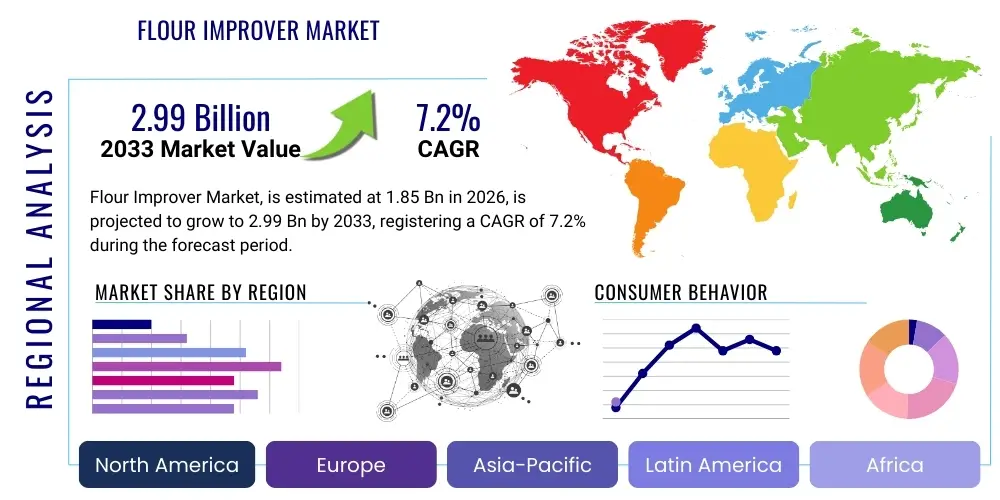

Flour Improver Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439521 | Date : Jan, 2026 | Pages : 243 | Region : Global | Publisher : MRU

Flour Improver Market Size

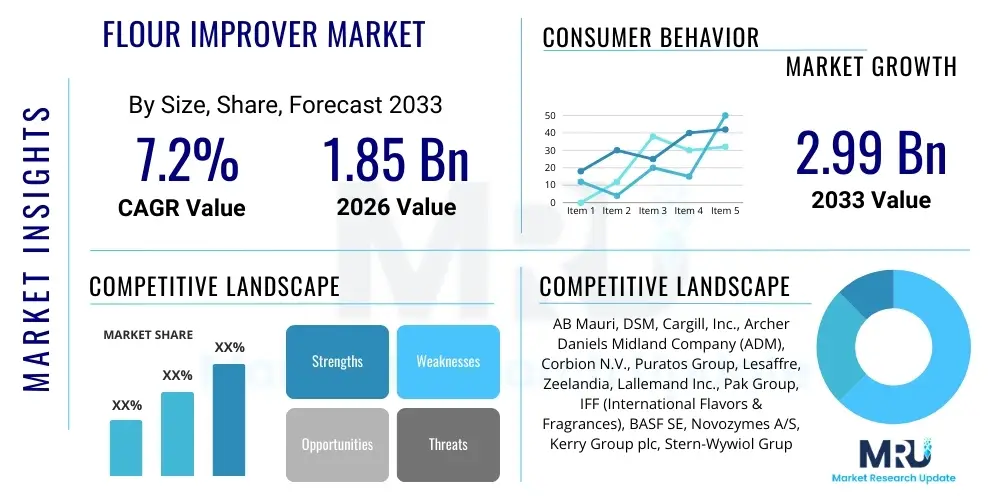

The Flour Improver Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 1.85 Billion in 2026 and is projected to reach USD 2.99 Billion by the end of the forecast period in 2033. This robust expansion is primarily driven by the escalating global demand for high-quality baked goods, increasing urbanization, and the evolving consumer preferences for convenience foods that maintain superior taste and texture. Flour improvers are indispensable in modern baking, playing a critical role in enhancing dough rheology, improving bread volume and crumb structure, extending the shelf life of products, and ensuring consistent quality across diverse baking applications and varying flour attributes. The market's significant growth trajectory is further bolstered by continuous advancements and innovations in enzyme technology, emulsifiers, and oxidizing agents, which empower bakers to overcome challenges posed by diverse flour qualities and complex industrial production processes. Manufacturers are increasingly concentrating on developing sustainable and clean-label improver solutions to comply with stringent food safety regulations and to cater to the growing segment of health-conscious consumers, thereby contributing substantially to overall market value and accelerating product adoption. The competitive landscape is marked by strategic initiatives such as mergers, acquisitions, collaborative partnerships, and extensive product portfolio expansions, especially targeting rapidly growing bakery sectors in emerging economies. These strategic moves aim to secure a dominant market position and capitalize on the expanding consumption of processed and artisanal bakery products worldwide.

Flour Improver Market introduction

The Flour Improver Market encompasses a diverse range of additives and enzyme preparations designed to enhance the quality, consistency, and functional performance of flour in various baking and food processing applications. These essential ingredients address challenges such as variability in flour quality, processing inconsistencies, and the demand for specific characteristics in finished baked goods, ranging from improved dough handling properties to enhanced volume, texture, and extended shelf life. Products within this market include enzymatic improvers (amylases, xylanases, proteases, lipases), emulsifiers (DATEM, SSL), oxidizing agents (ascorbic acid, azodicarbonamide), reducing agents, and other functional ingredients, often combined into proprietary blends tailored for specific baked goods like bread, cakes, pastries, and noodles. The primary objective of flour improvers is to optimize dough development, strengthen gluten networks, improve gas retention during fermentation, and enhance the overall aesthetic and sensorial attributes of the final product, thereby meeting both industrial production efficiency requirements and consumer expectations for quality. Their application allows for greater flexibility in using different flour types and enables bakers to produce high-quality products consistently, irrespective of variations in raw material sourcing. The market's continuous evolution is driven by technological advancements in ingredient science, allowing for more targeted and efficient solutions that address specific baking challenges and consumer demands. Furthermore, the growing trend towards industrial-scale baking and the increasing consumption of processed and convenience foods globally significantly underpin the demand for these crucial ingredients.

Major applications for flour improvers span a broad spectrum of the food industry, most prominently in bread and rolls, where they are critical for achieving optimal loaf volume, crumb structure, and crust properties. Beyond basic bread production, these improvers are extensively utilized in the manufacturing of cakes, biscuits, cookies, pastries, noodles, pizza bases, and various other leavened and unleavened products. The benefits derived from incorporating flour improvers are multifaceted, including improved dough stability and machinability, which is vital for high-speed industrial production lines, enhanced fermentation tolerance, superior product texture (softer crumb, finer grain), increased product volume, and a noticeable extension of freshness and shelf life. For manufacturers, these benefits translate into reduced waste, improved production efficiency, and the ability to consistently deliver premium products that meet rigorous quality standards and consumer expectations. For consumers, the outcome is access to a wider variety of appealing, fresh, and high-quality baked goods. The driving factors for this market's robust growth are manifold, anchored by the rapid expansion of the global bakery industry, a rising preference for convenience and ready-to-eat food items, increasing per capita consumption of bread and other flour-based products, and significant technological advancements in enzyme and ingredient science that allow for the development of highly specialized and effective improver blends. Additionally, the growing focus on reducing food waste by extending product freshness further stimulates demand for these essential ingredients, making them indispensable components in modern food production.

Flour Improver Market Executive Summary

The Flour Improver Market is experiencing dynamic shifts, driven by evolving business trends focused on sustainability, clean label formulations, and specialized functionality. Major players are strategically investing in research and development to introduce next-generation improvers that cater to specific regional flour characteristics and diverse product lines, emphasizing natural ingredients and enzyme-based solutions over chemical additives. This strategic shift is largely in response to consumer demand for healthier, transparently labeled food products and the industry’s push for more efficient and environmentally friendly production processes. Companies are also expanding their global footprint through mergers, acquisitions, and partnerships, particularly targeting high-growth emerging markets where the bakery sector is rapidly industrializing and modernizing. The increasing adoption of automated baking processes further necessitates consistent flour performance, amplifying the demand for high-efficacy flour improvers that can ensure uniformity and quality at scale. Supply chain optimization and ingredient sourcing become critical as manufacturers seek to maintain cost-effectiveness while adhering to quality and sustainability standards. Innovation is not just confined to product formulation; it also extends to application techniques and customized solutions that provide a competitive edge. The drive for food waste reduction also plays a significant role, as improvers that extend the shelf life of baked goods offer economic benefits and align with broader sustainability goals, reinforcing their value proposition across the entire food supply chain. Overall, the business landscape is characterized by intense competition, a strong focus on innovation, and a proactive response to changing consumer preferences and regulatory environments.

Regional trends indicate significant growth in the Asia Pacific market, fueled by increasing urbanization, rising disposable incomes, and the Westernization of dietary habits, leading to a surge in demand for convenience bakery products. Countries like China, India, and Southeast Asian nations are witnessing rapid expansion in their bakery and confectionary industries, driving substantial investment in flour improver technologies. Europe, a mature market, continues to innovate with a strong emphasis on clean label, organic, and gluten-free flour improvers, driven by stringent food regulations and health-conscious consumers. North America demonstrates a consistent demand, primarily due to the large-scale industrial baking sector and ongoing product diversification, including specialty breads and artisan bakery items. Latin America and the Middle East & Africa regions are emerging as promising markets, showing increased adoption of advanced baking technologies and a growing consumer base for processed foods. Each region presents unique opportunities and challenges, from ingredient sourcing complexities to varied consumer preferences and regulatory landscapes. Local manufacturers often partner with global players to access advanced formulations and market expertise, contributing to the regional market's evolution. The overall market is also influenced by global commodity price fluctuations for raw materials, impacting production costs and pricing strategies. Furthermore, the increasing focus on localized flavors and textures in baked goods worldwide necessitates adaptable and versatile flour improver solutions that can be customized to meet specific cultural and culinary demands, thus creating nuanced regional market dynamics.

In terms of segmentation trends, the enzyme-based flour improvers segment is witnessing the most rapid growth, attributed to their natural origin, high specificity, and effectiveness in improving dough characteristics without requiring chemical additives, aligning perfectly with clean label trends. Amylases, xylanases, and proteases are particularly prominent within this category. The emulsifiers segment, though mature, continues to hold a significant market share due to their proven functionality in dough strengthening and crumb softening, with innovations focusing on more natural or plant-derived options. The oxidizing agents segment, while facing some regulatory scrutiny for certain ingredients, remains crucial for gluten strengthening in specific applications, with ascorbic acid gaining preference. Application-wise, bread and rolls constitute the largest segment, driven by their staple food status and the industrial scale of production, demanding consistent quality and longer shelf life. However, other segments like cakes, pastries, and noodles are also showing robust growth as consumer preferences diversify. The demand for customized flour improver blends is increasing, allowing bakers to fine-tune their products for unique attributes and processing conditions. Furthermore, the trend towards specialized flours, such as whole grain, gluten-free, and ancient grain flours, creates a parallel demand for improvers specifically formulated to address the unique challenges these flours present. This diversification in both improver types and their applications underscores a market moving towards greater specialization, driven by technological advancement and a deep understanding of baking science.

AI Impact Analysis on Flour Improver Market

Common user questions regarding AI's impact on the Flour Improver Market frequently revolve around efficiency gains, quality control improvements, and the potential for new product development. Users are keen to understand how AI can optimize the formulation of improver blends, predict ingredient interactions, and automate quality assessment processes in real-time. Concerns often include the initial investment costs, data security, and the need for specialized expertise to implement and manage AI systems within the traditional baking industry. Expectations include AI leading to more precise, consistent, and customized improver solutions, enabling predictive maintenance for baking equipment, and fostering sustainable practices through optimized ingredient usage and waste reduction. There is also a strong interest in AI's role in accelerating R&D, potentially discovering novel enzymes or functional ingredients, and fine-tuning processing parameters to achieve superior baked good characteristics, ultimately enhancing both productivity and product innovation within the sector.

- AI-driven predictive analytics optimize flour improver formulations by analyzing vast datasets of flour characteristics, baking conditions, and finished product quality, leading to more precise and effective blends.

- Automated quality control systems, powered by AI, monitor dough rheology, fermentation processes, and final product attributes in real-time, ensuring consistent quality and reducing human error.

- AI enhances research and development by simulating ingredient interactions and predicting the performance of new improver components, significantly accelerating the discovery and commercialization of novel solutions.

- Supply chain optimization benefits from AI's ability to forecast demand for specific improvers, manage inventory efficiently, and identify reliable suppliers, mitigating risks and improving cost-effectiveness.

- Personalized baking solutions are emerging, with AI platforms assisting bakers in customizing improver blends to suit unique flour types, regional preferences, and specific desired product characteristics.

- Sustainability initiatives are bolstered by AI's capacity to optimize ingredient usage, minimize waste in production, and improve energy efficiency in baking processes, contributing to a reduced environmental footprint.

- Predictive maintenance for baking equipment can be integrated with AI, identifying potential issues before they cause downtime, thereby ensuring uninterrupted production and consistent application of improvers.

DRO & Impact Forces Of Flour Improver Market

The Flour Improver Market is shaped by a complex interplay of drivers, restraints, opportunities, and various impact forces that influence its growth trajectory and competitive landscape. Key drivers include the ever-increasing global demand for high-quality, consistent, and extended shelf-life baked goods, driven by urbanization, changing consumer lifestyles, and the expansion of convenience food sectors. Technological advancements in enzyme technology and ingredient science continually provide more effective and natural solutions, reducing the reliance on chemical additives and aligning with clean label trends. The industrialization and automation of the baking industry worldwide necessitate precise and reliable flour improvers to ensure consistent product output at scale, further bolstering demand. Restraints on market growth include the volatility in raw material prices, particularly for enzymes and specialty chemicals, which can impact production costs and overall profitability. Stringent food safety regulations and varying standards across different regions pose compliance challenges for manufacturers, requiring significant investment in research and development to meet diverse legislative requirements. Consumer perceptions regarding food additives, even those deemed safe and beneficial, can sometimes lead to resistance, pushing for more "natural" or "clean" label alternatives, which can limit the adoption of certain improver types. Opportunities for market expansion lie in the burgeoning demand for specialized improvers for alternative flours (e.g., gluten-free, whole grain, ancient grains) and in developing regions where the bakery sector is experiencing rapid modernization. The growing focus on reducing food waste by extending the freshness and shelf life of baked goods presents a significant opportunity for innovative improver solutions. Furthermore, customization of improver blends to cater to specific regional tastes, processing conditions, and unique product requirements offers a strong pathway for market penetration and differentiation. Impact forces encompass technological innovation, which constantly introduces new and more efficient improvers, regulatory changes influencing permissible ingredients, economic fluctuations affecting consumer spending on baked goods, and shifts in consumer preferences towards health, wellness, and sustainability. The competitive intensity, driven by a blend of multinational corporations and specialized ingredient providers, also plays a crucial role in shaping market dynamics. These forces collectively define the market’s evolution, challenging manufacturers to adapt and innovate continuously.

Segmentation Analysis

The Flour Improver Market is meticulously segmented across various parameters including ingredient type, application, and form, providing a comprehensive view of its intricate dynamics. This segmentation allows for a detailed analysis of specific market niches, growth drivers, and competitive landscapes within each category. Understanding these segments is crucial for stakeholders to identify key growth areas, formulate targeted strategies, and innovate effectively to meet diverse industry and consumer demands. For instance, the prevalence of enzyme-based improvers reflects a shift towards natural solutions, while the dominance of the bread and rolls application segment underscores its fundamental importance in global dietary patterns. Each segment presents unique challenges and opportunities, influenced by technological advancements, regulatory environments, and evolving consumer preferences. The market's overall growth is a composite of the performance of these individual segments, each contributing to the broader narrative of an indispensable component in modern baking and food processing. Further sub-segmentation within these categories allows for even finer granular insights, highlighting specialized needs and emerging trends such as improvers for specific flour types like whole wheat or gluten-free flours, or tailored solutions for artisanal baking versus industrial production lines. This detailed breakdown ensures that the report captures the full complexity and potential of the flour improver industry.

- By Ingredient Type:

- Enzymes (Amylases, Xylanases, Proteases, Lipases, Glucose Oxidase, etc.)

- Emulsifiers (DATEM, SSL, CSL, Mono- and Diglycerides, Lecithin)

- Oxidizing Agents (Ascorbic Acid, Azodicarbonamide (ADA), Potassium Bromate (though usage declining due to regulatory concerns))

- Reducing Agents (L-Cysteine, Sodium Metabisulfite)

- Other Ingredients (Gluten, Soy Flour, Fungal Alpha-Amylase, Yeast nutrients, Dextrins)

- By Application:

- Bread & Rolls

- Cakes & Pastries

- Biscuits & Cookies

- Noodles & Pasta

- Pizza Dough

- Donuts

- Other Bakery Products (e.g., Tortillas, Waffles, Crackers)

- By Form:

- Powder

- Granular

- Liquid

- By Function:

- Dough Strengthening

- Volume Enhancement

- Crumb Softening

- Anti-Staling

- Shelf Life Extension

- Processing Aid

Value Chain Analysis For Flour Improver Market

The value chain for the Flour Improver Market begins with the upstream analysis, which involves the sourcing and processing of raw materials crucial for the production of these specialized ingredients. This stage primarily includes the cultivation and processing of agricultural products such as cereals (for enzymes), oilseeds (for emulsifiers), and various chemicals (for oxidizing and reducing agents). Key upstream players are agricultural suppliers, chemical manufacturers, and biotechnology companies that specialize in enzyme production through fermentation processes. The quality and availability of these raw materials are paramount, directly influencing the cost, purity, and efficacy of the final flour improver products. Research and development activities also form a significant part of the upstream segment, where innovation in enzyme discovery, genetic engineering of microorganisms, and synthesis of novel functional ingredients drives product differentiation and competitive advantage. Relationships with raw material suppliers are often long-term, built on trust, quality assurance, and adherence to sustainability practices. Ensuring a stable and high-quality supply of inputs is critical for manufacturers to maintain consistent product quality and manage production costs effectively. Furthermore, adherence to regulatory standards for raw material sourcing and processing is increasingly important, particularly with the global emphasis on clean label and sustainable ingredient solutions, compelling upstream players to adopt transparent and ethical practices. The efficiency and reliability of these upstream operations directly impact the downstream production capabilities and the market competitiveness of flour improver manufacturers.

Moving downstream, the value chain encompasses the manufacturing, distribution, and end-use of flour improvers. Manufacturers blend and formulate the raw materials into finished improver products, often creating customized solutions for specific baking applications or regional flour characteristics. This stage involves complex chemical and biological processes, quality control, and packaging. The distribution channel is multifaceted, including direct sales from manufacturers to large industrial bakeries, and indirect sales through a network of distributors, wholesalers, and specialized ingredient suppliers that cater to small and medium-sized bakeries, as well as retail customers. Large multinational food ingredient companies typically leverage extensive global distribution networks to reach diverse markets efficiently. Direct sales allow for closer relationships with key industrial clients, offering tailored technical support and product customization, which is crucial for high-volume users. Indirect channels, conversely, enable broader market penetration, reaching a wider array of customers who might require smaller quantities or a more diverse product range. The effectiveness of the distribution network is a critical success factor, ensuring timely delivery, technical assistance, and market responsiveness. Moreover, regulatory compliance during transportation and storage, particularly for temperature-sensitive enzyme-based products, adds another layer of complexity to the downstream operations. Ultimately, the end-users of flour improvers are the various segments of the baking and food processing industries, including industrial bakeries, artisanal bakeries, confectioneries, noodle manufacturers, and food service providers. Their feedback and evolving demands continuously shape the product development and service offerings across the entire value chain.

The interplay between direct and indirect distribution channels is a defining characteristic of the flour improver market's downstream segment. Direct sales are predominantly to large-scale industrial bakeries and food manufacturers that have substantial and consistent demand, often requiring customized improver blends and comprehensive technical support. These relationships are typically long-term, involving direct communication between the improver manufacturer's R&D and sales teams and the client's production and quality control departments. This direct approach fosters deep understanding of client needs, enabling rapid innovation and tailored solutions. In contrast, indirect distribution through a network of specialized food ingredient distributors, brokers, and wholesalers serves a broader market, including smaller artisanal bakeries, confectioneries, and regional food processors. These distributors often aggregate products from multiple manufacturers, providing a one-stop shop for diverse ingredient needs and offering logistical advantages for clients requiring smaller quantities or a wide variety of ingredients. The choice between direct and indirect channels is often dictated by client size, geographical reach, product complexity, and the level of technical support required. Hybrid models are also common, where manufacturers maintain direct relationships with strategic key accounts while utilizing distributors to penetrate fragmented or geographically dispersed markets. The efficiency of both direct and indirect channels is continuously optimized through technological advancements in logistics, inventory management, and customer relationship management systems. The strategic deployment of these channels ensures that flour improvers are accessible to the entire spectrum of the food processing industry, from global giants to local craft bakeries, thereby maximizing market reach and responsiveness to diverse customer needs and market trends. Strong distribution partnerships are essential for scaling operations and maintaining a competitive edge in a dynamic global market.

Flour Improver Market Potential Customers

Potential customers for the Flour Improver Market span a wide array of entities within the food processing and baking industries, representing diverse operational scales and product focuses. At the forefront are large-scale industrial bakeries, which operate extensive automated production lines for staples like bread, rolls, buns, and pre-packaged pastries. These entities prioritize consistency, efficiency, extended shelf life for mass distribution, and cost-effectiveness, making flour improvers indispensable for maintaining product quality across millions of units daily. They often require highly customized blends to suit their specific flour sources, machinery, and desired product characteristics. Beyond traditional bakeries, specialized manufacturers of various flour-based convenience foods, such as frozen dough products, pizza bases, tortillas, and snack crackers, represent a significant customer segment. These manufacturers rely on improvers to ensure the structural integrity, texture, and freshness of their products under diverse processing and storage conditions. The demand from this segment is driven by the global trend towards convenience and ready-to-eat food options, which require products to withstand various handling stages without compromising quality. The growing sophistication of food science and production technologies within these large-scale operations further fuels the demand for advanced and highly specialized flour improver solutions that can address complex challenges in modern food manufacturing environments. The ability of improvers to facilitate automation and enhance product resilience makes them critical for maintaining efficiency and competitive advantage in this high-volume sector.

Another crucial customer segment comprises artisanal bakeries and local confectioneries, though their individual procurement volumes are smaller than industrial giants. These businesses value flour improvers for their ability to enhance product quality, texture, and consistency, allowing them to differentiate their offerings and maintain customer loyalty. For artisanal bakers, improvers can compensate for variations in local flour quality and provide greater control over dough properties, especially when working with traditional or specialized baking methods. They often seek improvers that support natural fermentation processes or specific textural outcomes desired in artisan breads and pastries. Additionally, noodle and pasta manufacturers constitute a distinct segment, utilizing improvers to enhance dough elasticity, reduce breakage during processing, improve textural mouthfeel, and extend the shelf life of fresh and dried pasta products. The specific functional requirements for pasta differ significantly from those for bread, necessitating specialized improver formulations. The food service industry, including restaurants, hotels, and catering companies that prepare baked goods in-house, also represents a growing customer base. These establishments benefit from improvers that simplify baking processes, reduce preparation time, and ensure consistent quality, especially when skilled labor might be limited. The increasing global awareness of gluten-free diets and the demand for products made from alternative flours also open up opportunities for specialized flour improvers designed for these niche applications, targeting manufacturers who cater to these dietary needs. Overall, the diversity of potential customers underscores the widespread utility and adaptability of flour improvers across the entire food industry spectrum, serving both large-scale industrial production and smaller, specialized operations.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 2.99 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AB Mauri, DSM, Cargill, Inc., Archer Daniels Midland Company (ADM), Corbion N.V., Puratos Group, Lesaffre, Zeelandia, Lallemand Inc., Pak Group, IFF (International Flavors & Fragrances), BASF SE, Novozymes A/S, Kerry Group plc, Stern-Wywiol Gruppe (Mühlenchemie), Calpro Foods, Fazer Group (Finnsugar), Goodmills Group, Bellarise, Grindsted (DuPont Nutrition & Health). |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flour Improver Market Key Technology Landscape

The Flour Improver Market is characterized by a dynamic and continuously evolving technology landscape, primarily driven by advancements in biotechnology, enzyme engineering, and food chemistry. A pivotal area of innovation lies in enzyme technology, where continuous research is focused on identifying and developing novel enzymes with highly specific functionalities. This includes engineering microorganisms to produce enzymes like highly thermostable amylases, potent xylanases for specific flour types, and lipases that target specific lipid substrates to improve dough rheology and crumb structure. The goal is to create enzymes that are more efficient at lower dosages, effective across a wider range of pH and temperature conditions, and capable of producing precise effects without undesirable off-flavors or textures. Furthermore, advancements in genetic engineering and bioinformatics are accelerating the discovery and optimization of enzyme variants, allowing manufacturers to tailor improver solutions with unparalleled precision for diverse baking applications and flour qualities. This focus on enzymatic solutions aligns perfectly with the growing consumer demand for clean label products, as enzymes are often considered processing aids rather than ingredients, allowing for simpler, more natural ingredient declarations on finished goods. The ability to create highly targeted enzymatic blends enhances product consistency, extends freshness, and optimizes processing efficiency in an increasingly automated baking industry.

Beyond enzymes, the technological landscape also encompasses significant progress in the development of emulsifiers and oxidizing/reducing agents. In the emulsifier segment, the trend is towards more natural and plant-derived alternatives, such as lecithin, alongside the enhancement of traditional emulsifiers like DATEM and SSL to improve their functional properties and cost-effectiveness. Research is also exploring new emulsifier structures that can provide superior dough stability and crumb softening, even in challenging baking environments. For oxidizing agents, there is a clear shift away from controversial chemicals like azodicarbonamide (ADA) and potassium bromate towards safer, more consumer-friendly options like ascorbic acid (Vitamin C) and its derivatives, as well as glucose oxidase, which offers a natural oxidative effect. Innovations in encapsulated ingredients are also noteworthy, allowing for controlled release of active components during different stages of baking, thereby maximizing their efficacy and preventing premature reactions. Furthermore, the integration of advanced analytical techniques, such as rheology meters, near-infrared spectroscopy (NIR), and high-performance liquid chromatography (HPLC), plays a crucial role in understanding flour characteristics and improver interactions, enabling formulators to develop more precise and effective blends. This comprehensive approach to technology, combining biological, chemical, and analytical advancements, ensures that the flour improver market continues to deliver sophisticated solutions that meet the complex demands of the modern baking industry and evolving consumer preferences.

Regional Highlights

- Asia Pacific (APAC): Expected to be the fastest-growing region, driven by increasing urbanization, rising disposable incomes, changing dietary habits towards Western-style baked goods, and rapid industrialization of the bakery sector in countries like China, India, and Southeast Asian nations.

- Europe: A mature market characterized by strong innovation, a high demand for clean label, organic, and non-GMO flour improvers, stringent food regulations, and sophisticated consumer preferences for specialty and artisan bakery products. Germany, France, and the UK are key markets.

- North America: Significant market share due to the presence of large-scale industrial bakeries, high per capita consumption of bread and convenience bakery items, and continuous product diversification, including gluten-free and health-oriented baked goods. The US and Canada are dominant.

- Latin America: Emerging market with increasing adoption of modern baking technologies, growing demand for processed and convenience foods, and expanding food service sector. Brazil and Mexico are key growth engines.

- Middle East & Africa (MEA): Growing market influenced by population growth, rising incomes, expanding tourism sector, and increasing investment in food processing infrastructure. Saudi Arabia, UAE, and South Africa are notable contributors.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flour Improver Market.- AB Mauri

- DSM

- Cargill, Inc.

- Archer Daniels Midland Company (ADM)

- Corbion N.V.

- Puratos Group

- Lesaffre

- Zeelandia

- Lallemand Inc.

- Pak Group

- IFF (International Flavors & Fragrances)

- BASF SE

- Novozymes A/S

- Kerry Group plc

- Stern-Wywiol Gruppe (Mühlenchemie)

- Calpro Foods

- Fazer Group (Finnsugar)

- Goodmills Group

- Bellarise

- DuPont Nutrition & Health (now part of IFF)

Frequently Asked Questions

What are flour improvers and why are they used in baking?

Flour improvers are functional ingredients, often enzyme-based, used to enhance the quality, consistency, and processability of flour in baking. They improve dough properties, increase loaf volume, extend shelf life, and achieve desired crumb structure, compensating for variations in flour quality and optimizing industrial production efficiency.

How do flour improvers impact the shelf life of baked goods?

Flour improvers, particularly those with anti-staling properties like certain enzymes (e.g., amylases), significantly extend the shelf life of baked goods by slowing down the retrogradation of starch. This process helps maintain softness, freshness, and desirable texture over a longer period, reducing food waste.

Are clean label flour improvers a growing trend in the market?

Yes, clean label flour improvers are a major growth trend, driven by increasing consumer demand for natural, transparently sourced, and chemical-free food products. Manufacturers are increasingly developing enzyme-based and other naturally derived solutions that align with these preferences.

What is the role of enzyme technology in the flour improver market?

Enzyme technology is pivotal in the flour improver market, offering highly specific and efficient solutions. Enzymes like amylases, xylanases, and proteases target specific components in flour to improve dough rheology, gas retention, and crumb structure, often replacing chemical additives to meet clean label demands.

Which regions are driving the growth of the flour improver market?

The Asia Pacific region, particularly countries like China and India, is a primary driver of market growth due to rapid urbanization, increasing disposable incomes, and the expansion of the industrial bakery sector. Europe and North America also contribute significantly with innovations in specialty and convenience baked goods.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager