Fluorobenzene Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 435030 | Date : Dec, 2025 | Pages : 251 | Region : Global | Publisher : MRU

Fluorobenzene Market Size

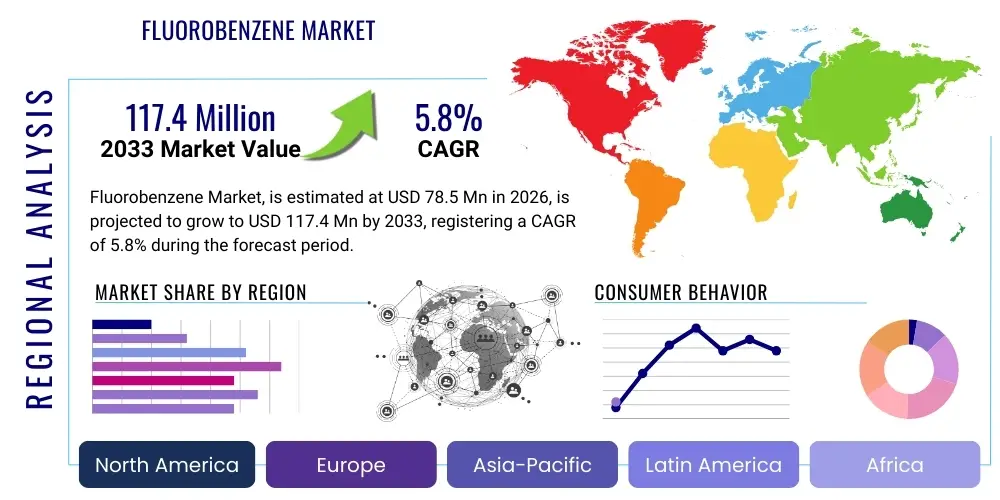

The Fluorobenzene Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 78.5 million in 2026 and is projected to reach USD 117.4 million by the end of the forecast period in 2033.

Fluorobenzene Market introduction

Fluorobenzene (C6H5F), a halogenated derivative of benzene, is a pivotal intermediate chemical characterized by a single fluorine atom substitution. This compound exhibits unique chemical properties, including enhanced thermal stability and altered polarity, making it indispensable across several high-value industries. Historically utilized primarily as a solvent and chemical precursor, its application scope has expanded significantly due to increasing complexity in material science and pharmaceutical synthesis. The compound's low boiling point and high dielectric constant further cement its role in specialized chemical processes.

Major applications for fluorobenzene center around its utility as a building block for advanced materials, specifically in the agrochemical and pharmaceutical sectors. In drug synthesis, it acts as a key scaffold for creating fluorinated active pharmaceutical ingredients (APIs), which often exhibit superior bioavailability and metabolic stability compared to their non-fluorinated counterparts. Furthermore, the electronics industry utilizes fluorobenzene derivatives in the production of liquid crystal displays (LCDs) and high-performance polymers, capitalizing on its unique electrical properties.

The primary driving factors propelling the fluorobenzene market include the accelerating global demand for advanced fluorinated molecules used in new drug development, particularly in oncology and infectious disease treatment. Simultaneously, the robust growth in specialized agrochemicals, designed for enhanced efficacy and environmental safety, mandates the use of fluorinated intermediates like fluorobenzene. Regulatory mandates in certain regions encouraging the use of more stable and less volatile solvents also contribute to market expansion, positioning fluorobenzene as a strategic chemical commodity.

Fluorobenzene Market Executive Summary

The fluorobenzene market is experiencing stable expansion, driven fundamentally by robust investments in pharmaceutical research and the sustained demand for high-efficacy agrochemical products globally. Key business trends indicate a shift towards higher purity grades of fluorobenzene, particularly those required for sensitive electronic applications and precise API synthesis, necessitating technological upgrades in manufacturing processes such as continuous flow synthesis and advanced distillation techniques. Consolidation among major specialty chemical producers and strategic partnerships aimed at securing long-term supply chains are defining the competitive landscape. Furthermore, heightened focus on green chemistry principles is prompting manufacturers to explore more environmentally benign synthesis routes for fluorobenzene, influencing operational expenditures and R&D strategies across the industry.

Regionally, the Asia Pacific (APAC) market, particularly China and India, dominates both production capacity and consumption, fueled by rapid industrialization, expansive generic drug manufacturing capabilities, and burgeoning electronics production bases. North America and Europe maintain significant market share, characterized by high-value consumption in proprietary pharmaceutical R&D and advanced material development, often demanding stringent purity standards. Segmentation trends underscore the dominance of the pharmaceutical application segment, owing to the high average selling prices and consistent volume requirements associated with fluorinated APIs. Concurrently, the electronics application segment, while smaller in volume, is projected to exhibit the highest growth rate due to the miniaturization and increasing sophistication of electronic components requiring high-performance fluorinated solvents and intermediates.

The market faces operational challenges primarily related to the complex handling and storage of fluorine-containing reagents and stringent regulatory oversight concerning chemical manufacturing and effluent management. However, significant opportunities exist in developing specialized derivatives for nascent applications, such as high-energy battery electrolytes and next-generation polymer coatings. Strategic market participants are focusing on optimizing yield rates and reducing energy intensity in production to enhance profitability, while simultaneously leveraging intellectual property surrounding novel fluorination methods to secure competitive advantages against generic manufacturers.

AI Impact Analysis on Fluorobenzene Market

Common user inquiries regarding the impact of Artificial Intelligence (AI) on the Fluorobenzene Market frequently revolve around optimizing chemical synthesis routes, predicting reaction outcomes, and streamlining quality control. Users are keen to understand how computational chemistry, augmented by machine learning (ML), can reduce the traditionally long and resource-intensive R&D cycle for novel fluorinated molecules that utilize fluorobenzene as a precursor. Key themes include the efficiency gains in drug discovery where AI models accelerate target identification and compound optimization, and the integration of predictive maintenance in manufacturing to minimize plant downtime and ensure consistent product quality, especially for high-purity grades required by the electronics industry.

The integration of AI and Machine Learning (ML) is fundamentally altering how specialty chemicals, including fluorobenzene, are developed and manufactured. AI algorithms are being deployed to analyze vast datasets of chemical reactions, identifying novel and more efficient fluorination pathways, potentially bypassing traditional, high-pressure synthesis methods which are often hazardous and energy-intensive. Furthermore, AI-driven process optimization allows manufacturers to fine-tune reaction parameters—such as temperature, pressure, and catalyst concentration—in real-time, leading to improved yield rates and reduced waste generation, directly impacting the overall cost structure of fluorobenzene production.

In the context of downstream applications, particularly pharmaceuticals, AI accelerates the design of fluorinated drug candidates. By predicting ADMET (Absorption, Distribution, Metabolism, Excretion, and Toxicity) properties of fluorobenzene-derived compounds early in the discovery phase, AI significantly lowers the failure rate of compounds entering clinical trials. This rapid iteration and optimization capability ensures a sustained, high-quality demand for fluorobenzene as a reliable intermediate. For market participants, this translates into a need for robust digital infrastructure capable of handling and processing large volumes of analytical and production data to maximize the benefits derived from AI integration.

- AI-driven Retrosynthesis Planning: Accelerates the identification of optimal synthetic routes using fluorobenzene, minimizing experimental failures.

- Predictive Quality Control: Machine learning models predict variations in fluorobenzene purity based on real-time sensor data, ensuring high-grade output for electronics applications.

- Enhanced Process Optimization: AI algorithms continuously adjust operational parameters (temperature, flow rates) in chemical reactors to maximize yield and energy efficiency.

- Drug Target Acceleration: AI speeds up the design and screening of novel fluorinated Active Pharmaceutical Ingredients (APIs) derived from fluorobenzene precursors.

- Supply Chain Forecasting: Advanced analytics predict demand fluctuations for fluorobenzene across different sectors, optimizing inventory and mitigating supply risks.

- Digital Twin Implementation: Creation of virtual representations of fluorobenzene manufacturing plants to simulate different operating conditions and predict equipment failure.

DRO & Impact Forces Of Fluorobenzene Market

The Fluorobenzene market dynamics are governed by a complex interplay of increasing demand from critical end-user sectors (Drivers), stringent regulatory and cost pressures (Restraints), and opportunities presented by technological advancements and emerging applications. The primary drivers include the consistent proliferation of fluorinated drug candidates in the pharmaceutical pipeline and the necessity for high-performance agrochemicals that offer better environmental profiles and higher efficacy per application unit. The unique physicochemical properties conferred by the fluorine atom in intermediate chemicals like fluorobenzene make it irreplaceable in many modern synthetic procedures, securing its indispensable role in specialty chemical supply chains globally.

Restraints largely center on the technical complexity and inherent safety risks associated with fluorination chemistry, which translates into high capital expenditure for manufacturing facilities and significant operational costs. Furthermore, the global regulatory environment, especially in highly developed regions, imposes strict controls on chemical processing waste disposal and the transportation of hazardous intermediates, adding layers of compliance burdens to manufacturers. Market growth is also marginally constrained by the availability and price volatility of key raw materials, although efficient vertical integration strategies by major players help mitigate this risk somewhat.

Opportunities for expansion are abundant in emerging technological fields. The increasing adoption of fluorinated compounds in non-traditional electronics, such as high-density data storage and advanced battery technology (particularly lithium-ion battery electrolytes), opens lucrative new avenues for fluorobenzene derivatives. Moreover, the push towards developing sustainable and cleaner synthetic methodologies, such as photochemical or enzymatic fluorination techniques, represents a long-term opportunity to reduce the environmental footprint and operational complexity associated with traditional methods, appealing to environmentally conscious industries and investors. The market is also heavily influenced by impact forces such as patent expirations for key fluorinated drugs, creating fluctuating demand cycles for the precursor chemical.

- Drivers

- Surging Demand in Pharmaceutical Synthesis for Fluorinated APIs.

- Expansion of Specialized Agrochemical Sector (Herbicides and Fungicides).

- Technical Superiority and Stability of Fluorinated Intermediates.

- Restraints

- High Capital and Operational Costs Associated with Fluorination Processes.

- Strict Global Regulatory Frameworks Governing Chemical Manufacturing and Safety.

- Price Volatility and Supply Chain Concentration of Key Raw Materials.

- Opportunities

- Development of Green Synthesis Techniques (e.g., Continuous Flow Chemistry).

- Emerging Applications in High-Performance Electronics and Battery Technology.

- Market Penetration in Developing Economies with Growing Chemical Industries.

- Impact Forces

- Fluctuating Raw Material Prices (Benzene, Fluorinating Agents).

- Technological Advancements in Fluorination Catalysis.

- Stringent Environmental, Social, and Governance (ESG) Standards.

Segmentation Analysis

The Fluorobenzene Market is systematically segmented based on Grade Type, distinguishing between the purity levels required for specific end-use applications, and by Application, which identifies the primary consuming industries. The segmentation by grade is critical because the requirements for pharmaceutical intermediates or electronic materials demand extremely high purity (typically >99.5%), often requiring multi-stage purification processes, which significantly affects pricing and production complexity. Conversely, technical-grade fluorobenzene is often sufficient for certain bulk chemical synthesis steps or as a solvent in less sensitive industrial reactions.

The application segmentation reveals the primary revenue streams and growth drivers. Pharmaceuticals constitute the largest and most valuable segment, driven by the indispensable role of fluorobenzene as a foundation for numerous blockbuster and next-generation drugs. The need for precise stereochemistry and high-yield synthesis pathways ensures continuous, steady demand in this sector. The Agrochemical segment follows, characterized by seasonal purchasing patterns but consistent innovation in pesticide efficacy requiring novel fluorinated structures.

The smallest but fastest-growing segments include Electronics and Specialty Chemicals, where fluorobenzene derivatives are employed in high-tech materials like liquid crystals, specialized polymers, and advanced solvents. This high-growth trajectory in specialty applications is fueled by the rapid technological evolution in consumer electronics and the demand for materials exhibiting specific thermal and electrical properties, cementing the strategic importance of fluorobenzene across diverse manufacturing value chains.

- By Grade

- High Purity Grade (>99.5%)

- Technical Grade (98% - 99.5%)

- By Application

- Pharmaceuticals (API Synthesis, Intermediates)

- Agrochemicals (Pesticides, Herbicides, Fungicides)

- Electronics (Liquid Crystals, Specialized Solvents)

- Specialty Chemicals and Intermediates (Polymer Additives, Research Chemicals)

- By End-Use

- Contract Manufacturing Organizations (CMOs)

- Bulk Chemical Producers

- Research Laboratories and Academia

Value Chain Analysis For Fluorobenzene Market

The value chain for the fluorobenzene market begins with the procurement of fundamental raw materials, primarily benzene and various fluorinating agents such as elemental fluorine, hydrogen fluoride, or specialty reagents like Selectfluor. The upstream segment involves large-scale petrochemical companies supplying benzene and specialized chemical manufacturers providing the fluorination reagents. Quality control at this initial stage is paramount, as the purity of the raw materials directly influences the yield and purity of the final fluorobenzene product, especially crucial for high-purity applications.

The central manufacturing process involves complex chemical reactions, typically either the Balz-Schiemann reaction or catalytic fluorination, followed by extensive purification steps including distillation and chromatography to achieve the requisite purity levels. Midstream players are specialized chemical manufacturers and custom synthesis organizations (CSOs) that possess the necessary expertise and infrastructure to handle hazardous fluorination chemistry safely and efficiently. Distribution channels are highly structured, relying heavily on specialized logistics providers certified to transport hazardous chemical intermediates. Direct sales channels are common for bulk orders to large pharmaceutical or agrochemical manufacturers, ensuring supply chain integrity and specific quality adherence.

The downstream segment comprises the end-user industries: pharmaceutical companies, which utilize fluorobenzene as a core building block for complex Active Pharmaceutical Ingredients (APIs); agrochemical producers; and electronics manufacturers. The indirect distribution channel primarily caters to smaller research institutions and specialty chemical producers through chemical distributors and laboratory supply houses. The value addition is maximized in the downstream segment, where the highly purified fluorobenzene is transformed into patented high-value end products, reinforcing the necessity for reliable supply and consistently high quality from upstream and midstream producers.

Fluorobenzene Market Potential Customers

The primary customers for fluorobenzene are highly specialized organizations within the life sciences and material science sectors, categorized largely as bulk manufacturing entities and research-intensive organizations. Pharmaceutical companies represent the largest consumer base, utilizing fluorobenzene as an essential starting material in the synthesis of numerous fluorinated drug compounds. These customers demand consistent supply, stringent quality documentation, and often require customized packaging and delivery protocols to integrate seamlessly into their highly regulated manufacturing environments.

Another significant customer segment includes Contract Manufacturing Organizations (CMOs) and Contract Research Organizations (CROs), which perform outsourced synthesis and production for both pharmaceutical and agrochemical firms. These entities require flexibility, technical support regarding synthesis scale-up, and reliable access to various purity grades of fluorobenzene to meet diverse client specifications. The rising trend of outsourcing drug substance manufacture further strengthens the CMO segment's demand profile for high-quality fluorobenzene intermediates.

Furthermore, specialized chemical companies focused on developing liquid crystals, advanced polymers, and specialized solvents constitute the third major group of potential customers. These end-users, particularly those serving the electronics industry, require ultra-high purity fluorobenzene with minimal metallic contaminants, driving demand for specialized manufacturing and purification technologies. Research institutions and university labs also serve as consistent, albeit smaller volume, buyers for exploratory chemistry and development purposes.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 78.5 million |

| Market Forecast in 2033 | USD 117.4 million |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck KGaA, TCI Chemicals, Alfa Aesar (Thermo Fisher), Sigma-Aldrich (Merck), Tokyo Chemical Industry, Santa Cruz Biotechnology, Fisher Scientific, Clearsynth Labs, Strem Chemicals, AkzoNobel (now Nouryon), Solvay, Lanxess, Daikin Industries, Fluorochem, Manchester Organics, SynQuest Laboratories, Angene International, BOC Sciences, P&M Chemistry, Acros Organics |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorobenzene Market Key Technology Landscape

The technological landscape of the fluorobenzene market is defined by advancements aimed at improving safety, increasing yield, and enhancing purity, moving away from classical, hazardous batch processes. One of the primary technologies utilized is the Balz-Schiemann reaction, involving the decomposition of diazonium tetrafluoroborates. While traditional, modern optimization of this method incorporates microreactor technology and continuous flow chemistry. Continuous flow systems offer superior control over reaction conditions, crucial for handling volatile and explosive intermediates, resulting in higher throughput and intrinsic safety improvements compared to large-scale batch reactors, particularly critical for high-purity pharmaceutical-grade material.

Another area of intense technological focus is catalytic direct fluorination and C-H bond activation, which aim to simplify the synthesis route by introducing fluorine directly onto the benzene ring under milder conditions. Techniques involving specialized palladium or transition metal catalysts, often coupled with novel fluorinating reagents, are being researched to achieve higher selectivity and lower energy consumption. Success in these catalytic methods would significantly reduce reliance on multi-step processes, thereby lowering manufacturing costs and reducing the generation of environmentally unfriendly byproducts, aligning with modern sustainability goals in chemical manufacturing.

Purification technology is equally vital, especially for satisfying the stringent specifications of the electronics sector. Advanced fractional distillation techniques, often under high vacuum and cryogenic conditions, are employed to remove trace impurities, including residual solvents and moisture, which can compromise the performance of liquid crystals or specialty polymers. Furthermore, analytical techniques, including high-resolution Gas Chromatography-Mass Spectrometry (GC-MS) and Nuclear Magnetic Resonance (NMR) spectroscopy, are integrated directly into the production line to ensure real-time quality assurance, supporting the production of ultra-high purity fluorobenzene essential for cutting-edge technological applications.

Regional Highlights

- Asia Pacific (APAC): APAC is the dominant market region, characterized by extensive manufacturing capabilities, particularly in China and India. This region benefits from lower operational costs, supportive government policies promoting chemical production, and a robust generic pharmaceutical industry that serves global markets. The rapid expansion of electronics manufacturing, coupled with significant investment in domestic agrochemical production, sustains high demand for fluorobenzene intermediates.

- North America: North America represents a mature, high-value market driven primarily by intensive pharmaceutical research and development activities. The demand is skewed towards high-purity fluorobenzene used in proprietary API synthesis, advanced materials for aerospace, and specialized solvents. Stringent environmental regulations necessitate advanced manufacturing compliance, favoring highly specialized and quality-focused suppliers.

- Europe: Europe is a key consumption hub, supported by leading chemical and pharmaceutical multinational corporations headquartered in countries like Germany, Switzerland, and the UK. The European market emphasizes innovation in green chemistry, driving demand for fluorobenzene produced using sustainable and environmentally sound processes. Regulatory frameworks, such as REACH, heavily influence supply chain practices and product registration requirements in this region.

- Latin America, Middle East, and Africa (MEA): This region exhibits emerging market potential. Latin America's growth is tied to its expanding agrochemical sector, while the MEA region is developing its petrochemical and specialty chemical manufacturing base. While currently smaller in market share, increasing foreign investment in pharmaceutical manufacturing and the modernization of local chemical industries are expected to drive moderate to high growth rates over the forecast period.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorobenzene Market.- Merck KGaA

- TCI Chemicals (Tokyo Chemical Industry Co., Ltd.)

- Alfa Aesar (A Thermo Fisher Scientific Company)

- Sigma-Aldrich (Part of Merck KGaA)

- Santa Cruz Biotechnology, Inc.

- Fisher Scientific (Part of Thermo Fisher Scientific)

- Clearsynth Labs Pvt. Ltd.

- Strem Chemicals (Part of Ascensus Specialties)

- Daikin Industries, Ltd. (Specialty Chemicals Division)

- Solvay S.A.

- Lanxess AG

- Fluorochem Ltd.

- Manchester Organics Ltd.

- SynQuest Laboratories, Inc.

- Angene International Limited

- BOC Sciences

- P&M Chemistry (Suzhou) Co., Ltd.

- Acros Organics (Part of Thermo Fisher Scientific)

- AkzoNobel (now Nouryon, specialized segments)

- Shaanxi Sinuote Biological Technology Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fluorobenzene market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary driver for the growth of the Fluorobenzene Market?

The primary driver is the accelerating demand from the pharmaceutical industry, where fluorobenzene serves as an essential intermediate for synthesizing fluorinated Active Pharmaceutical Ingredients (APIs) which offer superior pharmacokinetic profiles, notably enhanced metabolic stability and bioavailability.

Which purity grade of fluorobenzene is most sought after in the market?

The High Purity Grade (>99.5%) of fluorobenzene is the most sought after, particularly by the pharmaceutical and electronics sectors. Ultra-high purity is non-negotiable for API synthesis and the manufacture of specialized materials like liquid crystals to prevent detrimental trace element contamination.

How does AI technology specifically influence the production of fluorobenzene?

AI influences fluorobenzene production by optimizing synthesis parameters in continuous flow reactors, predicting reaction outcomes to improve yields, and enhancing real-time quality control to ensure consistent adherence to stringent purity standards, thereby increasing operational efficiency and safety.

What are the key restraint factors affecting market expansion?

Key restraint factors include the inherently high capital expenditure and operational costs associated with safe handling of hazardous fluorination reagents, coupled with strict global regulatory compliance requirements governing chemical waste management and manufacturing processes.

Which geographic region dominates the consumption of fluorobenzene, and why?

The Asia Pacific (APAC) region dominates the consumption of fluorobenzene. This dominance is attributed to the presence of large-scale generic drug manufacturing, burgeoning domestic agrochemical production, and the region's massive manufacturing base for consumer electronics.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager