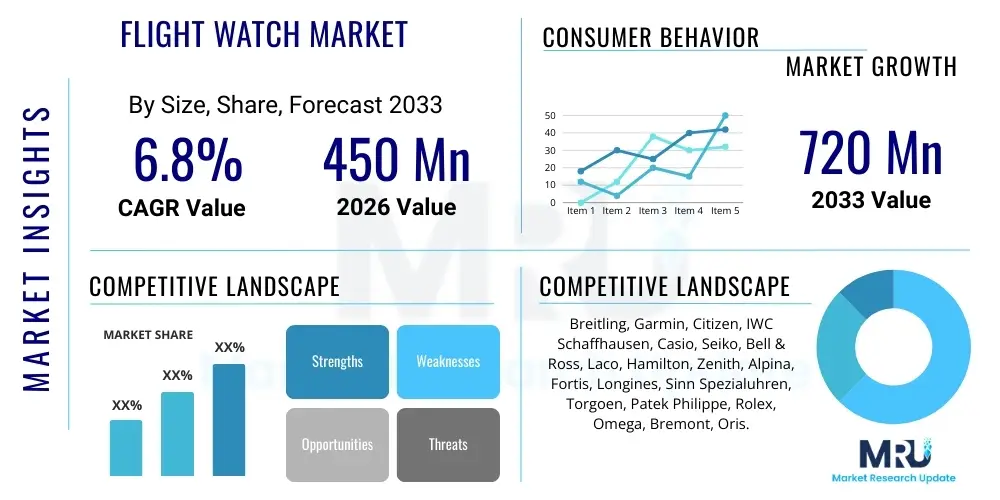

The Flight Watch Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 720 Million by the end of the forecast period in 2033.

Flight Watch Market introduction

The Flight Watch Market encompasses specialized timepieces designed explicitly for the needs of pilots and aviation professionals. These instruments are distinguished by features such as internal rotating bezels, slide rules for complex flight calculations (including fuel consumption, climb rates, and conversions), GMT/dual time zone functionality, and enhanced readability under varying light conditions. Modern flight watches, often referred to as pilot watches or aviator watches, incorporate advanced digital and hybrid technologies, integrating features like GPS navigation, aviation databases, and biometric monitoring, moving beyond purely mechanical chronographs. The evolution of the product line reflects a continuous drive for precision, reliability, and situational awareness enhancement within the cockpit environment.

Major applications of Flight Watches span commercial airline pilots, military aviators, private jet operators, and the expanding segment of recreational aviation enthusiasts. For commercial pilots, the watches serve as a crucial backup timing instrument and a tool for quick navigational arithmetic, maintaining operational redundancy mandated by aviation safety standards. Military applications demand extreme durability, anti-magnetic properties, and often specific functionality tailored to mission timing. The increasing sophistication of flight management systems has not diminished the utility of a dedicated, reliable wrist instrument, reinforcing its status as a critical piece of pilot gear rather than a mere accessory.

Key benefits driving market adoption include enhanced operational safety through reliable timekeeping, the ability to perform swift calculation adjustments without relying on cockpit instruments, and the inherent prestige and heritage associated with legacy aviator watch brands. The driving factors for market growth involve the substantial recovery and subsequent expansion of global commercial air travel, leading to higher demand for professional-grade equipment. Furthermore, technological advancements, such as the miniaturization of sensors and integration of sophisticated altimeters and barometers into wrist-wearable formats, are attracting tech-savvy users and broadening the product appeal beyond traditional mechanical enthusiasts.

Flight Watch Market Executive Summary

The Flight Watch Market is experiencing dynamic growth, propelled primarily by robust business trends centered on the integration of digital sophistication with traditional reliability. The market sees a bifurcation in demand: high-end luxury mechanical pilot watches maintain stable sales among collectors and senior captains, while the rapidly growing segment of digital and hybrid flight watches, led by tech giants specializing in aviation-grade GPS and sensor technology, captures the majority of new commercial and general aviation users. Key business strategies deployed include partnerships between watch manufacturers and major aviation organizations, focusing on producing specialized, certified equipment that meets strict regulatory standards. Pricing remains a critical differentiator, with significant consumer migration towards feature-rich, mid-range hybrid models that offer extensive data capabilities without the prohibitive cost of purely mechanical luxury chronographs.

Regionally, North America and Europe continue to dominate the market share, largely due to the presence of major aerospace and defense industries, high levels of commercial air traffic, and strong purchasing power for luxury and professional instruments. However, the Asia Pacific region is projected to exhibit the highest Compound Annual Growth Rate (CAGR) over the forecast period. This accelerated growth is attributed to rapid expansion in regional commercial aviation infrastructure, the proliferation of low-cost carriers, and substantial governmental investments in military aviation modernization programs, particularly in countries like China and India. Standardization of flight protocols across international borders also fuels global demand for watches capable of precise multi-time zone tracking and navigational computation.

Segmentation trends highlight the increasing importance of the 'Hybrid Flight Watch' category, which successfully bridges the gap between classic analog aesthetics and modern digital functionality, offering advantages in battery life and sensor integration. Application-wise, the Professional Pilots segment remains the core revenue driver, demanding certified accuracy and durability. The shift in distribution channels towards online retail platforms is also noteworthy, providing greater access to niche and international brands, supported by comprehensive digital product specifications and peer reviews. Furthermore, customization and limited-edition releases linked to historic aviation milestones are segment strategies used to capture the attention of high-net-worth aviation enthusiasts.

AI Impact Analysis on Flight Watch Market

Users frequently inquire whether Artificial Intelligence (AI) integration renders traditional pilot watches obsolete, or if AI capabilities, such as advanced predictive analytics and enhanced sensor data processing, will be integrated into future flight watch designs. Key concerns revolve around data security, the reliability of AI-driven alerts versus human judgment, and the necessity of maintaining physical, non-electronic backup tools. Users expect AI to primarily enhance situational awareness by processing vast amounts of environmental and aircraft data (like weather changes, turbulence predictions, and fuel efficiency optimization) and presenting contextual summaries directly on the watch face, transforming the flight watch from a computation tool into a real-time advisory system. The central theme is the expectation that AI will augment, not replace, the pilot's critical timing and navigational instruments.

- AI algorithms enable predictive maintenance alerts, optimizing watch durability and service intervals based on usage patterns.

- Advanced sensor fusion, processed by on-board AI, provides enhanced accuracy in measuring altitude, barometric pressure, and biometric stress indicators.

- AI-driven personalized content delivery offers context-aware flight checklists and emergency procedures based on real-time flight phase recognition.

- Natural Language Processing (NLP) capabilities integrated into the watch interface facilitate voice-command operation in high-stress, hands-busy cockpit environments.

- Machine learning models improve battery efficiency by intelligently managing power consumption based on predicted usage during long-haul flights.

- Enhanced cybersecurity protocols, leveraging AI monitoring, protect sensitive navigational data stored or processed on smart flight watches.

DRO & Impact Forces Of Flight Watch Market

The Flight Watch Market is fundamentally shaped by the dynamic interplay between stringent aviation safety standards and rapid technological advancements in microelectronics. Key drivers include the robust recovery and expansion of global air passenger traffic, necessitating a greater number of certified pilots who require standardized professional equipment. Simultaneously, restraints, particularly the high cost associated with certified mechanical chronographs and the increasing competition from feature-rich consumer smartwatches that offer overlapping functionalities at lower price points, dampen growth in the entry-level professional segment. Opportunities abound in the realm of hybrid watches, where advanced GPS, sophisticated mapping, and regulatory compliance features can be integrated efficiently. These forces are collectively impacted by technological innovation, which dictates the pace of product refresh cycles, and regulatory mandates, which ensure high barriers to entry for uncertified or unreliable devices.

Drivers fueling the market expansion are multifaceted. The substantial growth in the private and general aviation sectors, especially post-pandemic, has created a new segment of affluent enthusiasts willing to invest in high-quality pilot instruments for recreational use. Furthermore, military modernization programs globally continue to prioritize specialized, durable timepieces for tactical operations, often specifying unique features that consumer smartwatches cannot replicate. The intrinsic desire among pilots for a reliable, non-electronic, mechanical backup system remains a significant philosophical driver, ensuring that traditional flight watches retain their role as essential cockpit tools, regardless of the primary aircraft systems' complexity. This commitment to redundancy reinforces demand for high-reliability chronometers.

The primary restraint involves the significant price sensitivity among student pilots and commercial flight trainees, who often opt for cheaper alternatives or rely solely on aircraft instrumentation. Additionally, the complexity of certifying electronic devices for use in the cockpit, which must pass rigorous electromagnetic interference and radio frequency safety tests, slows down the adoption cycle for highly advanced smart flight watches compared to conventional devices. However, the opportunity to integrate advanced environmental sensors, such as sophisticated blood oxygen and altitude monitoring systems, directly into the watch, leveraging the growing trend of health monitoring, offers manufacturers a lucrative avenue for product differentiation and market capture, particularly among health-conscious aviators and recreational users navigating high altitudes.

DRO & Impact Forces Summary

- Drivers: Increased global air traffic and pilot recruitment; strong demand for reliable, certified cockpit backup instruments; expansion of recreational and general aviation activities.

- Restraints: High average selling price of certified chronographs; competitive pressure from versatile, lower-cost consumer smartwatches; complex regulatory hurdles for new electronic devices in the cockpit.

- Opportunities: Integration of advanced GPS, satellite communication, and biometric tracking capabilities; development of customizable, hybrid watches catering to specific flight types (e.g., helicopter, aerobatic); expansion into emerging APAC markets.

- Impact Forces: Technological Advancement (pushes product features and reduces size); Regulatory Compliance (sets minimum quality and safety standards); Economic Conditions (affects airline investment and pilot purchasing power).

Segmentation Analysis

The Flight Watch Market is broadly segmented based on Type, Application, and Distribution Channel, reflecting the diverse needs and preferences of the aviation community. The 'Type' segmentation distinguishes between traditional Analog (mechanical or quartz), purely Digital (electronic displays), and Hybrid watches, with the Hybrid segment currently showing the fastest adoption due to its combination of classic aesthetics and high-tech utility. The 'Application' segmentation targets the specific demands of Professional Pilots, which prioritize certification and reliability, versus Aviation Enthusiasts, who focus more on heritage and design authenticity. Analyzing these segments provides strategic insights into product development and targeted marketing efforts necessary to capture specific customer demographics, ranging from military precision requirements to luxury collector appeal.

Segmentation by Distribution Channel is increasingly critical, observing a pronounced shift from traditional Specialty Stores and Authorized Dealers towards robust Online Retail platforms. This shift enables niche brands to achieve global reach and allows consumers to compare technical specifications and certifications transparently. Furthermore, the segmentation analysis confirms that pricing strategy varies significantly across applications; watches targeted at military pilots emphasize durability and specific mission functionality, often procured through direct government contracts, whereas watches for commercial pilots are more focused on comfort, multi-time zone features, and brand recognition within the professional community. Understanding these granular differences is paramount for optimizing inventory management and regional market penetration.

The core of the market stability resides in the Analog segment, driven by the legacy brands and the unwavering regulatory requirement for non-electronic redundancy. However, the future market expansion will largely depend on the performance and reliability of the Hybrid segment, which must continuously integrate new, certified aviation data sources and maintain battery longevity appropriate for long-haul operations. Geographic segmentation reveals varied preferences; North American and European markets value certified devices highly, whereas APAC markets are rapidly adopting technologically advanced digital models, often prioritizing connectivity and smart features alongside basic timing capabilities. This detailed segmentation informs strategic decisions regarding production volumes and research and development investments.

- By Type:

- Analog Flight Watch (Mechanical and Quartz Chronographs)

- Digital Flight Watch (GPS, Multi-function electronic displays)

- Hybrid Flight Watch (Combination of analog display with digital smart features)

- By Application:

- Professional Pilots (Commercial Airlines, Cargo Pilots)

- Military Personnel (Tactical, Fighter, Transport Pilots)

- General Aviation Users (Private Pilots, Flight Instructors)

- Aviation Enthusiasts and Collectors

- By Distribution Channel:

- Specialty Aviation Stores

- Online Retail Platforms (E-commerce)

- Authorized Watch Dealers

- Direct Sales and Government Contracts

Value Chain Analysis For Flight Watch Market

The value chain for the Flight Watch Market begins with upstream activities dominated by the procurement of high-precision components, including specialized anti-magnetic alloys for casings, certified sapphire crystals for scratch resistance, and the sourcing of highly reliable movements, whether mechanical or advanced digital microprocessors and GPS modules. Component suppliers are often highly specialized, particularly for mechanical movements (e.g., ETA, Sellita) and for aviation-grade GPS chips (e.g., Garmin’s proprietary technology). Quality control at this stage is crucial, as the performance and certification status of the final product are highly dependent on the accuracy and durability of these core materials and sub-assemblies. The high standards required for aviation certification elevate the cost and complexity of the upstream phase compared to general consumer watches.

Midstream activities involve sophisticated design, assembly, and rigorous testing processes. Manufacturers invest heavily in R&D to incorporate complex features like integrated slide rules, E6B calculation capabilities, and altimeter functionality into a constrained wrist format. Crucially, the assembly phase involves strict adherence to certification standards (such as FAA or EASA requirements for backup instrumentation) and extensive quality assurance protocols to ensure water resistance, shock protection, and anti-magnetic shielding. Brands leverage their heritage and engineering prowess to create value through aesthetic design and proprietary movement technologies, differentiating themselves in a market where technical functionality is expected.

Downstream distribution channels are segmented into direct and indirect methods. Indirect channels predominantly rely on specialized aviation equipment retailers and high-end authorized watch dealers who provide expert consultation and after-sales service. Direct sales, including e-commerce platforms and government contracts for military applications, allow manufacturers greater control over branding and pricing. The value chain concludes with post-sales support, including maintenance, repair, and overhaul (MRO) services, which are critical for high-value mechanical watches, ensuring their longevity and continued accuracy, thereby retaining customer loyalty and maximizing the total lifetime value of the product for the end-user.

Flight Watch Market Potential Customers

The primary segment of potential customers for flight watches comprises professional pilots operating in commercial, corporate, and cargo aviation sectors. These end-users require certified, reliable chronometers for precise timing, fuel management calculations, and as an essential, non-electronic backup system in the cockpit. Their purchasing decisions are heavily influenced by regulatory requirements, brand reputation, and the specific functionality offered, such as GMT tracking for international flights and robust durability under varying environmental pressures. Furthermore, major airlines often recommend or standardize specific models, ensuring a consistent volume of professional sales.

A secondary, yet highly lucrative, customer base consists of military personnel, including fighter pilots and tactical transport operators. This segment demands watches built to extreme military specifications (MIL-SPEC), emphasizing shock resistance, readability under night vision, resistance to high G-forces, and specific tactical timing features. Purchases in this segment are often made through large, multi-year government contracts, necessitating manufacturers to meet stringent defense procurement standards and security clearances. The requirement for unique features unavailable in commercial models provides a significant barrier to entry and competitive advantage for specialized manufacturers.

The third major segment encompasses aviation enthusiasts, recreational pilots (general aviation), and watch collectors. While not driven by regulatory necessity, this group values the heritage, aesthetic design, and complex mechanical craftsmanship associated with pilot watches. This segment drives the demand for high-end luxury mechanical chronographs and limited-edition watches, where the emotional connection to aviation history and sophisticated engineering outweighs purely functional requirements. Marketing towards this group focuses heavily on brand storytelling, legacy, and exclusive feature sets, typically utilizing high-end specialty watch retailers and focused online luxury platforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 720 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Breitling, Garmin, Citizen, IWC Schaffhausen, Casio, Seiko, Bell & Ross, Laco, Hamilton, Zenith, Alpina, Fortis, Longines, Sinn Spezialuhren, Torgoen, Patek Philippe, Rolex, Omega, Bremont, Oris. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flight Watch Market Key Technology Landscape

The technology landscape of the Flight Watch Market is characterized by the coexistence of classical micro-mechanical engineering and state-of-the-art digital aviation technology. Traditional pilot watches rely on highly robust mechanical movements, often chronometers certified by institutions like COSC (Contrôle Officiel Suisse des Chronomètres), ensuring extreme precision and reliability independent of battery power. Key technologies include complex gearing systems necessary for chronographs, anti-magnetic cages (e.g., soft iron inner casings) to shield the movement from cockpit magnetic fields, and patented slide rule mechanisms (like the E6B computer bezel) enabling pilots to perform complex unit conversions and navigational calculations swiftly using physical manipulation. This mechanical segment focuses on refining traditional accuracy and ensuring operational redundancy, often using technologies like Silicon hairsprings for enhanced anti-magnetism and thermal stability.

In contrast, the digital and hybrid segments leverage advanced electronics and sensor technology. Critical digital technologies include high-sensitivity GPS receivers capable of rapid satellite acquisition and accurate position tracking, integrated barometric altimeters and pressure sensors for precise altitude and weather trend monitoring, and digital compasses with correction capabilities. Furthermore, connectivity technologies such as Bluetooth Low Energy (BLE) are essential for syncing flight plans, weather data, and logbook entries from mobile devices or electronic flight bags (EFBs). These watches employ high-resolution, sunlight-readable displays (e.g., transflective memory-in-pixel technology) optimized for the varying light conditions found in the cockpit, ensuring crucial information is always accessible.

The future technology trajectory focuses on enhancing the 'smart' capabilities while maintaining certification standards. This includes the development of sophisticated power management systems to extend battery life on GPS-intensive tasks, miniaturization of required sensors to maintain the traditional watch size profile, and integration of secure, certified aviation databases (e.g., airport and waypoint information) directly onto the device. Furthermore, advanced material science is being applied to the watch case construction, utilizing materials like titanium, carbon composite, and ceramics to reduce weight while maximizing structural integrity and resistance to extreme operational environments, thus ensuring the watch remains both functional and comfortable during extended periods of flight.

Regional Highlights

North America holds a commanding position in the Flight Watch Market, driven by the presence of major aerospace manufacturers, the highest volume of commercial air traffic globally, and significant defense spending on advanced aviation gear. The U.S. market specifically exhibits a high propensity for both high-end mechanical chronographs (due to the affluent pilot and collector base) and sophisticated digital flight watches (driven by companies like Garmin, based in the region). Strict adherence to FAA regulations necessitates the use of high-quality, reliable timing instruments, whether as primary or backup tools. Furthermore, a substantial general aviation community actively purchases specialized pilot watches for personal use, contributing significantly to regional sales volume and product testing environments.

Europe represents the second largest market, characterized by strong legacy luxury watch brands with centuries of aviation heritage (e.g., Breitling, IWC, Zenith). The market here is highly influential in setting trends for mechanical pilot watches, emphasizing COSC certification, historical design fidelity, and premium craftsmanship. Key growth accelerators include the robust intra-European commercial aviation network and high purchasing power in countries like Switzerland, Germany, and the UK. EASA regulations and the highly competitive nature of European airlines ensure a steady demand for professional-grade timepieces. The European market also shows a significant appreciation for limited-edition and heritage models, fueling high average selling prices in the luxury segment.

Asia Pacific (APAC) is projected to be the fastest-growing region during the forecast period. This growth is fueled by massive infrastructure investments in new airports, the rapid establishment and expansion of regional and international airlines (particularly in China, India, and Southeast Asia), and substantial government spending on modernizing military air fleets. While historically dominated by local and mid-range brands, the APAC region is quickly adopting global luxury and high-tech digital brands. The focus in this region is balanced between affordable, feature-rich digital models for new pilots and premium mechanical watches as status symbols, creating a wide spectrum of demand and opportunity for manufacturers across all price points. Educational expansion in aviation training schools further boosts demand for entry-level professional equipment.

Latin America and Middle East & Africa (MEA) collectively represent emerging markets for flight watches. Growth in the Middle East is particularly strong, driven by the large, globally recognized flagship carriers (e.g., Emirates, Qatar Airways) and the high disposable income of the expat pilot community working in the region. These markets show a preference for high-end, luxury flight watches that align with regional consumer trends in prestige goods. Latin America's market growth is slower but steady, primarily driven by domestic commercial aviation growth and private aviation ownership. Challenges in these regions include currency volatility and reliance on imports, which impact pricing and accessibility. Manufacturers often focus on key urban hubs and specialized aviation trade shows to reach professional customer bases in MEA and Latin America effectively.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flight Watch Market.- Breitling SA

- Garmin Ltd.

- IWC Schaffhausen (Richemont Group)

- Citizen Watch Co., Ltd. (Bremont)

- Casio Computer Co., Ltd.

- Seiko Holdings Corporation

- Bell & Ross

- Laco Uhrenmanufaktur

- Hamilton International Ltd. (Swatch Group)

- Zenith SA (LVMH)

- Alpina Watches International SA

- Fortis Watches SA

- Longines (Swatch Group)

- Sinn Spezialuhren GmbH

- Torgoen Watch Co.

- Omega SA (Swatch Group)

- Patek Philippe SA

- Rolex SA

- Oris SA

- Tissot SA (Swatch Group)

Frequently Asked Questions

Analyze common user questions about the Flight Watch market and generate a concise list of summarized FAQs reflecting key topics and concerns.What specific features differentiate a flight watch from a standard chronograph?

Flight watches, or pilot watches, are distinguished by key aviation-specific features such as the E6B slide rule bezel for in-flight calculations (fuel burn, crosswind), GMT or dual time zone functionality essential for international pilots, enhanced anti-magnetic properties to withstand cockpit electronics, and superior legibility designed for low-light conditions.

Are mechanical flight watches still relevant given the advanced digital cockpit displays?

Yes, mechanical flight watches remain highly relevant, primarily serving as critical, non-electronic backup timing instruments mandated by regulatory standards (e.g., FAA). They offer complete operational redundancy, ensuring precise timekeeping and calculation capabilities regardless of aircraft system failures or power loss, retaining their status as essential professional tools.

Which segments of the flight watch market are exhibiting the highest growth rate?

The Hybrid Flight Watch segment, which combines the durability and aesthetic of analog design with advanced digital features like GPS, certified aviation databases, and biometric sensors, is currently experiencing the fastest adoption rate, particularly among new commercial and general aviation pilots seeking comprehensive functionality.

How does AI technology impact the design and functionality of modern pilot watches?

AI is integrated into modern flight watches to enhance situational awareness by processing sensor data (altitude, weather) for predictive alerts, optimizing battery performance based on usage patterns, and improving the accuracy of GPS tracking and navigational summaries displayed directly on the wrist, augmenting the pilot's decision-making process.

Which geographical region leads the Flight Watch Market in terms of revenue and why?

North America currently leads the market in terms of revenue, driven by the substantial volume of commercial and private air traffic, the presence of major technological innovators (particularly in the digital segment), and high consumer purchasing power coupled with strict regulatory requirements for certified aviation equipment.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager