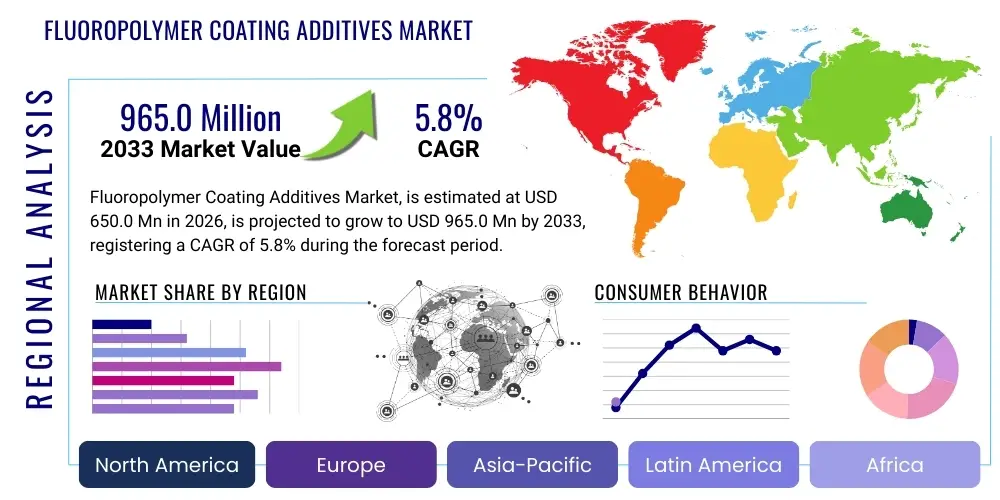

Fluoropolymer Coating Additives Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 437040 | Date : Dec, 2025 | Pages : 243 | Region : Global | Publisher : MRU

Fluoropolymer Coating Additives Market Size

The Fluoropolymer Coating Additives Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 650.0 million in 2026 and is projected to reach USD 965.0 million by the end of the forecast period in 2033. This consistent expansion is predominantly driven by the increasing demand for high-performance coatings across critical industrial sectors such as automotive, aerospace, and chemical processing, where conventional coating systems often fail to meet stringent requirements for thermal, chemical, and abrasion resistance. The unique properties conferred by fluoropolymers, particularly their low surface energy and exceptional non-stick characteristics, position these additives as indispensable components in advanced coating formulations.

Market size determination is further influenced by the technological advancements focused on developing sustainable and environmentally compliant fluoropolymer dispersions. While regulatory scrutiny on certain per- and polyfluoroalkyl substances (PFAS) presents challenges, the industry is proactively investing in next-generation short-chain and non-PFOA/PFOS-based chemistries, ensuring the continued viability and growth trajectory of the market. The adoption rate of fluoropolymer additives is also accelerating in developing economies, particularly in Asia Pacific, where massive infrastructure and manufacturing expansion initiatives necessitate durable, long-life coating solutions for capital equipment and construction materials, further solidifying the upward revision of market valuation over the forecast period.

Fluoropolymer Coating Additives Market introduction

The Fluoropolymer Coating Additives Market encompasses specialty chemicals derived from fluorinated polymers, such as PTFE, FEP, and PFA, which are incorporated into base coating formulations to significantly enhance surface characteristics and material performance. These additives function primarily to improve non-stick properties, friction reduction, corrosion resistance, UV stability, and overall coating durability. Product descriptions range from micronized powders and aqueous dispersions to specialized concentrates, tailored for integration into liquid, powder, and coil coating systems. Major applications span critical sectors including industrial cookware and bakeware, protective linings for chemical storage tanks, wire and cable insulation, and anti-icing coatings in aerospace components. The primary benefit of utilizing fluoropolymer additives is the achievement of unparalleled thermal and chemical inertness, extending the service life of coated substrates in harsh environments.

The driving factors behind market expansion are multifaceted, anchored by the escalating need for energy-efficient solutions and compliance with stringent environmental regulations requiring enhanced material longevity. In the automotive industry, for example, these additives are crucial for reducing friction in internal engine components and improving the durability of exterior finishes, contributing to fuel economy targets. Furthermore, the robust growth in specialized industrial manufacturing, particularly in semiconductor and electronics fabrication, demands ultra-pure and chemically resistant coating surfaces, achievable almost exclusively through the inclusion of fluoropolymers. The constant push for higher operational temperatures and pressures in industrial processes necessitates materials capable of withstanding these extremes, making fluoropolymer additives a foundational element in high-performance coating formulation strategy.

Fluoropolymer Coating Additives Market Executive Summary

The Fluoropolymer Coating Additives Market is characterized by robust business trends focusing on innovation in sustainable chemistry, expansion of capacity in high-growth application segments, and strategic mergers and acquisitions aimed at consolidating technical expertise. Major players are strategically shifting their product portfolios towards PFOA/PFOS-free alternatives to mitigate regulatory risks, fueling investment in advanced dispersion technologies and particle engineering. A significant business trend involves the increased collaboration between additive manufacturers and coating formulators to develop customized, multi-functional coating systems that address highly specific industrial challenges, such as coatings optimized for extremely abrasive or high-temperature environments. This collaboration ensures faster commercialization of novel additive chemistries and maintains technological relevance against competing materials.

Regional trends indicate that Asia Pacific remains the dominant growth engine, propelled by aggressive expansion in manufacturing (especially consumer goods and electronics) and infrastructure development, which drives high volume consumption of standard and mid-range fluoropolymer additives. North America and Europe, however, lead in technological innovation, focusing on high-value, niche applications like aerospace, medical devices, and high-purity chemical processing equipment, commanding premium pricing. Segment trends show that Polytetrafluoroethylene (PTFE) remains the largest segment by volume due to its widespread application in non-stick finishes, while specialty fluoropolymers like PFA (Perfluoroalkoxy alkane) and ETFE (Ethylene tetrafluoroethylene) are exhibiting the highest growth rates, driven by their superior melt processability and excellent mechanical strength compared to PTFE.

AI Impact Analysis on Fluoropolymer Coating Additives Market

User queries regarding AI's impact on the Fluoropolymer Coating Additives Market frequently center on themes such as accelerating R&D cycles, optimizing manufacturing processes for consistency, and predicting material performance under specific environmental conditions. Users seek to understand how AI-driven material informatics can replace traditional, time-consuming formulation trials, particularly in the complex area of optimizing additive particle size distribution and dispersion stability. Concerns often revolve around the high initial investment required for adopting AI platforms and the necessity of generating vast, high-quality data sets related to fluoropolymer synthesis and coating degradation kinetics. The general expectation is that AI will drastically enhance predictive modeling for coating longevity and chemical resistance, thereby shortening the time-to-market for new, specialized additive products, especially those addressing compliance with evolving environmental standards.

AI is set to revolutionize material discovery by screening thousands of potential fluoropolymer structures and additive combinations simultaneously, drastically reducing experimental costs. Machine learning algorithms are proving invaluable in analyzing complex polymerization parameters, ensuring highly consistent batch quality, which is crucial for maintaining the performance integrity of micronized additives. Furthermore, AI applications extend into supply chain management, optimizing the procurement of raw fluorinated monomers and predicting demand fluctuations in key end-use industries like automotive and industrial protective coatings. This data-driven approach enhances operational efficiency and helps manufacturers rapidly adapt their product mix in response to changing market needs, ensuring a highly responsive and optimized production landscape in this specialty chemical sector.

- Accelerated R&D and formulation optimization using material informatics platforms.

- Predictive modeling of coating performance (wear, corrosion, thermal stability) under various industrial conditions.

- Enhanced quality control and consistency in additive particle size distribution and morphology via machine vision and process optimization.

- Optimization of complex chemical synthesis routes for new, environmentally compliant fluoropolymers.

- Improved supply chain resilience through AI-driven demand forecasting for critical raw materials.

DRO & Impact Forces Of Fluoropolymer Coating Additives Market

The market is predominantly driven by the escalating demand for high-durability and chemically inert coatings across capital-intensive industries, complemented by technological advances improving the dispersion and integration of fluoropolymers into conventional paint systems. Restraints largely stem from the intense regulatory scrutiny on legacy fluorochemicals (PFAS) and the associated high cost and complexity of switching to certified non-regulated alternatives, alongside the inherently high processing cost of fluoropolymer materials compared to standard additives. Opportunities are abundant in emerging applications such as protective coatings for lithium-ion battery components and specialized medical device coatings, requiring stringent biocompatibility and non-thrombogenic properties. These forces—regulatory pressure, technical demand, and material science innovation—exert a significant combined impact on strategic investment decisions, forcing manufacturers to prioritize sustainability and high-performance niche applications to secure market share and maintain profitability.

A key impact force relates to the global push towards efficiency and safety. For instance, the use of fluoropolymer additives in anti-corrosion coatings significantly reduces maintenance costs and potential environmental risks associated with equipment failure in chemical plants and marine environments. This quantifiable economic benefit acts as a powerful driver. Conversely, the high investment required for the recycling and proper disposal of fluoropolymer waste presents a structural restraint, impacting the life cycle cost assessment for end-users. The continuous evolution of surface treatment technologies that allow for better adhesion of fluoropolymer coatings to diverse substrates (like composite materials) further amplifies the market’s growth potential, demonstrating the dynamic interplay between material innovation (Opportunity) and stringent performance demands (Driver) within this highly specialized sector.

Segmentation Analysis

The Fluoropolymer Coating Additives Market is extensively segmented based on the type of fluoropolymer utilized, the physical form in which the additive is supplied, and the diverse range of end-user applications. The segmentation provides critical insights into consumption patterns, pricing mechanisms, and the specialized technical requirements across different industrial verticals. Analysis by type, such as PTFE (Polytetrafluoroethylene), FEP (Fluorinated Ethylene Propylene), and PFA (Perfluoroalkoxy alkane), reveals variations in thermal stability, melt flow index, and overall cost-performance balance, guiding strategic product development. Meanwhile, segmentation by form—powder versus liquid dispersion—is crucial for manufacturers, as it dictates compatibility with different solvent-based and waterborne coating systems, a key factor in formulating compliant and effective coating solutions for various manufacturing environments.

The comprehensive segmentation by application highlights the major revenue pockets and areas of fastest growth. While industrial non-stick coatings, particularly for food processing and consumer goods, represent the high-volume segment, high-value applications like aerospace, electronics, and medical are driving innovation toward extremely specialized, ultra-high-performance additive chemistries. Understanding these segment dynamics is paramount for market players. For example, the increasing demand for high-density electronic packaging components requires fluoropolymer additives capable of delivering exceptional dielectric strength and high-frequency signal integrity, creating a distinct and premium sub-market independent of the larger industrial corrosion protection segment.

- By Type: PTFE, FEP, PFA, ETFE, PVDF, ECTFE, Others (e.g., PCTFE)

- By Form: Powder (Micronized), Dispersion/Liquid (Aqueous, Solvent-based)

- By Application: Industrial (Non-stick, Anti-corrosion, Wear Resistance), Automotive (Gaskets, Engine Parts), Aerospace & Defense, Electrical & Electronics, Medical, Architectural, Consumer Goods (Cookware)

Value Chain Analysis For Fluoropolymer Coating Additives Market

The value chain for fluoropolymer coating additives is intricate, starting with the complex upstream synthesis of fluorinated monomers (e.g., TFE, HFP, VDF). This highly concentrated upstream segment is dominated by a few major chemical manufacturers possessing proprietary polymerization technologies and economies of scale. Midstream involves the crucial step of processing these raw polymers into usable additive forms, which includes micronization, surface treatment, and dispersion stabilization. This stage requires significant technical expertise to control particle size, morphology, and dispersion quality, as these characteristics directly influence the additive's performance within the final coating formulation. Direct distribution channels are prevalent for large-volume industrial customers, while specialized distributors and agents manage outreach to smaller formulators and regional coating companies, ensuring technical support and localized inventory management.

Downstream analysis focuses on the coating formulators and the subsequent end-user industries. Formulators integrate the fluoropolymer additives to achieve specific performance targets, such as enhanced lubricity or chemical resistance, before supplying the finished coatings to applicators (e.g., coil coaters, powder coaters). The efficiency and stability of the distribution channel are critical, particularly for aqueous dispersions which have shelf-life and transport considerations. Direct distribution allows additive manufacturers to maintain tighter control over quality assurance and provide advanced technical services, a necessity when dealing with sensitive, high-performance chemical products. Indirect channels broaden market reach, especially in geographically fragmented or emerging markets, but necessitate stringent quality control protocols enforced through channel partnerships to maintain product integrity.

The overall value chain is highly capital-intensive upstream and technically specialized midstream. Upstream suppliers hold significant pricing power due to the proprietary nature of fluorochemical manufacturing. Success downstream hinges on the ability of additive producers to provide additives that are easily incorporated into diverse coating matrixes while meeting the ever-tightening performance and regulatory specifications dictated by aerospace, medical, and electronics end-users. This reliance on high-tech integration and regulatory compliance underscores the value derived throughout the chain.

Fluoropolymer Coating Additives Market Potential Customers

The primary customers and end-users of fluoropolymer coating additives are diverse, spanning multiple manufacturing and processing industries that require coatings possessing exceptional non-stick, friction-reducing, corrosion-resistant, or dielectric properties. The most significant customer segment includes industrial coating formulators who purchase additives in bulk to formulate specialized paints and functional surface treatments tailored for specific applications, such as high-temperature release agents for molding processes or protective linings for industrial equipment exposed to aggressive chemicals. Another major purchasing group consists of specialized OEM component manufacturers, particularly in the automotive and aerospace sectors, who require coating additives for internal components like pistons, valves, and aircraft control surfaces to reduce wear and minimize energy loss due to friction.

Furthermore, the cookware and bakeware manufacturing industry represents a substantial, high-volume customer base, relying heavily on PTFE additives to create durable, PFOA-free non-stick surfaces for consumer products. The electronics and semiconductor industries constitute a high-value customer segment, utilizing these additives for their excellent dielectric properties and chemical inertness, crucial for coating wires, cables, and fabrication equipment used in ultra-clean environments. The purchasing decisions of these end-users are primarily driven by three factors: the technical performance achieved, compliance with increasingly strict health and environmental regulations, and the long-term cost savings realized through extended asset life and reduced maintenance frequency.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 650.0 million |

| Market Forecast in 2033 | USD 965.0 million |

| Growth Rate | CAGR 5.8% |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M Company, DuPont de Nemours, Inc., Daikin Industries, Ltd., Solvay S.A., AGC Inc., Chemours Company, Shin-Etsu Chemical Co., Ltd., Halopolymer, Honeywell International Inc., Kureha Corporation, PolyOne Corporation, Gujarat Fluorochemicals Limited (GFL), Arkema S.A., DIC Corporation, Shandong Dongyue Group, Hubei Everflon Polymer Co., Ltd., Fluon Chemical, Shanghai 3F New Materials Co., Ltd. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluoropolymer Coating Additives Market Key Technology Landscape

The technological landscape of the Fluoropolymer Coating Additives Market is highly dynamic, centered around advanced particle engineering and dispersion chemistry designed to maximize performance characteristics while adhering to environmental standards. A crucial technological focus is on micronization techniques, such as cryogenic grinding and wet-milling, which achieve ultra-fine particle sizes (often below 5 microns) necessary for seamless integration into thin-film coating systems without compromising surface finish or optical clarity. Furthermore, surface modification technologies, including plasma treatment or functionalization with coupling agents, are essential to improve the adhesion and compatibility of chemically inert fluoropolymer particles with the surrounding organic polymer matrix in the base coating formulation, ensuring homogeneous distribution and superior mechanical integration.

Another significant technological thrust involves the development of stabilized aqueous dispersions. As the coating industry globally transitions from solvent-borne to waterborne systems for environmental reasons, manufacturers are investing heavily in surfactant technologies and stabilizers that can maintain the colloidal stability of high-solids fluoropolymer dispersions over extended periods and under varying storage conditions. This requires sophisticated control over critical micelle concentration and zeta potential. The development of short-chain, non-PFOA emulsifiers is a major technological differentiator, enabling compliance with global regulations while delivering comparable application performance to traditional chemistries, driving the next generation of fluorine-based additives.

Furthermore, advancements in encapsulation technology are enabling the creation of hybrid additives. These technologies allow fluoropolymers to be combined with other high-performance materials, such as ceramic particles or specialized lubricants (e.g., molybdenum disulfide), within a single additive structure. This approach creates synergistic effects, allowing formulators to achieve multi-functionality, such as combining extreme abrasion resistance with low coefficient of friction in a single coating layer, expanding the applicability of these additives into severe-service environments like oil and gas pipelines and heavy machinery components.

Regional Highlights

The global distribution of the Fluoropolymer Coating Additives Market reveals distinct regional consumption patterns and technological adoption rates driven by local industrial ecosystems and regulatory environments. Asia Pacific (APAC) currently holds the dominant market share, primarily due to the region's massive manufacturing base, particularly in China, India, and Southeast Asian nations. The high demand is fueled by the rapid growth in industrial coating applications, electronics manufacturing, and the production of non-stick consumer goods. The region serves as a major hub for both high-volume, cost-sensitive production and increasingly specialized applications in electric vehicle (EV) components and advanced electronics packaging.

North America and Europe represent mature markets characterized by stringent regulatory environments, particularly regarding PFAS use, driving innovation towards high-value, sustainable alternatives. These regions exhibit high demand from technically demanding sectors such as aerospace, medical implants, and high-purity chemical processing equipment, where performance criteria outweigh cost concerns. European manufacturers focus heavily on compliance and circular economy initiatives, often leading in the implementation of advanced aqueous dispersion technologies. Conversely, Latin America and the Middle East & Africa (MEA) are emerging markets, where growth is tied to investments in petrochemical processing, mining infrastructure, and renewable energy projects, necessitating robust anti-corrosion and wear-resistant coatings derived from fluoropolymer additives.

- Asia Pacific (APAC): Leading market in terms of volume consumption, driven by electronics manufacturing, consumer goods, and infrastructure development. Focus on balancing cost-effectiveness with performance.

- North America: High-value market segment focusing on aerospace, high-end automotive (EVs), and medical device coatings. Strong impetus for PFOA-free innovation and advanced material science.

- Europe: Characterized by stringent environmental regulations (REACH), pushing rapid adoption of sustainable, short-chain fluoropolymer chemistries. Strong application base in specialized industrial and protective coatings.

- Latin America: Growth driven by expanding industrialization, especially in oil and gas and construction sectors, requiring durable anti-corrosion solutions.

- Middle East and Africa (MEA): Demand linked to massive oil and gas processing infrastructure, requiring specialized high-temperature and chemical-resistant coatings for harsh operating environments.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluoropolymer Coating Additives Market.- 3M Company

- DuPont de Nemours, Inc.

- Daikin Industries, Ltd.

- Solvay S.A.

- AGC Inc.

- Chemours Company

- Shin-Etsu Chemical Co., Ltd.

- Halopolymer

- Honeywell International Inc.

- Kureha Corporation

- PolyOne Corporation (Now Avient)

- Gujarat Fluorochemicals Limited (GFL)

- Arkema S.A.

- DIC Corporation

- Shandong Dongyue Group

- Hubei Everflon Polymer Co., Ltd.

- Fluon Chemical

- Shanghai 3F New Materials Co., Ltd.

- Asahi Glass Co., Ltd.

- Mitsubishi Chemical Corporation

Frequently Asked Questions

Analyze common user questions about the Fluoropolymer Coating Additives market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving the demand for PTFE coating additives?

The primary applications driving demand for PTFE (Polytetrafluoroethylene) coating additives are non-stick coatings in consumer cookware and industrial baking, friction reduction elements in automotive parts (e.g., dry lubrication), and highly chemical-resistant linings for processing equipment due to PTFE's superior thermal stability and low coefficient of friction.

How is the regulatory landscape concerning PFAS affecting the future of fluoropolymer coating additives?

Regulatory efforts, particularly concerning PFOA and PFOS (legacy PFAS), are severely impacting the market, forcing manufacturers to rapidly transition toward short-chain fluoropolymers (e.g., GenX, ADONA-based chemistries) and other non-regulated alternatives, driving significant investment in R&D for environmentally sustainable and compliant additive formulations, specifically in aqueous dispersions.

What is the key technological challenge in formulating waterborne fluoropolymer additive systems?

The key technological challenge lies in achieving stable, high-solids aqueous dispersions. Maintaining uniform particle size distribution and colloidal stability of highly hydrophobic fluoropolymer particles in water without relying on regulated surfactants is complex, requiring advanced dispersion agents and sophisticated homogenization techniques to ensure performance equivalent to traditional solvent-borne systems.

Which fluoropolymer type is expected to exhibit the highest growth rate and why?

PFA (Perfluoroalkoxy alkane) and ETFE (Ethylene tetrafluoroethylene) are expected to show the highest growth rate. PFA is favored for high-purity applications in semiconductor and medical fields due to its melt processability and excellent stress-crack resistance, while ETFE is growing rapidly in architectural coatings and photovoltaic applications due to its superior durability and weather resistance.

How do fluoropolymer additives enhance the performance of industrial protective coatings?

Fluoropolymer additives significantly enhance protective coatings by lowering the surface energy, which imparts superior non-wetting properties (anti-fouling, easy-clean), and increasing the coating's chemical inertness, making the final film highly resistant to aggressive chemicals, solvents, and extreme temperature fluctuations typical of chemical processing and marine environments.

The extensive application in chemical processing, where operational continuity is paramount, drives consistent consumption. Furthermore, the specialized demands of the pharmaceutical sector for coatings that resist bacterial adhesion and can withstand harsh sterilization cycles provide a high-margin opportunity. This sector’s reliance on extremely pure and stable coating materials ensures that the demand for premium fluoropolymer additives, such particularly PVDF and ECTFE, remains robust, underpinning the market’s defensive characteristics even during broader economic downturns. The necessity of these additives for compliance with health and safety standards in food contact materials (FCMs) further solidifies their position as essential components rather than discretionary performance enhancers.

The competitive landscape is defined by the dichotomy between large integrated fluorochemical producers, who control the upstream monomer supply and possess extensive R&D resources, and smaller, specialized formulators focusing exclusively on customized additive solutions for niche coating segments. Key strategic movements include capacity expansion by major Asian players to cater to regional manufacturing growth, and focused divestitures or acquisitions among Western companies aimed at consolidating PFOA-free technology portfolios. Success in this market is increasingly dependent on the ability to navigate complex global chemical regulations while delivering superior technical support to coating formulators, enabling them to meet the exacting specifications of end-user industries such as aerospace and advanced electronics. The introduction of novel blending and compounding technologies that allow for lower loading levels of expensive fluoropolymer powders while maintaining high-performance characteristics is a crucial factor influencing competitive pricing and market penetration strategies.

The long-term outlook for the Fluoropolymer Coating Additives Market remains highly favorable, despite the regulatory headwinds, primarily due to the irreplaceable performance profile of fluorinated materials in extreme conditions. No commercially viable alternative currently offers the same combination of low friction, chemical inertness, and thermal stability. Future growth will be strongly linked to megatrends such as electrification (requiring thermal management and dielectric insulation coatings for EV batteries and motors) and digitalization (demanding specialized coatings for sensitive cleanroom equipment and advanced printed circuit boards). This sustained, high-tech demand ensures continued technological innovation, focusing on ultra-fine, highly dispersed particles and novel hybrid formulations that integrate fluoropolymers with other nanomaterials to create truly multi-functional coating systems capable of addressing the complex material challenges of the 21st century industrial landscape. This continuous evolution in material science maintains the market's high barrier to entry and premium pricing structure for specialized products.

In response to environmental concerns and the drive towards sustainability, green chemistry principles are increasingly integrated into the fluoropolymer additive production process. This includes using cleaner manufacturing methods, reducing energy consumption during polymerization and micronization, and developing additives that contribute to the durability and recyclability of the final coated product. While the chemical industry faces pressure to reduce its environmental footprint, the extended lifespan conferred by fluoropolymer coatings—reducing the need for frequent recoating and replacement of industrial assets—is often cited as a significant sustainability benefit. This life-cycle advantage helps offset the perceived environmental impact associated with the production of fluorinated materials themselves, providing a strong narrative for their continued essential use in critical applications where safety, efficiency, and longevity are paramount operational requirements.

Furthermore, the segmentation analysis must acknowledge the subtle but critical differences in end-user requirements. For instance, in the oil and gas sector, the focus is purely on achieving maximum chemical and thermal resistance to prevent equipment failure in highly corrosive downhole environments, favoring high-performance materials like PFA and ECTFE. Conversely, in the consumer goods segment, while non-stick properties are critical, factors such as scratch resistance, ease of application, and cost sensitivity are equally important, driving volume demand for micronized PTFE powders. This divergence in performance requirements and economic factors dictates highly segmented marketing and distribution strategies, necessitating that manufacturers offer a broad, technically diverse product line optimized for specific coating matrixes, whether they be epoxies, polyurethanes, or other thermoplastic systems. The ability to provide bespoke, pre-dispersed concentrates that minimize formulation complexity for end-users represents a significant competitive advantage.

The growth dynamics in the architectural segment are noteworthy. The utilization of high-performance fluoropolymer coatings (especially those based on PVDF and ETFE) for facades and roofing materials provides exceptional UV and weather resistance, significantly extending the maintenance cycle of large buildings and infrastructure. This demand is intrinsically linked to global urbanization trends and investments in high-profile, long-life architectural projects. This segment often demands highly durable, pigmented fluoropolymer additives that maintain color stability and aesthetic appeal over decades, contrasting sharply with the purely functional requirements of the industrial machinery segment. Therefore, successful market penetration necessitates not only technical expertise in chemical resistance but also capabilities in pigment dispersion and UV stabilization tailored for exterior exposure applications. The overall market complexity demands granular analysis across all segments to identify truly lucrative strategic opportunities.

A detailed examination of the Value Chain reveals inherent geopolitical risks associated with the raw material supply, as the production of key fluorinated monomers is concentrated in specific geographic regions, making the midstream additive producers vulnerable to supply chain disruptions and volatile pricing. Companies are mitigating this risk by establishing dual sourcing strategies and integrating backward into monomer production where feasible, though this is a capital-intensive undertaking. Downstream efficiency is heavily dependent on the quality control standards implemented by the additive producer. Since coating performance is extremely sensitive to minute variations in additive particle surface chemistry or dispersion quality, rigorous certification processes and collaborative technical service agreements between additive suppliers and coating formulators are paramount to maintaining product integrity and end-user trust. The transition away from legacy fluorosurfactants further complicates the value chain, requiring significant reformulation and re-qualification efforts across the entire ecosystem, from raw material synthesis to final application.

The role of specialized compounding houses and masterbatch producers in the distribution channel should not be underestimated. These intermediaries often blend fluoropolymer additives with other performance enhancers (e.g., waxes, defoamers) to create ready-to-use formulations for smaller coating companies that lack in-house technical capabilities for handling complex chemical dispersion. This indirect channel significantly expands the market reach of fluoropolymer additives into smaller and more regionally dispersed industrial coating operations, acting as a crucial enabler of market growth in fragmented territories. The intellectual property landscape, encompassing patents on polymerization processes, novel dispersion agents, and specific applications, forms a high barrier to entry and allows established players to command premium pricing, further solidifying the highly technical and specialized nature of the overall value chain, influencing profit margins at every stage of material transformation.

In the context of technology, the shift toward sustainable solvents and green chemistry mandates is compelling additive manufacturers to innovate beyond simple waterborne systems. Supercritical carbon dioxide (scCO2) dispersion techniques, while still nascent, represent a promising area for creating environmentally benign, solvent-free fluoropolymer coating compositions. This technology addresses both environmental compliance and end-product purity, particularly valuable for the demanding electronics and medical fields where even trace solvent residues are unacceptable. Furthermore, the integration of computational chemistry and machine learning (as discussed in the AI analysis) is accelerating the optimization of polymer molecular weight distribution and crystallinity, parameters critical for achieving maximum performance when the polymer is introduced as a micronized additive. These high-tech material informatics tools are becoming standard practice in leading R&D laboratories, ensuring that new additive products are robustly tested and optimized before costly scale-up, maintaining the technical competitive edge of the innovators in the market. This focus on material science precision underscores the high technological maturity required to succeed in this sector.

The regulatory evolution, particularly the global move towards potentially classifying all PFAS as substances of concern, forces continuous technological adaptation. While PTFE itself is generally considered polymer-of-low-concern due to its large molecular size and chemical inertness, the non-polymeric processing aids and emulsifiers used in its production are under intense scrutiny. Hence, the focus on developing non-fluorinated processing aids or novel purification steps that entirely remove residual PFOA or other regulated substances from the final additive product is a core technological focus. This drive for ultra-pure, trace-contaminant-free additives is particularly critical for medical and food-contact applications, where regulatory compliance hinges not just on the polymer itself but on the entire formulation composition. This necessity ensures that technological innovation in the fluoropolymer coating additives market is inherently tied to the evolving global health and environmental policy landscape, making regulatory anticipation a key component of R&D strategy.

The demand for specific types of fluoropolymer additives is highly application-dependent. For instance, FEP (Fluorinated Ethylene Propylene) additives are highly valued for applications requiring transparency and flexibility, such as specialized packaging films or wire coatings where clarity is necessary. FEP’s lower melting point compared to PTFE also makes it suitable for applications where lower curing temperatures are required in the coating process. Contrastingly, high-purity PFA is indispensable in critical fluid handling systems in semiconductor manufacturing, where absolute minimum levels of extractable ions or particles are mandated, justifying its higher cost. Understanding this granular demand structure enables additive suppliers to tailor production batches and inventory levels, ensuring optimal supply chain responsiveness to highly volatile, yet high-value, niche industrial sectors. The aerospace sector's adoption of advanced composite materials also drives demand for specialized fluoropolymer additives capable of surviving high-stress thermal cycling and bonding effectively with complex substrate chemistries, presenting continued technical challenges and lucrative opportunities for materials scientists.

Finally, the competitive strategy of key players frequently involves securing long-term supply contracts with major coating houses and offering proprietary additive blends under exclusive agreements. This vertical integration or deep collaboration minimizes price competition and maximizes technical synergy, especially in markets like North America and Europe where technical specifications are the primary differentiator. Patent protection on micronization and dispersion technologies forms a significant barrier to entry, safeguarding investments in highly specialized manufacturing assets. Furthermore, the provision of comprehensive technical service, including application support and failure analysis, is crucial for winning and retaining customers in this highly technical market, where successful coating application often depends on minute adjustments to the additive formulation and curing parameters. This emphasis on service and technical partnership highlights that competition in the Fluoropolymer Coating Additives Market is based less on pure price and more on demonstrated quality, reliability, and regulatory foresight.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager