Flux Cleaning Agents Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 434037 | Date : Dec, 2025 | Pages : 249 | Region : Global | Publisher : MRU

Flux Cleaning Agents Market Size

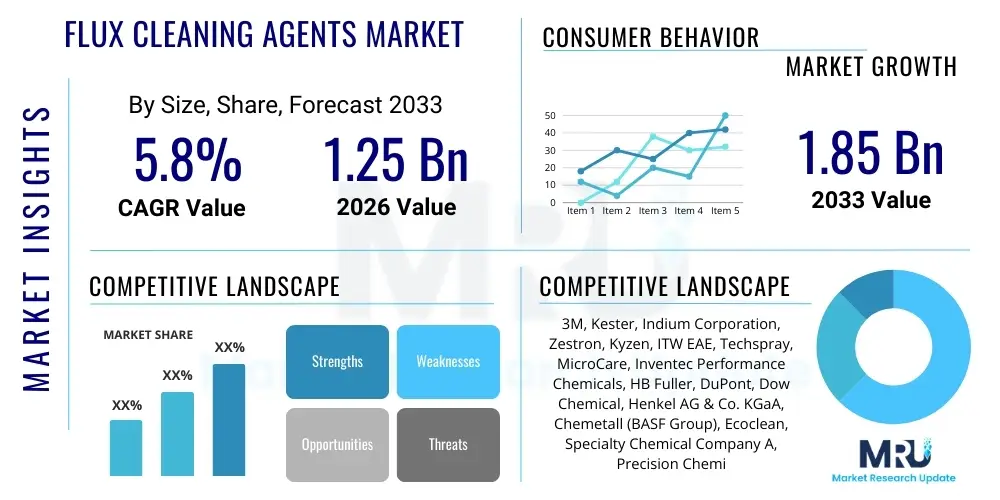

The Flux Cleaning Agents Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 5.8% between 2026 and 2033. The market is estimated at USD 1.25 Billion in 2026 and is projected to reach USD 1.85 Billion by the end of the forecast period in 2033.

Flux Cleaning Agents Market introduction

Flux cleaning agents, often referred to as defluxers, are specialized chemical formulations designed to remove flux residues left on printed circuit boards (PCBs) and electronic assemblies after soldering processes. Flux is essential during soldering to prevent oxidation, but its residue can lead to electrical failure, corrosion, and diminished device performance if not thoroughly removed. The demand for these agents is intrinsically linked to the expanding electronics manufacturing sector, particularly in consumer electronics, automotive components, and complex medical devices where miniaturization and reliability are paramount.

These cleaning agents are categorized based on their chemical composition, including aqueous, semi-aqueous, and solvent-based solutions, each tailored to specific flux chemistries (rosin, no-clean, water-soluble) and manufacturing requirements. The primary applications involve post-solder cleaning in high-volume PCB assembly lines, semiconductor fabrication, and precision cleaning of industrial metal components. Benefits derived from effective flux cleaning include enhanced electrical reliability, improved adhesion for conformal coatings and encapsulation, and adherence to stringent quality standards mandated by regulatory bodies in aerospace and healthcare.

The market is primarily driven by the increasing complexity and density of modern electronic devices, which necessitate higher cleaning standards to prevent signal interference from ionic contamination. Furthermore, the rapid growth of 5G infrastructure, electric vehicles (EVs), and IoT devices demands robust and reliable electronic components, consequently escalating the consumption of high-performance and environmentally compliant flux cleaning solutions. Regulatory shifts, particularly concerning volatile organic compounds (VOCs) and ozone-depleting substances, are forcing manufacturers to transition towards eco-friendly, bio-based, and aqueous cleaning alternatives.

Flux Cleaning Agents Market Executive Summary

The Flux Cleaning Agents Market exhibits robust growth driven by accelerating global demand for sophisticated electronic products and the stringent quality requirements imposed across high-reliability industries such as automotive electronics and aerospace. Current business trends indicate a significant shift away from traditional solvent-based cleaners toward more sustainable, lower-toxicity aqueous and semi-aqueous systems, influenced heavily by global environmental regulations and corporate sustainability mandates. Manufacturers are focusing on developing high-efficiency formulations compatible with sensitive components and high-throughput cleaning equipment, leading to innovations in surfactant technology and solvent substitutes. Strategic partnerships between chemical suppliers and equipment manufacturers are crucial for optimizing cleaning processes and maintaining competitive advantage.

Regional trends reveal Asia Pacific (APAC) as the dominant and fastest-growing region, primarily due to the concentration of global PCB manufacturing hubs, particularly in China, Taiwan, South Korea, and Southeast Asia. North America and Europe maintain strong market shares characterized by high-reliability applications, stringent regulatory compliance, and demand for premium, specialized cleaning chemicals for advanced packaging technologies and complex military electronics. The regional differentiation lies in the regulatory environment, with Europe pushing for stricter REACH compliance, while APAC growth is volumetric, driven by mass production volumes and scaling of consumer device manufacturing.

Segmentation trends highlight the increasing prominence of aqueous cleaning agents, favored for their low environmental impact and effectiveness in high-pressure spray systems. Solvent-based systems, while facing regulatory pressure, retain specialized niches in defluxing no-clean residues and precision cleaning where fast drying and non-corrosive properties are essential. Application-wise, the electronics assembly segment remains the largest consumer, but significant growth is anticipated in the semiconductor packaging and advanced medical device manufacturing sectors, reflecting the need for ultra-pure cleaning agents to meet nanoscale precision requirements.

AI Impact Analysis on Flux Cleaning Agents Market

User queries regarding the impact of Artificial Intelligence (AI) on the flux cleaning agents market primarily revolve around optimizing cleaning processes, reducing waste, and integrating smart quality control systems. Users are concerned with how AI can enhance the precision and efficiency of defluxing in highly automated lines, specifically asking about predictive maintenance for cleaning equipment, real-time residue analysis, and autonomous process adjustments to minimize chemical consumption. Key expectations center on AI-driven analytics providing deeper insights into solder joint quality and contamination levels, thereby creating a data-driven approach to selecting and deploying the most effective cleaning agent and process parameters, ultimately accelerating yield improvements and ensuring consistent compliance with cleanliness standards.

- AI-Powered Process Optimization: Utilizing machine learning algorithms to analyze parameters like temperature, spray pressure, dwell time, and chemical concentration in cleaning machines, leading to dynamic, real-time adjustments for optimal residue removal and minimizing chemical usage.

- Predictive Maintenance: AI systems analyzing sensor data from cleaning equipment (e.g., flow meters, pH sensors, conductivity monitors) to predict component failure or solution depletion, minimizing unexpected downtime and maximizing machine uptime.

- Automated Quality Inspection: Deployment of AI-vision systems to inspect PCBs post-cleaning for minute flux residues or white residues, offering faster, more consistent, and objective contamination analysis than traditional human inspection methods.

- Chemical Formulation and R&D: AI and machine learning facilitating the rapid screening and testing of novel, sustainable chemical formulations by simulating interaction dynamics between cleaning agents and complex flux chemistries, speeding up the development of next-generation low-VOC products.

- Supply Chain Efficiency: Integrating AI for demand forecasting related to specific flux cleaning agent types across global manufacturing sites, optimizing inventory levels, and enhancing the resilience of the supply chain against geopolitical or logistical disruptions.

DRO & Impact Forces Of Flux Cleaning Agents Market

The market for flux cleaning agents is influenced by a complex interplay of drivers, restraints, and opportunities that collectively shape its trajectory and competitive landscape. Key drivers include the relentless miniaturization of electronic components, necessitating exceptionally high cleanliness levels to prevent ionic migration and short circuits in tightly packed circuitry. Furthermore, the mandatory adoption of lead-free soldering processes, which require higher processing temperatures and often utilize more aggressive flux chemistries, increases the difficulty of residue removal, thus driving demand for powerful and effective cleaning solutions. The global push for increased electronic device reliability in critical applications like autonomous vehicles, aerospace systems, and medical implants further mandates rigorous cleaning protocols, sustaining market growth.

However, significant restraints temper the market’s expansion. The primary challenge remains the increasing regulatory scrutiny concerning environmental impact, particularly restrictions on volatile organic compounds (VOCs) and hazardous air pollutants (HAPs) enforced by global bodies such as the EPA and REACH. This forces manufacturers to invest heavily in reformulation, which can sometimes result in higher product costs or reduced cleaning efficacy compared to legacy solvent systems. Another restraint is the growing trend toward 'no-clean' fluxes, where manufacturers attempt to leave residues on the board to avoid the cleaning step entirely, although the viability of no-clean in high-reliability applications is often debated, limiting its universal adoption.

Opportunities in the market are concentrated around sustainable chemistry and advanced electronics packaging. The major opportunity lies in the development and commercialization of bio-based, non-flammable, and ultra-low surface tension cleaning agents capable of penetrating extremely tight gaps (e.g., under low-standoff components like BGA and QFN packages) effectively. Moreover, the expanding field of heterogeneous integration and advanced semiconductor packaging (e.g., 3D integration) requires specialized, delicate cleaning processes to remove flux without damaging fine pitch features or delicate materials, opening avenues for high-value, niche cleaning chemical sales. The expansion of automated, closed-loop cleaning systems also provides opportunities for chemical suppliers to offer integrated process consulting and recycling services.

Segmentation Analysis

The Flux Cleaning Agents Market is broadly segmented based on the type of cleaning agent, the chemistry of the flux being removed, the application method, and the specific end-use industry. This structure allows for a detailed analysis of specialized needs across the vast electronics and industrial sectors. The classification by type—aqueous, semi-aqueous, and solvent-based—remains the most critical differentiator, reflecting varied environmental footprints, cleaning power, and compatibility requirements with cleaning equipment. The adoption rates across these segments are heavily influenced by regional environmental legislation and the specific soldering processes employed by major electronic manufacturing service (EMS) providers.

Segmentation by flux type is vital as different cleaning agents are formulated to tackle specific residue chemistries, such as rosin-based fluxes, water-soluble (organic acid) fluxes, and various no-clean flux formulations, each presenting unique residue removal challenges. Furthermore, the application segmentation highlights whether the agent is used via batch cleaners, inline spray systems, ultrasonic cleaning, or manual applications, influencing the required packaging and concentration of the chemical. The largest end-use segmentation remains the PCB assembly market, yet high-growth segments include advanced packaging, MEMS, and optical component cleaning, demanding high-purity, low-residue solutions.

- By Type

- Aqueous Cleaning Agents

- Semi-Aqueous Cleaning Agents

- Solvent-Based Cleaning Agents (e.g., Alcohols, Hydrocarbons, Specialty Solvents)

- By Application Method

- Batch Cleaning Systems

- In-Line Cleaning Systems (Spray/Immersion)

- Manual Cleaning/Benchtop

- Ultrasonic Cleaning

- By Flux Type

- Rosin Flux Residue Cleaning

- Water-Soluble Flux Residue Cleaning

- No-Clean Flux Residue Cleaning

- By End-Use Industry

- Electronics Manufacturing (PCB Assembly)

- Semiconductor Packaging and Fabrication

- Aerospace and Defense

- Automotive Electronics

- Medical Devices and Healthcare

- Industrial Cleaning and Maintenance

Value Chain Analysis For Flux Cleaning Agents Market

The value chain for the Flux Cleaning Agents Market commences with the upstream supply of fundamental raw materials, including specialized solvents, surfactants, co-solvents, deionized water, and various neutralizing agents and inhibitors. Suppliers in this phase are typically large chemical producers focused on high purity and consistent quality of basic compounds derived from petrochemicals or, increasingly, bio-based sources. Consistency in the quality and availability of these raw materials is critical, as any variance directly impacts the efficacy and stability of the final cleaning agent formulation. Procurement strategies focus heavily on securing stable long-term contracts and navigating fluctuating commodity prices, especially for hydrocarbon-based inputs.

Mid-stream activities involve the formulation and compounding processes carried out by specialty chemical manufacturers. These companies invest heavily in R&D to develop proprietary blends that meet specific cleaning performance metrics, material compatibility requirements, and regulatory standards. Formulation expertise is a key competitive differentiator, particularly in creating high-performance aqueous and semi-aqueous solutions that can effectively clean aggressive no-clean flux residues while protecting sensitive electronic components. Manufacturing processes adhere to stringent quality management systems (e.g., ISO 9001) to ensure batch-to-batch consistency for critical electronics applications.

The downstream segment encompasses the distribution, sales, and end-use application of the cleaning agents. Distribution channels are bifurcated into direct sales to large, captive electronics manufacturing service (EMS) providers and indirect sales through specialized chemical distributors and equipment vendors. Direct channels facilitate technical consultation and tailored solutions, common in aerospace or high-reliability automotive sectors. Indirect distribution provides broader market access, especially to smaller manufacturers and repair/rework operations. The final stage involves the integration of the cleaning agent with sophisticated industrial cleaning equipment (e.g., inline washers), where technical support and process optimization services are crucial components of the total value proposition offered to the end-user.

Flux Cleaning Agents Market Potential Customers

The primary consumers and end-users of flux cleaning agents are concentrated within industries where electronic reliability, component longevity, and stringent quality control are non-negotiable prerequisites. The largest group comprises Electronic Manufacturing Services (EMS) companies and Original Equipment Manufacturers (OEMs) specializing in Printed Circuit Board (PCB) assembly. These entities utilize high-throughput inline and batch cleaning systems to ensure that mass-produced consumer electronics, industrial controllers, and communication equipment meet performance specifications before conformal coating or final assembly. Their purchasing decisions are driven by cleaning efficacy, cost per cleaned board, compatibility with existing equipment, and environmental compliance.

The second major group includes semiconductor manufacturers and advanced packaging facilities. As packaging densities increase and feature sizes shrink (e.g., flip-chip, wafer-level packaging), the need for ultra-pure cleaning agents to remove minute flux residues without causing material damage or contamination becomes paramount. These customers demand extremely high purity grades of cleaning agents, often requiring specialized formulations for delicate interconnections and novel materials. Purchasing criteria here are dominated by material compatibility, ultra-low non-volatile residue (NVR) levels, and process control expertise.

Other significant buyers include automotive electronics suppliers, who require robust cleaning for components used in severe operating environments (e.g., engine control units, ADAS sensors), and medical device manufacturers, particularly those producing implantable or life-support systems, where failure due to contamination is catastrophic. Military and aerospace sectors represent a high-value niche segment, demanding certified, high-specification cleaning agents for mission-critical avionic and defense systems, prioritizing long-term reliability and compliance with specific military standards over cost efficiencies.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 1.85 Billion |

| Growth Rate | 5.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | 3M, Kester, Indium Corporation, Zestron, Kyzen, ITW EAE, Techspray, MicroCare, Inventec Performance Chemicals, HB Fuller, DuPont, Dow Chemical, Henkel AG & Co. KGaA, Chemetall (BASF Group), Ecoclean, Specialty Chemical Company A, Precision Chemical Co. Ltd., Advanced Defluxing Solutions Inc., Flux-Off Technologies, Summit Cleaning Agents. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flux Cleaning Agents Market Key Technology Landscape

The technology landscape of the flux cleaning agents market is characterized by continuous innovation focused on balancing efficacy, environmental compliance, and component compatibility. A critical technological trend is the shift toward advanced aqueous and semi-aqueous chemistries. These formulations utilize sophisticated surfactant packages and proprietary blends of organic compounds to achieve high cleaning power comparable to traditional solvents while eliminating or drastically reducing VOC content. Key breakthroughs include microemulsion technology, which allows for stable mixtures of water and mild organic co-solvents, offering high solvency for complex flux residues, particularly those associated with lead-free solder alloys.

Furthermore, significant technological development is concentrated on high-performance solvent alternatives. Due to regulatory constraints on traditional halogenated solvents, manufacturers are increasingly adopting hydrofluoroethers (HFEs) and hydrofluorocarbons (HFCs), which offer low toxicity, non-flammability, and high solvency for no-clean fluxes. Although these solvents are often more expensive, their stability and compatibility with sensitive components (like optical sensors or delicate interconnects) ensure their continued use in specialized, high-precision cleaning applications within the aerospace and medical sectors. The compatibility of these agents with closed-loop vapor degreasing systems, allowing for chemical recycling and minimal environmental release, represents a critical technological advantage.

Beyond the chemical formulation itself, process technology advancements are intrinsically linked to the market. The integration of cleaning agents with modern, highly efficient equipment, such as high-pressure spray-in-air inline cleaners and sophisticated ultrasonic systems, dictates the functional requirements of the chemical. Technologies like saponifiers, which are added to aqueous systems to hydrolyze rosin-based residues, and advanced filtration and fluid management systems, which prolong the lifespan of the cleaning bath, are integral to optimizing the total cost of ownership for end-users. Future development efforts are heavily invested in creating fully biodegradable and carbon-neutral cleaning solutions tailored for advanced 3D integrated circuit (3DIC) packaging.

Regional Highlights

The global distribution of the Flux Cleaning Agents Market is highly correlated with the geographic concentration of the global electronics manufacturing and semiconductor industry, leading to significant regional variations in demand volume, regulatory stringency, and technological adoption rates.

- Asia Pacific (APAC): APAC represents the largest and fastest-growing market globally, driven by massive manufacturing volumes in China, Taiwan, South Korea, and emerging economies like Vietnam and India. The region dominates PCB assembly and consumer electronics production, resulting in high volumetric consumption of both cost-effective aqueous and specialized solvent cleaners. Regulatory standards vary significantly within APAC, but there is a growing trend toward adopting international environmental compliance measures, boosting demand for compliant cleaning solutions.

- North America: Characterized by a high demand for high-reliability electronics, particularly in the aerospace, defense, and high-end industrial control sectors. The market focuses on high-specification, low-toxicity cleaning agents capable of meeting stringent military and medical standards. Innovation in North America is driven by strict EPA regulations and the presence of major technological hubs, pushing research into sustainable, bio-based solvent alternatives and precision cleaning for advanced chip packaging.

- Europe: Europe is defined by some of the world's most rigorous environmental legislation, primarily driven by REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulations. This regulatory environment strongly mandates the use of low-VOC, non-hazardous, and biodegradable cleaning solutions, leading to high adoption rates of advanced aqueous and semi-aqueous technologies. Key demand originates from the high-value automotive electronics sector (especially electric vehicles) and precision industrial manufacturing.

- Latin America (LATAM): The market in LATAM is relatively smaller but growing steadily, primarily centered around localized manufacturing for consumer electronics and automotive parts in countries like Mexico and Brazil. Demand is often price-sensitive, balancing cost-effectiveness with necessary cleaning performance, with solvent-based and basic aqueous cleaners maintaining relevance.

- Middle East and Africa (MEA): This region constitutes the smallest share, with demand predominantly driven by localized maintenance, telecom infrastructure development, and defense applications. The market often relies on imported specialized chemicals, with adoption driven by major infrastructure projects and the establishment of local electronics assembly operations.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flux Cleaning Agents Market.- 3M

- Kester (ITW)

- Indium Corporation

- Zestron

- Kyzen Corporation

- ITW EAE

- Techspray

- MicroCare LLC

- Inventec Performance Chemicals

- HB Fuller

- DuPont de Nemours, Inc.

- Dow Chemical Company

- Henkel AG & Co. KGaA

- Chemetall (BASF Group)

- Ecoclean GmbH

- Specialty Chemical Company A

- Precision Chemical Co. Ltd.

- Advanced Defluxing Solutions Inc.

- Flux-Off Technologies

- Summit Cleaning Agents

Frequently Asked Questions

Analyze common user questions about the Flux Cleaning Agents market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are the primary drivers shifting the market towards aqueous flux cleaning agents?

The primary drivers include increasingly strict global environmental regulations (e.g., VOC limitations), mandates for reduced hazardous waste generation, and corporate sustainability initiatives. Aqueous agents are non-flammable, lower in toxicity, and compatible with high-volume spray cleaning systems essential for modern PCB manufacturing.

How does the adoption of no-clean fluxes impact the demand for cleaning agents?

While no-clean fluxes aim to eliminate the cleaning step, in high-reliability applications (aerospace, medical, automotive), residual flux still requires removal to prevent dendritic growth, electromigration, and adhesion issues with conformal coatings. Therefore, demand shifts towards specialized, high-solvency cleaning agents specifically formulated to remove polymerized no-clean residues.

Which type of flux cleaning agent is best suited for cleaning under low-standoff components like BGAs?

Semi-aqueous and specialized solvent-based cleaning agents often perform optimally for low-standoff components. These formulations typically possess lower surface tension and high solvency, allowing them to penetrate and effectively clean the tight gaps beneath Ball Grid Arrays (BGAs) and QFN packages, ensuring thorough residue removal critical for device reliability.

Is the Flux Cleaning Agents Market affected by the trend of miniaturization in electronics?

Yes, miniaturization is a core driver. As electronic components become smaller and denser, the tolerance for residual contamination decreases dramatically. This increases the demand for ultra-pure, high-performance cleaning agents and advanced cleaning processes capable of achieving extremely low levels of ionic and non-ionic contamination, directly boosting the market for premium solutions.

What role does the Asia Pacific region play in the overall Flux Cleaning Agents Market dynamics?

Asia Pacific is the central hub for global electronics manufacturing, dominating both supply and demand. The region accounts for the largest market share and the highest consumption volume due to the concentration of major PCB and EMS facilities, driving market growth and influencing pricing strategies globally.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager