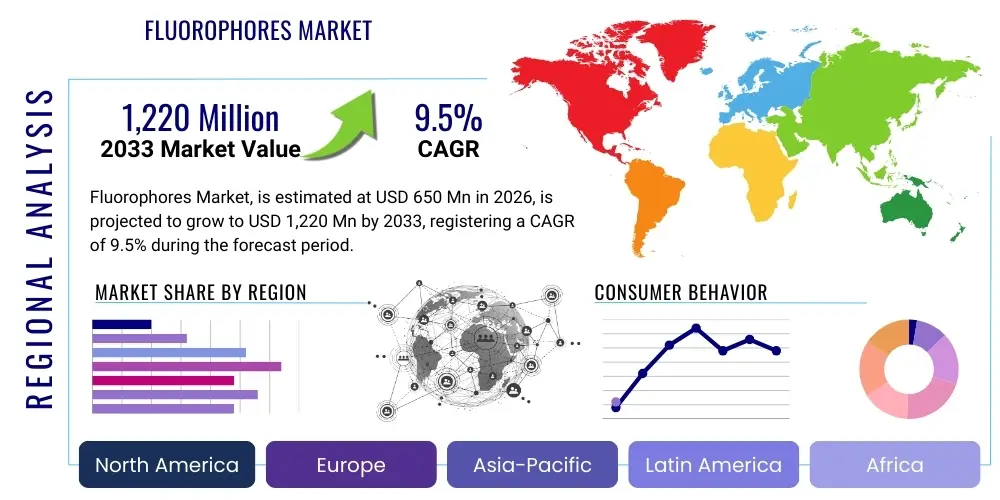

Fluorophores Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 438457 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fluorophores Market Size

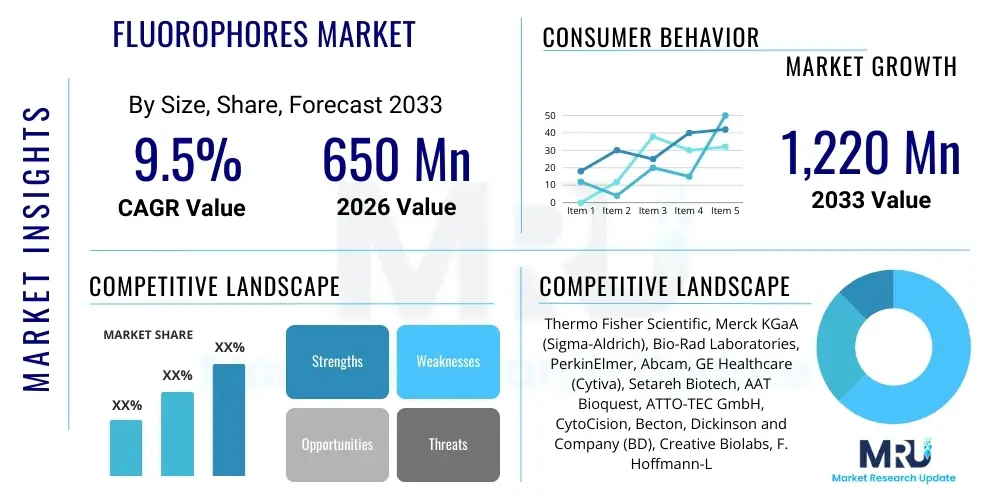

The Fluorophores Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.5% between 2026 and 2033. The market is estimated at $650 Million USD in 2026 and is projected to reach $1,220 Million USD by the end of the forecast period in 2033.

Fluorophores Market introduction

The Fluorophores Market encompasses the production and utilization of fluorescent chemical compounds, dyes, and probes that absorb light energy at one wavelength and re-emit it at a longer, visible wavelength. These specialized molecules are critical components in a vast array of life science research, diagnostics, and clinical applications, primarily due to their high sensitivity and specificity in labeling biological structures. Fluorophores enable researchers to visualize cellular processes, track molecular interactions, and quantify biological targets with unprecedented resolution, making them indispensable tools in modern biology and medicine.

Products within this market range from conventional organic dyes (like Rhodamine and Fluorescein) to advanced photostable probes, quantum dots, and fluorescent proteins. Major applications span high-content screening (HCS), flow cytometry, fluorescence microscopy, immunohistochemistry (IHC), and clinical diagnostics, particularly in areas like cancer detection and infectious disease tracking. The inherent benefits of fluorophores, such as rapid detection, multiplexing capability (using multiple colors simultaneously), and non-invasive imaging potential, are fueling their adoption across academic institutions, pharmaceutical companies, and clinical laboratories globally.

Key driving factors include the escalating demand for accurate and fast diagnostic tools, significant growth in drug discovery initiatives, particularly those involving high-throughput screening of complex biological samples, and continuous technological advancements leading to the development of brighter, more photostable, and spectrally distinct fluorophore chemistries. Furthermore, increasing funding for life science research and the rising prevalence of chronic diseases requiring advanced biomedical imaging are solidifying the market's trajectory towards substantial growth over the forecast period, positioning fluorophores as foundational elements in molecular biology research.

Fluorophores Market Executive Summary

The global Fluorophores Market is characterized by robust business trends driven by technological convergence in imaging and assay automation, leading to increased demand for highly specialized reagents. Major pharmaceutical and biotechnology firms are heavily investing in high-throughput screening platforms, which inherently rely on stable and bright fluorophores for reliable data generation in early-stage drug development. This technological push is shifting product emphasis towards custom-synthesized probes and bio-conjugation services, allowing for greater specificity in complex biological systems. Furthermore, market competition is intense, focusing on developing proprietary dye chemistries that offer superior performance characteristics, such as resistance to photobleaching and improved quantum yield, crucial for prolonged, live-cell imaging experiments. Strategic mergers, acquisitions, and collaborative partnerships between academic institutions and commercial entities remain a dominant strategy to expand product portfolios and penetrate emerging diagnostic applications.

Regional trends indicate North America currently holds the largest market share, attributable to substantial research and development (R&D) investments, the presence of major key players, and advanced healthcare infrastructure facilitating rapid technology adoption. However, the Asia Pacific (APAC) region is projected to exhibit the highest Compound Annual Growth Rate (CAGR), fueled by expanding biotechnology sectors in China and India, increasing government initiatives to support life science research, and growing clinical demand for sophisticated diagnostics. European markets maintain a steady growth trajectory, particularly driven by strong academic research environments and stringent regulatory frameworks promoting quality control in diagnostic tools. The regional landscape is increasingly shaped by localized manufacturing capabilities aiming to mitigate supply chain vulnerabilities and cater specifically to regional research needs.

Segmentation trends highlight that synthetic organic fluorophores, while mature, continue to dominate based on volume due to their cost-effectiveness and versatility. However, the fastest-growing segment is expected to be quantum dots and fluorescent proteins, driven by their superior photophysical properties necessary for advanced applications like single-molecule imaging and super-resolution microscopy. Application-wise, drug discovery and diagnostics remain the cornerstone segments. Within diagnostics, the use of fluorophores in flow cytometry for immunology and hematology is expanding rapidly. End-user trends show that Contract Research Organizations (CROs) are emerging as significant buyers, utilizing fluorophore technologies to provide comprehensive R&D services to pharmaceutical clients, thereby contributing significantly to overall market consumption and driving demand for bulk and customized reagent solutions.

AI Impact Analysis on Fluorophores Market

User queries regarding the intersection of Artificial Intelligence (AI) and the Fluorophores Market frequently center on how machine learning algorithms can enhance imaging quality, automate data analysis, and accelerate the discovery of novel fluorophores. Users are keen to understand if AI can compensate for inherent limitations like background noise, spectral overlap, and photobleaching, thereby improving the reliability and throughput of fluorescence assays. Key thematic concerns revolve around the integration costs of AI platforms, the standardization of imaging data for AI processing, and the role of AI in optimizing experimental design, specifically in determining the ideal fluorophore combinations for complex multiplexing experiments. Expectations are high that AI will transform laborious manual data interpretation into automated, quantitative insights, making high-content screening more efficient and reproducible across large biological datasets.

The integration of deep learning models, such as Convolutional Neural Networks (CNNs), is already starting to revolutionize fluorescence microscopy by enabling the automated segmentation and identification of subcellular structures labeled with fluorophores. This capability significantly enhances the objectivity of quantitative imaging data analysis, reducing inter-operator variability and accelerating the processing of massive datasets generated by high-throughput screening. Moreover, AI is being employed in the design space; predictive algorithms can model the photophysical properties of potential novel chemical structures, significantly shortening the traditional trial-and-error process involved in synthesizing next-generation, high-performance fluorescent probes. This predictive modeling capability is crucial for addressing the current market need for brighter and more stable dyes suitable for advanced super-resolution techniques.

In diagnostics, AI-powered image analysis systems are utilizing fluorophore-stained samples to rapidly diagnose diseases, particularly in pathology and hematology, often surpassing the speed and sometimes the accuracy of human analysis. By training models on vast libraries of images (e.g., immunohistochemistry slides labeled with specific fluorophores), AI can identify subtle patterns indicative of disease progression or treatment response. This convergence of advanced imaging reagents and sophisticated computational tools is lowering the technical barrier for complex experimentation and accelerating the translation of basic research findings into clinical applications, positioning AI as a crucial catalyst for market expansion and technological innovation within the fluorophores ecosystem.

- AI-driven automation of image segmentation and quantification in fluorescence microscopy, increasing throughput.

- Machine learning algorithms optimizing experimental parameters, reducing phototoxicity and spectral crosstalk.

- Predictive modeling using AI to accelerate the discovery and synthesis of novel, superior fluorophore chemistries.

- Enhanced data interpretation and visualization for high-content screening using deep learning methods.

- Automated quality control and artifact detection in fluorescence assays, improving data reliability.

- AI facilitating multiplexed imaging by optimizing fluorophore panel selection and mitigating spectral overlap.

DRO & Impact Forces Of Fluorophores Market

The Fluorophores Market is primarily driven by the escalating global expenditure on life science research, particularly in genomics, proteomics, and cellular biology, where high-resolution imaging and quantitative analysis are prerequisites for scientific breakthroughs. Key drivers include the rapid expansion of high-throughput screening (HTS) platforms in pharmaceutical research for drug toxicity studies and target validation, which mandates the use of reliable fluorescent reagents. Significant technological advancements, such as the introduction of super-resolution microscopy techniques (STORM, SIM, PALM), necessitate and simultaneously drive the development of photostable, high-performance fluorophores capable of sustaining intense illumination conditions without rapid decay. Furthermore, the rising incidence of chronic diseases, including various forms of cancer and neurological disorders, is spurring demand for sensitive and specific fluorescent probes in clinical diagnostics and biomarker detection, thereby sustaining high market momentum.

Restraints, however, pose challenges to the market's expansive potential. A primary constraint is the inherent limitation of existing fluorophores, such as photobleaching and phototoxicity, which restrict prolonged live-cell imaging studies and compromise data integrity. The complexity associated with multi-color experiments, involving issues like spectral overlap and the need for sophisticated compensation controls, demands specialized expertise, acting as a barrier to entry for smaller laboratories. Furthermore, the high cost associated with advanced fluorophore chemistries (like specialized dyes and quantum dots) and the sophisticated imaging instrumentation required to utilize them effectively can limit adoption, particularly in budget-constrained academic and clinical settings across developing regions. Regulatory hurdles related to the clinical use of novel fluorescent agents also introduce lengthy development cycles and high approval costs.

Opportunities for market growth are abundant, particularly centered on developing novel, next-generation probes. Significant potential lies in creating environmentally sensitive fluorophores that change their optical properties in response to cellular pH, viscosity, or enzyme activity, enabling dynamic monitoring of cellular status. The rise of personalized medicine and companion diagnostics presents a vast untapped area for highly specific fluorescent probes tailored for individual patient profiles. Additionally, expanding applications into non-traditional fields, such as food safety testing, environmental monitoring, and materials science (e.g., developing fluorescent polymers), opens new commercial avenues. The shift towards point-of-care (POC) diagnostics also creates opportunities for developing robust, simple-to-use fluorescent assays that do not require complex laboratory setups. The combination of sustained R&D investment and diverse application potential ensures a strong growth outlook, provided technological restraints are systematically addressed through innovation.

The impact forces within the market are predominantly high-velocity and transformative. Technological innovation acts as the primary propelling force, continuously obsolescing older dye chemistries and creating new niches (e.g., far-red and near-infrared probes for deep tissue imaging). Government funding in major research economies significantly influences the pace of academic adoption. However, regulatory scrutiny, particularly in clinical applications, exerts a strong mitigating force, requiring extensive validation and standardization before new products can reach the market. Competitive pressure among leading chemical companies to synthesize patentable, superior performance dyes is intense, driving prices down for commodity fluorophores while maintaining high margins for proprietary, specialized products. Customer demand for multiplexing capabilities and enhanced photostability exerts constant pressure on manufacturers to improve product performance metrics.

Segmentation Analysis

The Fluorophores Market is comprehensively segmented based on product type, application, and end-user, reflecting the diverse range of needs across research and clinical domains. The segmentation by product type is crucial as it distinguishes between foundational, cost-effective organic dyes and advanced, high-performance reagents, which exhibit varying adoption rates and profit margins. Application segmentation highlights the key usage areas where fluorescence technology is foundational, such as cellular imaging versus clinical diagnostics, allowing market players to tailor product development for specific functional requirements. Analyzing end-users provides insight into consumption patterns, distinguishing between high-volume bulk users like pharmaceutical companies and specialized users like academic research institutes, thereby guiding distribution and commercial strategies.

Understanding these segments is vital for effective market strategy. For instance, the demand for conventional organic dyes remains stable due to widespread use in academic teaching and basic research, whereas the growth rate for advanced probes, such as tandem dyes and genetically encoded fluorescent proteins, is significantly higher, driven by complex translational research and high-end biotechnology applications. Furthermore, the convergence of flow cytometry and imaging techniques necessitates fluorophores that perform optimally across multiple instrument types, influencing product design towards greater versatility and stability. Detailed segmentation analysis helps market participants identify lucrative sub-segments, assess competitive intensity within those niches, and strategically allocate R&D resources to meet future technological demands in areas like neurobiology and personalized medicine.

- Product Type

- Organic Fluorescent Dyes (e.g., Fluorescein, Rhodamine, Cyanine Dyes)

- Quantum Dots (QDs)

- Fluorescent Proteins (FPs) (e.g., GFP, RFP, YFP)

- Tandem Dyes

- Custom-Synthesized Probes

- Application

- Cellular Imaging and Microscopy

- Flow Cytometry

- Immunohistochemistry (IHC) / Immunofluorescence (IF)

- In-Vivo Imaging

- Fluorescence In Situ Hybridization (FISH)

- Clinical Diagnostics and Pathology

- High-Throughput Screening (HTS) / Drug Discovery

- End-User

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institutes

- Hospitals and Diagnostic Laboratories

- Contract Research Organizations (CROs)

- Forensic and Industrial Laboratories

Value Chain Analysis For Fluorophores Market

The value chain of the Fluorophores Market begins with the upstream segment involving the sourcing and synthesis of raw materials, primarily fine chemicals and specialized monomers necessary for complex dye structures or semiconductor nanocrystals (in the case of quantum dots). This segment requires specialized chemical expertise, high purity standards, and often proprietary synthesis protocols, making intellectual property protection crucial. Key activities here include the optimization of reaction yields and purification processes to ensure spectroscopic quality. Upstream suppliers are typically specialized chemical manufacturers who feed into the primary fluorophore producers, who then perform the final functionalization, purification, and standardization of the fluorescent agents. Quality assurance at this stage, particularly in minimizing batch-to-batch variability, is paramount, as inconsistencies directly impact end-user experimental reliability.

The midstream segment involves the core manufacturing, formulation, and quality control (QC) processes, followed by packaging and labeling. Producers convert raw chemical agents into marketable probes, often involving conjugation chemistry—attaching the fluorophore to a targeting molecule such as an antibody, peptide, or nucleic acid. This conjugation capability, known as bio-conjugation, is a critical differentiating factor, requiring specialized biochemical expertise. Products are then subjected to rigorous photophysical characterization (measuring excitation/emission spectra, quantum yield, photostability) before being marketed. Effective inventory management and stringent quality control are essential to manage the shelf-life sensitivity of these chemical products, which are often temperature and light-sensitive.

The downstream segment focuses on distribution and end-user engagement. Distribution channels are bifurcated into direct sales channels, typically used for large pharmaceutical clients or specialized custom orders, and indirect channels relying on a network of authorized distributors, scientific supply houses, and e-commerce platforms to reach the vast academic and clinical laboratory network. Customer service and technical support are critical downstream components, as fluorophore application often requires detailed technical guidance and troubleshooting. The ultimate downstream consumers (End-Users) incorporate the fluorophores into high-value applications like drug screening or clinical diagnostics. Direct interaction with end-users allows manufacturers to gather crucial feedback regarding performance limitations (e.g., photostability in new buffers) to drive future product innovation.

Fluorophores Market Potential Customers

The primary consumers and end-users of fluorophores span across three major sectors: pharmaceutical and biotechnology companies, academic and government research institutions, and clinical/diagnostic laboratories. Pharmaceutical and biotechnology firms constitute the largest revenue generating segment, utilizing fluorophores extensively in early-stage drug discovery, high-throughput screening (HTS), toxicology studies, and validation of novel drug targets. These organizations require large volumes of standard dyes for routine assays and also demand highly customized, proprietary probes for complex, mechanism-of-action studies. Their procurement decisions are heavily influenced by product performance metrics, such as brightness, specificity, and compatibility with automated screening systems, driving demand for premium and specialized reagents.

Academic and government research institutes form the foundational consumer base, driven by grants and public funding to conduct fundamental research in areas like cell signaling, neuroscience, and immunology. While often constrained by budget, these institutions are early adopters of cutting-edge technologies, frequently purchasing advanced probes like quantum dots and genetically encoded fluorescent proteins for sophisticated imaging techniques such as super-resolution and live-cell tracking. This sector drives demand for technical support, smaller customized batches, and educational resources. Furthermore, the increasing reliance on Contract Research Organizations (CROs) by pharmaceutical companies means that CROs are rapidly becoming key intermediary customers, purchasing diverse fluorophore portfolios to support outsourced preclinical and clinical services.

Clinical and diagnostic laboratories, including hospital pathology departments and reference labs, represent a critical segment, particularly with the growth of molecular diagnostics and companion diagnostics. Fluorophores are indispensable in techniques such as Flow Cytometry for monitoring immune status (e.g., HIV), Fluorescence In Situ Hybridization (FISH) for genetic disorder analysis, and immunohistochemistry (IHC) for cancer typing. Demand in this sector is driven by regulatory approval, stability, reproducibility, and the need for standardized kits. The shift towards point-of-care testing requires highly robust, stable, and easily detectable fluorophores suitable for rapid diagnostic platforms, ensuring this segment remains a stable yet increasingly quality-focused driver of market growth.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $650 Million USD |

| Market Forecast in 2033 | $1,220 Million USD |

| Growth Rate | 9.5% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Thermo Fisher Scientific, Merck KGaA (Sigma-Aldrich), Bio-Rad Laboratories, PerkinElmer, Abcam, GE Healthcare (Cytiva), Setareh Biotech, AAT Bioquest, ATTO-TEC GmbH, CytoCision, Becton, Dickinson and Company (BD), Creative Biolabs, F. Hoffmann-La Roche Ltd., Lumiprobe Corporation, GATTAquant GmbH, NanoLight Technology, Biotium, Inc., LI-COR Biosciences. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluorophores Market Key Technology Landscape

The technological landscape of the Fluorophores Market is characterized by continuous innovation aimed at overcoming the fundamental challenges of photostability, spectral complexity, and cellular toxicity. A major trend involves the move towards far-red and near-infrared (NIR) emitting fluorophores. These long-wavelength dyes are crucial for deep tissue imaging and in vivo studies because biological tissues exhibit lower autofluorescence and light scattering in this spectral range, leading to significantly enhanced signal-to-noise ratios. Companies are heavily investing in synthesizing novel indocyanine and cyanine chemistries (e.g., specific derivatives of Cy5, Cy7) that meet these requirements while maintaining high quantum yield and excellent photostability necessary for extended imaging sessions and clinical applications.

Another significant technological advancement is the widespread adoption and improvement of Quantum Dots (QDs). QDs are semiconductor nanocrystals that offer superior photophysical properties compared to organic dyes, including exceptionally broad excitation spectra, narrow and tunable emission spectra, and unparalleled resistance to photobleaching. These properties make QDs ideal for highly multiplexed assays where numerous targets must be simultaneously labeled without significant spectral crosstalk. Although toxicity concerns related to heavy metal cores (like cadmium) initially restricted their use, recent innovations focus on developing safer, heavy-metal-free alternatives (e.g., silicon-based or carbon-based QDs) and encapsulation techniques to enhance biocompatibility, thereby broadening their clinical and in-vivo applications.

The third critical technology area involves genetically encoded fluorescent proteins (FPs). FPs allow researchers to tag proteins of interest directly within a living cell through genetic engineering, enabling non-invasive, long-term monitoring of dynamic biological processes. Recent engineering efforts focus on optimizing FPs for faster maturation times, reduced dimerization (for accurate targeting), and the expansion of the color palette, particularly into the far-red and blue-shifting regions to facilitate complex genetic circuit studies. Furthermore, the development of biosensors that utilize FPs fused with sensing domains (e.g., Ca2+ or pH sensors) represents a cutting-edge area, transforming fluorophores from simple tags into dynamic reporters of cellular biochemistry. This technological evolution ensures that the fluorophores market remains at the forefront of biological measurement and visualization techniques.

Regional Highlights

The global Fluorophores Market exhibits significant regional variation in adoption rates, R&D intensity, and regulatory environments, influencing market size and growth dynamics across geographies.

- North America (NA)

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM) and Middle East & Africa (MEA)

North America, particularly the United States, currently dominates the Fluorophores Market, primarily due to immense government and private sector investment in biomedical research and development. The region hosts a concentrated presence of leading pharmaceutical and biotechnology companies, alongside globally recognized academic institutions that are early adopters of advanced imaging technologies. The high expenditure on HTS and drug discovery initiatives ensures a sustained, high-volume demand for both commodity and specialized, high-performance fluorescent probes. Robust regulatory frameworks administered by agencies like the FDA also ensure high quality and standardization for clinical diagnostic applications, reinforcing the region's market leadership. Furthermore, significant activity in genomics and personalized medicine drives specific demand for advanced FISH probes and flow cytometry reagents.

Europe represents a mature and technologically sophisticated market, characterized by strong governmental funding for academic research, particularly through initiatives led by the European Research Council (ERC). Countries like Germany, the United Kingdom, and Switzerland are hubs for pharmaceutical manufacturing and clinical research, maintaining a steady demand for fluorophores utilized in cell analysis, proteomics, and clinical pathology. The European market is highly focused on quality and regulatory compliance (e.g., CE marking requirements for diagnostics), favoring established suppliers offering well-validated, stable products. While growth is stable, the market is highly competitive, with a strong focus on collaborations between technology developers and clinical centers to integrate advanced imaging tools into routine diagnostics and personalized medicine pipelines.

The Asia Pacific region is projected to be the fastest-growing market globally, driven by rapid infrastructure development in life sciences, increasing foreign investment, and expanding government support for domestic biotech industries in countries like China, India, South Korea, and Japan. The increasing prevalence of chronic and infectious diseases is propelling demand for faster, more accurate diagnostic tools, particularly in large, underserved populations, leading to increased adoption of fluorescence-based diagnostics like flow cytometry and immunofluorescence. While cost sensitivity remains a factor, particularly in developing economies, the expanding network of CROs and the massive patient base for clinical trials ensure high growth potential for fluorophores utilized across research and clinical settings. Localization of manufacturing and distribution is becoming crucial for market penetration in this diverse region.

The LATAM and MEA regions currently hold smaller market shares but offer significant long-term growth potential. Growth in these areas is often concentrated in key economies such as Brazil, Mexico, Saudi Arabia, and South Africa, driven by improving healthcare access and increased funding for basic medical research. Adoption rates are generally slower compared to NA and Europe, constrained by budget limitations and less developed research infrastructure. However, specific applications, particularly in infectious disease diagnostics (e.g., malaria, HIV, tuberculosis) where rapid, fluorescence-based testing offers significant advantages, are seeing accelerated deployment. Market penetration relies heavily on the availability of affordable, robust reagents and strong partnerships with global suppliers to ensure reliable supply chains and technical support.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluorophores Market.- Thermo Fisher Scientific Inc.

- Merck KGaA (Sigma-Aldrich)

- Bio-Rad Laboratories, Inc.

- PerkinElmer, Inc.

- Abcam plc

- Becton, Dickinson and Company (BD)

- GE Healthcare (Cytiva)

- AAT Bioquest, Inc.

- Setareh Biotech LLC

- ATTO-TEC GmbH

- Lumiprobe Corporation

- Biotium, Inc.

- LI-COR Biosciences

- F. Hoffmann-La Roche Ltd.

- GATTAquant GmbH

- Creative Biolabs

- NanoLight Technology Inc.

- CytoCision

- Lonza Group AG

- Dojindo Molecular Technologies, Inc.

Frequently Asked Questions

Analyze common user questions about the Fluorophores market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary technical challenge limiting the use of fluorophores in live-cell imaging?

The primary technical challenge is photobleaching, where the fluorophore permanently loses its ability to fluoresce upon prolonged exposure to excitation light, severely limiting the duration and quality of time-lapse and live-cell imaging experiments.

How are Quantum Dots (QDs) superior to traditional organic fluorescent dyes?

QDs are superior due to their exceptional photostability, narrow emission spectra, and broad, single-wavelength excitation capabilities, which facilitate highly effective multiplexing (labeling multiple targets simultaneously) with minimal spectral overlap.

Which application segment drives the highest demand for advanced fluorophores?

The High-Throughput Screening (HTS) and Drug Discovery segment drives the highest demand for advanced and photostable fluorophores, as pharmaceutical companies require highly reliable reagents for rapid, automated testing of drug candidates and target validation.

What role does Artificial Intelligence play in the future of fluorophore discovery?

AI, specifically machine learning and deep learning, accelerates fluorophore discovery by predicting the optimal photophysical properties of novel chemical structures, significantly reducing the time and cost associated with synthesizing new, high-performance fluorescent probes.

Why is the Asia Pacific region expected to exhibit the highest growth rate?

The APAC region's high growth rate is attributed to increasing governmental funding for life science R&D, rapid expansion of biotechnology and pharmaceutical sectors, and growing clinical demand for advanced fluorescence-based diagnostic tools in populous nations like China and India.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager