Floating Roof AST Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434573 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Floating Roof AST Market Size

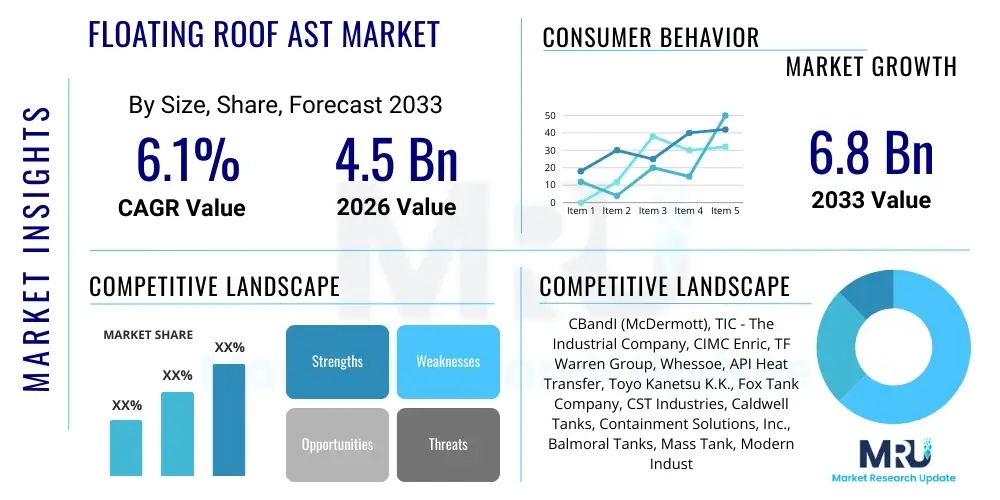

The Floating Roof AST Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.1% between 2026 and 2033. The market is estimated at USD 4.5 Billion in 2026 and is projected to reach USD 6.8 Billion by the end of the forecast period in 2033.

Floating Roof AST Market introduction

The Floating Roof Aboveground Storage Tank (AST) Market encompasses specialized storage solutions designed primarily for volatile organic liquids, such as crude oil, refined petroleum products, and petrochemicals. These tanks utilize a roof structure that floats directly on the liquid surface, significantly reducing vapor space, thereby minimizing evaporation losses and lowering the emission of volatile organic compounds (VOCs). This essential function not only results in considerable cost savings for operators by conserving valuable product but also ensures adherence to increasingly strict environmental regulations imposed globally, particularly in developed economies focusing on air quality standards. The structure involves complex engineering to ensure effective sealing, stability, and corrosion resistance, making it a critical asset in the midstream and downstream oil and gas sector.

Major applications of Floating Roof ASTs span across oil refineries, bulk storage terminals, chemical processing plants, and port facilities where large volumes of hazardous or valuable liquids require secure containment. The primary benefit driving their adoption is their superior environmental performance compared to fixed roof tanks, coupled with enhanced operational safety by reducing the risk of explosive vapor mixtures above the liquid surface. Furthermore, the inherent design provides better protection against internal corrosion and allows for easier inspection of the tank bottom when the roof is fully lowered. The demand for robust and reliable infrastructure to handle growing global energy consumption, alongside mandated compliance for VOC emission reduction, serves as the central driving factor for market expansion.

Key driving factors accelerating market growth include the global expansion of refining capacity, especially in the Asia Pacific region, coupled with the necessity of replacing aging storage infrastructure in North America and Europe. Regulatory bodies like the EPA and equivalent international organizations consistently update emission standards, compelling terminal operators to invest in high-efficiency storage solutions like Floating Roof ASTs. Additionally, technological advancements in seal materials, corrosion protection coatings, and monitoring systems are enhancing the longevity and operational efficiency of these tanks, making the investment highly attractive for large-scale industrial operators focused on long-term asset integrity and environmental stewardship.

Floating Roof AST Market Executive Summary

The Floating Roof AST Market is currently characterized by significant investment in infrastructure modernization and capacity expansion, largely propelled by stringent global environmental mandates focused on reducing VOC emissions from bulk storage facilities. Business trends indicate a strong move toward advanced sealing technology and integration of digital monitoring systems, emphasizing safety and operational efficiency as paramount concerns for stakeholders. Major refinery and terminal operators are allocating substantial capital expenditure towards compliance-driven infrastructure upgrades, ensuring the replacement of older, fixed-roof tanks with modern floating roof variants that offer superior environmental performance and product conservation benefits. The market sees intense competition based not only on price but primarily on engineering excellence, material quality, and adherence to international safety standards such as API 650 and API 653.

Regional trends highlight the Asia Pacific (APAC) region as the primary growth engine, driven by massive increases in petrochemical production and refining capacity, particularly in China, India, and Southeast Asian nations striving to meet rising domestic energy demand and establish export dominance. North America and Europe, while being mature markets, exhibit steady demand for replacement tanks and modernization projects, focusing heavily on adopting advanced internal floating roofs (IFR) for existing facilities to meet stringent regulatory pressures without full tank replacement. Meanwhile, the Middle East and Africa (MEA) continue significant investment in storage capacity expansion linked to crude oil and LNG export terminals, favoring large-scale external floating roof (EFR) designs for strategic crude storage.

Segmentation trends reveal that external floating roof tanks dominate the crude oil storage segment due to their massive capacity potential and cost-effectiveness for volatile materials stored at ambient temperatures, though internal floating roofs are increasingly preferred for highly refined products and specialty chemicals where contamination risk must be minimal and stricter environmental control is mandatory. Furthermore, the construction material segment is shifting towards high-strength, corrosion-resistant steel alloys and composite materials for seals and roof components, enhancing tank lifespan and reducing maintenance cycles. The service providers segment is consolidating, with larger engineering, procurement, and construction (EPC) firms providing end-to-end solutions, leveraging advanced automation in tank construction and inspection methodologies.

AI Impact Analysis on Floating Roof AST Market

Common user questions regarding AI's impact on the Floating Roof AST Market frequently revolve around how artificial intelligence can enhance safety protocols, predict maintenance failures, and optimize inventory management in large tank farms. Users are concerned with the cost-benefit ratio of integrating complex AI systems into established, heavy industrial infrastructure and whether AI can accurately model complex physical phenomena like seal wear, foundation settlement, and corrosion rates, which are critical for tank integrity. There is a strong interest in AI's ability to process vast streams of sensor data—acoustic, vibration, temperature, and level measurements—to provide proactive failure warnings, moving the industry decisively from reactive or time-based maintenance to true predictive maintenance. Key expectations center on AI improving operational uptime, lowering environmental risks associated with containment failure, and enhancing compliance reporting efficiency, effectively transforming tank farm management from manual monitoring to data-driven decision-making.

- AI-driven Predictive Maintenance: Utilizing machine learning algorithms to analyze real-time sensor data (e.g., roof movement, seal degradation, cathodic protection performance) to accurately forecast potential equipment failures, significantly reducing catastrophic risk and unplanned downtime.

- Enhanced Leak Detection Systems: Deployment of AI to filter noise and accurately identify minute anomalies in acoustic monitoring or fluid level data, providing faster and more reliable detection of leaks compared to conventional methods.

- Optimized Inventory Management: Employing AI models for real-time volumetric calculations, accounting for temperature and pressure changes, thus improving accuracy in inventory reconciliation and optimizing product transfer schedules.

- Automated Compliance and Reporting: AI platforms automatically aggregating and formatting operational data to ensure continuous compliance with strict regulatory reporting requirements (e.g., VOC emission thresholds and tank integrity inspection schedules).

- Robotic Inspection Planning: Utilizing AI to analyze historical inspection data and operational stress factors to prioritize and schedule focused inspections using drones or in-service robotic platforms, maximizing inspection efficiency and minimizing human risk.

DRO & Impact Forces Of Floating Roof AST Market

The dynamics of the Floating Roof AST Market are significantly influenced by a confluence of drivers promoting growth, restraints impeding rapid expansion, and emerging opportunities that promise future acceleration, all summarized under crucial impact forces. The primary driver remains the global imperative for environmental protection and regulatory compliance, particularly concerning the reduction of Volatile Organic Compound (VOC) emissions from petroleum and chemical storage. This force is amplified by the sheer necessity to replace aging global infrastructure built during the mid-20th century. However, the market faces significant restraints, chiefly the substantial initial capital expenditure required for tank construction and stringent governmental permitting processes, which often cause project delays. Opportunities are centered around the development of advanced materials (especially high-performance seals and coatings) and the integration of sophisticated digital monitoring and automation technologies, enhancing the tank's operational lifecycle and safety profile.

The major drivers include the ongoing demand for crude oil and refined products globally, necessitating robust storage infrastructure. Economic growth in developing nations fuels this demand, requiring corresponding expansion of terminal capacity. Moreover, heightened safety standards, particularly post-incident reviews in the chemical and petroleum sectors, push operators towards best-in-class storage solutions that minimize operational hazards. A key impact force is the regulatory pressure cycle: as regulations tighten (e.g., EPA requirements), compliance costs rise, but the necessary technology adoption drives market innovation and investment. This creates a sustained, non-cyclical demand for advanced floating roof solutions over fixed-roof alternatives, stabilizing market growth irrespective of short-term crude price volatility.

Restraints are dominated by the high barriers to entry, encompassing long lead times for construction and specialized engineering expertise required for large-scale tank projects. Fluctuations in steel and construction material costs introduce budgetary uncertainties, impacting the final investment decision. Furthermore, the rise of electric vehicles and the long-term energy transition towards renewables present a strategic restraint, leading some long-term investors to adopt a cautious approach regarding massive investments in traditional fossil fuel storage infrastructure, particularly beyond the 20-year horizon. Despite these restraints, the market remains fundamentally strong, supported by the essential nature of bulk liquid storage in the global supply chain, meaning the immediate impact forces favor measured, compliance-driven growth rather than exponential expansion.

Segmentation Analysis

The Floating Roof AST Market is comprehensively segmented based on the critical parameters of Roof Type, Application, and Material of Construction, each defining distinct market characteristics and demand patterns. Segmentation by Roof Type distinguishes between External Floating Roof Tanks (EFRTs) and Internal Floating Roof Tanks (IFRTs), reflecting differences in storage requirements, environmental exposure, and regulatory mandates. EFRTs are commonly utilized for vast, atmospheric storage of crude oil, offering economical capacity, while IFRTs are preferred for highly volatile or sensitive refined products (like jet fuel, gasoline) where contamination prevention and stringent vapor control are non-negotiable. This segmentation is crucial as it dictates the level of technological complexity—particularly concerning seal systems and ventilation required—driving divergent revenue streams for specialized manufacturers.

By Application, the market is broadly divided into Petroleum (Crude Oil, Gasoline, Diesel, Jet Fuel), Chemicals (Petrochemicals, Solvents), and Others (Water, Asphalt). The Petroleum segment remains the dominant consumer due to the sheer volume requirements inherent in the global refining and distribution network. However, the Chemicals segment is exhibiting accelerated growth, driven by investments in new cracking facilities and specialty chemical production, where highly regulated storage environments necessitate advanced floating roof designs and specific material compatibility. Analyzing these application segments allows market players to tailor product features—such as lining material and temperature control capabilities—to meet unique industry standards.

The Material of Construction segment focuses primarily on Steel (Carbon Steel and Stainless Steel) and Aluminum (often used for IFRs). Carbon steel constitutes the vast majority of the shell and tank bottom construction due to its durability and cost-effectiveness, requiring robust corrosion protection systems. Aluminum and stainless steel are crucial for internal components, particularly for the pontoons or skin-and-pontoons structure of IFRs, providing lightweight floating capability and enhanced resistance against corrosion from specific chemical vapors. The interplay between these three key segments defines the competitive landscape, with specialized vendors often dominating specific niches based on their expertise in either massive EFR construction or sophisticated IFR sealing technologies.

- By Roof Type:

- External Floating Roof Tanks (EFRT)

- Internal Floating Roof Tanks (IFRT)

- By Application:

- Petroleum (Crude Oil, Refined Products)

- Chemicals and Petrochemicals

- Others (Water Storage, Bitumen/Asphalt)

- By Capacity:

- < 50,000 Barrels

- 50,000 to 200,000 Barrels

- > 200,000 Barrels

- By Material of Construction:

- Carbon Steel

- Stainless Steel and Alloys

- Aluminum (Roof only)

- By End-User:

- Oil & Gas Refineries

- Terminals & Ports

- Chemical Manufacturers

Value Chain Analysis For Floating Roof AST Market

The value chain for the Floating Roof AST Market is complex and capital-intensive, starting with the sourcing of raw materials, primarily specialized steel plates and alloy components, followed by highly technical engineering and manufacturing processes. The upstream analysis focuses on the extraction and processing of steel and specific coating chemicals. Key upstream suppliers include large steel mills providing API-grade steel plates and specialized manufacturers supplying high-performance seal materials (e.g., fluoropolymers, elastomers) crucial for VOC emission control. Fluctuations in global commodity prices for steel directly impact the construction costs and profitability of tank fabricators, making stable supply chain management a significant competitive advantage.

The midstream process involves detailed design (in compliance with standards like API 650), fabrication of tank shells, roofs, and internal structures, and the final construction and assembly at the project site. This phase is dominated by Engineering, Procurement, and Construction (EPC) firms, which often manage the entire project lifecycle, from site preparation to commissioning. Distribution channels are generally direct; tank manufacturers or EPC firms contract directly with the end-users (oil majors, national oil companies, chemical producers). The sale of spare parts and replacement seals, however, involves a mix of direct sales and specialized third-party maintenance providers who handle ongoing operational support and compliance checks. Direct distribution ensures quality control and adherence to customized engineering specifications required by the client.

Downstream analysis centers on the utilization and maintenance of the ASTs by the end-users—oil refineries, independent terminal operators, and petrochemical plants. Once operational, the tank enters a long lifecycle requiring rigorous inspection, repair, and compliance activities governed by standards like API 653. Indirect channels are crucial in the aftermarket sector, where specialized maintenance contractors and inspection technology providers (e.g., NDT services, robotic inspection firms) offer essential services to maintain asset integrity and extend the operational life of the floating roof systems. The long-term profitability in this market is often found not just in the initial build but in the sustained demand for high-quality aftermarket seals, coatings, and structural maintenance services.

Floating Roof AST Market Potential Customers

The primary consumers and end-users of Floating Roof ASTs are large-scale industrial entities with critical requirements for the bulk storage of volatile liquids, where safety, environmental compliance, and minimization of evaporation losses are paramount operational concerns. Potential customers fundamentally reside within the energy and chemical sectors, driving demand based on their production throughput and global distribution networks. Oil and gas refineries represent the largest buyer segment, requiring vast storage capacity for crude inputs and various finished products such as gasoline, diesel, and aviation fuels, which mandates the use of floating roofs to comply with air quality regulations and ensure product quality integrity.

Independent storage terminal operators and port facilities constitute another significant customer base. These entities act as logistics hubs, facilitating the global transit and blending of petroleum and chemical products. Given their function as critical choke points in the supply chain, they must adhere to the highest international standards for environmental performance and safety, leading to consistent demand for high-capacity, externally or internally floating roof tanks capable of handling large transfer volumes and ensuring product stability during long-term storage periods. National oil companies (NOCs) and major international oil companies (IOCs) are key strategic buyers, initiating massive, multi-year capacity expansion and modernization projects.

Furthermore, large petrochemical manufacturers and specialty chemical producers are increasingly vital customers. While their individual tank capacity needs might be smaller than those of crude oil storage terminals, the highly corrosive or sensitive nature of their stored chemicals often necessitates specialized Internal Floating Roofs (IFRs) constructed from specific stainless steel or aluminum alloys, coupled with advanced sealing technologies. These end-users are driven by process safety management and the need to prevent product degradation due to oxidation or contamination, focusing on customized engineering solutions rather than standardized bulk storage units.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.5 Billion |

| Market Forecast in 2033 | USD 6.8 Billion |

| Growth Rate | CAGR 6.1% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | CBandI (McDermott), TIC - The Industrial Company, CIMC Enric, TF Warren Group, Whessoe, API Heat Transfer, Toyo Kanetsu K.K., Fox Tank Company, CST Industries, Caldwell Tanks, Containment Solutions, Inc., Balmoral Tanks, Mass Tank, Modern Industries, Highland Tank, Fisher Tank Company, Tuff Tank, Inc., Permian Tank & Manufacturing, Inc. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floating Roof AST Market Key Technology Landscape

The Floating Roof AST Market is highly dependent on continuous technological innovation focused primarily on enhancing safety, reducing emissions, and improving asset longevity. The most critical technological advancements are concentrated in the design and materials science of the roof seals. Advanced seal technologies, including mechanical shoe seals, secondary tip seals, and resilient foam-filled seals made from specialized fluoropolymers and proprietary rubber compounds, are vital for achieving near-zero VOC emissions, far surpassing older, less efficient seal designs. The development of robust, chemical-resistant materials is essential to withstand the aggressive and volatile environments inherent in storing crude oil and various refined products, leading to prolonged Mean Time Between Failures (MTBF) for these critical components. Furthermore, advances in welding technology, such as automated orbital welding and improved non-destructive testing (NDT) techniques, significantly accelerate construction schedules while ensuring the structural integrity of the massive tank shell and bottom plates, meeting stringent international standards.

Another pivotal technological area is advanced corrosion protection. Given that Floating Roof ASTs are designed for lifecycles extending beyond 30 to 40 years, the implementation of high-performance internal and external coatings, often involving multi-layer epoxies or polyurethanes, is crucial. These coatings are now frequently paired with sophisticated cathodic protection (CP) systems, leveraging remote monitoring and data analytics to optimize protection levels across the tank floor and structure, mitigating under-deposit corrosion and ensuring tank bottom integrity. The shift is towards smart coatings that can provide real-time feedback on their degradation status. Moreover, the design of the floating roof itself is continuously evolving; newer geodesic dome roofs over IFR tanks provide enhanced protection against weather elements and potential debris accumulation, improving overall roof stability and drainage efficiency.

Digitalization and the integration of smart monitoring solutions represent a paradigm shift in operational management within this sector. Key technologies include high-accuracy radar gauge systems for precise product level measurement, continuous vapor monitoring systems employing infrared spectroscopy to detect seal breaches, and structural health monitoring (SHM) systems using embedded sensors (e.g., strain gauges, accelerometers). These digital tools provide operators with real-time data on tank performance, roof stability, and settlement patterns. The aggregation of this data into centralized asset performance management (APM) systems, often powered by cloud computing and augmented by AI for predictive analytics, enables maintenance personnel to move away from scheduled physical inspections towards condition-based monitoring, dramatically increasing uptime and reducing risks associated with manual entry and inspection of hazardous storage environments.

Regional Highlights

The global Floating Roof AST Market exhibits varied growth trajectories influenced by regional economic development, differing energy policies, and the maturity of existing infrastructure. The market is segmented into North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA), each playing a distinct role in the demand landscape.

- Asia Pacific (APAC): Dominates the market in terms of new capacity additions and project volume. Countries like China, India, and South Korea are experiencing massive industrialization and petrochemical expansion, driving the need for large-scale storage terminals and refineries. Regulatory adoption of VOC standards, though historically slower than the West, is rapidly accelerating, fueling demand for both EFRTs and IFRTs for compliance upgrades. APAC is the fastest-growing region, characterized by large EPC tenders for greenfield projects.

- North America: Characterized by a strong emphasis on infrastructure replacement and modernization. The majority of demand stems from the need to upgrade or replace aging storage facilities built in the 1960s and 1970s, ensuring compliance with strict environmental regulations enforced by the EPA. Innovation adoption is high here, particularly in advanced seal technology and smart monitoring systems, driven by high labor costs and stringent safety protocols.

- Europe: A mature, highly regulated market where growth is moderate, primarily focused on upgrades and modifications (M&A) to existing IFRTs to meet the most stringent EU environmental directives (e.g., Industrial Emissions Directive). The move towards biofuels and alternative refined products also necessitates specialized storage solutions, driving demand for small to medium-capacity tanks with high levels of operational monitoring.

- Middle East and Africa (MEA): Critical region for large-capacity EFRTs, driven by massive investments in crude oil and LNG export infrastructure, particularly in Saudi Arabia, UAE, and Qatar. Demand is tied directly to global crude output capacity, focusing on reliable, high-volume storage. Projects in this region emphasize durability against extreme temperatures and large, strategic storage requirements.

- Latin America: Exhibits potential growth linked to developing energy resources (e.g., Brazil, Mexico). Market volatility often impacts investment cycles, but the long-term trend supports infrastructure upgrades to improve safety and operational efficiency in outdated port and refining facilities. Investment decisions are heavily influenced by national oil company policies and capital expenditure prioritization.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floating Roof AST Market.- CBandI (McDermott)

- TIC - The Industrial Company

- CIMC Enric

- TF Warren Group

- Whessoe

- API Heat Transfer

- Toyo Kanetsu K.K.

- Fox Tank Company

- CST Industries

- Caldwell Tanks

- Containment Solutions, Inc.

- Balmoral Tanks

- Mass Tank

- Modern Industries

- Highland Tank

- Fisher Tank Company

- Tuff Tank, Inc.

- Permian Tank & Manufacturing, Inc.

- Pond Technical

- Matrix Service Company

Frequently Asked Questions

Analyze common user questions about the Floating Roof AST market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a Floating Roof AST compared to a Fixed Roof Tank?

The primary function of a Floating Roof AST is to reduce the vapor space between the liquid surface and the tank roof. By having the roof float directly on the stored product, it minimizes the escape of Volatile Organic Compounds (VOCs) through evaporation, ensuring regulatory compliance and conserving valuable product, which is not achievable with a standard fixed roof.

What are the main types of Floating Roof ASTs and their typical applications?

The main types are External Floating Roof Tanks (EFRTs), used primarily for crude oil and large-volume volatile product storage exposed to weather, and Internal Floating Roof Tanks (IFRTs), which feature a fixed roof above the floating roof, typically used for high-value refined products like jet fuel, minimizing contamination and maximizing vapor control.

Which industry standards govern the design and construction of Floating Roof ASTs?

The design, fabrication, and erection of Floating Roof ASTs are primarily governed by the American Petroleum Institute (API) standards, specifically API Standard 650 (Welded Tanks for Oil Storage) for construction and API Standard 653 (Tank Inspection, Repair, Alteration, and Reconstruction) for in-service maintenance and integrity management.

How does the adoption of new seal technology impact market growth?

Advanced seal technology, featuring materials resistant to chemical degradation and improved mechanical designs (e.g., shoe seals with secondary tip seals), is crucial for market growth as it directly addresses increasingly stringent VOC emission limits worldwide. Better seals reduce operational risk, extend tank life, and ensure continuous environmental compliance, driving replacement demand.

What major challenges restrict the widespread adoption of Floating Roof ASTs globally?

The primary challenges include the exceptionally high initial capital investment required for engineering and construction, the long lead times associated with complex, site-built projects, and stringent regulatory complexity that demands specialized certification and expertise, creating significant barriers for smaller operators.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager