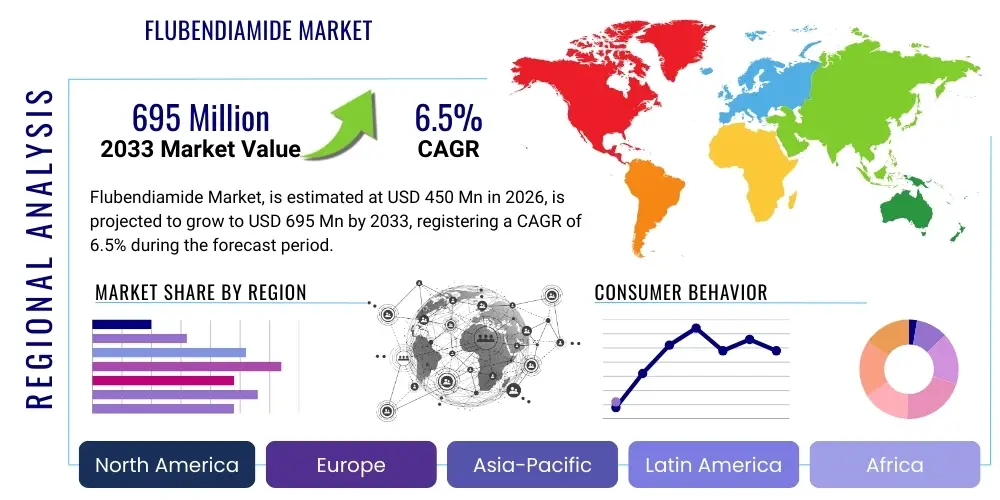

Flubendiamide Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436134 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Flubendiamide Market Size

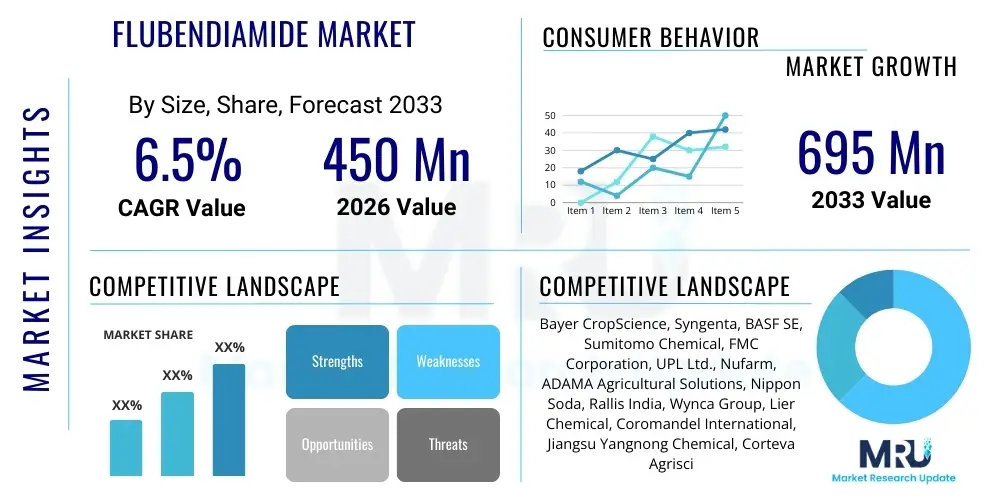

The Flubendiamide Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at $450 Million in 2026 and is projected to reach $695 Million by the end of the forecast period in 2033.

Flubendiamide Market introduction

The Flubendiamide market comprises the production, distribution, and utilization of Flubendiamide, a specialized, highly effective systemic insecticide belonging to the phthalic acid diamide class. This chemical compound operates by modulating the ryanodine receptor in insect muscles, leading to muscle contraction paralysis and subsequent insect mortality. Characterized by its specific activity against key Lepidopteran pests, Flubendiamide offers residual control and high efficacy even at low application rates, making it a critical component in modern integrated pest management (IPM) strategies globally. Its targeted action minimizes harm to beneficial insects, enhancing its environmental profile compared to older, broader-spectrum pesticides, which is a major factor driving its adoption in high-value horticulture and specialty crops.

Product applications primarily span major agricultural commodities, including staple crops like rice and cotton, alongside extensive use in fruits, vegetables, and ornamentals where pest control requirements are extremely stringent. The market growth is inherently tied to global food security concerns, the increasing prevalence of insecticide resistance in traditional pest populations, and the constant demand for enhanced crop yield and quality. Farmers increasingly seek robust solutions that provide season-long protection against destructive larvae, and Flubendiamide, known for its rapid knockdown and long persistence, fits this need effectively. Moreover, the formulation advancements, such as Suspension Concentrates (SC) and Water Dispersible Granules (WG), contribute to improved handling and application efficiency, further solidifying its market position.

However, the Flubendiamide market operates under significant regulatory scrutiny, particularly concerning environmental persistence and potential effects on aquatic ecosystems, which has led to high-profile regulatory challenges and market withdrawals in specific regions, such as the voluntary cancellation in the United States initiated by the EPA. Despite these constraints, the driving factors for future market expansion include the need for resistance management rotation programs, continuous development of synergistic formulations, and robust demand from the Asia Pacific region, especially in paddy rice cultivation, where Lepidopteran pests cause substantial economic losses. Innovation in application technology, particularly through precision agriculture, is also a key impetus.

Flubendiamide Market Executive Summary

The global Flubendiamide market exhibits moderate growth, underpinned by strong demand in the Asia Pacific agricultural sector, particularly for managing rice stem borers and cotton bollworms. Business trends show a strategic shift towards combination products, where Flubendiamide is co-formulated with other insecticides or fungicides to broaden the efficacy spectrum and mitigate the development of resistance. Major multinational corporations dominate the competitive landscape, investing heavily in regulatory defense and expansion into emerging markets in Latin America and Africa. Price volatility of raw materials and the complexity of synthesizing the active ingredient maintain high entry barriers, favoring established players capable of navigating strict intellectual property and regulatory regimes. Sustainability pressures are also compelling manufacturers to focus on low-drift formulations and optimized dosage rates.

Regional trends indicate that Asia Pacific remains the central hub for consumption, driven by intensive cultivation practices and favorable regulatory acceptance of diamide insecticides in countries like India, China, and Southeast Asia. Europe, conversely, faces market constraint due to stringent pesticide approval processes and the European Green Deal objectives, pushing consumption toward bio-based alternatives or highly specialized niche applications. North America’s market dynamics are highly influenced by the aforementioned regulatory uncertainty surrounding certain diamide registrations, leading to fluctuations in demand and necessitating shifts in crop protection strategies by growers. Latin America is emerging as a growth hotspot, fueled by expanding soybean and sugarcane acreage requiring sophisticated pest control solutions.

Segment trends highlight the dominance of the Suspension Concentrate (SC) formulation due to its stability, ease of mixing, and enhanced rain fastness, appealing greatly to large-scale mechanized farming operations. In terms of application, the rice segment holds the largest market share globally, reflecting the high incidence of target pests and the economic importance of rice as a global staple. Future growth is anticipated in the fruits and vegetables segment, where consumers demand pristine produce, driving farmers to adopt premium, residue-compliant chemical inputs like Flubendiamide. The long-term success of specific market players hinges on their ability to secure favorable registration status in critical geographies and effectively communicate the resistance management benefits of incorporating Flubendiamide into structured spray programs.

AI Impact Analysis on Flubendiamide Market

Common user questions regarding AI's impact on the Flubendiamide market often revolve around efficiency gains, predictive capabilities, and regulatory navigation. Users frequently inquire: "How can AI optimize the discovery and synthesis of new diamide compounds?" "Will AI-driven precision agriculture reduce the overall volume of Flubendiamide needed?" and "Can AI models predict pest outbreaks better to optimize timing of application?" The analysis reveals that key themes center on improving R&D efficiency, optimizing field application through predictive analytics and smart spraying, and utilizing AI/Machine Learning (ML) to analyze vast regulatory dossiers and environmental fate data faster, thereby aiding in preemptive regulatory compliance and risk assessment. Expectations are high that AI will lead to more targeted, sustainable, and less wasteful use of this specialized insecticide.

The application of Artificial Intelligence is revolutionizing the upstream segment of the Flubendiamide value chain, particularly in chemical synthesis and optimization. AI algorithms can model complex chemical reactions, predict the toxicity profiles of new intermediate compounds, and accelerate the identification of cost-effective synthetic pathways, significantly reducing the time and capital expenditure required to bring new formulations or analogues to market. Furthermore, AI-powered predictive maintenance models are deployed in manufacturing facilities to ensure consistent quality control and minimize downtime associated with complex chemical processing, thereby securing supply stability for this sensitive active ingredient.

In the downstream market, AI and ML are critical tools for precision pest management. By integrating diverse data sources—including drone imagery, weather patterns, soil moisture sensors, and historical pest pressure data—AI models can accurately forecast the location, intensity, and timing of Lepidopteran outbreaks. This capability allows farmers to transition from calendar-based spraying to true necessity-based application, ensuring Flubendiamide is applied only when and where required. This not only optimizes efficacy but also addresses sustainability concerns by significantly reducing the total volume of pesticide released into the environment, promoting AEO standards for sustainable agricultural practices.

- Accelerated discovery of novel diamide derivatives and synergistic mixtures using generative AI chemistry models.

- Optimized formulation stability and shelf-life prediction through Machine Learning analysis of material properties.

- Precision application facilitated by AI-driven drones and robotic sprayers, minimizing off-target drift and dosage variance.

- Predictive pest modeling (Forecasting pest pressure) enabling precise timing of Flubendiamide application for maximum efficacy.

- Enhanced regulatory compliance and toxicological data analysis through Natural Language Processing (NLP) tools.

DRO & Impact Forces Of Flubendiamide Market

The Flubendiamide market is influenced by a dynamic interplay of factors encapsulated by its Drivers, Restraints, and Opportunities. A primary driver is the rising global population demanding greater crop productivity, which necessitates highly effective solutions against yield-reducing pests like stem borers and Helicoverpa species. Flubendiamide’s classification as a highly selective and effective insecticide, crucial for managing resistance against older chemical classes (e.g., pyrethroids and organophosphates), further strengthens its market presence. Simultaneously, the impact forces of substitution threats (namely, the rise of biological control agents and advanced microbial pesticides) and regulatory crackdowns create significant market headwinds, demanding constant innovation and defensive regulatory strategies from market leaders. The impact forces determine the competitive intensity and market accessibility, particularly in environmentally sensitive regions.

Restraints are dominated by stringent and often unpredictable regulatory environments across major agricultural economies. The high-profile regulatory challenges, particularly the cancellation proceedings in the US, while specific, create a chilling effect globally, prompting extensive reassessment of environmental persistence data and field safety protocols. Furthermore, the substantial initial investment required for the synthesis, registration, and defense of proprietary molecules like Flubendiamide places significant financial pressure on research and development budgets. Consumer preference for residue-free produce and non-chemical pest control methods also acts as a subtle but persistent constraint, pushing the industry toward non-synthetic alternatives.

Opportunities for growth are abundant, primarily focused on developing countries with massive agricultural footprints and less established resistance management programs, such as key regions in Southeast Asia, Africa, and Latin America. The transition towards Integrated Pest Management (IPM) offers a significant avenue, positioning Flubendiamide not as a standalone solution but as a targeted tool within a rotational program. Technological advancements in controlled release formulations and encapsulation technology also promise to mitigate environmental risks and extend residual activity, unlocking new application methods and complying with stricter environmental guidelines. Successful market players will leverage these opportunities by focusing on novel delivery systems and securing long-term regional registrations.

- Drivers: High efficacy against resistant Lepidopteran pests; increasing demand for high-value export crops; implementation of insecticide resistance management programs (IRM).

- Restraints: Severe regulatory hurdles and product cancellation history in key markets; high cost of product synthesis and complex R&D cycles; growing market acceptance of biopesticides.

- Opportunities: Expansion into developing agricultural economies (LatAm, Africa); development of combination products for broader spectrum control; incorporation into precision agriculture spraying technologies.

- Impact Forces: Competitive pressure from next-generation diamides and biologicals; regulatory policies favoring low-residue or naturally derived crop protection; global climate change affecting pest migration and breeding cycles.

Segmentation Analysis

The Flubendiamide market segmentation provides a granular view of consumption patterns, driven primarily by formulation type, application crop, and mode of action. Understanding these segments is crucial for manufacturers to tailor their marketing and distribution strategies effectively. The market is highly differentiated by the user's operational needs; for instance, large-scale mechanized farms often prefer liquid concentrates for ease of handling and standardized application, whereas smaller holdings might utilize wettable powders. The segmentation by crop application reflects geographical crop importance and the specific pest pressures faced by different agricultural sectors, with rice and cotton cultivation dominating usage due to the severe threat posed by specific target pests.

Segmentation by formulation highlights the shift toward advanced, user-friendly forms that offer enhanced safety and environmental profiles. Suspension Concentrates (SC) are particularly favored globally due to their superior stability, reduced dust risk, and compatibility with modern spraying equipment. Water Dispersible Granules (WG) also maintain a significant share, valued for their ease of storage and precise dosing. Manufacturers are continually investing in microencapsulation technologies to improve rain fastness and prolong the residual effect, aiming to increase efficacy while reducing the frequency of application, directly addressing AEO requirements for sustainability and optimized resource use.

The application segmentation is a critical determinant of market revenue, clearly demonstrating the reliance on high-volume staple crops and high-value specialty crops. While rice remains the cornerstone of Flubendiamide demand, especially across Asian agricultural landscapes, the fruits and vegetables segment is witnessing the fastest growth rate. This accelerated adoption in horticulture is driven by strict quality standards and the necessity to manage pests like codling moths and leaf rollers, where even minimal damage renders the crop commercially unsaleable. Therefore, strategic market development focuses on creating specific label claims and efficacy data tailored to these lucrative specialty markets.

- By Formulation:

- Suspension Concentrate (SC)

- Wettable Powder (WP)

- Water Dispersible Granules (WG)

- Emulsifiable Concentrate (EC)

- By Application/Crop Type:

- Rice

- Cotton

- Vegetables (e.g., Solanaceous crops, Brassicas)

- Fruits (e.g., Pome fruits, Citrus)

- Corn/Maize

- By Mode of Action:

- Ryanodine Receptor Modulator

Value Chain Analysis For Flubendiamide Market

The Flubendiamide value chain begins with the highly complex upstream segment involving the synthesis of specialized chemical intermediates, often sourced from the fine chemical and pharmaceutical industries. Manufacturing the active ingredient (AI) requires sophisticated, multi-step chemical processes under strict quality control, characterized by high barriers to entry due to the proprietary nature of synthesis routes and the need for dedicated, compliant facilities. Key upstream activities include securing stable supplies of niche raw materials and managing intellectual property rights, which dictates cost structure and market competitiveness. The quality and purity of the AI synthesized at this stage directly impact the stability and efficacy of the final formulation delivered to the farmer.

The midstream segment involves formulation and packaging. Major market players convert the pure Flubendiamide AI into marketable products (SC, WG, WP). This requires specialized formulation expertise to ensure stability, bioavailability, and compatibility with water and spraying equipment. Regulatory hurdles dictate specific labeling and packaging requirements in each region. The downstream segment encompasses distribution, sales, and end-user application. Distribution channels are varied, including direct sales to large corporate farms, sales through established national distributors, cooperative societies, and local agro-chemical retailers. Direct channels offer greater control over pricing and technical support, while indirect channels provide wider market reach, especially in fragmented agricultural markets.

A crucial factor in the downstream flow is the provision of technical advisory services. Due to Flubendiamide's role in resistance management, effective utilization requires specialized knowledge regarding optimal timing, dosage, and rotation strategies. Therefore, manufacturers often invest heavily in training field agronomists who act as technical consultants to farmers, thereby influencing purchasing decisions. The effectiveness of the distribution network, coupled with high-quality agronomic advice, ensures that the product is utilized optimally, maximizing yield benefits and reinforcing brand loyalty among end-users. This integrated approach, linking R&D through to technical support, is essential for maintaining market leadership and ensuring product stewardship.

Flubendiamide Market Potential Customers

The primary customers for Flubendiamide are entities engaged in large-scale commercial agriculture and high-value horticulture who require highly effective, targeted insect control solutions. This includes large corporate farming operations focused on staple crops such as rice, cotton, and corn across Asia and the Americas. These customers prioritize insecticides that offer long residual control, high efficacy against resistant pests, and ease of integration into mechanized spraying programs. Their purchasing decisions are often centralized and highly sensitive to technical performance data, pricing contracts, and the availability of technical support regarding resistance management protocols.

A secondary, yet rapidly growing, customer base includes small to medium-sized growers specializing in fruits and vegetables, particularly those aiming for export markets with strict Maximum Residue Limits (MRLs). These customers value Flubendiamide’s selective toxicity, which aids in preserving beneficial predatory insects crucial for sustainable production, and its generally favorable residue profile when applied according to label instructions. Furthermore, government agricultural programs and cooperative societies in regions focusing on food security represent significant institutional buyers, utilizing bulk purchases of effective pest control agents to support national crop targets.

Finally, chemical formulators and distributors themselves constitute an important customer category in the business-to-business (B2B) aspect of the market. These entities purchase the technical grade active ingredient (TGAI) Flubendiamide from primary manufacturers and formulate it into branded end-use products under license or generic market agreements. Their decision-making criteria hinge on supplier reliability, consistent quality, competitive pricing for the TGAI, and the intellectual property status of the synthesis process. This B2B relationship is crucial for expanding the geographical reach of the active ingredient, particularly in markets where local formulation is preferred or mandated.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $450 Million |

| Market Forecast in 2033 | $695 Million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Bayer CropScience, Syngenta, BASF SE, Sumitomo Chemical, FMC Corporation, UPL Ltd., Nufarm, ADAMA Agricultural Solutions, Nippon Soda, Rallis India, Wynca Group, Lier Chemical, Coromandel International, Jiangsu Yangnong Chemical, Corteva Agriscience. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flubendiamide Market Key Technology Landscape

The technological landscape surrounding the Flubendiamide market is characterized by advancements focused on enhancing product efficacy, safety, and compatibility with modern farming techniques, driven largely by the need to counteract increasing pest resistance and comply with stricter environmental standards. A major technological focus involves novel formulation science, particularly the utilization of microencapsulation and nanotechnology. Microencapsulation involves embedding the active ingredient within polymer shells, which facilitates controlled release over a longer duration, reducing the required application frequency and minimizing immediate environmental exposure. This technology is critical for extending the residual efficacy of Flubendiamide in challenging weather conditions and ensuring uniform coverage.

Another pivotal technological area is the integration of Flubendiamide into advanced delivery systems. This includes developing highly stable Suspension Concentrate (SC) formulations optimized for use in precision agriculture equipment, such as drone sprayers and variable rate application systems. These systems utilize GPS and sensor data to apply the insecticide with unparalleled accuracy, targeting only the affected areas of the field. This targeted approach is technologically dependent on flow meters, nozzle technology, and software algorithms that adjust dosage based on real-time data input, significantly improving resource efficiency and supporting AEO standards for sustainable pesticide use by reducing non-target applications and potential environmental runoff.

Furthermore, technology plays a crucial role in resistance management strategies. Manufacturers are leveraging genomics and bioinformatics to monitor genetic shifts in target pest populations, allowing for the proactive adjustment of Flubendiamide usage protocols and the development of pre-mixed products. These combination products incorporate active ingredients with different modes of action (MOAs), such as Flubendiamide (a diamide) with a neonicotinoid or an avermectin, to minimize selection pressure for resistance. The success of these technological approaches relies heavily on robust field testing, chemical modeling, and strategic collaborations between agrochemical companies, academic institutions, and precision agriculture technology providers to ensure sustainable pest control efficacy across diverse agricultural ecosystems.

Regional Highlights

The global consumption and market dynamics of Flubendiamide are highly uneven, predominantly influenced by regional agricultural intensity, dominant crop types, and regulatory climate.

- Asia Pacific (APAC): APAC is the largest and fastest-growing market for Flubendiamide, driven primarily by intensive rice and cotton cultivation in China, India, and Southeast Asia. The high prevalence of key target pests like rice stem borer and bollworms, combined with generally less stringent regulatory hurdles compared to Western markets, propels high volume consumption. Government policies supporting increased agricultural output and the sheer scale of farmed land ensure APAC’s market dominance, making it the strategic focus for major manufacturers.

- North America: This region presents a fluctuating market, primarily focused on high-value crops like fruits and vegetables, and some field crops. The market dynamics have been heavily impacted by the specific regulatory challenges surrounding environmental persistence, leading to market withdrawal or voluntary cancellation proceedings for certain uses. Consequently, the emphasis is placed on highly technical application protocols and specialized niche uses where efficacy against difficult-to-control pests outweighs regulatory risks, ensuring a smaller but high-value market share.

- Europe: The European market is highly constrained due to extremely conservative pesticide registration policies and the EU’s strong push toward reducing chemical inputs through the Farm to Fork strategy. Flubendiamide use is highly restricted, limited to specific high-urgency applications and niche crop protection programs. Innovation here is geared towards ultra-low dosage formulations and strict compliance with extensive environmental fate data requirements, leading to slower growth and limited market penetration.

- Latin America (LatAm): LatAm represents a significant growth opportunity, particularly in Brazil and Argentina, fueled by massive soybean, sugarcane, and corn acreage expansion. The demand for highly effective, sophisticated insecticides to manage pervasive pests like fall armyworm (Spodoptera frugiperda) drives Flubendiamide adoption. Market penetration is accelerating due to supportive agricultural export policies and relatively efficient regulatory approval pathways compared to Europe.

- Middle East and Africa (MEA): This region holds nascent potential, constrained currently by fragmented agricultural infrastructure and lower adoption rates of advanced crop protection technologies. However, increasing commercial farming operations in countries like South Africa and Egypt, coupled with investments in irrigated agriculture, are slowly opening pathways for Flubendiamide, particularly in high-value vegetable and fruit production aimed at export markets.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flubendiamide Market.- Bayer CropScience AG

- Syngenta AG

- BASF SE

- Sumitomo Chemical Co., Ltd.

- FMC Corporation

- UPL Ltd.

- Nufarm Limited

- ADAMA Agricultural Solutions Ltd.

- Nippon Soda Co., Ltd.

- Rallis India Ltd.

- Wynca Group

- Lier Chemical Co., Ltd.

- Coromandel International Limited

- Jiangsu Yangnong Chemical Co., Ltd.

- Corteva Agriscience

- Arysta LifeScience (UPL subsidiary)

- Sino-Agri Leading Bioscience Co., Ltd.

- Dacheng Industrial Co., Ltd.

- Hubei Tianshui Chemical Co., Ltd.

- Tagros Chemicals India Ltd.

Frequently Asked Questions

Analyze common user questions about the Flubendiamide market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary mode of action and application of Flubendiamide?

Flubendiamide is a selective diamide insecticide that targets the ryanodine receptor in insect muscles, causing paralysis, and is primarily used for controlling Lepidopteran pests (moths and butterflies larvae) in high-value crops like rice, cotton, fruits, and vegetables.

Why did Flubendiamide face regulatory challenges, particularly in North America?

Regulatory concerns stemmed mainly from studies indicating the potential environmental persistence and transformation of specific degradates (metabolites) of Flubendiamide in aquatic environments, leading to review and, in some cases, voluntary or mandated cancellation of certain product registrations by environmental protection agencies.

Which geographical region dominates the consumption of Flubendiamide?

The Asia Pacific (APAC) region dominates the Flubendiamide market share, driven by extensive rice paddy cultivation and the need for robust control against common pests such as rice stem borers and leaf rollers across countries like China, India, and Southeast Asia.

How is the industry addressing resistance management related to Flubendiamide?

The industry addresses resistance by promoting strict rotation schedules with insecticides having different modes of action (MOAs), developing co-formulations (pre-mixes) that combine Flubendiamide with synergistic active ingredients, and actively supporting Integrated Pest Management (IPM) strategies.

What technological advancements are impacting the future use of this insecticide?

Key advancements include the use of microencapsulation technology for controlled, extended release and better environmental safety, alongside integration into AI-driven precision agriculture systems for highly targeted and optimized field application.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager