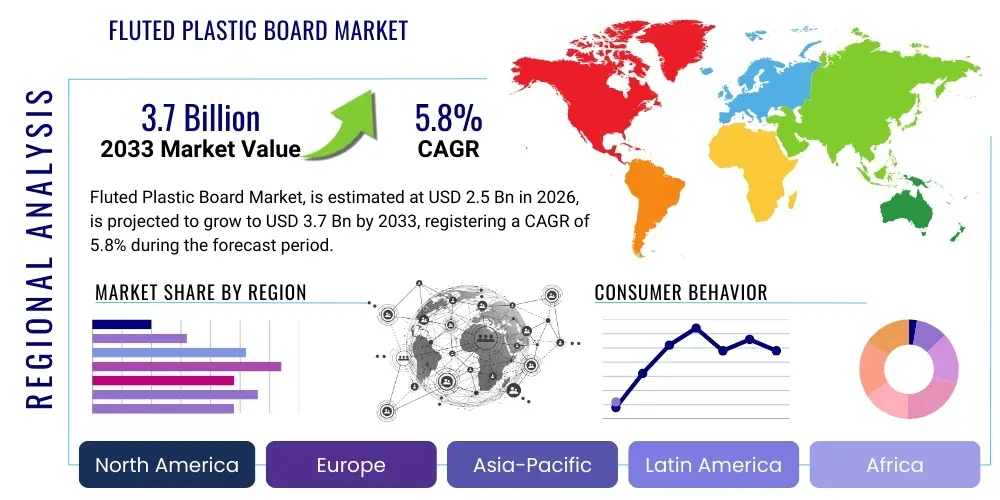

Fluted Plastic Board Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 436436 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Fluted Plastic Board Market Size

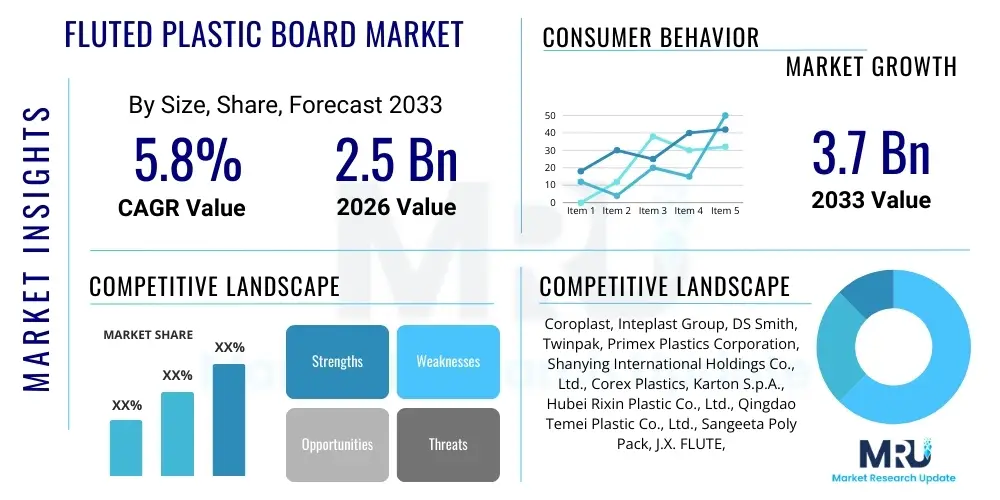

The Fluted Plastic Board Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 2.5 Billion in 2026 and is projected to reach USD 3.7 Billion by the end of the forecast period in 2033.

Fluted Plastic Board Market introduction

The Fluted Plastic Board Market, commonly identified by trade names such as Coroplast or Corflute, encompasses the manufacturing and distribution of extruded sheets made primarily from polypropylene (PP) resin. These sheets are characterized by a corrugated structure comprising two smooth outer layers separated by vertical ribs, which gives the material exceptional rigidity, lightness, and durability. This cellular structure makes fluted plastic board superior to traditional cardboard in environments requiring resistance to moisture, chemicals, and impact, providing a crucial advantage in demanding applications.

The product’s versatility drives its widespread adoption across numerous end-use sectors, including signage, packaging, construction, and agriculture. In packaging, fluted boards are utilized for reusable transit containers, protective layering, and specialty boxes due to their superior load-bearing capacity and recyclability, addressing growing corporate demands for circular economy solutions. Furthermore, their ease of fabrication, printability, and cost-effectiveness solidify their position as a preferred material for temporary outdoor signage and point-of-purchase displays globally.

Key market drivers include the rapid expansion of the e-commerce sector, which necessitates lightweight yet robust protective packaging solutions, and increasing infrastructural development globally, particularly in the Asia Pacific region, where fluted boards are used extensively as concrete formwork and temporary partitioning. The growing consumer preference for sustainable and reusable packaging alternatives further accelerates market penetration, as polypropylene fluted boards offer significantly longer lifecycles than single-use paperboard products, aligning with stringent environmental regulations and corporate sustainability mandates.

Fluted Plastic Board Market Executive Summary

The Fluted Plastic Board Market is experiencing robust growth fueled by transformative business trends focusing on material circularity and supply chain resilience. Regionally, the market exhibits dynamic shifts, with the Asia Pacific emerging as the predominant growth engine due to exponential infrastructure spending and booming manufacturing output, while North America and Europe prioritize the adoption of high-grade, UV-stabilized boards for long-term outdoor and specialty applications. Across various segments, the packaging segment dominates market share, propelled by the persistent demand for reusable containers and customized protective inserts across logistics and automotive industries.

Technological advancements in extrusion processes are leading to the development of enhanced fluted boards with improved fire retardancy, anti-static properties, and enhanced stiffness-to-weight ratios, catering to highly regulated industries such as electronics and pharmaceuticals. Furthermore, strategic trends indicate a move toward vertically integrated manufacturing models, allowing major players to control the quality of raw material inputs (PP resin) and optimize customization capabilities, thus improving profitability and responsiveness to niche market demands. The integration of digital printing technologies is simultaneously broadening the scope of application, particularly within the advertising and promotional signage segment, offering high-resolution graphics and personalized solutions quickly.

Segment trends reveal that thicker boards (5mm and above) are gaining traction in construction and automotive applications where high durability and impact resistance are paramount, while thinner boards (2mm to 4mm) remain critical to the massive volume required by the packaging and graphic arts sectors. The market structure, while competitive, is consolidating around key manufacturers who possess advanced recycling capabilities and extensive global distribution networks, ensuring stable supply amidst fluctuating polymer prices. This collective push towards operational efficiency and product diversification underscores the market's resilience and its steady upward trajectory over the forecast period.

AI Impact Analysis on Fluted Plastic Board Market

User inquiries regarding AI's influence in the Fluted Plastic Board market predominantly focus on optimization of resource utilization, predictive maintenance of complex extrusion lines, and enhancing design efficiency for custom applications. Common questions revolve around how AI can minimize raw material waste (polypropylene resin), improve quality control by detecting microscopic flaws in the corrugation, and accelerate turnaround times for highly personalized orders required by the signage and specialized packaging sectors. Furthermore, users are keen to understand AI's role in supply chain forecasting, particularly in managing the volatile prices of precursor chemicals and ensuring just-in-time inventory management for high-volume customers in the construction and logistics industries.

The primary theme emerging from this analysis is that AI is not revolutionizing the core product—the fluted plastic board itself—but is profoundly optimizing the manufacturing processes and supporting logistics ecosystem. AI and machine learning algorithms are being integrated into extrusion systems to dynamically adjust temperature, pressure, and flow rates based on real-time sensor data, ensuring maximum material yield and consistent board quality. This implementation directly addresses cost pressures and minimizes operational downtime, two critical factors in a highly competitive commodity market. Predictive analytics driven by AI models allows manufacturers to anticipate equipment failures long before they occur, scheduling preventative maintenance optimally, thus maximizing production uptime and output efficiency.

Additionally, AI-driven automation is transforming the post-processing phase, including automated cutting, creasing, and sorting of custom-designed boards. In design, AI tools can rapidly analyze structural requirements for complex packaging geometries, suggesting optimized material thickness and flute direction to achieve required load-bearing capacity with minimal material usage. This optimization capability reduces lead times for bespoke orders, offering a competitive edge, especially in the e-commerce protective packaging domain where speed and structural integrity are paramount concerns.

- AI optimizes extrusion parameters, reducing polypropylene resin consumption and enhancing material consistency.

- Machine learning algorithms enable predictive maintenance of complex manufacturing machinery, minimizing unplanned operational downtime.

- AI-powered vision systems significantly improve quality control by instantly detecting defects in board thickness and flute structure.

- Generative design tools utilize AI to optimize packaging geometries for maximum load capacity and minimum material waste.

- AI enhances supply chain management through precise demand forecasting, improving inventory levels and mitigating raw material price volatility.

DRO & Impact Forces Of Fluted Plastic Board Market

The Fluted Plastic Board Market is dynamically influenced by robust drivers, structural restraints, and evolving opportunities, collectively defining its trajectory over the forecast period. Key drivers include the escalating global demand for reusable and lightweight packaging solutions, directly benefiting from the surge in e-commerce and logistics activities worldwide. However, the market faces significant restraints, primarily stemming from the price volatility of feedstock materials, notably polypropylene resin, which subjects manufacturers to unpredictable cost fluctuations and margin erosion. Opportunities abound through technological advancements in material science, leading to the development of enhanced, fire-retardant, and increasingly recycled fluted boards, opening new specialized applications in construction and sensitive electronics sectors.

Impact forces currently favoring market growth include strong regulatory support for recycling infrastructure and restrictions on single-use conventional plastics, pushing end-users toward durable, multi-trip solutions like fluted plastic containers. Conversely, the high capital expenditure required for establishing advanced extrusion and material handling facilities acts as a formidable barrier to entry for smaller manufacturers, contributing to market concentration among established players. Consumer and corporate sustainability mandates are exerting pressure on manufacturers to maximize the percentage of post-consumer recycled content in their boards, transforming production processes and potentially increasing manufacturing complexity in the short term while driving long-term sustainability benefits.

The overall market equilibrium is shifting towards greater innovation in material composition and process efficiency. While economic downturns and geopolitical instability can temporarily suppress demand in construction and automotive sectors, the persistent need for protective and promotional materials ensures fundamental market stability. The convergence of superior performance characteristics—lightness, resistance to water, and durability—makes fluted plastic boards difficult to replace in many specialized applications, thus solidifying their market presence against substitute materials like traditional corrugated fiberboard.

Segmentation Analysis

The Fluted Plastic Board Market is comprehensively segmented based on material type, thickness, application, and geographical region, reflecting the diverse requirements of end-user industries. Segmentation by material type predominantly includes Polypropylene (PP) and High-Density Polyethylene (HDPE), with PP currently dominating due to its superior cost-effectiveness, flexibility, and excellent thermal stability, making it the material of choice for general packaging and signage. The thickness segmentation is crucial, differentiating boards used for lightweight graphics (2mm–3mm) from heavy-duty industrial applications (5mm–10mm) such as protective layering, concrete formwork, and reusable bulk bins.

The application segment provides the deepest insight into market dynamics, highlighting key sectors such as Packaging (which includes protective, transit, and reusable packaging), Signage & Graphics (for advertising, real estate, and event promotion), Construction (for temporary flooring protection, waterproofing membranes, and concrete forms), and Automotive (for dunnage and component protection). The packaging segment’s dominance is expected to continue, driven by the logistics sector’s transition towards durable, sustainable, and easily cleanable containers for efficient supply chain operations. The construction segment is witnessing accelerated growth as fluted boards increasingly replace conventional materials for cost and labor efficiency.

Regional segmentation reveals crucial differences in market maturity and growth potential. Asia Pacific leads in terms of volume consumption due to high manufacturing output and immense infrastructural projects, requiring large quantities of packaging and temporary construction materials. North America and Europe, while growing at a slower rate, focus on high-margin, specialized applications where fire-retardant, UV-stabilized, and high-recycled content boards command premium pricing, driven by stringent regulatory frameworks and sophisticated market demands for aesthetic quality in signage.

- By Material Type:

- Polypropylene (PP)

- High-Density Polyethylene (HDPE)

- Other Polymers (e.g., Polycarbonate, PVC)

- By Thickness:

- Less than 4 mm

- 4 mm to 6 mm

- More than 6 mm

- By Application:

- Packaging

- Signage & Graphics

- Construction

- Agriculture

- Automotive

- Others (e.g., Electronics, Stationery)

- By Region:

- North America

- Europe

- Asia Pacific (APAC)

- Latin America (LATAM)

- Middle East & Africa (MEA)

Value Chain Analysis For Fluted Plastic Board Market

The value chain for the Fluted Plastic Board Market begins with upstream activities dominated by petrochemical suppliers who produce the foundational raw material, primarily polypropylene (PP) resin, and various additives such as colorants, UV stabilizers, and anti-static agents. Price stability and consistent supply of high-grade resin are critical determinants of profitability at this stage, as PP resin typically constitutes the largest variable cost component for manufacturers. Strong relationships with large petrochemical companies are essential for securing favorable procurement terms, mitigating risks associated with global polymer market volatility, and ensuring quality control compliant with end-use industry specifications.

The core manufacturing process involves midstream operations, specifically the extrusion and conversion stages. Extrusion involves melting the polymer resin and additives, forcing the molten material through specialized dies to form the continuous fluted sheets. This phase is capital-intensive, requiring specialized, high-capacity machinery and significant energy input. Conversion activities follow, where the extruded sheets are subjected to cutting, printing (using screen, digital, or UV methods), creasing, welding, and fabrication into final products such as boxes, protective layers, or advertising signs. Process efficiency and waste reduction in this stage are paramount for maximizing margins.

The downstream segment involves distribution and end-user consumption. Distribution channels are varied, including direct sales to major industrial consumers (e.g., automotive OEMs, large construction firms), and indirect channels utilizing distributors, wholesalers, and specialized packaging or signage resellers. Direct sales offer higher margins but require robust logistical capabilities, while indirect channels provide wider market reach, especially for smaller-volume, regional customers. The final consumers—ranging from logistics companies seeking reusable dunnage to real estate agencies purchasing signage—drive demand based on factors like durability, cost, and specific customization requirements, completing the value cycle and dictating future product innovation directions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 2.5 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Coroplast, Inteplast Group, DS Smith, Twinpak, Primex Plastics Corporation, Shanying International Holdings Co., Ltd., Corex Plastics, Karton S.p.A., Hubei Rixin Plastic Co., Ltd., Qingdao Temei Plastic Co., Ltd., Sangeeta Poly Pack, J.X. FLUTE, Zhejiang Yuanda Polypropylene Co., Ltd., Northern Ireland Plastics, P.P. Corrugated Sheets Co., Ltd., Regent Plastic Industrial Co., Ltd., Box Plásticos S.A. de C.V., Shanghai Huiyuan Package Materials Co., Ltd., T.P. Manufacturing Co., Ltd., and New-Tech Industries. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Fluted Plastic Board Market Potential Customers

The primary potential customers for fluted plastic boards span across diverse industrial and commercial sectors, fundamentally driven by their need for durable, customizable, lightweight, and moisture-resistant sheet materials. Logistics and E-commerce companies represent a substantial customer base, utilizing fluted boards extensively for reusable packaging, specialized shipping containers, and protective layering within freight transportation. These customers prioritize longevity and stackability, seeking solutions that reduce recurring packaging waste and streamline supply chain operations, especially in automated warehousing environments where consistency and resilience are essential.

Another major segment comprises advertising and commercial print companies, along with real estate developers. These customers require fluted boards primarily for temporary and semi-permanent signage, point-of-sale displays, and promotional graphics due to the material's excellent printability, resistance to outdoor elements, and cost-effectiveness compared to rigid substrates like aluminum or PVC. For large-scale promotional campaigns or construction site notices, the ease of handling and installation offered by the lightweight material significantly reduces labor costs, making it a highly attractive option for rapid deployment and removal.

Furthermore, the automotive and construction industries are high-volume purchasers of specialized fluted boards. Automotive manufacturers use these sheets as dunnage for protecting delicate components during transit within assembly plants and across global supply chains. Construction firms utilize them for temporary protective flooring, wall coverings, concrete form liners, and moisture barriers. These applications often demand specific performance characteristics, such as anti-static properties in electronics packaging or higher flame-retardant grades in some construction environments, defining the technical specifications required by these critical, high-value end-users.

Fluted Plastic Board Market Key Technology Landscape

The manufacturing technology for fluted plastic boards is centered around advanced extrusion processes, which are crucial for achieving the desired structure, density, and dimensional stability of the sheets. Modern manufacturing lines utilize sophisticated single-screw or twin-screw extruders combined with specialized flat dies to precisely control the flow and temperature of molten polymer. Key technological advancements focus on optimizing the die design to ensure uniform wall thickness and consistent flute size across wide sheets, minimizing material stress, and maximizing output speed while maintaining structural integrity. Energy efficiency in these high-temperature, high-pressure environments is a continuous focus area for technological investment, driving the adoption of high-efficiency motors and precise thermal control systems.

Beyond core extrusion, the landscape is defined by conversion technologies, most notably in printing and finishing. Digital printing technology, particularly UV-curing inkjet systems, has gained significant traction, allowing for high-resolution, full-color graphic application directly onto the fluted surface without requiring plates. This facilitates customization, short runs, and faster turnaround times, catering to the growing demand for personalized signage and promotional materials. Simultaneously, traditional screen printing remains vital for high-volume, single-color industrial applications due to its speed and low ink cost. Cutting and finishing technologies, including computer numerical control (CNC) routing and automated die-cutting systems, ensure precise fabrication of complex packaging shapes and sign contours with minimal human intervention and waste.

Material technology enhancements also form a critical part of the landscape, focusing on sustainability and specialized performance. Innovations involve formulating PP resins to incorporate high percentages of post-consumer recycled (PCR) content without compromising mechanical properties such as stiffness and impact resistance. Furthermore, the development of functional additives, including enhanced UV stabilizers for extended outdoor life, anti-microbial agents for agricultural applications (e.g., harvest bins), and advanced flame retardants, are expanding the functional scope and market eligibility of fluted plastic boards in highly regulated sectors. These technological advancements collectively enhance the product's value proposition against competing materials and ensure long-term market competitiveness.

Regional Highlights

The Fluted Plastic Board Market exhibits distinct growth patterns and maturity levels across key geographical regions, with Asia Pacific (APAC) currently positioned as the fastest-growing and largest consuming region. This robust growth in APAC is primarily attributed to massive urbanization and infrastructure projects, particularly in countries like China, India, and Southeast Asian nations, generating substantial demand for construction protection materials and high-volume industrial packaging. Furthermore, the region serves as the global manufacturing hub, driving enormous requirements for internal logistics and component dunnage within sectors like electronics and automotive. The focus in APAC remains on cost-effective, large-scale production, though increasing environmental regulations are slowly nudging manufacturers toward higher recycled content.

North America holds a significant market share, characterized by a highly mature market focused on premium applications and sophisticated end-uses. Demand is strong for high-performance boards, including UV-stabilized products for long-term outdoor advertising and specialized, anti-static grades required by the burgeoning semiconductor and aerospace industries. Market saturation is offset by consistent technological innovation and a strong regulatory push towards circular economy models, driving the replacement of less sustainable materials with reusable fluted plastic solutions, particularly within the automotive supply chain and the highly developed e-commerce logistics network across the US and Canada.

Europe represents a stable and environmentally conscious market, where growth is highly regulated by stringent EU directives focusing on recycling targets and plastic reduction. European demand leans towards high-quality, traceable materials, often requiring specific certifications for recycled content and chemical safety. Key applications include sophisticated reusable transit packaging used in the pharmaceutical and food sectors, alongside premium display graphics where aesthetic quality and durability are paramount. The market also sees steady consumption in agricultural applications, such as tree guards and specialized vineyard covers, reflecting the region's strong commitment to sustainable farming practices. Latin America and the Middle East & Africa (MEA) are emerging markets, displaying high potential due to industrialization and infrastructure development, particularly in the packaging and construction sectors, though market development is often constrained by local political and economic stability.

- Asia Pacific (APAC): Dominates volume and growth, driven by manufacturing, e-commerce boom, and significant infrastructure development in China, India, and ASEAN countries.

- North America: Mature market focusing on high-value applications, anti-static, and UV-resistant grades, heavily influenced by automotive and sophisticated logistics packaging needs.

- Europe: Characterized by high environmental standards and stringent recycling mandates, driving demand for premium, high-recycled content boards in pharmaceutical and agricultural applications.

- Latin America (LATAM): Emerging market with increasing industrial activity, primarily focused on packaging and basic signage applications, showing potential in Mexico and Brazil.

- Middle East & Africa (MEA): Growth is primarily tied to construction projects and oil & gas sector logistics, demanding durable temporary protective materials.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Fluted Plastic Board Market.- Coroplast (Inteplast Group)

- DS Smith

- Primex Plastics Corporation

- Twinpak Inc.

- Corex Plastics (Integrated Packaging Group)

- Karton S.p.A.

- Shanying International Holdings Co., Ltd.

- Hubei Rixin Plastic Co., Ltd.

- Qingdao Temei Plastic Co., Ltd.

- Sangeeta Poly Pack Pvt. Ltd.

- J.X. FLUTE

- Zhejiang Yuanda Polypropylene Co., Ltd.

- Northern Ireland Plastics Ltd.

- P.P. Corrugated Sheets Co., Ltd.

- Regent Plastic Industrial Co., Ltd.

- Box Plásticos S.A. de C.V.

- Shanghai Huiyuan Package Materials Co., Ltd.

- T.P. Manufacturing Co., Ltd.

- New-Tech Industries

- A.P. Packaging Co., Ltd.

Frequently Asked Questions

Analyze common user questions about the Fluted Plastic Board market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary applications driving demand in the Fluted Plastic Board Market?

The primary driver is the Packaging sector, specifically reusable transit containers, dunnage for automotive components, and protective layering in logistics. Significant demand also stems from Signage and Graphics (outdoor displays) and Construction (temporary protection and concrete forms).

What is the main material used in fluted plastic board manufacturing and why?

Polypropylene (PP) is the main material due to its superior combination of low cost, light weight, high durability, excellent chemical resistance, and ease of recycling, making it ideal for large-volume industrial and commercial applications.

How does the Fluted Plastic Board Market address sustainability concerns?

The market addresses sustainability through the inherent reusability and long lifespan of the product compared to paperboard. Furthermore, manufacturers are increasingly incorporating Post-Consumer Recycled (PCR) polypropylene content and enhancing closed-loop recycling programs to minimize environmental impact.

Which geographical region holds the largest market share for fluted plastic boards?

Asia Pacific (APAC) currently holds the largest market share, fueled by large-scale manufacturing output, substantial infrastructure investments, and booming e-commerce activities requiring massive volumes of protective packaging solutions.

What technological trends are impacting the quality and customization of fluted plastic boards?

Key technological impacts include the adoption of advanced UV digital printing for high-resolution customization and rapid turnaround, alongside improved extrusion processes that allow for precise control over thickness, stiffness, and the integration of specialized additives like fire retardants or UV stabilizers.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager