Flow Switches Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435475 | Date : Dec, 2025 | Pages : 242 | Region : Global | Publisher : MRU

Flow Switches Market Size

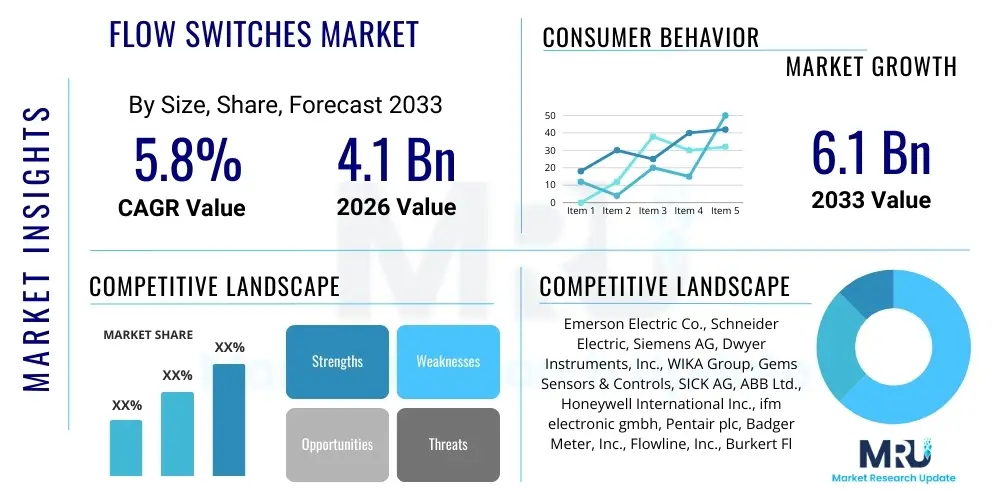

The Flow Switches Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 4.1 Billion in 2026 and is projected to reach USD 6.1 Billion by the end of the forecast period in 2033. This consistent growth trajectory is primarily underpinned by increasing infrastructural development across emerging economies, coupled with stringent safety and regulatory standards mandated for critical fluid handling systems in industries such as oil and gas, chemical processing, and water/wastewater management. The modernization of existing industrial facilities, particularly in North America and Europe, also drives the replacement cycle for older, less efficient mechanical switches with advanced electronic and thermal dispersion variants.

The market expansion is further influenced by the growing demand for automation and process optimization in manufacturing environments. Flow switches are integral components in monitoring liquid or gas flow rates, ensuring system integrity, preventing equipment damage, and maintaining efficiency. The shift towards smart factories utilizing Industrial Internet of Things (IIoT) technologies necessitates highly reliable, precise flow monitoring devices that can integrate seamlessly with centralized control systems, thereby boosting the adoption of magnetic, paddle, and ultrasonic flow switch technologies. Capital expenditure increases in sectors prioritizing environmental compliance, such as HVAC and utilities, also contribute significantly to the overall market valuation.

Flow Switches Market introduction

Flow switches are electromechanical or electronic devices designed to monitor the rate of fluid (liquid or gas) movement within a pipeline or process system, triggering an alarm or initiating a corrective action when the flow rate deviates from a predetermined setpoint. These devices are critical safety and control mechanisms, preventing catastrophic equipment failures, dry running of pumps, or overheating in critical cooling systems. The product landscape encompasses several types, including paddle (mechanical), thermal dispersion, ultrasonic, and magnetic/electromagnetic switches, each tailored for specific fluid types, pressure ranges, and operational environments. Their utility spans diverse sectors, where precise flow confirmation is non-negotiable for operational integrity and regulatory adherence.

Major applications for flow switches are concentrated in HVAC systems (monitoring coolant circulation), water treatment plants (confirming disinfection additive flow), petrochemical refineries (ensuring lubricant and chemical transfer rates), and power generation facilities (safeguarding cooling loops for turbines). The primary benefits derived from the deployment of these devices include enhanced process safety, maximized equipment lifespan by preventing operational stress, improved energy efficiency, and compliance with industry-specific operational guidelines. Furthermore, modern flow switches offer diagnostic capabilities, providing predictive maintenance alerts and integrating sophisticated digital communication protocols like Modbus and HART, thereby increasing their value proposition in complex industrial control architectures.

Key driving factors propelling this market include the global expansion of infrastructure projects, particularly in water and sewage systems in Asia Pacific and Latin America, coupled with the mandatory automation drive across mature industrial sectors. Increased focus on preventive maintenance strategies, supported by data generated from smart flow switches, reduces downtime and operational costs. Moreover, regulatory pushes concerning environmental protection and industrial safety, demanding reliable shutdown mechanisms based on flow conditions, continually stimulate demand for accurate and dependable flow monitoring solutions across all regional markets.

Flow Switches Market Executive Summary

The global Flow Switches Market is characterized by robust technological advancements focusing on non-intrusive measurement techniques and enhanced connectivity features to align with Industry 4.0 standards. Business trends indicate a strong move toward specialization, with manufacturers developing highly durable, corrosion-resistant switches for harsh environments, notably in offshore oil and gas and chemical processing. Strategic alliances, mergers, and acquisitions remain prevalent as key players seek to consolidate market share, expand their technological portfolios (especially in thermal and ultrasonic sensing), and improve regional distribution networks, particularly targeting high-growth areas in Southeast Asia and the Middle East. Furthermore, sustainable manufacturing practices and the development of energy-efficient switches are becoming competitive differentiators, responding to corporate social responsibility mandates and consumer preference for green technologies.

Regional trends reveal that North America and Europe, while mature, maintain leadership in terms of technological innovation and high-value applications, driven by stringent safety regulations and significant investment in smart manufacturing and pharmaceutical sectors. The Asia Pacific region is expected to exhibit the fastest growth, fueled by rapid industrialization, large-scale infrastructural development (especially in China and India), and growing adoption of sophisticated flow control systems in municipal water management and thermal power generation. Conversely, regulatory volatility and economic instability in certain parts of Latin America and Africa present constraints, though investment in basic utility infrastructure continues to provide foundational market demand in these regions.

Segment trends underscore the increasing dominance of electronic flow switches (thermal dispersion and ultrasonic) over traditional mechanical switches (paddle type), due to superior accuracy, lower maintenance requirements, and better integration capabilities with distributed control systems (DCS) and programmable logic controllers (PLCs). The process industry vertical, encompassing chemicals, oil and gas, and food and beverage, remains the largest application segment, demanding high reliability and resistance to corrosive media. However, the commercial segment, particularly HVAC and building automation, is witnessing accelerated growth as systems become increasingly complex and require granular flow monitoring for optimized energy performance and occupant safety.

AI Impact Analysis on Flow Switches Market

Common user questions regarding AI's impact on the Flow Switches Market typically revolve around whether AI will replace traditional sensing hardware, how predictive maintenance capabilities are enhanced, and what role AI plays in optimizing complex flow networks. Users are primarily concerned with the transition cost, data security, and the necessity of integrating AI algorithms with existing legacy flow control infrastructure. Key themes emerging from these inquiries highlight expectations for AI to move beyond simple monitoring toward predictive diagnostics, adaptive control tuning, and holistic system optimization. Users anticipate that AI integration will significantly reduce false positives, improve calibration intervals, and provide nuanced insights into operational anomalies based on multivariate data analysis gathered from smart flow switches and surrounding sensors.

The integration of Artificial Intelligence primarily affects the data analysis layer rather than the physical sensing mechanism of the flow switch itself. AI algorithms are essential for processing the large volumes of flow data, temperature readings, and pressure metrics transmitted by smart flow switches (equipped with IIoT connectivity). This advanced analysis enables highly accurate anomaly detection, distinguishing between genuine equipment failure precursors and transient process variations. By applying machine learning models to historical operational data, end-users can develop customized behavioral baselines, leading to more precise predictive maintenance scheduling, maximizing asset uptime, and minimizing costly unscheduled shutdowns—a paradigm shift from traditional reactive maintenance triggers.

Furthermore, AI facilitates adaptive control. In complex systems, such as large-scale cooling towers or chemical reactors, flow requirements are often dynamic. AI-driven systems can analyze real-time process inputs (e.g., product quality, external temperature, energy consumption) and adjust the flow switch setpoints or control valve positions autonomously through the feedback loop. This level of optimization ensures the system runs at peak efficiency under varying conditions, significantly improving resource utilization (e.g., reduced chemical consumption or energy use) and ensuring tighter process stability, thereby driving demand for AI-ready, digitally enabled flow switch hardware.

- AI enhances predictive maintenance by analyzing flow patterns to anticipate component failure before it occurs.

- Machine learning optimizes setpoint accuracy, reducing calibration frequency and improving operational stability.

- AI facilitates anomaly detection, drastically cutting down on false alarms caused by minor pressure or temperature fluctuations.

- Integration with AI platforms drives demand for smart flow switches equipped with IIoT connectivity and digital protocols (e.g., OPC UA).

- AI-driven adaptive control enables real-time tuning of flow parameters, maximizing energy efficiency in fluid handling systems.

DRO & Impact Forces Of Flow Switches Market

The dynamics of the Flow Switches Market are shaped by powerful Drivers (D) such as the increasing global focus on industrial safety standards and regulatory compliance, particularly in hazardous environments like oil, gas, and chemical manufacturing, which mandates reliable flow monitoring to prevent accidents and environmental contamination. The accelerating trend of industrial automation and the widespread implementation of Industry 4.0 principles, requiring precise, digitally integrated sensors for real-time control and diagnostics, further fuels market expansion. Additionally, significant investments in municipal infrastructure, especially for water distribution and wastewater treatment in developing nations, consistently generate substantial demand for reliable, corrosion-resistant flow switches.

However, the market faces notable Restraints (R), primarily stemming from the complexity and cost associated with integrating advanced electronic flow switches into existing legacy infrastructure, often necessitating substantial capital upgrades and specialized technical expertise. Furthermore, the variability in performance and calibration requirements across different flow switch technologies (e.g., paddle vs. thermal) can lead to user confusion and reluctance to adopt newer, higher-cost solutions, especially in price-sensitive segments. Competitive pressure from alternative flow monitoring technologies, such as full flow meters which offer more extensive quantitative data, also limits the market share expansion of simpler switch solutions in high-precision applications.

Significant Opportunities (O) lie in the rapid proliferation of non-contact and non-intrusive flow switch technologies, such as ultrasonic and clamp-on devices, which offer ease of installation, reduced maintenance, and superior performance in highly corrosive or abrasive media where traditional mechanical switches fail quickly. The untapped potential in niche applications, including hydrogen production, pharmaceuticals, and specialized cooling systems for data centers, presents high-margin growth avenues. Moreover, developing markets offer opportunities for establishing local manufacturing and robust distribution channels to meet the growing infrastructure needs efficiently. The interplay of these forces—mandated safety (Driver), integration challenges (Restraint), and technological innovation (Opportunity)—dictates the strategic direction of market participants, emphasizing rugged design, connectivity, and cost-effectiveness as critical success factors.

Segmentation Analysis

The Flow Switches Market is comprehensively segmented based on technology, end-user industry, fluid type, and material. This segmentation reveals distinct adoption patterns and growth pockets across the global landscape. The analysis of technology segmentation highlights a critical industry shift towards electronic and non-intrusive methods, driven by the need for enhanced accuracy, minimal pressure drop, and reduced maintenance cycles compared to traditional mechanical switches. The end-user segmentation clearly indicates the sustained dominance of the process industries, which require high-reliability solutions for continuous operation, but also points to the rapid emergence of commercial and residential HVAC markets as key growth contributors fueled by increasing energy efficiency mandates and smart building automation trends.

The classification by fluid type—liquid and gas—is crucial, as switch design and material selection are highly dependent on the medium’s characteristics (viscosity, density, corrosiveness). Liquid flow switches remain the larger segment, intrinsically linked to water management and oil and gas transportation, while the demand for gas flow switches is rising sharply, driven by applications in high-purity environments, such as semiconductor manufacturing, and in rapidly expanding utility networks for natural gas distribution. Analyzing the market by material composition provides insights into resilience requirements; stainless steel components are essential for chemical and high-temperature processes, whereas engineering plastics are favored for water and sanitary applications requiring corrosion resistance and lower cost profiles.

These segmentations not only provide a framework for assessing current market distribution but also act as a predictive tool for future investment. For instance, the superior growth rates observed in the thermal dispersion switch segment suggest that R&D efforts should prioritize miniaturization and advanced sensor coatings. Furthermore, understanding the precise needs of segments like wastewater treatment—which demand switches resistant to fouling and solids—allows manufacturers to tailor their product offerings and marketing strategies effectively, ensuring maximum relevance and market penetration across geographically diverse and technologically varied user bases.

- Technology: Mechanical (Paddle, Piston, Spring-Actuated), Electronic (Thermal Dispersion, Ultrasonic, Magnetic), Pressure Differential.

- End-User Industry: Oil and Gas, Chemical and Petrochemical, Water and Wastewater Treatment, HVAC (Heating, Ventilation, and Air Conditioning), Power Generation, Food and Beverage, Pharmaceuticals, Semiconductor and Electronics.

- Fluid Type: Liquid Flow Switches, Gas Flow Switches.

- Material: Stainless Steel, Engineering Plastics, Alloys.

- Switch Type: Inline Flow Switches, Insertion Flow Switches, Clamp-on Flow Switches.

Value Chain Analysis For Flow Switches Market

The Value Chain for the Flow Switches Market begins with the upstream activities involving raw material procurement, focusing heavily on specialized metals (stainless steel, exotic alloys) for switch construction, high-grade plastics for corrosive media applications, and sophisticated electronic components (sensors, microprocessors, PCBs) critical for smart and thermal switches. Component fabrication and sub-assembly are centralized processes where precision engineering ensures the reliability and calibration accuracy of the final product. Key challenges in the upstream segment include volatile metal pricing and maintaining a secure supply chain for high-performance sensor elements, which are often proprietary or sourced from specialized component manufacturers, directly impacting manufacturing costs and product lead times.

Midstream activities encompass the core manufacturing, assembly, rigorous calibration, and quality assurance processes, followed by branding and product certification (e.g., ATEX, UL, CSA) required for use in hazardous industrial environments. The downstream segment involves sophisticated distribution channels. Direct distribution is common for highly customized or technically complex electronic switches where direct support and integration expertise are necessary, often involving Original Equipment Manufacturers (OEMs) and large Engineering, Procurement, and Construction (EPC) firms. Indirect channels, involving industrial distributors, wholesalers, and regional technical resellers, dominate the distribution of standard mechanical and high-volume switches to smaller end-users and maintenance, repair, and operations (MRO) markets.

The effectiveness of the distribution channel is crucial for market reach. Direct channels allow for higher margins and better control over service quality, especially when dealing with complex instrumentation packages for process control systems. Conversely, indirect channels provide broad geographical coverage and crucial local inventory buffers, essential for rapid replacement and quick maintenance turnaround. Optimizing the flow of information and inventory management across these channels—from fabrication centers to the final end-user site—is paramount for minimizing operational expenditure and maximizing customer responsiveness in a competitive marketplace, emphasizing the increasing role of digital platforms for order processing and technical documentation access.

Flow Switches Market Potential Customers

Potential customers for the Flow Switches Market are diverse and span virtually every sector that handles large volumes of fluids under controlled conditions. The primary segment consists of process industries, specifically global oil and gas operators (upstream, midstream, and downstream), large petrochemical and chemical manufacturing conglomerates, and pharmaceutical and biotech firms that require precise flow verification for batch integrity and regulatory compliance. These entities purchase high-reliability, often custom-engineered flow switches designed for extreme temperature, high pressure, and corrosive media, integrating them directly into critical safety instrumented systems (SIS) and distributed control systems (DCS). Reliability and certification (e.g., SIL ratings) are the highest purchasing priorities for this segment.

The second major group includes infrastructure and utility providers, such as municipal water treatment plants, power generation utilities (thermal, nuclear, and renewables), and district heating/cooling service providers. These customers prioritize robustness against fouling, longevity, and ease of maintenance, favoring durable mechanical and simple electronic switches for monitoring large pipeline flows, pump protection, and cooling water circuits. Growth in this segment is strongly tied to public spending and regulatory mandates concerning water quality and energy efficiency. Additionally, large commercial facilities and data center operators are increasingly significant buyers, utilizing flow switches extensively within their specialized HVAC systems to monitor chiller performance and fire suppression systems, demanding products optimized for building automation integration.

Finally, OEMs and system integrators represent indirect but critical customers. These companies incorporate flow switches into their finished equipment—such as industrial ovens, specialized machine tools, large compressors, and packaged pump skids—before the product reaches the final end-user. For OEMs, purchasing decisions are driven by compactness, standardization, ease of assembly, and competitive pricing. The ability of flow switch manufacturers to meet high-volume supply requirements and integrate sophisticated digital interfaces is paramount to securing long-term OEM contracts and ensuring widespread market adoption.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Emerson Electric Co., Schneider Electric, Siemens AG, Dwyer Instruments, Inc., WIKA Group, Gems Sensors & Controls, SICK AG, ABB Ltd., Honeywell International Inc., ifm electronic gmbh, Pentair plc, Badger Meter, Inc., Flowline, Inc., Burkert Fluid Control Systems, Tasi Group, Kobold Instruments, Inc., Fine Tek Co., Ltd., Eletta Flow AB, AW-Lake Company, Inc., SOR Controls Group, Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flow Switches Market Key Technology Landscape

The technology landscape of the Flow Switches Market is evolving rapidly, moving away from purely mechanical solutions toward highly sophisticated electronic sensing methods. Thermal dispersion technology represents a significant advancement, utilizing temperature differential between two probes to determine flow velocity. These switches are highly versatile, capable of monitoring both liquid and gas flow with exceptional sensitivity, particularly at low flow rates where traditional paddle switches struggle. The core technological advancement here lies in integrating microprocessors for temperature compensation and self-diagnostics, ensuring stability across wide process variations and minimizing drift over time. This technology is increasingly favored in semiconductor and chemical processes requiring precise low-flow verification.

Ultrasonic flow switch technology constitutes another key innovation, offering the distinct advantage of non-intrusive measurement. These devices clamp onto the exterior of a pipe (clamp-on) or utilize transducers within the pipe walls (inline) to measure the speed of sound pulses traveling through the fluid, confirming the presence or absence of flow. This eliminates issues related to pressure drop, fouling, and media compatibility, making them ideal for highly abrasive, corrosive, or sanitary applications like food and beverage or pharmaceutical manufacturing. Continuous advancements in sensor algorithms and transducer design are improving signal strength and accuracy, enabling reliable operation even in pipes containing high concentrations of entrained solids or bubbles, expanding their applicability beyond clear liquids.

Furthermore, the entire spectrum of flow switch technology is being digitized through the incorporation of IIoT capabilities. Modern flow switches feature integrated communication protocols such as IO-Link, HART, and Ethernet/IP, transforming them from simple limit sensors into smart, connected devices that feed diagnostic data, error logs, and calibration status directly to cloud-based monitoring platforms or enterprise asset management (EAM) systems. This enhanced connectivity facilitates remote monitoring, condition-based maintenance, and seamless integration into smart factory ecosystems, positioning technology providers who offer robust digital connectivity as market leaders in the era of Industry 4.0.

Regional Highlights

- North America: North America holds a substantial share of the global Flow Switches Market, characterized by high adoption rates of advanced electronic flow switches due to stringent safety regulations enforced by bodies like OSHA and API, particularly within the vast oil and gas exploration, refining, and pipeline network. The region is a leader in technological innovation, emphasizing the integration of flow switches into complex, highly automated industrial environments, including pharmaceuticals and advanced manufacturing. Significant investment in modernization of aging infrastructure, coupled with the growing demand for energy-efficient HVAC and building management systems, drives consistent market growth. The US market dominates regional consumption, focusing on high-precision, diagnostic-enabled devices for critical applications.

- Europe: The European market is mature and technology-focused, strongly influenced by European Union directives emphasizing industrial process optimization, environmental protection, and energy efficiency targets. Countries such as Germany, the UK, and Italy are significant consumers, driven by large chemical, automotive, and machine-building sectors. The region shows a strong preference for high-quality, reliable, and ATEX-certified flow switches suitable for hazardous area classification. The market is increasingly adopting thermal dispersion switches and non-intrusive technologies to comply with strict operational standards and minimize maintenance downtime, ensuring high system integrity across the continent’s complex utility grids.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region, owing to rapid urbanization, massive government investment in core infrastructure (water management, power generation, and gas distribution), and the rapid expansion of the manufacturing base, particularly in China, India, and Southeast Asian nations. While the market historically favored cost-effective mechanical switches, there is a strong and accelerating transition toward modern electronic switches as industries automate and move up the technology curve. The enormous scale of water and wastewater projects, combined with expansion in the semiconductor and electronics manufacturing sectors, provides unparalleled growth opportunities for all types of flow switches in this region.

- Middle East and Africa (MEA): The MEA market is heavily dominated by the Oil and Gas sector, which dictates the demand for extremely rugged, high-pressure, and high-temperature flow switches designed for upstream production, storage, and refining operations. Large-scale desalination projects and power generation capacity expansions in the GCC countries further contribute to market volume. While adoption in Africa remains concentrated in mining and basic utilities, Middle Eastern nations drive high-value sales, prioritizing certified safety standards and reliable performance in extremely demanding environmental conditions, often requiring specialized material construction and sophisticated switch monitoring capabilities.

- Latin America: Latin America represents a growing but somewhat fragmented market, with demand primarily driven by mining, petrochemicals (especially in Brazil and Mexico), and ongoing efforts to upgrade municipal water infrastructure. Economic volatility and political uncertainty can occasionally temper investment, but the fundamental need for reliable industrial process control ensures continuous demand. The market is characterized by a mix of mechanical and basic electronic switches, with increasing traction for smart technologies driven by international companies investing in regional industrial complexes, aiming to harmonize operational standards with global best practices.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flow Switches Market.- Emerson Electric Co.

- Schneider Electric

- Siemens AG

- Dwyer Instruments, Inc.

- WIKA Group

- Gems Sensors & Controls

- SICK AG

- ABB Ltd.

- Honeywell International Inc.

- ifm electronic gmbh

- Pentair plc

- Badger Meter, Inc.

- Flowline, Inc.

- Burkert Fluid Control Systems

- Tasi Group

- Kobold Instruments, Inc.

- Fine Tek Co., Ltd.

- Eletta Flow AB

- AW-Lake Company, Inc.

- SOR Controls Group, Ltd.

Frequently Asked Questions

Analyze common user questions about the Flow Switches market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary flow switch technologies and which is best for chemical applications?

The primary technologies include mechanical (paddle, piston), thermal dispersion, and ultrasonic. For chemical applications involving corrosive media, ultrasonic (non-intrusive) and magnetic flow switches made of highly resistant materials like PTFE or specialized alloys are generally preferred, as they avoid direct contact with the process fluid or offer high chemical resistance, minimizing degradation and maintenance needs.

How does the Flow Switches Market integrate with Industry 4.0 initiatives?

Flow switches integrate with Industry 4.0 by incorporating digital communication standards (like IO-Link or HART) and embedded microprocessors, transforming them into smart sensors. This enables them to transmit diagnostic data, calibration status, and real-time process alerts directly to IIoT platforms and central control systems, facilitating predictive maintenance and remote operational management across automated industrial facilities.

What factors are driving the shift from mechanical to electronic flow switches?

The shift is driven by the electronic switches' superior accuracy, increased reliability across varying flow conditions (especially low flow), minimal maintenance requirements, and crucial ability to interface digitally with modern control systems (DCS/PLC). Electronic switches also offer faster response times and better longevity in harsh environments compared to their mechanical counterparts.

Which regions demonstrate the highest growth potential for flow switch manufacturers?

The Asia Pacific (APAC) region, specifically China and India, exhibits the highest growth potential. This growth is fueled by massive infrastructure development, increasing automation penetration in manufacturing, and large-scale government investments in water and wastewater management projects, necessitating a rapid increase in the installation base of flow monitoring equipment.

What are the key application areas where flow switches are critical for safety?

Flow switches are critical for safety in cooling loop protection (preventing overheating in power generation and compressors), pump protection (preventing dry running which causes equipment failure), and fire suppression systems (confirming water or foam flow). In petrochemicals, they are essential for interlocking systems to prevent mixing of incompatible chemicals or confirming minimum flow rates for reactor integrity.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Liquid Flow Switches Market Statistics 2025 Analysis By Application (For Water, For), By Type (Mechanical Type, Electronic Type), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Mechanical Flow Switches Market Statistics 2025 Analysis By Application (For Liquids, For Gas, For Solids), By Type (Paddle, Thermal, Piezo, Shuttle/Piston), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

- Flow Switches Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Paddle Flow Switch, Piston Flow Switch), By Application (Household Use, Commercial Use, Industrial Use), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager