Floor Underlayment Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437679 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Floor Underlayment Market Size

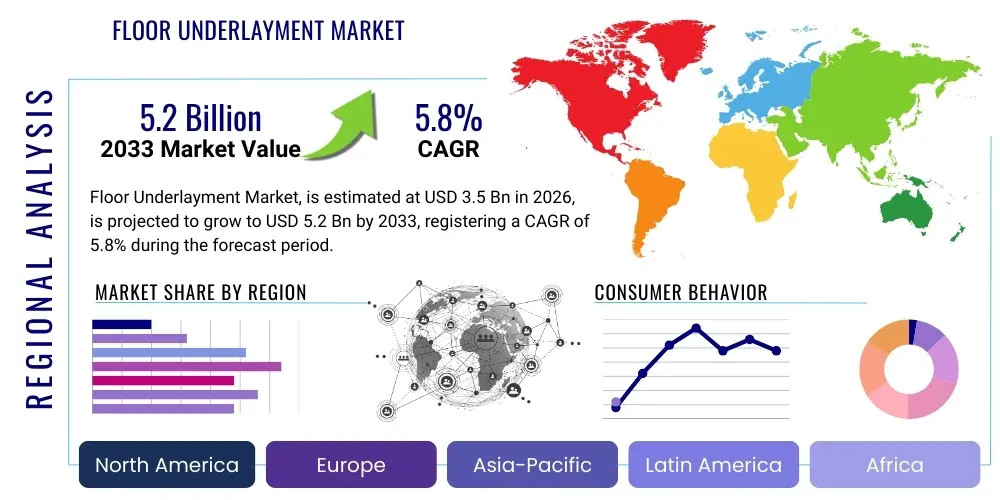

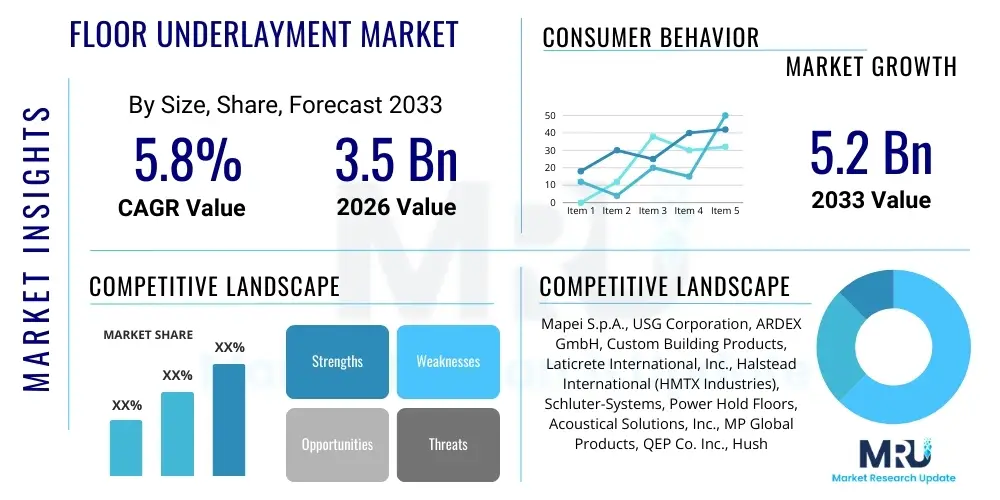

The Floor Underlayment Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 3.5 Billion in 2026 and is projected to reach USD 5.2 Billion by the end of the forecast period in 2033. The steady growth is primarily attributed to the global resurgence in construction activities, coupled with stringent building codes mandating enhanced soundproofing and moisture mitigation in residential and commercial infrastructure projects.

Floor Underlayment Market introduction

The Floor Underlayment Market encompasses materials installed between the subfloor and the finished floor covering. These essential products, which include specialized foams, cork, rubber, cement boards, and fiber underlayments, serve multiple critical functions aimed at improving the overall performance, longevity, and comfort of flooring systems. Key applications span across residential buildings, commercial spaces, and industrial facilities, driven by the necessity for moisture barrier protection, thermal insulation, acoustic dampening, and mitigation of minor subfloor irregularities. The introduction of innovative, eco-friendly materials, such as recycled rubber and sustainable cork underlayments, is significantly shaping consumer preferences and regulatory compliance, particularly in environmentally conscious developed economies.

Product performance is highly dependent on the flooring type it supports; for instance, specialized acoustic underlayments are mandatory for multi-family dwellings utilizing hard surfaces like laminate or engineered wood, addressing critical sound transmission control (STC) and impact insulation class (IIC) requirements. The inherent benefits derived from proper underlayment usage—including enhanced structural integrity, reduced impact noise, prevention of mold and mildew growth due to moisture barriers, and overall improvement in walking comfort—are key factors sustaining high market demand. Furthermore, the continuous trend towards renovation and remodeling of aging infrastructure, especially in North America and Europe, necessitates the replacement and upgrade of existing flooring systems, thereby driving the consumption of modern, high-performance underlayment solutions.

Driving factors are primarily related to urbanization and infrastructural development. The rapid expansion of the middle class in Asia Pacific countries leads to increased spending on quality housing and interior finishes. Moreover, technological advancements focusing on thin-profile, multi-functional underlayments that address both moisture and sound issues simultaneously are expanding application versatility. The rising popularity of resilient flooring (LVT/LVP) and stricter regulatory environments concerning noise pollution and energy efficiency in building codes are powerful catalysts compelling manufacturers and constructors to adopt high-quality floor underlayment products across all construction phases.

Floor Underlayment Market Executive Summary

The Floor Underlayment Market demonstrates robust resilience driven by global construction spending and the increasing consumer demand for premium, quieter, and more durable flooring installations. Key business trends indicate a shift towards sustainable and recycled materials, prompting manufacturers to invest heavily in R&D for bio-based and low-VOC (Volatile Organic Compound) products, aligning with green building standards like LEED certification. Mergers, acquisitions, and strategic partnerships focused on expanding distribution networks and technological capabilities, particularly in specialized sound control technologies, define the current competitive landscape. Manufacturers are increasingly focusing on delivering integrated subfloor systems that simplify installation and ensure compliance with stringent performance specifications, optimizing the value chain from raw material sourcing to final installation.

Regional trends highlight Asia Pacific (APAC) as the fastest-growing market, primarily fueled by massive infrastructural projects and escalating residential construction in China, India, and Southeast Asian nations. North America and Europe, characterized by established markets, exhibit high demand for premium, value-added products, especially those offering superior acoustic performance and moisture barriers for basement and slab-on-grade applications. Regulatory frameworks concerning noise isolation in densely populated urban centers are most mature in European countries, ensuring sustained demand for advanced polymeric and cork underlayments. Furthermore, the robust renovation cycle in developed economies ensures a consistent replacement market, counterbalancing fluctuating new construction starts.

Segment trends reveal that the material segment dominated by foam (polyethylene/polyurethane) continues to hold the largest market share due to its cost-effectiveness and versatility across various floor types, including laminate and carpet. However, the rubber and cork segments are projected to experience accelerated growth, driven by their superior environmental profile and inherent acoustic properties, making them preferred choices for high-end commercial and institutional projects. Application-wise, the residential sector remains the largest consumer, but the commercial segment, particularly healthcare and hospitality, mandates higher performance specifications, driving the growth of premium, specialized underlayments designed for heavy traffic and compliance requirements.

AI Impact Analysis on Floor Underlayment Market

Common user questions regarding the impact of Artificial Intelligence (AI) on the Floor Underlayment Market center on how AI can optimize supply chain efficiency, improve material formulation for enhanced performance, and automate quality control processes during manufacturing. Users often inquire about AI's role in predicting material stress points, optimizing inventory management based on real-time construction demands, and utilizing generative design to create novel geometric structures in foam or rubber underlayments for superior sound dampening. The consensus expectation is that AI will primarily enhance operational efficiency and product quality, moving the industry towards smarter, more customized material solutions and significantly reducing waste associated with imprecise production scheduling and formulation inconsistencies.

- AI-powered predictive maintenance optimizes machinery schedules, reducing unplanned downtime in continuous production lines for foam and membrane underlayments.

- Generative design algorithms assist material scientists in formulating polymer blends that achieve optimal sound transmission control (STC) and impact insulation class (IIC) ratings with reduced material usage.

- AI integration in Enterprise Resource Planning (ERP) systems enhances supply chain visibility, forecasting regional demand for specific material types (e.g., cork vs. felt) with higher accuracy, thus minimizing stockouts and excess inventory.

- Automated visual inspection systems leveraging machine learning algorithms detect microscopic defects and inconsistencies in underlayment thickness and density, ensuring compliance with strict quality standards faster than manual checks.

- AI tools analyze construction project data to recommend the optimal underlayment thickness and material type based on subfloor condition, intended use, and specific regional acoustic regulations, improving specification accuracy.

DRO & Impact Forces Of Floor Underlayment Market

The dynamics of the Floor Underlayment Market are powerfully shaped by drivers emphasizing environmental responsibility and regulatory compliance, opportunities arising from technological material breakthroughs, and restraints related to volatile raw material costs. Key drivers include the global mandate for noise reduction in urban development, prompting the increased adoption of specialized acoustic underlayments, and the rising awareness among consumers and builders about the necessity of moisture protection to prevent structural damage and maintain indoor air quality. Impact forces demonstrate that regulatory standards related to fire safety and VOC emissions are exerting strong pressure on manufacturers, forcing the phase-out of traditional materials in favor of inherently safer and non-toxic polymeric alternatives, thereby continuously pushing the average selling price upwards for compliant products.

Restraints primarily revolve around the fluctuating costs and availability of petrochemical-derived raw materials, such as specialized polymers used in foam and membrane manufacturing. This volatility complicates pricing strategies and margin maintenance for producers, particularly those operating globally. Furthermore, the perceived optionality of high-quality underlayment in budget-constrained construction projects acts as a restraint, leading some contractors to utilize lower-cost, less effective alternatives that fail to meet long-term performance expectations. Overcoming this restraint requires enhanced education within the construction value chain regarding the long-term cost benefits associated with superior acoustic and moisture control provided by premium underlayments.

Significant opportunities lie in leveraging the expanding market for sustainable building materials. The demand for underlayments made from recycled rubber tires, post-industrial waste, and sustainably harvested cork provides a differentiation pathway for manufacturers. Moreover, the burgeoning trend of modular and prefabricated construction necessitates factory-applied, integrated underlayment solutions that offer rapid installation and guaranteed performance parameters, presenting a unique niche for product innovation and specialized supply contracts. The ongoing renovation wave targeting energy efficiency in existing buildings also creates substantial opportunities for high-performance, thin-profile thermal underlayments designed to be integrated seamlessly without raising floor heights significantly.

Segmentation Analysis

The Floor Underlayment Market is primarily segmented by material type, application (residential/commercial), and flooring type, each exhibiting distinct growth characteristics based on regional construction trends and regulatory requirements. Material segmentation is crucial as it dictates the product’s core performance attributes, cost profile, and environmental footprint. The market's complexity arises from the necessity of matching specific underlayment materials—ranging from basic felt and fiberglass to advanced cross-linked polyethylene foams and vulcanized rubber sheets—to a wide variety of finished flooring products, including luxury vinyl tile (LVT), ceramic, stone, and various forms of wood flooring. This precision requirement drives product differentiation and targeted marketing efforts within the construction supply chain, ensuring that contractors select the optimal solution for acoustic, thermal, and moisture control challenges unique to each project.

The Application segment highlights the disparity in performance specifications between residential and commercial projects. Residential applications prioritize ease of installation and cost-effectiveness for single-family homes, typically driving demand for foam and felt. Conversely, commercial applications, encompassing hotels, hospitals, educational institutions, and corporate offices, necessitate underlayments that meet rigorous fire safety standards, superior durability against heavy foot traffic, and the highest possible IIC and STC ratings, favoring specialized rubber, cork, and high-density polymer matrices. The flooring type segmentation underscores the critical role of underlayment compatibility; for instance, ceramic tile installations often require cementitious or synthetic membrane underlayments to prevent cracking and manage moisture, while floating floors like laminate strictly require resilient, sound-dampening materials.

Geographic segmentation is vital for understanding market dynamics, with regional variations in building codes significantly impacting product choice. North America and Europe lead in the adoption of specialized acoustic barriers due to stringent multi-family housing regulations, while the Asia Pacific market is primarily driven by massive volumes in general residential construction, favoring volume-based, cost-effective solutions. The continuous introduction of hybrid underlayment products, combining the moisture protection of poly membranes with the sound absorption of recycled materials, represents a key evolutionary trend within the material segment, aimed at simplifying inventory and offering multi-functional performance to end-users.

- By Material Type:

- Foam (Polyethylene, Polyurethane, Polystyrene)

- Felt/Fiber (Wood Fiber, Synthetic Fiber)

- Cork

- Rubber (Recycled Rubber, Synthetic Rubber)

- Cement Board/Gypsum

- Others (e.g., Plywood, Specialty Membranes)

- By Application:

- Residential (Single-family, Multi-family)

- Commercial (Healthcare, Education, Hospitality, Office Space)

- By Flooring Type:

- Laminate Flooring

- Hardwood Flooring (Solid and Engineered)

- Luxury Vinyl Tile/Plank (LVT/LVP)

- Ceramic Tile/Stone

- Carpet/Carpet Tile

- Others

Value Chain Analysis For Floor Underlayment Market

The Value Chain for the Floor Underlayment Market begins with the sourcing of specialized raw materials, primarily polymers (for foam and membranes), natural resources (cork and wood fiber), and recycled rubber granules. Upstream analysis involves key chemical producers and material suppliers who provide resins, additives, and foaming agents. Efficiency at this stage is crucial, as the volatility of petrochemical prices directly impacts the manufacturing cost of most foam and polymeric underlayments. Manufacturers often engage in long-term procurement contracts or backward integration to stabilize raw material costs and ensure a consistent supply of high-quality inputs required for specialized acoustic products.

The manufacturing stage involves highly specialized processes, including extrusion, lamination, and compression molding, to produce the final underlayment products. Differentiation occurs here through patented formulations that achieve superior IIC/STC ratings or enhanced moisture vapor transmission rates (MVTR). Distribution channels are highly varied, encompassing both direct and indirect routes. Direct sales are often utilized for large commercial contracts or high-volume sales to national home builders, allowing manufacturers to maintain direct control over pricing and technical specifications. Indirect distribution relies heavily on wholesale distributors, specialty flooring retailers, and large format home improvement centers (DIY stores), which provide regional market access and inventory management, catering primarily to the residential and small-to-medium contractor segment.

Downstream analysis focuses on installers and end-users. The performance of the underlayment is highly dependent on correct installation; therefore, manufacturers invest in training programs for contractors to ensure product warranties are upheld. The final link in the chain involves the end-user (homeowner, property developer, facility manager), whose purchasing decision is influenced by cost, warranty, and perceived long-term performance benefits like acoustic comfort and durability. The trend towards integrated floor systems and prefabricated construction demands closer collaboration between underlayment manufacturers and finished flooring producers, streamlining the overall procurement and installation process and minimizing compatibility issues on site.

Floor Underlayment Market Potential Customers

The primary customers and end-users of floor underlayment products are broadly categorized into professional contractors, architectural and design firms (specifiers), property developers, and consumers engaging in do-it-yourself (DIY) home renovation. Professional flooring installers and general contractors represent the largest volume buyers, purchasing through wholesale distribution networks. These buyers are focused on product quality, ease of installation, compliance with local building codes, and competitive pricing, often preferring standardized, multi-functional products that reduce complexity on the job site. For large-scale multi-family and commercial projects, the decision is heavily influenced by specifiers—architects and engineers—who mandate specific acoustic or moisture barrier performance criteria based on the building’s functional requirements and regulatory compliance needs, thus requiring specialized technical data and certifications from manufacturers.

Property developers and national home builders constitute another significant customer base, particularly in the residential segment. Their purchasing strategy often involves securing bulk contracts with manufacturers to supply standardized, cost-effective underlayment systems across entire housing developments. Their focus is on ensuring consistency, minimizing warranty claims related to moisture intrusion or subfloor noise, and maintaining project timelines. The rising demand for sustainable and green-certified construction also makes developers keen buyers of environmentally friendly underlayments like cork and recycled rubber, aligning their projects with market demand for sustainable certifications.

Finally, the DIY segment, catered to predominantly by large retail home improvement chains, represents a consistent source of demand, particularly for easily installed products like thin foam rolls compatible with floating laminate or LVT floors. These consumers prioritize ease of handling, clear instructions, and cost-effectiveness. The increasing sophistication of modern underlayments, incorporating self-adhesive layers or integrated vapor barriers, aims to simplify the installation process further, broadening the appeal to this consumer segment and ensuring market penetration across various retail channels. Understanding the distinct procurement priorities of each customer group is critical for effective market strategy and product portfolio management.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 3.5 Billion |

| Market Forecast in 2033 | USD 5.2 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mapei S.p.A., USG Corporation, ARDEX GmbH, Custom Building Products, Laticrete International, Inc., Halstead International (HMTX Industries), Schluter-Systems, Power Hold Floors, Acoustical Solutions, Inc., MP Global Products, QEP Co. Inc., Hushmat, Wagner Corporation, National Gypsum Services Company, Inc., Interface Inc., Henry Company, DMX Plastics, Tarkett S.A., Mohawk Industries, Inc., Johns Manville. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floor Underlayment Market Key Technology Landscape

The technology landscape of the Floor Underlayment Market is primarily focused on material science innovation and manufacturing efficiency, aiming to create multi-functional products that address multiple performance needs simultaneously within a thinner profile. A crucial technological advancement is the development of advanced polymer chemistries, specifically cross-linked polyethylene (XLPE) and high-density polyurethane (HDPU) foams. These materials offer superior compressive strength and resilience compared to traditional open-cell foams, essential for maintaining the integrity of click-lock flooring systems like laminate and LVT under heavy loads. Furthermore, the integration of advanced vapor barrier technology, often utilizing low-permeability metallic or specialized plastic films laminated directly onto the underlayment, ensures superior moisture protection, particularly vital for installations over concrete slabs.

Another significant technological focus area is acoustic performance optimization. Manufacturers are utilizing layered material structures, sometimes incorporating mass-loaded vinyl (MLV) or granulated rubber compounds, to achieve high IIC (Impact Insulation Class) ratings required in multi-story residential and commercial buildings. Computational modeling and acoustic simulation software are increasingly being employed during the R&D phase to predict and optimize the sound dampening capabilities of new underlayment designs before physical prototyping, significantly speeding up the development cycle for high-performance acoustic products. This emphasis on measurable acoustic performance drives technology in both the resilient (foam/rubber) and non-resilient (cement board/gypsum) segments.

Installation technology also plays a key role. Innovations such as peel-and-stick or self-adhesive underlayment systems are gaining traction, drastically reducing installation time and the reliance on traditional liquid adhesives, thereby minimizing curing time and potential job site moisture issues. Moreover, specialized interlocking or floating underlayment panels designed for large-format tile and stone installations (e.g., decoupling membranes) provide crucial stress relief, preventing cracking caused by subfloor movement or thermal expansion. The ongoing pursuit of low-VOC and non-toxic formulations also necessitates advanced manufacturing technologies that can process sustainable and recycled content while maintaining the required physical properties and ensuring product certification compliance.

Regional Highlights

- North America: This region is characterized by high adoption rates of premium and specialized underlayments, particularly in Canada and the US, driven by rigorous noise control standards for multi-family housing and the widespread use of engineered wood and LVT flooring. The renovation market is robust, and there is a strong preference for domestically manufactured, environmentally compliant products. Demand is particularly high for products offering integrated moisture control suitable for regions with fluctuating humidity levels and basement installations.

- Europe: Europe represents a mature market with the most stringent regulatory landscape globally, especially regarding acoustic performance (IIC and STC ratings) and sustainability. Countries like Germany, France, and the UK demonstrate high penetration of cork and high-density rubber underlayments. The market is also heavily influenced by EU directives related to energy efficiency and indoor air quality, favoring low-VOC and thermal-insulating underlayment solutions for both new build and deep renovation projects.

- Asia Pacific (APAC): APAC is the engine of market growth, fueled by rapid urbanization, massive infrastructure development, and substantial residential construction in countries like China, India, and Indonesia. While price sensitivity remains a factor, the increasing awareness of quality and the influx of foreign developers adhering to international standards are accelerating the demand for better quality, functional underlayments, moving away from simple plastic sheeting towards foam and specialized polymeric membranes, particularly in high-rise constructions.

- Latin America (LATAM): This region exhibits moderate but steady growth, heavily influenced by residential expansion and commercial infrastructure development in Brazil and Mexico. The market often faces challenges related to sourcing specialized materials locally, leading to reliance on imports. Key demand drivers include basic moisture barriers for concrete slab construction and cost-effective foam underlayments for laminate flooring, reflecting a price-conscious yet growing quality-seeking market segment.

- Middle East and Africa (MEA): Growth in MEA is highly concentrated in the GCC states (Saudi Arabia, UAE) due to large-scale, luxury commercial and hospitality projects that demand high-specification underlayments for acoustic separation and thermal performance. The extreme climate mandates advanced thermal insulation underlayments, and the rapid pace of construction ensures sustained bulk material demand. Africa, while nascent, shows emerging demand in developing urban centers focused on foundational moisture protection products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floor Underlayment Market.- Mapei S.p.A.

- USG Corporation

- ARDEX GmbH

- Custom Building Products

- Laticrete International, Inc.

- Halstead International (HMTX Industries)

- Schluter-Systems

- Power Hold Floors

- Acoustical Solutions, Inc.

- MP Global Products

- QEP Co. Inc.

- Hushmat

- Wagner Corporation

- National Gypsum Services Company, Inc.

- Interface Inc.

- Henry Company

- DMX Plastics

- Tarkett S.A.

- Mohawk Industries, Inc.

- Johns Manville

Frequently Asked Questions

What are the primary functions of floor underlayment?

The primary functions of floor underlayment are sound dampening (reducing both airborne and impact noise), moisture mitigation (acting as a vapor barrier over concrete), thermal insulation, and leveling minor subfloor imperfections to ensure the proper installation and longevity of the finished floor covering, especially for floating systems like laminate and LVT.

Which material segment is projected to grow fastest in the underlayment market?

The rubber and cork material segments are projected to experience the fastest growth, driven by increasing regulatory mandates for superior acoustic performance in multi-family housing and the rising consumer preference for sustainable, environmentally friendly building materials with excellent inherent insulation properties.

How does LVT/LVP popularity impact the demand for floor underlayments?

The increasing popularity of Luxury Vinyl Tile (LVT) and Luxury Vinyl Plank (LVP) significantly boosts demand for specialized thin-profile underlayments. These resilient floors often require high-density, low-compression underlayments to prevent movement, provide sound deadening, and protect the locking mechanisms, ensuring performance integrity.

What role do acoustic ratings like IIC and STC play in market segmentation?

Acoustic ratings, specifically IIC (Impact Insulation Class) and STC (Sound Transmission Class), are critical market drivers, especially in the commercial and multi-family residential sectors in North America and Europe. Underlayment products achieving high certified IIC/STC values command a premium price and are mandated by local building codes, heavily influencing product specification and manufacturer focus.

Which geographical region holds the largest market share for floor underlayments?

North America currently holds a significant market share due to its established construction industry, high consumer spending on high-quality home finishes, and strict adherence to acoustic and moisture control building regulations. However, the Asia Pacific region is forecast to demonstrate the highest growth rate during the projection period, driven by unparalleled construction volume.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager