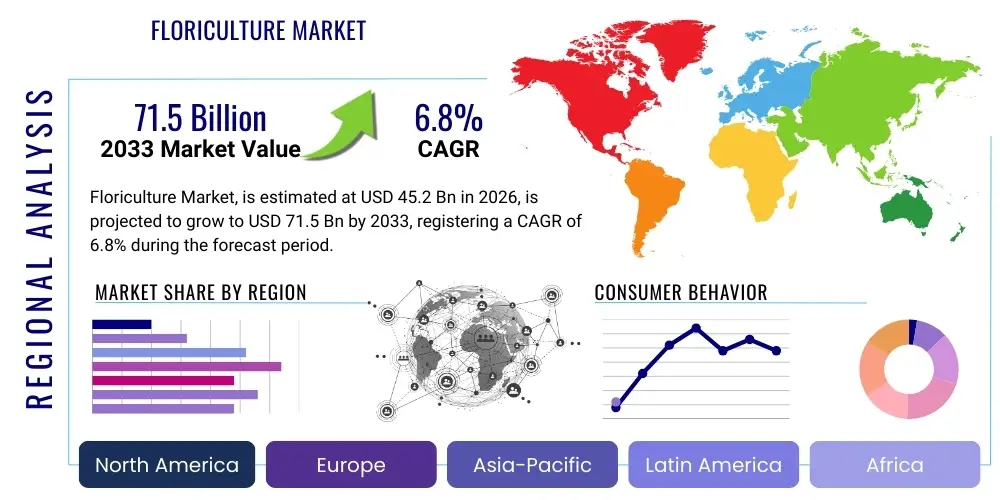

Floriculture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437808 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Floriculture Market Size

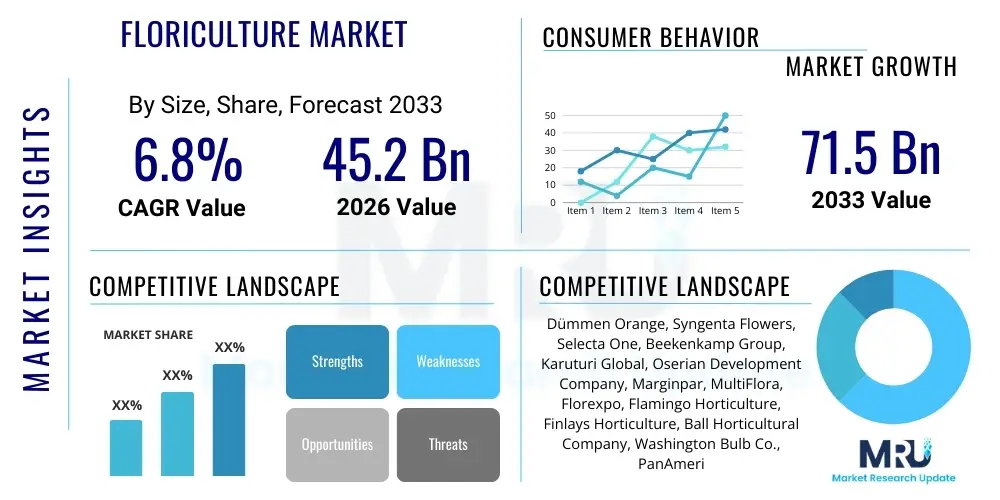

The Floriculture Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 45.2 Billion in 2026 and is projected to reach USD 71.5 Billion by the end of the forecast period in 2033.

Floriculture Market introduction

Floriculture, encompassing the cultivation and trade of cut flowers, flowering plants, foliage plants, and bedding plants, serves primarily aesthetic, ornamental, and therapeutic purposes. This sophisticated segment of horticulture is driven by global consumer trends emphasizing natural beauty, personal well-being, and the tradition of gifting. Key products range from widely traded roses, chrysanthemums, and tulips to specialized exotic orchids and seasonal bedding plants used extensively in urban landscaping and interior design. The industry operates through a complex global supply chain, relying heavily on controlled environment agriculture (CEA) to ensure year-round availability and consistent quality, mitigating the natural seasonality and geographical limitations associated with open-field farming.

Major applications of floricultural products span several sectors, including personal consumption (home décor), celebratory events (weddings, funerals, holidays), commercial landscaping (hotels, corporate offices), and the perfumery and essential oils industry. The versatility and emotional significance attached to flowers sustain robust demand, positioning them as essential luxury items. Furthermore, the market benefits significantly from the increasing global focus on green spaces and biophilic design principles, which promote the incorporation of natural elements into constructed environments. This application drives demand for robust foliage and long-lasting potted plants, particularly in densely populated urban centers where access to nature is limited.

Driving factors underpinning market growth include rising disposable incomes in emerging economies, which translate directly into higher spending on non-essential decorative items, and the robust expansion of e-commerce platforms, which have revolutionized the distribution and accessibility of fresh flowers, allowing for direct-to-consumer delivery. Moreover, technological advancements, such as precision irrigation, optimized LED lighting in vertical farms, and the development of new plant varieties resistant to disease and stress, are enhancing cultivation efficiency and extending the vase life of cut flowers, thereby improving consumer satisfaction and reducing post-harvest losses, strengthening the overall market structure.

Floriculture Market Executive Summary

The global Floriculture Market is characterized by a significant shift toward technology-intensive cultivation and a restructuring of traditional trade flows. Business trends highlight the increasing consolidation among large-scale growers and distributors, particularly in regions specializing in high-volume, low-cost production such as Africa and South America. Simultaneously, premium markets in North America and Europe are witnessing an expansion of niche segments focused on sustainable, locally sourced, and ethically certified flowers. Digital transformation is a paramount trend, with advanced logistics and cold chain monitoring systems being crucial for maintaining product integrity across vast distances. This competitive landscape is pushing industry stakeholders towards adopting sustainable practices, notably reducing water usage and minimizing pesticide application, addressing heightened consumer environmental awareness.

Regional trends indicate divergent growth patterns. The Asia Pacific region, led by China and India, is experiencing exponential growth driven primarily by massive domestic consumption for religious ceremonies, festivals, and urbanization-fueled landscaping projects. Conversely, Europe remains the dominant revenue generator and the largest importer, with the Netherlands serving as the central hub for global trade, auctioning, and redistribution, leveraging its expertise in breeding and logistics. North America demonstrates strong growth in the protected cultivation segment, aiming to reduce dependence on international imports by cultivating specialty crops closer to major metropolitan areas, responding to the demand for traceable and lower-carbon footprint products. This dichotomy underscores the segmentation of the global market into high-volume export hubs and sophisticated, high-value consumer markets.

Segment trends confirm that cut flowers continue to dominate the market share due to their enduring popularity in gifting and event decoration, although potted plants and bedding plants are gaining momentum, fueled by the pandemic-induced boost in home gardening and interior décor projects. The distribution landscape is rapidly evolving, with online channels showing the fastest growth rate, challenging the traditional dominance of specialized florists and supermarkets. The development of varieties with enhanced longevity (long vase life) and novel colors is a core driver within the product segments, supported by significant investment in plant biotechnology. Furthermore, the ornamental foliage segment is gaining traction, particularly in commercial applications requiring long-term, low-maintenance decorative solutions, aligning with corporate budget efficiencies.

AI Impact Analysis on Floriculture Market

Common user questions regarding AI's influence in floriculture predominantly revolve around its practical implementation challenges, return on investment (ROI) for small to medium enterprises (SMEs), and the ethical implications concerning labor displacement and data ownership. Users frequently inquire about the feasibility of using AI to accurately predict disease outbreaks specific to high-value ornamental crops and how machine learning algorithms can optimize complex variables like light spectrum, humidity, and nutrient delivery in highly controlled environments such as vertical farms. The underlying key theme is the expectation that AI should transition floriculture from empirical, labor-intensive decision-making to data-driven, hyper-efficient production models, ultimately enhancing yield per square meter and reducing operational costs, particularly for energy and water. Consumers are also interested in AI's role in verifying provenance and quality, ensuring they receive the freshest possible product through sophisticated supply chain monitoring.

The integration of Artificial Intelligence, specifically machine learning and computer vision, is fundamentally transforming cultivation practices in the floriculture sector. AI algorithms are essential for processing the massive influx of data generated by Internet of Things (IoT) sensors installed within greenhouses and vertical farms, enabling real-time adjustments to climate control systems. This capability allows growers to maintain optimal microclimates tailored precisely to the specific growth stage and variety of the flower, leading to superior quality, faster cycle times, and maximized resource efficiency. Furthermore, predictive analytics powered by AI can forecast market demand fluctuations, assisting growers in optimizing planting schedules and harvest timing, thereby minimizing waste and ensuring better alignment between supply and fluctuating consumer needs, which is critical for perishable goods.

Beyond cultivation, AI is revolutionizing post-harvest handling and quality control. Automated grading and sorting systems utilize computer vision to instantly identify defects, measure stem length, and categorize flowers based on precise quality parameters far faster and more accurately than human labor. In the supply chain, AI-driven routing and inventory management systems are optimizing logistics, determining the fastest and coldest routes to market, significantly extending the crucial vase life of cut flowers. This comprehensive integration of AI from seed selection to final retail point ensures higher product consistency, lowers the likelihood of contamination or spoilage, and provides unparalleled transparency and efficiency across the complex global value chain, acting as a major competitive differentiator for early adopters.

- AI-driven optimization of greenhouse microclimates using predictive modeling for temperature, CO2, and humidity control.

- Computer vision systems for automated disease and pest detection at early stages, minimizing chemical use and yield loss.

- Machine learning algorithms for yield forecasting and production planning, aligning harvest with projected market demand.

- Automated flower grading, sorting, and packaging based on precise quality metrics and aesthetic parameters.

- Optimization of supply chain logistics (cold chain management) using AI for real-time route optimization and spoilage prediction.

- Development of personalized irrigation and nutrient delivery systems (fertigation) tailored to individual plant needs, enhancing resource efficiency.

DRO & Impact Forces Of Floriculture Market

The dynamics of the Floriculture Market are governed by a complex interplay of demand-side drivers, supply-side limitations, and technological opportunities, moderated by significant external impact forces such as regulatory shifts and climate change. Key drivers include the deep-rooted cultural importance of flowers in social traditions globally, coupled with a steady increase in global disposable incomes, particularly in Asian economies, which enables greater discretionary spending on ornamental products. Conversely, the market faces significant restraints, including the high initial capital expenditure required for establishing advanced controlled environment agriculture (CEA) facilities and the inherent vulnerability of flowers to extreme weather events, pests, and diseases, necessitating continuous prophylactic and curative measures. Opportunities arise primarily from advancements in vertical farming, which promises localized, stable production independent of climate, and the rapidly expanding e-commerce segment that enables direct, personalized consumer engagement. These factors combine to create a highly competitive environment where logistical precision and technological adoption are essential determinants of market success and resilience.

Drivers are strongly influenced by urbanization and the corresponding rise in demand for residential and commercial interior landscaping, often termed biophilic design. Furthermore, the growing awareness of the psychological benefits associated with flowers and plants (reducing stress, improving air quality) acts as a subtle but powerful market driver, pushing consumption beyond traditional celebratory moments into everyday home and office environments. However, these drivers are counterbalanced by the substantial restraints related to the global cold chain logistics challenge. Maintaining the delicate balance of temperature and humidity necessary to prevent wilting and degradation across transcontinental shipping routes results in high transportation costs and significant risks of post-harvest losses, deterring entry for smaller, geographically disadvantaged producers.

The primary opportunities for market expansion lie in developing resilient, high-value varieties through advanced breeding techniques, catering specifically to markets demanding extended vase life and unique colors. The integration of sustainable practices, such as rainwater harvesting, closed-loop irrigation systems, and the utilization of bio-stimulants instead of traditional chemical pesticides, presents an opportunity for companies to differentiate themselves and capture the growing consumer segment that prioritizes environmental responsibility. The primary impact forces affecting this sector include stringent phytosanitary regulations imposed by importing countries, which necessitate costly compliance measures, and the fluctuating prices of essential inputs like energy (for climate control) and fertilizers, which directly affect profitability and supply stability across all geographic regions.

Segmentation Analysis

The Floriculture Market is broadly segmented based on product type, application, and distribution channel, reflecting the diverse ways in which ornamental plants are produced, sold, and utilized globally. Product segmentation distinguishes between cut flowers, which are highly perishable and dominate the high-value gifting and event segments, and living plants, which include potted plants and bedding plants that cater to long-term decorative and landscaping needs. This distinction influences cultivation methods, supply chain requirements (especially cold chain intensity), and market seasonality. Cut flowers, for instance, see peak demand during major holidays like Valentine's Day and Mother's Day, requiring growers to manage high-volume, short-burst production cycles, while potted plants maintain a more stable, year-round demand profile driven by home décor trends and commercial interior design.

The application segmentation is crucial for understanding demand elasticity and end-user behavior, primarily dividing consumption into gifting, decorative use, and industrial applications such as perfumery or specialized extracts. Gifting remains the emotional cornerstone of the market, highly responsive to cultural norms and disposable income levels. Decorative applications, encompassing both home and commercial interior/exterior landscaping, are increasingly driven by architectural trends and sustainability certifications. The final segmentation, distribution channel, is currently undergoing significant disruption. While traditional channels like specialty florists and large supermarket chains maintain substantial market presence, the accelerated adoption of e-commerce and direct-to-consumer models is fundamentally altering the flow of goods, prioritizing speed, freshness, and personalized fulfillment, especially in developed markets, ensuring a shorter lead time from farm to vase.

The strategic importance of segmentation analysis lies in enabling market players to tailor their production and marketing strategies precisely. For instance, producers targeting the supermarket channel prioritize high-volume, standardized varieties that require less specialized handling, whereas those focusing on high-end florists invest in unique, luxury, or rare breeds that command premium prices. As the market matures, there is a distinct trend toward hyper-segmentation, focusing on certified organic flowers, sustainable fair-trade products, or specific species cultivated through innovative methods like vertical farming. This granularity allows companies to minimize competitive overlap and capitalize on specialized consumer preferences, thereby maximizing profit margins and strengthening brand identity within specific market niches.

- By Product Type:

- Cut Flowers (Roses, Carnations, Chrysanthemums, Tulips, Lilies, Gerberas, Others)

- Potted Plants (Orchids, Bonsai, Foliage Plants, Cacti & Succulents, Others)

- Bedding Plants

- Nursery Plants

- By Application:

- Gifting

- Decorative (Commercial, Residential, Events)

- Perfumery & Essential Oils

- Landscaping & Gardening

- By Distribution Channel:

- Specialty Florists

- Supermarkets and Hypermarkets

- Online Retail/E-commerce

- Auction Houses

- Garden Centers and Nurseries

Value Chain Analysis For Floriculture Market

The Floriculture Market value chain is inherently linear yet globally dispersed, beginning with intensive upstream activities focused on genetic innovation and specialized cultivation. The upstream segment is dominated by R&D, where plant breeders, biotechnology firms, and specialized seed/cutting suppliers develop novel varieties focusing on traits like extended vase life, unique colors, disease resistance, and adaptability to specific growing conditions (e.g., low light or high heat tolerance). This initial stage sets the quality benchmark and determines the intellectual property associated with high-demand varieties. Key stakeholders here include global breeding companies primarily located in the Netherlands and the US, providing essential starting material—seeds, bulbs, or cuttings—to commercial growers worldwide. The efficiency of this stage directly impacts subsequent yield, quality, and the global competitiveness of the final product, necessitating significant investment in genomics and plant pathology research.

The core cultivation stage involves commercial growers utilizing either open fields or, increasingly, advanced controlled environment agriculture (CEA) facilities like greenhouses and vertical farms. This midstream activity focuses on optimizing growth parameters—nutrient delivery, climate control, pest management, and timely harvesting. Post-harvest handling is a critical intermediary step, involving meticulous grading, cleaning, packaging, and, most importantly, immediate pre-cooling and storage to stop the biological aging process. The sheer perishability of floricultural products means that failures in this stage, even minor temperature fluctuations, can render the entire product worthless, necessitating strict quality control protocols and the rapid deployment of specialized preservatives.

Downstream activities center on distribution and final sales, utilizing complex direct and indirect channels. Indirect distribution overwhelmingly relies on centralized auction houses, notably the Dutch auctions (Aalsmeer), which serve as crucial clearing mechanisms, aggregating supply and setting global benchmark prices before goods are shipped internationally to wholesalers, secondary distributors, and large retailers (supermarkets). Direct channels, increasingly prominent due to e-commerce, involve growers shipping directly to large buyers or consumers, bypassing intermediaries to reduce transit time and enhance freshness. Logistics firms specializing in cold chain management are essential enablers across the entire downstream flow, connecting major production centers (e.g., Kenya, Ecuador) to high-consumption markets (e.g., Germany, UK, US). The successful navigation of this complex, time-sensitive chain defines market profitability and customer experience.

Floriculture Market Potential Customers

Potential customers for the floriculture market are exceptionally diverse, spanning B2C, B2B, and B2G segments, each purchasing products for distinct purposes and valuing different attributes, such as price, exoticism, longevity, or ethical sourcing. The largest segment remains the B2C consumer base, individuals who purchase cut flowers and potted plants primarily for gifting during celebratory occasions (holidays, birthdays, anniversaries), personal home décor, or therapeutic use (hobby gardening). This customer segment is highly influenced by seasonality, cultural trends, and marketing campaigns, increasingly utilizing online platforms for convenience and tailored arrangements. Key buying factors for B2C consumers are freshness guarantee, aesthetic appeal, perceived value, and the emotional message conveyed by the floral selection, driving demand for premium, customized bouquets and unique, long-lasting flowering plants that serve as focal points in residential settings.

The B2B segment constitutes a significant and more stable source of demand, including professional interior decorators, event management companies, wedding planners, hotels, corporate offices, and hospitals. These institutional buyers prioritize volume, consistency, reliability of supply, and adherence to specific design briefs or corporate branding standards. For instance, hotels and commercial real estate managers require large quantities of durable foliage plants and rotationally updated floral arrangements to maintain ambient aesthetics. Similarly, event planners demand specific color palettes and varieties delivered precisely on time under strict contractual obligations. This segment relies heavily on long-term relationships with established wholesalers and florists who can guarantee certified quality and consistent product availability across bulk orders, prioritizing operational dependability over slight price variations.

Furthermore, government and municipal bodies (B2G) represent a consistent demand stream for large-scale landscaping projects, public park maintenance, and beautification initiatives. These customers primarily procure bedding plants, shrubs, and ornamental trees from wholesale nurseries and garden centers, often through competitive tendering processes where factors like regional suitability, disease resistance, and volume capacity are key selection criteria. The emerging customer segment is the direct-to-consumer online subscriber base, seeking recurring flower delivery for weekly or monthly home freshness. This customer type values convenience, customization, and subscription flexibility, driving innovation in protective packaging and highly streamlined last-mile logistics, creating a predictable revenue stream for integrated growers and specialized e-commerce retailers.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 45.2 Billion |

| Market Forecast in 2033 | USD 71.5 Billion |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Dümmen Orange, Syngenta Flowers, Selecta One, Beekenkamp Group, Karuturi Global, Oserian Development Company, Marginpar, MultiFlora, Florexpo, Flamingo Horticulture, Finlays Horticulture, Ball Horticultural Company, Washington Bulb Co., PanAmerican Seed, Suntory Flowers, Fides, Danziger, Terra Nova Nurseries, HilverdaFlorist, Afriflora Haile |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Floriculture Market Key Technology Landscape

The technological landscape of the floriculture market is rapidly evolving, driven by the imperative to maximize yield, enhance product quality, and significantly reduce operational costs, particularly energy and labor inputs. Central to this transformation is the widespread adoption of Controlled Environment Agriculture (CEA), utilizing sophisticated glasshouses and emerging vertical farming structures. These environments rely heavily on advanced climate control systems integrated with Internet of Things (IoT) sensors and smart monitoring devices. IoT technology allows for precise, real-time tracking of critical environmental parameters such as substrate moisture, light intensity, root zone temperature, and atmospheric gas concentrations (e.g., CO2 levels), enabling automated system responses that minimize waste and optimize plant health at a micro-level, ensuring uniform high-quality blooms essential for the export market.

Hydroponics, aeroponics, and aquaponics represent core cultivation technologies that are replacing traditional soil-based methods, especially in high-density urban farming initiatives. These soilless systems deliver nutrient-rich water solutions directly to the roots, providing complete control over the plant's mineral intake, accelerating growth cycles, and conserving up to 90% of the water compared to open-field irrigation. Paired with this is the optimization of artificial lighting through high-efficiency LED grow lights. Modern LED technology allows growers to manipulate the light spectrum—specifically tuning the red, blue, and green wavelengths—to precisely influence morphological development, induce flowering, and enhance desired traits like stem thickness, color vibrancy, and biomass production, offering unprecedented control over the final product characteristics irrespective of external weather conditions or daylight hours.

In post-harvest and supply chain operations, technology is focused on maintaining product integrity and logistical efficiency. Advanced refrigeration and vacuum cooling technologies are standardizing the cold chain, coupled with digital tracking and monitoring solutions that use telematics to detect and flag temperature deviations during transit, ensuring accountability and reducing spoilage. Furthermore, automation is revolutionizing labor-intensive tasks; robotic arms equipped with computer vision are utilized for tasks such as transplanting seedlings, pruning, grading cut flowers based on stem length and bud size, and complex packaging, addressing persistent labor shortages while significantly improving processing speed and standardization, which is critical for meeting large retail procurement standards globally.

Regional Highlights

- Europe: Dominance in Consumption and Trade Hubs: Europe remains the leading market by value consumption, driven by high per capita spending on flowers and ornamental plants, particularly in Germany, the UK, and France. The Netherlands is the undisputed center of the global floriculture trade, acting as the primary hub for breeding, R&D, and the world's largest flower auction systems (e.g., FloraHolland). European standards demand exceptionally high quality, driving technological adoption in climate control and sustainable practices. The region imports heavily from Africa and Latin America but maintains strong internal production focusing on high-value potted plants and specialized cut flowers produced in technologically advanced glasshouses.

- Asia Pacific (APAC): Fastest Growth Trajectory: APAC is the fastest-growing market globally, propelled by rising disposable incomes, rapid urbanization, and the deep cultural significance of flowers in countries like China, India, and Japan. China is transitioning from a major internal consumer to a large-scale producer, leveraging vast domestic labor resources and expanding protected cultivation areas. Demand is primarily centered around traditional festivals (e.g., Lunar New Year) and large-scale public landscaping projects. The region presents significant opportunities for suppliers of high-quality seeds, bulbs, and cultivation technology as local farming methodologies modernize rapidly to meet escalating domestic requirements.

- North America: Focus on Localized and Specialty Production: The North American market, particularly the United States, is characterized by a strong consumer preference for domestically grown, traceable products, though it relies heavily on imports (primarily from Ecuador and Colombia) for high-volume cut flowers like roses. Key regional growth drivers include the massive expansion of the home gardening segment post-2020 and significant investment in controlled environment agriculture facilities (CEA). This strategic shift aims to secure local supply chains for specialty crops and decrease the carbon footprint associated with air freighted imports, catering to the environmentally conscious consumer base in metropolitan areas.

- Latin America: Global Production Powerhouse: Latin America, particularly Ecuador and Colombia, dominates the global supply of premium cut flowers, especially roses and carnations, capitalizing on ideal year-round climates and lower labor costs. Production in this region is optimized for export, focusing on scale and adherence to rigorous phytosanitary standards required by European and North American buyers. The market here is defined by immense scale, reliance on efficient air freight logistics, and the continuous need to invest in social and environmental compliance certifications (e.g., Fair Trade, Florverde) to maintain access to premium international markets and mitigate labor rights concerns.

- Middle East & Africa (MEA): Export Hub and Emerging Demand: The MEA region is bifurcated; East Africa (Kenya, Ethiopia) is a major global export hub, utilizing favorable climates and proximity to Europe to supply low-cost, high-volume cut flowers via air freight. Kenya is particularly dominant in rose cultivation. Meanwhile, the Middle East is an emerging consumer market, with significant demand driven by luxury spending, large-scale events, and expansive landscape beautification projects in wealthy nations like the UAE and Saudi Arabia. This consumption relies almost entirely on imports or highly sophisticated, energy-intensive controlled environment facilities due to the arid climate.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Floriculture Market.- Dümmen Orange

- Syngenta Flowers

- Selecta One

- Beekenkamp Group

- Karuturi Global

- Oserian Development Company

- Marginpar

- MultiFlora

- Florexpo

- Flamingo Horticulture

- Finlays Horticulture

- Ball Horticultural Company

- Washington Bulb Co.

- PanAmerican Seed

- Suntory Flowers

- Fides

- Danziger

- Terra Nova Nurseries

- HilverdaFlorist

- Afriflora Haile

Frequently Asked Questions

Analyze common user questions about the Floriculture market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary factor driving the growth of the global floriculture market?

The primary factor driving market growth is the increase in global disposable income, particularly in emerging Asian economies, coupled with robust expansion in e-commerce and direct-to-consumer delivery models, making flowers more accessible for gifting and everyday décor.

How is controlled environment agriculture (CEA) impacting flower production?

CEA, including advanced greenhouses and vertical farms, is crucial for ensuring year-round, consistent supply independent of climate, optimizing resource use (water, nutrients), and producing higher-quality blooms with extended vase life, addressing consumer demand for reliability.

Which product segment holds the largest share in the floriculture market?

The Cut Flowers segment holds the largest market share globally due to its historical dominance in gifting, event decoration, and ceremonial use, though the Potted Plants segment is rapidly growing due to increased interest in home décor and biophilic design.

What technological advancements are most relevant for improving cut flower longevity?

Key technologies include advanced cold chain logistics monitoring (IoT sensors and telematics), precise LED light manipulation during growth, and proprietary post-harvest handling techniques involving specialized chemical solutions and vacuum cooling to minimize biological degradation during transit.

Which region dominates the global trade and auctioning of floriculture products?

Europe dominates the global trade and consumption by value, with the Netherlands serving as the central hub for R&D, breeding, and the world's largest flower auction houses, facilitating the redistribution of products sourced globally, particularly from Africa and Latin America.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Consumer Floriculture Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Floriculture Market Size Report By Type (Cut Flowers, Bedding Plants, Potted Plants, Other), By Application (Personal Use, Gift, Conference & Activities, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Consumer Floriculture Market Size Report By Type (Cut Flowers, Bulbous Plants, Potted Flowers), By Application (Personal Use, Gifts, Conference and Activities, Others), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager