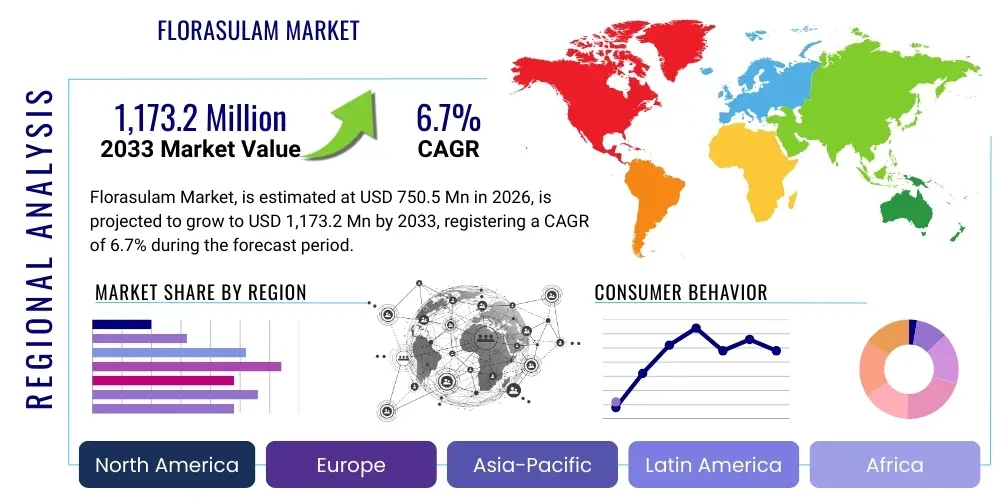

Florasulam Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435936 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Florasulam Market Size

The Florasulam Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.7% between 2026 and 2033. The market is estimated at USD 750.5 million in 2026 and is projected to reach USD 1,173.2 million by the end of the forecast period in 2033.

Florasulam Market introduction

Florasulam is a highly effective, selective post-emergence herbicide belonging to the triazolopyrimidine sulfonanilide chemical family. It is primarily utilized for the control of a broad spectrum of broadleaf weeds, including species resistant to other herbicide classes, in major cereal crops such such as wheat, barley, and oats, as well as in specific non-crop situations. The chemical action of Florasulam involves the inhibition of the acetolactate synthase (ALS) enzyme, which is critical for the biosynthesis of essential branched-chain amino acids in susceptible plants. This targeted mechanism ensures effective weed control at low application rates while maintaining crop safety, positioning Florasulam as a cornerstone product in integrated weed management strategies globally. Its systemic activity allows it to be absorbed rapidly by the foliage and roots, translocating quickly throughout the plant to meristematic zones where growth inhibition occurs.

The widespread adoption of Florasulam is significantly driven by the increasing global demand for high-quality cereal production and the persistent challenge of herbicide resistance development in weed populations. As farming practices become more intensive, farmers require precise, low-dose solutions that offer flexibility in application timing and tank-mix compatibility with other crop protection products. Florasulam excels in these criteria, offering excellent residual control and minimizing environmental impact due compared to older, less targeted chemistries. Moreover, the compound exhibits favorable toxicological and ecotoxicological profiles, supporting its continuous registration and use in stringent regulatory markets like the European Union and North America, further solidifying its market position.

Major applications of Florasulam concentrate heavily on enhancing the yield and purity of staple food crops. Beyond cereals, its use is explored in other areas like turf and industrial vegetation management, though cereals remain the dominant segment. Key benefits include its efficacy against difficult-to-control weeds such as cleavers, chickweed, and mayweeds, and its formulation versatility, allowing it to be integrated into complex spray programs. The market is propelled by factors such as shrinking arable land, necessity for sustainable agriculture intensification, and robust investment in research and development by agrochemical giants seeking novel formulations and synergistic combinations to combat evolving weed challenges effectively.

Florasulam Market Executive Summary

The Florasulam Market is characterized by stable growth, underpinned by sustained demand from the global cereal farming sector and increasing awareness regarding the long-term economic damage caused by uncontrolled broadleaf weeds. Key business trends include the consolidation among major manufacturers, leading to streamlined production processes and enhanced distribution efficiencies. Furthermore, significant investment is being channeled into developing synergistic combination products, often pairing Florasulam with other active ingredients like Fluroxypyr or 2,4-D, to broaden the spectrum of weed control and manage resistance. The market landscape is also being influenced by heightened regulatory scrutiny in developed markets, pushing manufacturers towards highly pure and refined formulations that meet strict residue limits, thereby creating a preference for branded, quality-assured products over generic alternatives.

Regionally, the market exhibits divergent growth dynamics. North America and Europe currently hold the largest market shares due to advanced agricultural practices, high adoption rates of selective herbicides, and extensive cereal cultivation areas, particularly winter wheat. However, the Asia Pacific region, driven primarily by Australia, China, and India, is projected to register the fastest growth rate. This accelerated expansion is attributed to the mechanization of farming, increasing adoption of modern crop protection methods to boost food security, and the emergence of domestic manufacturers increasing market access in previously underserved areas. Latin America, especially Brazil and Argentina, also represents a significant opportunity due to the expansion of commercial farming operations focused on high-value commodity crops, where effective weed management is paramount for profitability.

In terms of segment trends, the formulation type segment sees liquid formulations (Suspension Concentrates - SC, Emulsifiable Concentrates - EC) dominating the market due to ease of application, stability, and excellent tank-mix compatibility. Based on Crop Type, the Wheat segment remains overwhelmingly dominant globally, reflecting its status as a primary staple crop and its susceptibility to the weeds targeted by Florasulam. However, usage in secondary cereals like barley and oats is also expanding as farmers seek to maximize yields from these crops. The market structure emphasizes the importance of robust supply chains capable of delivering specialized agrochemicals efficiently across diverse agricultural landscapes, necessitating strong relationships between active ingredient producers, formulators, and local distributors.

AI Impact Analysis on Florasulam Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Florasulam market typically revolve around optimizing application efficiency, predicting resistance development, and enhancing R&D discovery processes. Users are specifically concerned about how AI-driven precision agriculture tools, such as automated drones and satellite imagery analysis, can minimize herbicide usage while maintaining efficacy, potentially affecting volume demand for products like Florasulam. Key expectations include using AI for predictive modeling of weed emergence patterns based on weather and soil data, thereby enabling farmers to determine the optimal timing and localized dosage of Florasulam application. Furthermore, the industry seeks AI solutions to accelerate the identification of novel herbicide targets and optimize formulation chemistry, ensuring that next-generation Florasulam combinations remain highly effective against evolving weed biotypes and regulatory challenges.

- AI-driven precision spraying optimizes Florasulam dosage, minimizing waste and potentially reducing overall volume consumption per hectare.

- Predictive analytics models, powered by machine learning, forecast weed resistance patterns, guiding farmers toward proactive rotational strategies involving Florasulam.

- Integration of Florasulam application data with remote sensing (satellite/drone imagery) allows for localized variable rate application, increasing efficacy and sustainability.

- AI accelerates R&D processes by simulating chemical interactions and optimizing co-formulations of Florasulam with adjuvants or safeners.

- Automated decision support systems provide real-time recommendations for product selection and timing based on field-specific environmental parameters, enhancing the value proposition of Florasulam.

- Supply chain optimization using AI ensures timely delivery and inventory management of Florasulam products across global distribution networks, stabilizing prices and availability.

DRO & Impact Forces Of Florasulam Market

The market dynamics of Florasulam are shaped by a complex interplay of Drivers, Restraints, and Opportunities, which collectively determine the strategic outlook for manufacturers and distributors. A primary driver is the inherent advantage of Florasulam as an ALS inhibitor, which offers crucial rotation options for managing weeds that have developed resistance to common chemistries like glyphosate and triazines. The global focus on maximizing cereal yields in limited arable land further fuels demand, as effective weed control directly translates into higher quality and quantity of harvested grain. Furthermore, regulatory support in key agricultural regions, predicated on Florasulam's favorable environmental characteristics (low dose rate, rapid degradation in soil), ensures its continued preference over older, high-residue alternatives. The compounding effect of these drivers creates a resilient demand curve for this specific herbicide class.

However, the market faces significant restraints. The most critical constraint is the global threat of ALS-inhibitor resistance. As Florasulam is widely adopted, the continuous selection pressure on weed populations leads to the inevitable evolution of resistant biotypes, necessitating the development of alternative chemistries or complex tank mixes, which increases costs and complexity for the end-user. Secondly, the stringent and time-consuming regulatory approval process for new agrochemicals, coupled with high initial capital investment required for dedicated manufacturing facilities, limits market entry for smaller players. Economic instability and fluctuating commodity prices also impact farmers’ ability to invest in premium crop protection inputs like specialized herbicides, particularly in emerging economies where financial liquidity is sensitive to market volatility.

Opportunities for market expansion are substantial, focusing primarily on geographical penetration and technological advancement. Significant opportunity exists in expanding the registration and use of Florasulam in high-growth markets within APAC and Africa, where agricultural intensification is a priority. Furthermore, the development of advanced micro-encapsulation and targeted release formulations represents a key technological opportunity, potentially enhancing the residual activity and reducing the required application rates, thereby improving both sustainability and cost-effectiveness. The increasing acceptance of integrated pest management (IPM) strategies also favors Florasulam, as its selective action makes it compatible with biological control methods. The long-term success of the market will depend on how effectively manufacturers can mitigate resistance risk through innovative combination products and proactive stewardship programs.

Segmentation Analysis

The Florasulam market is extensively segmented across several dimensions, including formulation type, crop type, and geography, to provide a granular view of consumption patterns and market potential. Segmentation by formulation type is crucial as it reflects the product's usability and stability; manufacturers constantly refine these to enhance efficacy and compatibility with diverse application equipment. Segmentation by crop type highlights the dominant agricultural applications, with cereals forming the backbone of demand, while differentiation by geography underscores the varied regulatory landscapes, climatic influences, and agricultural practices that dictate regional market growth trajectories. Understanding these segments is vital for targeted marketing and strategic resource allocation within the agrochemical industry.

- By Formulation Type:

- Suspension Concentrate (SC)

- Water Dispersible Granules (WG)

- Emulsifiable Concentrate (EC)

- Wettable Powder (WP)

- By Crop Type:

- Wheat (Winter Wheat, Spring Wheat)

- Barley

- Oats

- Rye

- Triticale

- Other Cereals and Non-Crop Areas

- By Application Method:

- Foliar Spray

- Soil Application (Less common but used in specific pre-emergence combinations)

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia Pacific (China, India, Japan, Australia, Rest of APAC)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (MEA) (South Africa, Saudi Arabia, Rest of MEA)

Value Chain Analysis For Florasulam Market

The value chain for Florasulam initiates with the upstream activities involving the sourcing of petrochemical derivatives and specialized chemical intermediates essential for synthesizing the active ingredient. Highly specialized manufacturers, often operating under strict Good Manufacturing Practices (GMP), perform the complex multi-step chemical synthesis to produce high-purity Florasulam technical grade material. This stage is capital-intensive and requires substantial R&D expertise to ensure process efficiency, yield maximization, and regulatory compliance. Key upstream risks include volatility in raw material prices and the maintenance of intellectual property surrounding the synthesis pathways, which are critical for proprietary advantage in the technical grade market.

Midstream processes focus on formulation and packaging. Technical Florasulam is rarely sold directly to end-users; instead, it is formulated into commercially viable products (e.g., SC, WG, EC) by combining the active ingredient with adjuvants, surfactants, solvents, and dispersants. This formulation stage is essential for optimizing product stability, tank-mix compatibility, and biological efficacy. The formulated product is then packaged in various sizes suitable for commercial, professional, or smaller farming operations. Distribution channels are highly structured, relying on both direct and indirect routes. Direct sales often involve large corporate farming entities or cooperatives sourcing directly from the manufacturer, while indirect distribution relies heavily on regional agrochemical distributors, wholesalers, and retail farm supply stores which provide the necessary logistical support and localized agronomic advice to smaller, individual farmers.

Downstream activities involve the final sale and application. The distribution network must navigate varying regional regulatory requirements and storage mandates. Key stakeholders in the downstream segment include independent distributors who manage regional supply, farm retail outlets that serve as the interface with the end-user, and agricultural consultants who provide essential advisory services regarding product selection, dosage, and rotation strategies. The effectiveness of the indirect distribution channel, which reaches the vast majority of growers, is paramount for market penetration. Post-sales support and product stewardship programs, addressing issues like resistance management and safe handling, close the value loop, ensuring responsible use and sustaining market reputation.

Florasulam Market Potential Customers

The primary and most significant end-users of Florasulam are professional farmers and large-scale agricultural enterprises specializing in the cultivation of major cereal crops, predominantly wheat and barley, across temperate regions globally. These customers rely on Florasulam to ensure high-quality yields by effectively managing competitive broadleaf weeds that can substantially reduce harvestable output if left unchecked. Due to the high value of commercial cereal crops and the narrow margins in modern farming, these professional users demand premium, reliable, and selective herbicides that minimize crop injury while providing consistent weed control, positioning Florasulam as a preferred choice in their crop protection toolkits. Their buying decisions are heavily influenced by efficacy data, cost-per-acre performance, and the availability of local agronomic support.

Secondary but important customer segments include government and private entities involved in managing large tracts of non-agricultural land, such as railway lines, utility corridors, and industrial sites, where vegetation control is necessary for safety and infrastructure maintenance. Furthermore, professional turf managers overseeing large areas like golf courses, public parks, and athletic fields, where certain broadleaf weeds are aesthetic or functional liabilities, also represent a niche market for specialized Florasulam formulations. These buyers prioritize targeted control and regulatory approval for use in public access areas, often opting for more customized or ready-to-use formulations. The purchasing behavior in these non-crop segments is typically driven by long-term contract pricing and compliance with environmental regulations.

A growing segment of potential customers includes large agricultural cooperatives and buying groups who aggregate demand from numerous smaller farmers. These groups negotiate bulk purchases, serving as a critical intermediary distribution point, and their procurement strategy often focuses on securing cost-effective solutions for their members. Additionally, specialized formulation companies who do not manufacture the technical grade active ingredient, but instead purchase it to produce proprietary combination products under their own brand, are also key purchasers within the upstream segment of the market, driven by the need to secure high-quality technical material for their market offerings.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 750.5 Million |

| Market Forecast in 2033 | USD 1,173.2 Million |

| Growth Rate | 6.7% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Corteva Agriscience, Syngenta AG, Bayer CropScience AG, FMC Corporation, Nufarm Limited, ADAMA Agricultural Solutions, UPL Limited, Albaugh LLC, Jiangsu Yangnong Chemical Group Co. Ltd., Shandong Hailir Chemical Co., Ltd., Bailing Agrochemical Co. Ltd., Jiangsu Good Harvest-Weien Agrochemical Co., Ltd., Lier Chemical Co., Ltd., Hunan Chemical Research Institute, Zhejiang Jinfanda Biochemical Co. Ltd., Sharda Cropchem Ltd., Sipcam Oxon, Rotam Agrochemical Co., Ltd., SinoHarvest, Helm AG. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Florasulam Market Key Technology Landscape

The technology landscape surrounding the Florasulam market is dynamic, driven by the twin needs of enhancing efficacy and ensuring environmental safety. A critical technological focus is on advanced formulation science, particularly the development of high-load Suspension Concentrate (SC) and Water Dispersible Granule (WG) formulations. These advanced systems utilize sophisticated dispersion and wetting agents to ensure the active ingredient remains uniformly suspended or easily dispersible in water, thereby improving handling safety, storage stability, and application efficiency. Micro-encapsulation technology is also gaining traction, allowing for controlled release of Florasulam, which can extend its residual activity and potentially reduce volatility losses, contributing to better long-term weed management.

Another significant technological advancement lies in the area of combination products. Given the challenge of herbicide resistance, manufacturers are increasingly leveraging proprietary co-formulation technologies to mix Florasulam with herbicides possessing different modes of action (e.g., phenoxy acids or sulfonylureas). These technologies ensure that the different active ingredients remain stable and efficacious within a single package, offering farmers a broad-spectrum, anti-resistance solution without the need for complex tank mixing. Furthermore, the integration of new-generation adjuvants—specific chemical additives that enhance the uptake and translocation of Florasulam within the weed plant—is vital for maximizing performance, particularly under challenging environmental conditions such as drought or cool temperatures.

Beyond chemistry, digital agriculture technologies are rapidly integrating into the Florasulam application process. This includes the development of sensors and software systems that enable Variable Rate Technology (VRT) spraying. Utilizing GPS mapping, normalized difference vegetation index (NDVI) data from satellites or drones, and AI-driven predictive modeling, VRT systems allow applicators to adjust the concentration of Florasulam applied in real-time based on the specific weed pressure in localized sections of the field. This precision technology significantly reduces the total amount of herbicide used, lowering costs, minimizing environmental exposure, and optimizing the product's effectiveness, marking a key shift towards sustainable crop protection practices.

Regional Highlights

The Florasulam market exhibits significant regional variation in terms of consumption, regulation, and growth trajectory, reflecting diverse agricultural practices globally. North America, comprising the United States and Canada, represents a mature but highly valuable market segment. Its dominance is founded on large-scale mechanized cereal farming operations, particularly in the Wheat Belt, where selective broadleaf weed control is critical for maximizing yields. High adoption rates are driven by farmers’ acceptance of advanced agrochemical solutions and the need to manage established resistance issues, often utilizing premium Florasulam combination products. Regulatory standards are stringent but predictable, favoring high-quality, branded products, leading to substantial market value despite moderate volume growth.

Europe, historically a strong consumer of Florasulam, continues to be a core market, especially in major wheat-producing countries like France, Germany, and the UK. The European market is characterized by extremely strict environmental and residue regulations, which Florasulam often meets due to its low application rate and favorable dissipation profile, giving it a competitive edge over older chemistries. However, growth is tempered by the EU's Farm to Fork strategy and increasing scrutiny on all synthetic crop protection products, necessitating constant innovation in sustainable formulation and application methods. The market requires manufacturers to invest heavily in robust data packages to maintain registration under the EU’s challenging re-approval processes.

The Asia Pacific (APAC) region stands out as the primary engine for future volume growth. While key markets like China and India still grapple with challenges related to infrastructure and small land holdings, the accelerating adoption of modern farming techniques, coupled with substantial government support for increasing food security, is fueling demand. Australia is a highly advanced market within APAC, mirroring North American practices, while the vast cereal acreage in India and China offers immense potential for basic and generic Florasulam technical material consumption. As regulatory frameworks standardize and farmers gain access to better distribution networks, the demand for effective broadleaf weed control in staple crops will surge, making strategic investment in manufacturing and distribution infrastructure across APAC essential for global market leaders.

Latin America, particularly the agricultural powerhouses of Brazil and Argentina, shows promising, high-growth potential. Although Florasulam is primarily known for cereals, its utility is expanding into rotation crops and specific non-crop applications within the diverse Latin American agricultural ecosystem. The market here is highly price-sensitive but rapidly modernizing, with a growing reliance on effective solutions to handle aggressive tropical and subtropical weed species. Finally, the Middle East and Africa (MEA) remains the smallest region but offers targeted growth opportunities, particularly in North Africa (Morocco, Egypt) and South Africa, where cereal production is commercially vital and effective post-emergence broadleaf weed control is a prerequisite for overcoming environmental stress and maximizing yields in arid and semi-arid conditions.

- North America: Dominates the market value due to advanced farming technologies, extensive wheat and barley cultivation, and high adoption of premium formulated products. Focus on resistance management and VRT application.

- Europe: Characterized by stringent regulatory oversight (EU), driving demand for low-dose, high-efficacy, and environmentally favorable Florasulam formulations to ensure regulatory compliance.

- Asia Pacific (APAC): Fastest-growing region, fueled by agricultural modernization in China and India, expanding cereal acreage, and increasing availability of generic active ingredients. Australia is a key mature sub-market.

- Latin America: High-potential region, driven by commercial expansion in Brazil and Argentina, focusing on high-efficacy solutions for broadleaf weed control in competitive environments.

- Middle East and Africa (MEA): Emerging market concentrated in key agricultural zones (e.g., South Africa, Maghreb), with demand linked to achieving food security goals and improving crop yields under challenging climatic conditions.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Florasulam Market.- Corteva Agriscience

- Syngenta AG

- Bayer CropScience AG

- FMC Corporation

- Nufarm Limited

- ADAMA Agricultural Solutions

- UPL Limited

- Albaugh LLC

- Jiangsu Yangnong Chemical Group Co. Ltd.

- Shandong Hailir Chemical Co., Ltd.

- Bailing Agrochemical Co. Ltd.

- Jiangsu Good Harvest-Weien Agrochemical Co., Ltd.

- Lier Chemical Co., Ltd.

- Hunan Chemical Research Institute

- Zhejiang Jinfanda Biochemical Co. Ltd.

- Sharda Cropchem Ltd.

- Sipcam Oxon

- Rotam Agrochemical Co., Ltd.

- SinoHarvest

- Helm AG

Frequently Asked Questions

Analyze common user questions about the Florasulam market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is Florasulam and how does it function as an herbicide?

Florasulam is a selective, post-emergence herbicide belonging to the triazolopyrimidine sulfonanilide class. It works by inhibiting the acetolactate synthase (ALS) enzyme in susceptible weeds. This inhibition prevents the synthesis of essential amino acids, leading rapidly to cessation of cell division and subsequent plant death. It is primarily used for controlling broadleaf weeds in cereal crops like wheat and barley.

Which crop types represent the largest consumer segment for Florasulam globally?

The Wheat segment, particularly winter wheat and spring wheat cultivation across North America and Europe, constitutes the largest consumer base for Florasulam. Its high efficacy against common, yield-reducing broadleaf weeds in these crops makes it an indispensable tool for maximizing global cereal production and quality.

What are the main risks associated with the sustained use of Florasulam?

The primary risk is the development of Herbicide Resistance, specifically ALS-inhibitor resistance, in weed populations due to repeated use. To mitigate this risk, agricultural experts strongly recommend rotating Florasulam with herbicides having different modes of action (MOA) and integrating non-chemical weed control methods as part of a comprehensive management strategy.

How is the adoption of precision agriculture impacting Florasulam market demand?

Precision agriculture, utilizing Variable Rate Technology (VRT) and AI, enables highly targeted and localized application of Florasulam. While this technology improves efficacy and reduces overall waste, it may lead to a decrease in the volume of product required per acre, shifting market focus towards higher-value, specialized formulations rather than bulk volume sales.

Which geographical region is forecast to exhibit the highest growth rate for Florasulam products?

The Asia Pacific (APAC) region, driven by the agricultural modernization and increasing demand for effective crop protection solutions in large markets such as China and India, is projected to record the highest Compound Annual Growth Rate (CAGR) for the Florasulam market during the forecast period.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager