Flour Treatment Agent Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 440357 | Date : Jan, 2026 | Pages : 255 | Region : Global | Publisher : MRU

Flour Treatment Agent Market Size

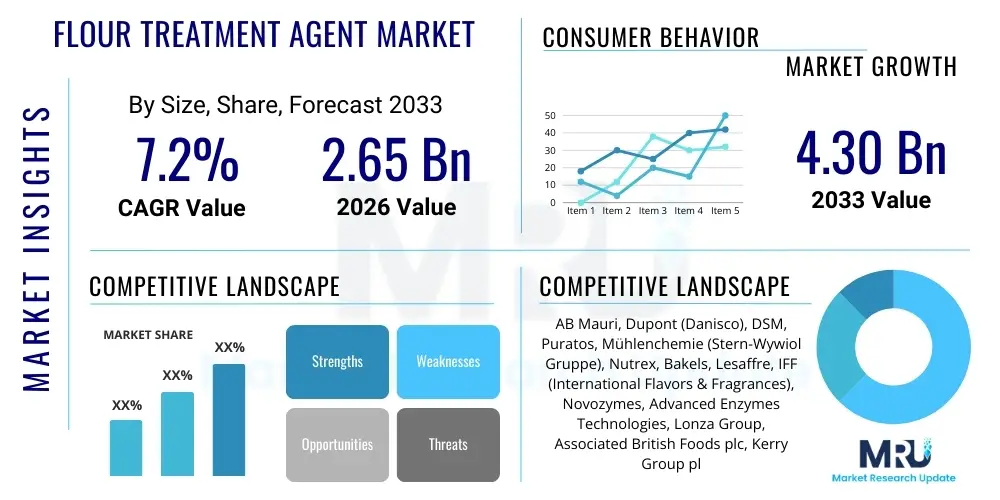

The Flour Treatment Agent Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.2% between 2026 and 2033. The market is estimated at USD 2.65 Billion in 2026 and is projected to reach USD 4.30 Billion by the end of the forecast period in 2033.

Flour Treatment Agent Market introduction

The flour treatment agent market encompasses a diverse range of additives designed to improve the functional properties of flour, primarily for baking and food processing applications. These agents enhance dough rheology, improve loaf volume, optimize crumb structure, extend product shelf life, and ensure consistency in baked goods. From oxidizing and reducing agents to enzymes and emulsifiers, these ingredients play a critical role in standardizing flour quality, which can vary significantly based on wheat variety, harvest conditions, and milling processes. The global demand for flour treatment agents is intrinsically linked to the expanding bakery industry, driven by evolving consumer dietary preferences and the rising consumption of convenience foods.

Major applications for flour treatment agents span a wide spectrum of food products, including various types of bread, cakes, pastries, noodles, pasta, and biscuits. In breadmaking, they are crucial for achieving optimal gluten development, leading to better elasticity, gas retention, and overall texture. For pastries and cakes, these agents contribute to desired tenderness, volume, and extended freshness. The primary benefits derived from the judicious use of flour treatment agents include improved product quality, enhanced processing efficiency, reduced production costs through waste minimization, and the ability to consistently meet consumer expectations for appearance, taste, and texture. These benefits are pivotal for manufacturers aiming to maintain competitive advantage in a dynamic food market.

Several driving factors are propelling the growth of the flour treatment agent market. The increasing global population and urbanization are leading to a surge in demand for processed and convenience foods, particularly baked goods, in both developed and emerging economies. Innovations in food technology, especially in enzyme biotechnology, are enabling the development of more effective and natural-label-friendly treatment solutions. Furthermore, the rising focus on food quality, safety, and extended shelf life by both consumers and regulatory bodies is encouraging bakers and food manufacturers to adopt advanced flour treatment solutions. The globalization of food tastes also necessitates consistent flour performance across diverse product lines and geographical regions, further stimulating market expansion.

Flour Treatment Agent Market Executive Summary

The flour treatment agent market is experiencing robust growth, primarily fueled by the burgeoning global bakery and food processing industries. Business trends indicate a strong move towards enzyme-based and clean-label solutions, driven by consumer demand for natural ingredients and industry efforts to replace synthetic additives. Strategic collaborations between enzyme manufacturers and flour millers, along with investments in R&D for novel functional ingredients, are shaping the competitive landscape. Companies are increasingly focusing on customized solutions that address specific flour characteristics and product requirements, leading to enhanced product differentiation and market penetration.

Regional trends highlight Asia Pacific as a rapidly expanding market, attributed to its large population, rising disposable incomes, and the Westernization of diets leading to increased consumption of bread and other baked goods. North America and Europe, while mature markets, continue to innovate, with a strong emphasis on organic, non-GMO, and allergen-free flour treatment agents. Latin America and the Middle East & Africa regions are also showing significant growth potential, driven by urbanization and the expansion of organized retail and food service sectors. Each region presents unique challenges and opportunities, influencing product development and distribution strategies for market players.

Segmentation trends reveal a sustained dominance of enzyme-based treatment agents due to their natural origin, high efficiency, and versatility across various applications. Amylases, lipases, and proteases remain the most widely used enzymes for improving dough handling and final product quality. By application, the bread segment holds the largest share, followed by cakes, pastries, and noodles, reflecting global dietary staples. The shift towards industrial and commercial bakeries, which require consistent, high-volume production, further solidifies the demand for reliable and efficient flour treatment solutions, driving technological advancements and market growth across these segments.

AI Impact Analysis on Flour Treatment Agent Market

User inquiries regarding AI's impact on the flour treatment agent market primarily revolve around how artificial intelligence can optimize production processes, enhance quality control, facilitate new product development, and improve supply chain efficiency. Users are keenly interested in AI's potential to predict flour performance based on real-time data, personalize treatment formulations, and automate complex analytical tasks to ensure consistent output. There is also an expectation that AI could accelerate the discovery of novel enzyme structures or natural alternatives, addressing the industry's push for cleaner labels and sustainable practices. Concerns often touch upon the initial investment costs, data privacy, and the need for specialized skills to integrate AI technologies effectively into existing operations, alongside questions about the ethical implications of AI-driven optimization in food ingredient formulation.

- AI optimizes enzyme production through predictive modeling, enhancing yield and purity.

- AI-driven sensors and vision systems enable real-time quality control of flour and dough.

- Predictive analytics helps customize flour treatment agent blends based on flour quality variability.

- Machine learning algorithms accelerate the discovery of new functional enzymes and natural additives.

- AI improves supply chain efficiency by forecasting demand and optimizing inventory management.

- Automated systems for dosage and mixing ensure precise application of treatment agents.

- Data analytics platforms provide insights into product performance, aiding R&D and formulation refinement.

- Robotics in packaging and handling of flour treatment agents increases operational speed and safety.

DRO & Impact Forces Of Flour Treatment Agent Market

The flour treatment agent market is shaped by a complex interplay of drivers, restraints, and opportunities. Key drivers include the escalating global demand for baked goods and processed foods, propelled by urbanization, changing lifestyles, and rising disposable incomes, particularly in emerging economies. The continuous innovation in baking technology and the need for consistent product quality in large-scale industrial bakeries also significantly boost demand. Furthermore, the increasing consumer preference for natural ingredients and clean label products is driving research and development into enzyme-based and other bio-derived treatment agents, fostering market growth.

However, the market faces several restraints. Stringent regulatory frameworks and varying food additive regulations across different regions pose significant challenges for manufacturers, requiring complex compliance processes and potentially limiting market entry for certain ingredients. Consumer perception regarding synthetic additives and a general trend towards "less processed" foods can also create resistance to some flour treatment agents, pushing manufacturers towards more natural or enzyme-based alternatives. The volatility in raw material prices, such as for specific enzymes or emulsifier components, can impact production costs and profit margins, further constraining market expansion.

Despite these challenges, substantial opportunities exist. The growing demand for gluten-free and specialty baked goods opens new avenues for customized flour treatment solutions designed to improve the texture and shelf life of these challenging products. Advances in biotechnology and enzyme engineering offer the potential for developing highly specific, efficient, and cost-effective treatment agents that align with clean label trends. Furthermore, the expansion into untapped markets in developing countries, coupled with the rising adoption of western dietary habits, presents significant growth prospects for manufacturers willing to adapt to local preferences and regulatory environments. Strategic partnerships and mergers among key players can also lead to synergistic innovation and market expansion.

Segmentation Analysis

The flour treatment agent market is broadly segmented based on various critical attributes, allowing for a comprehensive understanding of its dynamics and consumer preferences. These segments include classification by type of agent, application area, form, and source, each revealing distinct market trends and growth trajectories. The detailed segmentation helps stakeholders identify niche markets, target specific consumer needs, and strategize product development and marketing efforts effectively. Understanding these segments is crucial for market players to tailor their offerings and maximize their market penetration in a highly competitive landscape.

- By Type

- Oxidizing Agents (e.g., Ascorbic Acid, Azodicarbonamide)

- Reducing Agents (e.g., L-Cysteine, Sodium Metabisulphite)

- Enzymes (e.g., Amylase, Lipase, Protease, Glucose Oxidase, Hemicellulase)

- Emulsifiers (e.g., Diacetyl Tartaric Acid Esters of Mono- and Diglycerides (DATEM), Sodium Stearoyl Lactylate (SSL))

- Others (e.g., Calcium Carbonate, Soy Flour)

- By Application

- Bread (White Bread, Whole Wheat Bread, Specialty Breads)

- Cakes and Pastries

- Noodles and Pasta

- Biscuits and Cookies

- Others (e.g., Tortillas, Pizza Bases, Crackers)

- By Form

- Powder

- Liquid

- Granular

- By Source

- Synthetic

- Natural (Enzyme-based, Plant-based)

Value Chain Analysis For Flour Treatment Agent Market

The value chain for the flour treatment agent market initiates with the sourcing of various raw materials, which include chemical precursors for synthetic agents, microbial strains for enzyme production, and agricultural products for natural additives. Upstream analysis involves a network of chemical manufacturers, biotechnology companies, and agricultural suppliers providing these essential components. The quality and availability of these raw materials significantly influence the cost and efficacy of the final flour treatment agents. Suppliers in this segment often specialize in high-purity ingredients and advanced synthesis or fermentation processes, forming the foundational layer of the value chain.

Following raw material procurement, the manufacturing phase involves complex processes such as chemical synthesis, fermentation, purification, and blending to produce the desired flour treatment agents. Manufacturers in this segment, who are often large ingredient companies, invest heavily in R&D to develop innovative, efficient, and cost-effective solutions. They also focus on ensuring compliance with global food safety standards and regulations. This stage adds significant value through specialized knowledge, technological expertise, and stringent quality control, transforming basic raw materials into functional food ingredients.

Downstream analysis focuses on the distribution and end-use of flour treatment agents. The distribution channel can be direct, where manufacturers supply directly to large industrial bakeries and food processors, or indirect, involving a network of distributors, wholesalers, and specialized ingredient suppliers. These intermediaries play a crucial role in market reach, logistics, and providing technical support to smaller bakeries and food businesses. The end-users, primarily industrial bakeries, commercial bakeries, food service providers, and confectionery manufacturers, integrate these agents into their flour to achieve desired product characteristics, thereby completing the value chain. The effectiveness of this distribution network is vital for ensuring timely delivery and widespread adoption of flour treatment agents across diverse food industry segments.

Flour Treatment Agent Market Potential Customers

The primary consumers and end-users of flour treatment agents are entities within the food processing and baking industries that require consistent flour performance to produce high-quality and standardized products. Industrial bakeries constitute a significant customer segment, relying on these agents to manage large-scale production of bread, buns, and other baked goods, ensuring uniformity in texture, volume, and freshness across millions of units. Their demand is driven by the need for efficiency, reduced waste, and adherence to specific product specifications, making flour treatment agents indispensable for their operations.

Commercial bakeries, ranging from medium-sized operations to local patisseries, also represent a substantial customer base. While their scale may be smaller than industrial giants, the need for product consistency, improved dough handling, and extended shelf life remains critical for their business. They often seek versatile and easy-to-use flour treatment solutions that can accommodate a variety of recipes and baking methods, from artisan breads to delicate pastries, contributing to their brand reputation and customer satisfaction.

Beyond traditional bakeries, the food service industry, including restaurants, catering companies, and quick-service establishments, utilizes pre-mixes and prepared doughs that often incorporate flour treatment agents. Furthermore, manufacturers of noodles, pasta, biscuits, cookies, and other processed flour-based products are key buyers. These companies leverage flour treatment agents to optimize the textural properties, cooking characteristics, and stability of their offerings, ensuring consumer appeal and meeting stringent quality benchmarks in a competitive global food market. The diverse applications underscore the broad customer base for these essential food ingredients.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.65 Billion |

| Market Forecast in 2033 | USD 4.30 Billion |

| Growth Rate | 7.2% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | AB Mauri, Dupont (Danisco), DSM, Puratos, Mühlenchemie (Stern-Wywiol Gruppe), Nutrex, Bakels, Lesaffre, IFF (International Flavors & Fragrances), Novozymes, Advanced Enzymes Technologies, Lonza Group, Associated British Foods plc, Kerry Group plc, Cargill, BASF SE, Corbion, Lallemand Inc., Palsgaard A/S, Chr. Hansen Holding A/S |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flour Treatment Agent Market Key Technology Landscape

The flour treatment agent market is continuously evolving, driven by advancements in food science and biotechnology, with a significant emphasis on developing more efficient, sustainable, and consumer-friendly solutions. One of the most prominent technological trends is the widespread adoption and continuous innovation in enzyme technology. Enzyme engineering, including directed evolution and rational design, enables the creation of highly specific enzymes (e.g., improved amylases, lipases, glucose oxidases, xylanases) that can precisely target desired flour components to enhance dough rheology, crumb structure, and shelf life, often allowing for "clean label" formulations by reducing the need for chemical additives. This area is characterized by ongoing research into novel microbial sources and genetic modification to produce enzymes with enhanced stability and activity under various baking conditions.

Another crucial technological development involves the encapsulation of flour treatment agents. Encapsulation technologies, such as microencapsulation, allow for controlled release of active ingredients during specific stages of the dough mixing or baking process. This technology ensures optimal functionality, protects sensitive agents from degradation, and can improve the stability and extend the shelf life of the treatment agents themselves. It is particularly beneficial for ingredients that are highly reactive or whose full effect is desired at a particular temperature or hydration level, offering greater precision and efficiency in their application within complex baking systems, minimizing premature reactions.

Furthermore, there is a growing focus on developing natural and plant-based alternatives to synthetic flour treatment agents. This includes exploring extracts from various plants, seeds, and grains that possess functional properties such as antioxidant activity, emulsifying capabilities, or dough strengthening effects. The use of advanced extraction and purification techniques is vital in isolating these functional compounds while maintaining their efficacy and natural integrity. Coupled with analytical techniques like chromatography and spectroscopy, these technologies enable the characterization and optimization of novel natural ingredients, supporting the industry's shift towards clean label and health-conscious product offerings, and addressing consumer demand for transparency in food ingredients.

Regional Highlights

- North America: A mature market characterized by high consumption of processed and convenience foods. Key drivers include a sophisticated food processing industry and strong demand for consistent product quality. Innovation focuses on natural, organic, and non-GMO solutions. The U.S. and Canada are dominant.

- Europe: A significant market with stringent food safety regulations and a strong inclination towards clean label and enzyme-based solutions. Western European countries like Germany, France, and the UK lead in consumption, driven by established bakery traditions and advanced food technology.

- Asia Pacific (APAC): The fastest-growing region, propelled by increasing population, rapid urbanization, rising disposable incomes, and the Westernization of diets. Countries like China, India, Japan, and Southeast Asian nations are experiencing booming demand for baked goods and noodles, driving market expansion.

- Latin America: Emerging as a promising market due to economic growth, changing food habits, and the expansion of the organized retail sector. Brazil, Mexico, and Argentina are key contributors, with increasing demand for bread, pastries, and other processed foods.

- Middle East and Africa (MEA): Demonstrating steady growth, driven by urbanization, population growth, and the expansion of the food service industry. Countries in the GCC region and South Africa are notable markets, with growing consumer awareness about quality baked products.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flour Treatment Agent Market.- AB Mauri

- Dupont (Danisco)

- DSM

- Puratos

- Mühlenchemie (Stern-Wywiol Gruppe)

- Nutrex

- Bakels

- Lesaffre

- IFF (International Flavors & Fragrances)

- Novozymes

- Advanced Enzymes Technologies

- Lonza Group

- Associated British Foods plc

- Kerry Group plc

- Cargill

- BASF SE

- Corbion

- Lallemand Inc.

- Palsgaard A/S

- Chr. Hansen Holding A/S

Frequently Asked Questions

What are flour treatment agents used for?

Flour treatment agents are used to improve the functional properties of flour, enhancing dough rheology, improving loaf volume, optimizing crumb structure, extending shelf life, and ensuring consistency in various baked goods and flour-based products.

Are flour treatment agents safe for consumption?

Yes, when used within approved regulatory limits, flour treatment agents are considered safe. Regulatory bodies globally, such as the FDA and EFSA, evaluate and approve their use based on extensive scientific studies to ensure consumer safety.

What is the difference between oxidizing and reducing agents?

Oxidizing agents strengthen the gluten network, leading to better dough elasticity and gas retention, while reducing agents weaken the gluten network, making dough more extensible and easier to process, particularly for biscuits and crackers.

How do enzymes contribute to flour treatment?

Enzymes act as natural catalysts to break down specific components in flour, such as starch or proteins, to improve dough handling, enhance fermentation, increase loaf volume, and extend the freshness and softness of the final baked product.

What are the key trends in the flour treatment agent market?

Key trends include a shift towards clean label and natural ingredients, increasing demand for enzyme-based solutions, growing consumption of convenience baked goods, and rising adoption of customized treatment solutions to address varying flour qualities and regional preferences.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager