Fluoropore Membrane Filter Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 433603 | Date : Dec, 2025 | Pages : 255 | Region : Global | Publisher : MRU

Fluoropore Membrane Filter Market Size

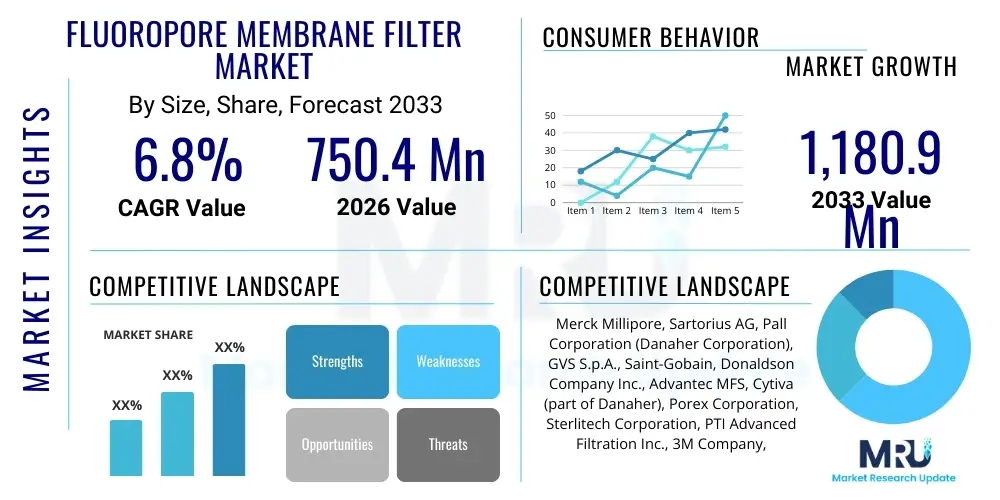

The Fluoropore Membrane Filter Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at $750.4 Million in 2026 and is projected to reach $1,180.9 Million by the end of the forecast period in 2033.

Fluoropore Membrane Filter Market introduction

The Fluoropore Membrane Filter Market encompasses filtration media constructed primarily from Polytetrafluoroethylene (PTFE), renowned for its exceptional chemical resistance, high thermal stability, and inherent hydrophobicity. These characteristics make Fluoropore filters indispensable in critical separation and purification processes across highly demanding industries, particularly pharmaceuticals, biotechnology, microelectronics, and advanced chemical manufacturing. The unique pore structure ensures high flow rates and efficient particle retention, making them superior choices for aggressive solvents, corrosive fluids, and sterilization applications where traditional polymer membranes fail to maintain integrity. The increasing stringency of regulatory standards regarding product purity and environmental discharge is fundamentally accelerating the demand for these high-performance membrane solutions.

Fluoropore filters are pivotal in applications such as sterile venting, gas filtration, sample preparation, and ultra-pure water production. Their inherent non-shedding properties and broad chemical compatibility—withstanding strong acids, bases, and organic solvents—position them as the default standard for quality control and process scale-up in specialized sectors. Major applications include pharmaceutical sterilization and clarification, filtration of highly corrosive industrial chemicals, semiconductor manufacturing requiring ultra-clean processing, and critical air and gas filtration where moisture resistance is paramount. The market growth trajectory is closely linked to global expansion in bioprocessing infrastructure and the continuous innovation in filtration technologies designed to enhance throughput and reduce overall processing costs.

The primary benefit of utilizing Fluoropore membranes lies in their robust operational longevity and reliable performance in extreme conditions, mitigating the risk of product contamination or filter failure. Key driving factors propelling this market include the rapid expansion of the global biotechnology sector, significant investment in high-purity microelectronics fabrication, and the growing need for sophisticated liquid and gas handling systems in environmental monitoring. Furthermore, the development of composite Fluoropore membranes and optimized cartridge formats allows for scalability and integration into automated systems, catering to the efficiency requirements of modern industrial and laboratory settings.

Fluoropore Membrane Filter Market Executive Summary

The Fluoropore Membrane Filter Market is experiencing robust growth driven by irreversible trends in pharmaceutical regulatory compliance and the sustained demand for high-purity materials in technology sectors. Business trends highlight a strong focus on strategic acquisitions by major players to consolidate advanced membrane technologies and expand geographic reach, particularly in emerging Asian markets where industrialization is escalating rapidly. Manufacturers are prioritizing innovation in pore size uniformity and filter geometry to improve flow characteristics and reduce fouling, aiming to deliver tangible operational savings to end-users. The shift towards single-use disposable filtration systems in biopharma is significantly boosting the consumption of pre-validated Fluoropore cartridges and capsules, signaling a profitable evolution in product format preference among industry stakeholders.

Regionally, North America and Europe currently dominate the market due to established biopharmaceutical hubs, rigorous regulatory environments, and high adoption rates of advanced filtration technologies. However, the Asia Pacific (APAC) region is projected to register the highest Compound Annual Growth Rate (CAGR) during the forecast period. This accelerated growth in APAC is underpinned by massive government investments in healthcare infrastructure, the localization of manufacturing capabilities for active pharmaceutical ingredients (APIs), and the explosive expansion of the electronics manufacturing sector, particularly in countries like China, India, and South Korea. These regional trends suggest a future market landscape characterized by global manufacturing decentralization balanced with high centralized quality control standards.

Segmentation trends indicate that the pharmaceutical and biotechnology segment remains the largest end-user category, primarily due to critical sterilization and final product purification needs. Within the product type segmentation, hydrophobic Fluoropore filters designed for gas venting and non-aqueous solutions maintain significant demand, while customized membrane formats (such as pleated cartridges and syringe filters) are gaining traction due to convenience and targeted application performance. The microfiltration segment, defined by precise pore size control, continues to be the dominant technology sub-segment, critical for particle removal in processes ranging from chemical synthesis to aseptic processing validation.

AI Impact Analysis on Fluoropore Membrane Filter Market

User queries regarding AI in the Fluoropore Membrane Filter Market predominantly center on how artificial intelligence can optimize filtration performance, predict filter lifespan, and enhance supply chain resilience. Key themes include the implementation of predictive maintenance models to reduce unplanned downtime associated with filter clogging, the use of machine learning algorithms to analyze fluid dynamics and optimize membrane structure for specific chemical batches, and concerns about integrating highly technical, specialized membrane production with generalized AI platforms. Users are seeking quantifiable evidence of AI reducing operational expenditure (OPEX) and improving the fidelity of regulatory data capture related to filtration processes, driven by the desire to move beyond reactive maintenance strategies.

The immediate impact of AI is seen in manufacturing process control, where complex algorithms monitor variables such as coating uniformity, material consistency, and pore distribution during membrane fabrication. This leads to higher batch consistency and reduced material waste, directly impacting the profitability of membrane producers. Furthermore, AI-driven data analysis platforms are increasingly being deployed in bioprocessing facilities to correlate upstream process parameters with downstream filtration performance, allowing for real-time adjustments that maximize throughput without compromising critical purity thresholds. This data-centric approach elevates the quality assurance process, moving it from manual spot checks to comprehensive, automated monitoring.

Looking forward, AI integration is expected to revolutionize filter application design. Machine learning can simulate the interaction between novel or aggressive solvents and the PTFE matrix, significantly shortening the R&D cycle for application-specific membrane filters. This rapid prototyping capability, combined with optimized inventory management systems guided by demand forecasting AI, ensures that high-specification Fluoropore products are available precisely when and where complex manufacturing operations require them, thereby enhancing the overall efficiency and responsiveness of the specialized filtration market ecosystem.

- AI optimizes membrane manufacturing consistency through real-time process monitoring.

- Machine learning algorithms enable predictive maintenance, forecasting filter fouling and lifespan.

- AI enhances supply chain management by accurately predicting specialized product demand across critical sectors.

- Data analytics correlate filtration performance with upstream processing variables in biopharma.

- Simulations powered by AI accelerate the development of application-specific Fluoropore membrane structures.

DRO & Impact Forces Of Fluoropore Membrane Filter Market

The Fluoropore Membrane Filter Market is significantly influenced by a unique set of Drivers, Restraints, and Opportunities (DRO), collectively manifesting strong Impact Forces on market dynamics. The primary drivers stem from the regulatory push for high-purity standards across pharmaceutical and microelectronics industries, coupled with the unmatched chemical inertness and thermal stability that PTFE offers compared to cheaper alternatives. Restraints largely revolve around the high initial cost associated with PTFE membrane production and the technical complexities involved in achieving extremely tight pore size control in ultra-filtration grades. Opportunities are found in the expansion into emerging fields like electric vehicle battery manufacturing and advanced environmental remediation, which require robust chemical separation technologies. These forces collectively dictate pricing structures, drive R&D intensity, and define competitive strategies within this highly specialized market segment.

A key Driver is the expansion of the biomanufacturing industry, specifically the rapid adoption of single-use technologies where validated, chemically inert filters are essential for maintaining sterility and preventing cross-contamination in flexible processing lines. This demand is further amplified by the global trend toward personalized medicine and complex biologics, necessitating highly reliable filtration steps. However, a significant Restraint is the environmental concern and disposal complexity associated with PTFE materials, which presents a challenge in meeting sustainability goals, pushing manufacturers to invest in more sustainable production methods or highly efficient recycling programs for used cartridges.

The foremost Opportunity lies in geographical expansion into untapped industrial markets, especially in Southeast Asia and Latin America, where industrial quality control standards are rapidly maturing. Furthermore, technological innovation focused on improving the flux rate (flow rate per unit area) without sacrificing retention efficiency represents a critical area for competitive differentiation. The inherent Impact Forces of high entry barriers due to complex manufacturing expertise and strict regulatory requirements ensure that market growth is primarily concentrated among a limited number of specialized, experienced manufacturers, solidifying their competitive advantage and maintaining premium pricing for high-quality products.

Segmentation Analysis

The Fluoropore Membrane Filter Market is comprehensively segmented based on product type, application, and pore size, reflecting the diverse and highly specialized needs of the end-user industries. This structured approach allows for targeted analysis of growth pockets and technology adoption trends across various sectors. The high chemical resistance and thermal stability of these membranes necessitate detailed segmentation to address specific requirements, ranging from aseptic filtration in drug manufacturing to the purification of highly corrosive etchants in semiconductor fabrication. Understanding these segments is crucial for strategic decision-making, enabling manufacturers to align production capabilities with high-growth demand areas and customize products for niche applications requiring precise pore geometry and surface modifications.

The segmentation by product type typically differentiates between disc filters, which are standard for laboratory testing and small-scale operations, and pleated cartridges and capsules, predominantly used for large-volume industrial processes requiring higher throughput and greater surface area. Application-based segmentation reveals the disproportionate influence of the pharmaceutical sector, yet it also highlights the emerging importance of sectors like specialty chemicals and ultra-pure water systems. The granularity offered by pore size segmentation (e.g., sterilization grade vs. general clarification grade) directly correlates with the filtration objective and the critical nature of the process step, impacting material selection and pricing structure across the entire value chain.

- Product Type: Disc Filters, Capsule Filters, Cartridge Filters, Syringe Filters, Filter Sheets.

- Material Type: Hydrophobic Fluoropore (PTFE), Modified/Hydrophilic Fluoropore (e.g., PTFE with binding agents).

- Pore Size: 0.1 µm and below (Ultrafiltration/Fine Particle Removal), 0.2 µm (Sterilization Grade), 0.45 µm (Clarification Grade), Above 0.45 µm (Prefiltration/General Purpose).

- Application: Pharmaceutical and Biotechnology (Sterile Filtration, Venting), Microelectronics (Chemical Filtration, Ultra-Pure Water), Food and Beverage (Solvent Filtration), Chemical Processing (Corrosive Fluids), Environmental Monitoring (Air Sampling, Water Testing).

Value Chain Analysis For Fluoropore Membrane Filter Market

The value chain for the Fluoropore Membrane Filter Market is characterized by high technical expertise required at the upstream and manufacturing stages, often involving proprietary processes. Upstream activities begin with the procurement and processing of specialized raw materials, primarily high-grade PTFE resin, which is then converted into thin, porous membranes through complex processes like paste extrusion and stretching (sintering). This stage requires significant capital investment in machinery and stringent quality control protocols to ensure the desired porosity, thickness, and uniformity, which directly determines the final product's performance attributes and cost structure. Key challenges upstream include managing the volatile pricing of specialty polymer resins and maintaining intellectual property protection over unique membrane fabrication techniques.

The manufacturing and midstream segments involve converting the raw membrane into final product formats such as pleated cartridges, capsules, or syringe filters. This stage includes complex assembly processes, validation testing (e.g., integrity testing), and sterilization, often requiring cleanroom environments. Distribution channels are specialized, typically utilizing a mix of direct sales forces for large industrial accounts and high-volume bioprocess customers, coupled with indirect distribution through authorized technical distributors and specialized laboratory suppliers. Due to the critical nature of the products, technical support and application expertise are integral components of the distribution process, differentiating standard commodity suppliers from high-value solution providers.

Downstream activities involve the final end-user application, maintenance, and eventual disposal. Direct channels ensure close collaboration with high-volume pharmaceutical and microelectronics manufacturers for custom solutions and supply chain integration. Indirect channels cater more to research laboratories and smaller chemical processing plants. The technical complexity means that the downstream buyer heavily relies on the supplier for validation data, compatibility studies, and ongoing training. The disposal aspect, given the PTFE content, is a growing consideration, influencing customers' decisions towards suppliers offering efficient product life cycle management or closed-loop systems, thereby adding an influential element to the value chain structure.

Fluoropore Membrane Filter Market Potential Customers

Potential customers for Fluoropore Membrane Filters are predominantly concentrated within industries demanding the highest levels of purity, chemical resistance, and thermal stability in their separation processes. The primary end-users are large multinational pharmaceutical and biotechnology companies utilizing these filters for critical steps like aseptic filtration of media, buffers, and final drug products, as well as for tank and fermenter venting where hydrophobic, sterile barriers are necessary. These buyers prioritize product validation, regulatory documentation (e.g., FDA compliance), and documented low extractables profiles, making purchasing decisions heavily reliant on supplier credibility and product quality certifications rather than mere cost considerations.

The microelectronics industry represents another significant customer base, especially manufacturers of semiconductors, flat panel displays, and critical electronic components. These processes require ultra-high-purity chemicals (such as photoresists, acids, and solvents) and deionized water, where even minimal contamination can lead to catastrophic yield loss. Fluoropore membranes are essential for the final polishing filtration of these critical fluid streams, offering the necessary chemical inertness to prevent leaching of contaminants. Furthermore, the aerospace and defense sectors utilize these filters for demanding fluid filtration and gas sampling in extreme operational environments where traditional materials would fail.

Secondary but rapidly growing customer segments include specialty chemical manufacturers that handle aggressive organic solvents and corrosive intermediates, and companies involved in advanced laboratory research and quality control testing where small-volume, high-precision filtration (e.g., using syringe filters) is routine. Emerging applications in renewable energy, particularly in the production and purification of specialized electrolytes for advanced battery manufacturing, are also driving new customer acquisition, demanding robust filters capable of withstanding novel, often highly reactive, chemical compositions under varying temperature conditions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | $750.4 Million |

| Market Forecast in 2033 | $1,180.9 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Merck Millipore, Sartorius AG, Pall Corporation (Danaher Corporation), GVS S.p.A., Saint-Gobain, Donaldson Company Inc., Advantec MFS, Cytiva (part of Danaher), Porex Corporation, Sterlitech Corporation, PTI Advanced Filtration Inc., 3M Company, Meissner Filtration Products, Parker Hannifin Corporation, Roki Co., Ltd., W. L. Gore & Associates, Cobetter Filtration, Membrane Solutions, Fuji Filter Mfg. Co., Ltd., Atlas Filtri. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluoropore Membrane Filter Market Key Technology Landscape

The technology landscape for the Fluoropore Membrane Filter Market is characterized by continuous innovation aimed at optimizing membrane structure, enhancing throughput, and improving chemical compatibility under extreme conditions. A foundational technology is the ePTFE (expanded Polytetrafluoroethylene) process, which creates a highly porous membrane with a fibrillar structure, offering superior strength and high void volume compared to traditional sintered PTFE. Recent technological advances focus heavily on surface modification techniques, such as plasma treatment or chemical grafting, to render the inherently hydrophobic PTFE surface hydrophilic for aqueous applications without compromising its chemical backbone or high temperature tolerance. This modification expands the usability of Fluoropore filters into broad pharmaceutical clarification processes previously dominated by other polymers.

Another crucial technological development involves the integration of asymmetric pore structures within the membrane depth. Asymmetric membranes utilize a gradient of pore sizes, where larger pores on the upstream side capture coarser particles, protecting the tighter downstream layer. This multi-layer approach significantly extends the filter life, reduces overall filtration cost, and maintains high flow rates, which is especially critical in high-volume bioprocessing environments. Furthermore, the precision manufacturing technology—particularly lithography and laser cutting techniques—is increasingly employed to ensure absolute consistency in pore size distribution across large membrane surfaces, a non-negotiable requirement for sterilization-grade filters used in aseptic processing validation.

Currently, the market is seeing increased adoption of pleated cartridge technology utilizing high-density stacking and optimized pleat geometry to maximize filtration surface area within a compact housing. This advancement directly addresses the industrial need for high throughput and reduced equipment footprint. Additionally, in the microelectronics sector, the focus is on developing Fluoropore membranes with ultra-low extractables and low particle shedding properties, often achieved through rigorous post-treatment cleaning protocols and specialized housing materials. The convergence of material science, fluid dynamics modeling, and precision engineering is defining the next generation of high-performance Fluoropore filtration solutions, pushing the boundaries of chemical separation fidelity.

Regional Highlights

The regional dynamics of the Fluoropore Membrane Filter Market are heavily skewed toward established economies with mature regulatory frameworks and robust R&D spending, though emerging markets are rapidly closing the gap.

- North America: This region holds the largest market share, driven by the presence of global biotechnology and pharmaceutical giants, significant investment in R&D, and stringent FDA regulations demanding high-quality, validated filtration solutions. The robust microelectronics sector, particularly in the US, necessitates consistent demand for ultra-pure chemical filtration.

- Europe: Europe represents a mature market, characterized by high adoption rates in countries like Germany, France, and the UK. Growth is supported by strong chemical processing industries and advanced water treatment facilities. The European Union’s commitment to pharmaceutical excellence and environmental monitoring sustains high demand for specialized Fluoropore membranes.

- Asia Pacific (APAC): APAC is projected to be the fastest-growing region. This acceleration is fueled by massive urbanization, burgeoning pharmaceutical manufacturing capabilities (especially in India and China), and the dominance of the electronics supply chain. Increasing awareness of quality standards and foreign direct investment in manufacturing plants are key growth catalysts.

- Latin America (LATAM): Growth in LATAM is more nascent but accelerating, driven by the modernization of healthcare systems and increased local production of generic drugs. Brazil and Mexico are leading the adoption of imported high-specification filters, transitioning away from lower-quality alternatives.

- Middle East and Africa (MEA): This region shows specialized growth, particularly within the petrochemical and water desalination sectors, where chemical resistance and thermal stability of Fluoropore filters are crucial. Infrastructure investment and growing medical facilities in the GCC countries support niche market demand.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluoropore Membrane Filter Market.- Merck Millipore

- Sartorius AG

- Pall Corporation (Danaher Corporation)

- GVS S.p.A.

- Saint-Gobain

- Donaldson Company Inc.

- Advantec MFS

- Cytiva (part of Danaher)

- Porex Corporation

- Sterlitech Corporation

- PTI Advanced Filtration Inc.

- 3M Company

- Meissner Filtration Products

- Parker Hannifin Corporation

- Roki Co., Ltd.

- W. L. Gore & Associates

- Cobetter Filtration

- Membrane Solutions

- Fuji Filter Mfg. Co., Ltd.

- Atlas Filtri

Frequently Asked Questions

What is a Fluoropore Membrane Filter and what are its primary uses?

A Fluoropore Membrane Filter is a high-performance filtration medium typically manufactured from Polytetrafluoroethylene (PTFE). It is characterized by exceptional chemical inertness, high temperature resistance, and inherent hydrophobicity. Primary uses include sterile filtration in pharmaceuticals, aggressive solvent filtration in chemical processing, critical gas venting in bioreactors, and ultra-pure chemical polishing in microelectronics manufacturing.

Why are Fluoropore filters preferred over standard polymer filters in bioprocessing?

Fluoropore filters are preferred in bioprocessing, particularly for sterile applications and venting, because PTFE’s chemical inertness ensures minimal extractables and non-specific binding, preventing product contamination. Their high hydrophobicity makes them ideal for moisture-laden gas filtration and sterile air venting, reliably maintaining a critical sterile barrier where hydrophilic membranes would rapidly fail or clog.

Which application segment drives the highest demand in the Fluoropore Membrane Market?

The Pharmaceutical and Biotechnology segment consistently drives the highest demand. This is due to the mandatory requirement for absolute filtration integrity (typically 0.2 µm sterilization grade) in drug manufacturing, buffer preparation, and final product clarification, where Fluoropore membranes are the validated standard for chemical compatibility and safety assurance.

What is the key technological innovation shaping the future of Fluoropore membranes?

Key technological innovations include surface modification techniques, such as plasma treatment, to create hybrid hydrophilic Fluoropore filters for aqueous applications, and the development of asymmetric ePTFE structures. These advancements are aimed at increasing flow rate (flux) and extending filter service life without compromising the filter’s robust chemical resistance or particle retention efficiency, optimizing industrial throughput.

How does the high cost of Fluoropore filters affect market adoption?

While the initial cost of Fluoropore filters is higher compared to standard materials, their adoption remains strong in critical sectors because the long-term total cost of ownership is often lower. Their extended lifespan, superior chemical resistance, and the minimal risk of failure in sensitive processes significantly mitigate risks associated with costly batch loss or equipment damage, justifying the premium price point in high-value manufacturing.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager