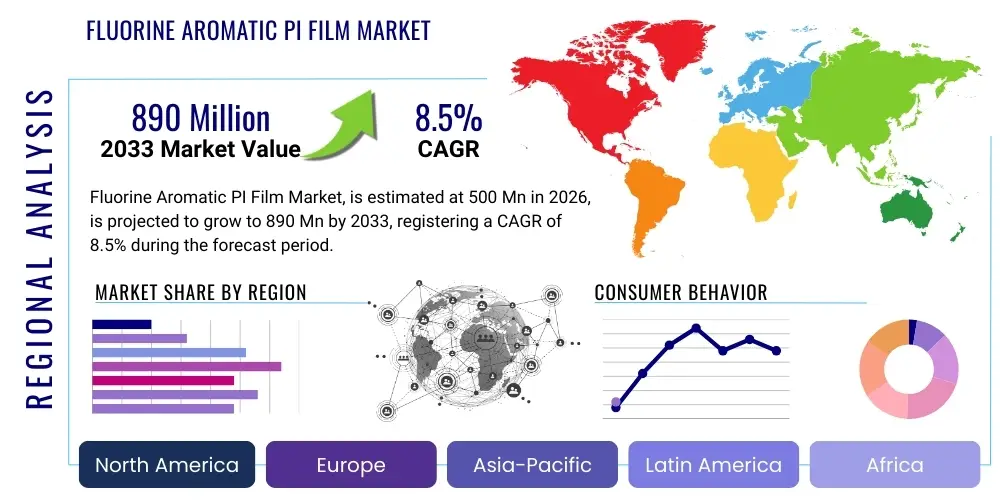

Fluorine Aromatic PI Film Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439205 | Date : Jan, 2026 | Pages : 257 | Region : Global | Publisher : MRU

Fluorine Aromatic PI Film Market Size

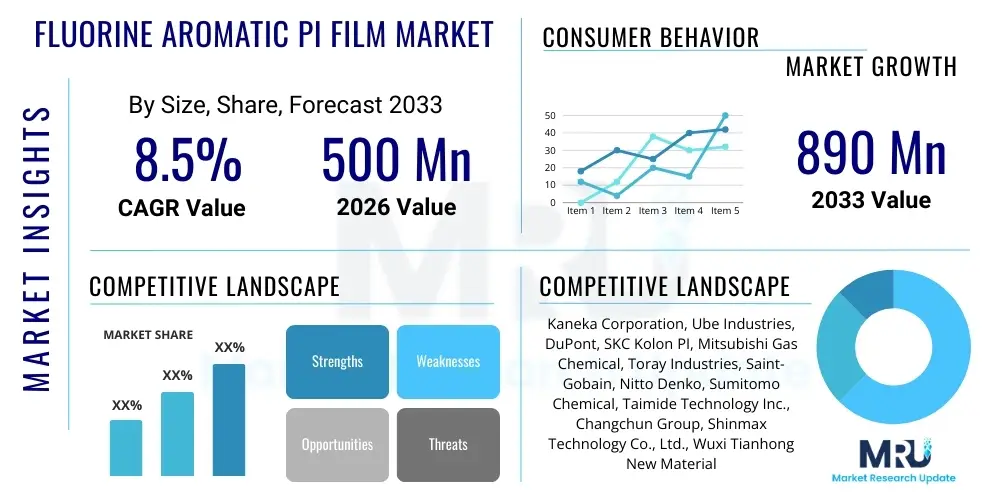

The Fluorine Aromatic PI Film Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.5% between 2026 and 2033. The market is estimated at USD 500 Million in 2026 and is projected to reach USD 890 Million by the end of the forecast period in 2033.

Fluorine Aromatic PI Film Market introduction

The Fluorine Aromatic Polyimide (PI) Film market is at the forefront of advanced material innovation, offering a unique combination of thermal stability, mechanical strength, and electrical insulation properties, further enhanced by the introduction of fluorine for improved dielectric performance and moisture resistance. These films are high-performance polymeric materials derived from the polymerization of diamines and dianhydrides, where fluorine atoms are strategically incorporated into the polymer backbone. This modification significantly reduces the dielectric constant and dissipation factor while simultaneously boosting hydrophobicity and chemical resistance, making them indispensable in an array of high-tech applications where traditional polyimide films may fall short.

The primary applications for Fluorine Aromatic PI films span across critical sectors such as flexible printed circuits (FPCs), advanced packaging for semiconductors, high-frequency communication devices (e.g., 5G/6G infrastructure), flexible displays (OLED, AMOLED), and aerospace components. In flexible electronics, these films serve as substrates, coverlays, and bonding sheets, facilitating miniaturization and enhancing device reliability due to their superior dimensional stability and low coefficient of thermal expansion. Their excellent dielectric properties are particularly crucial for signal integrity and power efficiency in high-speed data transmission, addressing the growing demand for faster and more compact electronic devices.

The market's robust growth is primarily driven by the escalating demand for advanced electronic devices, particularly in areas like 5G technology rollout, increasing adoption of flexible and foldable displays in consumer electronics, and the automotive industry's shift towards electric vehicles and autonomous driving systems which require high-reliability electronic components. Furthermore, the burgeoning demand for lightweight and high-performance materials in aerospace and defense, coupled with advancements in semiconductor manufacturing, continues to fuel innovation and expand the application landscape for Fluorine Aromatic PI Films. Benefits such as enhanced heat resistance, superior mechanical properties even at elevated temperatures, exceptional electrical insulation, and resistance to harsh environments position these films as critical enablers for next-generation technological advancements across diverse industries.

Fluorine Aromatic PI Film Market Executive Summary

The Fluorine Aromatic PI Film market is experiencing a significant growth trajectory, underpinned by compelling business trends driven by technological advancements and evolving consumer demands. Key business trends include the ongoing miniaturization of electronic components, which necessitates thinner, more flexible, and highly reliable insulating materials. There is also a pronounced shift towards high-frequency and high-speed data transmission, particularly with the global deployment of 5G and future 6G networks, where the low dielectric constant and low dissipation factor of fluorine aromatic PI films are indispensable. Furthermore, increased investment in research and development by key players is leading to the introduction of novel film compositions with even more tailored properties, such as ultra-low dielectric constants and enhanced adhesion, driving product innovation and market expansion into new niche applications. Strategic collaborations and partnerships between film manufacturers and end-product innovators are also becoming more prevalent, aimed at accelerating product integration and addressing specific application challenges.

Regionally, the market exhibits dynamic growth patterns, with Asia Pacific emerging as the dominant force, primarily due to the concentration of electronics manufacturing hubs, particularly in countries like China, South Korea, Japan, and Taiwan. These nations are at the forefront of semiconductor production, flexible display manufacturing, and 5G infrastructure development, creating a massive demand for fluorine aromatic PI films. North America and Europe also demonstrate substantial growth, propelled by strong R&D investments in aerospace, defense, and advanced automotive electronics, alongside a growing emphasis on high-performance materials for specialized industrial applications. Latin America, the Middle East, and Africa are showing nascent but promising growth, as these regions progressively adopt advanced technologies and invest in their digital infrastructure, although their market share remains comparatively smaller.

Segment-wise, the market is characterized by distinct trends. The application segment for Flexible Printed Circuits (FPCs) continues to hold the largest share, driven by the pervasive use of FPCs in consumer electronics, automotive systems, and industrial equipment. However, the Flexible Displays segment, encompassing OLED and AMOLED technologies, is projected to witness the highest growth rate, fueled by the rapid innovation and increasing consumer preference for foldable smartphones, wearable devices, and large-format flexible screens. In terms of product type, modified fluorine aromatic PI films, offering customized properties for specific high-end applications, are gaining traction, indicating a market moving towards specialized and value-added solutions. The end-use industry trend shows electronics as the largest segment, but significant growth is also observed in aerospace, automotive, and telecommunications, reflecting a broad adoption across diverse high-performance sectors.

AI Impact Analysis on Fluorine Aromatic PI Film Market

Users frequently inquire about how artificial intelligence (AI) might transform the Fluorine Aromatic PI Film market, focusing on aspects like material design optimization, manufacturing process efficiency, quality control, and predictive maintenance. Common concerns revolve around whether AI could accelerate the discovery of new fluorine-containing polyimide formulations with superior properties, optimize synthesis pathways to reduce costs and environmental impact, or revolutionize inspection processes to ensure zero-defect production. Expectations are high regarding AI's potential to drive innovation in materials science by enabling advanced simulations and data-driven insights, leading to the rapid development of next-generation films tailored for increasingly demanding applications in areas like high-frequency electronics and extreme environments.

- AI can significantly enhance the speed and efficiency of new material discovery and design for Fluorine Aromatic PI Films by simulating molecular structures and predicting their properties.

- Optimization algorithms powered by AI can fine-tune manufacturing processes, reducing waste, improving yield, and ensuring consistent product quality in film production lines.

- AI-driven predictive analytics can forecast equipment failures in manufacturing, enabling proactive maintenance and minimizing downtime, thus improving operational efficiency.

- Machine learning models can analyze vast datasets from experimentation, providing insights into the correlation between fluorine content, aromatic structure, and specific film performance characteristics.

- Enhanced quality control systems utilizing AI-powered vision inspection can detect microscopic defects in films more accurately and rapidly than human inspectors, ensuring higher product reliability.

- AI can contribute to more sustainable manufacturing practices by optimizing energy consumption and material usage during the synthesis and processing of these advanced films.

- Supply chain optimization through AI can improve logistics, inventory management, and demand forecasting for raw materials and finished Fluorine Aromatic PI Films, leading to cost savings and increased responsiveness.

DRO & Impact Forces Of Fluorine Aromatic PI Film Market

The Fluorine Aromatic PI Film market is shaped by a complex interplay of drivers, restraints, and opportunities, collectively known as DRO & Impact Forces. A primary driver is the relentless technological advancement in the electronics sector, particularly the surging demand for 5G and future 6G communication devices, which mandate materials with ultra-low dielectric constants and superior thermal management capabilities to handle high-frequency signals and increased power density. The rapid proliferation of flexible and foldable display technologies in consumer electronics, coupled with the miniaturization trend in semiconductor packaging, further fuels the demand for these high-performance films as essential substrates and insulating layers. Additionally, the growing adoption of electric and autonomous vehicles, requiring highly reliable and durable electronic components for power electronics, sensors, and battery management systems, significantly boosts the market. The aerospace and defense industries also contribute significantly, demanding lightweight, radiation-resistant, and high-temperature stable materials for various critical applications.

Despite the strong drivers, the market faces several restraints. The high manufacturing cost associated with fluorine aromatic PI films, primarily due to the complex synthesis processes, expensive raw materials (fluorine-containing monomers), and specialized production equipment, acts as a significant barrier, especially for smaller players or in cost-sensitive applications. The technical challenges in achieving uniform fluorine incorporation and precise control over film thickness and surface properties during large-scale manufacturing also pose limitations. Furthermore, the market's reliance on a limited number of specialized suppliers for specific fluorine-containing monomers can create supply chain vulnerabilities and price volatility. Stringent environmental regulations concerning the use and disposal of fluorinated compounds, though often less impactful on fully polymerized films, can influence research and development directions and manufacturing practices, leading to increased compliance costs.

Opportunities for market expansion are abundant and diverse. The continuous evolution of advanced packaging technologies, such as Chip-on-Film (COF) and Fan-out Wafer Level Packaging (FoWLP), presents new avenues for fluorine aromatic PI films to serve as critical interposers and encapsulants. The burgeoning Internet of Things (IoT) ecosystem and the demand for flexible, wearable electronics create an expanding landscape for these films, enabling smaller, more robust, and innovative device designs. Emerging applications in medical devices, particularly for implantable electronics and smart sensors where biocompatibility and long-term stability are paramount, also offer significant growth potential. Moreover, ongoing research into novel fluorine-containing monomers and polymerization techniques promises to yield films with even more enhanced properties and potentially lower production costs, unlocking new market segments and displacing incumbent materials in various high-performance applications. The strategic development of sustainable and eco-friendly manufacturing processes could also open up new market opportunities by addressing environmental concerns and catering to green initiatives.

Segmentation Analysis

The Fluorine Aromatic PI Film market is comprehensively segmented to provide a detailed understanding of its diverse landscape and growth dynamics across various dimensions. This segmentation helps in analyzing market trends, identifying key demand drivers, and assessing the competitive environment within specific product types, applications, and end-use industries. Each segment represents distinct market characteristics and growth potentials, reflecting the specialized requirements and technological advancements prevalent in different sectors utilizing these high-performance films.

- By Type:

- Low Fluorine Content Fluorine Aromatic PI Film: Characterized by a lower percentage of fluorine atoms, offering a balance of properties suitable for a broad range of general high-performance applications.

- High Fluorine Content Fluorine Aromatic PI Film: Features a higher concentration of fluorine, leading to superior dielectric properties, lower moisture absorption, and enhanced chemical resistance, critical for ultra-high frequency and extreme environment applications.

- Modified Fluorine Aromatic PI Film: Custom-engineered films with additional co-monomers or specific fluorine structures to achieve tailored properties such as improved adhesion, optical transparency, or specific thermal expansion coefficients.

- By Application:

- Flexible Printed Circuits (FPCs): Utilized as substrates, coverlays, and bonding sheets in various electronic devices requiring flexibility and high reliability.

- Flexible Displays (OLED, AMOLED): Essential for the manufacturing of pliable screens in smartphones, wearables, and other cutting-edge display technologies due to their dimensional stability and optical properties.

- Aerospace Composites: Incorporated into lightweight, high-strength structures and components for aircraft and spacecraft, leveraging their thermal and mechanical resilience.

- Automotive Electronics: Applied in advanced driver-assistance systems (ADAS), infotainment, and battery management systems where durability and thermal resistance are crucial.

- 5G Communication Devices: Crucial for antennas, modules, and other components requiring materials with ultra-low dielectric loss for high-frequency signal transmission.

- Semiconductor Packaging: Used in various forms for insulation, stress relief, and protection in advanced semiconductor packages.

- Industrial Films: Employed in specialized industrial applications demanding high temperature resistance, chemical inertness, and electrical insulation.

- Medical Devices: Utilized in implantable devices, diagnostic equipment, and surgical instruments due to their biocompatibility and stability.

- By End-Use Industry:

- Electronics: Encompasses consumer electronics, computing, telecommunications, and other broad electronic applications.

- Aerospace & Defense: Includes aircraft, spacecraft, satellites, and military equipment.

- Automotive: Covers components for electric vehicles, autonomous driving, and in-cabin electronics.

- Medical: Pertains to various medical devices, equipment, and instrumentation.

- Industrial: Applications in heavy machinery, energy, and other specialized industrial sectors.

- Telecommunications: Focused specifically on network infrastructure, optical fibers, and high-frequency communication systems.

Value Chain Analysis For Fluorine Aromatic PI Film Market

The value chain for the Fluorine Aromatic PI Film market is intricate, commencing with upstream raw material suppliers and extending through film manufacturers to downstream integrators and end-users. Upstream analysis primarily involves the procurement of highly specialized monomers, including various diamines and dianhydrides, with the fluorine-containing monomers being particularly critical and often proprietary. Chemical companies specializing in advanced polymers and fine chemicals form the backbone of this segment, supplying essential building blocks such as fluorinated diamines (e.g., 2,2′-Bis(trifluoromethyl)-4,4′-diaminobiphenyl, 6FDA) and dianhydrides. The quality and availability of these unique chemical precursors directly impact the properties and cost of the final PI film. Research and development activities at this stage are crucial for introducing novel fluorine-containing compounds that offer improved film characteristics or reduced synthesis complexities.

Further along the chain, the core manufacturing process involves the polymerization of these monomers to form polyamic acid, followed by casting into thin films and subsequent thermal or chemical imidization to yield the final polyimide film. This stage requires sophisticated equipment and precise process control to ensure uniformity, thickness accuracy, and desired physical properties. Film manufacturers often possess proprietary technologies for polymerization, film casting (e.g., solution casting), and post-treatment processes. After manufacturing, these films undergo rigorous quality control, testing, and sometimes surface treatments or lamination to prepare them for specific applications. The efficiency and technological capabilities of these film manufacturers are key determinants of market competitiveness.

Downstream analysis involves the integration of Fluorine Aromatic PI Films into various end products by component manufacturers and assemblers. This includes flexible printed circuit board (FPCB) manufacturers, flexible display panel makers, semiconductor packaging companies, and specialized manufacturers in aerospace and automotive sectors. These integrators often work closely with film suppliers to customize film specifications to meet stringent application requirements. The distribution channels for Fluorine Aromatic PI Films can be direct, where film manufacturers sell directly to large-scale industrial customers or strategic partners, especially for highly customized orders. Indirect channels involve distributors and specialized material suppliers who cater to a broader range of smaller and medium-sized enterprises, offering logistical support, technical assistance, and inventory management. Both direct and indirect channels play vital roles in ensuring market reach and efficient delivery of these advanced materials to a diverse customer base globally.

Fluorine Aromatic PI Film Market Potential Customers

The Fluorine Aromatic PI Film market caters to a diverse range of potential customers who are primarily end-users and buyers in various high-technology industries, seeking materials with superior thermal, mechanical, and electrical performance, especially in demanding environments. A significant segment of these customers includes manufacturers of advanced electronic devices, such as those producing smartphones, tablets, wearable electronics, and high-performance computing components. These companies require films for flexible printed circuits (FPCs), chip-on-film (COF) packaging, and interposers, valuing the film's ability to enable miniaturization, enhance signal integrity, and withstand high operating temperatures without degradation. The growing consumer demand for thinner, lighter, and more powerful electronic gadgets directly translates into a continuous need for innovative, high-performance materials like fluorine aromatic PI films.

Another crucial customer segment encompasses manufacturers within the telecommunications infrastructure, particularly those involved in the rollout and development of 5G and upcoming 6G networks. These customers seek materials for antennas, high-frequency modules, and other critical components where extremely low dielectric loss and excellent signal transmission characteristics are paramount. The film's low dielectric constant ensures minimal signal attenuation at high frequencies, making it an indispensable material for achieving the bandwidth and speed requirements of next-generation wireless communication. Furthermore, companies specializing in flexible and foldable display technologies, including those producing OLED and AMOLED panels for consumer electronics and industrial applications, are key buyers, leveraging the films' exceptional optical properties, dimensional stability, and flexibility to create cutting-edge visual interfaces.

Beyond electronics and telecommunications, significant potential customers exist in the automotive industry, particularly in the rapidly evolving electric vehicle (EV) and autonomous driving sectors. Automakers and their tier-one suppliers require robust, high-temperature resistant, and durable films for battery management systems, power electronics, sensors, and ADAS modules, where reliability and performance under harsh operating conditions are non-negotiable. Similarly, the aerospace and defense sectors represent high-value customers, demanding lightweight, high-strength, and radiation-resistant materials for critical components in aircraft, spacecraft, and military equipment, where mission-critical reliability is paramount. Industrial manufacturers and medical device companies also represent growing segments, utilizing these films in specialized applications requiring high chemical resistance, thermal stability, and biocompatibility, thus broadening the customer base significantly.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 500 Million |

| Market Forecast in 2033 | USD 890 Million |

| Growth Rate | CAGR 8.5% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Kaneka Corporation, Ube Industries, DuPont, SKC Kolon PI, Mitsubishi Gas Chemical, Toray Industries, Saint-Gobain, Nitto Denko, Sumitomo Chemical, Taimide Technology Inc., Changchun Group, Shinmax Technology Co., Ltd., Wuxi Tianhong New Material Technology Co., Ltd., Suzhou Polytime New Material Technology Co., Ltd., Guangdong GBS Technology Co., Ltd., China Lucky Film Corporation, Daicel Corporation, Kolon Industries, DIC Corporation, 3M Company |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorine Aromatic PI Film Market Key Technology Landscape

The key technology landscape of the Fluorine Aromatic PI Film market is characterized by sophisticated polymerization techniques, advanced film casting methods, and innovative fluorine chemistry aimed at tailoring material properties for high-performance applications. The core technology revolves around the precise synthesis of fluorine-containing diamines and dianhydrides, which are the fundamental building blocks. This often involves intricate organic synthesis pathways to incorporate fluorine atoms into the aromatic backbone of the monomers, a process crucial for achieving desired dielectric constants, thermal stability, and mechanical properties. Manufacturers heavily invest in R&D to develop novel fluorine-containing monomers that can provide even lower dielectric constants, superior moisture resistance, and enhanced adhesion to metals, addressing the ever-increasing demands of high-frequency electronics and extreme environmental conditions. The ability to control the position and concentration of fluorine atoms within the polymer chain is a critical technological differentiator among market players.

Once the monomers are synthesized, the next critical technological phase is the polymerization process, typically involving a two-step method where polyamic acid is first formed, followed by imidization. Solution casting is the predominant film-forming technology, where the polyamic acid solution is cast onto a smooth surface (e.g., a stainless steel belt) and then carefully dried and heated to induce cyclization, converting it into a polyimide film. This process requires precise control over solvent evaporation rates, temperature profiles, and film thickness uniformity, which directly impacts the film's mechanical strength, dimensional stability, and optical clarity. Advancements in casting technology include ultra-thin film fabrication capabilities, enabling the production of films merely a few micrometers thick, which are essential for miniaturized electronic components and flexible display substrates.

Beyond synthesis and casting, the technology landscape also includes specialized surface treatments, lamination techniques, and post-processing methods designed to enhance specific film properties. For instance, plasma treatments or chemical etching can improve adhesion to metallic layers in flexible printed circuits, while specialized coating technologies can further reduce moisture absorption or impart anti-reflective properties. Furthermore, the development of composite films, where fluorine aromatic PI is combined with other materials, such as nanoparticles or inorganic fillers, represents an evolving technological frontier aimed at achieving multifunctional properties like enhanced thermal conductivity without compromising electrical insulation. The integration of artificial intelligence and machine learning in material design and process optimization is an emerging trend, promising to accelerate the discovery of new formulations and improve manufacturing efficiency and quality control across the entire technological landscape.

Regional Highlights

- Asia Pacific (APAC): Dominates the global market due to the presence of major electronics manufacturing hubs in countries like China, South Korea, Japan, and Taiwan. These regions are leading in semiconductor fabrication, flexible display production (OLED, AMOLED), and 5G infrastructure deployment, driving immense demand for Fluorine Aromatic PI Films. Significant investments in R&D and manufacturing capabilities further solidify APAC's leading position, with a strong focus on high-frequency electronics and advanced packaging.

- North America: A significant market driven by robust R&D activities, especially in aerospace, defense, and high-performance computing sectors. The region benefits from strong government funding for advanced material research and the presence of key technology innovators. Demand is also high from the automotive electronics industry as the region embraces electric vehicles and autonomous driving technologies.

- Europe: Characterized by strong growth in specialized industrial applications, advanced automotive systems, and medical devices. European countries, particularly Germany and France, are investing heavily in innovative material science and high-end manufacturing, contributing to a steady demand for Fluorine Aromatic PI Films. Environmental regulations also influence the development of more sustainable production methods here.

- Latin America: An emerging market with growing investments in telecommunications infrastructure and increasing adoption of consumer electronics. While smaller in market share compared to other regions, steady economic development and technological integration are expected to drive gradual growth, particularly in electronic component manufacturing and assembly.

- Middle East & Africa (MEA): A nascent market with potential for future growth, primarily driven by investments in digital transformation initiatives, telecommunication network expansion, and the development of specialized industrial sectors. The region's increasing focus on diversifying its economy away from traditional resources could lead to opportunities for advanced materials in new industrial applications.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorine Aromatic PI Film Market.- Kaneka Corporation

- Ube Industries

- DuPont

- SKC Kolon PI

- Mitsubishi Gas Chemical

- Toray Industries

- Saint-Gobain

- Nitto Denko

- Sumitomo Chemical

- Taimide Technology Inc.

- Changchun Group

- Shinmax Technology Co., Ltd.

- Wuxi Tianhong New Material Technology Co., Ltd.

- Suzhou Polytime New Material Technology Co., Ltd.

- Guangdong GBS Technology Co., Ltd.

- China Lucky Film Corporation

- Daicel Corporation

- Kolon Industries

- DIC Corporation

- 3M Company

Frequently Asked Questions

What are Fluorine Aromatic PI Films?

Fluorine Aromatic PI Films are high-performance polyimide films modified with fluorine atoms in their polymer structure, enhancing properties such as a lower dielectric constant, reduced moisture absorption, improved chemical resistance, and excellent thermal stability for demanding electronic and industrial applications.

What are the primary applications of Fluorine Aromatic PI Films?

The main applications include flexible printed circuits (FPCs), flexible displays (OLED, AMOLED), 5G communication devices, semiconductor packaging, automotive electronics, and components for aerospace and defense, due to their superior electrical and thermal properties.

Why is the dielectric constant important for these films?

A low dielectric constant is crucial for high-frequency electronic applications, such as 5G/6G, because it minimizes signal loss and cross-talk, enabling faster data transmission and improved device performance in compact designs.

Which region dominates the Fluorine Aromatic PI Film market?

Asia Pacific (APAC) currently dominates the Fluorine Aromatic PI Film market, primarily driven by its robust electronics manufacturing ecosystem, including semiconductor, flexible display, and 5G infrastructure production hubs in countries like China, South Korea, and Japan.

What are the key drivers for market growth?

Key drivers include the global rollout of 5G/6G technologies, the increasing adoption of flexible and foldable displays in consumer electronics, ongoing miniaturization trends in device manufacturing, and the rising demand for high-reliability components in electric vehicles and aerospace applications.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

- Fluorine Aromatic Pi Film Market Size Report By Type (25m), By Application (Flexible Display Substrates, Solar Cell, Flexible Printed Circuit Boards, Aerospace), By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Share, Trends, Outlook and Forecast 2025-2032

- Fluorine Aromatic PI Film Market Statistics 2025 Analysis By Application (Flexible Display Substrates, Solar Cell, Organic Photovoltaics (OPVs), Flexible Printed circuit boards (PCBs)), By Type (Thickness?15?m, 15?m25?m), and By Region (North America, Latin America, Europe, Asia Pacific, Middle East, and Africa) - Size, Share, Outlook, and Forecast 2025 to 2032

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager