Flux Injection Machine Market Size By Region (North America, Europe, Asia-Pacific, Latin America, Middle East and Africa), By Statistics, Trends, Outlook and Forecast 2026 to 2033 (Financial Impact Analysis)

ID : MRU_ 431577 | Date : Dec, 2025 | Pages : 241 | Region : Global | Publisher : MRU

Flux Injection Machine Market Size

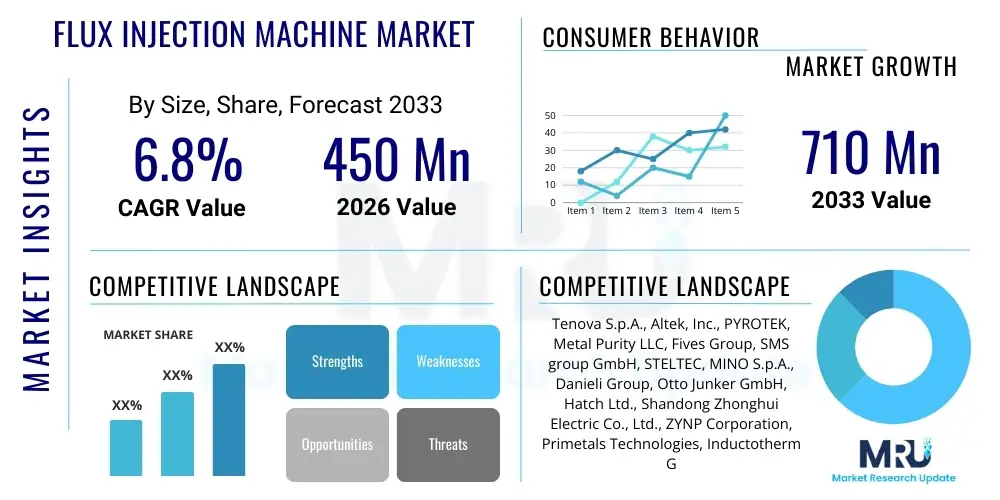

The Flux Injection Machine Market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% between 2026 and 2033. The market is estimated at USD 450 Million in 2026 and is projected to reach USD 710 Million by the end of the forecast period in 2033.

Flux Injection Machine Market introduction

The Flux Injection Machine Market encompasses highly specialized equipment essential for metallurgical processes, primarily centered on the refinement of molten metals, particularly aluminum, steel, and specialty alloys. These machines facilitate the precise and controlled introduction of powdered or granular flux materials (such as magnesium, calcium silicide, or proprietary compounds) directly into the molten bath. This process is critical for reducing inclusion defects, improving mechanical properties, neutralizing impurities, and achieving stringent quality control standards required by demanding industries like aerospace and automotive manufacturing. The core application involves deep-level treatment and homogenization of the melt, surpassing the limitations of surface skimming or simpler ladle additions, thereby maximizing material yield and operational efficiency across casting and foundry operations globally.

Flux injection technology is instrumental in enhancing the purity of molten metal, a non-negotiable requirement for high-integrity components. By injecting reagents below the surface, the machines ensure optimal contact area and reaction kinetics, leading to superior degassing and demagging compared to conventional methods. The systems typically incorporate sophisticated components such as gravimetric feeders, pressurized carriers (argon or nitrogen), and specialized injection lances designed to withstand extreme temperatures and corrosive environments. Adoption is accelerating due to increasing regulatory pressure regarding component durability and the rising demand for lightweight, high-performance materials in electric vehicle platforms and advanced infrastructure projects, necessitating finer control over alloy compositions and microstructural integrity.

Major applications of flux injection machines span secondary aluminum production, continuous casting of steel billets, and specialized treatment of non-ferrous alloys. Key benefits include enhanced metal cleanliness, significant reduction in dross formation, improved energy efficiency through faster processing times, and greater consistency in end-product quality. The market is fundamentally driven by the expansion of the automotive sector, particularly the pivot towards lighter vehicle architectures, coupled with persistent capital investment in modernizing existing foundry infrastructure across developing economies. Furthermore, the capacity of these machines to handle complex alloy treatments efficiently reinforces their indispensability within modern metallurgy.

Flux Injection Machine Market Executive Summary

The global Flux Injection Machine Market is currently experiencing robust momentum, predominantly fueled by transformative business trends in high-precision manufacturing and material science. A significant trend involves the integration of automated handling systems and predictive maintenance capabilities, moving beyond basic operational control to sophisticated process optimization. Foundries are increasingly prioritizing modular and high-throughput injection systems that can handle diverse flux chemistries and particle sizes, driven by the shift towards complex, multi-metal casting operations. Furthermore, intense competition among original equipment manufacturers (OEMs) is pushing innovation in lance design (e.g., refractory materials and specialized porous plugs) to improve flux dispersion homogeneity and minimize refractory wear, contributing directly to lower operational expenditure for end-users.

Regionally, the market exhibits divergent growth patterns. Asia Pacific, particularly China and India, represents the largest and fastest-growing segment due to massive capacity expansion in their respective steel and aluminum industries, supported by governmental infrastructure initiatives and rising domestic automotive production. North America and Europe, while mature, are characterized by high-value investments focused on replacing older equipment with advanced, high-efficiency, environmentally compliant models. Strict environmental regulations in these Western economies pertaining to fugitive emissions and waste reduction mandate the use of precision metallurgical treatment equipment like flux injection systems, thereby sustaining demand despite lower volumetric growth rates compared to APAC.

In terms of segmentation, the market for large-capacity, fully automated systems dominates the revenue landscape, primarily due to their essential role in continuous casting lines and large-scale secondary aluminum smelters. However, the semi-automatic and mid-capacity machine segment is forecasted to demonstrate strong CAGR, largely catering to small-to-medium enterprises (SMEs) and specialized casting operations focused on specific alloy production for aerospace and medical devices. The utilization of calcium-based fluxes remains dominant by material type, although specialized complex flux chemistries are gaining traction as manufacturers seek to treat highly contaminated or specific alloy batches more effectively, driving segmentation growth in customized flux application systems.

AI Impact Analysis on Flux Injection Machine Market

User inquiries regarding the impact of Artificial Intelligence (AI) on the Flux Injection Machine Market predominantly revolve around optimizing injection parameters, predicting melt quality outcomes, and enhancing equipment uptime through smart maintenance. Key themes center on whether AI can dynamically adjust flux dosing based on real-time spectrometer readings, ensuring tighter chemical tolerances and reducing material waste. Concerns frequently address the complexity of integrating machine learning models with existing legacy foundry control systems and the required investment in high-fidelity sensors necessary to feed reliable data to AI algorithms. Expectations are high regarding the ability of AI to model complex fluid dynamics and thermodynamics within the molten metal bath, leading to unprecedented efficiency gains and preemptive identification of potential casting defects before the metal solidification phase, fundamentally transforming quality assurance protocols.

- AI-driven real-time flux dosing adjustment based on dynamic melt composition analysis, optimizing reagent consumption.

- Predictive maintenance algorithms utilizing sensor data (temperature, pressure, vibration) to forecast lance failure or feeding system malfunctions, maximizing operational uptime.

- Integration of machine vision and learning models to analyze dross formation rates and surface turbulence, providing feedback for process control refinement.

- Simulation and modeling of flux dispersion patterns and inclusion flotation kinetics using deep learning, leading to optimized lance insertion depth and injection speed protocols.

- Automated quality control reporting and traceability by correlating injection parameters directly with final component metallurgical test results.

- Enhanced energy management by optimizing carrier gas usage and treatment time based on predicted temperature loss profiles.

DRO & Impact Forces Of Flux Injection Machine Market

The Flux Injection Machine Market is subject to a complex interplay of Drivers, Restraints, and Opportunities (DRO), underpinned by significant technological and economic Impact Forces. Key drivers include the relentless global push toward lightweighting in the automotive and aerospace industries, which necessitates high-purity, high-strength alloys achievable only through advanced molten metal treatment. The increasing worldwide capacity for secondary aluminum production also serves as a critical driver, as recycled metal often requires more extensive and precise flux injection treatment to remove impurities compared to primary metal. Furthermore, stringent quality and safety standards imposed by global regulatory bodies (e.g., ISO, NADCAP) enforce the adoption of consistent, verifiable refining processes, cementing the need for automated flux injection technology over manual or rudimentary methods.

Conversely, several restraints impede market growth. The high initial capital investment required for installing sophisticated flux injection systems, especially integrated, fully automated models, poses a barrier for smaller foundries or those operating in regions with limited access to capital financing. Operational challenges, such as the frequent replacement and maintenance of refractory lances due to extreme thermal and chemical stresses, contribute to high running costs. Moreover, the dependence on skilled technical personnel for system operation, calibration, and maintenance presents a persistent challenge in regions facing labor shortages in specialized industrial trades. Economic volatility in the primary commodity markets (aluminum, steel) can also lead to delayed capital expenditure decisions, intermittently affecting machine sales volume.

Significant opportunities are emerging from the growing focus on sustainable metallurgy and the circular economy. The efficient processing of complex scrap alloys, which requires nuanced multi-stage flux treatments, offers a substantial growth avenue for advanced injection systems capable of handling varied chemistries. Technological advancements, particularly in sensor integration, automation, and closed-loop control systems leveraging Industry 4.0 principles, promise improved efficiency, lower operational costs, and enhanced safety, thereby boosting the total cost of ownership proposition for new buyers. The expansion into specialized niche markets, such as the production of high-performance master alloys for additive manufacturing applications, further diversifies the potential customer base and application scope for these precision machines.

Segmentation Analysis

The Flux Injection Machine Market is segmented based on critical operational and structural characteristics, primarily categorized by Machine Type, Operation Mode, Flux Material Type, and End-Use Industry. This stratification allows for detailed analysis of demand patterns, technological maturity, and regional specialization within the global market landscape. Machine Type segmentation differentiates based on capacity and throughput, while Operation Mode separates manual, semi-automatic, and fully automated systems, reflecting the level of investment and process sophistication adopted by end-users. Flux Material Type is crucial as it dictates the machine's material handling specifications and chemical resistance requirements, catering to specific metallurgical needs like degassing (magnesium-based fluxes), desulfurization (calcium-based fluxes), or removal of specific non-metallic inclusions.

- By Machine Type:

- Low Capacity (Up to 100 kg/min)

- Medium Capacity (100 kg/min to 300 kg/min)

- High Capacity (Above 300 kg/min)

- By Operation Mode:

- Semi-Automatic Systems

- Fully Automatic Systems (PLC/HMI Controlled)

- Integrated Line Systems

- By Flux Material Type:

- Calcium-based Fluxes (e.g., CaSi)

- Magnesium-based Fluxes

- Alumina/Fluoride Fluxes

- Complex Proprietary Mixtures

- By End-Use Industry:

- Automotive (Engine blocks, chassis components)

- Aerospace and Defense (Turbine blades, structural components)

- Primary and Secondary Metal Production (Steel, Aluminum, Copper)

- Infrastructure and Construction

- Others (General Foundry, Specialized Alloy Producers)

Value Chain Analysis For Flux Injection Machine Market

The value chain for the Flux Injection Machine Market commences with the upstream analysis, which involves the sourcing and preparation of essential raw materials and components. This stage is dominated by specialized suppliers providing high-grade steels and alloys for machine bodies, refractory materials (such as high-alumina ceramics and carbon composites) crucial for lance fabrication, and high-precision electronic components, including sensors, PLCs, and servo motors for control systems. Efficiency at this stage is highly dependent on reliable sourcing of specialized refractory materials capable of withstanding extreme thermal shock and chemical attack inherent in molten metal processes. Suppliers capable of offering certified, long-life components hold significant leverage, directly impacting the manufacturing costs and performance guarantees offered by machine OEMs.

The midstream involves the core activities of research and development, machine manufacturing, assembly, and rigorous testing. Machine manufacturers invest heavily in R&D to optimize flux feeding reliability, improve lance cooling mechanisms, and integrate advanced automation and safety features, meeting increasingly strict industrial standards. Distribution channels are typically bifurcated into direct sales and indirect channels. Direct sales are preferred for large, customized, high-capacity integrated systems sold to Tier 1 steel mills and major aluminum smelters, requiring extensive consultation and post-installation support. Indirect channels, involving authorized distributors and regional agents, handle sales of standard or smaller capacity machines, particularly within fragmented regional foundry markets, often bundling the machine sales with flux material supply contracts.

The downstream analysis focuses on the installation, commissioning, operational support, and post-sales service provided to the end-users. The performance of the equipment directly influences the quality and yield of the final metal product, making robust maintenance and spare parts availability critical. Potential customers often assess the OEM not only on the machine's performance but also on the longevity of the consumable parts (lances, feeders) and the responsiveness of technical support, particularly in highly sensitive continuous casting environments. The market is also seeing increasing reliance on digital servicing, where remote diagnostics and predictive maintenance services, often provided via subscription models, enhance customer lifetime value and strengthen the connection between the manufacturer and the operational foundries.

Flux Injection Machine Market Potential Customers

The primary end-users and buyers of Flux Injection Machines are diverse organizations operating within heavy industry, metallurgical processing, and advanced component manufacturing. The largest segment comprises primary and secondary metal producers, specifically large-scale aluminum smelters and integrated steel plants utilizing continuous casting operations. These customers require high-throughput, fully automatic injection systems to manage vast quantities of molten metal, focusing on bulk desulfurization in steel production or large-scale degassing and refinement in secondary aluminum recycling, where impurity removal is paramount for achieving high-grade specifications necessary for automotive applications.

Another crucial customer segment includes specialized foundries and die-casting companies, particularly those supplying the critical components markets such as aerospace, defense, and high-performance automotive platforms (including electric vehicles). These entities require medium-capacity, highly precise flux injection capabilities to produce specialized alloys with extremely tight chemical tolerances and minimal defect rates. For instance, aerospace component manufacturers utilize these systems to ensure the structural integrity of complex aluminum or titanium castings, where even minute inclusions could lead to catastrophic failure under operational stress, leading to a strong demand for advanced process control and verification features integrated within the flux injection system.

Additionally, independent specialty alloy manufacturers and master alloy producers represent a growing segment. These buyers utilize the machines for creating small-batch, highly customized metal compositions required for niche applications, often involving exotic flux materials and highly controlled treatment environments. Furthermore, research institutions and governmental metallurgical testing facilities also constitute a small but significant customer base, requiring versatile, precise injection equipment for experimental alloy development and standardizing quality control protocols across various industries, emphasizing flexibility and detailed data logging capabilities in their purchasing decisions.

| Report Attributes | Report Details |

|---|---|

| Market Size in 2026 | USD 450 Million |

| Market Forecast in 2033 | USD 710 Million |

| Growth Rate | 6.8% CAGR |

| Historical Year | 2019 to 2024 |

| Base Year | 2025 |

| Forecast Year | 2026 - 2033 |

| DRO & Impact Forces |

|

| Segments Covered |

|

| Key Companies Covered | Tenova S.p.A., Altek, Inc., PYROTEK, Metal Purity LLC, Fives Group, SMS group GmbH, STELTEC, MINO S.p.A., Danieli Group, Otto Junker GmbH, Hatch Ltd., Shandong Zhonghui Electric Co., Ltd., ZYNP Corporation, Primetals Technologies, Inductotherm Group |

| Regions Covered | North America, Europe, Asia Pacific (APAC), Latin America, Middle East, and Africa (MEA) |

| Enquiry Before Buy | Have specific requirements? Send us your enquiry before purchase to get customized research options. Request For Enquiry Before Buy |

Flux Injection Machine Market Key Technology Landscape

The technological landscape of the Flux Injection Machine Market is characterized by a push toward precision dosing, enhanced reliability, and digitalization, moving away from rudimentary pneumatic systems toward sophisticated closed-loop control architectures. A core technological advancement involves gravimetric flux feeding systems. These systems utilize highly accurate load cells and calibrated screw feeders to ensure precise dosing of powdered flux materials, overcoming the inconsistencies associated with volumetric feeding, which can vary significantly based on flux density and particle size distribution. Precision feeding is crucial for metallurgical purity, especially when dealing with expensive or highly potent flux agents, minimizing waste and guaranteeing chemical composition repeatability in the final treated metal bath. The integration of advanced flow meters and pressure regulators for the inert carrier gas (usually argon or nitrogen) further ensures optimal flux dispersion and prevents excessive turbulence or splashing, which can degrade the refractory lining and introduce atmospheric contamination.

Another major area of innovation is centered on lance and refractory material science. Modern flux injection machines utilize multi-layered, specialized refractory lances designed for longevity and chemical inertness under severe operating conditions, sometimes incorporating active cooling mechanisms to mitigate thermal degradation. Developments include the use of composite ceramic materials, which exhibit superior resistance to erosion and thermal shock compared to traditional single-material lances. Furthermore, the positioning and insertion mechanisms are highly engineered, often utilizing servo-driven gantries to ensure reproducible depth and angle of injection. This repeatability is essential for achieving homogenous treatment across large molten metal volumes and is often coupled with sensor technology, such as acoustic monitoring or infrared cameras, to verify submerged injection and assess the structural integrity of the lance during operation, contributing significantly to process safety and efficiency.

The most transformative technology currently being adopted is the integration of Industry 4.0 capabilities, facilitating full automation and data analytics. This includes PLC-based control systems interfaced with SCADA platforms, allowing for remote monitoring, detailed data logging of every injection cycle, and seamless integration with plant-wide Manufacturing Execution Systems (MES). These systems enable sophisticated diagnostics, fault prediction, and automatic recipe management, adapting injection profiles based on the specific charge material analysis (often supplied by external or in-line spectrometers). The goal is to move towards a self-optimizing system where the flux injection process autonomously adjusts to minor variations in melt temperature, composition, and volume, ultimately achieving zero-defect production cycles and maximizing operational resource utilization, creating substantial competitive differentiation among equipment manufacturers offering these advanced digital solutions.

Regional Highlights

The market dynamics of the Flux Injection Machine Market vary substantially across major geographic regions, dictated by regional industrial maturity, regulatory frameworks, and the prevalence of primary vs. secondary metal production.

- Asia Pacific (APAC): APAC dominates the global market, driven primarily by high volume industrial activity in China, India, and Southeast Asia. China, being the world's largest producer of steel and aluminum, drives massive demand for high-capacity, integrated flux injection systems necessary for continuous casting lines and large-scale secondary aluminum refining operations. The region benefits from lower manufacturing costs and persistent governmental support for infrastructure and automotive sector growth, leading to APAC exhibiting the highest CAGR during the forecast period.

- North America: This region is characterized by mature, high-value manufacturing, particularly in aerospace and high-end automotive sectors. Demand here is focused on advanced, precision-oriented systems with stringent process control features. Investments are often directed towards upgrading existing facilities with automated, data-centric machines to comply with stringent environmental regulations and meet demanding quality specifications for critical structural components.

- Europe: Similar to North America, the European market emphasizes technological sophistication and environmental compliance. Key drivers include the stringent EU emissions standards and the robust recycling sector, which necessitates efficient cleaning of complex aluminum scrap. Germany, Italy, and France are major adopters, valuing high energy efficiency, modular design, and robust safety standards in their metallurgical equipment procurement.

- Latin America: The market in Latin America is developing, with growth tied closely to investments in primary metal production (e.g., Brazilian steel and aluminum sectors). Adoption rates are increasing as local producers seek to improve output quality and reduce reliance on older, manual treatment methods, but growth is susceptible to macroeconomic volatility and regional capital spending limitations.

- Middle East and Africa (MEA): MEA presents specific opportunities linked to large-scale primary aluminum and steel projects, particularly in the Gulf Cooperation Council (GCC) states. These projects necessitate large, reliable injection systems. Market penetration is steady, driven by capacity building and efforts to establish vertically integrated industrial complexes.

Top Key Players

The market research report includes a detailed profile of leading stakeholders in the Flux Injection Machine Market.- Tenova S.p.A.

- Altek, Inc.

- PYROTEK

- Metal Purity LLC

- Fives Group

- SMS group GmbH

- STELTEC

- MINO S.p.A.

- Danieli Group

- Otto Junker GmbH

- Hatch Ltd.

- Shandong Zhonghui Electric Co., Ltd.

- ZYNP Corporation

- Primetals Technologies

- Inductotherm Group

- Thermcon Ovens B.V.

- Pangborn Group

- ASCO S.r.l.

- Sidet Engineering

- Müller Industrie-Elektronik GmbH

Frequently Asked Questions

Analyze common user questions about the Flux Injection Machine market and generate a concise list of summarized FAQs reflecting key topics and concerns.What is the primary function of a flux injection machine in metallurgy?

The primary function is to precisely introduce powdered flux agents (e.g., magnesium or calcium silicide) directly into molten metal baths—primarily aluminum and steel—to refine the metal, remove impurities (such as non-metallic inclusions and dissolved gases), and achieve specific alloy chemistry requirements necessary for high-integrity casting.

Which end-use industry drives the highest demand for flux injection machines?

The Automotive Industry, followed closely by the Primary and Secondary Metal Production sector, drives the highest demand. This growth is accelerated by the global shift towards manufacturing lighter, high-strength aluminum and steel components required for electric vehicles and enhanced fuel efficiency standards.

How does flux injection technology improve metal quality compared to surface treatment?

Flux injection delivers reagents beneath the melt surface via specialized lances, ensuring optimal chemical reaction kinetics, maximum contact area with the molten metal, and effective removal of impurities through flotation, resulting in significantly cleaner, more homogenous final casting quality than surface skimming methods.

What are the key technological trends affecting machine design?

Key trends include the implementation of gravimetric (weight-based) flux dosing for superior accuracy, advanced refractory materials for lance longevity, and the integration of Industry 4.0 features such as predictive maintenance, closed-loop process control, and real-time data logging via HMI/PLC systems.

What factors influence the operating cost of a flux injection system?

Operating costs are primarily influenced by the consumption rate and cost of flux materials, the frequency of replacement for consumable refractory lances (due to wear), and the cost and efficiency of the carrier gas (argon or nitrogen) used to transport the flux into the molten bath.

Is the Flux Injection Machine Market growing faster in developed or developing regions?

While developed regions (North America, Europe) focus on high-value equipment upgrades, the market is growing faster in developing regions, especially Asia Pacific (China and India), driven by massive expansion in foundational steel and secondary aluminum production capacity.

What is the typical lifespan of the injection lance, and why is it a critical component?

The lifespan of an injection lance varies widely based on refractory quality and process severity, typically ranging from several hours to a few days in continuous operation. It is critical because its failure can disrupt continuous casting operations, introduce refractory particulates into the melt, and require costly emergency shutdowns for replacement.

How does the type of flux material impact machine design specifications?

The flux material type dictates machine design specifications by requiring specialized handling systems; for instance, highly hygroscopic fluxes need sealed and dehumidified feeders, while finer powders require more precise pneumatic transport controls to prevent blockages and ensure smooth flow.

What role does automation play in modern flux injection systems?

Automation, enabled by PLC/HMI controls, allows for precise recipe management, automatic sequencing of the injection cycle (lance insertion, dosage, retraction), interlocks for safety, and detailed reporting, significantly reducing human error and ensuring process repeatability critical for certified components.

Are there environmental benefits associated with using flux injection machines?

Yes, flux injection improves energy efficiency by reducing overall treatment time and increasing material yield. Furthermore, optimized flux use minimizes the generation of hazardous dross and slag, contributing to cleaner industrial practices and reduced waste disposal volumes compared to manual treatment methods.

How is the Flux Injection Machine Market affected by the price volatility of commodities like aluminum?

Price volatility in commodities like aluminum can cause cyclical impacts. High prices typically encourage investment in efficiency (buying new machines), while sharp downturns can lead to delayed capital expenditure and reduced maintenance spending by metal producers.

What challenges do SMEs face when adopting flux injection technology?

SMEs often face challenges related to high initial capital investment costs, the complexity of integrating advanced systems with existing infrastructure, and securing trained personnel for operational maintenance and technical support of the sophisticated equipment.

In the Value Chain, what is considered the upstream segment?

The upstream segment involves the sourcing and supply of key raw materials, primarily specialized high-temperature refractory materials for lances, high-grade steel for machine fabrication, and sophisticated electronic and control components (sensors, PLCs).

Which Operation Mode segment is expected to see the fastest growth?

The Fully Automatic Systems segment is expected to see the fastest growth, particularly in large-scale operations, driven by the demand for higher throughput, superior repeatability, and integration capabilities necessary for Industry 4.0 manufacturing environments.

How do flux injection machines contribute to the circular economy?

By enabling the effective purification and refining of complex and highly contaminated secondary (recycled) aluminum and steel scrap, flux injection machines allow manufacturers to utilize recycled inputs while meeting high-quality specifications, thereby significantly supporting circular economy initiatives.

What is the typical carrier gas used in flux injection, and why?

Argon or Nitrogen are the typical carrier gases used. Argon is generally preferred because it is inert and prevents oxidation of the molten metal, while simultaneously aiding in the removal of dissolved hydrogen gas (degassing) alongside the flux action.

How do regulatory standards influence the purchase of new machines?

Strict regulatory standards, such as those governing component safety (e.g., in aerospace) and environmental impact (e.g., emissions control), mandate the use of precise, verifiable processes, pushing foundries to invest in newer, certified flux injection systems that offer superior process control and data traceability.

What is the significance of the High Capacity machine segment?

The High Capacity segment is significant as it caters to massive continuous production environments, like integrated steel mills and primary aluminum smelters, where the machine's ability to handle throughputs exceeding 300 kg/min directly impacts the profitability and production volume of the entire plant.

What primary impurity is targeted when using Calcium-based fluxes?

Calcium-based fluxes (like CaSi) are primarily used in steel production to target desulfurization, reducing sulfur content to very low levels necessary for high-grade pipeline and structural steel applications, while also modifying inclusions.

How does AI contribute to optimizing flux injection operations?

AI contributes by analyzing real-time sensor data and spectrometer readings to dynamically adjust injection parameters—such as dosing rate, insertion depth, and treatment time—ensuring optimal metallurgical results while minimizing flux material and carrier gas consumption.

What is "lightweighting," and how does it relate to this market?

"Lightweighting" is the industrial trend of manufacturing components, especially for vehicles, using lighter materials (like advanced aluminum alloys) to improve fuel efficiency and performance. Flux injection machines are essential for refining these high-purity, lightweight alloys.

Why is precise temperature control important during the flux injection process?

Precise temperature control is crucial because the chemical reactions between the flux and impurities are highly temperature-dependent. Maintaining the optimal temperature window ensures maximum reaction efficiency and prevents premature solidification or excessive temperature loss during the treatment cycle.

What challenges exist regarding the integration of flux injection systems with legacy foundry equipment?

Integration challenges often involve compatibility issues between modern digital control systems (PLCs) and older analog or proprietary control interfaces used in legacy melting and casting equipment, requiring complex middleware solutions and significant engineering effort.

What is the difference between direct and indirect distribution channels for these machines?

Direct distribution involves the OEM selling and supporting high-value, customized machines directly to major end-users. Indirect distribution utilizes regional agents or distributors who handle sales, often bundling machine units with flux material supply contracts to serve smaller or geographically dispersed customers.

How do the leading companies in this market achieve competitive advantage?

Leading companies achieve competitive advantage through continuous innovation in lance design, superior software integration (Industry 4.0 readiness), global service networks providing rapid refractory and spare parts availability, and offering specialized expertise in complex alloy treatment processes.

What are the typical safety considerations for operating a flux injection machine?

Safety considerations include managing the high pressure of carrier gases, handling reactive powdered flux materials, mitigating exposure to extreme heat and molten metal splash risks, and ensuring robust interlocking mechanisms to prevent operation if the lance is improperly positioned or damaged.

How is the market for Flux Injection Machine components segmented?

The components market is segmented into feeding systems (gravimetric vs. volumetric), refractory consumables (lances, nozzles), and control systems (PLCs, sensors, HMI interfaces), with refractory consumables representing a significant recurring revenue stream due to their wear and tear.

What impact do macroeconomic factors have on capital expenditure in this market?

Macroeconomic factors such as global industrial output, interest rates, and GDP growth directly influence foundry profitability and their willingness to commit to large capital expenditures for new injection machines, making the market sensitive to global economic cycles.

Why is customization important for flux injection machines in the aerospace sector?

Customization is vital in aerospace because the production of critical components requires extremely specific, often proprietary, flux chemistries and highly controlled, repeatable injection parameters to meet ultra-strict safety, reliability, and metallurgical specifications mandated by certification authorities.

What is the projected role of secondary aluminum production in market growth?

Secondary aluminum production is projected to be a major growth driver because recycled aluminum often contains high levels of impurities that require intensive, precise flux injection treatment (demagging, degassing) to be upgraded to foundry-grade quality, significantly boosting demand for advanced machines.

How do manufacturers ensure the consistent quality of the injected flux powder?

Manufacturers ensure flux quality through strict particle size control, consistent bulk density, and minimizing moisture content (especially for reactive fluxes), often requiring specialized storage and feeding systems integrated into the machine to prevent degradation before injection.

What is the definition of "DRO" in the context of this market report?

DRO stands for Drivers, Restraints, and Opportunities, which are the fundamental analytical components used to structure the strategic analysis of the market, identifying forces that promote growth, hinder progress, and present future potential, respectively.

Which flux material type is dominant in terms of usage volume?

Calcium-based fluxes, particularly calcium silicide (CaSi), remain dominant by usage volume, primarily due to their extensive application in the high-volume desulfurization and inclusion shape control processes within the global steel industry.

What are the main advantages of fully automated flux injection systems?

The main advantages include high precision in dosing, guaranteed process repeatability, minimized reliance on manual labor, increased safety due to remote operation, and comprehensive data logging capabilities for quality assurance and process optimization.

What criteria do potential customers use to evaluate suppliers?

Customers evaluate suppliers based on machine reliability and uptime, the longevity of consumable components (lances), post-sales service responsiveness, integration capabilities with existing plant infrastructure, and the ability to meet specific metallurgical purity guarantees.

To check our Table of Contents, please mail us at: sales@marketresearchupdate.com

Research Methodology

The Market Research Update offers technology-driven solutions and its full integration in the research process to be skilled at every step. We use diverse assets to produce the best results for our clients. The success of a research project is completely reliant on the research process adopted by the company. Market Research Update assists its clients to recognize opportunities by examining the global market and offering economic insights. We are proud of our extensive coverage that encompasses the understanding of numerous major industry domains.

Market Research Update provide consistency in our research report, also we provide on the part of the analysis of forecast across a gamut of coverage geographies and coverage. The research teams carry out primary and secondary research to implement and design the data collection procedure. The research team then analyzes data about the latest trends and major issues in reference to each industry and country. This helps to determine the anticipated market-related procedures in the future. The company offers technology-driven solutions and its full incorporation in the research method to be skilled at each step.

The Company's Research Process Has the Following Advantages:

- Information Procurement

The step comprises the procurement of market-related information or data via different methodologies & sources.

- Information Investigation

This step comprises the mapping and investigation of all the information procured from the earlier step. It also includes the analysis of data differences observed across numerous data sources.

- Highly Authentic Source

We offer highly authentic information from numerous sources. To fulfills the client’s requirement.

- Market Formulation

This step entails the placement of data points at suitable market spaces in an effort to assume possible conclusions. Analyst viewpoint and subject matter specialist based examining the form of market sizing also plays an essential role in this step.

- Validation & Publishing of Information

Validation is a significant step in the procedure. Validation via an intricately designed procedure assists us to conclude data-points to be used for final calculations.

×

Request Free Sample:

Related Reports

Select License

Why Choose Us

We're cost-effective and Offered Best services:

We are flexible and responsive startup research firm. We adapt as your research requires change, with cost-effectiveness and highly researched report that larger companies can't match.

Information Safety

Market Research Update ensure that we deliver best reports. We care about the confidential and personal information quality, safety, of reports. We use Authorize secure payment process.

We Are Committed to Quality and Deadlines

We offer quality of reports within deadlines. We've worked hard to find the best ways to offer our customers results-oriented and process driven consulting services.

Our Remarkable Track Record

We concentrate on developing lasting and strong client relationship. At present, we hold numerous preferred relationships with industry leading firms that have relied on us constantly for their research requirements.

Best Service Assured

Buy reports from our executives that best suits your need and helps you stay ahead of the competition.

Customized Research Reports

Our research services are custom-made especially to you and your firm in order to discover practical growth recommendations and strategies. We don't stick to a one size fits all strategy. We appreciate that your business has particular research necessities.

Service Assurance

At Market Research Update, we are dedicated to offer the best probable recommendations and service to all our clients. You will be able to speak to experienced analyst who will be aware of your research requirements precisely.

Contact With Our Sales Team

Customer Testimonials

The content of the report is always up to the mark. Good to see speakers from expertise authorities.

Privacy requested , Managing Director

A lot of unique and interesting topics which are described in good manner.

Privacy requested, President

Well researched, expertise analysts, well organized, concrete and current topics delivered in time.

Privacy requested, Development Manager