Floor Saw Cutting Equipment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435668 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Floor Saw Cutting Equipment Market Size

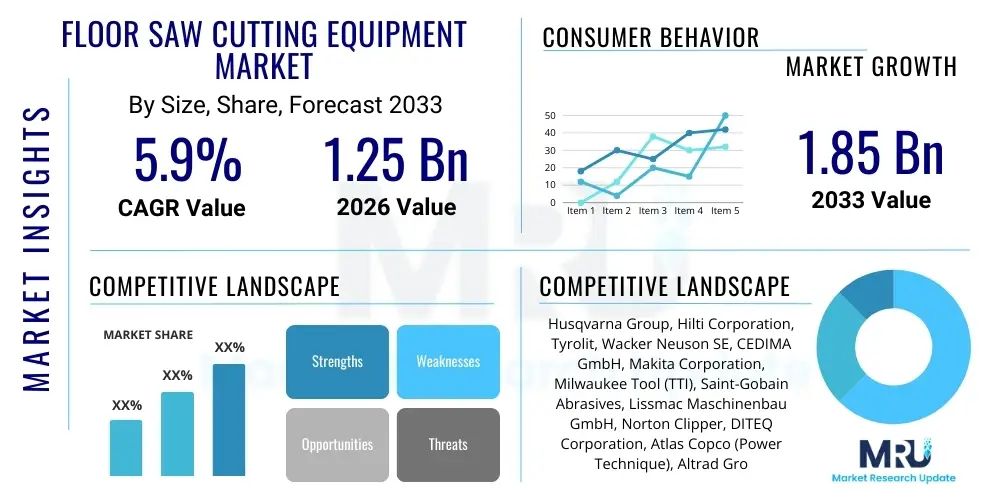

The Floor Saw Cutting Equipment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.85% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033. This steady growth is primarily attributed to rapid urbanization projects, extensive government investments in infrastructure rehabilitation, and the increasing global focus on non-destructive methods for precision concrete cutting in commercial and residential construction sectors. The high efficiency and durability of modern floor saw equipment, coupled with advancements in blade technology, further solidify this growth trajectory.

Floor Saw Cutting Equipment Market introduction

The Floor Saw Cutting Equipment Market encompasses specialized machinery designed for precision cutting of horizontal surfaces such as concrete, asphalt, reinforced concrete slabs, and paving stones. These heavy-duty machines utilize rotating diamond-tipped blades to execute deep and straight cuts, crucial for road construction, runway repair, industrial flooring installation, and complex demolition activities. Floor saws, also known as road saws or flat saws, are categorized based on their power source (hydraulic, electric, or gasoline/diesel) and operational capacity, catering to diverse cutting depths and material hardness requirements across various construction environments globally.

Major applications for floor saw cutting equipment span across infrastructure development, utility trenching, bridge deck rehabilitation, and general building refurbishment. The versatility of the equipment allows for controlled structural modification and expansion joint creation, significantly reducing the downtime associated with conventional demolition methods. Furthermore, the enhanced safety features, including dust suppression systems and remote-control options available in high-end models, contribute to their increasing adoption in densely populated urban construction sites where environmental compliance and worker safety are paramount.

Driving factors for this market include the global surge in large-scale public infrastructure projects, particularly in emerging economies, alongside stringent regulatory requirements demanding structural integrity and precision in construction outputs. The continuous innovation focused on developing lighter, more powerful, and environmentally friendly equipment, such as zero-emission electric floor saws, provides substantial benefits to contractors seeking operational efficiency and compliance with evolving global sustainability mandates.

Floor Saw Cutting Equipment Market Executive Summary

The global Floor Saw Cutting Equipment Market is characterized by robust business trends centered on technological integration, primarily involving telematics and automation to enhance operational productivity and safety. Key market players are prioritizing the development of modular and multifunctional equipment capable of handling a variety of materials and cutting tasks, thereby offering greater value proposition to end-users. A significant trend involves the transition toward battery-powered and electric floor saws, driven by global environmental policies aimed at reducing carbon emissions and noise pollution on construction sites, particularly within established markets like Western Europe and North America.

Regionally, the Asia Pacific (APAC) stands out as the primary growth engine, fueled by massive infrastructural investments in countries like China, India, and Southeast Asian nations focused on expanding road networks, high-speed rail, and commercial real estate. North America and Europe, while mature markets, show high demand for replacement cycles, advanced remote-controlled systems, and equipment conforming to stringent worker health and safety standards, driving the premium segment. Latin America and MEA are experiencing gradual market penetration driven by large-scale mining and oil & gas infrastructure projects.

Segmentation trends indicate hydraulic floor saws maintaining a strong market share due to their superior power output and reliability in heavy-duty applications, while electric saws are gaining traction rapidly in indoor and controlled environment projects where ventilation is restricted. Furthermore, the market segment dedicated to specialized diamond blades and consumable accessories shows consistent growth, reflecting the recurring operational necessity for high-quality, application-specific cutting tools to maintain equipment performance.

AI Impact Analysis on Floor Saw Cutting Equipment Market

User inquiries regarding the impact of Artificial Intelligence (AI) and Machine Learning (ML) on the floor saw market predominantly center on maximizing operational efficiency, enabling predictive maintenance, and establishing automated safety protocols. Users are keen to understand how AI can optimize cutting parameters (like feed rate, blade speed, and cooling agent dosage) in real-time based on material composition analyzed through integrated sensors. Furthermore, there is significant interest in using AI algorithms to analyze historical performance and failure data to forecast equipment lifespan and schedule maintenance proactively, thereby minimizing costly unplanned downtime on construction sites.

The core expectation from AI integration is the realization of truly autonomous or highly assisted floor sawing operations. Contractors seek AI systems that can interpret 3D scanning data or Building Information Modeling (BIM) inputs to define precise cutting paths, adjust automatically to unexpected obstacles beneath the surface (e.g., utility lines identified by ground-penetrating radar), and ensure cuts adhere exactly to design specifications without continuous manual intervention. This transition promises to enhance precision, reduce material waste, and significantly lower labor requirements and associated human error risks, fundamentally changing how large-scale concrete demolition and renovation is executed.

Consequently, AI integration is moving the floor saw market toward intelligent machinery capable of self-diagnosis and operational optimization. While fully autonomous heavy machinery remains complex due to the variability of cutting environments, AI-powered predictive analytics, anomaly detection in machine performance (vibration analysis, temperature monitoring), and adaptive process control are already emerging as critical differentiators. These enhancements focus on making the equipment safer, more reliable, and capable of higher throughput, especially in projects demanding extreme accuracy and continuous operation over extended periods.

- AI-driven Predictive Maintenance: Forecasting component failure using sensor data (vibration, heat) to optimize maintenance scheduling and prevent costly operational halts.

- Real-time Cutting Parameter Optimization: AI algorithms adjusting blade speed and feed rate based on material density detected by integrated sensors, maximizing blade life and cutting efficiency.

- Autonomous Navigation and Path Planning: Utilizing ML to interpret BIM data and Lidar/GPS inputs for precise, automated cutting paths, reducing manual oversight and increasing dimensional accuracy.

- Enhanced Safety Protocols: AI analyzing operator behavior and environmental conditions to automatically stop or adjust equipment operation in hazardous situations.

- Data-driven Inventory Management: Using historical usage patterns (e.g., blade wear) analyzed by AI to optimize inventory levels for consumables and spare parts across a fleet.

DRO & Impact Forces Of Floor Saw Cutting Equipment Market

The market dynamics for floor saw cutting equipment are heavily influenced by a delicate balance of strong macroeconomic drivers, operational restraints, and substantial technological opportunities, creating specific impact forces that shape investment and adoption patterns. The primary driver is the global commitment to massive infrastructure spending, particularly in transportation networks (roads, rail, airports) and energy utilities, which necessitates high volumes of precision concrete and asphalt cutting. These large-scale projects provide sustained demand for powerful, reliable equipment, ensuring market buoyancy across all geographic regions experiencing economic expansion.

Conversely, the market faces significant restraints, including the high initial capital investment required for advanced, remote-controlled, or hydraulic floor saws, making adoption challenging for smaller contracting firms, particularly in developing markets. Furthermore, stringent regulations surrounding noise pollution and silica dust exposure, while promoting the adoption of cleaner technologies, increase the complexity and cost of compliance for manufacturers and end-users alike. The availability and cost of skilled labor capable of operating and maintaining specialized cutting equipment also act as a constraint, particularly when utilizing sophisticated digital models and integrated sensing technology.

Opportunities for market growth are vast, notably driven by the integration of IoT (Internet of Things) and telematics into equipment, allowing for remote monitoring, performance tracking, and enhanced diagnostics. The rising demand for automated and remote-controlled saws in hazardous environments (like nuclear decommissioning or chemical plant maintenance) presents a lucrative niche. Furthermore, advancements in diamond blade materials and bonding agents that significantly increase blade lifespan and cutting speed offer manufacturers a competitive edge, simultaneously improving the overall operational cost-effectiveness for contractors.

Segmentation Analysis

The Floor Saw Cutting Equipment Market is segmented based on the power source, application, type of cutting mechanism, and operational capacity. This segmentation allows manufacturers to tailor equipment specifications to specific operational requirements, ranging from small, handheld electric models used in residential renovation to large, self-propelled, diesel-powered saws utilized in heavy highway construction and airport runway refurbishment. Understanding these segments is critical for forecasting demand shifts, especially as environmental regulations push the industry toward electric and hybrid models for sensitive applications.

Segmentation by power source is perhaps the most defining characteristic, dividing the market into gasoline/diesel, electric (both corded and battery-powered), and hydraulic systems. Gasoline/diesel saws dominate large outdoor projects due to their high power output and mobility, but electric saws are rapidly capturing the market share in indoor demolition, utility trenching, and areas where exhaust fumes are prohibited. The application segmentation highlights the dominant role of infrastructure development and road repair sectors, which consistently account for the largest revenue share, followed by building demolition and general construction activities requiring expansion joints or controlled openings.

- By Power Source:

- Gasoline/Diesel Floor Saws

- Electric Floor Saws (Corded and Battery)

- Hydraulic Floor Saws

- By Operation Mode:

- Walk-Behind Saws

- Self-Propelled Saws (Ride-On)

- Remote-Controlled Saws

- By Application:

- Road and Highway Construction & Repair

- Airport Runway and Bridge Deck Repair

- Utility Trenching and Underground Works

- Building Demolition and Renovation

- Industrial Flooring and Slabs

- By Cutting Depth:

- Low Depth (Up to 150mm)

- Medium Depth (150mm - 350mm)

- High Depth (Over 350mm)

Value Chain Analysis For Floor Saw Cutting Equipment Market

The value chain for the Floor Saw Cutting Equipment Market begins with upstream activities focusing on the sourcing and processing of raw materials, primarily specialized steels, engines (diesel/gasoline/electric motors), and critical components for hydraulic systems. The procurement of high-grade diamond segments and metal powders for blade manufacturing is a crucial and often specialized aspect of the upstream supply chain, as blade performance dictates the overall efficacy of the cutting equipment. Suppliers in this phase are essential partners, and their quality control directly impacts the reliability and longevity of the final product, necessitating strong vertical integration or specialized partnership agreements among OEMs.

Midstream activities involve the design, manufacturing, and assembly of the floor saw units. Leading manufacturers invest heavily in R&D to incorporate ergonomic design, advanced engine technology (meeting Euro V/Tier 4 standards), and specialized frame fabrication for vibration dampening and increased durability. Quality assurance and rigorous testing are paramount during this phase, ensuring that the heavy machinery can withstand the harsh operational environments typical of construction sites. Efficiency in manufacturing and economies of scale are key competitive advantages for global OEMs in optimizing production costs.

Downstream elements focus on distribution, sales, and aftermarket services. Distribution channels are predominantly indirect, relying on a network of specialized construction equipment dealers, rental companies, and regional distributors who provide local sales support, financing options, and technical expertise. Direct sales are often reserved for large governmental or multi-national infrastructure contracts. The aftermarket segment, which includes spare parts, consumables (primarily diamond blades), and maintenance services, represents a substantial and stable revenue stream, demanding robust logistics and service engineer availability to ensure minimal customer downtime.

Floor Saw Cutting Equipment Market Potential Customers

The primary consumers of floor saw cutting equipment are professional entities engaged in large-scale civil engineering, infrastructure maintenance, and specialized demolition services. These potential customers prioritize equipment reliability, cutting precision, operational efficiency, and adherence to regional safety and environmental standards. Their purchasing decisions are often long-term investments, influenced by total cost of ownership (TCO), fuel efficiency, and the availability of responsive local technical support and quality consumables, making equipment rental fleets a critical intermediary market segment.

Key end-user segments include road construction contractors responsible for building and maintaining highways and urban streets, requiring powerful self-propelled saws for asphalt and thick concrete. Specialist utility contractors are also major buyers, using floor saws extensively for precise trenching to install or repair underground cables, pipes, and communication lines in controlled environments. Furthermore, industrial flooring specialists and building renovation companies utilize electric and walk-behind saws for cutting control joints, removing damaged sections of factory floors, and facilitating structural modifications in existing buildings, driving demand for lower noise and exhaust models.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.85% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Husqvarna Group, Hilti Corporation, Tyrolit, Wacker Neuson SE, CEDIMA GmbH, Makita Corporation, Milwaukee Tool (TTI), Saint-Gobain Abrasives, Lissmac Maschinenbau GmbH, Norton Clipper, DITEQ Corporation, Atlas Copco (Power Technique), Altrad Group, Fairport Construction Equipment, Probst GmbH, Dymatec, GSSI, E-Z Cutter Inc., Diamond Products Unlimited, KERN-DEUDIAM Diamantwerkzeuge GmbH. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floor Saw Cutting Equipment Market Key Technology Landscape

The current technology landscape in the Floor Saw Cutting Equipment Market is defined by a significant push toward digitalization, automation, and enhanced material science, moving away from purely mechanical operations. A core focus is on integrating IoT sensors and telematics systems to monitor equipment performance remotely, track operational hours, manage maintenance schedules, and geo-fence assets, dramatically improving fleet management for large contractors. These connectivity features allow for proactive diagnostics, reducing unexpected failures and optimizing equipment utilization across multiple work sites, which is essential for maximizing ROI on expensive heavy machinery.

Another major technological advancement involves the rapid development and commercialization of powerful, battery-electric floor saws. These zero-emission, low-noise machines utilize high-capacity lithium-ion battery packs, providing power comparable to smaller hydraulic systems, making them ideal for urban centers, indoor projects, and environments with strict air quality regulations. This shift is not merely an adaptation to regulations but a strategic move toward offering sustainable solutions, often integrated with fast-charging capabilities and sophisticated battery management systems (BMS) to ensure consistent performance throughout a full work shift.

Furthermore, innovations in cutting technology itself remain crucial. This includes the development of multi-layered diamond segments incorporating new synthetic diamond grades and improved bond matrices tailored for specific aggregate types and cutting speeds. Dust and slurry management systems are also becoming significantly advanced, utilizing high-efficiency vacuum shrouds, integrated water delivery control systems, and filtration units to meet increasingly stringent occupational safety requirements concerning crystalline silica dust exposure, ensuring compliance and improving site cleanliness simultaneously.

Regional Highlights

Regional dynamics significantly influence the demand and technological preference within the Floor Saw Cutting Equipment Market, reflecting differences in infrastructure maturity, construction regulations, and climate challenges. North America is characterized by high replacement cycles for existing machinery and a strong emphasis on automation and remote-control functionality, primarily driven by high labor costs and advanced safety requirements. The market here demands high-performance gasoline and diesel saws for large highway projects, alongside a growing segment for electric and remote-controlled systems for specialized demolition and concrete renovation, ensuring a premium market structure.

Europe represents a mature but highly fragmented market heavily regulated by environmental standards, specifically noise and emissions mandates (e.g., EU Stage V). This regulatory environment has accelerated the adoption of electric and battery-powered floor saws, making the region a global leader in sustainable cutting technology adoption. Germany, the UK, and Nordic countries show particularly strong demand for equipment that integrates advanced dust and slurry control systems, prioritizing worker health and minimizing environmental impact on densely populated areas, often leading to rapid uptake of technologically advanced, albeit expensive, equipment.

The Asia Pacific (APAC) region is the undisputed epicenter of market volume growth due to unprecedented levels of urbanization and infrastructure expansion, especially in India, China, and Southeast Asia. Demand in APAC is broad, encompassing both high-power diesel saws for large-scale road construction and affordable, robust walk-behind models for smaller contractors. While price sensitivity is often higher, there is increasing investment in sophisticated equipment in major urban centers where precision and compliance with emerging environmental standards are becoming mandatory, suggesting a dual-market structure characterized by both high-volume and high-tech segments.

- North America: Focus on automation, fleet management (telematics), and adoption of high-power diesel saws for infrastructure rehabilitation; robust rental market penetration.

- Europe: Driven by stringent environmental and safety regulations; high adoption rate of electric, battery-powered, and low-noise equipment; strong demand for integrated dust suppression technology.

- Asia Pacific (APAC): Leading market in terms of volume growth fueled by massive urbanization and expansion of road, rail, and port infrastructure across developing economies; mixed demand for both basic and advanced machinery.

- Latin America: Moderate growth driven by mining projects and energy infrastructure investment; often relies on imports of used equipment or robust, mid-range machinery prioritizing durability over technological complexity.

- Middle East & Africa (MEA): Growth tied to large-scale construction projects (e.g., Saudi Arabia’s Vision 2030); demand concentrated on heavy-duty, reliable diesel saws capable of operating in high-temperature, harsh environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floor Saw Cutting Equipment Market.- Husqvarna Group

- Hilti Corporation

- Tyrolit

- Wacker Neuson SE

- CEDIMA GmbH

- Makita Corporation

- Milwaukee Tool (TTI)

- Saint-Gobain Abrasives

- Lissmac Maschinenbau GmbH

- Norton Clipper

- DITEQ Corporation

- Atlas Copco (Power Technique)

- Altrad Group

- Fairport Construction Equipment

- Probst GmbH

- Dymatec

- GSSI

- E-Z Cutter Inc.

- Diamond Products Unlimited

- KERN-DEUDIAM Diamantwerkzeuge GmbH

Frequently Asked Questions

Analyze common user questions about the Floor Saw Cutting Equipment market and generate a concise list of summarized FAQs reflecting key topics and concerns.What factors are primarily driving the demand for advanced floor saw cutting equipment?

Demand is primarily driven by escalating global infrastructure modernization projects, stringent occupational safety regulations necessitating automated and remote-controlled machinery, and technological advancements in diamond blade quality that enhance cutting speed and material efficiency.

How are environmental regulations influencing the selection of floor saw power sources?

Strict environmental regulations, particularly concerning noise and emissions in urban areas (like the EU's Stage V standards), are rapidly accelerating the shift away from traditional diesel/gasoline models toward electric and battery-powered floor saws, driving innovation in zero-emission equipment.

Which regional market is anticipated to exhibit the fastest growth for floor saw equipment?

The Asia Pacific (APAC) region is projected to show the fastest market expansion due to extensive government investments in large-scale infrastructure and rapid urbanization, particularly across developing economies such as India and Southeast Asian nations.

What role does Artificial Intelligence (AI) play in modern floor saw operations?

AI is increasingly used for predictive maintenance, analyzing sensor data (vibration, temperature) to forecast equipment failure, and optimizing real-time cutting parameters based on material conditions, thereby minimizing downtime and maximizing operational accuracy.

What is the most significant constraint impacting the growth potential of the floor saw market?

The high initial capital investment required for advanced, high-performance, and compliant floor saws, coupled with a persistent shortage of adequately skilled labor capable of operating and maintaining sophisticated cutting equipment, represents the most significant growth constraint.

The Floor Saw Cutting Equipment Market, while mature in certain segments, is undergoing a profound transformation driven by digital integration. The ability of manufacturers to incorporate features such as GPS tracking, sophisticated telematics, and operator assistance systems not only addresses safety concerns but also significantly improves project management capabilities for contractors. This integration of data management is crucial for large construction firms managing extensive fleets across numerous sites, providing real-time operational insights into machine health and utilization rates. Furthermore, the convergence of AI with IoT allows for dynamic adjustments to operational parameters, ensuring that the equipment operates at peak efficiency regardless of variations in concrete composition or reinforcement density encountered during the cutting process. This move towards 'smart' cutting equipment ensures sustained high demand in the premium segment.

Technological advancement is not limited to power and connectivity; material science innovation in diamond consumables is a continuous area of investment. Blades now feature optimized segment geometry and novel bonding technologies designed to handle ultra-hard aggregates and heavily reinforced concrete with less friction, reduced heat generation, and extended lifespan. This specialization minimizes blade changes and maximizes cutting throughput, directly impacting profitability for end-users. The competition in the consumables segment drives manufacturers to continually optimize the blade-to-machine synergy, ensuring that the equipment provides the best possible performance profile when paired with the manufacturer's proprietary cutting tools. This interdependence reinforces the value chain linkage between equipment OEMs and specialty abrasive suppliers.

In terms of application, the trend toward controlled, surgical demolition—as opposed to traditional brute-force methods—is a major market propellant. Floor saws are indispensable for structural alterations where vibration must be minimized to preserve adjacent structures. This is particularly relevant in urban renewal projects, hospital renovations, and bridge repair where structural integrity is critical. The high precision and low vibration characteristics of modern hydraulic and remote-controlled saws make them essential tools for creating clean openings for escalators, stairwells, or utility access points, positioning the equipment as a necessity for high-tolerance construction tasks.

The shift towards rental models, particularly in North America and Europe, is also shaping the market. Contractors prefer renting expensive, specialized equipment like high-capacity floor saws to avoid the substantial capital outlay and ongoing maintenance responsibilities. This trend places pressure on equipment manufacturers to design machines that are highly durable, easy to transport, and simple to service in the field. Rental companies, as major buyers, demand robust telemetry systems for asset tracking and maintenance scheduling, acting as key drivers for the adoption of IoT features in standard equipment offerings. This dynamic is influencing the overall equipment design philosophy toward modularity and remote diagnostic capabilities.

Sustainability is moving from a niche concern to a central operational mandate, heavily influencing procurement decisions globally. The necessity to operate 'green' construction sites has led to rapid development cycles for electric floor saws that utilize advanced power management systems to maximize cutting time between charges. Moreover, manufacturers are focusing on improving dust collection efficacy to capture harmful silica particles at the source, not only meeting but exceeding occupational health standards. These sustainability-focused features, while increasing unit cost, provide a compelling value proposition by ensuring regulatory compliance and improving working conditions, thus becoming a major competitive differentiator for leading brands.

Geopolitical stability and trade policies also exert an external impact on the market. Supply chain vulnerabilities exposed in recent years have pushed manufacturers to diversify sourcing for critical components, especially microprocessors for integrated electronics and specialized steel alloys. Tariffs and trade agreements can influence the regional cost of manufacturing, affecting the price competitiveness of imported equipment in various markets. For instance, manufacturers serving the North American market might seek assembly or partial manufacturing capabilities within the region to mitigate tariff risks, influencing distribution and local job creation strategies within the market ecosystem.

Looking ahead, the convergence of technologies such as automated guided vehicles (AGVs) and floor saws is poised to create fully robotic cutting solutions, especially for repetitive, large-area cutting tasks like airport runway grooving or highway joint creation. While still nascent, this integration promises unprecedented precision, continuous operation capacity (24/7), and freedom from dangerous environments. This future trajectory suggests that the floor saw cutting equipment market will increasingly transition toward a technology-driven service model, where the value lies not just in the machine itself but in the integrated data, software, and autonomous operational capabilities it provides to the user.

Finally, the competitive landscape is intensifying as smaller, specialized manufacturers focus on niche technologies, such as advanced diamond formulations or specialized remote-control systems, challenging the market dominance of established global conglomerates. Mergers and acquisitions are common as large players seek to integrate innovative niche technologies quickly to maintain their competitive edge in segments like high-depth cutting and robotic operation. This continuous innovation cycle ensures that the market remains dynamic, offering increasing levels of efficiency and safety to the global construction and demolition industries.

The demand for specialized cutting solutions for composite materials and non-traditional construction media is also opening new avenues. As architectural designs become more complex and incorporate advanced materials beyond standard concrete and asphalt, floor saw equipment must evolve to handle these varying substrates effectively. This requires ongoing collaboration between material scientists, equipment designers, and blade manufacturers to develop optimized systems that maintain performance and blade life when cutting materials such as carbon fiber-reinforced polymer (CFRP) or highly abrasive engineered stone products, diversifying the application portfolio beyond traditional infrastructure maintenance.

The operational efficiency gains realized through telematics and AI are redefining contractor fleet management. Detailed reports on fuel consumption, idle time, and maintenance needs allow fleet managers to make data-backed decisions on machine allocation and replacement schedules. This shifts procurement focus from simply the purchase price to the long-term operational cost-effectiveness and utilization rate provided by digitally enabled equipment. For the high-power hydraulic and diesel saw segment, this digital optimization is critical, ensuring regulatory compliance regarding engine run hours and emission limits while maximizing productivity.

Furthermore, safety standards across the globe are forcing equipment redesigns. Beyond dust and noise reduction, features like enhanced anti-vibration technology (AVT) are being integrated into floor saw handles and frames to reduce operator fatigue and minimize the risk of hand-arm vibration syndrome (HAVS). Remote-controlled models directly address safety by removing the operator from the immediate vicinity of the high-vibration, high-noise cutting zone. This focus on operator welfare is becoming a major selling point, especially in developed economies where labor unions and regulatory bodies exert significant influence over equipment specifications and procurement standards.

The market for replacement components, particularly high-quality diamond blades, is stable and vital. This consumables segment is highly competitive, driven by innovation in bonding technologies (e.g., laser welding) and diamond grade consistency. Contractors often balance the cost of a blade against its expected lifespan and cutting speed. The proliferation of electric saws, which typically operate at different RPMs and torque profiles than diesel counterparts, necessitates the continuous development of specialized blades optimized for electric power delivery, adding complexity and opportunities to the consumables value chain.

Finally, global infrastructure resilience initiatives, focused on seismic retrofitting and climate change mitigation (e.g., flood defense construction), are generating specialized demand. Floor saws are essential tools for accurately preparing and cutting structures for reinforcement installation. This niche application requires highly precise, deep-cutting capabilities often necessitating specialized, oversized hydraulic saw systems, pushing the boundaries of current cutting depth capacity and ensuring a steady, high-value segment within the overall market structure.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager