Floating PV System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431940 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Floating PV System Market Size

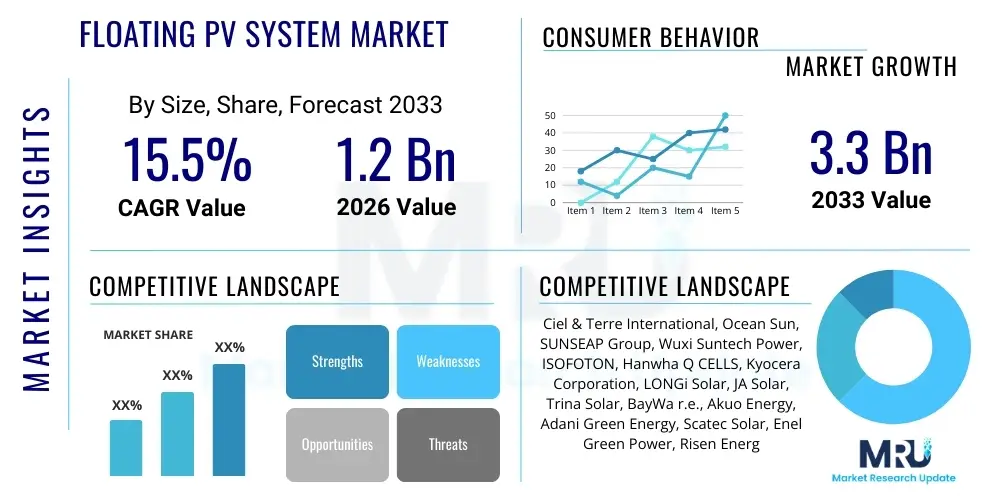

The Floating PV System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 15.5% between 2026 and 2033. The market is estimated at USD 1.2 Billion in 2026 and is projected to reach USD 3.3 Billion by the end of the forecast period in 2033.

Floating PV System Market introduction

The Floating PV (Photovoltaic) System Market involves the deployment of solar power generation infrastructure on water bodies, such as reservoirs, lakes, quarry ponds, and increasingly, near-shore marine environments. This innovative solution addresses the critical constraint of land scarcity for large-scale renewable energy projects, particularly in densely populated regions across Asia and Europe. Floating PV systems, often referred to as floatovoltaics, comprise standard photovoltaic modules mounted on specialized buoyant structures (floats or pontoons) and secured by advanced mooring and anchoring systems. These systems are connected to the onshore grid via submersible cables and include specific inverters and electrical balance-of-system (BOS) components designed to withstand humid and aquatic conditions. The technology offers several distinct advantages over traditional ground-mounted systems, driving its accelerated adoption globally.

A primary benefit of deploying solar panels on water is the inherent cooling effect provided by the water body. This natural temperature regulation significantly enhances the efficiency of the photovoltaic modules, leading to higher energy yields compared to equivalent land-based installations exposed to intense heat. Furthermore, Floating PV installations contribute substantially to environmental sustainability by reducing water evaporation from reservoirs, which is crucial in arid and semi-arid regions. By covering a portion of the water surface, these systems mitigate the heat transfer between the air and the water, conserving valuable water resources while simultaneously generating clean electricity. The dual functionality of water conservation and energy generation makes floatovoltaics a highly appealing infrastructure solution for water management authorities and utility providers.

Key driving factors propelling the market include aggressive renewable energy targets set by national governments, declining costs of PV module technology, and the growing demand for sustainable power solutions that do not necessitate extensive land use or deforestation. The major applications span utility-scale power generation, particularly on hydropower reservoir surfaces where existing grid infrastructure can be readily utilized, and smaller-scale industrial applications on wastewater treatment ponds or irrigation reservoirs. Continuous advancements in materials science, particularly in developing durable and environmentally friendly high-density polyethylene (HDPE) floats and specialized marine-grade electrical equipment, are solidifying the technical feasibility and long-term reliability of these sophisticated aquatic power platforms.

Floating PV System Market Executive Summary

The Floating PV System Market is experiencing robust growth driven by escalating global electricity demand and the imperative need for sustainable, land-efficient renewable energy sources. Business trends indicate a strong move toward large-scale utility projects, often integrated with existing hydropower facilities (hydro-floating PV hybrid systems), which leverage shared transmission infrastructure and offer enhanced grid stability through complementary generation profiles. Key market players are focusing heavily on strategic partnerships, mergers, and acquisitions to consolidate expertise in specialized areas such as mooring and anchoring technology and advanced float design. Furthermore, the market is seeing increased investment in manufacturing localized floating structures to reduce logistical costs and enhance responsiveness to regional project specifications, particularly in the rapidly expanding Asia Pacific region.

Regional trends are overwhelmingly dominated by Asia Pacific (APAC), particularly driven by China, India, Japan, and South Korea, where high population density and limited available land make FPV an optimal solution. China leads in terms of installed capacity, leveraging large inland lakes and subsided mining areas for major projects. Europe, particularly countries like the Netherlands and France, is also showing significant momentum, focusing on commercial and industrial applications on quarry lakes and wastewater treatment facilities, supported by strong governmental feed-in tariffs and supportive regulatory frameworks. North America is poised for accelerated growth, fueled by utility interest in utilizing hydroelectric reservoirs and implementing pilot projects across states focused on grid modernization and decarbonization initiatives.

Segmentation trends highlight the dominance of the Utility-Scale application segment, requiring massive installations of 10 MW and above to meet national energy quotas. Technologically, the Stationary FPV segment currently holds the largest share due to its lower complexity and installation costs, though investments in Tracking FPV systems—which promise higher yields through optimized sun exposure—are increasing as technology matures. In terms of components, the Floats/Pontoons segment commands a significant value share, necessitating specialized engineering focused on durability, UV resistance, and minimal environmental impact. The long-term viability and growth trajectory of the market are intrinsically linked to continuous improvements in mooring system resilience and standardization of permitting processes for large water surface leases.

AI Impact Analysis on Floating PV System Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Floating PV System Market frequently center on themes of operational efficiency, predictive maintenance, and optimized design. Users are keenly interested in how AI algorithms can improve the energy yield prediction accuracy of these systems, which are inherently complex due to water movement, humidity variations, and unique thermal profiles. Specific concerns involve the application of AI in minimizing downtime through early fault detection in submerged electrical components and the sophisticated monitoring of mooring integrity under unpredictable weather events. There is also significant curiosity about using machine learning models to optimize the placement and orientation of FPV arrays on irregular water bodies to maximize solar capture while minimizing environmental disturbance and installation costs.

The key theme emerging from user inquiries is the expectation that AI will transition FPV operations from reactive maintenance to proactive, high-precision asset management. AI-driven predictive maintenance utilizes sensor data collected from PV modules, inverters, and environmental monitoring stations (such as wave height and wind speed) to anticipate component failures weeks or months in advance. This capability is particularly critical for FPV systems where access for repair can be challenging and costly. Furthermore, machine learning models are becoming indispensable tools for financial institutions and project developers by providing highly accurate long-term performance assessments, thereby reducing investment risk and streamlining the financial closure process for multi-billion dollar FPV projects.

Ultimately, AI is viewed as the technological lever necessary to unlock the full potential of FPV systems by addressing their inherent operational complexities. Beyond maintenance and performance optimization, AI is influencing the initial design phase through Generative Design algorithms. These algorithms can simulate millions of potential float designs and array layouts based on specific water depth, climate zone, and environmental regulations, selecting the most resilient and highest-performing configurations. The integration of sophisticated AI and IoT (Internet of Things) platforms ensures that FPV systems remain highly competitive against other renewable energy sources, delivering superior return on investment and enhancing overall grid reliability.

- AI-driven Predictive Maintenance: Enables real-time monitoring of electrical components and mooring systems, forecasting failures to reduce costly downtime in aquatic environments.

- Optimized Energy Yield Prediction: Machine learning models analyze complex environmental variables (water temperature, humidity, wave motion) to provide highly accurate power generation forecasts.

- Generative Design for Floats and Arrays: AI algorithms simulate and optimize the geometric design of floating structures and array layout based on hydrodynamics and solar irradiation data.

- Enhanced Security and Surveillance: Utilizes AI-powered video analytics for detecting unauthorized access or environmental hazards around the water body installation.

- Automated Environmental Monitoring: AI platforms analyze water quality data and aquatic ecosystem responses to ensure FPV installations comply with stringent ecological standards.

- Streamlined Operational Control: Implementing AI for automated inverter management and maximizing power export based on dynamic grid conditions.

DRO & Impact Forces Of Floating PV System Market

The Floating PV System Market growth is dictated by a potent combination of drivers, restraints, and opportunities (DRO), which collectively shape the impact forces acting upon industry expansion. The primary driver is undoubtedly the compelling global necessity to accelerate the transition to sustainable energy, coupled with severe limitations on land availability for solar farms, particularly in Asia. This driver is amplified by supportive government policies, including lucrative incentives and mandated renewable portfolio standards, which make FPV projects financially attractive. However, these drivers are counterbalanced by significant restraints, primarily the higher upfront capital expenditure required for FPV compared to traditional ground-mounted systems, driven by the specialized engineering needed for floats, mooring, and underwater electrical components. Furthermore, the inherent complexity of obtaining water body leases and navigating multifaceted environmental permitting processes poses a major bottleneck, slowing down project timelines and increasing regulatory risk.

Opportunities in the FPV market are vast and concentrated on technological innovation and synergistic applications. The potential for integrating FPV with existing hydropower infrastructure presents a major opportunity, allowing for efficient use of shared transmission lines and providing valuable water management flexibility. The development of hybrid systems that combine FPV with battery energy storage systems (BESS) is also poised to stabilize power output, enhancing the value proposition for grid operators. Furthermore, significant untapped potential exists in expanding FPV deployments into non-traditional water bodies such as mining pit lakes, desalination plant reservoirs, and near-shore coastal areas, provided resilient and corrosion-resistant materials can be standardized and cost-effectively deployed. These opportunities incentivize continuous research and development efforts among key industry stakeholders, focusing on optimizing float longevity and minimizing ecological impact.

The core impact forces—the Drivers and Opportunities—are currently outweighing the Restraints, leading to a net positive force driving market expansion. The technological maturity and declining component costs are steadily mitigating the high capital expenditure restraint, making FPV more competitive. Regulatory frameworks are gradually adapting to accommodate water surface utilization for power generation, especially as the benefits of water conservation and land sparing become undeniable public goods. The momentum created by international climate commitments and the proven success of gigawatt-scale projects in China and India solidify the FPV market’s trajectory toward mainstream adoption within the global energy mix. Continuous innovation in mooring systems capable of handling dynamic water levels and challenging weather conditions remains the critical determinant for sustaining this growth momentum, particularly as projects move to larger, more exposed water bodies.

Segmentation Analysis

The Floating PV System Market segmentation provides a detailed structural breakdown of the industry based on technology type, installation location, primary components utilized, and end-user application scale. This granular view is essential for strategic planning, allowing manufacturers and project developers to target specific market needs effectively. The market is primarily divided by the type of floating mechanism, distinguishing between simpler, fixed-tilt (stationary) systems and more advanced, costly tracking systems designed to maximize solar irradiation capture. The installation location variable highlights the critical difference between freshwater (reservoirs, lakes) and saline water (seawater) deployments, each requiring specialized material resistance and mooring resilience. The component segmentation emphasizes the value chain allocation, with floats and specialized electrical Balance of System (BOS) components representing the highest value additions specific to this market segment.

The Application segmentation is crucial as it defines the commercial viability and regulatory landscape of projects. Utility-Scale projects (typically >5 MW) dominate the market share, driven by government tenders and Independent Power Producers (IPPs) seeking massive capacity additions to meet national renewable energy targets. The Commercial and Industrial (C&I) segment involves smaller, distributed generation systems installed on irrigation ponds or industrial effluent reservoirs, prioritizing self-consumption and reducing local energy costs. Understanding these segments is key to customizing product offerings; for instance, Utility-Scale requires extreme durability and scalability, while C&I demands quicker installation and modularity. The future market dynamics are expected to involve increasing complexity within the Component segment, particularly in high-voltage submerged cable technologies and robust hybrid inverter solutions designed for aquatic operational environments.

- By Type: Stationary FPV, Tracking FPV (Single-Axis Tracking, Dual-Axis Tracking)

- By Installation Location: Reservoir, Quarry Lake, Tailings Pond, Irrigation Ponds, Wastewater Treatment Ponds, Seawater (Near-Shore and Offshore)

- By Component: PV Modules (Monocrystalline, Polycrystalline, Thin-Film), Floats/Pontoons (HDPE, Ferrocement, Aluminum), Mooring & Anchoring Systems (Deadweight, Pile-Mooring, Tension Mooring), Inverters (String Inverters, Central Inverters), Electrical Components (Submersible Cables, Transformers, Switchgear), Mounting Structure & Racks.

- By Application: Utility-Scale (5 MW and above), Commercial & Industrial (C&I) (100 kW to 5 MW), Residential (Small-scale projects, generally <100 kW).

Value Chain Analysis For Floating PV System Market

The Floating PV System market value chain begins with the Upstream segment, dominated by the sourcing and manufacturing of raw materials crucial for system components. This includes the production of specialized polymers (e.g., High-Density Polyethylene - HDPE) for floats, silicon for PV modules, and marine-grade steel for mooring systems. Key upstream activities involve advanced R&D for material science to ensure longevity, UV resistance, and minimal biofouling. Efficiency improvements in PV module manufacturing remain central to cost reduction. The float manufacturing sub-segment is highly specialized, demanding precision molding and robust structural design unique to the aquatic environment. Optimization at this stage is critical, as floats represent a significant portion of the total system cost relative to conventional solar projects.

The Midstream activities encompass the system integration and distribution channel management. This stage involves the complex engineering design tailored to specific water bodies (bathymetry, water level fluctuations), procurement of specialized electrical BOS components (submersible cables, aquatic-rated transformers), and the logistical assembly and installation process. Distribution channels are typically a combination of Direct and Indirect sales models. Large Utility-Scale projects often rely on Direct engagement between specialized Engineering, Procurement, and Construction (EPC) firms and Independent Power Producers (IPPs) or utility companies. Indirect channels involve distributors or specialized integrators supplying modular FPV solutions for the smaller C&I market, providing localized support and rapid deployment capabilities. Effective project management and efficient supply chain logistics for large, bulky components like floats are paramount at this stage.

The Downstream segment focuses on the operation, maintenance (O&M), and asset management of the deployed FPV systems. Due to the inherent challenges of accessing aquatic installations, O&M requires specialized boats, underwater drones for inspection, and robotics for cleaning and maintenance, which differentiate it significantly from ground-mounted O&M. Advanced predictive analytics and remote monitoring systems are increasingly used to minimize maintenance downtime. The end-users—primarily utilities, water management authorities, and large industrial consumers—drive the demand. Successful downstream activities ensure long-term performance, high capacity factors, and regulatory compliance, particularly regarding water quality and ecological safeguards, thereby maximizing the project's long-term profitability and demonstrating the technology's viability to potential investors.

Floating PV System Market Potential Customers

The primary consumers and end-users of Floating PV Systems are entities with large, accessible water resources combined with a significant need for electricity generation, grid stabilization, or water management. Dominant customers include Independent Power Producers (IPPs) and national Utility Companies that utilize FPV to meet stringent renewable energy mandates and diversify their generation portfolio. These entities typically fund and manage large-edge, multi-megawatt installations on existing hydropower reservoirs, leveraging the site’s existing grid connection infrastructure and the benefits of hybrid operations. The integration of FPV enhances the capacity factor of the hydro facility, making this customer segment the largest driver of market revenue globally.

A secondary, yet rapidly growing, customer base consists of Water Management and Irrigation Authorities, particularly those operating reservoirs essential for agriculture or municipal water supply. These customers seek FPV solutions primarily for the dual benefit of generating power and significantly reducing water evaporation losses, which is a critical concern in water-stressed regions. By combining water conservation with electricity generation, FPV offers a cost-effective infrastructure upgrade. Furthermore, the Industrial sector, including mining operations (utilizing tailings ponds and pit lakes) and wastewater treatment facilities, represents a highly specific customer segment focused on waste-to-energy concepts and utilizing otherwise unproductive water surfaces for localized, sustainable power generation to offset high operational energy costs.

The least developed, but emerging, customer segment includes local Municipalities and specific Commercial entities such as large agricultural farms or fish farms. These users typically invest in smaller-scale FPV installations to achieve energy self-sufficiency and promote sustainable business practices. Government entities and public bodies also serve as key customers, initiating pilot projects to test technical feasibility and demonstrate commitment to climate resilience. The expansion of the FPV market critically depends on utility companies and IPPs gaining confidence in the long-term asset integrity and bankability of these water-based power projects, leading to further scale and deployment.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.2 Billion |

| Market Forecast in 2033 | USD 3.3 Billion |

| Growth Rate | 15.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ciel & Terre International, Ocean Sun, SUNSEAP Group, Wuxi Suntech Power, ISOFOTON, Hanwha Q CELLS, Kyocera Corporation, LONGi Solar, JA Solar, Trina Solar, BayWa r.e., Akuo Energy, Adani Green Energy, Scatec Solar, Enel Green Power, Risen Energy, GCL System Integration, Yingli Solar, Jinko Solar, TSK Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floating PV System Market Key Technology Landscape

The technological landscape of the Floating PV System market is defined by several core innovations aimed at enhancing resilience, efficiency, and cost-effectiveness in aquatic environments. A cornerstone technology is the design and material composition of the floating structures themselves. While High-Density Polyethylene (HDPE) remains the dominant material due to its buoyancy, durability, and recyclable nature, significant research is being invested in hybrid structures, including modularized pre-cast concrete or advanced composite materials, especially for very large, turbulent, or near-shore deployments. The focus is on increasing the lifespan of the floats to match or exceed the 25-year operational life of the PV modules, while also optimizing the raft design to withstand substantial wind loads, wave action, and rapid fluctuations in water level without compromising system stability or creating undue stress on the interconnection cables. Robust, interlocking float designs that facilitate easier assembly and scalability are key differentiators among leading providers.

Another crucial area of technological advancement is the development of Mooring and Anchoring Systems. Unlike fixed land installations, FPV requires dynamic, resilient mooring solutions capable of holding the massive solar array in place, often spanning hundreds of acres, under severe weather conditions. Technologies vary based on water depth and bottom substrate; solutions range from deadweight anchors and pile-mooring systems (in shallow waters) to advanced tension mooring and catenary systems engineered for deeper reservoirs or coastal environments. Continuous innovation is centered on smart mooring systems integrating tension sensors and data analytics platforms (often utilizing AI) that provide real-time feedback on mooring integrity, allowing operators to preemptively adjust tension or detect potential failure points. This minimizes the risk of catastrophic system failure and environmental damage, which is a major concern for investors.

Furthermore, specialized Balance of System (BOS) components, particularly inverters and electrical cabling, represent a distinct technological challenge and opportunity. Inverters used in FPV must handle higher humidity levels and temperature variations than typical ground-mounted units; consequently, decentralized string inverter architectures are often preferred for their modularity and ease of maintenance, although highly protected central inverters are still used in large utility-scale projects. The development of submersible, UV-resistant, and chemically inert medium-voltage cables that safely transmit power from the array across the water to the shore connection is vital. Future technological breakthroughs are anticipated in optimizing the hydro-floating PV hybrid architecture, focusing on advanced power electronics and control systems that seamlessly manage the complementary generation profiles of solar and hydropower, thereby maximizing the total capacity value delivered to the grid and solidifying FPV’s position as a reliable, dispatchable power source.

Regional Highlights

- Asia Pacific (APAC): APAC is the global leader in the Floating PV System Market, holding the largest market share and demonstrating the highest growth trajectory. This dominance is driven by acute land scarcity across highly populated nations like China, India, Japan, and South Korea, coupled with aggressive national renewable energy targets. China, in particular, leads the world in installed capacity, utilizing vast inland water bodies, including subsided coal mining pits, for multi-gigawatt installations. Japan, motivated by high domestic energy prices and the proximity of industrial complexes to reservoirs, has also been an early adopter. The region’s growth is fundamentally supported by strong governmental support, declining manufacturing costs, and increasing technological expertise in complex aquatic deployments.

- Europe: Europe represents a sophisticated and maturing market for Floating PV, characterized by targeted deployments in countries like the Netherlands, France, and the UK. European projects frequently focus on smaller, high-value C&I applications, such as installations on quarry lakes, industrial cooling ponds, and wastewater treatment facilities, aimed at achieving energy self-sufficiency and reducing carbon footprints. The key driver here is a stringent regulatory environment that promotes renewable energy and a strong emphasis on innovative, aesthetically pleasing, and ecologically sound designs. High power tariffs incentivize industrial users to invest in FPV solutions that utilize existing, otherwise wasted, water surfaces.

- North America: The North American market, predominantly the United States, is accelerating its FPV adoption, moving rapidly from pilot projects to large-scale utility deployment, particularly within the hydroelectric infrastructure network. The growth is fueled by regulatory pushes for grid modernization and decarbonization, especially in states with significant water resources like California and the Southeast. Major utility companies are recognizing the strategic value of FPV integration with hydroelectric dams to manage peak loads and increase water conservation efforts. Challenges include rigorous environmental assessment processes and adapting global FPV technologies to specific regional regulations and unique water body characteristics.

- Latin America (LATAM): LATAM is emerging as a strong potential market, largely centered around countries with substantial hydropower capacity, such as Brazil and Chile. The regional appeal lies in the massive untapped potential of existing hydropower reservoirs. FPV offers a fast, cost-effective way to boost total power capacity and stabilize energy supply in regions prone to seasonal droughts affecting hydro generation. The focus remains on strategic utility-scale partnerships and securing long-term Power Purchase Agreements (PPAs) to finance the high initial capital requirements.

- Middle East and Africa (MEA): The MEA region is at an early stage of adoption, yet possesses significant potential, driven primarily by water-scarce nations seeking simultaneous power generation and critical water evaporation reduction. Countries in the Gulf Cooperation Council (GCC) are exploring FPV on desalination plant reservoirs and municipal storage ponds. In Africa, FPV offers a decentralized solution for electrification in areas with large irrigation reservoirs. The market growth here is highly dependent on governmental infrastructure investment and the establishment of stable regulatory frameworks that reduce political and financial risk for foreign developers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floating PV System Market.- Ciel & Terre International

- Ocean Sun

- SUNSEAP Group

- Wuxi Suntech Power

- ISOFOTON

- Hanwha Q CELLS

- Kyocera Corporation

- LONGi Solar

- JA Solar

- Trina Solar

- BayWa r.e.

- Akuo Energy

- Adani Green Energy

- Scatec Solar

- Enel Green Power

- Risen Energy

- GCL System Integration

- Yingli Solar

- Jinko Solar

- TSK Group

Frequently Asked Questions

Analyze common user questions about the Floating PV System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Floating PV systems over traditional ground-mounted solar farms?

The primary advantage is the dual benefit of land sparing and enhanced energy efficiency. Floating PV systems utilize non-productive water surfaces (reservoirs, lakes), conserving valuable land. Additionally, the cooling effect of the water naturally boosts PV module efficiency, resulting in higher power output compared to similar land-based installations.

What is the expected CAGR for the Floating PV System Market between 2026 and 2033?

The Floating PV System Market is projected to exhibit a robust Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period from 2026 to 2033, driven largely by accelerated adoption in Asia Pacific and integrating FPV with hydropower facilities.

How does the implementation of Floating PV impact water evaporation in reservoirs?

By covering a portion of the water surface, FPV systems significantly reduce solar exposure and wind interaction, substantially mitigating water evaporation. This water conservation benefit is a major driver for adoption, particularly in arid and semi-arid regions facing water scarcity issues.

Which component segment represents the highest specialized value within the FPV market structure?

The Floats/Pontoons and Mooring & Anchoring Systems segments represent the highest specialized value. These components require advanced engineering using materials like HDPE to ensure buoyancy, durability, UV resistance, and resilience against dynamic water movements, differentiating them entirely from standard solar installations.

What technological advancements are crucial for successfully deploying FPV in near-shore seawater environments?

Successful seawater deployment hinges on highly specialized, corrosion-resistant materials for floats and electrical components, along with advanced mooring and anchoring systems (e.g., tension mooring) designed to withstand high-salinity environments, powerful waves, and biofouling while ensuring asset integrity over a 25-year lifespan.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager