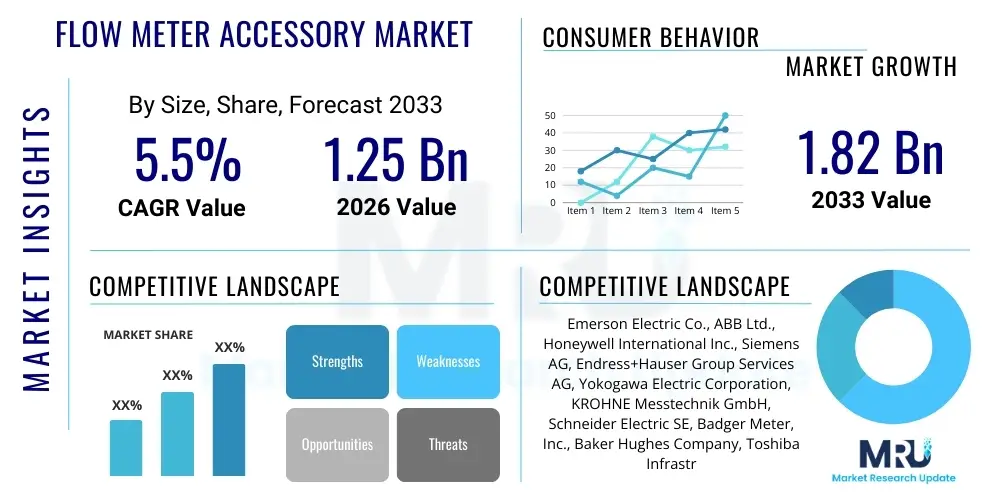

Flow Meter Accessory Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433021 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Flow Meter Accessory Market Size

The Flow Meter Accessory Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.5% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.82 Billion by the end of the forecast period in 2033.

Flow Meter Accessory Market introduction

The Flow Meter Accessory Market encompasses a specialized segment of industrial equipment focusing on components essential for the optimal functioning, maintenance, calibration, and integration of flow meters across various process industries. These accessories, which range from mounting hardware, specialized flanges, transmitters, signal converters, power supplies, flow conditioners, and diagnostic tools, play a critical role in ensuring measurement accuracy, system reliability, and extended lifespan of the primary flow measurement device. Flow meters, critical instruments for quantifying fluid dynamics in pipelines, require robust accessory infrastructure to handle demanding conditions such as high pressure, extreme temperatures, and corrosive media.

Major applications driving the demand for flow meter accessories include critical processes within the oil and gas sector (upstream, midstream, and downstream), water and wastewater management (for distribution and regulatory compliance), chemical processing (for batch control and safety monitoring), and the pharmaceutical and food and beverage industries (requiring high purity and sanitary connections). The accessories facilitate seamless integration into complex industrial automation systems, enabling remote monitoring and data logging functionalities crucial for modern industrial operations. The increasing global focus on efficient resource management and regulatory compliance regarding emissions and water usage mandates the employment of highly accurate flow measurement, thereby sustaining the demand for high-performance accessories.

Key benefits derived from utilizing high-quality flow meter accessories include enhanced measurement accuracy by minimizing external influences (e.g., turbulence through flow conditioners), reduced total cost of ownership (TCO) through improved diagnostics and simplified maintenance procedures, and extended system longevity due to superior material compatibility and robust mechanical design. Driving factors for this market include the widespread adoption of Industry 4.0 and the Industrial Internet of Things (IIoT), necessitating smarter, connected accessories, alongside significant global investments in infrastructure development, particularly in emerging economies focused on upgrading water treatment and energy production facilities.

Flow Meter Accessory Market Executive Summary

The Flow Meter Accessory Market is characterized by steady, technology-driven growth, propelled by the global shift towards intelligent process automation and stringent environmental regulations demanding higher measurement precision. Current business trends indicate a strong emphasis on modular and standardized accessory designs that promote interchangeability and ease of maintenance, favoring vendors offering integrated solutions and strong digital diagnostic capabilities. Technological advancements are focused on developing accessories compatible with wireless communication protocols (e.g., WirelessHART) and specialized materials suitable for extreme and sanitary applications, positioning customization as a key competitive differentiator. Market consolidation is moderate, with established players focusing on acquiring niche technology providers to bolster their digital offerings and broaden their accessory portfolios for complex flow measurement applications.

Regionally, the market exhibits divergent growth trajectories. North America and Europe maintain dominance, driven by robust regulatory frameworks governing industrial emissions and high investment in modernizing existing infrastructure, particularly in mature oil and gas and chemical sectors. However, the Asia Pacific (APAC) region is projected to register the highest growth rate, fueled by rapid industrialization, massive infrastructure projects (water utilities, power generation), and increasing governmental spending on smart city initiatives that require extensive flow monitoring networks. Latin America and the Middle East & Africa (MEA) present significant opportunities, primarily associated with expanding oil and gas exploration activities and necessary upgrades to foundational utility services, creating persistent demand for rugged and reliable accessory components.

Segmentation trends reveal that transmitters and signal converters remain the largest segment by product type, reflecting the ongoing necessity to integrate analog flow measurement signals into digital control systems (DCS/PLC). By end-user, the water and wastewater treatment sector is witnessing accelerated growth due to escalating global water scarcity issues and the subsequent need for precise leakage detection and billing accuracy, heavily relying on specialized flanges, mounting kits, and connectivity accessories. Furthermore, accessories designed for specialized flow meters, such as Coriolis and ultrasonic devices, are outpacing those for traditional differential pressure meters, driven by the requirement for accessories that can handle complex fluid dynamics and high-accuracy applications prevalent in high-value manufacturing processes.

AI Impact Analysis on Flow Meter Accessory Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Flow Meter Accessory Market primarily revolve around how AI enhances predictive maintenance capabilities, optimizes calibration schedules, and transforms the data generated by flow meter systems. Users are keenly interested in whether AI-driven analytics can preemptively identify accessory component failure (like transmitter drift or power supply instability) before catastrophic system failure occurs, thus maximizing uptime. They also question the role of AI in processing vast datasets from multiple accessories to fine-tune system performance parameters and improve overall measurement reliability. The key themes summarize user expectations for AI to shift accessory usage from reactive replacement to proactive, data-informed lifecycle management, enabling smarter inventory management and significantly reducing operational expenditure (OPEX) associated with unexpected failures.

- AI algorithms facilitate predictive diagnostics within smart transmitters and signal converters, anticipating component degradation.

- Machine learning models optimize calibration cycles for flow meters by analyzing historical drift data from associated accessories, minimizing unnecessary downtime.

- AI integration in cloud-based platforms enhances remote monitoring capabilities, allowing for proactive inventory planning and accessory replacement scheduling.

- Enhanced data processing through AI improves noise filtration and compensation in complex flow conditions, increasing the effective accuracy reliance on sophisticated accessories.

- AI contributes to the development of self-validating or self-calibrating accessory systems, reducing the reliance on manual verification procedures.

DRO & Impact Forces Of Flow Meter Accessory Market

The dynamics of the Flow Meter Accessory Market are fundamentally shaped by a confluence of accelerating industrial digitization, stringent regulatory oversight, and complex infrastructural demands. The primary drivers include the pervasive trend of Industry 4.0 adoption, which mandates connected and intelligent accessory components for real-time monitoring and control. Furthermore, global infrastructural investment in water management, oil & gas pipeline expansions, and chemical processing upgrades necessitates large volumes of durable and reliable accessory components. The restraints mainly center on the high initial investment required for advanced, digitized accessories compared to traditional mechanical parts, coupled with the slow standardization across different regions and reluctance from legacy industrial operators to fully integrate sophisticated IIoT-enabled systems. Opportunities arise from the booming demand for specialized accessories in niche markets such as hydrogen production and carbon capture, and the rising need for retrofit solutions to modernize existing industrial facilities. The overall market is heavily impacted by the cyclical nature of capital expenditure in the oil and gas sector and the accelerating pace of digital transformation across all process industries.

Drivers: The increasing global adoption of Industrial Internet of Things (IIoT) protocols necessitates accessories with enhanced digital communication capabilities (HART, Profibus, Ethernet/IP). Additionally, the focus on asset integrity management in sectors like energy and refining compels operators to invest in high-reliability accessories that support diagnostic functions and minimize unplanned downtime. Regulatory mandates, particularly those concerning environmental protection and custody transfer measurement accuracy, consistently push the demand for certified, high-precision accessories, such as specialized calibration kits and certified primary elements. This regulatory pressure ensures sustained investment in accessory components even during economic slowdowns, emphasizing compliance and safety.

Restraints: Significant restraints include the technical complexity involved in integrating accessories from disparate vendors into existing legacy systems, leading to interoperability challenges that deter widespread adoption of the newest smart accessories. Furthermore, fluctuating commodity prices, especially crude oil, often lead to delayed or canceled capital projects in the oil and gas sector, directly impacting the procurement volumes of highly specific, high-cost accessories. A secondary constraint is the shortage of skilled personnel capable of installing, configuring, and maintaining highly sophisticated digital accessories, particularly in developing economies, which slows down the technological transition.

Opportunities: The substantial opportunity landscape is defined by the growing market for retrofit accessories designed to upgrade millions of installed flow meters globally, enabling them with modern digital capabilities without complete system overhaul. The emergence of specialized applications, such as high-purity flow accessories for biotechnology and specialized materials for harsh environments (e.g., geothermal energy), offers lucrative growth avenues for specialized manufacturers. Moreover, the increasing demand for energy efficiency monitoring and sophisticated process optimization presents an ongoing requirement for advanced transmitters and communication accessories that provide granular, actionable data to control systems.

Segmentation Analysis

The Flow Meter Accessory Market is broadly segmented based on product type, material, application, and end-use industry, providing a granular view of market dynamics and adoption patterns. Segmentation by product type reveals a dominance of electronic accessories, specifically transmitters, due to the universal need to convert raw sensor signals into standardized industrial communication formats. Mechanical accessories, such as flanges, mounting kits, and flow conditioners, form a foundational segment driven by infrastructural maintenance and new construction. Material segmentation highlights the growing demand for specialized, non-corrosive materials (e.g., stainless steel, PTFE, exotic alloys) crucial for sanitary and aggressive fluid applications. These segmentation details are vital for manufacturers aiming to target specific industrial requirements with optimized product portfolios.

The application segmentation often differentiates between high-pressure, high-temperature, sanitary, and standard flow measurement needs, directly correlating to the type and robustness of the required accessory. For instance, custody transfer applications necessitate highly certified accessories with robust security features, whereas general utility applications may rely on more cost-effective standard components. End-use industry analysis confirms that heavy process industries—Oil & Gas, Chemical, and Water & Wastewater—remain the largest consumers, accounting for the bulk of demand for high-specification, durable accessories. The detailed segmentation analysis provides strategic insights for market entry and product differentiation, emphasizing the trend toward customization and performance optimization over generic component supply.

- By Product Type:

- Transmitters and Signal Converters

- Flow Conditioners and Straightening Vanes

- Mounting Hardware (Flanges, Gaskets, Valves)

- Power Supplies and Wiring Harnesses

- Calibration and Verification Tools

- Display Units and Indicators

- By Flow Meter Type:

- Differential Pressure Flow Meter Accessories

- Coriolis Flow Meter Accessories

- Magnetic Flow Meter Accessories

- Ultrasonic Flow Meter Accessories

- Turbine Flow Meter Accessories

- By Material:

- Stainless Steel (316L, 304)

- Carbon Steel

- Plastics and Polymers (PTFE, PEEK)

- Exotic Alloys (Hastelloy, Monel)

- By End-Use Industry:

- Oil and Gas

- Water and Wastewater Treatment

- Chemical and Petrochemical

- Power Generation (Conventional and Renewables)

- Food and Beverage

- Pharmaceutical and Biotechnology

Value Chain Analysis For Flow Meter Accessory Market

The value chain for the Flow Meter Accessory Market initiates with the raw material suppliers, predominantly providing specialized metals (e.g., high-grade stainless steel for flanges and enclosures) and electronic components (semiconductors, specialized circuits for transmitters). Upstream analysis highlights the critical nature of reliable supply chains for certified materials, as accessory performance is directly tied to material integrity, especially in corrosive and high-pressure environments. The core manufacturing stage involves precision machining, fabrication, and assembly, requiring high technical expertise to meet strict dimensional tolerances and communication standards. Key activities at this stage include the development of proprietary algorithms for signal processing in smart transmitters and advanced metallurgy for robust mechanical components.

The downstream segment focuses on distribution channels, which are characterized by a mix of direct sales to large Original Equipment Manufacturers (OEMs) and major End-Users (like national oil companies), and an extensive network of indirect distributors and system integrators. System integrators play a vital role, often bundling accessories with flow meters and control systems to deliver complete measurement solutions, particularly crucial for complex projects in the chemical or pharmaceutical sectors. Direct distribution is favored for specialized, high-value accessories requiring significant technical support, while indirect channels efficiently handle standardized, high-volume items.

The post-sales segment of the value chain, encompassing installation, calibration, maintenance, and technical support, is highly critical. Since flow meter accessories directly impact measurement accuracy, end-users depend heavily on robust support services, including certified field technicians and remote diagnostic services. The effectiveness of the value chain is increasingly measured by the ability of participants to seamlessly integrate digital components, ensuring compatibility with evolving IIoT architectures and providing timely, data-driven maintenance insights, thereby locking in customer loyalty through superior service delivery rather than solely relying on hardware sales.

Flow Meter Accessory Market Potential Customers

The potential customers for flow meter accessories are diverse, spanning all sectors involved in fluid handling, process control, and resource management. The primary end-users are large industrial operators requiring continuous, accurate monitoring of liquid, gas, or steam flow. These buyers prioritize product reliability, adherence to industrial standards (e.g., NEMA, ATEX, API), and seamless integration capabilities with existing plant infrastructure. Procurement decisions are heavily influenced by the accessories' ability to reduce operational risks, maximize uptime, and ensure regulatory compliance, meaning customers often seek suppliers with strong application expertise and global service networks. Given the long lifecycle of flow meters, potential customers also include maintenance and overhaul (MRO) departments focused on retrofit and replacement components.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.82 Billion |

| Growth Rate | CAGR 5.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., ABB Ltd., Honeywell International Inc., Siemens AG, Endress+Hauser Group Services AG, Yokogawa Electric Corporation, KROHNE Messtechnik GmbH, Schneider Electric SE, Badger Meter, Inc., Baker Hughes Company, Toshiba Infrastructure Systems & Solutions Corporation, Fuji Electric Co., Ltd., Brooks Instrument, Danaher Corporation (Setra Systems), Spirax Sarco Engineering plc, Flowserve Corporation, Christian Bürkert GmbH & Co. KG, GF Piping Systems (Georg Fischer AG), Teledyne Technologies Incorporated, Dwyer Instruments, LLC |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flow Meter Accessory Market Key Technology Landscape

The Flow Meter Accessory Market is heavily influenced by the integration of advanced diagnostic capabilities and connectivity standards, moving beyond simple mechanical components toward smart, data-enabled solutions. Key technology advancements center around improving accuracy, extending lifespan, and facilitating remote monitoring. The transition towards Industry 4.0 paradigms necessitates accessories that are compatible with Industrial Internet of Things (IIoT) frameworks, demanding enhanced communication protocols such as HART, Foundation Fieldbus, and Profibus. These technologies allow flow meter accessories, such as specialized sensors, transmitters, and signal converters, to function as integral parts of a complex automation ecosystem, enabling predictive maintenance and real-time process optimization. The focus is shifting to highly specialized materials (e.g., ceramics, PEEK, exotic alloys) for accessories used in harsh environments (high pressure, high temperature, corrosive media), ensuring reliability and chemical compatibility, which is critical in sectors like chemical processing and upstream oil and gas.

Furthermore, the technological landscape includes innovations in wireless connectivity and power management for remote or inaccessible installations. Low-power wide-area network (LPWAN) technologies, including LoRaWAN and NB-IoT, are increasingly utilized in accessory components to transmit flow data wirelessly, significantly reducing installation complexity and cabling costs. This trend is particularly evident in large-scale water management and distribution networks. Calibration and verification accessories are also undergoing digitalization, incorporating sophisticated software algorithms and portable testing equipment that minimize downtime and ensure compliance with stringent regulatory standards (e.g., ISO, API). The adoption of modular designs allows users to easily upgrade or replace accessory components, promoting long-term system flexibility and reducing total cost of ownership (TCO).

The integration of advanced sensing elements, such as micro-electromechanical systems (MEMS) technology for highly precise differential pressure measurements, represents a significant technological leap. For ultrasonic and magnetic flow meters, accessories now include sophisticated signal processing units that filter out noise and compensate for fluid property variations, thus enhancing measurement fidelity under non-ideal conditions. The development of specialized flow conditioners and straightening vanes, utilizing computational fluid dynamics (CFD) analysis during design, ensures laminar flow conditions upstream of the meter, addressing one of the major sources of measurement error. This emphasis on enhancing signal integrity and robustness through intelligent accessory design is pivotal in maintaining high performance in demanding industrial applications. The shift towards proprietary diagnostic tools embedded within transmitters, utilizing edge computing principles, enables localized fault detection and self-correction, further reducing latency and reliance on central control systems.

The evolution of cybersecurity standards is also highly pertinent, particularly for smart accessories utilizing network connectivity. Manufacturers are increasingly incorporating robust encryption and authentication mechanisms within their transmitter and communication modules to protect sensitive operational data from external threats, aligning accessory technology with critical infrastructure protection mandates. Material science innovation continues to be a cornerstone, particularly in the development of corrosion-resistant coatings and lightweight composite materials for housing and mounting components, optimizing system longevity and installation efficiency, especially in offshore and maritime applications.

Another crucial technological element is the integration of advanced human-machine interfaces (HMI) and diagnostic displays directly into accessory units. These localized interfaces provide technicians with immediate, contextual information regarding flow meter health, calibration status, and fault diagnostics without needing to access the central control room. This capability, often facilitated by augmented reality (AR) support tools accessible via mobile devices, streamlines field service operations and minimizes the potential for human error during maintenance, thereby contributing significantly to overall plant safety and operational efficiency.

Regional Highlights

- North America: This region holds a leading market share, characterized by high adoption rates of advanced flow measurement technology, stringent environmental and safety regulations, and significant ongoing modernization projects in the oil and gas (shale plays), chemical, and food & beverage industries. Demand is driven by the need for high-accuracy custody transfer accessories and IIoT-enabled transmitters compliant with highly specialized communication protocols.

- Europe: Europe is a mature market focusing heavily on sustainability and efficiency. Growth is concentrated in the water/wastewater sector, driven by EU directives on water quality and leakage reduction, necessitating specialized smart accessories for widespread monitoring networks. The chemical and pharmaceutical industries also drive demand for high-purity, standardized, and traceable accessory components.

- Asia Pacific (APAC): APAC is the fastest-growing market, primarily fueled by massive infrastructural investments in China, India, and Southeast Asia. Rapid industrialization, urbanization, and expansion of utility networks (power, water) generate substantial demand for both basic mechanical accessories (flanges, piping) and digital transmitters for new installations and expansive monitoring systems.

- Latin America: This region's market growth is closely tied to the volatile nature of the energy sector, particularly in Brazil and Mexico. There is a strong, sustained demand for robust and durable accessories capable of operating reliably in challenging field environments within oil production and refining facilities, alongside moderate investments in upgrading public water infrastructure.

- Middle East and Africa (MEA): Growth in MEA is dominated by large-scale capital projects in the oil and gas sector (upstream exploration and export terminals) and major desalination and power generation plants. The region requires highly specialized, high-temperature, and high-pressure accessories compliant with international safety standards, making it a lucrative, albeit specification-heavy, market segment.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flow Meter Accessory Market.- Emerson Electric Co.

- ABB Ltd.

- Honeywell International Inc.

- Siemens AG

- Endress+Hauser Group Services AG

- Yokogawa Electric Corporation

- KROHNE Messtechnik GmbH

- Schneider Electric SE

- Badger Meter, Inc.

- Baker Hughes Company

- Toshiba Infrastructure Systems & Solutions Corporation

- Fuji Electric Co., Ltd.

- Brooks Instrument

- Danaher Corporation (Setra Systems)

- Spirax Sarco Engineering plc

- Flowserve Corporation

- Christian Bürkert GmbH & Co. KG

- GF Piping Systems (Georg Fischer AG)

- Teledyne Technologies Incorporated

- Dwyer Instruments, LLC

Frequently Asked Questions

Analyze common user questions about the Flow Meter Accessory market and generate a concise list of summarized FAQs reflecting key topics and concerns.What role do flow conditioners play in improving flow meter accuracy?

Flow conditioners, a critical accessory, minimize fluid turbulence and swirl generated by upstream pipe components (valves, pumps). By establishing a predictable, laminar flow profile immediately before the flow meter, they significantly reduce measurement error, which is crucial for high-accuracy applications like custody transfer and regulatory monitoring.

How is the adoption of IIoT influencing the demand for flow meter transmitters?

IIoT significantly boosts demand for smart transmitters and signal converters, as they are essential for converting analog flow data into digital, actionable information compliant with networking protocols (HART, Ethernet/IP). This digitalization enables remote diagnostics, cloud connectivity, and predictive maintenance functionality, which are core tenets of Industry 4.0.

Which end-use industry is expected to show the fastest growth in accessory adoption?

The Water and Wastewater Treatment sector is projected to exhibit the fastest growth in accessory adoption. This is driven by global initiatives for smart water management, pipeline leakage detection, and the necessity to deploy vast networks of monitoring points requiring robust, durable, and network-enabled mounting and transmission accessories.

What are the primary material requirements for flow meter accessories in the chemical industry?

In the chemical industry, accessories must utilize highly corrosion-resistant materials such as 316L stainless steel, PTFE, or specialized exotic alloys (e.g., Hastelloy). This material selection is mandatory to ensure chemical compatibility, prevent contamination, and guarantee long-term operational integrity under exposure to aggressive process fluids and high temperatures.

What is the main challenge faced by manufacturers in the Flow Meter Accessory Market?

The primary challenge for manufacturers is ensuring seamless interoperability and standardization across a highly fragmented industrial control landscape. Developing accessories that reliably interface with diverse flow meter technologies (e.g., Coriolis, Magnetic, DP) and communicate via multiple proprietary and open-source industrial protocols simultaneously requires continuous investment in complex software and hardware integration, increasing R&D costs.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager