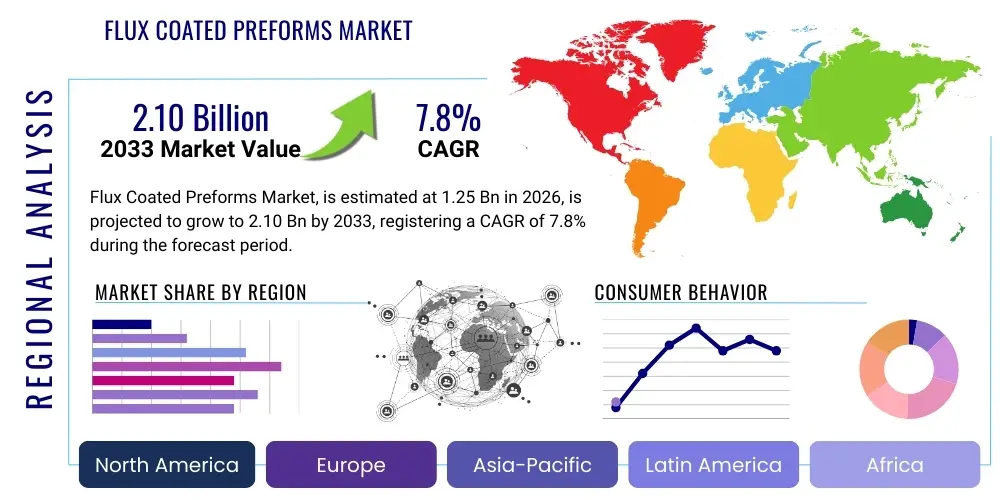

Flux Coated Preforms Market Size, By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 439819 | Date : Jan, 2026 | Pages : 249 | Region : Global | Publisher : MRU

Flux Coated Preforms Market Size

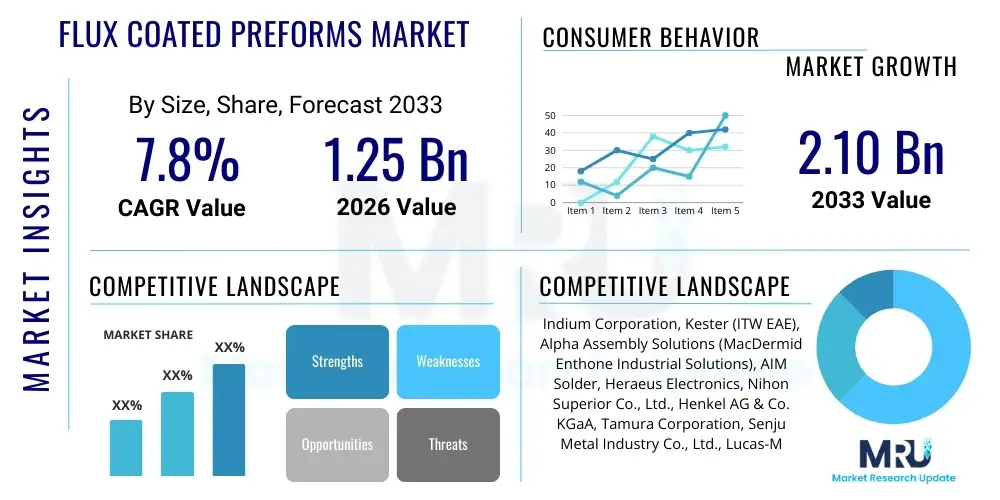

The Flux Coated Preforms Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 7.8% between 2026 and 2033. The market is estimated at USD 1.25 billion in 2026 and is projected to reach USD 2.10 billion by the end of the forecast period in 2033.

Flux Coated Preforms Market introduction

The Flux Coated Preforms Market is integral to advanced electronics manufacturing and assembly, providing a precisely engineered solution for various soldering applications. Flux coated preforms are pre-shaped solder materials, often in forms such as rings, washers, discs, or custom geometries, that come pre-applied with a controlled amount of flux. This innovative design eliminates the need for separate flux application, ensuring consistent deposition, reducing waste, and improving process control in complex assembly operations. These preforms are crucial in achieving high-reliability solder joints, especially in miniaturized electronic components and sensitive assemblies where precision is paramount.

Major applications for flux coated preforms span across diverse industries, including semiconductor packaging, automotive electronics, medical devices, aerospace and defense, and consumer electronics. In semiconductor packaging, they are used for die attach, lid attach, and module assembly, providing robust interconnections. For automotive electronics, their reliability is critical for components exposed to harsh environments, such as engine control units and advanced driver-assistance systems (ADAS). The benefits of using flux coated preforms are numerous: they offer superior solder joint quality, reduce solder waste, improve process efficiency by streamlining assembly steps, and enhance manufacturing consistency. The precise flux coating ensures optimal wetting and spread of solder, minimizing defects and improving yield rates.

Several driving factors are propelling the growth of this market. The continuous trend towards miniaturization in electronic devices demands increasingly precise and reliable soldering solutions, which flux coated preforms readily provide. The escalating complexity of electronic assemblies, coupled with the need for high-density interconnections, further fuels their adoption. Furthermore, the robust expansion of industries such as automotive (especially electric and hybrid vehicles), 5G infrastructure, and advanced medical imaging equipment, all of which rely heavily on high-performance electronic components, directly contributes to the rising demand for these specialized soldering materials. The increasing automation in manufacturing processes also favors pre-fluxed solutions that integrate seamlessly into automated lines, reducing manual intervention and improving throughput.

Flux Coated Preforms Market Executive Summary

The Flux Coated Preforms Market is experiencing significant growth, driven by key business trends such as the relentless push for miniaturization and increased functionality in electronic devices. Manufacturers are increasingly adopting automated assembly lines, where the precision and consistency offered by flux coated preforms are highly valued. There is a strong emphasis on developing lead-free and halogen-free formulations to comply with evolving environmental regulations, prompting research and development in advanced flux chemistries. Additionally, customization is a prominent trend, with suppliers offering preforms in a wide array of shapes, sizes, and alloy compositions to meet highly specific application requirements across diverse industrial sectors, from high-frequency communication modules to power electronics.

Regionally, Asia Pacific continues to dominate the market, largely due to its robust electronics manufacturing base, particularly in countries like China, South Korea, Japan, and Taiwan, which are global hubs for semiconductor production and consumer electronics assembly. North America and Europe also demonstrate steady growth, fueled by strong demand from the aerospace, defense, and medical device sectors, which require ultra-reliable solder joints. These regions are also at the forefront of R&D for advanced packaging technologies and automotive electronics, further contributing to market expansion. Emerging markets in Latin America and the Middle East & Africa are showing increasing potential as their electronics manufacturing capabilities mature and industrialization progresses, albeit from a smaller base.

Segment-wise, the market sees dynamic shifts. Lead-free alloys are increasingly outpacing traditional tin-lead options, driven by regulatory mandates and environmental consciousness. Within applications, semiconductor packaging and automotive electronics represent the largest and fastest-growing segments, respectively. The demand for preforms in advanced packaging, such as flip-chip and system-in-package (SiP), is particularly strong due to the increasing complexity and density of integrated circuits. Furthermore, the development of new flux types, including low-residue and no-clean formulations, is gaining traction, addressing industry needs for improved reliability and reduced post-soldering cleaning processes, thereby optimizing manufacturing workflows and reducing operational costs for electronics manufacturers globally.

AI Impact Analysis on Flux Coated Preforms Market

Users frequently inquire about how Artificial Intelligence can enhance the precision, quality control, and manufacturing efficiency within the Flux Coated Preforms market. Common questions revolve around AI’s role in optimizing flux application, predicting material performance, automating inspection processes, and personalizing preform designs for specific applications. Concerns also arise regarding the integration complexity of AI systems with existing production lines and the data privacy implications when leveraging machine learning for process improvements. Expectations are high for AI to reduce defects, minimize material waste, and accelerate product development cycles, thereby leading to more cost-effective and reliable flux coated preform solutions across the electronics industry.

- AI-driven vision systems can significantly enhance quality control by performing real-time, high-speed inspection of flux coating thickness and uniformity, identifying micro-defects invisible to the human eye.

- Predictive analytics powered by AI can optimize raw material sourcing and inventory management for solder alloys and flux chemicals, minimizing supply chain disruptions and cost fluctuations.

- Machine learning algorithms can analyze production data to predict equipment maintenance needs for preform stamping and flux coating machines, reducing downtime and improving operational efficiency.

- AI can facilitate the rapid design and prototyping of custom flux coated preform geometries by simulating soldering behavior and joint reliability under various conditions, accelerating product development cycles.

- Automated process control systems integrated with AI can dynamically adjust flux deposition parameters based on real-time feedback, ensuring optimal coating consistency and reducing rework rates.

- Leveraging AI for data analysis enables manufacturers to identify patterns in defect occurrences, leading to targeted process improvements and a higher overall yield of high-quality preforms.

- AI-powered systems can enhance traceability and data logging for each batch of preforms, providing comprehensive quality assurance records essential for high-reliability applications in aerospace or medical fields.

DRO & Impact Forces Of Flux Coated Preforms Market

The Flux Coated Preforms Market is significantly influenced by a dynamic interplay of drivers, restraints, and opportunities, all contributing to its evolving landscape. Key drivers include the pervasive trend of miniaturization in electronic components, which demands precise and consistent soldering solutions to accommodate high-density interconnects. The escalating demand for high-reliability electronic assemblies across sectors such as automotive, aerospace, and medical devices further bolsters market growth, as preforms offer superior joint integrity. Additionally, the increasing adoption of automated manufacturing processes benefits from the standardized and ready-to-use nature of flux coated preforms, streamlining production and enhancing throughput.

However, the market also faces considerable restraints. The volatility in raw material prices, particularly for tin, silver, and other precious metals used in solder alloys, poses a significant challenge, impacting production costs and profit margins. Stringent environmental regulations, especially those mandating the transition to lead-free and halogen-free materials, necessitate continuous R&D and often entail higher costs for compliance and material development. Furthermore, the technical complexity involved in developing specialized flux chemistries that balance performance, shelf-life, and environmental friendliness can be a barrier for new entrants, leading to market concentration among established players with significant R&D capabilities.

Opportunities for growth are abundant and strategically important for market players. The expansion into emerging applications like 5G infrastructure, Internet of Things (IoT) devices, and advanced energy storage systems presents new avenues for demand. The development of novel flux formulations that offer enhanced performance, lower residues, or improved compatibility with advanced substrates provides a competitive edge. Customization services, catering to specific customer needs for unique preform geometries or alloy compositions, can unlock niche markets. Moreover, the integration of smart manufacturing principles and additive manufacturing techniques could revolutionize preform production, offering unprecedented levels of precision, design flexibility, and material efficiency, thus propelling the market into new phases of innovation and application.

Segmentation Analysis

The Flux Coated Preforms market is meticulously segmented to provide a comprehensive understanding of its diverse landscape, enabling targeted strategies for manufacturers and suppliers. This segmentation typically categorizes the market based on critical attributes such as the type of alloy used, the specific flux chemistry, the physical form factor of the preform, and its end-use application across various industries. Each segment reflects unique demand patterns, technological requirements, and regulatory considerations, highlighting the specialized nature of these advanced soldering materials. Understanding these segments is crucial for identifying growth opportunities and addressing specific market needs effectively.

- By Alloy Type

- Tin-Lead Alloys

- Lead-Free Alloys

- Tin-Silver-Copper (SAC Alloys)

- Tin-Bismuth (SnBi)

- Tin-Silver (SnAg)

- Indium Alloys

- Gold-Tin (AuSn)

- Other Lead-Free Alloys

- Low-Temperature Alloys

- High-Temperature Alloys

- By Flux Type

- Rosin-Based Flux

- No-Clean Flux

- Water-Soluble Flux

- Low-Residue Flux

- Halogen-Free Flux

- Activated Rosin Flux (RA)

- Mildly Activated Rosin Flux (RMA)

- By Form Factor

- Washers

- Discs

- Spheres/Balls

- Rings

- Ribbons

- Custom Geometries

- Rectangles/Squares

- Foil

- By Application

- Semiconductor Packaging

- Die Attach

- Lid Attach

- Module Assembly

- Flip Chip Interconnect

- Automotive Electronics

- Engine Control Units (ECUs)

- ADAS Modules

- Power Electronics

- Lighting Systems

- Medical Devices

- Implantable Devices

- Diagnostic Equipment

- Surgical Instruments

- Aerospace & Defense

- Avionics

- Radar Systems

- Satellite Communication

- Consumer Electronics

- Smartphones & Tablets

- Laptops & PCs

- Wearable Devices

- LED Lighting

- Photovoltaics

- Industrial Electronics

- Telecommunications

- 5G Infrastructure

- Optical Modules

- Semiconductor Packaging

- By End-Use Industry

- Electronics Manufacturing Services (EMS)

- Original Equipment Manufacturers (OEMs)

- Contract Manufacturers

Value Chain Analysis For Flux Coated Preforms Market

The value chain for the Flux Coated Preforms Market begins with the upstream raw material suppliers, a critical foundational stage. This segment involves the mining and refining of base metals like tin, lead, silver, copper, indium, and gold, which are essential constituents of solder alloys. Furthermore, chemical manufacturers supply the various organic and inorganic compounds required for flux formulations, including resins, activators, solvents, and rheological modifiers. The quality and availability of these raw materials directly impact the cost, performance, and environmental compliance of the final flux coated preforms, necessitating robust supplier relationships and strategic sourcing to ensure consistent quality and mitigate supply chain risks. Manufacturers in this stage focus on purity and material science innovation.

Moving downstream, the value chain encompasses the specialized manufacturing processes of flux coated preforms. This involves alloy smelting and formation into specific shapes (e.g., wire, foil, spheres), followed by precision stamping, cutting, or molding into the desired preform geometries like washers, discs, or rings. Subsequently, a highly controlled flux coating process is applied, which can involve dipping, spraying, or transfer techniques to ensure uniform and precise flux deposition. Manufacturers at this stage heavily invest in advanced machinery, quality control systems, and R&D for developing new alloy compositions and flux chemistries that meet evolving industry demands, such as lead-free requirements and ultra-fine pitch applications. They also focus on automation to enhance efficiency and reduce defects.

The distribution channel for flux coated preforms typically involves both direct and indirect routes. Direct sales often occur for large-volume customers, particularly major semiconductor manufacturers, automotive Tier 1 suppliers, and defense contractors, where technical support and customized solutions are paramount. Indirect channels include a network of specialized distributors and sales agents who cater to a broader range of smaller to medium-sized electronics manufacturers and contract manufacturing service (EMS) providers. These distributors often maintain regional warehouses, offer technical assistance, and provide value-added services like inventory management. Effective distribution is crucial for timely delivery and reaching diverse end-users, ensuring that these specialized soldering materials are readily available to support the rapid pace of electronics production globally.

Flux Coated Preforms Market Potential Customers

Potential customers for flux coated preforms are primarily concentrated within industries that demand high-reliability, high-precision, and efficient soldering solutions for their electronic assemblies. At the forefront are semiconductor manufacturers, who utilize these preforms extensively for critical packaging applications such as die attach, lid attach, and module assembly in microprocessors, memory chips, and various integrated circuits. The imperative for robust interconnections in these components, especially with the trend towards miniaturization and higher performance, makes flux coated preforms indispensable. Furthermore, electronics manufacturing service (EMS) providers and contract manufacturers, who serve a wide array of clients, represent a significant customer base, as they require versatile and reliable soldering materials to meet diverse production needs.

The automotive electronics sector is another major end-user, driven by the proliferation of advanced driver-assistance systems (ADAS), electric vehicle (EV) power electronics, infotainment systems, and engine control units (ECUs). Components in these applications are exposed to harsh operating environments, requiring extremely durable and thermally stable solder joints, which flux coated preforms are designed to provide. Similarly, the medical device industry, encompassing implantable devices, diagnostic equipment, and surgical tools, relies heavily on these preforms for assemblies where absolute reliability and biocompatibility are non-negotiable. The stringent regulatory environment in healthcare mandates the highest quality and consistency in materials, making flux coated preforms a preferred choice.

Beyond these core sectors, the aerospace and defense industries are critical customers, utilizing flux coated preforms in avionics, radar systems, and satellite communication components where mission-critical reliability is paramount. The telecommunications industry, particularly with the rollout of 5G infrastructure and optical modules, also represents a growing segment due as high-frequency components demand precise and low-defect soldering. Additionally, manufacturers of LED lighting, consumer electronics (smartphones, wearables), and industrial electronics (power supplies, control systems) all constitute significant segments of the potential customer base, seeking improved quality, efficiency, and consistency in their soldering processes through the adoption of flux coated preforms.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 1.25 Billion |

| Market Forecast in 2033 | USD 2.10 Billion |

| Growth Rate | 7.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Indium Corporation, Kester (ITW EAE), Alpha Assembly Solutions (MacDermid Enthone Industrial Solutions), AIM Solder, Heraeus Electronics, Nihon Superior Co., Ltd., Henkel AG & Co. KGaA, Tamura Corporation, Senju Metal Industry Co., Ltd., Lucas-Milhaupt, Fusion Inc., Qualitek International Inc., Superior Flux & Mfg. Co., Eutectic Corporation, Soldertec (a division of AIM Metals & Alloys), Johnson Matthey, Metalliage, Platinus, M.B. Associates, Solder Chemistry. |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flux Coated Preforms Market Key Technology Landscape

The Flux Coated Preforms Market is characterized by a sophisticated technological landscape, with continuous innovation driving performance enhancements and application versatility. A primary area of focus is advanced alloy development, where research is concentrated on creating new lead-free and low-temperature solder alloys that offer superior mechanical strength, thermal fatigue resistance, and electrical conductivity, while adhering to environmental regulations. Innovations include bismuth-containing alloys for lower melting points and specialized gold-tin (AuSn) alloys for high-reliability, high-temperature applications in aerospace and medical devices. These advancements aim to address the unique challenges posed by diverse substrate materials and operating conditions across various electronic assemblies, ensuring robust and long-lasting solder joints.

Another critical technological frontier lies in the refinement of flux chemistry and coating technologies. Manufacturers are continuously developing novel flux formulations that offer specific advantages such as ultra-low residue, no-clean properties, halogen-free compositions, and enhanced wetting performance. These advanced fluxes are designed to improve joint reliability, reduce post-soldering cleaning steps, and minimize environmental impact. The coating processes themselves are evolving, with techniques like precision spraying, vacuum deposition, and advanced encapsulation methods ensuring uniform, controlled, and consistent flux application, even on complex preform geometries. This precision is vital for minimizing void formation, optimizing solder spread, and achieving consistent process control in automated assembly lines.

Furthermore, manufacturing precision and quality control technologies are paramount in the flux coated preforms market. This involves the use of high-precision stamping, laser cutting, and molding techniques to produce preforms with extremely tight dimensional tolerances, crucial for fine-pitch and miniaturized applications. Advanced metrology and inspection systems, often incorporating vision systems and automated optical inspection (AOI), are employed to ensure the precise thickness and uniformity of the flux coating, as well as the geometric accuracy of the preforms. The integration of Industry 4.0 principles, including sensor-based monitoring, real-time data analytics, and machine learning, is becoming increasingly prevalent to optimize production parameters, predict equipment maintenance, and ensure consistent product quality, further solidifying the technological sophistication of this market.

Regional Highlights

- Asia Pacific (APAC): Dominates the market due to its position as a global manufacturing hub for consumer electronics, semiconductors, and automotive components. Countries like China, South Korea, Japan, Taiwan, and Singapore host major electronics assembly operations, driving immense demand for flux coated preforms. Significant investments in 5G infrastructure and advanced packaging technologies further bolster growth.

- North America: A robust market driven by demand from high-reliability sectors such as aerospace & defense, medical devices, and advanced automotive electronics. Strong R&D capabilities and a focus on specialized, high-performance applications contribute to sustained growth. Innovation in lead-free and high-temperature alloys is also a key factor.

- Europe: Characterized by a strong presence in automotive manufacturing, industrial electronics, and specialized medical technology. Stringent environmental regulations drive the adoption of lead-free and halogen-free solutions. Germany, France, and the UK are key contributors, with ongoing advancements in IoT and smart manufacturing bolstering demand.

- Latin America: An emerging market with growing electronics manufacturing capabilities, particularly in Mexico and Brazil. Increased foreign investment and expanding domestic demand for consumer electronics and automotive components are driving the adoption of modern soldering solutions.

- Middle East & Africa (MEA): A developing market witnessing increased industrialization and infrastructure development. Growth in telecommunications, energy, and localized electronics assembly provides opportunities for flux coated preforms, albeit from a smaller market base.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flux Coated Preforms Market.- Indium Corporation

- Kester (ITW EAE)

- Alpha Assembly Solutions (MacDermid Enthone Industrial Solutions)

- AIM Solder

- Heraeus Electronics

- Nihon Superior Co., Ltd.

- Henkel AG & Co. KGaA

- Tamura Corporation

- Senju Metal Industry Co., Ltd.

- Lucas-Milhaupt

- Fusion Inc.

- Qualitek International Inc.

- Superior Flux & Mfg. Co.

- Eutectic Corporation

- Soldertec (a division of AIM Metals & Alloys)

- Johnson Matthey

- Metalliage

- Platinus

- M.B. Associates

- Solder Chemistry

Frequently Asked Questions

Analyze common user questions about the Flux Coated Preforms market and generate a concise list of summarized FAQs reflecting key topics and concerns.What are flux coated preforms and why are they used in electronics?

Flux coated preforms are pre-shaped solder materials with a controlled amount of flux pre-applied. They are used in electronics for precise, consistent, and high-reliability soldering, eliminating separate flux application, reducing waste, and improving process control in complex assemblies like semiconductor packaging and automotive electronics.

What are the primary benefits of using flux coated preforms over traditional soldering methods?

The primary benefits include enhanced solder joint quality and consistency, reduced solder and flux waste, improved manufacturing efficiency through streamlined processes, better control over flux volume and placement, and suitability for automated assembly lines, leading to higher yield rates and lower defect counts.

Which industries are the largest consumers of flux coated preforms?

The largest consumers are typically the semiconductor packaging industry, automotive electronics (especially for EVs and ADAS), medical device manufacturing, and the aerospace & defense sectors, all requiring ultra-reliable and precise interconnections for critical components.

How do environmental regulations impact the flux coated preforms market?

Environmental regulations, such as RoHS and REACH, significantly drive the market towards lead-free and halogen-free solder alloys and flux formulations. This necessitates continuous research and development into new, compliant materials that maintain high performance, often leading to increased R&D costs and material complexities.

What are the emerging trends in flux coated preform technology?

Emerging trends include the development of novel low-temperature and high-performance lead-free alloys, advanced no-clean and low-residue flux chemistries, customization of preform geometries for specialized applications, and the integration of smart manufacturing and AI for enhanced quality control and process optimization.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager