Floating Roof Monitoring System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434550 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Floating Roof Monitoring System Market Size

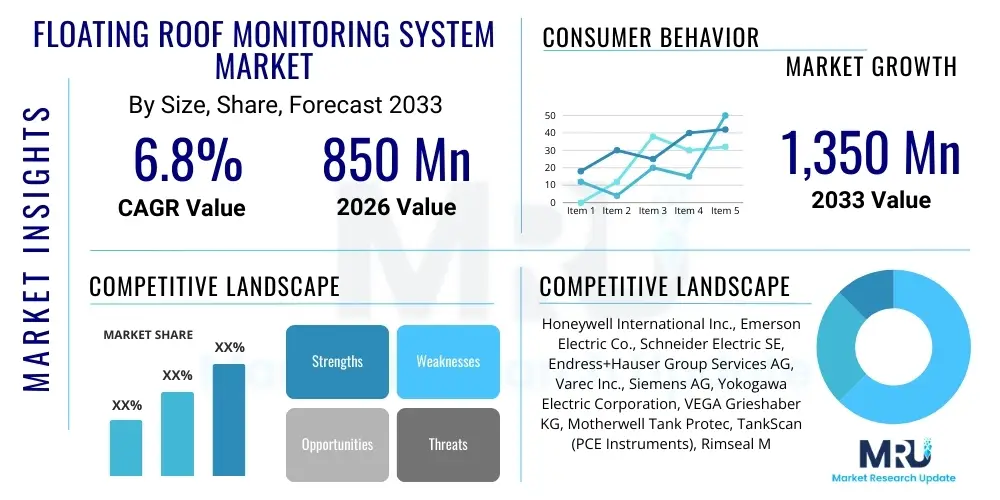

The Floating Roof Monitoring System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1,350 Million by the end of the forecast period in 2033.

Floating Roof Monitoring System Market introduction

The Floating Roof Monitoring System (FRMS) Market encompasses specialized instrumentation and software solutions designed to continuously monitor the structural integrity, position, seal condition, and overall operational safety of floating roof storage tanks, primarily utilized within the petroleum, petrochemical, and chemical industries. These tanks are crucial for storing volatile liquids, and monitoring systems are essential for preventing vapor loss, minimizing environmental impact, and mitigating catastrophic failure risks such as roof sinking or seal fires. The primary goal of FRMS is to ensure compliance with stringent safety and environmental regulations while optimizing inventory management and maintenance scheduling.

FRMS typically integrates various technologies, including radar gauges, guided wave radar, level sensors, tilt sensors, and advanced telemetry systems, all connected to a central data acquisition and processing unit. The product monitors critical parameters such as the vertical position of the roof, the gap between the roof seal and the tank wall (rim seal integrity), and the detection of hazardous conditions like excessive liquid accumulation on the roof surface. Major applications span crude oil storage terminals, refined product depots, chemical processing plants, and port facilities where large volumes of liquid hydrocarbons are managed under high security and regulatory scrutiny.

The market is predominantly driven by the increasing global emphasis on industrial safety standards, particularly those mandated by organizations like API (American Petroleum Institute) and OSHA (Occupational Safety and Health Administration). The benefits of deploying FRMS are multifaceted, including enhanced operational efficiency through accurate real-time inventory measurement, significant reduction in environmental emissions (volatile organic compounds, VOCs), and drastically improved safety profiles, leading to lower insurance premiums and reduced risk of production downtime. Furthermore, the aging infrastructure of global storage tank farms necessitates advanced monitoring solutions for predictive maintenance and asset longevity extension.

Floating Roof Monitoring System Market Executive Summary

The Floating Roof Monitoring System Market is poised for stable and consistent growth, propelled primarily by increasing global regulatory pressure concerning environmental protection and industrial safety, alongside the need for digital transformation in asset management within the oil and gas sector. Business trends indicate a strong shift towards integrated, wireless, and cloud-based monitoring solutions that allow remote diagnostics and real-time data analysis, moving away from manual inspections which are often hazardous and prone to error. Technological innovation is focused on enhancing sensor accuracy, improving battery life for wireless deployments, and integrating predictive maintenance algorithms utilizing machine learning to forecast potential equipment failures or environmental non-compliance events before they occur.

Regional trends reveal that North America and Europe currently hold significant market shares due to early adoption of advanced safety standards and substantial existing storage infrastructure. However, the Asia Pacific region, particularly emerging economies like China, India, and Southeast Asia, is projected to exhibit the highest growth rate during the forecast period. This rapid expansion is driven by massive investments in new refinery and storage capacity, coupled with the mandatory implementation of modern safety technologies as these nations harmonize their industrial regulations with global benchmarks. The Middle East remains a crucial market due to its immense crude oil storage capacity, focusing heavily on robust, high-reliability systems capable of operating in extreme environmental conditions.

Segment trends highlight the growing dominance of advanced sensor technologies, such as radar and laser-based systems, over traditional mechanical methods due to their superior accuracy and reliability. In terms of end-use, the oil and gas sector remains the undisputed largest consumer, driven by the sheer volume of hydrocarbons stored globally. There is also a notable trend toward subscription-based software and service models (SaaS), where companies opt for managed monitoring services rather than large upfront capital investments in hardware, thus ensuring continuous system maintenance and software updates crucial for cybersecurity and regulatory compliance.

AI Impact Analysis on Floating Roof Monitoring System Market

Users frequently inquire about how Artificial Intelligence (AI) and Machine Learning (ML) can move monitoring from reactive fault detection to proactive predictive maintenance within the Floating Roof Monitoring System domain. Common questions revolve around the integration of real-time sensor data with historical operational parameters to detect subtle anomalies indicative of impending rim seal failure or roof stability issues, often before human operators or traditional alert systems identify them. Key concerns include the reliability of AI models in highly variable environments, data security during cloud processing, and the cost-effectiveness of deploying complex AI infrastructure versus traditional hard-wired alarm systems. Users expect AI to significantly reduce false positives, optimize inspection intervals, and ultimately extend the useful life of highly valuable storage assets.

The implementation of AI algorithms fundamentally transforms the utility of the voluminous data generated by modern FRMS sensors. Instead of simply triggering alarms when a threshold is breached, AI models continuously analyze patterns related to tank filling/emptying cycles, ambient temperature fluctuations, and subtle shifts in roof tilt or seal gap measurements. By learning the 'normal' operational signature of a specific tank, AI can identify minute deviations that signify component fatigue, structural stress, or incipient seal degradation. This capability is paramount in reducing unscheduled downtime and ensuring that maintenance resources are deployed precisely when and where they are most critically needed.

Furthermore, AI-driven insights are invaluable for optimizing inventory control and loss mitigation. By accurately correlating atmospheric conditions with vapor emissions monitored by the system, AI can help operators refine operational procedures, such as controlling the rate of tank filling or adjusting temperatures, to minimize VOC losses—a critical environmental and economic factor. This shift towards intelligent, data-driven asset performance management transforms the monitoring system from a purely safety device into a core element of operational optimization and long-term asset strategic planning, thereby increasing the value proposition of modern FRMS deployments significantly.

- AI algorithms enable predictive maintenance forecasting for rim seals and structural components.

- Machine learning models enhance anomaly detection, reducing false alarms and improving operational uptime.

- Advanced data processing correlates sensor data with historical records to identify subtle precursors to failure.

- AI integration facilitates optimized inventory management and quantifiable reduction in VOC emissions.

- Computer vision and AI are used for automated analysis of remote visual inspection data (e.g., drone imagery of the roof surface).

DRO & Impact Forces Of Floating Roof Monitoring System Market

The dynamics of the Floating Roof Monitoring System market are shaped by a complex interplay of stringent safety regulations and technological advancements, countered by high initial investment costs and inherent complexities of retrofitting legacy infrastructure. Primary drivers include the global mandate for industrial safety following high-profile incidents, the necessity to comply with environmental regulations aimed at reducing volatile organic compound (VOC) emissions, and the technological push towards digitization of industrial assets (Industry 4.0). Restraints largely center on the capital expenditure required for sophisticated monitoring installations and the challenge of integrating proprietary systems into diverse, often aging, tank infrastructure environments.

Opportunities are abundant in emerging markets undergoing rapid industrialization and in the development of modular, scalable wireless systems that dramatically lower installation complexity and cost, making advanced monitoring accessible to smaller operators. Furthermore, the convergence of IoT (Internet of Things) and sophisticated sensor fusion provides a robust platform for future market growth. The principal impact forces driving the market are regulatory compliance, which acts as a non-negotiable requirement for operators, coupled with the economic force of asset preservation, as companies seek to extend the operational life of multi-million-dollar storage tanks through continuous health monitoring. The competitive landscape is intensely focused on offering integrated solutions combining hardware, software, and managed services to maximize customer retention and recurring revenue streams.

Ultimately, the market trajectory is heavily influenced by global energy consumption patterns and geopolitical stability, which dictate the volume of stored hydrocarbons and the corresponding need for enhanced monitoring. However, the core growth engine remains the relentless global drive towards zero-harm industrial environments. The necessity to demonstrate verifiable environmental stewardship and operational excellence provides the critical momentum, outweighing initial cost barriers for most large-scale operators globally. The market is therefore characterized by mandatory upgrades and continuous technological evolution driven by both legislative requirements and competitive advantage seeking behaviors.

Segmentation Analysis

The Floating Roof Monitoring System Market is comprehensively segmented based on the components utilized, the type of storage tank being monitored, and the specific industrial application. Understanding these segmentations is critical for market participants to tailor their product development and strategic marketing efforts, focusing on high-growth and high-value niches. The core segmentation reflects the diverse technological pathways available to customers, ranging from simple level gauges to complex, integrated wireless networks managed by sophisticated software platforms. Component segmentation highlights the shift towards sensor technologies offering higher accuracy and lower maintenance requirements, such as non-contact radar systems.

Further analysis of the tank type segmentation reveals distinct challenges and monitoring requirements for external floating roof tanks (EFRTs) versus internal floating roof tanks (IFRTs). EFRTs are more exposed to environmental factors, necessitating robust rim seal and drain monitoring, while IFRTs require specialized vapor space monitoring. The end-use industry segmentation confirms the oil and gas sector's dominance, yet also shows emerging opportunities in specialized chemical and petrochemical processing, where materials often require highly specialized, chemically resistant sensor technologies. These distinct needs necessitate vendors offering customizable and modular solutions.

- By Component:

- Sensors (Radar, Guided Wave Radar, Tilt Sensors, Temperature Sensors)

- Data Acquisition Systems (Dataloggers, RTUs)

- Software & Services (SCADA Integration, Cloud Analytics, Predictive Maintenance Software)

- By Roof Type:

- External Floating Roof Tanks (EFRTs)

- Internal Floating Roof Tanks (IFRTs)

- By End-Use Industry:

- Oil & Gas (Upstream, Midstream, Downstream)

- Petrochemical

- Chemical

- Others (Power Generation, Water Treatment)

Value Chain Analysis For Floating Roof Monitoring System Market

The value chain for the Floating Roof Monitoring System Market begins with the highly specialized upstream component manufacturers who supply core technology, such as high-frequency radar components, industrial-grade sensors, and ruggedized communication modules. This stage is characterized by intense R&D investment to ensure precision, reliability, and compliance with hazardous area certifications (e.g., ATEX, IECEx). Key suppliers are often specialized electronics firms and traditional instrumentation companies. The quality and performance of these upstream components directly influence the reliability and lifespan of the final monitoring system.

Midstream activities involve system integrators and Original Equipment Manufacturers (OEMs) who assemble these components, develop proprietary software platforms for data visualization and analysis, and tailor the solution to specific tank geometries and operational requirements. This is where value addition through software development and system integration occurs, transforming discrete hardware into a cohesive operational intelligence tool. Downstream activities are dominated by sales, installation, commissioning, and, critically, post-sales support and maintenance. Given the safety-critical nature of the systems, ongoing technical support, calibration services, and software updates are major revenue streams.

Distribution channels are typically mixed, relying on direct sales teams for large integrated projects involving major oil and gas companies, and indirect distribution through specialized local distributors and system integrators for localized support and quicker access to smaller chemical plant operators. The preference for direct engagement often stems from the need for highly technical consultation during the project specification and implementation phase. The provision of long-term service contracts often solidifies customer relationships, making the service segment a critical strategic advantage within the value chain.

Floating Roof Monitoring System Market Potential Customers

The primary customers for Floating Roof Monitoring Systems are entities managing large inventories of volatile liquids and hydrocarbons, where asset integrity, safety compliance, and environmental protection are paramount operational concerns. This includes major international and national oil companies (IOCs and NOCs) involved in upstream production, midstream storage and transportation, and downstream refining operations. These customers require enterprise-level, highly scalable monitoring solutions that integrate seamlessly into existing SCADA and Distributed Control Systems (DCS).

Secondary but rapidly growing customer segments include large petrochemical manufacturers and specialized chemical processing companies. These operators often store a wider variety of hazardous and specialty chemicals, necessitating monitoring systems that can withstand corrosive environments and measure highly specific liquid properties. Port authorities and independent terminal operators, who manage storage facilities on behalf of multiple third parties, also represent significant buyers, driven by the need to adhere to strict international shipping and safety standards and minimize liability risks.

In essence, any organization operating large storage tanks for flammable, volatile, or environmentally sensitive liquids is a potential customer. The buying decision is usually made by a combination of reliability engineers, safety managers, and procurement officers, prioritizing system accuracy, reliability, certification compliance, and total cost of ownership (TCO) over the asset lifecycle.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1,350 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Honeywell International Inc., Emerson Electric Co., Schneider Electric SE, Endress+Hauser Group Services AG, Varec Inc., Siemens AG, Yokogawa Electric Corporation, VEGA Grieshaber KG, Motherwell Tank Protec, TankScan (PCE Instruments), Rimseal Monitoring Systems, Remote Control Technologies, Leidos Holdings Inc., TechnipFMC plc, L&T Technology Services Limited, Saab AB, Wartsila Corporation, Rosemount Inc. (Emerson), API Systems, Metrolog Automation. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floating Roof Monitoring System Market Key Technology Landscape

The technological landscape of the Floating Roof Monitoring System Market is characterized by the increasing adoption of highly accurate, non-contact measurement methodologies and robust wireless communication protocols. Non-contact radar level transmitters (FMCW technology) have largely replaced older servo gauges and hydrostatic systems due to their superior reliability in harsh environments, immunity to product density changes, and high precision required for inventory reconciliation. Guided Wave Radar (GWR) also plays a critical role, particularly in systems where redundancy is necessary or for measuring secondary parameters such as temperature gradients. The integration of these advanced sensors provides the foundational data integrity necessary for the sophisticated analytical layers above.

A significant ongoing trend is the rapid transition towards wireless Industrial Internet of Things (IIoT) architectures. Utilizing low-power, wide-area network (LPWAN) technologies, such as LoRaWAN or proprietary wireless protocols (e.g., WirelessHART), enables cost-effective deployment across vast tank farms without the massive expense and regulatory headache associated with running miles of armored cable in hazardous areas. This shift not only reduces installation costs but also enhances flexibility, making systems easier to maintain and scale. Data security and network reliability within these wireless deployments remain central areas of technological focus for vendors.

Furthermore, the convergence of visualization software and cloud-based analytics platforms defines the cutting edge of the market. Modern FRMS solutions leverage sophisticated software to provide 3D graphical representations of tank geometry and roof position, combined with predictive analytics tools. These tools utilize big data processing capabilities to analyze patterns, such as unexpected differential settlement or seal wear progression, allowing maintenance teams to shift from calendar-based maintenance schedules to condition-based monitoring. Cybersecurity, particularly safeguarding the operational technology (OT) network from external threats, is a continually evolving technology requirement demanding robust authentication and encryption standards across all deployed components.

Regional Highlights

Regional dynamics are critical to understanding the fragmented yet high-value Floating Roof Monitoring System Market. Growth rates and market maturity vary significantly based on regulatory maturity, existing infrastructure age, and energy market focus.

- North America (U.S. and Canada): This region is characterized by early adoption of sophisticated monitoring technologies, driven by extremely strict EPA regulations regarding VOC emissions and API standards for tank integrity. The market is mature but highly focused on retrofitting aging infrastructure with wireless and AI-enabled systems for predictive maintenance. High demand for real-time inventory measurement further fuels market stability and continuous technological upgrades.

- Europe (Germany, UK, Netherlands): Europe’s market growth is anchored by stringent environmental directives and the implementation of sophisticated safety management systems (SMS). Emphasis is placed on certified intrinsically safe equipment (ATEX compliance) and integrated software solutions that support operational transparency and emissions reporting. The Netherlands, with its large port and refining capacity, is a key hub for advanced FRMS installations.

- Asia Pacific (China, India, Southeast Asia): Projected to be the fastest-growing market. This exponential growth is directly linked to massive infrastructure investment in new refineries, pipelines, and storage terminals. As these emerging economies adopt international safety standards, the demand for modern, reliable FRMS solutions skyrockets. Cost-effectiveness and ease of local integration are major purchasing criteria in this region.

- Middle East and Africa (MEA): Dominated by large national oil companies, the MEA region demands robust, highly reliable systems capable of functioning in extreme temperatures and arid environments. Investment cycles are large and often focused on securing strategic, high-volume crude oil storage capacity. Reliability and long-term service contracts are prioritized over low upfront cost.

- Latin America (Brazil, Mexico): Market expansion is accelerating due to privatization and increasing foreign investment in the energy sector, which introduces international safety benchmarks. While historically slower in adoption, regulatory harmonization is pushing operators to modernize storage facilities, creating significant opportunities for suppliers offering modular and localized service support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floating Roof Monitoring System Market.- Honeywell International Inc.

- Emerson Electric Co.

- Schneider Electric SE

- Endress+Hauser Group Services AG

- Varec Inc.

- Siemens AG

- Yokogawa Electric Corporation

- VEGA Grieshaber KG

- Motherwell Tank Protec

- TankScan (PCE Instruments)

- Rimseal Monitoring Systems

- Remote Control Technologies

- Leidos Holdings Inc.

- TechnipFMC plc

- L&T Technology Services Limited

- Saab AB

- Wartsila Corporation

- Rosemount Inc. (Emerson)

- API Systems

- Metrolog Automation

Frequently Asked Questions

Analyze common user questions about the Floating Roof Monitoring System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary regulatory drivers influencing the adoption of Floating Roof Monitoring Systems?

The primary drivers are stringent environmental regulations, such as the U.S. EPA’s requirements for minimizing Volatile Organic Compound (VOC) emissions, and international industrial safety standards (e.g., API 653) mandating continuous monitoring of tank integrity and roof stability to prevent catastrophic failures and environmental damage.

How does wireless technology impact the installation and maintenance costs of FRMS?

Wireless technology, utilizing protocols like WirelessHART and LoRaWAN, significantly reduces installation costs and time by eliminating the need for extensive cable trenches and conduit systems, especially in hazardous areas. It also lowers long-term maintenance by simplifying sensor calibration and replacement without extensive wiring disruption.

What is the main difference between monitoring External Floating Roof Tanks (EFRTs) and Internal Floating Roof Tanks (IFRTs)?

EFRTs require robust systems to monitor the external rim seal integrity and roof drainage due to environmental exposure (rain, wind). IFRTs, situated within a fixed roof, primarily require monitoring for the stability of the floating deck and the concentration of hazardous vapor buildup in the vapor space above the roof.

How is Artificial Intelligence (AI) being utilized within modern Floating Roof Monitoring Systems?

AI is employed for predictive maintenance by analyzing real-time sensor data against historical operational norms. This allows operators to identify subtle anomalies, such as minute changes in roof tilt or seal wear progression, thereby forecasting potential mechanical failures before they can trigger system downtime or safety hazards.

Which regional market is anticipated to exhibit the fastest growth rate for FRMS adoption?

The Asia Pacific (APAC) region is projected to register the fastest growth rate. This acceleration is driven by massive new infrastructure development in countries like China and India, coupled with the rapid adoption of modern international safety and environmental regulations within their burgeoning energy sectors.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager