Flower Pots and Planters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 432431 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Flower Pots and Planters Market Size

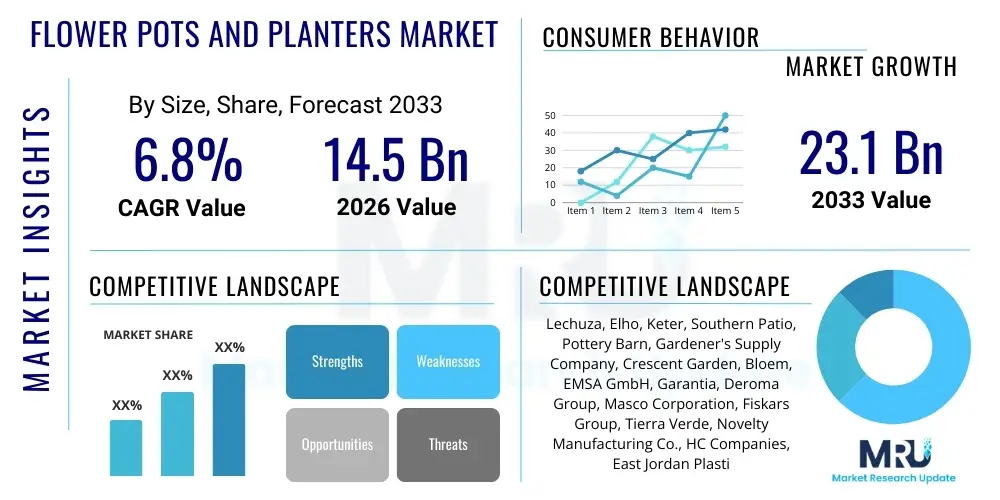

The Flower Pots and Planters Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $14.5 Billion in 2026 and is projected to reach $23.1 Billion by the end of the forecast period in 2033.

Flower Pots and Planters Market introduction

The Flower Pots and Planters Market encompasses a diverse range of vessels designed to hold plants, offering functional utility for horticulture and aesthetic value for interior and exterior design. These products are crucial components in both residential gardening, ranging from small balcony setups to expansive backyard landscaping, and large-scale commercial applications such as urban greening projects, corporate office decoration, and hospitality industry enhancement. The market features a wide material spectrum, including traditional materials like terracotta and ceramics, alongside modern innovations such as composite fibers, recycled plastics, and self-watering polymers, catering to varied consumer preferences regarding durability, portability, and environmental sustainability.

Major applications span indoor décor, enhancing living spaces and promoting biophilic design principles, and outdoor landscaping, where durable planters define spaces, manage soil conditions, and contribute to architectural aesthetics. The immediate benefits derived from using specialized flower pots and planters include improved plant health through better drainage and aeration, enhanced portability allowing for seasonal arrangement changes, and significant aesthetic upgrades contributing to property value and occupant well-being. Furthermore, the development of smart planters incorporating sensors and automated watering systems is expanding the functional utility beyond mere containment.

The market is significantly driven by several macroeconomic and behavioral factors, notably the accelerating trend of urbanization coupled with increased disposable incomes allocated toward home and garden improvement projects. The burgeoning interest in indoor gardening, often fueled by Millennials and Gen Z seeking stress relief and connection with nature (the ‘plant parent’ phenomenon), provides robust demand, particularly for small-to-medium-sized aesthetic pots. Furthermore, growing governmental emphasis on sustainable infrastructure and public green spaces necessitates the procurement of large, durable, and often recycled or environmentally friendly planter solutions for municipal projects. Technological advancements in material science are also driving innovation, offering lighter, more resilient, and more customizable products, thus sustaining market momentum.

Flower Pots and Planters Market Executive Summary

The Flower Pots and Planters Market exhibits strong resilience driven by robust business trends focusing on sustainability and product diversification. Key business trends include the shift towards biodegradable and recycled materials, mandatory Extended Producer Responsibility (EPR) regulations impacting plastic usage, and aggressive merger and acquisition activity among manufacturers seeking to consolidate market share and acquire specialized design capabilities, particularly in the premium and smart planter segments. Companies are increasingly integrating e-commerce platforms and Direct-to-Consumer (DTC) models to bypass traditional retail bottlenecks, utilizing sophisticated digital marketing to target niche consumer segments such as urban apartment dwellers and vertical gardening enthusiasts, thereby maximizing market penetration and margin retention.

Regionally, Asia Pacific (APAC) is projected to be the fastest-growing market, largely due to rapid urbanization, increasing construction activities, and the cultural importance of indoor plants in countries like China and India, alongside significant growth in landscaping projects across Southeast Asia. North America and Europe, while mature, maintain their dominant market share through high per capita spending on home décor, sophisticated consumer demand for premium designer products, and rapid adoption of innovative ‘smart’ gardening solutions, which command higher average selling prices (ASPs). Regulatory frameworks promoting green building standards in these regions further stimulate the demand for commercial-grade, environmentally compliant planters suitable for LEED-certified properties.

Segmentation trends highlight the increasing dominance of the plastic segment in volume terms due to its cost-effectiveness and durability, although the ceramic and fiber/composite segments are capturing significant value share due to their aesthetic appeal and perceived quality. The residential application segment remains the largest consumer base, but the commercial segment, particularly public infrastructure and corporate landscaping, is witnessing the fastest expansion, requiring bulk orders of large-format, high-durability planters. Distribution channels are undergoing a transformation, with online retail showing exponential growth, challenging the traditional dominance of physical garden centers and big-box retailers, necessitating a seamless omnichannel strategy for major market players to remain competitive.

AI Impact Analysis on Flower Pots and Planters Market

User queries regarding AI's impact on the Flower Pots and Planters Market predominantly revolve around the automation of gardening, the integration of smart sensors, and supply chain efficiencies. Users are particularly interested in how AI can optimize plant care for non-experts, asking about self-diagnosing planters that recommend watering schedules, nutrient adjustments, or environmental control specific to plant species. Concerns also focus on the cost and complexity of integrating AI, contrasting the traditional, simple nature of flower pots with high-tech solutions. Furthermore, commercial users inquire about AI's role in optimizing inventory management, forecasting demand for seasonal materials (like specific types of clay or plastic resins), and automating quality control during the high-volume manufacturing of ceramic and terracotta products, ensuring minimal defect rates and streamlined production flow.

- AI-driven personalized plant care recommendations based on environmental data collected by integrated sensors within smart planters.

- Predictive analytics for optimal soil moisture, pH levels, and nutrient delivery scheduling, minimizing manual intervention.

- Automated diagnostics identifying early signs of plant disease or pest infestation through microscopic imaging and pattern recognition.

- Optimization of manufacturing supply chains, using AI to forecast demand variability for different material types (plastic resins, ceramic clay).

- Enhancement of robotics in molding, firing, and finishing processes, particularly for complex designer planters.

- AI-powered design generation tools creating novel, ergonomically optimized planter shapes and internal structures for enhanced root health.

- Automated quality control (QC) systems employing computer vision to detect minor aesthetic flaws or structural weaknesses in high-end pottery.

- Dynamic inventory management systems adjusting stock levels based on real-time sales data across diverse distribution channels (AEO/GEO driven retail).

- Optimizing logistics and route planning for the transportation of fragile, bulky ceramic and concrete planters, reducing breakage rates.

- Virtual reality (VR) and augmented reality (AR) tools, powered by AI, allowing consumers to digitally place and visualize different planters in their actual home environments before purchase.

- AI assistants integrated into smart planter apps offering guidance on seasonal planting and regional suitability of different plant species.

- Energy efficiency optimization in climate-controlled greenhouses using AI to manage lighting and temperature based on plant growth stage, indirectly influencing demand for specialized containers.

- Sentiment analysis of online reviews and social media trends to rapidly identify popular colors, textures, and material preferences, influencing product development cycles.

- Creation of closed-loop recycling systems (Circular Economy) managed by AI, tracking the lifecycle and material composition of plastic and composite planters for effective end-of-life processing.

- Predictive maintenance schedules for high-throughput injection molding machinery, minimizing downtime in large-scale plastic manufacturing operations.

- Development of adaptive pricing models for seasonal and geographically variable products like winter-resistant concrete pots versus light summer plastic baskets.

- AI-enabled customization tools allowing commercial clients to rapidly prototype and order bespoke planter designs for large infrastructural projects.

- Improved water management in large public installations using centralized AI systems monitoring dozens of connected commercial planters simultaneously.

DRO & Impact Forces Of Flower Pots and Planters Market

The Flower Pots and Planters Market is driven primarily by the escalating demand for aesthetically pleasing and functional home and garden products, fueled by global urbanization and increased consumer spending on leisure and decorating. Key drivers include the biophilic design movement, promoting natural elements in built environments, and technological integration leading to smart gardening solutions that simplify plant ownership. However, the market faces significant restraints, including the high cost and fragility associated with premium materials like specialized ceramics and concrete, coupled with volatile raw material prices for petroleum-derived plastics and industrial clay. Moreover, logistical challenges in transporting bulky and fragile items globally impose limitations on supply chain efficiency, particularly affecting small and medium-sized enterprises (SMEs). The overarching opportunity lies in the burgeoning market for sustainable and recycled products, leveraging circular economy models and capitalizing on the growing consumer willingness to pay a premium for eco-friendly alternatives, alongside exploiting the commercial sector’s need for large, custom-designed planters for infrastructure and corporate real estate projects. These forces collectively shape the market's trajectory, mandating innovation in material science and distribution logistics to overcome current hurdles and capitalize on enduring consumer trends.

Segmentation Analysis

The Flower Pots and Planters Market is extensively segmented across multiple dimensions, predominantly based on material, application, size, and distribution channel, reflecting the diverse functional and aesthetic requirements of end-users. Material segmentation remains critical, distinguishing between low-cost, high-volume products (plastic) and high-value, durable goods (ceramic, concrete, composite), impacting pricing structures and target markets. Application segmentation clearly delineates the distinct needs of residential users, who prioritize aesthetics and mobility, versus commercial users, who demand durability, large capacity, and resistance to environmental factors. The continuous refinement of these segmentations allows manufacturers to optimize their product portfolios and tailor marketing strategies (GEO targeting) to specific consumer demographics and purchasing behaviors, ensuring maximum market reach and efficient resource allocation across the product lifecycle.

- By Material:

- Plastic (Polyethylene, Polypropylene, PVC, Recycled Plastics)

- Ceramic/Terracotta

- Metal (Aluminum, Steel, Copper)

- Fiber/Composite (Fiberglass, Fiber Cement, Wood-Plastic Composites)

- Wood (Treated Wood, Hardwood)

- Concrete/Stone

- By Application:

- Residential (Indoor Gardening, Outdoor Patios, Balconies)

- Commercial (Hotels, Restaurants, Retail Spaces)

- Institutional (Government Buildings, Hospitals, Educational Facilities)

- Municipal & Infrastructure (Public Parks, Streetscaping)

- By Size:

- Small (Under 10 inches)

- Medium (10 to 20 inches)

- Large (20 to 30 inches)

- Extra Large (Over 30 inches, typically for commercial use)

- By Distribution Channel:

- Online Retail/E-commerce

- Specialty Stores (Garden Centers, Nurseries)

- Supermarkets/Hypermarkets & Mass Retailers

- Direct Sales (B2B for commercial projects)

Value Chain Analysis For Flower Pots and Planters Market

The value chain for flower pots and planters begins with upstream activities heavily focused on raw material procurement and preparation, which varies drastically depending on the product type. For plastic planters, this involves sourcing various polymer resins (such as high-density polyethylene or polypropylene) from chemical suppliers, necessitating strong commodity risk management due to fluctuating oil prices. For ceramic and terracotta products, the upstream segment involves mining, processing, and blending specialized industrial clays, requiring sophisticated milling and purification processes to ensure material consistency and structural integrity during the firing stage. Manufacturers often establish long-term contracts with regional mining operations or polymer distributors to secure stable input costs and ensure predictable supply volumes, which is critical for maintaining high-volume production efficiency across different product lines.

The midstream segment involves the core manufacturing processes: injection molding for plastic, slip casting and kiln firing for ceramics, and specialized layering or compression techniques for composite materials. This stage is characterized by intense capital expenditure in machinery and the adoption of advanced automation to reduce labor costs and improve product quality consistency. Post-processing activities, including painting, glazing, anti-UV treatment, and the integration of smart components (sensors, reservoirs), add significant value and differentiate premium products. Effective quality control procedures are paramount at this stage, particularly for preventing defects in fragile goods, which can incur substantial write-offs and logistical complications, thereby requiring stringent adherence to ISO standards and internal quality benchmarks.

Downstream activities center on distribution and end-user engagement, utilizing a multi-channel approach. Direct sales (B2B) are crucial for penetrating the commercial and institutional segments, often involving customized bulk orders managed through specialized sales teams. Indirect channels leverage extensive networks including major big-box retailers (Home Depot, Walmart), specialized garden centers, and, increasingly, high-growth e-commerce platforms (Amazon, dedicated brand websites). The complexity of transporting these products, which are typically high-volume, relatively low-density (especially plastic), and prone to breakage (ceramics), makes logistics and warehousing a critical component of the downstream value chain, driving the need for optimized packaging solutions (e.g., nesting designs, shock-absorbent materials) and localized fulfillment centers to minimize last-mile costs and consumer damage complaints.

- Upstream Activities: Raw Material Sourcing and Preparation

- Procurement of Polymer Resins (HDPE, PP) from Petrochemical Suppliers

- Mining and Processing of Specialized Industrial Clay and Kaolin

- Sourcing of Fiberglass, Fiber Cement, and Natural Fiber Reinforcements

- Acquisition of Pigments, Glazes, and UV-Stabilizers

- Initial Material Testing and Quality Assurance for Consistency

- Supplier Relationship Management and Contract Negotiation

- Midstream Activities: Manufacturing and Assembly

- Plastic Injection Molding and Blow Molding Operations

- Ceramic Slip Casting, Throwing, and Firing (Kiln Operations)

- Composite Material Lay-up and Curing Processes

- Surface Treatment (Glazing, Painting, Weatherproofing)

- Integration of Self-Watering Systems and Smart Sensors

- Tooling Design and Mold Maintenance for Customization

- In-process Quality Control and Defect Reduction

- Downstream Activities: Distribution and Sales

- Warehousing and Inventory Management (Focus on Volume and Fragility)

- Packaging Optimization (Nesting, Protective Inserts, Palletization)

- Logistics and Transportation Management (LTL and FTL shipping)

- Sales to Mass Retailers (Big-Box Stores) and Supermarkets

- Sales to Specialty Garden Centers and Independent Nurseries

- E-commerce Fulfillment (Direct-to-Consumer shipping)

- B2B Sales and Contract Management for Commercial Landscaping Projects

- After-Sales Support and Handling of Breakage Claims

- Support Activities:

- Product Research and Development (Sustainable Materials, IoT Integration)

- Marketing and Branding (Focus on AEO/GEO Content for Home & Garden)

- Intellectual Property Management (Design Patents, Process Know-how)

- Regulatory Compliance (Toxicity Standards, Recycling Directives)

- Information Technology (ERP Systems, E-commerce Platforms)

Flower Pots and Planters Market Potential Customers

Potential customers for flower pots and planters are broadly categorized into three major groups: Residential Consumers, Commercial Entities, and Institutional Buyers, each exhibiting distinct purchasing motivations and requirements. Residential customers form the largest volume segment, driven primarily by aesthetic considerations, personal interest in gardening (indoor and outdoor), and seasonal decorating trends. This segment encompasses diverse demographics, from affluent homeowners investing in large, high-end designer planters for patios and landscaping features to apartment dwellers seeking small, stylish, and often smart self-watering pots for indoor windowsills. Marketing efforts targeting this group focus heavily on lifestyle branding, visual appeal, and ease of purchase through streamlined e-commerce interfaces, leveraging social media and AEO strategies focused on 'home decor' and 'urban gardening.'

Commercial entities represent a high-value segment, including sectors such as hospitality (hotels, resorts), corporate real estate (office parks, lobbies), and retail establishments. These buyers prioritize durability, uniformity, large capacity, and specific architectural compliance. Their purchasing decisions are often driven by interior designers, landscape architects, and facilities managers who require planters that can withstand heavy traffic, specific temperature fluctuations, and often need bespoke sizing or corporate branding integration. For commercial buyers, performance specifications like frost resistance, UV stability, and the ability to integrate heavy-duty handling systems are crucial, necessitating a B2B sales approach focused on long-term contracts and bulk order discounts.

Institutional buyers, encompassing government bodies, municipal agencies, educational campuses, and healthcare facilities, primarily focus on public utility, longevity, and sustainability credentials. These customers frequently issue public tenders requiring products made from recycled content (e.g., recycled plastic or fiber cement) and specified colors or designs compliant with urban planning guidelines. Their purchasing cycle is slower and more bureaucratic but involves high-volume orders for streetscaping, park development, and permanent internal installations. The primary motivation here is the creation of visually appealing, durable, and low-maintenance public green spaces, making factors like anti-graffiti coatings and secure anchoring systems essential specifications for this end-user group.

- Residential Consumers (B2C Focus):

- Urban Apartment Dwellers (seeking small, smart, aesthetically modern planters)

- Suburban Homeowners (focus on outdoor landscaping, large patio containers)

- Hobby Gardeners and Plant Enthusiasts (requiring specialized materials like breathable terracotta)

- Interior Decor Enthusiasts (seeking trendy, designer ceramic and metal pots)

- DIY and Home Improvement Consumers (utilizing mass-market plastic containers)

- Commercial Entities (B2B Focus):

- Hospitality Sector (Hotels, Resorts, Event Venues demanding premium, large-format pieces)

- Corporate Real Estate and Office Parks (requiring uniform, durable, professional-grade planters)

- Retail and Shopping Centers (using planters for seasonal displays and common area beautification)

- Restaurants and Cafes (seeking weather-resistant, often portable outdoor dining containers)

- Landscape Architecture and Design Firms (specifying bespoke and high-end materials)

- Institutional and Public Sector Buyers:

- Municipal Governments (for streetscaping, public parks, and urban revitalization projects)

- Educational Institutions (universities, schools for campus grounds and internal lobbies)

- Healthcare Facilities and Hospitals (using planters for therapeutic gardens and biophilic design compliance)

- Infrastructure Developers (for integrating greenery into new construction and public transit hubs)

- Specialized Buyers:

- Wholesale Nurseries and Plant Growers (requiring propagation and bulk growing containers)

- Agricultural and Hydroponic Operations (needing specific container dimensions and material inertness)

- E-commerce Platforms and Dropshippers (purchasing high-volume inventory)

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $14.5 Billion |

| Market Forecast in 2033 | $23.1 Billion |

| Growth Rate | CAGR 6.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Lechuza, Elho, Keter, Southern Patio, Pottery Barn, Gardener's Supply Company, Crescent Garden, Bloem, EMSA GmbH, Garantia, Deroma Group, Masco Corporation, Fiskars Group, Tierra Verde, Novelty Manufacturing Co., HC Companies, East Jordan Plastics, Scheurich GmbH, Capi Europe, Capital Garden. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flower Pots and Planters Market Key Technology Landscape

The technological landscape within the Flower Pots and Planters Market is rapidly evolving, moving beyond traditional molding and firing techniques towards advanced material science and digital integration. A primary area of innovation lies in sustainable material technology, where manufacturers are heavily investing in research into bioplastics derived from renewable sources, and high-performance composites utilizing recycled fibers or aggregates. This technology aims to produce planters that retain the aesthetic and structural qualities of premium materials while significantly reducing environmental footprint, addressing consumer demand for eco-friendly products. Innovations in glazing and surface treatments are also crucial, providing enhanced UV resistance, improved thermal regulation to protect roots, and self-cleaning or anti-microbial surfaces, particularly important for commercial and institutional applications.

A second major technological advancement involves manufacturing processes, specifically driven by automation and precision engineering. The adoption of large-format 3D printing is emerging, particularly for bespoke, designer planters and complex prototypes, offering unparalleled freedom in geometric complexity without the need for expensive tooling molds associated with traditional methods like injection molding or slip casting. Furthermore, advanced robotics and AI-powered vision systems are being integrated into ceramic production lines to standardize quality control, ensuring consistent wall thickness and defect detection in the firing process, thereby minimizing waste and optimizing resource utilization in energy-intensive operations. These manufacturing enhancements directly contribute to cost reduction and speed-to-market for complex designs.

The most transformative technology in the sector is the integration of Internet of Things (IoT) and sensor technology, giving rise to 'smart planters.' These systems incorporate sensors for monitoring vital parameters such as soil moisture, light exposure, temperature, and nutrient levels (NPK). The collected data is transmitted to user smartphones via Wi-Fi or Bluetooth, often linked with AI algorithms that provide actionable advice or automate functions like controlled drip irrigation and LED grow lighting. This technological layer fundamentally changes the product offering from a passive container to an active horticultural management tool, targeting the novice gardener market and high-value indoor agriculture segments, establishing a new premium product category that commands significantly higher ASPs.

- Material Science Innovations:

- Development of high-performance, weather-resistant polymer compounds.

- Integration of recycled content (e.g., recycled ocean plastic, construction debris aggregates) into manufacturing.

- Bio-based and compostable plastic alternatives derived from corn starch or sugar cane.

- Self-watering polymers and capillary action technology for improved water retention and distribution.

- Lightweight fiber-cement and fiberglass composites offering high durability with reduced weight.

- Advanced ceramic formulas providing enhanced frost resistance and reduced porosity.

- Smart Technology and IoT Integration:

- Embedded micro-sensors for real-time monitoring of soil parameters (pH, moisture, conductivity).

- Bluetooth and Wi-Fi connectivity for data transmission to mobile applications.

- Automated and precision drip irrigation systems integrated into reservoir bases.

- AI-driven algorithms for personalized plant care alerts and diagnostic recommendations.

- Solar-powered smart planters for sustainable outdoor operation without external power sources.

- Integration with smart home ecosystems (e.g., Google Home, Amazon Alexa) for voice control.

- Manufacturing & Production Techniques:

- Advanced robotic injection molding for precision plastic manufacturing.

- Large-scale industrial 3D printing for customized and complex geometric designs (prototyping and low-volume premium batches).

- Vacuum forming and rotational molding techniques for extra-large, seamless plastic planters.

- Energy-efficient tunnel kilns and rapid firing techniques for ceramic production.

- Augmented reality tools used in the design phase for rapid visualization and modification.

- High-speed automated glazing and painting processes achieving uniform finishes.

- Aesthetic and Functional Enhancements:

- Modular and stackable planter systems for vertical and urban gardening solutions.

- Integrated drainage systems with removable plugs for versatile indoor/outdoor use.

- Anti-graffiti and anti-microbial surface coatings for public and institutional planters.

- Self-leveling and secure anchoring mechanisms for large outdoor commercial installations.

- Textured and matte finishes achieved through specialized molding techniques mimicking natural stone or wood.

Regional Highlights

North America currently holds a substantial share of the Flower Pots and Planters Market value, characterized by high consumer spending power and a mature market for home and garden improvement. The U.S. market drives demand through significant investment in outdoor living spaces, leading to high consumption of large, premium planters made from fiberglass, concrete, and designer ceramics. The region shows robust demand for smart planters and technologically advanced gardening solutions, reflective of a general trend toward IoT integration in household items. Furthermore, regulatory support for green infrastructure projects in major metropolitan areas, particularly in LEED-certified commercial buildings, necessitates consistent procurement of high-quality, durable commercial-grade planters, supporting strong B2B growth and sustaining the market's premium pricing structure.

Europe represents another mature, high-value market segment, distinguished by a strong emphasis on sustainability and aesthetic design heritage. European consumers, particularly in Germany, the Netherlands, and the UK, exhibit a marked preference for products made from recycled or natural materials, favoring brands that adhere strictly to circular economy principles and minimize plastic waste. The popularity of small, highly stylized indoor plants and balcony gardening, particularly in densely populated cities, drives demand for small-to-medium ceramic and terracotta pots with sophisticated design language. Regulatory pressure, such as the upcoming EU plastics directives, accelerates the shift toward innovative composite materials and environmentally verified products, positioning European manufacturers as leaders in sustainable innovation and design excellence within the sector.

Asia Pacific (APAC) is projected to record the highest growth rate throughout the forecast period, driven by unparalleled rates of urbanization, a rapidly expanding middle class, and cultural significance placed on indoor plants and Feng Shui principles, particularly in East Asia. Infrastructure development and massive commercial construction projects across China, India, and Southeast Asia are fueling explosive demand for commercial-grade planters for corporate and municipal landscaping. While cost-sensitive plastic planters dominate volume sales, the emerging affluence in major urban centers is simultaneously boosting the demand for imported high-end design products and locally manufactured premium ceramics. The confluence of increased construction, cultural value placed on greenery, and rising disposable incomes makes APAC the critical growth engine for the global market.

- North America (NA):

- Dominant market share driven by high residential spending on outdoor living.

- Strong adoption of IoT-enabled smart gardening technology.

- Significant B2B demand tied to commercial real estate development and biophilic office design.

- Preference for large, durable, weather-resistant materials (fiberglass, heavy plastic, concrete).

- Favorable regulatory environment promoting green roof and urban farming initiatives.

- Europe (EU):

- Focus on sustainability, driving demand for recycled and biodegradable materials.

- High aesthetic standards favoring designer ceramic, terracotta, and unique metal planters.

- Strict regulatory environment regarding plastic usage and waste management.

- Strong growth in small-format balcony and indoor gardening in densely populated urban centers.

- Germany, UK, and Netherlands are key consumers and innovation hubs.

- Asia Pacific (APAC):

- Fastest-growing region fueled by rapid urbanization and infrastructure investment.

- Massive volume demand for low-cost plastic planters (China, India).

- Increasing affluence boosting demand for premium and imported Western designs in major cities (e.g., Shanghai, Tokyo, Singapore).

- Cultural significance of plants in home and office décor driving indoor segment growth.

- Regional manufacturing hubs provide cost-effective sourcing for global distributors.

- Latin America (LATAM):

- Market growth linked to rising middle-class disposable income and home improvement projects.

- Strong regional production of terracotta and clay products based on traditional craftsmanship.

- Economic volatility poses challenges to import-heavy premium segments.

- Middle East and Africa (MEA):

- High demand for specialized, heat-resistant, and high-quality planters for luxury developments and public installations (UAE, Saudi Arabia).

- Growth driven by major hospitality and construction boom requiring large-scale, aesthetically uniform commercial solutions.

- Focus on low-water consumption planters (self-watering, glazed ceramics) due to arid climate challenges.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flower Pots and Planters Market.- Lechuza

- Elho

- Keter

- Southern Patio

- Pottery Barn

- Gardener's Supply Company

- Crescent Garden

- Bloem

- EMSA GmbH

- Garantia

- Deroma Group

- Masco Corporation (through subsidiaries)

- Fiskars Group

- Tierra Verde

- Novelty Manufacturing Co.

- HC Companies

- East Jordan Plastics

- Scheurich GmbH

- Capi Europe

- Capital Garden

Frequently Asked Questions

Analyze common user questions about the Flower Pots and Planters market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the projected growth rate (CAGR) for the Flower Pots and Planters Market?

The Flower Pots and Planters Market is anticipated to register a Compound Annual Growth Rate (CAGR) of 6.8% between the forecast years of 2026 and 2033, driven largely by increased residential interest in gardening and expanding commercial landscaping projects worldwide.

Which material segment currently dominates the market, and why?

The plastic segment dominates the market by volume, primarily due to its cost-effectiveness, lightweight nature, inherent durability, and versatility in manufacturing. However, the fiber/composite and ceramic segments are rapidly growing in value share due to increased consumer preference for premium aesthetics and eco-friendly attributes.

How is the trend toward smart gardening influencing planter design and sales?

The smart gardening trend is driving significant innovation by integrating IoT sensors, automated watering systems, and mobile connectivity into planters. This technology transforms the traditional container into an active plant management tool, appealing to novice gardeners and positioning smart planters as a high-margin premium segment.

Which geographical region is expected to show the fastest market expansion?

Asia Pacific (APAC) is projected to exhibit the highest growth rate. This expansion is attributed to rapid urbanization, substantial investment in commercial and public infrastructure, and rising disposable incomes leading to greater expenditure on home and office décor across major economies like China and India.

What are the primary challenges restraining the growth of the premium planter segment?

The premium segment, including high-end ceramics and concrete, is restrained mainly by volatile raw material costs, the high cost of specialized labor, and significant logistical challenges associated with transporting bulky and fragile goods globally, which leads to high potential for breakage and increased final consumer prices.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Home Plastic Flower Pots and Planters Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033

- Flower Pots and Planters Market Size Report By Type (Plastic, Ceramics, Wood, Fiber Glass, Other), By Application (Commercial Use, Municipal Construction, Other), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Flower Pots and Planters Market Size, Share, Trends, & Covid-19 Impact Analysis By Type (Plastic, Ceramics, Wood, Other Material), By Application (Offline (Brick & Motar), Online), By Region - North America, Latin America, Europe, Asia Pacific, Middle East, and Africa | In-depth Analysis of all factors and Forecast 2023-2030

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager