Flumioxazin Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433237 | Date : Dec, 2025 | Pages : 258 | Region : Global | Publisher : MRU

Flumioxazin Market Size

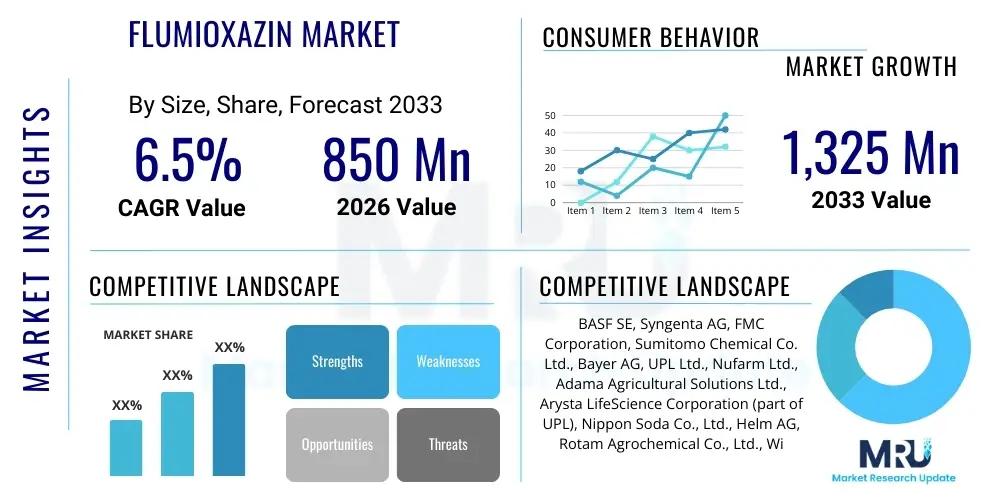

The Flumioxazin Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5% between 2026 and 2033. The market is estimated at USD 850 million in 2026 and is projected to reach USD 1,325 million by the end of the forecast period in 2033.

Flumioxazin Market introduction

Flumioxazin is a highly effective pre-emergence and post-emergence herbicide belonging to the N-phenylphthalimide group, functioning primarily as a protoporphyrinogen oxidase (PPO) inhibitor. Its mechanism of action disrupts the biosynthesis of chlorophyll, leading to cell membrane destruction and subsequent necrosis of susceptible weeds upon exposure to light. Developed initially for broadleaf weed control in various specialty crops and field crops, Flumioxazin is characterized by its broad spectrum of activity and relatively low application rates, making it an economically viable solution for agricultural producers facing escalating weed resistance challenges globally. The product's versatility allows for application in perennial crops, such as fruits and nuts, as well as major row crops, notably soybeans, peanuts, and cotton, contributing significantly to improved crop yield and quality.

The primary driver for the increased adoption of Flumioxazin lies in its critical role in resistance management strategies. As glyphosate-resistant weeds continue to spread across major agricultural geographies, farmers are increasingly relying on herbicides with different modes of action (MOA) to maintain effective weed control. Flumioxazin, due to its PPO inhibition mechanism, provides an essential rotational tool, minimizing the selection pressure on single-MOA herbicides. Furthermore, its efficacy as a residual herbicide, offering prolonged weed control after application, reduces the need for repeated spraying, aligning with modern sustainable farming practices that prioritize efficiency and reduced environmental impact.

Major applications of Flumioxazin extend beyond traditional row crop agriculture into non-crop areas, including turf management, industrial vegetation control, and forestry. In agriculture, its use is critical in conservation tillage systems where pre-plant residual control is paramount for successful crop establishment. The flexibility of its formulations, including water-dispersible granules (WDG) and suspension concentrates (SC), ensures ease of application across diverse farming systems and equipment types. Benefits derived from using Flumioxazin include superior control of troublesome weeds like Palmer amaranth and waterhemp, prolonged residual activity, and compatibility with integrated pest management (IPM) programs, securing its status as a foundational component of modern weed control programs.

Flumioxazin Market Executive Summary

The global Flumioxazin market trajectory is characterized by robust growth, primarily fueled by pervasive issues surrounding herbicide resistance and the increasing need for diversified chemical portfolios in major agricultural regions. Business trends indicate a strong focus on strategic mergers, acquisitions, and collaborations among key manufacturers aimed at consolidating market share and expanding geographical reach, particularly into high-growth agricultural economies in Asia Pacific and Latin America. Innovations in formulation technology, concentrating on enhanced stability, reduced volatility, and improved safety profiles, represent a crucial competitive differentiator. Furthermore, the market is navigating complex regulatory landscapes, requiring manufacturers to invest heavily in toxicological and environmental studies to maintain registration and access to vital markets such as the European Union.

Regional trends highlight North America and Europe as established markets where Flumioxazin demand is driven by high-value specialty crops and resistance management needs in corn and soybeans. However, the Asia Pacific region is rapidly emerging as the principal growth engine, propelled by massive agricultural output, particularly in rice, cotton, and oilseeds, coupled with increased farmer awareness regarding the economic losses inflicted by uncontrolled weeds. Latin America, specifically Brazil and Argentina, remains vital due to extensive soybean cultivation where Flumioxazin provides essential pre-emergence control. Shifts in farming practices globally, emphasizing reduced tillage and conservation agriculture, structurally favor residual herbicides like Flumioxazin, guaranteeing sustained demand.

Segmentation trends reveal that the agricultural segment, specifically row crops (soybeans and corn), dominates the consumption volume. Within formulation types, water-dispersible granules (WDG) remain the preferred segment due to their ease of handling, storage, and mixing capabilities, offering superior convenience to end-users compared to older formulations. The pre-emergence application method segment maintains the largest share, valued highly for its ability to prevent weed establishment early in the growing season, maximizing crop potential. The market is witnessing increased utilization in non-crop areas, such as rights-of-way and industrial sites, indicating diversification opportunities beyond core agriculture, although these segments account for a smaller proportion of overall revenue.

AI Impact Analysis on Flumioxazin Market

Analysis of common user questions regarding the intersection of Artificial Intelligence (AI) and the Flumioxazin market reveals key themes centered on precision application, supply chain optimization, and accelerated R&D processes. Users frequently inquire about how AI-driven imagery analysis can precisely map weed infestation levels, allowing for variable rate application (VRA) of Flumioxazin, thereby minimizing waste and environmental exposure. Concerns are also raised about the integration challenges of AI platforms with legacy farm equipment. Furthermore, there is significant interest in using machine learning algorithms to predict optimal Flumioxazin application timing based on real-time weather, soil moisture, and weed growth stage data, maximizing efficacy and supporting the transition towards highly sophisticated, input-efficient agricultural systems. The expectation is that AI will transform Flumioxazin from a standard chemical input into a precision-managed resource.

The immediate impact of AI is visible in enhancing the efficiency of Flumioxazin distribution and usage. AI-powered inventory management systems predict regional demand fluctuations based on climate forecasts and crop planting intentions, preventing stockouts and ensuring timely supply to agro-dealers. Moreover, AI is crucial in automating the interpretation of satellite and drone imagery. These tools identify specific resistance patterns or emerging weed populations that Flumioxazin is best suited to treat, generating highly localized prescription maps that dictate the exact quantity needed per square meter, moving away from uniform broadcast applications.

In the long term, AI algorithms are poised to revolutionize the discovery and formulation phases of Flumioxazin and its derivatives. Machine learning can analyze massive chemical databases and biological interaction data to optimize the molecular structure for improved efficacy against resistant strains or reduced environmental persistence. This accelerated R&D capability slashes the time and cost associated with bringing new, improved Flumioxazin formulations to market. Additionally, predictive maintenance algorithms utilize sensor data on application equipment (e.g., sprayers) to ensure optimal nozzle performance, guaranteeing that the highly specialized Flumioxazin mixture is delivered accurately, maintaining its potency and intended weed control outcome.

- Optimization of application rates through Variable Rate Technology (VRT) driven by AI mapping.

- Enhanced supply chain forecasting and logistics management reducing inventory holding costs.

- Accelerated R&D and screening of novel Flumioxazin derivatives and synergistic mixtures using machine learning.

- Real-time monitoring and detection of weed resistance patterns informing prescriptive usage strategies.

- Integration of AI systems with drone and autonomous spraying equipment for ultra-precise spot treatment.

DRO & Impact Forces Of Flumioxazin Market

The dynamics of the Flumioxazin market are heavily influenced by a confluence of driving forces, inherent constraints, and strategic opportunities. The primary driver is the widespread evolution of herbicide-resistant weeds, forcing reliance on PPO inhibitors like Flumioxazin as integral components of rotational and tank-mix programs. The shift towards conservation tillage practices, which necessitates strong residual pre-emergence control to manage overwintering weeds without mechanical cultivation, further amplifies demand. Opportunities are emerging through the development of specialized, low-dose encapsulated formulations that offer prolonged residual activity and reduced off-target movement, opening up possibilities for use in environmentally sensitive areas and specialty crops with stricter residue requirements. This technological enhancement allows manufacturers to differentiate their products in a competitive landscape.

Restraints primarily revolve around the stringent regulatory environment governing agrochemicals, particularly in developed regions like the EU and North America, where pressure mounts to phase out or heavily restrict herbicides based on environmental fate and potential non-target toxicity. The high costs and long timelines associated with regulatory compliance and new product registration deter smaller players and limit the speed at which innovative formulations can reach the market. Furthermore, the inherent risk of cross-resistance developing against the PPO inhibitor class, though currently manageable, remains a long-term threat that requires constant monitoring and necessitates continuous development of novel mixtures to prolong the viability of Flumioxazin.

The core impact forces shaping this market include regulatory policies (external force), which dictate availability and usage restrictions, and farmer adoption rates of Integrated Weed Management (IWM) strategies (internal force), which directly influence purchasing decisions. Economic factors, such as volatile commodity prices and rising input costs, pressure farmers to seek highly effective, cost-efficient weed control, thereby sustaining demand for proven actives like Flumioxazin. Technological forces, specifically advances in application equipment (drones, VRT), make the precise and efficient use of Flumioxazin increasingly accessible. The balance between these forces determines the market's overall growth potential and regional distribution of demand.

Segmentation Analysis

The Flumioxazin market is segmented across several critical dimensions, including its formulation type, application method, crop type, and regional geography. Understanding these segments is crucial for tailoring marketing strategies and R&D efforts. The formulation segment distinguishes between the technical grade active ingredient and various end-use formulations such as water-dispersible granules (WDG), wettable powders (WP), and suspension concentrates (SC), with WDG often preferred for its handling and stability characteristics. Segmentation by application method separates pre-emergence control, which accounts for the largest market share due to its foundational role in preventing early weed competition, from post-emergence and burndown applications.

The crop segmentation is paramount, highlighting the dominance of row crops, particularly soybeans and corn, which utilize large volumes of the herbicide, especially in the Americas. However, the high-value specialty crop segment, encompassing fruits, nuts, vines, and vegetables, contributes significantly to revenue due to the premium pricing associated with niche applications and the absolute necessity of weed control for these crops. Geographic segmentation reveals divergent growth patterns, with established markets providing stability and emerging economies offering explosive growth opportunities driven by agricultural modernization and market penetration of sophisticated chemical solutions.

Analyzing these segments provides strategic insights; for instance, the rapid growth in Asia Pacific is predominantly driven by increasing usage in rice and cotton, requiring locally tailored formulations. Conversely, in North America, segmentation highlights the ongoing challenges of multi-resistant weeds, necessitating Flumioxazin's integration into complex tank-mixes with other MOA herbicides. The overall segmentation structure reflects a mature product maintaining relevance through continuous formulation innovation and its irreplaceable role in managing global weed challenges, ensuring stable, differentiated demand across diverse agricultural practices.

- Formulation Type

- Water Dispersible Granules (WDG)

- Wettable Powders (WP)

- Suspension Concentrates (SC)

- Emulsifiable Concentrates (EC)

- Application Method

- Pre-Emergence Application

- Post-Emergence Application

- Burndown Application (Pre-Plant)

- Crop Type

- Soybeans

- Corn

- Peanuts

- Cotton

- Fruits and Vegetables (e.g., Grapes, Tree Nuts, Citrus)

- Non-Crop Applications (e.g., Industrial, Turf, Forestry)

- Geography

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Flumioxazin Market

The value chain for Flumioxazin is complex, originating with the procurement of specialized chemical intermediates and culminating in its application by the end-user farmer. The upstream segment involves the synthesis of the technical-grade active ingredient (TGAI), a capital-intensive process requiring specialized chemical manufacturing expertise. Key raw materials include various organic solvents and phthalamide precursors. Major manufacturers, such as large agrochemical multinationals, often engage in backward integration to secure the supply and quality of these proprietary intermediates, ensuring cost efficiency and control over the purity of the TGAI, which is vital for regulatory approval and efficacy.

The midstream phase centers on formulation and packaging. Technical-grade Flumioxazin is formulated into marketable products—such as WDG or SC—by adding inert ingredients, surfactants, dispersants, and stabilizers. This formulation process transforms the raw chemical into a product that is safe, effective, and easy for the farmer to mix and apply. Distribution forms the critical bridge to the downstream market. The channel involves large international distributors, national wholesalers, and regional agro-dealers. Direct sales models are sometimes utilized for very large commercial farms, but the indirect channel through specialized agricultural retailers remains dominant, as they provide critical logistical support, credit facilities, and technical advice to local farmers.

The downstream analysis focuses on the end-user application. Agricultural customers, primarily commercial farm operators, utilize the product for weed management. Their purchasing decisions are heavily influenced by the advice received from agricultural consultants, extension services, and local dealers, emphasizing the importance of strong relationships in the indirect distribution channel. The entire chain is subject to intense quality control measures, particularly regarding product labeling and residual management, ensuring that Flumioxazin is used effectively and responsibly, which is crucial for maintaining market access in environmentally sensitive regions.

Flumioxazin Market Potential Customers

The primary customer base for Flumioxazin consists of large-scale commercial farming operations, particularly those focused on extensive row crops in regions prone to challenging weed species and herbicide resistance issues. These customers, including integrated farming businesses and cooperative operations, require high-volume, reliable pre-emergence herbicides to support no-till or reduced-tillage conservation systems. Their buying criteria prioritize proven efficacy against resistant weeds like glyphosate-resistant weeds and excellent residual control, minimizing the need for multiple post-emergence applications and reducing overall operational costs. These sophisticated buyers often engage in pre-season procurement contracts to secure consistent supply and favorable pricing.

A secondary, yet highly valuable, customer segment includes growers of high-value specialty crops such as vineyards, tree nuts (almonds, walnuts), citrus, and various fruits and berries. In these perennial cropping systems, weed control is critical for preventing competition during the vulnerable establishment phase and maintaining high crop quality. These growers often require formulations with enhanced crop safety and specific residue tolerances. They are generally less price-sensitive than row crop farmers, focusing instead on specialized, high-performance products that guarantee weed-free conditions, often delivered through niche distribution channels specialized in horticultural inputs.

Furthermore, non-agricultural entities represent a growing pool of potential customers. These include professional turf and ornamental managers responsible for golf courses, parks, and athletic fields, who use Flumioxazin for selective weed control in sensitive turfgrass environments. Additionally, infrastructure maintenance organizations, such as railway and utility companies, utilize the product for industrial vegetation management (IVM) along rights-of-way, where long-term, bare-ground control is essential for safety and operational efficiency. These customers seek robust, long-lasting residual control solutions, often purchasing technical services alongside the chemical product.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 million |

| Market Forecast in 2033 | USD 1,325 million |

| Growth Rate | 6.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | BASF SE, Syngenta AG, FMC Corporation, Sumitomo Chemical Co. Ltd., Bayer AG, UPL Ltd., Nufarm Ltd., Adama Agricultural Solutions Ltd., Arysta LifeScience Corporation (part of UPL), Nippon Soda Co., Ltd., Helm AG, Rotam Agrochemical Co., Ltd., Willowood Chemicals Pvt. Ltd., Sipcam Agro USA Inc., Albaugh LLC, Sinon Corporation, Kenworth Biotech, Jiangsu Bailing Agrochemical Co., Ltd., Zhejiang Xin'an Chemical Industrial Group Co., Ltd., Lier Chemical Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flumioxazin Market Key Technology Landscape

The technological landscape surrounding Flumioxazin is heavily focused on optimizing its physical properties and delivery mechanisms to enhance efficacy, minimize environmental impact, and improve user safety. A primary area of innovation is in advanced formulation science, particularly the utilization of microencapsulation and suspension concentrate (SC) technologies. Microencapsulation involves embedding the active ingredient within a protective polymer matrix. This slow-release mechanism extends the residual activity of Flumioxazin, offering longer weed control periods while simultaneously protecting the chemical from premature degradation due to environmental factors such as UV light or microbial activity. This sustained release capability is crucial for maximizing performance, especially in minimum-till environments where soil incorporation is limited.

Another significant technological advancement involves optimizing Flumioxazin's integration with precision agriculture platforms. This includes compatibility with variable rate technology (VRT) systems, enabling applicators to adjust dosage based on real-time weed density maps generated by GPS-guided systems and remote sensing. Furthermore, the development of specialized adjuvant systems and compatibility agents ensures that Flumioxazin can be successfully tank-mixed with various other herbicides (e.g., glyphosate, 2,4-D) and liquid fertilizers. This technological compatibility is essential for the product's widespread adoption in complex Integrated Weed Management (IWM) programs, where synergistic effects are sought to control a broader spectrum of weeds and manage resistance evolution.

The manufacturing process itself is undergoing continuous refinement to improve the purity of the technical grade Flumioxazin and reduce production costs, often through process chemistry optimization and solvent recycling techniques. Emerging delivery technologies also include advanced drone and unmanned aerial vehicle (UAV) application systems. These systems require highly concentrated, low-volume formulations of Flumioxazin that must possess exceptional stability and low drift potential. This push towards low-volume precision spraying necessitates ongoing research into high-performance surfactants and drift reduction agents tailored specifically for Flumioxazin formulations, ensuring maximum deposition efficiency and minimized off-target movement in modern aerial application methods.

Regional Highlights

Regional dynamics play a crucial role in shaping the global Flumioxazin market due to varying regulatory climates, crop focuses, and the prevalence of herbicide resistance issues.

- North America: This region holds a significant market share, driven primarily by extensive soybean and corn production in the US Midwest. Demand is highly stable and concentrated on managing difficult-to-control, resistant broadleaf weeds like Palmer Amaranth and waterhemp. Flumioxazin is foundational in the pre-plant burndown and pre-emergence programs for conservation tillage systems, making it an indispensable tool. The market is mature but sophisticated, with high adoption rates of precision application technologies that leverage Flumioxazin efficiently.

- Asia Pacific (APAC): APAC is projected to exhibit the highest growth rate during the forecast period. Expansion is fueled by increasing agricultural intensity, particularly in China, India, and Southeast Asian nations where rice, cotton, and oilseed production is expanding. Modernization of farming practices and increased awareness regarding the yield-protecting benefits of residual herbicides are key drivers. Localized formulation development to suit paddy conditions and tropical climates is a significant growth area for manufacturers targeting this region.

- Latin America: Dominated by Brazil and Argentina, this region is a massive consumer of Flumioxazin, mainly due to the vast acreage devoted to soybean cultivation. Flumioxazin is essential for managing tough weeds and preventing the proliferation of multi-resistant biotypes, supporting the region's position as a major global agricultural exporter. Economic volatility can sometimes impact purchasing power, but the structural need for effective weed control ensures sustained high demand.

- Europe: The market here is constrained by rigorous regulatory scrutiny under the European Union's pesticide legislation (e.g., Regulation (EC) No 1107/2009). While the product is valued in specific specialty crops (e.g., olives, vineyards) and non-agricultural sectors, the overall growth is modest compared to the Americas and APAC. Market success in Europe hinges on maintaining favorable regulatory status and emphasizing environmental safety profiles.

- Middle East & Africa (MEA): This region represents a smaller but expanding market, characterized by increasing investment in high-efficiency agriculture, particularly in North Africa and South Africa. Adoption is concentrated in high-value horticulture and fruit crops, where localized irrigation systems and precision agriculture techniques are being implemented, creating niche opportunities for Flumioxazin formulations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flumioxazin Market.- BASF SE

- Syngenta AG

- FMC Corporation

- Sumitomo Chemical Co. Ltd.

- Bayer AG

- UPL Ltd.

- Nufarm Ltd.

- Adama Agricultural Solutions Ltd.

- Arysta LifeScience Corporation (part of UPL)

- Nippon Soda Co., Ltd.

- Helm AG

- Rotam Agrochemical Co., Ltd.

- Willowood Chemicals Pvt. Ltd.

- Sipcam Agro USA Inc.

- Albaugh LLC

- Sinon Corporation

- Kenworth Biotech

- Jiangsu Bailing Agrochemical Co., Ltd.

- Zhejiang Xin'an Chemical Industrial Group Co., Ltd.

- Lier Chemical Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Flumioxazin market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function and mode of action of Flumioxazin?

Flumioxazin is a pre-emergence and post-emergence herbicide used to control broadleaf weeds and some grasses. It operates as a Protoporphyrinogen Oxidase (PPO) inhibitor, disrupting chlorophyll synthesis and leading to rapid cell membrane degradation upon light exposure, causing necrosis.

How does Flumioxazin contribute to herbicide resistance management?

As a PPO inhibitor, Flumioxazin offers a distinct mode of action compared to highly utilized herbicides like glyphosate. It is crucial for rotational strategies and tank mixes, helping to reduce selection pressure on single-MOA products and effectively managing established resistant weed populations, such as glyphosate-resistant waterhemp and amaranth.

Which crop types are the largest consumers of Flumioxazin globally?

The largest volume consumers of Flumioxazin are major row crops, specifically soybeans and corn, predominantly in North and South America where it is utilized extensively for residual pre-emergence control. It is also highly valued in specialty crops like tree nuts, vineyards, and fruits.

What are the primary formulation types of Flumioxazin available in the market?

The dominant formulations include Water Dispersible Granules (WDG), Wettable Powders (WP), and Suspension Concentrates (SC). WDG is favored for its ease of use, safety profile, and stability, offering optimal flexibility for farmers in preparing spray mixtures.

What technological innovations are impacting the future use of Flumioxazin?

Future use is being shaped by advanced microencapsulation technologies for extended residual activity, integration with Artificial Intelligence (AI) and Variable Rate Technology (VRT) for precision spot spraying, and the development of specialized co-formulants for improved tank-mix compatibility.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager