Fluorene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438648 | Date : Dec, 2025 | Pages : 253 | Region : Global | Publisher : MRU

Fluorene Market Size

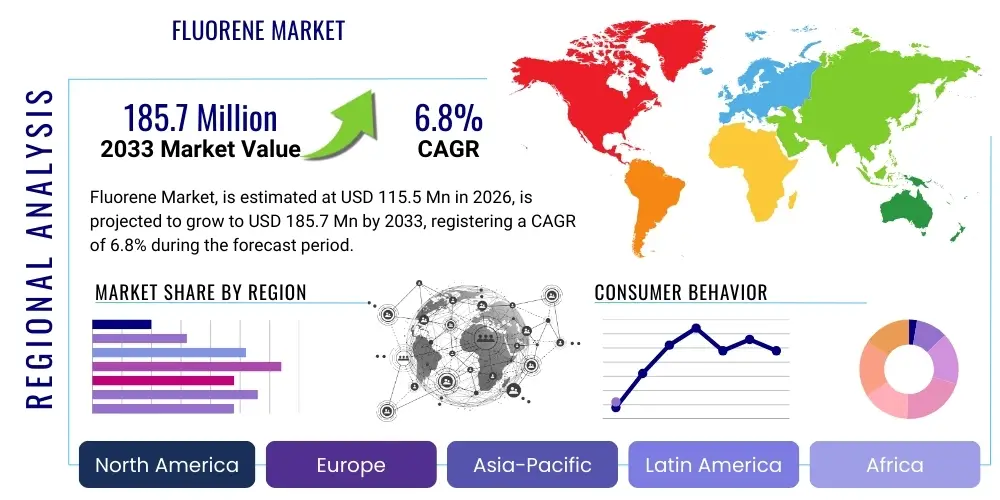

The Fluorene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 115.5 Million in 2026 and is projected to reach USD 185.7 Million by the end of the forecast period in 2033.

Fluorene Market introduction

The Fluorene Market centers on a colorless, polycyclic aromatic hydrocarbon (PAH) primarily derived from coal tar and known for its rigid molecular structure and high thermal stability. Fluorene (C13H10) serves as a critical intermediate in the synthesis of specialized polymers, advanced functional materials, and pharmaceuticals. Its structural integrity makes it invaluable in producing high-performance plastics and liquid crystal monomers (LCMs), which are foundational components in the display technology sector. The intrinsic chemical properties of fluorene derivatives, such as 9,9-bis(4-hydroxyphenyl)fluorene (BHPF) and fluorenylidene-containing compounds, enhance the thermal, mechanical, and optical performance of end products, driving demand across high-tech industries.

Major applications for fluorene span the electronic materials sector, particularly in the manufacturing of organic light-emitting diodes (OLEDs) and advanced display panels where its derivatives contribute to improved efficiency and longevity. Furthermore, fluorene finds substantial use in the production of highly durable engineering plastics, protective coatings, and synthetic dyes. The benefits of using fluorene derivatives include improved glass transition temperatures (Tg), enhanced transparency, superior thermal resistance, and exceptional mechanical strength, which are essential for materials used in automotive, aerospace, and semiconductor packaging applications. These unique performance characteristics position fluorene as a strategic chemical commodity.

The market growth is fundamentally driven by the accelerating demand for advanced display technologies, especially the shift towards OLED displays in consumer electronics and automotive dashboards. Concurrently, the increasing regulatory focus on high-performance, lightweight materials in the transportation and construction industries further mandates the use of specialized fluorene-based polymers. Expansion in pharmaceutical research utilizing fluorene scaffolds for drug discovery, coupled with technological advancements in fluorene extraction and purification, are acting as significant catalysts for market expansion globally. The versatility of fluorene as a chemical building block ensures its continued relevance across multiple high-value industrial segments.

Fluorene Market Executive Summary

The Fluorene Market is experiencing robust expansion driven by pronounced business trends favoring specialization and functional material development. Key trends include the substantial investment in next-generation display technologies, particularly the commercialization and scaling of OLED production, which heavily relies on fluorene derivatives for light-emitting and hole-transporting layers. Furthermore, there is a distinct push toward high-Tg polymers for demanding industrial applications, fueling the consumption of fluorene-based epoxies and polycarbonates. Strategic alliances focused on developing sustainable, high-purity fluorene extraction methods from coal tar and minimizing environmental impact are also shaping competitive landscapes. Companies are increasingly integrating vertically to secure raw material supply chains and maintain cost efficiencies in the production of derivative chemicals.

Regionally, Asia Pacific (APAC) dominates the fluorene market, primarily due to its massive concentration of electronics manufacturing hubs, especially in China, South Korea, and Japan, which are global leaders in display panel and semiconductor fabrication. North America and Europe demonstrate mature markets characterized by stringent quality standards and a strong focus on advanced materials research for aerospace and medical devices, driving demand for high-value fluorene derivatives. Emerging economies in Southeast Asia are presenting new growth opportunities as their industrial bases mature and local electronics assembly capabilities expand. Regulatory frameworks concerning chemical safety and environmental standards in developed regions significantly influence processing techniques and product formulation within these territories.

Segmentation trends indicate that the polymer intermediate segment, particularly for polycarbonates and polyimides, maintains the largest market share owing to its use in high-performance structural applications. However, the liquid crystal monomers (LCMs) and OLED materials segments are projected to exhibit the highest Compound Annual Growth Rate (CAGR), reflecting the dynamic technological transition occurring within the display industry. By application, the electronics and automotive sectors remain the core revenue generators, while the pharmaceutical and specialty chemicals segments demonstrate specialized, high-margin growth. The Fluorene alcohol and Fluorene amine product types are gaining traction due to their enhanced reactivity, facilitating the synthesis of complex functional molecules critical for advanced material science innovations.

AI Impact Analysis on Fluorene Market

User inquiries regarding AI's impact on the Fluorene Market typically revolve around four core areas: how AI can optimize the chemical synthesis and purification processes of fluorene; the role of AI in material discovery, specifically identifying novel fluorene-based compounds with superior properties; the potential for AI-driven demand forecasting in volatile end-use markets (like electronics); and the application of machine learning in quality control for high-purity derivatives required by the semiconductor industry. These questions highlight user expectations that AI will primarily drive operational efficiency, accelerate R&D cycles, and enhance product quality consistency, thereby lowering costs and speeding up the introduction of new fluorene-based materials into commercial use. Users are highly interested in how AI simulation can bypass traditional, time-consuming laboratory experimentation for material screening.

Artificial intelligence, particularly through machine learning (ML) and computational chemistry models, is fundamentally transforming the R&D landscape for fluorene derivatives. AI algorithms can analyze vast datasets concerning molecular structures, reaction pathways, and material performance characteristics to predict and optimize new compounds suitable for advanced displays or high-temperature polymers. This capability drastically reduces the timeline for discovering novel materials with tailored thermal, optical, and mechanical properties, accelerating the development pipeline from laboratory concept to commercial viability. Furthermore, predictive modeling helps manufacturers refine synthesis protocols to maximize yield and purity, which is crucial given the stringent quality requirements in electronics manufacturing.

In the operational sphere, AI is being deployed for advanced process optimization in fluorene extraction and refinement, managing complex separation columns and minimizing energy consumption during crystallization. Predictive maintenance systems, powered by machine learning, ensure the reliability of specialized production equipment, reducing unexpected downtimes and maximizing throughput. The integration of AI-enabled sensors and control systems facilitates real-time monitoring of quality parameters, ensuring consistent production of ultra-high-purity fluorene derivatives required for specialized electronic applications. This focus on efficiency and purity is a direct response to the increasingly competitive global market for high-performance chemical intermediates.

- AI-driven optimization of synthetic routes reduces processing time and waste generation.

- Machine learning accelerates the discovery of novel fluorene derivatives for OLED and polymer applications.

- Predictive modeling enhances quality control, ensuring ultra-high purity levels necessary for semiconductor use.

- AI improves supply chain efficiency and enables precise demand forecasting for key end-use industries.

- Computational chemistry simulations predict material performance (e.g., thermal stability, glass transition temperature) before physical synthesis.

- Predictive maintenance implemented on production equipment minimizes downtime and operational costs.

- Automation enhanced by AI improves worker safety and handles hazardous material processing more effectively.

DRO & Impact Forces Of Fluorene Market

The Fluorene Market dynamics are significantly influenced by a balanced combination of market drivers, constraints, and emerging opportunities, all mediated by critical impact forces such as technology adoption and regulatory changes. Key drivers include the exponential growth in the global OLED display market across consumer electronics, signage, and automotive sectors, creating persistent demand for fluorene-based functional materials that improve display efficiency and lifespan. Additionally, the mandated shift towards lightweight, high-performance materials in the aerospace and electric vehicle (EV) industries necessitates fluorene derivatives for advanced composites and high-Tg polymers. These drivers establish a foundational impetus for sustained market expansion, particularly in technologically advanced regions.

Conversely, market expansion is restrained by the inherent volatility in the price and supply of coal tar, the primary raw material source for fluorene, making production planning complex and susceptible to energy market fluctuations. Stringent environmental regulations related to the processing and handling of polycyclic aromatic hydrocarbons (PAHs) pose operational challenges and necessitate substantial investment in compliance and advanced purification technologies, particularly in Europe and North America. Furthermore, the specialized nature of the derivative production requires high capital investment and advanced technical expertise, creating significant barriers to entry for new market participants and concentrating the market power among a few key established players.

Despite these restraints, substantial opportunities exist, primarily through the development of green chemistry approaches for fluorene production, such as utilizing bio-based feedstock or developing cleaner extraction techniques, addressing sustainability concerns. The emerging field of specialized energy storage, including advanced batteries and supercapacitors, offers a lucrative avenue for fluorene derivatives that enhance electrode stability and conductivity. The impact forces—specifically rapid technological advancements in polymerization and display engineering—exert a moderate-to-high influence, continuously raising the bar for required purity and performance, compelling manufacturers to innovate rapidly. Furthermore, macroeconomic stability in Asian manufacturing zones dictates short-term demand cycles and price stability for derivative products.

Segmentation Analysis

The Fluorene Market segmentation provides a detailed structural analysis based on product type, application, and end-use industry, revealing the varying growth trajectories and value pools across the market landscape. The differentiation in product types—ranging from basic fluorene to complex derivatives like fluorene alcohol and fluorene amine—reflects the material’s versatility in synthesizing high-performance end products. Analyzing these segments helps stakeholders pinpoint high-growth areas, particularly those tied to technological innovation in the electronics sector, ensuring targeted strategic investment and resource allocation to maximize profitability.

- By Product Type:

- Fluorene (Base Chemical)

- Fluorene Alcohol

- Fluorene Amine

- Fluorene Derivatives (e.g., 9,9-bis(4-hydroxyphenyl)fluorene (BHPF), 2-Aminofluorene)

- By Application:

- Polymer Intermediates (Polycarbonates, Polyimides, Epoxies)

- Liquid Crystal Monomers (LCMs)

- Organic Light-Emitting Diode (OLED) Materials

- Pharmaceutical Intermediates

- Specialty Coatings and Additives

- Dye and Pigment Synthesis

- By End-Use Industry:

- Electronics and Display Technology

- Automotive and Transportation

- Aerospace and Defense

- Healthcare and Pharmaceuticals

- Construction and Infrastructure

- Chemical Manufacturing

- By Region:

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain, Rest of Europe)

- Asia Pacific (China, Japan, South Korea, India, Southeast Asia)

- Latin America (Brazil, Argentina, Rest of Latin America)

- Middle East and Africa (GCC Countries, South Africa, Rest of MEA)

Value Chain Analysis For Fluorene Market

The Fluorene market value chain begins with the upstream processes focused on securing and refining raw materials, primarily crude coal tar distillation and subsequent extraction of fluorene-rich fractions. Key upstream activities involve meticulous quality control to manage impurities, as the purity of the raw fluorene significantly dictates the feasibility and quality of complex downstream derivatives used in high-tech applications like OLEDs. Strategic supplier relationships with major coking plants and coal processing facilities are essential for maintaining stable, cost-effective supply, underpinning the entire production structure and ensuring resilience against commodity market volatility.

The midstream segment involves the core chemical processing, encompassing the synthesis of various high-value fluorene derivatives such as fluorene alcohol, fluorene amine, and sophisticated monomers like BHPF. This stage requires high levels of technical expertise, capital-intensive reaction infrastructure, and adherence to rigorous purity standards, often demanding multi-stage purification processes (e.g., fractional distillation, crystallization). Companies specializing in midstream production often possess proprietary synthetic methods that offer competitive advantages in yield, purity, and environmental compliance. Efficient midstream operations are crucial for transforming commodity fluorene into specialized chemical building blocks.

The downstream segment includes the utilization of fluorene derivatives by end-use industries. Distribution channels are highly specialized; direct channels dominate for high-volume, critical intermediates supplied to major electronics manufacturers (e.g., display panel fabricators and polymer producers). Indirect channels, including regional chemical distributors and specialty brokers, cater primarily to smaller pharmaceutical R&D labs and regional coating manufacturers. The final value added occurs when these intermediates are polymerized or incorporated into end products such as high-temperature plastics, advanced liquid crystals, or active pharmaceutical ingredients (APIs), integrating fluorene's unique structural benefits into final consumer goods.

Fluorene Market Potential Customers

The primary consumers of fluorene and its high-purity derivatives are large multinational corporations operating within the high-tech manufacturing sectors, predominantly the electronics, automotive, and specialized chemical industries. Electronics manufacturers, particularly those engaged in the production of flexible, high-resolution OLED displays, represent a critical customer segment due to their high volume consumption of fluorene monomers and specialty polymers that influence display performance and flexibility. Similarly, major polymer compounding and resin producers that focus on engineering plastics, such as polycarbonates and polyimides, are significant buyers, utilizing fluorene derivatives to achieve superior mechanical and thermal properties essential for harsh environment applications.

Beyond bulk chemical users, pharmaceutical companies and Contract Research Organizations (CROs) constitute a highly valuable, albeit smaller, customer base. Fluorene skeletons are often incorporated into novel drug candidates due to their rigid, planar structure, which can enhance binding affinity and pharmacokinetic profiles. Automotive OEMs and Tier 1 suppliers are increasingly becoming important customers, driven by the shift towards electric vehicles (EVs) that require lightweight, thermally stable materials for battery casings, internal components, and advanced display systems integrated into the vehicle dashboard. These customers prioritize consistency, certification, and long-term supply agreements over spot market pricing.

Finally, specialized coating manufacturers and adhesive producers represent another significant demand pool, utilizing fluorene-based resins to formulate protective coatings and high-performance adhesives that require exceptional chemical and heat resistance, often used in aerospace and industrial maintenance applications. Due to the high criticality of purity in many applications (especially electronics), potential customers often engage in rigorous qualification processes and seek suppliers capable of meeting ISO and customized industry-specific quality standards. This customer group values technical support and collaborative innovation in material formulation.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 115.5 Million |

| Market Forecast in 2033 | USD 185.7 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Mitsui Chemicals, TCI Chemicals, Sigma-Aldrich (Merck KGaA), ABCR GmbH, P&G Chemicals, Hunan Chemical Industry Research Institute, Hangzhou Bay Chemical, Zibo Guangyuan Chemical, Tianjin Zhongxin Chemical, Jiangsu Zhongyuan Chemical, Zhejiang Haishuo Chemical, Shanghai Haiyan Chemical, Tokyo Chemical Industry (TCI), Alfa Aesar (Thermo Fisher), Wako Pure Chemical (FUJIFILM), J&K Scientific, Acros Organics, Santa Cruz Biotechnology, Fisher Scientific, BASF SE |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorene Market Key Technology Landscape

The technological landscape of the Fluorene Market is characterized by continuous advancements aimed at achieving ultra-high purity levels and developing novel synthetic pathways for complex derivatives. A critical technology involves advanced fractional distillation and crystallization techniques used in the initial extraction from coal tar. These separation processes must be highly optimized to remove trace impurities, particularly other polycyclic aromatic compounds, ensuring the base fluorene meets the exacting standards required for electronic materials. Furthermore, proprietary catalytic synthesis methodologies are paramount for efficiently converting fluorene into key derivatives, such as 9,9-bis(4-hydroxyphenyl)fluorene (BHPF), which serves as a vital monomer for high-Tg polycarbonates and epoxies.

In the downstream segment, the technology focuses on polymerization chemistry and material formulation. Innovative polymerization techniques, including controlled radical polymerization methods, are utilized to integrate fluorene monomers into polymer backbones, tailoring the resulting materials' thermal stability, optical transparency, and mechanical strength precisely for end-use applications like transparent conductive films and optical lenses. Significant R&D efforts are concentrated on developing highly efficient and stable fluorene-based hosts and emitters for use in third and fourth-generation OLEDs, demanding molecular engineering expertise and access to high-precision analysis tools like nuclear magnetic resonance (NMR) and mass spectrometry (MS) to verify molecular structure and purity.

Furthermore, sustainable chemistry technologies are gaining prominence, including solvent recycling, minimization of hazardous waste, and exploration of alternative, non-fossil fuel-derived feedstocks (bio-fluorene synthesis). Process intensification, which involves integrating multiple reaction steps into a single unit operation, is also a growing trend aimed at reducing energy consumption and operational footprint. The continuous technological innovation within this market is not only driven by performance enhancement but also increasingly by the need for compliance with global environmental, health, and safety (EHS) standards, pushing manufacturers toward cleaner, more energy-efficient production technologies.

Regional Highlights

The global fluorene market exhibits distinct regional dynamics shaped by industrial concentration, regulatory environments, and technological adoption rates.

- Asia Pacific (APAC): Dominates the global market, accounting for the largest share in terms of volume and value. This prominence is driven by the massive concentration of consumer electronics manufacturing, display panel fabrication (OLEDs and LCDs), and automotive production in countries like China, South Korea, Japan, and Taiwan. These nations are both major producers and consumers of high-purity fluorene derivatives. Favorable government policies supporting technological advancements in semiconductors and displays further solidify APAC's leading position.

- North America: Represents a mature market characterized by demand for high-specification fluorene derivatives used in specialized applications, including aerospace composites, advanced military technologies, and high-end medical devices. R&D activities in the U.S. and Canada focus heavily on novel polymer science and pharmaceutical applications, valuing purity and custom synthesis capabilities over volume production.

- Europe: Exhibits steady growth fueled by the region's robust automotive sector and stringent regulations pushing for lightweight, energy-efficient materials. Demand is strong for fluorene-based specialty chemicals and coatings used in advanced construction and industrial machinery. Germany, France, and the UK are key contributors, driven by chemical innovation and a focus on sustainable production practices (Green Chemistry initiatives).

- Latin America (LATAM): A developing market with demand primarily driven by localized manufacturing expansions and infrastructure projects. Brazil is the largest market within LATAM, showing increasing consumption in plastics and coatings sectors, though overall market growth remains dependent on regional economic stability and investment in manufacturing capacity.

- Middle East and Africa (MEA): A nascent market primarily focused on industrial coatings, construction chemicals, and specific oil and gas applications requiring high thermal resistance. Market penetration is gradually increasing as local industrialization and diversification away from traditional energy sectors boost demand for specialty chemical intermediates.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorene Market.- Mitsui Chemicals

- TCI Chemicals

- Sigma-Aldrich (Merck KGaA)

- ABCR GmbH

- P&G Chemicals

- Hunan Chemical Industry Research Institute

- Hangzhou Bay Chemical

- Zibo Guangyuan Chemical

- Tianjin Zhongxin Chemical

- Jiangsu Zhongyuan Chemical

- Zhejiang Haishuo Chemical

- Shanghai Haiyan Chemical

- Tokyo Chemical Industry (TCI)

- Alfa Aesar (Thermo Fisher)

- Wako Pure Chemical (FUJIFILM)

- J&K Scientific

- Acros Organics

- Santa Cruz Biotechnology

- Fisher Scientific

- BASF SE

Frequently Asked Questions

Analyze common user questions about the Fluorene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary factors driving the growth of the Fluorene Market?

The key drivers are the global surge in demand for Organic Light-Emitting Diode (OLED) display panels across consumer electronics and automotive applications, coupled with increasing regulatory requirements for high-performance, lightweight polymers in the electric vehicle (EV) and aerospace industries. Fluorene derivatives enhance thermal stability and durability, making them essential for these high-growth sectors.

Which region holds the largest market share for fluorene derivatives and why?

Asia Pacific (APAC), particularly China, South Korea, and Japan, holds the largest market share. This dominance is attributed to the substantial presence of global electronics manufacturing hubs and leading display panel fabrication facilities (LCD and OLED), which require vast quantities of fluorene-based liquid crystal monomers and functional materials.

How is the purity of fluorene crucial, particularly for high-tech applications?

High purity is critical because even trace impurities can negatively affect the optical and electrical performance of sophisticated electronic materials, such as those used in OLEDs and semiconductors. Ultra-high purity fluorene derivatives ensure the efficiency, longevity, and color stability required for next-generation display and electronic components.

What substitutes or alternative materials could potentially restrain the Fluorene Market?

Potential restraints include the development of non-fluorene-based specialty polymers or monomers offering comparable thermal and mechanical properties at a lower cost or with greater sustainability credentials. Additionally, volatility in the coal tar feedstock supply, which is the traditional source of fluorene, encourages research into alternative chemical scaffolds for polymer synthesis.

What is the role of Fluorene derivatives in the pharmaceutical industry?

In pharmaceuticals, the rigid, planar fluorene scaffold is utilized as a fundamental building block in drug discovery. Its structure often enhances the pharmacological properties of active pharmaceutical ingredients (APIs), particularly by influencing molecular binding and stability, leading to new compounds used in targeted therapeutic research.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager