Floor Polisher Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432799 | Date : Dec, 2025 | Pages : 248 | Region : Global | Publisher : MRU

Floor Polisher Market Size

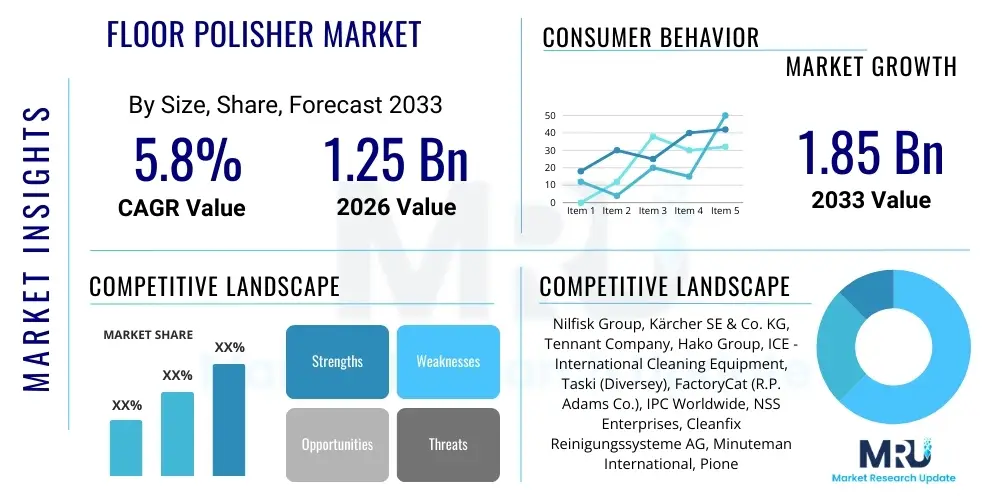

The Floor Polisher Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This consistent expansion is primarily fueled by the accelerating global demand for professional cleaning and facility maintenance services across commercial, industrial, and institutional sectors. The increasing awareness regarding hygiene standards, especially in healthcare and retail environments, mandates the frequent and effective maintenance of various floor types, directly contributing to the heightened adoption of efficient and specialized floor polishing equipment.

Floor Polisher Market introduction

The Floor Polisher Market encompasses a wide range of specialized cleaning equipment designed for scrubbing, buffing, burnishing, and polishing hard flooring surfaces such as concrete, marble, wood, terrazzo, and vinyl. These devices are crucial for maintaining aesthetic appeal, extending the lifespan of flooring materials, and ensuring compliance with stringent hygiene standards, particularly in high-traffic commercial and industrial settings. The product landscape includes various formats such as walk-behind machines, ride-on units, and increasingly, autonomous robotic polishers, categorized typically by operational speed (low, high, or ultra-high speed) and power source (corded or battery-operated).

Major applications of floor polishers span across key vertical markets including hospitality (hotels, resorts), healthcare (hospitals, clinics), retail (supermarkets, malls), institutional buildings (schools, government offices), and industrial facilities (warehouses, manufacturing plants). The essential benefit derived from using advanced floor polishing machinery lies in achieving superior cleaning results and a high-gloss finish with significantly reduced labor hours compared to manual methods. This efficiency gain is a primary driver, alongside the growing trend of outsourcing facility management services, which encourages investment in high-performance, durable cleaning technology designed for professional use.

Driving factors supporting market growth include rapid urbanization and infrastructure development globally, leading to an increase in commercial floor space requiring continuous maintenance. Furthermore, technological advancements, such as the integration of lithium-ion batteries for extended run times and the incorporation of sensors and telemetry for optimized usage tracking, are improving operational efficiency and reducing total cost of ownership (TCO). The necessity for creating sterile environments, particularly post-pandemic, has also heightened the reliance on professional-grade polishers capable of effective deep cleaning and sanitization processes, reinforcing their indispensable role in modern facility upkeep strategies.

Floor Polisher Market Executive Summary

The Floor Polisher Market is undergoing a significant transformation driven by pronounced shifts in business trends, regional development patterns, and technological segmentation. Key business trends indicate a strong move towards automation and sustainability. Manufacturers are heavily investing in developing autonomous floor polishers and scrubbers to address escalating labor costs and shortages in professional cleaning staff. Furthermore, there is a distinct emphasis on eco-friendly cleaning solutions, requiring polishers to utilize less water, consume less energy, and employ sustainable consumables (pads and chemicals), aligning with corporate social responsibility goals and regulatory pressures across developed economies.

Regionally, the market dynamics are characterized by mature markets in North America and Europe focusing on replacement cycles and premium, high-efficiency equipment, particularly advanced battery-powered ride-on and robotic systems. Conversely, the Asia Pacific (APAC) region, driven by massive investments in new commercial infrastructure, retail expansion, and hospitality sectors, exhibits the fastest growth trajectory. While APAC still sees substantial demand for cost-effective, basic walk-behind models, the increasing penetration of international facility management companies is pushing the adoption of sophisticated, automated machinery in metropolitan areas, creating a dual-market structure.

Segment-wise, the robotic floor polisher segment is experiencing explosive growth, although it currently holds a smaller market share compared to traditional walk-behind and ride-on machines. Within the application segment, the healthcare and retail sectors remain paramount due to their high demand for stringent cleanliness and polished appearances that impact customer perception and regulatory compliance. Trends also show a preference for modular and multi-functional machines that can perform scrubbing, stripping, and polishing with minimal changeover time, thus maximizing operational utility and justifying higher capital expenditure for end-users, especially large contract cleaning organizations.

AI Impact Analysis on Floor Polisher Market

Common user questions regarding AI's impact on the Floor Polisher Market typically center on how artificial intelligence and machine learning (ML) contribute to operational efficiency, reduction of human intervention, and predictive maintenance schedules. Users frequently ask about the economic viability of autonomous cleaning fleets, the reliability of AI-driven navigation systems in complex, dynamic environments (like crowded retail spaces), and the security implications of integrated IoT platforms collecting operational data. Furthermore, there is strong interest in whether AI can optimize energy consumption based on floor type and dirt accumulation, ensuring the machine applies the minimum necessary effort for maximum results. These inquiries highlight user expectations for smarter, more self-sufficient, and cost-effective cleaning solutions.

The integration of AI algorithms fundamentally transforms floor polishing from a manual task to a data-driven service. AI enables polishers to learn and adapt to facility layouts, automatically identifying high-traffic zones that require more intensive cleaning versus low-traffic areas. This optimization ensures uniform quality and significantly reduces resource consumption (battery life, water, and consumables). Machine learning models process real-time sensor data—including LIDAR, cameras, and ultrasonic sensors—to enhance navigation, obstacle avoidance, and path planning, allowing autonomous polishers to operate safely and effectively alongside human personnel, making them reliable substitutes for manual labor during off-peak hours.

Moreover, AI is pivotal in predictive maintenance. By analyzing operational parameters such as motor load, brush wear rates, battery cycle degradation, and error patterns, AI systems can accurately predict potential failures before they occur. This transition from reactive to proactive servicing minimizes equipment downtime, significantly reducing maintenance costs and ensuring maximum equipment availability, which is particularly critical for contract cleaning companies managing large fleets across multiple client sites. Ultimately, AI integration is elevating floor polishers from simple mechanical devices to sophisticated, connected endpoints within broader smart building management systems.

- AI-driven autonomous navigation systems enhance operational safety and efficiency.

- Machine learning optimizes cleaning routes, minimizing overlap and maximizing coverage.

- Predictive maintenance algorithms reduce unexpected breakdowns and extend machine lifespan.

- Real-time data analytics allow optimization of resource use (power, water, chemical dosage).

- Integration with IoT platforms facilitates fleet management and operational reporting.

- Automated surface recognition adjusts polishing intensity based on floor material and soil level.

DRO & Impact Forces Of Floor Polisher Market

The dynamics of the Floor Polisher Market are shaped by a complex interplay of Drivers, Restraints, and Opportunities (DRO), alongside external competitive Impact Forces. Key drivers include the stringent health and safety regulations mandating pristine facilities, especially in regulated environments like food processing and healthcare, coupled with the global growth in the facility management sector which prefers mechanized solutions for scale. Technological innovations, particularly in battery technology (extended run times) and automation (robotic polishers), further propel market adoption by lowering operational dependency on manual labor and improving overall cleaning quality. These factors collectively create a robust foundational demand for high-performance equipment.

However, the market faces significant restraints, primarily revolving around the high initial capital investment required for professional-grade, large-scale machines, particularly sophisticated ride-on and robotic units. This high entry cost can be prohibitive for smaller cleaning service providers or individual facility owners, leading them to opt for less efficient, less durable alternatives or rental options. Furthermore, the operational complexity associated with advanced machines, requiring specialized training for maintenance and operation, acts as a barrier to widespread adoption in regions with less skilled labor pools. The need for specialized consumables, such as specific polishing pads and chemicals for different floor types, also adds to the recurring operational expenses, sometimes overshadowing the labor savings.

Opportunities for growth are vast, particularly in emerging economies where infrastructure development is accelerating, creating a massive influx of new commercial and retail spaces requiring professional floor maintenance. The increasing adoption of the 'equipment-as-a-service' (EaaS) or rental model presents a substantial opportunity, mitigating the high upfront cost restraint for end-users and allowing manufacturers to secure recurring revenue streams. The rising focus on IoT and connectivity enables manufacturers to offer advanced telematics and remote diagnostics, improving customer service and opening new avenues for data monetization. Impact Forces, such as the high bargaining power of large contract cleaning organizations (who demand customized pricing and fleet discounts) and the moderate threat of substitution (due to highly specialized flooring materials requiring minimal polishing), continually influence pricing strategies and innovation cycles within the industry.

Segmentation Analysis

The Floor Polisher Market is systematically segmented based on product type, operation mode, power source, and end-use application, allowing for a granular understanding of consumer preference and market maturity across different regions. This structured segmentation helps manufacturers tailor their product development strategies and marketing efforts towards high-growth niches. Analyzing these segments reveals that while traditional single-disc, low-speed polishers remain popular for smaller areas and routine tasks due to their lower cost, the most significant growth is projected in the high-speed and ultra-high-speed burnishers, which cater to large facilities demanding a superior, reflective finish, particularly in the hospitality and high-end retail sectors.

The operational mode segmentation, encompassing walk-behind, ride-on, and robotic units, clearly demonstrates a market shift towards maximizing automation and coverage area. Ride-on machines, though requiring higher capital, offer substantial efficiency gains in expansive spaces like airports and convention centers. The rapid advancement and commercial viability of robotic polishers, incorporating AI and advanced sensor technology, signal the future of the industry, particularly as regulatory environments tighten around labor hours and safety. These autonomous units offer the highest return on investment in environments operating 24/7 or those where operations can be conducted safely without supervision.

From an end-use perspective, the Contract Cleaning Companies (CCCs) segment dominates the market due to their requirement for diverse fleets of highly durable, efficient equipment capable of handling numerous environments under strict service level agreements (SLAs). However, the direct institutional user segment, particularly healthcare and education, is showing accelerated adoption, driven by the specific need for machines that guarantee hygienic cleanliness (often paired with integrated scrubber technology) and quiet operation. Understanding these distinct segment needs is paramount; for instance, healthcare demands quiet, battery-powered systems, whereas industrial settings prioritize ruggedness and torque for heavy-duty floor restoration.

- By Product Type:

- Single Disc/Rotary Polishers

- High Speed Burnishers (1000–1500 RPM)

- Ultra-High Speed Burnishers (Over 1500 RPM)

- Floor Scrubbers (often integrated with polishing capabilities)

- By Operation Mode:

- Walk-Behind/Push Models

- Ride-On Models

- Autonomous/Robotic Models

- By Power Source:

- Corded Electric

- Battery Powered (Lithium-ion dominant)

- Propane/Gas (less common due to ventilation requirements)

- By Application/End-Use:

- Commercial (Offices, Retail, Malls)

- Industrial (Warehouses, Manufacturing)

- Institutional (Hospitals, Schools, Government)

- Hospitality (Hotels, Restaurants)

Value Chain Analysis For Floor Polisher Market

The value chain of the Floor Polisher Market initiates with upstream activities encompassing the sourcing of critical components and raw materials. Key inputs include high-performance electric motors (often brushless DC motors for battery models), specialized plastics and durable metals for housing, advanced battery packs (primarily Lithium-ion), and specialized consumable components like polishing pads (microfiber, natural fiber, or diamond-impregnated). Success at this stage relies heavily on forging stable relationships with specialized component suppliers, especially for proprietary technologies like ultra-high-speed motor assemblies and smart sensor arrays required for robotic systems. The manufacturing stage focuses on precision engineering, assembly, quality control, and testing, often involving complex integration of software and hardware for autonomous models.

The downstream segment of the value chain is dominated by distribution, sales, and post-sale services. Distribution channels are generally categorized as direct sales (used for large contracts with major facility management firms or government tenders) and indirect sales, which involve a network of specialized dealers, distributors, and increasingly, equipment rental companies. Rental fleets play a crucial role as they allow end-users to access expensive equipment without the full capital outlay, providing manufacturers with predictable recurring revenue through maintenance contracts and consumables sales. The strength of the distribution network, particularly the availability of local parts and certified service technicians, significantly influences customer satisfaction and brand loyalty.

Direct sales channels are preferred when servicing major international Contract Cleaning Companies (CCCs) that require customized fleet solutions, bulk pricing, and integration with their existing operational software. Indirect channels, through specialized industrial and janitorial supply distributors, cater to smaller businesses and regional clients, offering convenience and localized support. Effective management of the distribution channel, ensuring proper training on complex machine operation and rapid response for repairs, is critical to maintaining high equipment uptime, which is a core metric for end-users. The continuous feedback loop from downstream users back to R&D, regarding machine ergonomics, durability, and technological needs, ensures the continuous evolution and relevance of the product portfolio.

Floor Polisher Market Potential Customers

The Floor Polisher Market's potential customers are broadly segmented into professional entities responsible for maintaining large-scale, hard-surface flooring across various industries. The primary and most influential customer group comprises Contract Cleaning Companies (CCCs), which operate on narrow margins and high volume, making operational efficiency and equipment reliability paramount purchasing criteria. These companies often seek fleet pricing, modular equipment that can be used across diverse client sites, and telematics integration for centralized fleet management and performance tracking. Their demand drives innovation toward robustness, versatility, and low total cost of ownership (TCO).

A second major customer segment includes institutional and in-house facility managers, particularly those in the healthcare and education sectors. Healthcare facilities, driven by infection control mandates and the need for 24/7 operation, are strict buyers, favoring quiet, battery-powered machines that minimize disruption while delivering clinically hygienic standards. Educational institutions, managing large, durable floor spaces (gymnasiums, hallways), prioritize rugged, user-friendly equipment that can withstand rough usage and be operated by custodial staff, often balancing budgetary constraints with functional necessity. Their purchasing decisions are highly influenced by regulatory compliance and durability, seeking extended warranties and readily available local service.

Furthermore, the hospitality and retail sectors represent high-value potential customers. High-end hotels and luxury retail outlets place a premium on maintaining a flawless, high-gloss floor aesthetic, making ultra-high-speed burnishers essential tools. Their buying decisions are less price-sensitive and more focused on the quality of finish, noise reduction, and brand image. Industrial facilities, such as large distribution centers and manufacturing plants, form another distinct group, requiring heavy-duty scrubber-polisher combinations capable of removing industrial residue and accommodating vast floor areas, making large ride-on units the favored choice for achieving necessary coverage within tight operational windows.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Nilfisk Group, Kärcher SE & Co. KG, Tennant Company, Hako Group, ICE - International Cleaning Equipment, Taski (Diversey), FactoryCat (R.P. Adams Co.), IPC Worldwide, NSS Enterprises, Cleanfix Reinigungssysteme AG, Minuteman International, Pioneer Eclipse, Tornado Industries, Tomcat, Betco Corporation, Pacific Floorcare, Amano Corporation, Fimap S.p.A., Columbus GmbH, Powerboss. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floor Polisher Market Key Technology Landscape

The Floor Polisher Market is defined by continuous technological innovation aimed at enhancing autonomy, sustainability, and operational efficiency. A critical technology driving modern polishers is the advancement in battery power, specifically the widespread adoption of lithium-ion batteries. These batteries offer significantly longer run times, faster charging cycles, and lower overall weight compared to traditional lead-acid batteries, enabling the development of larger, more powerful ride-on and robotic units that can complete extensive cleaning tasks without interruption for recharging. Furthermore, brushless DC motors are becoming standard, providing higher efficiency, requiring less maintenance, and contributing to reduced noise levels, a necessity for operation in noise-sensitive environments like hospitals and daytime offices.

Another major technological focal point is the integration of advanced sensor technology and telematics. Modern floor polishers are equipped with sophisticated sensor suites (LIDAR, vision systems, ultrasonic sensors) essential for safe and precise navigation in autonomous models. Telematics systems allow fleet managers to monitor machine usage, location, battery status, and maintenance needs remotely. This Internet of Things (IoT) capability enables predictive maintenance, optimizes route planning based on usage data, and ensures compliance tracking for cleaning schedules, significantly enhancing the value proposition for large Contract Cleaning Companies. Data collected through these systems informs ongoing software updates and improvements, making the machines continuously smarter over their operational lifespan.

Moreover, substantial innovation is occurring in consumables and finishing technologies. The introduction of proprietary polishing pads—such as specialized diamond or ceramic impregnated pads—allows for mechanical polishing and restoration of surfaces using only water, significantly reducing reliance on chemicals and improving environmental sustainability. High-speed and ultra-high-speed burnishing technology continues to evolve, incorporating better pad pressure controls and dust collection systems to achieve superior gloss levels while minimizing airborne particulates. These combined technological advances ensure that the newest generation of floor polishers offers unmatched performance, sustainability, and data-driven management capabilities compared to previous generations.

Regional Highlights

Geographical analysis reveals distinct market maturity levels and growth drivers across major global regions. North America and Europe currently represent the largest revenue share segments, characterized by high labor costs and stringent regulatory standards for workplace hygiene and noise pollution. These regions are early adopters of premium, high-automation solutions, including ride-on and robotic polishers. Market growth here is primarily driven by replacement demand, the integration of advanced telematics, and a focus on reducing the total cost of ownership (TCO) through efficiency gains. The preference for battery-powered, quieter machines is strong, particularly in dense urban areas and commercial facilities where noise disruption must be minimized.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) throughout the forecast period. This rapid expansion is a direct consequence of massive urbanization, booming construction of commercial complexes, retail infrastructure, and increasing foreign investment in logistics and industrial hubs. While price sensitivity remains higher in many APAC countries, the escalating demand for international-standard facility maintenance services, particularly in countries like China, India, and Southeast Asian nations, is rapidly driving the adoption of mid-range to advanced equipment. Manufacturers are strategically partnering with local distributors to penetrate these emerging markets, offering a mix of cost-effective walk-behind models and specialized high-performance machines for premium venues.

Latin America (LATAM) and the Middle East & Africa (MEA) are also emerging as significant growth territories. LATAM’s growth is spurred by increasing commercial real estate development and improved economic conditions stabilizing investment in modern equipment. In MEA, particularly the Gulf Cooperation Council (GCC) countries, large-scale infrastructure projects (e.g., hospitality, leisure complexes, and airports) necessitate heavy-duty, reliable floor polishing equipment capable of handling large areas. The operational climate in the Middle East often favors ride-on machines due to the immense scale of facilities, with an increasing interest in robust, battery-powered systems that can handle high heat environments efficiently. These regions offer substantial opportunity for specialized industrial equipment providers and rental services.

- North America: Leads in revenue, characterized by high adoption of robotic and advanced battery-powered systems due to high labor costs and focus on efficiency.

- Europe: Strong regulatory environment mandates quiet operation and sustainability; high demand for multi-functional scrubber-polisher hybrids and telematics.

- Asia Pacific (APAC): Fastest growing market, driven by new commercial construction and urbanization; mixed demand for cost-effective models and premium automated solutions.

- Latin America (LATAM): Growth driven by expanding retail and commercial sectors; increasing demand for durable, mid-range machines.

- Middle East and Africa (MEA): High demand linked to massive infrastructure and hospitality projects; strong preference for large ride-on polishers.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floor Polisher Market.- Nilfisk Group

- Kärcher SE & Co. KG

- Tennant Company

- Hako Group

- ICE - International Cleaning Equipment

- Taski (Diversey)

- FactoryCat (R.P. Adams Co.)

- IPC Worldwide

- NSS Enterprises

- Cleanfix Reinigungssysteme AG

- Minuteman International

- Pioneer Eclipse

- Tornado Industries

- Tomcat

- Betco Corporation

- Pacific Floorcare

- Amano Corporation

- Fimap S.p.A.

- Columbus GmbH

- Powerboss

Frequently Asked Questions

Analyze common user questions about the Floor Polisher market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the adoption of robotic floor polishers?

The primary factor driving robotic polisher adoption is the rising cost and scarcity of manual cleaning labor globally. Autonomous machines offer predictable operational costs, consistent cleaning quality, and the ability to operate safely during off-hours, significantly increasing efficiency and reducing dependence on human resources, resulting in a favorable return on investment (ROI).

How do battery technology advancements impact the commercial floor polisher market?

Advancements, particularly in Lithium-ion battery technology, have substantially increased machine run times and reduced charge times. This eliminates the constraint of power cords, enhances operational flexibility, and enables larger, ride-on, and robotic units to cover vast commercial and industrial areas without midday downtime for frequent recharging, thus boosting productivity.

Which end-use application segment demonstrates the highest growth potential for floor polishers?

The healthcare and hospitality segments exhibit high growth potential due to increasingly strict hygiene regulations and the critical need to maintain flawless aesthetics for brand perception. These sectors demand specialized polishers that are quiet, efficient, and capable of integrating with deep cleaning and sanitization protocols.

What are the key differences between high-speed and ultra-high-speed burnishers?

High-speed burnishers typically operate between 1,000 to 1,500 revolutions per minute (RPM), providing a good level of gloss and finish. Ultra-high-speed burnishers operate above 1,500 RPM, achieving a superior, mirror-like "wet look" finish, and are primarily used in high-end retail, hospitality, and areas where visual appeal is a critical requirement.

What role does the 'Equipment-as-a-Service' (EaaS) model play in market accessibility?

The EaaS model, involving equipment rental and leasing, significantly lowers the high initial capital expenditure (CapEx) barrier for potential customers, especially smaller businesses and regional contract cleaners. This model converts CapEx into manageable operating expenses (OpEx), making advanced, expensive machinery accessible and ensuring predictable maintenance and service support from the provider.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Floor Polisher Market Statistics 2025 Analysis By Application (Home, Industry and Commercial), By Type (Concrete Floor Polisher, Stone Floor Polisher, Wood Floor Polisher, Other), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Floor Polisher Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Concrete Floor Polisher, Stone Floor Polisher, Wood Floor Polisher, Other), By Application (Home, Industry and Commercial), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager