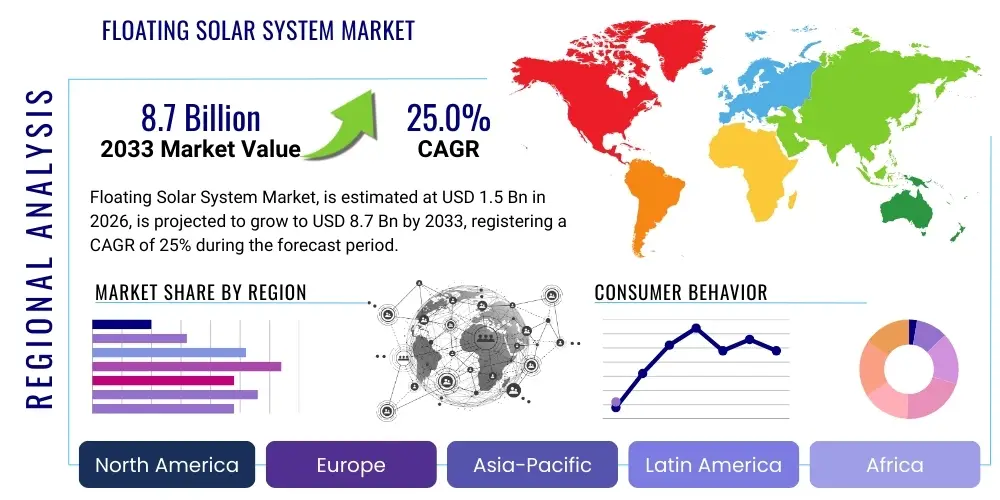

Floating Solar System Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438777 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Floating Solar System Market Size

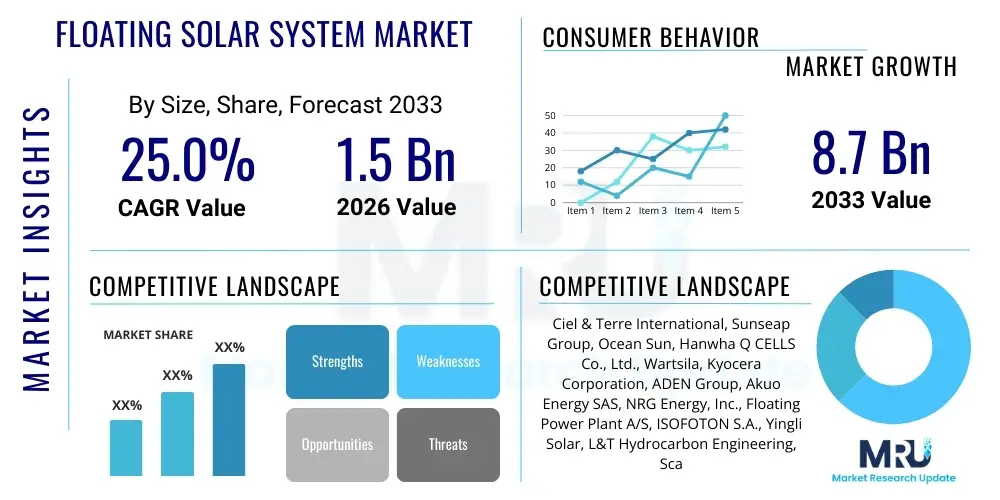

The Floating Solar System Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 25.0% between 2026 and 2033. The market is estimated at USD 1.5 Billion in 2026 and is projected to reach USD 8.7 Billion by the end of the forecast period in 2033. This substantial expansion is driven by the increasing global emphasis on renewable energy deployment, coupled with the scarcity of land suitable for conventional ground-mounted solar farms, especially in densely populated Asian countries.

Floating Solar System Market introduction

The Floating Solar System (FSS) Market, also commonly referred to as Floato-Voltaics (FPV), encompasses photovoltaic systems deployed on water bodies such as reservoirs, lakes, quarry ponds, and artificial basins. Unlike traditional land-based solar installations, FSS involves specialized mounting structures, typically high-density polyethylene (HDPE) pontoons, designed to withstand aquatic environments, rigorous mooring systems to ensure stability, and robust cabling infrastructure for power transmission. The core product offering includes the floating platform, solar modules (PV panels), inverters optimized for humid conditions, and anchoring solutions tailored to the specific water body's characteristics and depth. This technology offers superior energy yield compared to land-based systems due to the cooling effect of the water on the solar panels, mitigating temperature-related efficiency losses and thereby increasing overall electricity generation.

Major applications of Floating Solar Systems are predominantly found in sectors requiring large-scale, sustainable power generation without compromising valuable agricultural or urban land. These include municipal reservoirs managed by water utility companies, hydropower plant reservoirs seeking hybrid power generation models, and industrial sites, such as mining operations, that utilize quarry ponds. The primary benefit of FSS deployment is the dual-use of water surface area, which also aids in reducing water evaporation rates—a critical advantage in arid and semi-arid regions. Furthermore, the installation process minimizes environmental disruption compared to clearing land for large-scale solar projects, preserving terrestrial biodiversity while providing clean electricity.

Driving factors propelling the market include stringent governmental targets for decarbonization, competitive Levelized Cost of Energy (LCOE) compared to conventional power sources, and technological advancements that enhance the durability and ease of installation of floating structures. Specifically, innovations in modular design, corrosion-resistant materials, and advanced monitoring systems are lowering operational risks and making FSS projects more financially appealing to private and public utility investors globally. The capacity of FSS to integrate seamlessly with existing hydropower infrastructure is also a significant market accelerator, enabling optimized grid management and improved reliability through combined renewable energy sources.

Floating Solar System Market Executive Summary

The Floating Solar System Market is characterized by vigorous growth driven by synergistic factors including environmental policy shifts and technological maturity. Business trends indicate a strong move toward hybridization, particularly the co-location of FSS installations with hydroelectric power generation facilities, maximizing resource utilization and optimizing grid stability. Key industry players are increasingly focusing on developing highly durable and modular floating platforms made from recycled or sustainable polymers, alongside sophisticated anchoring and mooring techniques capable of handling challenging marine or large reservoir environments. Investment is trending heavily toward large-scale utility projects (over 5 MW capacity) driven by favorable long-term power purchase agreements (PPAs) supported by government renewable energy auctions, fostering consolidation among platform manufacturers and EPC (Engineering, Procurement, and Construction) providers.

Regional trends highlight Asia Pacific (APAC) as the dominant and fastest-growing region, primarily due to the intense pressure on land resources in countries like China, India, and across Southeast Asia, where water bodies, particularly irrigation reservoirs, present ideal deployment opportunities. Europe, led by the Netherlands and France, focuses on integrating FSS into industrial waters and complex coastal environments, driven by high population density and robust climate targets. North America is experiencing steady growth, with significant potential emerging from the use of FSS on water treatment facilities and the expansion of regulatory frameworks that incentivize clean energy deployment on non-traditional sites, positioning the U.S. as a critical future growth hub, particularly in states with high solar irradiance and water resource management challenges.

Segment trends underscore the dominance of the Non-Tilted/Fixed structure segment due to its cost-effectiveness and simpler maintenance requirements, although the Tracking segment is gaining traction in high-irradiance areas where maximizing energy yield offsets the higher upfront structural complexity. In terms of capacity, the Utility-Scale segment (greater than 5 MW) commands the largest market share, reflecting the imperative for governments and large utilities to meet ambitious renewable energy quotas rapidly. The use of reservoirs remains the primary application segment, given their protected, controlled environment and easy access for maintenance, though the potential for offshore FSS deployment is a nascent segment attracting substantial R&D investment for long-term viability.

AI Impact Analysis on Floating Solar System Market

User queries regarding AI's influence on the FSS market predominantly revolve around three critical areas: predictive maintenance of complex floating infrastructure, optimization of energy output amidst variable environmental factors (waves, water level changes, humidity), and automated monitoring of water quality and structural integrity. Users are keen to understand how AI algorithms can mitigate the inherent risks associated with operating electrical infrastructure in aquatic environments, such as detecting minor leakages in floats, identifying early-stage corrosion in mooring lines, and predicting component failures before they result in costly downtime. There is significant expectation that AI-driven analytics will transition the FSS industry from reactive maintenance schedules to highly efficient, predictive operational models, leading to substantial reductions in O&M costs and increased system longevity. Furthermore, integration with meteorological and hydrological data streams is expected to enable precise, real-time adjustments to inverter loads and grid input, enhancing overall energy delivery reliability.

The application of AI extends significantly into the design and deployment phases, addressing common concerns related to site-specific engineering challenges. AI models are now being used to analyze bathymetric data, wind loads, wave patterns, and seismic risk factors to optimize the design of the mooring and anchoring systems, ensuring maximum resilience and minimal environmental impact. This capability allows developers to rapidly evaluate hundreds of potential deployment sites, minimizing the extensive manual engineering studies traditionally required. For operating FSS facilities, machine learning models analyze continuous sensor data from PV panels, inverters, and environmental probes (temperature, humidity), identifying anomalies that human operators might miss, thereby maximizing uptime and ensuring peak performance throughout the system's operational lifespan.

- AI-powered predictive maintenance models reduce system downtime by forecasting component failure (inverters, cables, pontoons) based on real-time sensor data and historical trends.

- Advanced AI algorithms optimize energy yield by adjusting power conversion strategies in real-time based on fluctuating environmental variables (irradiance, water temperature, humidity).

- Machine learning facilitates optimal site selection and structural design by analyzing complex hydrological and geotechnical data (bathymetry, current velocity, soil type) for robust anchoring solutions.

- AI integration with Supervisory Control and Data Acquisition (SCADA) systems enables remote, autonomous monitoring and control of large FSS plants, improving operational efficiency.

- Computer vision and drone-based inspection, utilizing AI for image analysis, detect panel defects, biofouling, and minor structural damage on the floating array with high precision and speed.

DRO & Impact Forces Of Floating Solar System Market

The Floating Solar System (FSS) market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO) which collectively dictate its growth trajectory and competitive landscape. The primary drivers are the acute shortage of suitable land for utility-scale PV deployment, particularly in Asia, coupled with the proven technological advantage of increased energy yield derived from the water's cooling effect on the PV modules. Furthermore, global initiatives promoting water conservation benefit FSS, as installations significantly reduce evaporation from reservoirs. However, these forces are tempered by substantial restraints, mainly revolving around the high initial capital expenditure (CAPEX) required for specialized mooring and anchoring infrastructure, the potential challenges associated with permitting and regulatory clarity across different types of water bodies, and the heightened operational risks related to cable management and corrosion in aquatic environments.

Opportunities in the sector are vast, focusing on the development of hybrid power generation systems, combining FSS with existing hydropower facilities to create reliable, dispatchable power sources. The increasing global focus on climate adaptation and water management also presents avenues for FSS adoption in sectors like municipal water treatment and large industrial process water ponds. Innovation in material science, particularly the use of highly durable, recycled, or novel polymer composite materials for floating platforms, promises to reduce manufacturing costs and enhance system longevity, thereby improving the LCOE and making FSS more competitive against land-based alternatives. Strategic partnerships between FSS platform manufacturers, PV module suppliers, and marine engineering firms are essential to capitalize on these opportunities.

Impact forces currently shaping the market are heavily influenced by government policies regarding renewable energy quotas and investment incentives, such as tax credits and feed-in tariffs. The impact of escalating material costs, particularly steel and specialized polymers, poses a short-term constraint on CAPEX stability. Additionally, the increasing maturity of mooring and anchoring technologies is reducing long-term risk perception among investors. Regulatory harmonization across key markets, particularly standardizing guidelines for FSS safety, environmental impact assessments, and grid connection protocols, is a powerful force accelerating market acceptance and large-scale deployment. The environmental impact assessment (EIA) requirements for FSS deployment, particularly concerning aquatic ecosystems and biodiversity, remain a significant regulatory hurdle, requiring detailed ecological studies before large-scale projects can proceed.

Segmentation Analysis

The Floating Solar System market is meticulously segmented based on structure, capacity, component type, and application, reflecting the diverse needs and technical requirements of various end-users across different geographical and hydrological settings. Segmentation by structure primarily distinguishes between non-tilted or fixed structures, which are simpler and cost-effective, and tracking structures, which maximize output but require more complex mechanical and control systems. Capacity segmentation categorizes installations into highly granular scales, ranging from small-scale decentralized systems to massive utility-scale projects that dominate the current investment landscape. Understanding these segmentations is vital for manufacturers and investors to target specific regulatory environments and operational niches effectively, ensuring optimized design and competitive pricing strategies for bespoke FSS solutions.

Component segmentation differentiates between the primary structural elements—the floating platform (pontoons and floaters), the balance of system (BOS) including inverters and cables, and the PV modules themselves. The materials used for floating platforms, such as High-Density Polyethylene (HDPE) or reinforced concrete, define the platform segment and significantly influence the system’s longevity and installation cost. Application segmentation is crucial, identifying the primary end-users, with hydropower reservoirs and water treatment plants representing the most mature segments, whereas open ocean and coastal FPV represent the high-potential, high-R&D-intensity segments requiring more advanced marine engineering solutions to ensure resilience against severe weather conditions and wave action.

- By Structure Type:

- Non-Tilted (Fixed Tilt)

- Tilted (Tracking or Variable Tilt)

- By Capacity:

- Less than 1 MW (Small Scale)

- 1 MW – 5 MW (Medium Scale)

- Above 5 MW (Utility Scale)

- By Component:

- Floating Platforms (Pontoons/Floaters)

- PV Modules

- Inverters

- Mooring and Anchoring Systems

- Electrical Components and Transmission Cables

- By Application/Site:

- Hydroelectric Reservoirs

- Water Treatment Ponds/Reservoirs

- Irrigation Ponds and Dams

- Quarry Ponds and Mining Pools

- Coastal and Offshore Water Bodies (Emerging)

Value Chain Analysis For Floating Solar System Market

The value chain of the Floating Solar System market is complex, beginning with upstream activities focused on raw material sourcing and the manufacturing of specialized components. Upstream analysis highlights the critical reliance on polymer suppliers (for HDPE and LLDPE used in pontoons) and specialized metal manufacturers for corrosion-resistant components used in mooring systems. Key activities at this stage involve R&D into advanced material compositions that enhance buoyancy, reduce biofouling, and improve structural resilience under UV and hydrostatic stress. Component manufacturing—specifically the production of optimized PV modules, marine-grade inverters, and customized floating platforms—is highly specialized and often outsourced to companies with expertise in marine engineering and sustainable material science.

The midstream and downstream activities involve Engineering, Procurement, and Construction (EPC) services, which are critical for the successful deployment of FSS projects. EPC firms manage site surveys, bathymetric mapping, civil works for anchoring, platform assembly, PV panel installation, and grid interconnection. Distribution channels are predominantly direct, involving large-scale contracts between platform manufacturers, EPC providers, and utility companies or independent power producers (IPPs). Indirect channels, though less common for utility-scale projects, sometimes involve strategic partnerships or agents facilitating smaller, specialized installations for private industrial clients or water management districts. The complexity of deployment necessitates deep integration between design firms and installers to ensure regulatory compliance and operational safety.

Post-installation, the downstream phase focuses on Operations and Maintenance (O&M), which is uniquely challenging for FSS due to the aquatic environment. O&M includes routine cleaning (to minimize biofouling and maintain efficiency), structural inspections, preventative maintenance of mooring lines, and monitoring of electrical systems for moisture ingress and corrosion. Direct O&M services are often provided by the same EPC provider or specialized marine service companies. Technological integration, particularly AI-driven monitoring systems, is crucial in this phase to maintain system reliability. The value chain culminates with the long-term sale of electricity (PPA) to utility grids or direct consumers, emphasizing the need for highly reliable systems with lifecycles comparable to land-based PV (25+ years).

Floating Solar System Market Potential Customers

The primary end-users and buyers of Floating Solar Systems are large entities requiring stable, high-volume electricity generation while facing constraints on available land or seeking enhanced water management benefits. The most significant customer segment comprises Electric Utility Companies and Independent Power Producers (IPPs) who utilize FSS to meet regulatory renewable energy mandates and diversify their generation portfolios. These customers typically invest in utility-scale projects (over 5 MW) deployed on large existing reservoirs, often integrated with hydroelectric dams to create hybrid systems, capitalizing on shared grid infrastructure and operational synergies. Their purchasing decisions are primarily driven by LCOE, system reliability, and the availability of long-term government subsidies or guaranteed PPAs.

Another crucial customer group includes Governmental Water Management Authorities and Municipalities. These entities purchase FSS primarily for deployment on municipal drinking water reservoirs, irrigation ponds, and sewage treatment lagoons. For this segment, the benefit of reduced water evaporation (estimated at 70-90% reduction) is as critical as power generation, offering a dual return on investment, particularly in water-stressed regions. Furthermore, the shading provided by FSS helps suppress algae growth, improving water quality management and reducing chemical treatment needs. These buyers prioritize systems with proven environmental safety records and minimal maintenance requirements, often preferring non-tilted, fixed structures for simplicity.

Industrial and Commercial (C&I) sectors, specifically mining operations, quarry operators, and specialized manufacturing plants that possess large industrial process water or effluent ponds, represent a growing market segment. These customers deploy FSS to achieve energy independence and reduce operational electricity costs, utilizing otherwise unproductive surface area. Their buying criteria revolve around robust, customized mooring systems capable of handling dynamic water levels typical of industrial ponds, focusing on resilience and compliance with internal safety standards. The decision-making unit often includes the facility engineering management and corporate sustainability officers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.5 Billion |

| Market Forecast in 2033 | USD 8.7 Billion |

| Growth Rate | 25.0% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Ciel & Terre International, Sunseap Group, Ocean Sun, Hanwha Q CELLS Co., Ltd., Wartsila, Kyocera Corporation, ADEN Group, Akuo Energy SAS, NRG Energy, Inc., Floating Power Plant A/S, ISOFOTON S.A., Yingli Solar, L&T Hydrocarbon Engineering, Scatec Solar, BayWa r.e., Mitsubishi Heavy Industries, Sharp Corporation, JA Solar Technology Co., Ltd., Trina Solar Co., Ltd., Sungrow Power Supply Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floating Solar System Market Key Technology Landscape

The technological landscape of the Floating Solar System market is defined by continuous innovation focused on improving structural resilience, enhancing energy conversion efficiency in humid environments, and optimizing installation methodologies. A key area of innovation is the floating platform design, where High-Density Polyethylene (HDPE) remains the dominant material due to its buoyancy, resistance to corrosion, and relative cost-effectiveness. However, there is growing research into hybrid materials, including fiber-reinforced concrete or specialized composite polymers, particularly for larger, more exposed installations requiring greater stability and lifespan. Modular design is paramount, allowing for rapid assembly and scalability, thus reducing onsite labor costs and construction timelines. Manufacturers are refining interlocking mechanisms between pontoons to better distribute stresses caused by water movement and variable loading from maintenance crews.

Mooring and anchoring technology represent a critical technological bottleneck and opportunity. The system must reliably handle fluctuations in water level (especially in reservoirs linked to hydropower), significant wind speeds, and wave action. Technologies span from traditional deadweight anchors and pile mooring systems to advanced taut-leg mooring utilized in deeper water applications. Innovations include smart mooring systems that incorporate sensors to monitor tension and movement, feeding data back into AI systems for predictive maintenance alerts. Furthermore, customized underwater cabling and specialized, corrosion-resistant inverters (often centralized and placed on land or on a stable platform close to shore) are vital to managing the electrical connection and protecting sensitive equipment from the highly humid and potentially saline environment, thereby mitigating major operational risks.

The integration of advanced monitoring and data analytics tools is rapidly transforming FSS operations. This includes using drone-based thermography and visual inspections to detect module hot spots and structural degradation efficiently. Furthermore, specialized cooling techniques are being explored beyond the passive water-cooling effect, such as utilizing the system’s design to channel cooler water underneath the panels, maximizing the thermal transfer benefit. The development of bifacial PV modules specifically adapted for floating applications, which can capture reflected light from the water surface, represents a future trend aimed at significantly increasing the total energy generation capacity per unit area, pushing system efficiency beyond current single-sided module performance metrics.

Regional Highlights

The Floating Solar System Market exhibits distinct regional patterns influenced by local land availability, governmental support, and hydrological characteristics. Asia Pacific (APAC) leads the global market in terms of installed capacity and future pipeline, driven primarily by nations like China, India, and Japan. These countries face severe land scarcity combined with ambitious renewable energy targets, making their vast networks of irrigation and hydroelectric reservoirs ideal deployment sites. China, in particular, has pioneered massive FSS projects, often utilizing subsided coal mining areas or large freshwater lakes, setting the benchmark for utility-scale deployment and technological advancement. Investment incentives and supportive regulatory frameworks in Southeast Asian nations are fueling explosive growth in this region.

Europe represents a technologically mature, albeit slower-growing, market, concentrating on integrating FSS into industrial waters, commercial quarry ponds, and near-shore coastal areas. The Netherlands, France, and the UK are key markets, prioritizing innovation in offshore FPV platforms to manage high wind and wave loads typical of the North Sea environment. European projects often emphasize stringent environmental protection standards and sophisticated integration with circular economy principles, focusing on sustainable platform materials and minimal ecological disturbance. High electricity prices and strong decarbonization mandates provide a stable investment environment.

North America, particularly the United States, is poised for significant growth, with deployment concentrating on reservoirs associated with the Bureau of Reclamation and municipal water treatment facilities. The market is accelerating due to supportive federal policies and the demonstrated benefits of FSS in reducing reservoir evaporation, particularly relevant in drought-stricken Western states. Latin America, specifically Brazil and Chile, is a nascent but rapidly developing market, leveraging their extensive hydropower infrastructure for hybrid FSS integration. Meanwhile, the Middle East and Africa (MEA) are exploring FSS potential, recognizing the critical dual benefit of power generation and water conservation in arid climates, utilizing desalination plant reservoirs and industrial cooling ponds for deployment.

- Asia Pacific (APAC): Dominates globally due to high population density, intense land pressure, and large-scale renewable energy mandates in China, India, and Japan, focusing on hydroelectric reservoirs.

- Europe: Focuses on technological refinement, environmental sustainability, and integrating FSS into industrial and highly regulated water bodies; strong growth in specialized offshore systems (Netherlands, France).

- North America: Emerging market driven by federal incentives and the critical need for water evaporation mitigation in Western U.S. states; growth concentrated around water treatment plants and large government reservoirs.

- Latin America (LATAM): High potential due to existing substantial hydropower infrastructure, facilitating cost-effective hybrid power generation, particularly in Brazil and Chile.

- Middle East & Africa (MEA): Nascent market focusing on dual benefits of power generation and water conservation, utilizing industrial and irrigation ponds in highly water-stressed regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floating Solar System Market.- Ciel & Terre International

- Sunseap Group

- Ocean Sun

- Hanwha Q CELLS Co., Ltd.

- Wartsila

- Kyocera Corporation

- ADEN Group

- Akuo Energy SAS

- NRG Energy, Inc.

- Floating Power Plant A/S

- ISOFOTON S.A.

- Yingli Solar

- L&T Hydrocarbon Engineering

- Scatec Solar

- BayWa r.e.

- Mitsubishi Heavy Industries

- Sharp Corporation

- JA Solar Technology Co., Ltd.

- Trina Solar Co., Ltd.

- Sungrow Power Supply Co., Ltd.

- CubicPV, Inc.

- Cemex Ventures

- TBEA Xinjiang Sunoasis Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Floating Solar System market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary advantage of Floating Solar Systems over traditional land-based solar farms?

The primary advantage is the dual-use of space, preserving valuable land for agriculture or urban development. Additionally, the water body provides a cooling effect, which increases the efficiency and power output of the PV modules by minimizing temperature-related energy losses.

How do Floating Solar Systems impact the environment and local aquatic ecosystems?

FSS can reduce water evaporation significantly and suppress harmful algae growth due to shading. However, developers must conduct rigorous Environmental Impact Assessments (EIAs) to ensure minimal disruption to water circulation, light penetration, and local fish and wildlife habitats, particularly regarding material leachate and shading intensity.

What are the main technological challenges associated with deploying large-scale FSS projects?

Key technological challenges include designing resilient and durable mooring and anchoring systems capable of handling significant water level fluctuations and wind loads; ensuring the longevity and corrosion resistance of electrical components (inverters and cables) in humid environments; and managing the logistics of assembly and maintenance on water.

Which region currently leads the Floating Solar System market, and what drives its dominance?

Asia Pacific (APAC), particularly driven by China, leads the market in terms of installed capacity and pipeline. This dominance is due to high population density, extreme land scarcity, and robust government renewable energy policies favoring the utilization of vast existing hydroelectric and irrigation reservoir networks for power generation.

Is the Levelized Cost of Energy (LCOE) for Floating Solar competitive with land-based solar?

While the initial Capital Expenditure (CAPEX) for FSS is generally higher due to specialized structural and mooring requirements, the increased energy yield from water cooling and the savings from avoiding land acquisition costs often make the LCOE highly competitive, particularly for utility-scale projects integrated with existing grid infrastructure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager