Fluorochrome Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434332 | Date : Dec, 2025 | Pages : 245 | Region : Global | Publisher : MRU

Fluorochrome Market Size

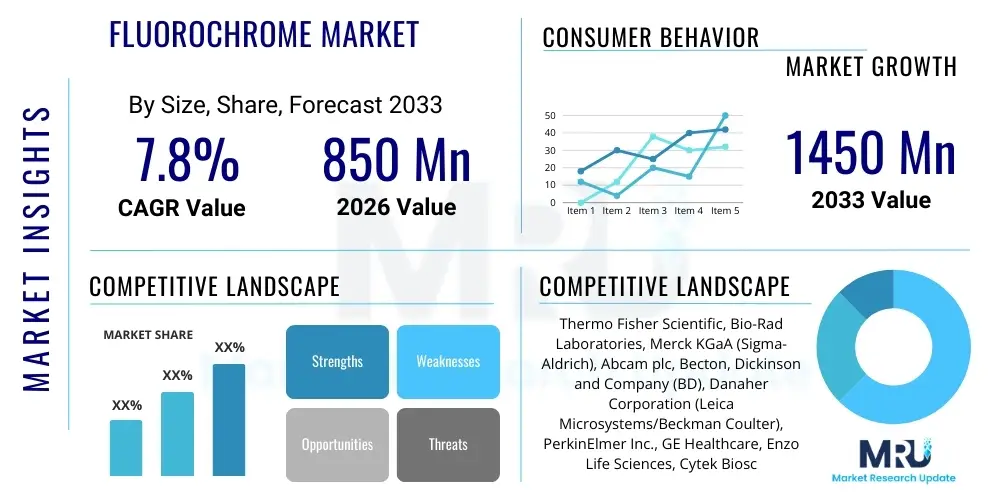

The Fluorochrome Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 850 Million in 2026 and is projected to reach USD 1450 Million by the end of the forecast period in 2033. This substantial expansion is fundamentally driven by escalating investments in life science research, particularly in genomics, proteomics, and cell biology, where highly sensitive and specific detection methods are indispensable for complex analytical processes. The increasing adoption of advanced diagnostic technologies and the rising prevalence of chronic diseases requiring sophisticated detection tools further solidify this growth trajectory.

Fluorochrome Market introduction

The Fluorochrome Market encompasses the production and distribution of fluorescent dyes and probes utilized extensively across various biological and medical sciences. Fluorochromes are chemical compounds that re-emit light upon excitation, making them essential tools for labeling specific molecules or structures within cells and tissues, enabling high-resolution visualization and quantification. Key products include organic dyes such as FITC and Rhodamine derivatives, as well as inorganic materials like quantum dots and fluorescent proteins. These reagents are critical components in advanced analytical techniques, providing unparalleled sensitivity and specificity in complex biological systems. The primary application domains are vast, ranging from fundamental cellular research to clinical diagnostics and drug discovery.

Major applications of fluorochromes span flow cytometry, fluorescence microscopy, immunohistochemistry (IHC), DNA sequencing, and various forms of immunoassays. In research settings, they facilitate the study of molecular interactions, protein localization, and cellular function kinetics. Clinically, fluorochromes are vital for diagnostic tests, including disease detection, pathogen identification, and monitoring therapeutic efficacy. The inherent benefits of fluorochromes, such as their high quantum yield, photostability (in modern formulations), and capacity for multiplexed analysis (using multiple colors simultaneously), drive their continuous integration into new scientific protocols and commercial products.

The market growth is primarily driven by the global surge in research and development activities within the pharmaceutical and biotechnology sectors, aimed at developing personalized medicine and advanced therapeutics. Furthermore, technological advancements leading to the creation of brighter, more stable, and spectrally distinct fluorochromes, alongside the increasing automation of high-throughput screening processes (HCS), are major accelerators. The growing incidence of cancer and infectious diseases requiring precise and early diagnosis also fuels the demand for sophisticated fluorescent diagnostic tools, ensuring the market maintains a robust expansion rate across all key geographical regions.

Fluorochrome Market Executive Summary

The Fluorochrome Market is characterized by robust innovation and strong demand stemming from the life sciences industry’s relentless pursuit of high-resolution biological analysis. Current business trends indicate a significant shift towards developing advanced probes optimized for in-vivo imaging and multiplexing assays, moving beyond traditional organic dyes towards highly photostable solutions like quantum dots and engineered fluorescent proteins. Key players are focusing heavily on strategic acquisitions and collaborations with academic research institutions to rapidly commercialize novel chemistries and integrate them into existing instrumentation platforms, enhancing assay efficiency and reducing analysis time. This competitive landscape is driving the overall quality and sensitivity of fluorescent reagents available to researchers and clinicians globally. Emerging markets are showing accelerated adoption rates due to increasing government funding for biomedical research.

Regionally, North America maintains the dominant market share, attributed to the presence of leading biotechnology and pharmaceutical companies, substantial R&D expenditure, and early adoption of cutting-edge technologies like high-content screening and advanced flow cytometry techniques. However, the Asia Pacific region is demonstrating the highest growth trajectory, primarily fueled by massive investments in healthcare infrastructure, the establishment of world-class research hubs in countries like China and India, and the rising prevalence of chronic diseases demanding molecular diagnostics. European markets remain steady, supported by strong academic research funding and rigorous regulatory frameworks promoting high-quality diagnostic products. Regional trends emphasize localized manufacturing and supply chain resilience to mitigate geopolitical and logistical risks associated with specialized chemical synthesis.

In terms of segmentation, the organic dyes segment continues to hold the largest volumetric share due to their cost-effectiveness and established use in standard protocols, but the growth rate is significantly higher in the fluorescent proteins and quantum dots segments, reflecting the demand for enhanced sensitivity and reduced photobleaching in demanding applications like super-resolution microscopy and long-term live-cell imaging. Application-wise, Flow Cytometry and Fluorescence Microscopy segments are the primary revenue generators. End-user trends show that Pharmaceutical and Biotechnology companies, driven by drug discovery pipelines and toxicology testing requirements, represent the most rapidly expanding consumer base, outpacing the steady consumption rates of academic and government research institutions. The market is consolidating around specialized providers offering comprehensive reagent portfolios compatible with automated laboratory systems.

AI Impact Analysis on Fluorochrome Market

User inquiries regarding AI's influence on the Fluorochrome Market primarily revolve around how artificial intelligence and machine learning can optimize image analysis, accelerate drug discovery workflows, and mitigate common experimental challenges such as noise reduction and automated data interpretation. Users frequently ask if AI-powered image processing will lessen the need for specialized, ultra-bright fluorochromes by compensating for low signal-to-noise ratios, or conversely, if AI will enable more complex multiplexing experiments that demand even higher quality reagents. A significant theme is the expectation that AI integration will lead to higher-throughput screening (HTS) capabilities, necessitating reagents that are stable and consistent across massive datasets. Concerns often center on the standardization of AI models across different instrument platforms and how this affects fluorochrome compatibility and performance guarantees.

The overarching analysis suggests that AI is poised to revolutionize the application side of the fluorochrome market rather than the core chemistry synthesis, though it will indirectly influence product development priorities. By enabling sophisticated analysis of complex fluorescent images derived from microscopy and flow cytometry, AI models (such as deep learning algorithms for segmentation and classification) dramatically increase the data yield and reliability from experiments. This enhanced data processing capability validates the use of highly complex, expensive multiplexing panels that were previously limited by the sheer volume of manual analysis required. Consequently, the demand for highly specific, spectrally distinct fluorochromes (essential for effective multiplexing) will surge, pushing manufacturers to innovate faster in spectral separation technology and probe design.

Furthermore, AI is increasingly being used in the drug discovery phase to predict optimal staining protocols, automate quality control for large batches of reagents, and analyze cellular responses in high-content screening systems. This transition to highly automated and predictable experimental pipelines necessitates fluorochromes with minimal batch-to-batch variation and exceptional long-term stability under continuous illumination, essentially raising the performance bar for all commercial products. The synthesis and testing of novel fluorochrome chemistries can also be accelerated using computational chemistry and predictive modeling, reducing the time required to bring new, specialized probes to market, thereby driving continuous innovation in the material science of fluorescence.

- AI-driven image analysis enhances signal-to-noise ratio, supporting complex multiplexing assays.

- Machine learning algorithms automate cell segmentation and feature extraction in fluorescence microscopy.

- AI accelerates high-throughput screening (HTS) in drug discovery, increasing the demand for consistent and stable fluorochromes.

- Predictive modeling assists in the design and optimization of novel fluorochrome chemistries and labeling protocols.

- Integration with automated laboratory systems requires higher standardization and minimal batch variability in fluorescent probes.

- AI enhances the capability for quantitative analysis, moving research beyond qualitative observation and increasing reliance on high-fidelity fluorescent quantification.

- Automated spectral unmixing powered by AI improves accuracy when utilizing spectrally overlapping dyes, widening the usable color palette.

DRO & Impact Forces Of Fluorochrome Market

The fluorochrome market is driven primarily by escalating global investment in life science R&D, particularly in molecular diagnostics and targeted therapy development. Technological advances, such as the introduction of super-resolution microscopy and advanced flow cytometers requiring highly specialized and bright probes, further propel market expansion. However, the market faces significant restraints, chiefly high capital expenditure associated with purchasing and maintaining the necessary specialized analytical instruments (like high-end confocal microscopes), coupled with the inherent chemical instability and vulnerability to photobleaching exhibited by many traditional organic dyes, which limits their use in long-term live-cell imaging. Opportunities for growth are abundant, notably in the development and commercialization of next-generation fluorophores like quantum dots and novel genetically encoded fluorescent proteins, which offer enhanced photostability and brightness, along with the increasing integration of fluorochromes in personalized medicine and companion diagnostics.

Impact forces within the market operate across several levels. Supply-side forces are centered on innovation in chemical synthesis, where manufacturers compete on factors such as probe brightness, specificity, and shelf stability, creating a high barrier to entry for new competitors who cannot match the specialized intellectual property. Demand-side forces are driven by clinical needs; the rising global incidence of chronic diseases, especially cancer and autoimmune disorders, mandates highly sensitive molecular profiling techniques where fluorochromes are indispensable components. Regulatory scrutiny, particularly from bodies like the FDA and EMA regarding clinical diagnostics kits that incorporate fluorochromes, enforces stringent quality control and consistency standards, indirectly favoring established, compliant manufacturers. Technological obsolescence remains a moderate force; while traditional dyes persist, the rapid advancement of spectroscopy and imaging technology continually pushes older, less sensitive probes out of favor in high-end research environments, forcing continuous product upgrading.

The interdependence of the fluorochrome market with the instrumentation market is profound, creating a symbiotic impact force. The capabilities of advanced microscopes and flow cytometers are often bottlenecked by the performance of the available fluorochromes; conversely, the utility of a novel fluorochrome is dependent on the spectral capabilities of the existing installed base of instruments. This necessitates close collaboration between dye manufacturers and instrument vendors to ensure maximal performance. Furthermore, the economic pressure to reduce research costs, especially in academic settings, creates a force pushing for more cost-effective, high-yield bulk reagents, contrasting with the premium pricing commanded by highly specialized, low-volume reagents essential for cutting-edge techniques. Successfully navigating these opposing forces—high performance versus cost-efficiency—will determine market leadership in the coming decade.

Segmentation Analysis

The Fluorochrome Market is systematically segmented across Type, Application, and End-User, allowing for granular analysis of demand patterns and technological adoption across various scientific disciplines. Segmentation by Type distinguishes between the chemical nature and structural characteristics of the probes, ranging from traditional small molecule dyes to complex protein-based tags, reflecting varying performance characteristics like photostability and spectral properties. Application segmentation highlights the functional use of the reagents, with dominant segments including sophisticated analytical techniques such as flow cytometry and high-resolution microscopy, directly correlating to specific experimental requirements in both research and clinical diagnostics. Lastly, segmentation by End-User identifies the primary consumer bases, illustrating differences in volume consumption, budget allocations, and technological sophistication between academic, pharmaceutical, and diagnostic sectors.

This structured analysis provides crucial insights into growth drivers. For instance, the high growth rate observed in the fluorescent proteins and quantum dots segments suggests a market preference for enhanced long-term stability and multiplexing capability, indicating a shift towards complex, dynamic studies like live-cell imaging and tracking. Similarly, the increasing revenue generated by the In-Vivo Imaging application segment underscores the commercial viability of translational research and drug development efforts that require non-invasive, real-time visualization within living organisms. Understanding these segmentation dynamics is vital for market players to prioritize R&D efforts, optimize distribution channels, and tailor their product offerings to meet the specific, stringent technical demands of specialized end-users, ensuring maximum market penetration and return on investment in a highly specialized biotechnology landscape.

- By Type:

- Organic Dyes (e.g., Fluorescein Isothiocyanate (FITC), Rhodamine B, Texas Red)

- Inorganic Dyes (e.g., Quantum Dots, Lanthanide Chelates)

- Fluorescent Proteins (e.g., GFP, RFP, YFP derivatives)

- Tandem Dyes

- Environment-Sensitive Probes

- By Application:

- Flow Cytometry

- Fluorescence Microscopy (Confocal, Super-Resolution)

- Immunohistochemistry (IHC) / Immunofluorescence (IF)

- In-Vivo Imaging (Small Animal Imaging)

- DNA Sequencing and Analysis

- High-Content Screening (HCS)

- Fluorescence Resonance Energy Transfer (FRET) Assays

- By End-User:

- Academic and Research Institutes

- Pharmaceutical and Biotechnology Companies

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

Value Chain Analysis For Fluorochrome Market

The value chain for the Fluorochrome Market begins with the upstream analysis, which involves the specialized synthesis and purification of raw chemical precursors and complex chemical building blocks required for developing high-quality fluorescent molecules. This stage is highly capital-intensive and requires rigorous quality control due to the need for ultra-high purity to ensure minimal background fluorescence and maximal quantum yield in the final product. Key activities include securing stable supplies of rare or specialized intermediate chemicals, performing multi-step organic synthesis, and optimizing production scale-up while maintaining batch-to-batch consistency. The intellectual property rights associated with novel fluorescent chemistries, patented structures, and proprietary purification methods form a critical part of the value capture at this upstream level, primarily dominated by specialized chemical and life science tool providers.

Midstream activities focus on the formulation, functionalization, and commercialization of the fluorochromes. This involves conjugating the purified fluorophores to biological targeting molecules such as antibodies, peptides, or nucleic acids, transforming raw dyes into functional fluorescent probes ready for specific applications (e.g., flow cytometry antibodies labeled with specific dyes). Packaging, rigorous quality assurance testing (including spectral analysis and performance validation in specific assays), and regulatory documentation are integral to this stage. Distribution channels are bifurcated into direct and indirect routes. Direct sales are often utilized for large pharmaceutical clients and specialized research centers that require direct technical support and large-volume purchasing agreements. This allows manufacturers to maintain tight control over inventory and customer service, fostering direct feedback loops for product improvement.

Indirect distribution relies heavily on global and regional specialized scientific distributors and e-commerce platforms, particularly for smaller academic laboratories and general diagnostic labs that require quick access to a broad portfolio of reagents. Distributors manage logistics, inventory warehousing, and localized customer support, expanding the market reach efficiently. The downstream analysis focuses on the end-users—academic institutions, biotech firms, and diagnostic laboratories—who utilize the fluorochromes in conjunction with expensive analytical instrumentation. The effective deployment and success of the reagents are heavily dependent on technical application support and training provided by the manufacturer or distributor, concluding the value chain and generating the final utility and value through scientific discovery and clinical diagnostics.

Fluorochrome Market Potential Customers

The primary consumers and end-users of fluorochromes are institutions engaged in life sciences research, drug development, and clinical diagnostics, demanding high-fidelity molecular visualization and quantification tools. Pharmaceutical and biotechnology companies represent a highly lucrative customer segment due to their intensive R&D pipelines focused on novel therapeutics and diagnostics. These buyers utilize fluorochromes extensively in high-throughput screening (HTS) to assess compound efficacy, perform toxicity testing, and characterize molecular targets, requiring large volumes of standardized, highly stable reagents for automated systems. Their procurement is often characterized by large-scale, long-term contracts and a preference for proprietary, performance-validated dyes that minimize experimental variability.

Academic and government research institutes form the foundational customer base, driving methodological innovation and basic discovery. These customers purchase a wide variety of specialized fluorochromes for fundamental research across cell biology, genetics, and immunology, utilizing advanced techniques like super-resolution microscopy and multi-parameter flow cytometry. Although their purchase volumes per single reagent may be lower than corporate customers, their aggregate demand across a diverse range of niche and cutting-edge probes is essential for market sustainment. Budget cycles and grant funding significantly influence their procurement timing and choice of products, often favoring cost-effective solutions when performance metrics are comparable.

Hospitals and diagnostic laboratories constitute a rapidly expanding segment, particularly those involved in molecular pathology and personalized medicine testing. These buyers utilize fluorochromes integrated into commercial diagnostic kits, such as those used for FISH (Fluorescence In Situ Hybridization), flow cytometry panels for blood cell counting and immunophenotyping, and high-complexity immunoassays. For these end-users, regulatory approval, batch consistency, ease of use, and compatibility with clinical instrumentation are paramount purchasing criteria. Contract Research Organizations (CROs) also represent significant customers, acting as intermediates by purchasing fluorochromes on behalf of their pharmaceutical and biotech clients to conduct outsourced pre-clinical and clinical trials, thereby aggregating demand across multiple sponsors.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 850 Million |

| Market Forecast in 2033 | USD 1450 Million |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Bio-Rad Laboratories, Merck KGaA (Sigma-Aldrich), Abcam plc, Becton, Dickinson and Company (BD), Danaher Corporation (Leica Microsystems/Beckman Coulter), PerkinElmer Inc., GE Healthcare, Enzo Life Sciences, Cytek Biosciences, Lonza Group, Agilent Technologies (Dako), Miltenyi Biotec, Setareh Biotech, AAT Bioquest. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorochrome Market Key Technology Landscape

The technological landscape of the Fluorochrome Market is characterized by continuous innovation focused on overcoming the limitations of conventional organic dyes, primarily photobleaching and limited spectral resolution. A major trend involves the development of proprietary, chemically modified dyes, such as the Alexa Fluor, DyLight, and CF Dye series, which boast superior brightness, greater photostability, and sharper excitation/emission spectra compared to their traditional counterparts (like FITC or Rhodamine). These engineered dyes enable researchers to perform more challenging experiments, including long-term live-cell tracking and high-sensitivity single-molecule detection, thereby increasing the performance ceiling for fluorescence-based assays. The ability to precisely control the chemical structure ensures high specificity when conjugated to target biomolecules, forming the foundation of many commercial reagent lines.

Beyond traditional organic chemistry, the landscape is rapidly embracing advanced materials. Quantum dots (QDs) represent a significant technological leap; these semiconductor nanocrystals offer exceptional photostability, high quantum yield, and the unique ability to be excited by a single light source while emitting across the entire visible spectrum (size-tunable emission). This characteristic is revolutionary for multiplexing applications, allowing simultaneous detection of numerous targets with minimal spectral bleed-through, a key limitation of traditional dyes. However, concerns regarding the potential cytotoxicity of heavy-metal-containing QDs are driving research into safer, cadmium-free alternatives, maintaining an active area of technological competition and regulatory focus.

Furthermore, genetically encoded fluorescent proteins (FPs), derived from organisms like jellyfish (GFP) and coral, represent another crucial technology. Advancements in protein engineering have yielded a vast palette of spectrally diverse FPs (e.g., mCherry, YFP, CFP variants) with improved maturation kinetics, enhanced brightness, and lower propensity for aggregation. These FPs are indispensable for studying protein dynamics and cellular events within living cells without the need for external chemical labeling. The continuous effort to integrate these advanced fluorochromes seamlessly with next-generation instrumentation—such as spectral flow cytometers and super-resolution microscopes (like STED and STORM)—which can effectively distinguish subtle spectral differences, ensures that the technological synergy between probe chemistry and analytical hardware remains the core driver of market evolution and scientific capability.

Regional Highlights

The Fluorochrome Market exhibits distinct growth patterns influenced by regional investment in life sciences, regulatory environments, and the concentration of major biotechnology hubs. North America, encompassing the United States and Canada, currently dominates the market share due to the immense funding allocated to biomedical research, the presence of global pharmaceutical and biotechnology giants, and the rapid adoption of sophisticated research tools such as high-end flow cytometers and super-resolution microscopy systems. The established ecosystem of academic institutions, coupled with robust venture capital backing for new life science startups, ensures continuous technological uptake and high expenditure on advanced fluorescent reagents and kits. This dominance is further cemented by the proactive clinical adoption of molecular diagnostics.

Europe represents the second-largest market, driven by substantial government and EU funding initiatives for health research (e.g., Horizon Europe). Countries such as Germany, the United Kingdom, and France possess world-class research infrastructure and strong pharmaceutical industries. While European researchers are rapid adopters of new fluorochrome technologies, the market is characterized by stricter regulatory pathways for clinical diagnostic kits, emphasizing consistency and quality control. The high focus on precision medicine and personalized healthcare across the region is fostering steady demand for highly specific and validated fluorescent probes for clinical applications.

The Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) over the forecast period. This rapid growth is attributable to massive government investments in developing indigenous biotechnology capabilities, particularly in China, Japan, and South Korea. Improving healthcare infrastructure, increasing awareness of advanced diagnostic techniques, and a growing patient pool demanding sophisticated diagnostics are key accelerators. The outsourcing of drug discovery and clinical trials to Contract Research Organizations (CROs) in India and China further fuels the demand for high-volume fluorochrome reagents. The expansion of regional manufacturing capabilities aimed at reducing reliance on Western suppliers is a critical trend defining the APAC market structure.

- North America (USA, Canada): Market leader; driven by high R&D spending, established biotech sector, and early adoption of super-resolution techniques and spectral flow cytometry.

- Europe (Germany, UK, France): Strong growth supported by EU research funding, focused on personalized medicine, and strict regulatory standards driving demand for high-quality, certified clinical reagents.

- Asia Pacific (China, Japan, India): Fastest growing region; characterized by increasing government investment in infrastructure, outsourcing activities, and expanding diagnostic market penetration.

- Latin America (Brazil, Mexico): Emerging market potential, driven by improving access to advanced diagnostic tools and increasing collaborations with global pharmaceutical firms.

- Middle East and Africa (MEA): Limited but growing market, primarily concentrated in scientifically advanced countries like Israel and Saudi Arabia, focused on specialized academic research and infectious disease diagnostics.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorochrome Market.- Thermo Fisher Scientific Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA (Sigma-Aldrich)

- Abcam plc

- Becton, Dickinson and Company (BD)

- Danaher Corporation (including Beckman Coulter and Leica Microsystems)

- PerkinElmer Inc.

- GE Healthcare (now part of Danaher/Caretower)

- Enzo Life Sciences, Inc.

- Cytek Biosciences, Inc.

- Lonza Group AG

- Agilent Technologies, Inc. (Dako)

- Miltenyi Biotec GmbH

- Setareh Biotech LLC

- AAT Bioquest, Inc.

- Takara Bio Inc.

- BioLegend, Inc.

- Cell Signaling Technology, Inc.

- F. Hoffmann-La Roche AG

- Promega Corporation

Frequently Asked Questions

Analyze common user questions about the Fluorochrome market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is driving the shift from traditional organic dyes to advanced fluorochromes like Quantum Dots?

The primary driver is the need to overcome the limitations of traditional dyes, mainly their poor photostability (photobleaching) and broad emission spectra, which hinders complex multiplexing experiments. Advanced fluorochromes, such as Quantum Dots, offer superior brightness, high resistance to photobleaching, and narrow, size-tunable emission peaks, enabling highly sensitive long-term imaging and simultaneous detection of multiple molecular targets in a single experiment.

Which application segment holds the largest share in the Fluorochrome Market?

Flow Cytometry and Fluorescence Microscopy collectively represent the dominant application segments in the fluorochrome market. Flow cytometry relies heavily on multicolor panels for cellular analysis and immunophenotyping, driving high-volume consumption of conjugated antibodies. Fluorescence Microscopy demands high-performance dyes for high-resolution visualization and dynamic cellular studies.

How significant is the role of personalized medicine in fluorochrome market growth?

Personalized medicine is a major catalyst for market growth. It requires highly specific molecular diagnostic tools to profile patient samples, identify biomarkers, and monitor treatment efficacy. Fluorochromes are essential components in these diagnostics (e.g., FISH, specialized IHC), necessitating demand for FDA-approved, highly consistent, and validated clinical-grade fluorescent reagents and kits.

What are the main regional growth opportunities for fluorochrome manufacturers?

The Asia Pacific (APAC) region offers the highest growth opportunities, driven by rapid investments in healthcare infrastructure, increasing clinical trial activities, and government initiatives promoting advanced biotechnology research in countries like China, India, and South Korea. Manufacturers are capitalizing by expanding distribution networks and establishing localized manufacturing facilities in these high-growth markets.

What challenges do new fluorochrome technologies face regarding instrument compatibility?

A key challenge is ensuring that novel fluorochromes (like specialized tandem dyes or ultra-bright organic probes) are spectrally compatible with the installed base of existing analytical instrumentation (e.g., older flow cytometers). New dyes often require instrument upgrades, specialized filters, or advanced spectral unmixing software, necessitating collaboration between dye producers and instrument manufacturers to facilitate seamless technological integration.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager