Floor and Roof Joists Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435097 | Date : Dec, 2025 | Pages : 246 | Region : Global | Publisher : MRU

Floor and Roof Joists Market Size

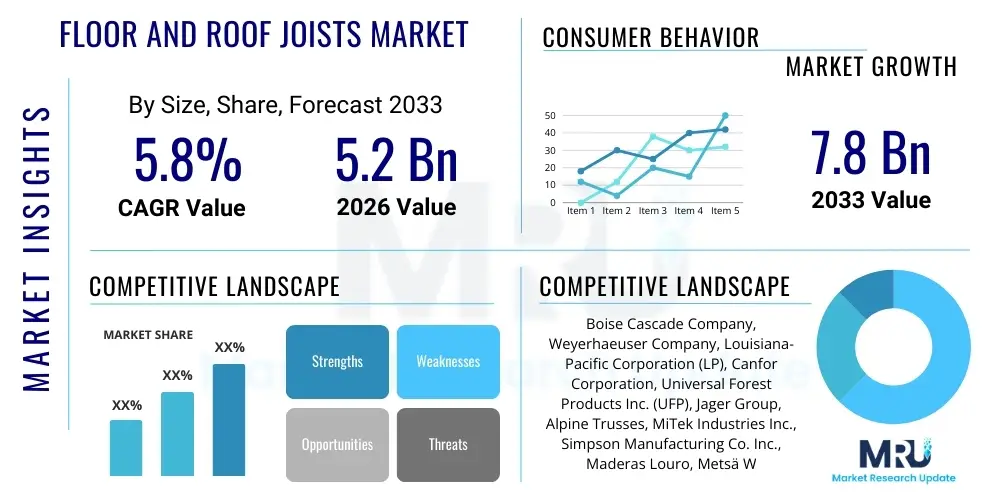

The Floor and Roof Joists Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 5.2 Billion in 2026 and is projected to reach USD 7.8 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily fueled by accelerated residential construction activity globally, particularly in emerging economies, coupled with increasing adoption of engineered wood products due to their superior performance characteristics and sustainability benefits compared to traditional lumber.

Floor and Roof Joists Market introduction

The Floor and Roof Joists Market encompasses structural components, predominantly beams and rafters, designed to support weight and provide structural integrity in residential, commercial, and industrial buildings. These components are essential horizontal framing members that transfer loads from the floor or roof surface to the vertical bearing walls, columns, or girders. Key products include solid sawn lumber joists, I-joists (or I-beams), and open web trusses, each offering unique strength-to-weight ratios and spanning capabilities. The choice of joist type depends heavily on application requirements, cost considerations, and local building codes, with engineered wood products like I-joists gaining significant market share due to their consistency, reduced material usage, and enhanced resistance to warping and shrinkage.

Major applications for floor and roof joists span new construction, renovation, and repair activities across various sectors. In residential construction, they form the foundation of flooring systems and the framework for roofing structures, requiring materials that are lightweight yet immensely strong. Commercial applications, such as offices and retail spaces, often utilize robust engineered joists or trusses to accommodate longer spans and higher live loads. Benefits associated with modern joist systems include faster installation times, reduced material waste on-site, consistent dimensions that simplify construction processes, and improved thermal performance when integrated with specialized insulation strategies, thereby contributing to overall building efficiency and reduced lifetime operational costs.

The primary driving factors sustaining market expansion involve the global emphasis on sustainable building practices, leading to increased demand for wood-based engineered products (like laminated veneer lumber and cross-laminated timber), rapid urbanization necessitating high-density housing solutions, and technological advancements in manufacturing processes such as automation and precision cutting. Furthermore, favorable government policies promoting affordable housing and infrastructure development, particularly in the Asia Pacific region, are critical contributors to the projected market growth over the forecast period. The necessity for seismic-resistant and high-performance buildings also drives the preference for advanced, meticulously engineered joist systems.

Floor and Roof Joists Market Executive Summary

The Floor and Roof Joists Market exhibits robust business trends characterized by a significant shift towards prefabricated and engineered solutions, moving away from traditional solid sawn lumber due to supply volatility and material inconsistencies. Key industry players are focusing on vertical integration and automation to enhance manufacturing efficiency, secure raw material supplies, and reduce production lead times, thereby mitigating cost pressures associated with fluctuating timber prices. Furthermore, the integration of Building Information Modeling (BIM) into the design and fabrication process is a critical technological trend, enabling customized, precise production of joist systems tailored to complex architectural specifications, promoting higher efficiency and reduced on-site errors in large-scale construction projects.

Regionally, North America remains a dominant market, largely driven by resilient housing starts and the established infrastructure for engineered wood product consumption. However, the Asia Pacific region is poised for the highest growth rate, fueled by massive infrastructure investments, rapid urbanization in countries like China and India, and increasing awareness regarding the long-term benefits of using standardized, high-quality engineered joists in multi-family dwellings. European markets demonstrate stability, prioritizing sustainable and low-carbon construction methods, thereby boosting the demand for certified timber and advanced wood components. Latin America and the Middle East and Africa are emerging markets, witnessing slow but steady adoption driven by new construction projects in hospitality and residential sectors, often imported from established manufacturing hubs.

Segment trends highlight the dominance of I-joists within the product type category, owing to their superior strength, lightweight nature, and versatility in residential and light commercial structures. In terms of material, wood-based engineered products are accelerating their market capture against conventional steel and solid timber, supported by their environmental profile and cost-effectiveness. Application analysis indicates that the residential segment is the largest end-user, though the commercial and institutional segments are adopting specialized long-span trusses and composite joists to meet demanding structural requirements. The structural integrity and fire resistance features of these engineered products are becoming key differentiators influencing procurement decisions across all major end-user categories.

AI Impact Analysis on Floor and Roof Joists Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Floor and Roof Joists Market primarily revolve around themes of design optimization, supply chain prediction, and automated manufacturing quality control. Common questions address how AI-driven generative design can minimize material waste and improve structural efficiency, whether AI algorithms can accurately forecast fluctuating lumber prices and manage inventory for just-in-time delivery, and the role of robotics and machine learning in enhancing the precision of cutting and assembly lines. Users are particularly concerned with how AI can address persistent industry challenges such as skilled labor shortages and escalating raw material costs by introducing higher levels of automation and predictive capabilities in the fabrication and installation phases.

AI's influence is transforming the pre-construction phase by leveraging machine learning to optimize structural design parameters. AI tools can analyze complex building codes, stress loads, and material availability simultaneously, generating optimal joist layouts that reduce overall material consumption while ensuring maximum structural integrity. This transition from traditional manual design calculations to AI-driven generative design significantly cuts down on design iteration time and leads to cost savings. Furthermore, predictive maintenance applications utilize sensor data collected from manufacturing equipment to forecast potential failures, thereby minimizing downtime and ensuring continuous, high-volume production of standardized components, which is crucial for meeting construction deadlines.

The deployment of AI is also revolutionizing supply chain resilience within the timber and engineered wood sector. Machine learning models analyze global commodity markets, weather patterns, logistics data, and construction project timelines to provide highly accurate forecasts for material demand and price fluctuations. This predictive capability allows manufacturers to strategically source raw materials and manage inventory levels effectively, reducing the risk of project delays due to material shortages. Consequently, AI integration enhances overall operational efficiency, ensures the consistency and quality of manufactured joists, and accelerates the adoption of custom, pre-engineered solutions in modern modular and prefabricated construction methodologies.

- AI-driven Generative Design: Optimizes joist placement and dimensions, minimizing material use by up to 15%.

- Predictive Supply Chain Management: Uses machine learning to forecast timber price volatility and optimize procurement strategies.

- Automated Quality Control: Deploys computer vision systems to inspect engineered wood products for defects at high speeds.

- Robotics in Fabrication: Enhances precision cutting, assembly, and packaging of custom-sized joists and trusses.

- Site Logistics Optimization: AI algorithms plan the sequencing and timing of joist delivery to construction sites, minimizing storage needs.

- BIM Integration Enhancement: AI processes BIM data faster to create detailed fabrication drawings and material takeoffs automatically.

DRO & Impact Forces Of Floor and Roof Joists Market

The Floor and Roof Joists Market is shaped by a compelling set of Dynamics, Restraints, and Opportunities (DRO), collectively driven by underlying Impact Forces related to global demographics, regulatory changes, and technological evolution. Key drivers include accelerating residential construction globally, particularly the surge in multi-family dwellings requiring reliable and scalable structural components, coupled with growing environmental mandates favoring engineered wood products over steel or concrete due to their lower embodied carbon footprint. These dynamics are pushing manufacturers to innovate continually, focusing on mass customization and sustainable material sourcing to meet the demands of modern, quick-to-build structures.

Restraints primarily revolve around the volatility of raw material costs, particularly dimensional lumber and wood adhesives, which directly impacts the profitability and price stability of engineered joists. Regulatory hurdles, including stringent fire resistance codes and varying international structural standards, often necessitate complex and costly product certifications, potentially slowing down the adoption of innovative joist materials like advanced composite wood. The market also faces constraints from the cyclical nature of the construction industry and a persistent shortage of skilled construction labor capable of efficiently installing highly specialized engineered floor systems, demanding simpler, more installer-friendly designs.

Opportunities for market expansion are significant, primarily centered on the growing adoption of modular and prefabricated construction methods, which heavily rely on pre-cut, precision-engineered joist systems for rapid assembly. Furthermore, research and development into advanced composite materials, combining wood fibers with polymers or carbon fiber, offers pathways for creating joists with superior spanning capabilities and resistance to moisture and pests. The increasing global focus on energy-efficient building codes provides an opportunity for manufacturers to integrate insulation features directly into the joist design (e.g., open web trusses allowing for easy mechanical routing), enhancing overall thermal performance and securing a competitive edge in green building markets. The Impact Forces of globalization, urbanization, and climate change regulation are the underlying catalysts intensifying these DRO factors.

Segmentation Analysis

The Floor and Roof Joists Market is comprehensively segmented based on product type, material, application, and end-user, providing a granular view of market dynamics and adoption patterns. Segmentation by product type highlights the shift from traditional solid sawn joists towards high-performance engineered alternatives like I-joists and open web trusses, reflecting the industry's demand for materials offering greater predictability, higher strength-to-weight ratios, and longer unsupported spans. Material segmentation underscores the dominance of wood-based products, though composite and steel joists maintain strong footholds in specific demanding commercial and industrial applications. Application analysis focuses on the differences between floor structures, which demand high stiffness and load-bearing capacity, and roof structures, which require optimization for snow load and wind uplift resistance across various architectural designs.

The largest volume driver is the residential segment, where cost-effectiveness, ease of installation, and adherence to standard housing dimensions are paramount. Conversely, the commercial and industrial segments prioritize robust structural performance, fire resistance, and the ability to accommodate complex mechanical, electrical, and plumbing (MEP) systems, often leading to the selection of steel bar joists or custom-designed open web timber trusses. Geographic segmentation also plays a crucial role, as building practices, material preferences (e.g., preference for Glulam in certain European markets), and seismic requirements dictate the regional demand for specific joist types and configurations. Understanding these distinct segments is vital for manufacturers to tailor their production capabilities and marketing strategies effectively.

The ongoing trend towards sustainability is influencing purchasing decisions across all segments. Certifications such as FSC (Forest Stewardship Council) and PEFC (Programme for the Endorsement of Forest Certification) are becoming prerequisites, particularly in government-funded or high-end construction projects. Manufacturers are responding by developing eco-friendly adhesives and minimizing waste in production, further solidifying the position of engineered wood products as the preferred structural element in segments committed to achieving low-carbon building goals. This focus on life-cycle assessment (LCA) compliance is expected to amplify the demand for highly optimized, precision-fabricated joist systems, regardless of the ultimate end-user application.

- By Product Type:

- I-Joists (Engineered Wood Joists)

- Open Web Trusses (Parallel Chord, Pitched Trusses)

- Solid Sawn Lumber Joists

- Steel Joists (Bar Joists, Joist Girders)

- Composite Joists (Wood-Steel Hybrids)

- By Material:

- Wood (Solid Sawn, Glulam, LVL, PSL)

- Engineered Wood Products (Plywood/OSB Webbing)

- Steel

- Composites

- By Application:

- Floor Systems

- Roof Systems

- By End-User:

- Residential Construction (Single-Family, Multi-Family)

- Commercial Construction (Office Buildings, Retail)

- Industrial Construction (Warehouses, Factories)

- Infrastructure & Institutional

Value Chain Analysis For Floor and Roof Joists Market

The value chain for the Floor and Roof Joists Market is characterized by a complex progression from raw material extraction to final installation, heavily reliant on efficient logistics and technological integration at the manufacturing stage. Upstream activities involve forestry, logging, and the primary processing of timber into dimensional lumber, veneer, or strand materials (such as OSB or plywood), which form the core components of engineered joists. The volatility in global timber markets and the necessity for sustainable harvesting practices pose significant challenges upstream, requiring sophisticated supply chain management and strong adherence to international environmental standards (e.g., FSC certification) to ensure a steady supply of compliant raw materials for the highly automated midstream fabrication process.

The midstream segment, dominated by specialized joist manufacturers, involves transforming these raw materials into finished structural components, utilizing high-precision machinery for cutting, assembly, and bonding, particularly for I-joists and trusses. This stage is critical for adding value through engineering, ensuring that products meet exacting load specifications and dimensional consistency. Technological inputs, including specialized software for design optimization and automated robotics for fabrication, define this stage. Downstream activities involve distribution, which is bifurcated into direct sales to large construction companies and indirect sales through a network of specialized building material distributors and wholesalers who maintain local inventory and provide technical support to smaller contractors and builders.

Distribution channels are crucial due to the bulky nature of the products and the need for timely delivery to construction sites. Direct channels facilitate customization and large volume orders for commercial projects, ensuring a closer relationship between the manufacturer and the project manager. Indirect channels, typically involving established lumberyards and building supply centers, are essential for serving the dispersed residential renovation and smaller builder market. Effective coordination across all stages, especially between manufacturing (midstream) and installation (downstream), using digital tools like BIM, significantly reduces on-site delays, optimizes material handling, and ultimately enhances overall project profitability for the end-user. The success of the value chain is increasingly measured by its efficiency, sustainability profile, and ability to deliver customized products on demand.

Floor and Roof Joists Market Potential Customers

Potential customers and end-users of floor and roof joists are diverse, spanning the entire spectrum of the construction industry, with varying needs concerning strength, spanning capacity, and installation complexity. The largest demographic comprises Residential Home Builders, ranging from large-scale tract developers constructing multi-family housing to custom home builders focusing on single-family units. These buyers prioritize cost-effectiveness, ease of use (simple nailing/fastening), and material consistency to maintain tight construction schedules and adhere to stringent budget constraints typical of mass housing projects. They increasingly favor engineered I-joists due to their reliability and reduced likelihood of material shrinkage or warping over time.

The second major customer group includes Commercial and Institutional Contractors, who manage the construction of office complexes, schools, hospitals, and government buildings. These projects demand high performance regarding fire rating, acoustic separation, and long, clear spans to maximize usable interior space. Consequently, this segment frequently procures specialized products like heavy-duty steel bar joists, long-span glulam beams, and customized open web trusses that facilitate the complex routing of HVAC and utility systems. Their procurement decisions are heavily influenced by specific architectural specifications, adherence to strict regulatory standards, and the supplier's ability to provide detailed structural engineering support and certifications.

A growing segment of buyers includes Modular and Prefabrication Companies, which rely entirely on pre-engineered components for off-site assembly. These manufacturers require extremely precise, pre-cut, and sometimes pre-assembled joist components delivered in a just-in-time manner. Their focus is on minimizing on-site work and maximizing factory throughput, necessitating a close partnership with joist suppliers capable of high volume, repeatable precision manufacturing. Furthermore, independent Repair and Renovation Contractors constitute a steady demand source for replacement and retrofitting projects, typically sourced through local lumberyards and distributors, prioritizing product compatibility with existing structures and immediate availability.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 5.2 Billion |

| Market Forecast in 2033 | USD 7.8 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Boise Cascade Company, Weyerhaeuser Company, Louisiana-Pacific Corporation (LP), Canfor Corporation, Universal Forest Products Inc. (UFP), Jager Group, Alpine Trusses, MiTek Industries Inc., Simpson Manufacturing Co. Inc., Maderas Louro, Metsä Wood, Georgia-Pacific LLC, Rosboro, RedBuilt LLC, Pacific Woodtech, Structurlam Mass Timber Corporation, iLevel by Weyerhaeuser, Anthony Forest Products, Inc., Tolko Industries Ltd., Stella-Jones. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floor and Roof Joists Market Key Technology Landscape

The technological landscape of the Floor and Roof Joists Market is evolving rapidly, driven by the need for greater precision, material optimization, and enhanced structural performance. A pivotal technology is the widespread adoption of Building Information Modeling (BIM), which allows architects, engineers, and manufacturers to collaborate on a single 3D model. BIM software facilitates the precise customization of joist systems, ensuring that every component is fabricated to exact site requirements, minimizing on-site cutting and waste. This integration streamlines the entire design-to-installation workflow, substantially reducing project timelines and increasing overall construction efficiency, particularly for complex roof structures and long-span floor systems.

Furthermore, advancements in automated manufacturing techniques are redefining the production of engineered joists. High-speed, computer numerical control (CNC) cutting machines and automated assembly lines utilizing robotics ensure dimensional consistency and superior quality control for I-joists and open web trusses. These advanced production methods not only boost throughput but also allow for the cost-effective mass customization of products, enabling manufacturers to efficiently handle diverse order specifications. Innovations in adhesive technology, including formaldehyde-free and lower-VOC (Volatile Organic Compound) structural glues, are also crucial, improving product sustainability credentials and meeting stricter indoor air quality regulations prevalent in developed markets.

The emergence of mass timber construction, encompassing technologies like Cross-Laminated Timber (CLT) and Glued Laminated Timber (Glulam), is creating new market segments for floor and roof joists designed to integrate seamlessly with these large-scale engineered wood systems. Joists in this context often serve as secondary structural members or require specialized connection details. Additionally, the increasing use of digital scanning and remote monitoring technologies at construction sites enables real-time verification of installation accuracy, ensuring compliance with design specifications and further integrating the digital twin concept throughout the lifespan of the structure. This technological convergence ensures that modern joists are not merely materials but precision-engineered components of a digital construction ecosystem.

Regional Highlights

The global Floor and Roof Joists Market displays distinct regional characteristics influenced by construction volume, regulatory environments, and material availability. North America, encompassing the United States and Canada, represents the mature and leading market, characterized by high rates of single-family housing starts and a deep reliance on engineered wood products, particularly I-joists and prefabricated roof trusses. The region benefits from established supply chains, high technological adoption in manufacturing (BIM, automated fabrication), and strict building codes that favor the predictability and consistency offered by engineered systems. Economic fluctuations in residential construction, particularly mortgage rates and lumber costs, remain the primary drivers of short-term market performance in this region, consistently demanding large volumes of structurally robust and easily installed products.

Europe demonstrates a strong commitment to sustainable and low-carbon construction, driving high demand for certified timber and advanced wood-based products such as Glulam and specialized timber trusses. Countries like Germany, Sweden, and the Nordic nations lead in adopting complex, long-span engineered timber solutions for both commercial and multi-story residential buildings, often integrating renewable energy and high thermal performance requirements directly into the structural design. The European market focuses heavily on resource efficiency and mandates strict fire safety and acoustic performance, pushing innovation in composite and advanced timber materials. The prevalence of renovation and retrofitting projects also contributes significantly to stable, albeit slower, market growth compared to North America.

Asia Pacific (APAC) is projected to be the fastest-growing region, propelled by massive urbanization, infrastructure development, and a booming middle-class demanding modern housing solutions, particularly in China, India, and Southeast Asia. While traditional construction materials still dominate some segments, the region is rapidly transitioning towards prefabricated, standardized building systems to address labor shortages and accelerate project completion. Government initiatives promoting high-rise timber structures and the import of specialized engineered wood components from North America and Europe are driving significant market expansion, presenting substantial opportunities for international manufacturers specializing in high-performance joist systems suitable for earthquake-prone zones and high-density residential developments.

- North America: Dominant market share; driven by high residential housing starts, advanced engineering standards, and robust supply chain for I-joists and light-gauge steel framing.

- Europe: Focus on sustainability, high adoption of certified timber (Glulam, timber trusses), stable growth fueled by strict energy efficiency mandates and renovation activity.

- Asia Pacific (APAC): Highest projected CAGR; rapid urbanization, infrastructure investment, increasing adoption of prefabricated components in high-density housing projects.

- Latin America: Emerging market; growth tied to commercial developments and governmental housing programs; localized material preferences and reliance on imported engineered products.

- Middle East and Africa (MEA): Growth driven by mega-projects in hospitality and industrial sectors; high demand for steel joists and specialized, fire-resistant engineered wood in certain sub-regions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floor and Roof Joists Market.- Boise Cascade Company

- Weyerhaeuser Company

- Louisiana-Pacific Corporation (LP)

- Canfor Corporation

- Universal Forest Products Inc. (UFP)

- Jager Group

- Alpine Trusses

- MiTek Industries Inc.

- Simpson Manufacturing Co. Inc.

- Maderas Louro

- Metsä Wood

- Georgia-Pacific LLC

- Rosboro

- RedBuilt LLC

- Pacific Woodtech

- Structurlam Mass Timber Corporation

- iLevel by Weyerhaeuser

- Anthony Forest Products, Inc.

- Tolko Industries Ltd.

- Stella-Jones

Frequently Asked Questions

Analyze common user questions about the Floor and Roof Joists market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the demand for engineered I-joists over traditional lumber?

Engineered I-joists offer superior strength-to-weight ratios, dimensional stability, and the ability to span longer distances without intermediate supports, reducing material waste and enabling faster, more predictable construction compared to solid sawn lumber.

How does the volatility of timber prices impact the Floor and Roof Joists Market?

Raw material volatility introduces cost uncertainty for manufacturers, leading to price fluctuations for the finished joist products. This necessitates advanced supply chain forecasting and forward purchasing strategies to maintain stable pricing for construction clients.

What role does modular construction play in the adoption of prefabricated joist systems?

Modular construction heavily relies on precision-fabricated components, making prefabricated joists and trusses essential. They enable high-speed off-site assembly, minimize on-site labor requirements, and ensure strict quality control vital for modular building standards.

Which geographical region is expected to show the fastest growth rate in the market?

The Asia Pacific (APAC) region, driven by extensive urbanization projects, massive investments in infrastructure, and increasing adoption of modern, standardized building techniques, is projected to register the highest Compound Annual Growth Rate (CAGR).

What technological innovations are currently optimizing the structural design of joists?

Building Information Modeling (BIM) coupled with AI-driven generative design software allows for the automated optimization of joist layouts based on load requirements and material costs, significantly reducing material consumption and streamlining fabrication.

Are timber-based joists environmentally superior to steel joists?

Yes, timber and engineered wood joists generally possess a lower embodied carbon footprint than steel or concrete due to carbon sequestration during tree growth and lower energy consumption during manufacturing. This aligns with global sustainability goals.

What are the key benefits of using open web trusses in commercial buildings?

Open web trusses provide long, clear spans and crucially offer built-in cavities that allow for easy, efficient routing of mechanical, electrical, and plumbing (MEP) systems, reducing installation time and construction complexity in commercial spaces.

How are fire safety regulations addressed when using engineered wood joists?

Manufacturers address fire safety through the application of fire-retardant treatments, designing protective gypsum board assemblies around joist systems, and adhering to strict building codes that specify necessary fire ratings for different structural types and building uses.

What is the impact of specialized adhesive technologies on joist performance?

Advanced adhesives, including those with low or zero VOCs (Volatile Organic Compounds), enhance the durability, moisture resistance, and structural integrity of engineered joists while meeting stringent environmental and indoor air quality standards.

How does supply chain automation affect the manufacturer's operational efficiency?

Automation in the supply chain, supported by AI, ensures precise inventory management, minimizes material waste during fabrication, and guarantees just-in-time delivery, thereby reducing overall operational costs and accelerating production cycles for custom orders.

What are the primary challenges facing the adoption of mass timber structural systems?

Challenges include the need for specialized construction techniques, securing sufficient supply of engineered mass timber products (like Glulam), addressing initial cost premiums, and navigating stringent, often outdated, local building codes regarding fire resistance and height limits.

In which market segment are steel joists most prevalent?

Steel joists, particularly bar joists, are most prevalent in the commercial and industrial construction segments, where they are required for exceptionally long spans, very high load-bearing capacity, and non-combustible construction requirements (e.g., warehouses, large retail centers).

What is the significance of the Forecast Period 2026-2033 for the market?

This forecast period is critical as it is expected to witness the large-scale transition towards industrialized construction methods globally, solidifying the market dominance of engineered wood products and integrating digital technologies into core structural processes.

How is the shortage of skilled labor influencing joist product design?

The labor shortage drives the demand for products that are simpler, lighter, and faster to install, leading manufacturers to develop pre-cut, pre-drilled, and highly standardized joist packages that minimize complex on-site adjustments and reduce reliance on specialized trades.

What are key opportunities in R&D for the joists market?

Key R&D opportunities lie in developing durable composite joists that combine wood with high-performance materials like carbon fiber for enhanced strength and developing smart joists equipped with embedded sensors for structural health monitoring during a building's lifecycle.

Why are building codes in seismic zones influencing joist material choices?

Building codes in seismic zones often favor lighter structural materials with predictable performance under dynamic loading. Engineered wood joists are frequently preferred due to their excellent energy absorption capacity and favorable strength-to-weight ratio, contributing to overall structural resilience.

How do floor joists contribute to building acoustics?

Floor joist systems, especially those using open web designs, allow for the strategic placement of acoustic insulation and mass barriers. Design choices regarding joist depth and spacing significantly influence floor stiffness and vibration damping, which are critical for achieving desired sound transmission ratings (STC).

What is 'just-in-time' delivery and why is it important for joist logistics?

'Just-in-time' delivery ensures that custom-fabricated joists arrive at the construction site precisely when needed for installation. This minimizes costly on-site storage, reduces the risk of material damage or theft, and maintains project flow, especially critical for dense urban sites.

How do manufacturers ensure the quality and consistency of I-joist flanges and webs?

Manufacturers utilize rigorous testing protocols, including mechanical stress grading for flanges (typically LVL or solid lumber) and ultrasonic testing for the OSB or plywood webs, combined with automated assembly processes to ensure consistent bonding strength and dimensional accuracy throughout the production run.

What distinguishes the institutional segment from the commercial segment in joist demand?

The institutional segment (schools, hospitals) often has even stricter requirements regarding fire rating, vibration control, and long-term durability than general commercial buildings, driving demand for specialized, high-specification joists and systems that ensure patient and occupant safety over decades.

What role does digitalization play in minimizing material waste in joist production?

Digitalization, particularly through integrated design and CNC manufacturing, enables highly accurate material takeoffs and optimization algorithms that determine the most efficient cutting patterns, drastically reducing scrap material generated during the fabrication of custom-length joists.

Why is moisture resistance a key concern for joist performance?

Moisture exposure can lead to warping, weakening of adhesives, and fungal growth in wood-based joists. Manufacturers address this through use of moisture-resistant treatments and high-performance, water-resistant adhesives to ensure long-term structural integrity and prevent callbacks.

What is the primary difference between parallel chord trusses and pitched trusses?

Parallel chord trusses have parallel top and bottom chords, making them suitable for flat floors and roofs where maximum headroom is desired. Pitched trusses have sloping top chords, specifically designed to support angled roof structures and manage drainage or snow loads.

How are government affordable housing policies influencing the market?

Affordable housing initiatives increase the volume of multi-family dwelling construction. These projects typically rely on cost-effective, standardized engineered joist systems that allow for rapid, repetitive construction while meeting basic structural and safety requirements efficiently.

What is Laminated Veneer Lumber (LVL) and how is it used in joists?

LVL is an engineered wood product made by bonding multiple layers of thin wood veneers with adhesives under heat and pressure. It is primarily used for the flanges (top and bottom chords) of I-joists due to its exceptionally high strength, predictability, and stability.

Why is the supply of qualified structural timber essential for market growth?

The consistent supply of high-quality, certified structural timber (sawn lumber, veneers) is the foundational requirement for engineered joist manufacturing. Supply chain resilience and sustainability certifications ensure manufacturers can meet growing global demand without compromising product quality or environmental mandates.

What is the significance of the structural capacity of a floor system?

Structural capacity refers to the joist system’s ability to support both dead loads (weight of the structure itself) and live loads (occupants, furniture, snow). Accurate calculation and material selection are crucial to prevent deflection, vibration, and catastrophic structural failure.

How does the repair and renovation segment contribute to market stability?

The repair and renovation segment provides a stabilizing demand source, particularly during slowdowns in new construction. It requires replacement joists that match or exceed the structural performance of older systems, often utilizing modern engineered products for enhanced durability.

What technological barriers might slow down the adoption of AI in joist design?

Technological barriers include the high initial investment required for advanced AI platforms, the need for standardized, high-quality input data (BIM models), and overcoming resistance from traditional engineering practices that rely heavily on established manual calculation methods.

Why is the ability to accommodate mechanical routing important for modern joist systems?

Modern buildings require extensive mechanical and utility systems. Joist systems like open web trusses are designed specifically to allow ducts, pipes, and wiring to pass through the structure easily, saving time and costs associated with drilling or complicated ceiling assemblies.

What is the difference in load bearing between floor and roof joists?

Floor joists are typically designed for higher uniform live loads and require greater stiffness to minimize vibration and deflection. Roof joists/rafters are primarily designed to handle dynamic loads like snow, wind uplift, and the weight of the roofing material, often optimized for sloped configurations.

How does the market address global concerns regarding deforestation and resource management?

The market increasingly addresses these concerns by relying on wood sourced from sustainably managed forests, verified by certifications (FSC, PEFC), and by maximizing resource efficiency through the use of engineered wood products, which utilize timber more effectively than solid sawn lumber.

Why are specialized connection details important in mass timber construction?

Mass timber systems require highly specialized, often concealed, metal connectors to efficiently transfer massive structural loads between heavy components like Glulam joists and CLT panels, ensuring seismic and fire resistance meet rigorous standards.

What competitive advantage do companies gain through vertical integration in this market?

Vertical integration allows companies to control the entire process from timber harvesting (upstream) to engineered product manufacturing (midstream), securing raw material supply, controlling costs, and ensuring consistent quality, leading to better price stability and market responsiveness.

How significant is the impact of rising energy efficiency standards on joist demand?

Rising standards demand better thermal envelopes. Joists systems, especially deep I-joists and trusses, allow for thicker layers of insulation, minimizing thermal bridging and improving the overall energy performance of the building structure, thereby driving their selection over less efficient solid components.

What key factors influence an end-user's choice between wood and steel joists?

The decision depends on factors such as required span length, structural load magnitude, project budget, fire rating requirements (steel is non-combustible), and the builder's preference for material handling and construction methods (steel requires welding/bolting; wood requires nailing/fastening).

In which material segment are technical innovations currently most active?

Technical innovations are most active in the engineered wood segment, focusing on new adhesive formulations, fire-retardant treatments, and hybrid composite wood products designed to push the boundaries of strength, sustainability, and spanning capabilities.

What challenges do manufacturers face regarding international regulatory compliance?

Manufacturers must navigate disparate international building codes, structural design standards (e.g., Eurocodes vs. North American standards), and varying product certification processes, requiring costly re-engineering and testing for global market entry.

How do open web trusses maximize floor-to-floor height in multi-story construction?

By integrating necessary mechanical systems within the depth of the truss itself, open web designs eliminate the need for dropped ceilings or excessive voids, effectively maximizing the usable ceiling height or reducing the overall floor-to-floor dimension of the structure.

What impact does digital fabrication have on customization capabilities?

Digital fabrication (CNC) enables high-precision, rapid customization of joist lengths, hole placements, and connection details based directly on digital models, allowing manufacturers to efficiently fulfill unique architectural specifications for non-standard construction projects.

What key market trend is expected to dominate demand for roof joists by 2033?

The dominance of prefabricated, custom-designed roof trusses is expected to increase significantly, driven by the demand for complex, architecturally challenging rooflines and the necessity for rapid, reliable on-site installation to meet tight construction deadlines.

How does the adoption of new composite materials enhance joist longevity?

Composite materials often provide superior resistance to moisture, pests, and rot compared to conventional wood, significantly extending the service life of the joists and reducing the requirement for costly maintenance or premature replacement in demanding environments.

What are the key drivers for utilizing Glulam beams in construction?

Glulam (Glued Laminated Timber) is favored for its aesthetic appeal, high fire resistance (charring protects the core), and ability to span extremely long distances while offering superior strength and dimensional consistency compared to large-section solid timber beams.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager